Migliori piattaforme DeFi – Guida 2026 al trading DeFi

With today’s article we want to talk to you about the best DeFi platforms, or Decentralized Finance , terms that you have surely often heard around lately. If you ended up here there are two probable reasons: either you are a crypto enthusiast, and an investor, or in recent months you have often heard about DeFi and Centralized Finance, and now you want to learn more about the topic. In this guide we will show you what the two terms mean, what are the best platforms for trading and much more.

Top DeFi Platforms of 2026 with Crypto DeFi

In this list we will show you what we believe to be the best trading platforms for buying and selling DeFi coins .

- Tamadoge – the best DeFi project in the metaverse in 2026

- Battle Swap – The Best DeFi Platform for NFT Games Overall

- Defi Swap – One of the Best Platforms to Trade DeFi

- Libertex – Platform with Minimum Spreads and Commission Discounts

- Crypto.com – the trading platform with a built-in DeFi wallet

- Bitstamp – entirely European, among the most loved by traders

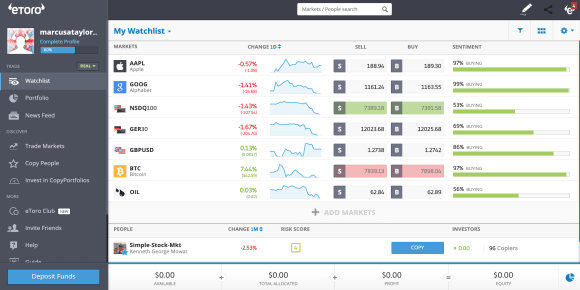

- eToro – The Richest Crypto DeFi Platform

1. Tamadoge – the best DeFi project in the metaverse in 2026

Tamadoge

Being a decentralized finance project, all Tamadoge transactions are peer-to-peer and therefore without intermediaries: the advantage of DeFi is therefore to offer enormous utility and at the same time to make investors earn significant incentives.

In the Tamadoge ecosystem, users can mint pets and domestic animals – which are nothing more than NFTs – feed them, take care of them from when they are babies to adulthood. At this point, the virtual animals will be ready to fight with other players and therefore earn rewards.

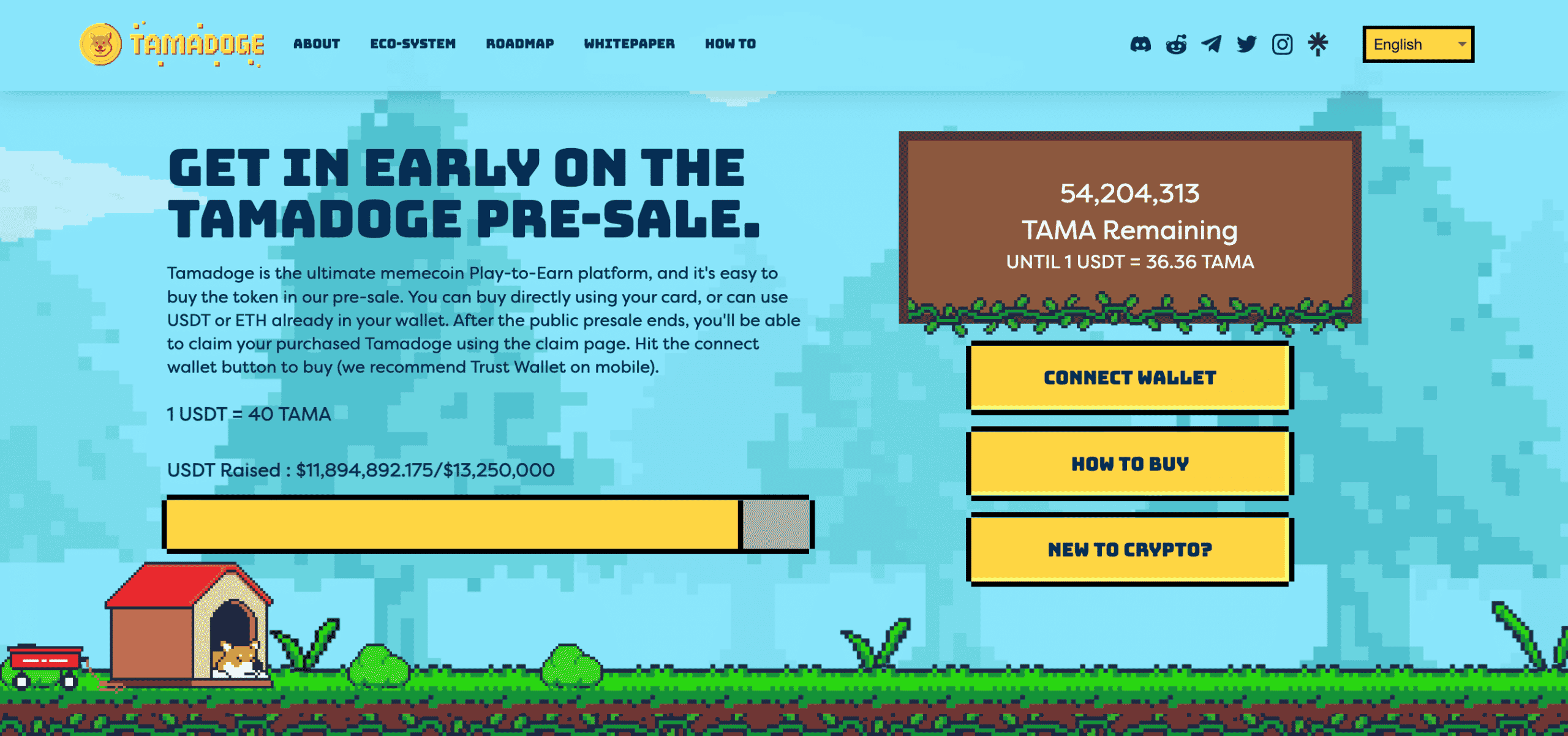

The success of Tamadoge’s pre-sale puts the DeFi platform at the forefront of 2026 news, allowing investors to purchase tokens at very attractive prices using ETH or USDT.

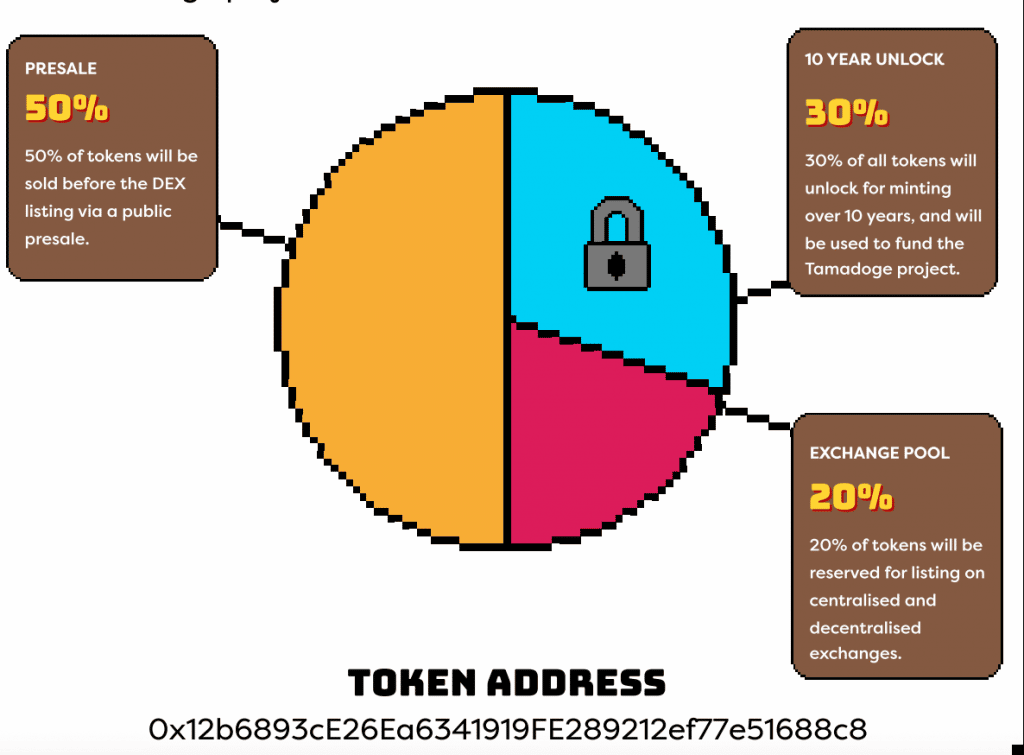

As of now, TAMA has launched a pre-sale in Q3 2022 with 50% of the total supply cap being offered. 20% of the TAMA coin supply has been reserved for listing on centralized and decentralized exchanges, which will help make the asset more globally available. The remaining 30% will be made available over the next 10 years and will be accessible through minting operations.

Not only that, Tamadoge’s roadmap also includes the release of an augmented reality (AR) app, which will retain all the play-to-earn aspects that already characterize the current platform. To receive all the updates on Tamadoge, follow the DeFi platform’s Telegram channel .

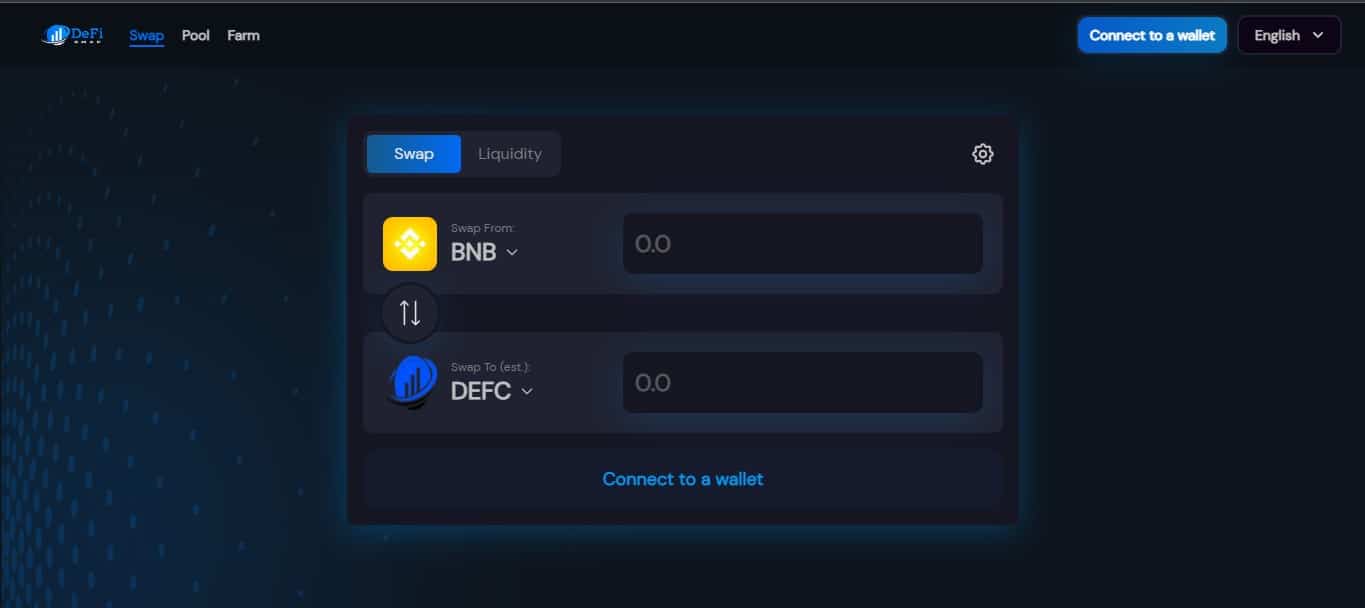

Il tuo capitale è a rischio. Al primo posto della classifica DeFi non poteva che esserci Battle Swap di Battle Infinity, il miglior exchange in assoluto dell'ecosistema metaverso nel 2026. Questo innovativo progetto è costituito da unapiattaforma che integra elementi appartenenti alla DeFi con il play to earn (P2E). In Battle Infinity i giocatori vivono un'esperienza coinvolgente e immersiva nel metaverso, aperti a un mondo di possibilità infinite. Non solo potranno combattere, ma anche interagire con altri utenti, scoprire, guardare e farsi guardare, e molto altro. In. primo piano, la massima trasparenza e sicurezza: l'ecosistema infatti integra il gioco alla tecnologia della blockchain Binance Smart Chain (BSC), assicurando i dati degli utenti con una delle reti crittografate più a prova di hacking. Tutto ciò fornisce un'esperienza del tutto decentralizzata, in cui ciascun giocatore ha la proprietà diretta dei token e degli oggetti di gioco e partecipa attivamente ai multigiochi NFT per ottenere ricompense, o Premier League IBAT. Il token IBAT è la valuta nativa di Battle Infinity. Può essere utilizzato dai giocatori per acquistare giochi, oggetti dei giochi e NFT tramite il "Battle Market". Puoi acquistare IBAT attraverso l'exchange Battle Swap con BNB, ETH o USD. Battle Swap è il posto migliore per acquistare IBAT nel 2026. Puoi acquistare IBAT oggi e iniziare a prendere parte alla piattaforma Battle Infinity nell'evento di prevendita. Il tuo capitale è a rischio. Su questa piattaforma è possibile fare, oltre al Trading, anche il Token Swap, ovvero scambiare un token con un altro utente (da non confondere con vendere e comprare), Staking e Yield Farming, che spiegheremo più approfonditamente in un paragrafo apposito. Inoltre, è possibile guadagnare dagli interessi generati tenendo “bloccati” i propri fondi per un determinato periodo di tempo. A differenza delle Stacking Pool e dello Yield Farming, i fondi sono bloccati fino alla fine del termine prefissato e non della riuscita dello smart contract. Il tuo capitale è a rischio. A differenza delle altre piattaforme di trading Libertex ha deciso di abbassare al minimo gli spread. Questo permette all’utente di consultare facilmente il prezzo di entrata e di uscita dall’operazione finanziaria, risultando quindi uno dei siti in cui i costi sono più chiari ed evidenti. Despite not having a wide crypto offering, Libertex offers traders the possibility to invest in Defi, through for example Ethereum, a reference platform and a very popular base for DeFi applications. Very popular in the UK, Libertex is a safe and reliable broker, as it is regulated by CySEC, one of the main bodies authorised to issue licenses in the sector in the EU area.

85% of retail investor accounts lose money when trading CFDs with this provider. You can make a deposit by bank transfer, credit card or digital wallet, just respect the minimum limit of about €0.95. Crypto.com has launched on the market, like Binance, its own cryptocurrency, CRO, with which you can obtain benefits and discounts if used to pay commissions or transactions.

Il tuo capitale è a rischio. Bitstamp offre ai trader la possibilità di investire sulle più importanti criptovalute come Bitcoin o Ethereum, comprese le crypto DeFi. Ethereum in particolare è una piattaforma molto nota per le applicazioni DeFi. Il tuo capitale è a rischio. It is a different type of platform, where you can find security certificates such as Cysec, FCA or ASIC. It does not require costs and commissions, only a minimum deposit of about €48, but which allows you to trade with over 18 cryptocurrencies, such as Bitcoin, Ethereum, Ripple, Cardano, and also with FIAT currencies, such as Pounds, Dollars or Euros.

Il {etoroCFDrisk} % dei conti degli investitori retail perde denaro negoziando CFD con questo fornitore. È necessario sapere come funzionano i CFD e se ci si può permettere di perdere i propri soldi.

Minimum investment

10,000 TAMA (∼$10 + gas)

Maximum investment

N/A

Purchase Methods

ETH, USDT, Debit/Credit Card (via Transak)

Chain

Ethereum

Beta V Sale Ends.

September 2, 2022

Pre-sale end

4th quarter 2022

Pros:

Against:

2. Battle Swap - in assoluto, la migliore piattaforma DeFi per i giochi NFT

Investimento minimo

0.1 BNB

Investimento massimo

500 BNB

Blockchain di riferimento

Binance Smart Chain (BSC)

Inizio della prevendita

11 Luglio 2022

Fine della prevendita

10 Ottobre 2022

Pro:

Contro:

3. Defi Swap - una delle migliori piattaforme in cui scambiare DeFi

Commissioni di Defi Swap

Commissioni

Importo

Per il trading di criptovalute

10% alla vendita di Defi Coin (DEFC)

Commissioni di inattività

Non disponibile

Commissione di prelievo

Non disponibile

Pro:

Contro:

4. Libertex, piattaforma con Spread minimi e sconti sulle commissioni

Libertex Commissions

Commissions

Amount

For cryptocurrency trading

Variable commissions, to which discounts are applied based on the trader's profile

Inactivity Fees

After 90 days

Withdrawal fee

Variable: bank transfer 0.5%, credit cards 1€, Skrill no commission

Pros:

Against:

5. Crypto.com, the trading platform with an integrated DeFi wallet

Crypto.com Fees

Commissions

Amount

For cryptocurrency trading

0.04% commission

Inactivity Fees

No commission

Withdrawal fee

Based on the currency withdrawn. 0.0004 per ETH

Pros:

Contro:

6. Bitstamp, interamente europea, tra le più amate dai trader

Commissioni di Bitstamp

Commissioni

Importo

Per il trading di criptovalute

Variabile tra lo 0.10 e lo 0.25% a seconda della coppia e dei volumi generati

Commissioni di inattività

1,95 euro mensili per ogni tipo di conto (attivo e inattivo)

Commissione di prelievo

Variabile: per prelievo SEPA 3 Euro, con acquisto tramite Carta di Credito 5%

Pro:

Contro:

7. eToro, la migliore piattaforma in assoluto per le crypto DeFi

eToro Commissions

Commissions

Amount

For cryptocurrency trading

Spread of 0.75% for Bitcoin

Inactivity Fees

$10 per month after one year

Withdrawal fee

$5 on all withdrawals

Pros:

Against:

Platform Fees - Comparison Table

Platform

Crypto Trading - Fees

Inactivity - commissions

Withdrawal - commissions

DeFi Swaps

10% on Defi Coin (DEFC) sale

Not available

Not available

Libertex

Variable commissions, to which discounts are applied based on the trader's profile

After 90 days

Variable: bank transfer 0.5%, credit cards 1€, Skrill no commission

Crypto.com

0.04% commission

No commission

Based on the currency withdrawn. 0.0004 per ETH

Bitstamp

Varies between 0.10 and 0.25%

1.95 Euro per month for each type of account (active and inactive)

For SEPA withdrawal 3 Euro, with purchase by Credit Card 5%

Kraken

Commission, starting from 1% per trade for sellers. Free for buyers

Free

According to the currency withdrawn. 0.0005 for BTC

What is DeFi?

The term DeFi is an acronym for Decentralized Finance and is used to refer to all those financial actions that are not carried out by centralized institutions, such as banks. This system is based entirely on cryptocurrencies and Blockchain, and aims to offer a series of financial services such as:

- Trading: exchanging, or buying and selling cryptocurrencies;

- Lending: lending, and thus making a profit, or receiving loans of cryptocurrencies;

- Staking: Using your Crypto to unlock nodes on the blockchain, earning a profit.

The main question, for many, is: why decentralized? Unlike classical finance, the Crypto world is not tied to any bank, state or government, and is entirely managed by users, except in rare cases. The amount of money and investors in circulation has attracted the interest of classical finance and economics, which, having understood the potential, do not want to be left behind and are instead intent on actively participating.

Just think that, to date, several governments around the world have passed laws to protect the national economy from possible frauds committed by tax evaders. Even in Italy, you are required to declare your cryptocurrencies and the earnings obtained from them above certain amounts. Another interesting aspect is knowing that most exchanges such as eToro, Crypto.com, Binance and so on, being platforms regulated by governments, require their users during registration to provide documents that can verify their identity, so as to avoid tax evasion.

There are also exchanges that are not regulated and where you can own as many cryptocurrencies as you want without being monitored. Of course, there are pros and cons to using these decentralized exchanges, such as the lack of legal protection and, in general, a less secure environment.

How to Invest in Decentralized Finance (DeFi)

Now we will show you how you can invest in Decentralized Finance ( DeFi ) and succeed in obtaining profits by trying to be clear and concise.

We can do Trading for example, that is, buy and sell Crypto DeFi , so first of all we will have to buy them. There are several ways to do it but the simplest is to buy ETH, that is Ethereum, or other known ones such as DAI or Uni swap through any exchange. Now there are two types of exchanges, as mentioned before, the centralized ones, such as eToro, Crypto.com, Binance, etc., and the decentralized ones such as Defi swap, a platform that is not regulated by any State and that ensures the anonymity of the user. Remember that venturing into the jungle of cryptocurrencies involves risks, but venturing into that of exchanges based on Decentralized Finance is something for those who are fully aware of their actions, therefore expert traders.

Best DeFi Cryptos by Market Cap

Let's now move on to a list of what we think are DeFi cryptocurrencies worthy of your attention.

Uniswap - One of the Largest DeFi Exchange Platforms

An interesting feature is the fact that, since it works through open source software, any enthusiast can access the source code and create their own crypto and DeFi tokens . Uniswap has also created its own token that is called like the platform itself, in crypto UNI, and is of the governance type. So all holders will be able to actively participate in the development and growth of this platform with their votes. The average value of the Uniswap Token is around €16, while the value of the Market Cap of Uniswap (UNI), updated to May 2026, is $3717863.971 3519330034.95€

Chainlink - One of the most popular DeFi platforms

Chainlink (LINK) developers are working to make the platform and token much more flexible, so as to become much more attractive to investors. The value of the Market Cap of Chainlink (LINK), updated to May 2026, is 3256505667$, 3082608264.38€.

DAI - One of the Best DeFi Stable Coins

Consider Bitcoin, for example, whose value changes dramatically even in just 24 hours. Therefore, DAI holders are much more at ease knowing that the value of their investment will not be aggressively affected by market volatility. The Market Cap of DAI (DAI), updated to May 2026, is $6507715163, €6160203173.30.

Compound - A DeFi Token Notable for Interest

0x - Ethereum-based DeFi exchange

Risks of Crypto DeFi Trading

We cannot fail to dedicate a whole paragraph to the topic of risks, or rather, risk: that of losing everything. How? Let's take a step back. When we talk about Decentralized Finance we are referring to an economic system that is born, develops and grows in complete autonomy and without any control by institutions capable of giving the investor any guarantee. While a bank usually provides insurance or tools to verify the transaction or those who participate in it, when you exchange crypto on decentralized platforms you will not be able to receive any guarantee or help from the latter, ergo you will be much more exposed to scams and thefts.

For this reason, many exchanges, such as eToro, Binance, Crypto.com and others, have become centralized and have increased their user base precisely thanks to investment insurance, insurance policies signed with very important companies such as Lloyd's of London, and security measures to protect funds and transactions as attested by the ASIC, CySEC and AFA licenses or the use of the cold storage system, that is, storing cryptocurrencies on unassailable offline servers. All this, logically, is not possible when using platforms that cannot give us any guarantee and where the responsibility will be entirely yours.

Aside from the risk of scams and hacking, another danger you may run into is investing in companies that can declare bankruptcy overnight. You can find a lot of startups on DeFi platforms , so we advise you to invest wisely because many of these small companies close their doors in a very short time and you will find yourself penniless and without the possibility of recovering your investment.

HODL, a strategy for DeFi trading

If you are interested in making profits from your DeFi cryptocurrencies, you will already have an idea of how to invest your money, since we have already talked about Lending, Staking and Yield Farming. Have you ever heard of the “Hodl” or “Hodling” technique? Do you know who the “Hodlers” are?

Let's take a step back: it's 2013 and Bitcoin is experiencing a significant decline, on a user forum they are discussing this. Of course, opinions are disparate and there are a certain number of people who, in fear of seeing their money go up in smoke, rush to sell their Bitcoins and suggest others do the same. One of these, whose nickname was Game Kyuubi, suddenly debuts with a message in which he invites others to "Hodling", or rather "Hold Bitcoin", that is, not to sell but to wait.

Of course, on the internet this has turned into a real meme, also used in contexts other than the economic financial one. HODL is the abbreviation for “Hold On for Dear Life!”, which in Italian we can translate as “Grit your teeth”. So doing Hold or Hodling means, in essence, not selling cryptocurrencies even if they are going through moments of decline and the Hodlers are those who follow this particular strategy.

Hodling for DeFi trading

Investors who do not want to exchange their cryptocurrencies, even in a declining phase, keep them in storage in digital wallets, or eWallets, and wait for the price to rise and become profitable again. By doing so, they do not sell off and earn from the interest generated by holding their coins still. Of course, it is an applicable strategy when you know you have a cryptocurrency in your wallet that can bring you a significant profit, such as Bitcoin, which towards the end of 2021 recorded a value of around 54,000 dollars (around €50,000) and which in the month of May 2026 is around 30,000 dollars (around €28,000).

Many may think that Hodling is very easy, but we must consider the psychological pressures that surround investors. The two most common psychological pathologies are FOMO (Fear of Missing Out), that is, the fear of being left out, and FUD (Fear, Uncertainty and Doubt), that is, "fear, uncertainty and doubt". The first refers to the fear of losing the investment, with cases recognized during the great Bitcoin crisis of 2017, while the second refers to the fear of being influenced by false market rumors, which could lead the investor to ruin.

Buying and Selling Governance Tokens

Governance Tokens are the essence of Decentralized Finance , because they are digital currencies that allow their owners to actively participate in the life of the blockchain to which they belong, like the shares of a company (we specify that they should not be legally defined as such). Those who own governance tokens can take part, for example, in voting regarding the project that created them and the developers will take into account the choices made by the community and modify the blockchain accordingly. To obtain profits from DeFi cryptocurrencies we can essentially implement different strategies, which we will list in detail.

DeFi Degen

Degen is short for the English term “Degenerate,” and is a term coined on the popular social media platform Twitter to refer to DeFi cryptocurrency holders who, in the throes of FOMO, continually buy and sell their coins.

Rules-based DeFi trading

This type of investment is the exact opposite of “Degen”, because it consists of trading by setting a strategy. We could decide when to buy and when to sell before starting to invest or, more or less, make a prediction, so as not to receive bad surprises.

Defi Momentum Trading

In this case we are talking about a mix between the first two, in fact many investors start with a rules-based approach, but when the price drops, and this justifies selling for them, they enter degen mode and sell.

DeFi Lending Interest

Let's talk now about AMMs, or Automated Market Makers, a completely automated system that, without authorization, exchanges assets through a liquidity pool, making profits. Roughly speaking, AMMs work like this:

- Users will take funds to lend or trade directly from the pool;

- Investors (LPs) will earn from the commissions they receive in exchange for the service provided, i.e. having deposited funds into the pool.

Benefits of Yield Farming

Another possible strategy is called Yield Farming and consists of lending cryptocurrencies to third parties via smart contracts, getting paid for the service. This technique is also called Liquidity Mining and those who practice it Liquidity Provider, and it resembles a more complicated version of traditional Staking: users make their tokens available, necessarily ERC-20 that relies on the Ethereum blockchain, to reach the goal of the smart contract and receive rewards for the service obtained in the same token.

Is DeFi trading legal?

More than legality, we should talk about regulation. We have already mentioned this topic so you will know that there is nothing illegal in buying, selling or holding cryptocurrencies, as you can also safely buy FIAT currencies, such as Euros, Dollars or Pounds. The problem arises when you move from the virtual world to the real one, this is because since a Crypto is a real currency, therefore with a value, it should be declared.

This is why we talked about regulated exchanges that ask users for specific documentation to track down the individual user and, in cases where they require it, prosecute them for legal purposes. We also talked about non-centralized exchanges, where users are anonymous and impossible to track, but in this case we are talking about a gray area, difficult to regulate and on which it is not easy to offer a complete picture. It is good for the investor to be aware of the risks he runs, from legal ones or simply those related to computer piracy through market volatility, and to continuously update himself so as not to suffer repercussions on his person and on his investment.

Create a DeFi Trading Account - Complete eToro Guide

We will now show you a quick guide to creating an account on the eToro exchange platform, to trade Crypto DeFi . Among the steps, you will be asked to send documents that certify your identity, which is not required by Decentralized Finance exchange platforms , therefore not regulated.

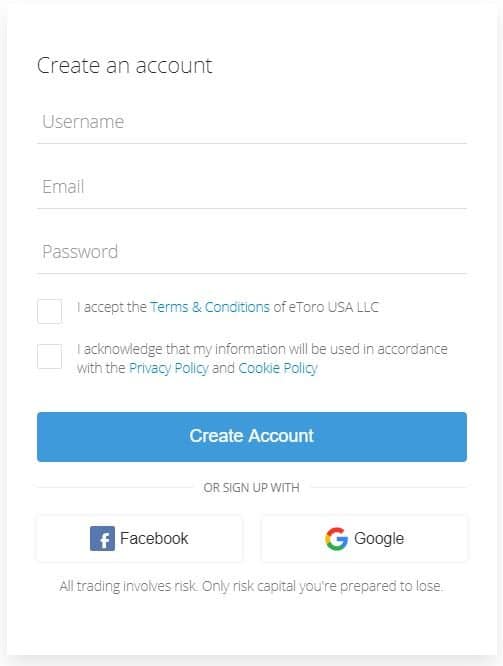

Step 1 - Create an account

To start trading Crypto DeFi on eToro, simply go to the website and click on “Sign Up”.

Step 2 - Fill out the form

Now fill out the online form with your login credentials, such as username, email and password, and your personal data, such as surname and name, where you were born, the street where you live, etc.

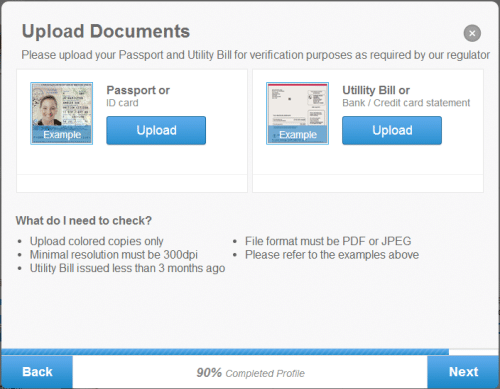

Step 3 - Upload documents

To complete the registration phase you will be asked to send documents that prove your identity such as your identity card, driving license or passport, in odt, jpeg or pdf format.

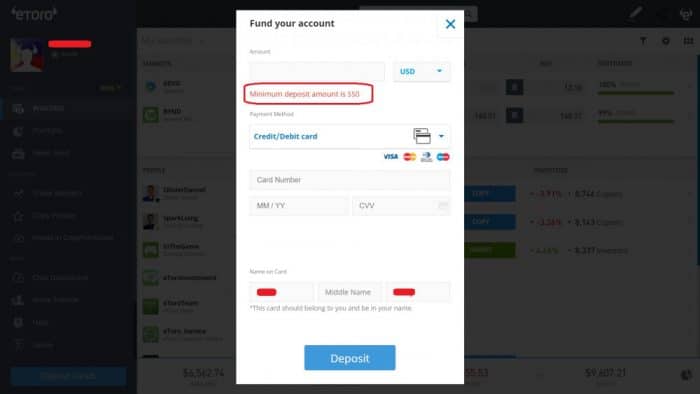

Step 4 - Make a deposit:

Once you have completed the registration phase, you will have the possibility to load your account via the payment method you prefer (bank transfer, credit card or digital wallet) with the amount necessary (minimum approximately €48) to purchase the DeFi cryptocurrencies you are interested in.

Step 5 - Trading

Now you have everything you need to start trading. Start by buying crypto from the markets section, clicking on “buy” after selecting the DeFi coin you want and the quantity. After that, you will have DeFi cryptocurrencies to sell or trade as soon as the market values allow you to earn a significant profit.

Il {etoroCFDrisk} % dei conti degli investitori retail perde denaro negoziando CFD con questo fornitore. È necessario sapere come funzionano i CFD e se ci si può permettere di perdere i propri soldi.

Conclusions

We have come to the conclusion of this article on Decentralized Finance hoping to have managed to dispel your doubts on the matter. As far as we are concerned, we believe that this sector of finance is both new and full of great potential, therefore if well understood it can bring great profit margins to investors. Of course, those who want to approach this world can start by investing first of all in DeFi cryptocurrencies such as Ethereum (ETH), perhaps on eToro, a safe, reliable and intuitive platform.

Tamadoge - The Most Revolutionary and Promising DeFi Platform

Your capital is at risk.

Battle Swap - The Best Platform Ever in the Metaverse Ecosystem

Your capital is at risk.

Frequently Asked Questions

What are the best DeFi Cryptocurrencies to Trade?

What are the best DeFi trading platforms?

What is a DeFi crypto wallet?

Do I need a crypto wallet to do DeFi Trading?

What is DeFi leveraged trading?

How much money do you need to start DeFi trading?

Is there a platform for automated DeFi trading?