- UK Trading Platforms

- Cryptocurrency Exchanges

- Main menuCryptocurrency Exchanges

- Best Crypto Wallets

- Best Altcoin Trading Platforms

- Best NFT Marketplaces

- Best Crypto Staking Platforms

- Best crypto Lending Platforms

- UK Forex Brokers

- Main menuUK Forex Brokers

- Best Low Spread Forex Brokers

- Best Swap Free Brokers

- Best Islamic Forex Brokers

- Best ECN Forex Brokers

- Broker Reviews

- Main menuBroker Reviews

- eToro Review

- Plus500 Review

- Alvexo Review

- Pepperstone Review

- Hargreaves Lansdown Review

- Coinbase Review

- Binance Review

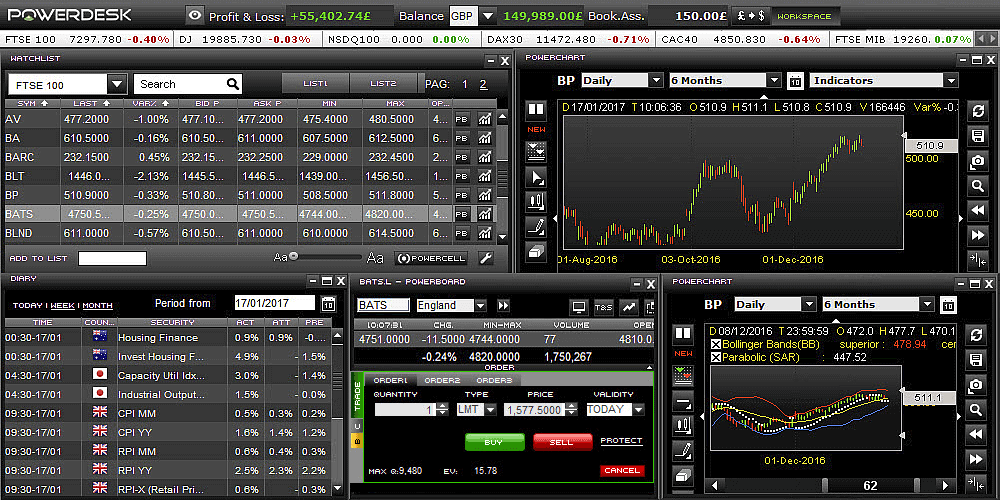

The Best Trading Platforms in the UK for June 2025

Use our interactive tool to find UK trading platforms that offer a variety of asset classes across various markets. We review licensed and regulated brokers that provide UK traders access to stocks, forex and crypto, among other financial instruments.

- We only review licensed & regulated trading platforms;

- Our experts analyse all the fees & spreads you need to know about;

- Compare UK brokers that offer advanced trading tools and features.

Licensed & Regulated

Expertly Reviewed

Secure & Trusted

Transparent Fees

Mobile Friendly

This guide provides an in-depth analysis of online brokerage firms in the UK that are regulated by the FCA (Financial Conduct Authority). The purpose of this guide is to help UK traders to better understand the options that are available, so that they can make informed trading decisions.

There are numerous platforms online that present varied features and access to different asset classes. We spent time reviewing 14 UK trading platforms and online brokers that can be used to trade a variety of assets. Our findings are presented below in a series of mini reviews that outline the main features that each platform has to offer, the type of trading that each platform is suitable for and the platform fees.

-

- 1. eToro – Leading copy trading provider with over 20 million users worldwide

- 2. XTB – Best online broker for active traders

- 3. AvaTrade – Online CFD broker that offers over 1200 FX pairs

- 4. Admiral Markets – Top UK online brokerage account with over 8000 financial instruments

- 5. Pepperstone – Best spread betting platform in the UK for tax-free trading

- 6. Trade Nation – Spread betting broker that offers regulated signals software

- 7. Eightcap –MetaTrader4 broker that offers a user-friendly mobile app

- 8. Fineco Bank – Best long-term trading platform for stock and ETF trades

- 9. IG – UK trading platform with more than 17,000 assets available and commissions from 0%

- 10. Hargreaves Lansdown – Reputable brokerage account for long-term stock market investing

- 11. Saxo Markets – Uk based trading platform with over 40,000 instruments

- 12. Interactive Brokers – The best UK trading platform for advanced trading strategies

-

- 1. eToro – Leading copy trading provider with over 20 million users worldwide

- 2. XTB – Best online broker for active traders

- 3. AvaTrade – Online CFD broker that offers over 1200 FX pairs

- 4. Admiral Markets – Top UK online brokerage account with over 8000 financial instruments

- 5. Pepperstone – Best spread betting platform in the UK for tax-free trading

- 6. Trade Nation – Spread betting broker that offers regulated signals software

- 7. Eightcap –MetaTrader4 broker that offers a user-friendly mobile app

- 8. Fineco Bank – Best long-term trading platform for stock and ETF trades

- 9. IG – UK trading platform with more than 17,000 assets available and commissions from 0%

- 10. Hargreaves Lansdown – Reputable brokerage account for long-term stock market investing

- 11. Saxo Markets – Uk based trading platform with over 40,000 instruments

- 12. Interactive Brokers – The best UK trading platform for advanced trading strategies

Best Trading Platforms in the UK in 2025

[stocks_table id=”676″]

14 Best Trading Platforms & Online Brokers in the UK June 2025

- eToro: The best social trading platform in the UK with over 20 million users. eToro has a simple user interface, offers a variety of assets, and supports copy trading. The minimum trade amount if $10.

- XTB: XTB is a trading platform that supports the MT4 charting tool. This tool provides users with advanced analysis features that can be used to conduct technical analysis which is suitable for active traders.

- AvaTrade: AvaTrade is a regulated trading platform that provides a variety of account types to suit all traders including an Islamic trading account and a professional trading account. The online broker also provides traders with a dedicated account manager and efficient customer support options.

- Admiral markets: Admiral Markets supports the trading of over 8000 CFD instruments in the UK. Traders can also access leverage trading and trading during extended hours through the platform.

- Pepperstone: Pepperstone is a CFD broker that also offers tax-free spread-betting in the UK. The platform also supports leverage trading of up to 1:30. Pepperstone is compatible with MT4, MT5and Ctrader which can all be used to conduct technical analysis.

- Trade Nation: Trade Nation is a UK-based trading platform that can be used for spread-betting, CFD trading, forex trading and indices trading. The platform also provides a regulated signals software that can be used to assist trading decisions.

- Eightcap: Eightcap is an online UK trading platform for forex and CFDs. The platform supports a variety of well-known charting tools including MT4, MT5 and TradingView.

- Fineco Bank: Fineco Bank provides access to 26 global markets spanning stocks, ETFs, CFDs and forex. The platform is also a banking provider with a variety of investment options available for long-term investors.

- IG: IG is a well-known trading platform that can be used for spread-betting and CFD trading. It is also possible to invest in stocks and shares through the platform in the UK.

- Hargreaves Lansdown: Hargreaves Lansdown is an online UK brokerage that offers various investing accounts and trading tools. UK investors can access ISAs as well as high-yield savings accounts. The platform also provides a range of educational materials and real-time market data to assist investment decisions.

- Saxo Markets: Traders can trade assets with Saxo Markets by using the SaxoTrader GO platform. This tool offers a variety of features and real-time data. Saxo Markets offers low commissions and tight spreads as low as 0.4 pips.

- Interactve Brokers: Interactive Brokers offers a number of features including trading APIs, a trading probability tool, advanced charting tools and a mobile application. It is possible to access multiple asset classes including stocks, options and commodities.

How We Ranked The Best Online Brokers

To provide valuable information that could help readers to better understand different UK trading sites, we spent time carefully reviewing each platform. During our reviews, we looked at regulation, fees, platform features and asset availability. It is possible to find this information on the broker’s website. Regulatory status should be clearly displayed with proof of certification and fees should be evidently disclosed. To better understand how we ranked each platform, here is an overview of the ranking criteria that was used.

- Low platform fees including commissions, spreads, and account fees.

- Access to a variety of assets to support a diverse trading strategy.

- The provision of charting tools for technical analysis. Examples include MT4/5, TradingView, and cTrader.

- A free demo account that can be used to test out a platform without putting any real money at risk.

- Educational resources such as in-depth guides, webinars, and professional advisors.

- Excellent customer support services that are available 24/7. The best platforms should offer live chat.

- The ability to manage your portfolio on both desktop and mobile.

What Is a Trading Platform?

A trading platform is an online application that facilitates the buying and selling of financial instruments, such as stocks, bonds, commodities, and derivatives. Trading platforms serve as a bridge between traders and the market, enabling them to place orders, analyze market data, and execute trades. These platforms may be provided by brokerage firms, banks, or other financial institutions, and can be accessed through various devices, including desktop, smartphones, and tablets.

Most trading accounts allow traders to view real-time market prices, monitor their investments, and access technical analysis tools. This provides a comprehensive view of the market, displaying price charts, order books, and trade history. Traders can customize their trading platform according to their preferences, such as adding specific indicators and setting up alerts for price movements.

Trading platforms also offer different types of orders, allowing traders to place market orders, limit orders, stop orders, and more. They provide access to a range of financial markets, including domestic and international exchanges. In addition to executing trades, some platforms also offer research and educational resources to help traders make informed decisions.

Which Trading Platform is Suitable For Beginners in the UK?

Making investments through a trading platform comes with a high level of risk and is not recommended for beginners. However, less-experienced traders should look for a platform that is user-friendly, offers educational resources, and provides a supportive community.

A user-friendly interface is essential because it makes the platform easy to navigate. Users shouldn’t have to spend hours trying to figure out how to execute a basic trade. A good trading platform will have a simple design with clear instructions, making it easier for traders to understand and use.

A good trading platform will provide a wealth of educational materials such as tutorials, videos, webinars, and articles that cater specifically to new traders. These resources should cover the basics of trading, including terminology, strategies, and risk management.

A good trading platform will also provide excellent support services and the opportunity to connect with others. This can help less-experienced traders seek advice and learn from other platform users.

Take the above into consideration when reading through the following mini-reviews. This could help you to decide which platforms are suitable for beginners.

Our Reviews of 14 UK Trading Platforms & Online Brokers

The UK stock market is one of the largest and most liquid in the world, with a total market capitalisation of £4.4 trillion as of June 2022. With so many trading sites available in the online arena, knowing which provider to sign up with can be challenging.

In the following section, we will review each online brokerage to help you find the platform that is most suitable for your needs.

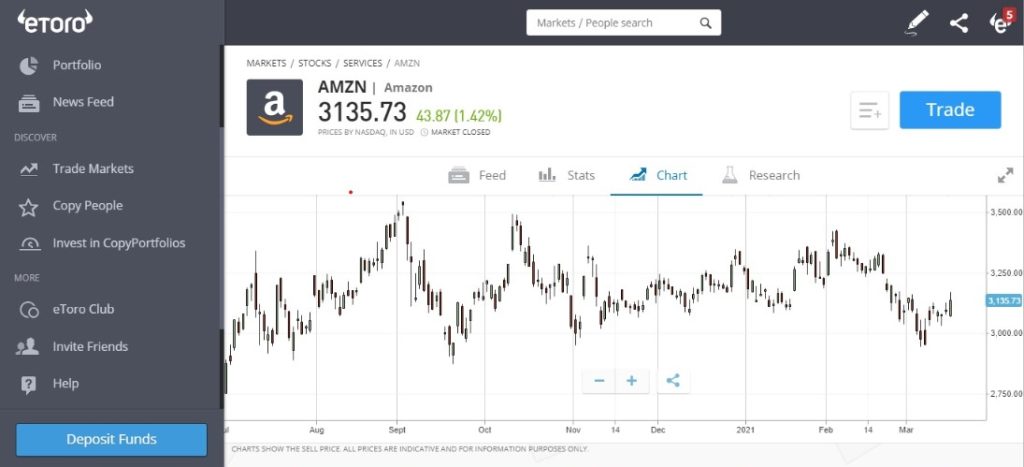

1. eToro – Leading copy trading provider with over 20 million users worldwide

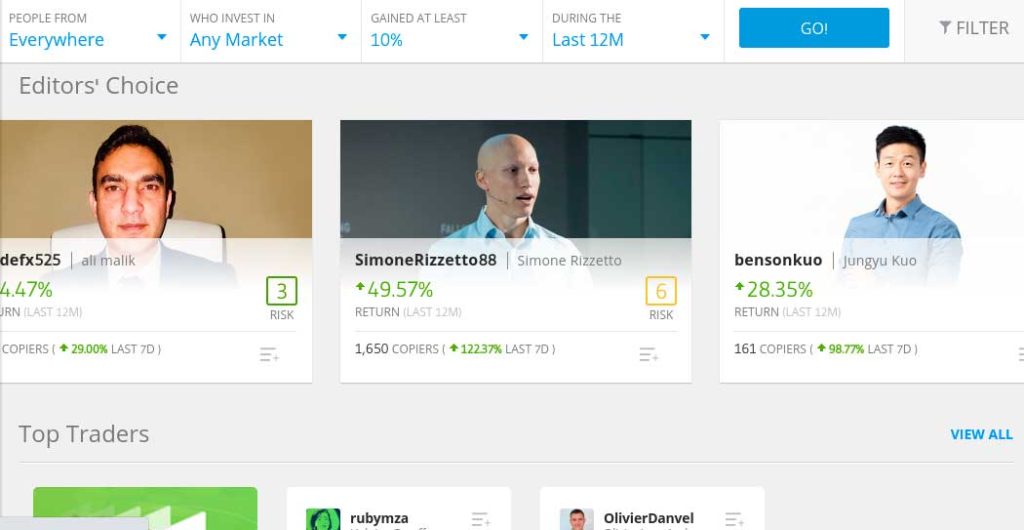

Launched in 2007, eToro is an online broker with more than 27 million clients as of Q2 2023. This platform allows users to trade over 5000 instruments including stocks, ETFs. indices, cryptocurrencies, mutual funds, and more.

The platform is well-known for providing a market-leading social trading feature that makes it possible to interact with other traders and gain insight into trades that are being placed.

eToro Fees

Fee Amount Stock trading fee Commissions Forex trading fee Spread, 2.1 pips for GBP/USD Crypto trading fee 1% commission Inactivity fee $10 a month after one year Withdrawal fee $5 What we like:

- Users can access social trading and copy trading features.

- eToro offers a free to use demo account that can be accessed at any time.

- No fees for deposits or withdrawals.

- Access news and real-time data.

- Available on mobile.

What we don’t like:

- Does not provide advanced price charts for technical analysis.

- The selection of crypto assets is limited.

- No leverage trading available.

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

2. XTB – Best online broker for active traders

XTB Online Trading (XTB) went public in 2016, listing under the ticker symbol XTB on the Warsaw Stock Exchange. XTB has been steadily making inroads, currently offering access to various markets such as forex, shares, indices, metals, commodities, and cryptocurrencies. It is regulated by the Financial Conduct Authority (FCA #522157) and is registered with the Polish Financial Supervision Authority (KNF).

XTB is a good option for active traders because it is compatible with the MT4 charting tool. MetaTrader is considered to be one of the best charting systems that offers an extensive range of indicators, APIs, automated tools, and more.

XTB Fees

Fee Amount Stock trading fee 0.03% Forex trading fee Between 0.05 – 1 pips incorporated into spread Crypto trading fee $4 Inactivity fee After 12 months €10 Withdrawal fee 1.5% with credit cards What we like:

- Commission-free trading for US stocks and ETFs.

- XTB offers a user-friendly mobile app that can be used for price alerts.

- Trade with leverage of up to 30:1.

- Compatible with MT4, MT5, and xStation charting tools.

- Regulated by the Financial Conduct Authority in the UK.

What we don’t like:

- High fees for cryptocurrency trading.

- No social trading features.

- XTB charges an inactivity fee which may not be suitable for long-term investors.

75% of retail investor accounts lose money when trading CFDs with this provider.

3. AvaTrade – Online CFD broker that offers over 1200 FX pairs

AvaTrade is a reputable online broker that offers a variety of trading options for traders all around the world. Founded in 2006, the broker is regulated by multiple financial authorities, including the Central Bank of Ireland, the Financial Services Commission of the British Virgin Islands, and the Australian Securities and Investments Commission.

AvaTrade provides its clients with access to a wide range of financial instruments, including forex, stocks, commodities, and cryptocurrencies. The broker also offers a user-friendly interface, educational resources, and top-notch customer support to provide help and assistance to users on their trading journey.

AvaTrade Fees

Fee Amount Stock trading fee Commission in spread between 0.1 – 2% markup across different assets Forex trading fee Between 0.5 – 1.6 pips incorporated into spread Inactivity fee After 3 months £50 Withdrawal fee 1.5% with credit cards What we like:

- AvaTrade provides daily market analysis to users.

- Low commissions on CFD trading.

- Over 1200 forex pairs are available on the platform.

- Access to a range of educational resources.

- AvaTrade has a mobile app that makes trading accessible.

What we don’t like:

- AvaTrade is not regulated by the Financial Conduct Authority.

- The minimum trading deposit is $100.

There is no guarantee that you will make any profits with this provider. Your money is at risk.

4. Admiral Markets – Top UK online brokerage account with over 8000 financial instruments

Admiral Markets was established in 2001 and considers themselves as a trading and investment ecosystem. The brokerage account has a variety of features and offers users the possibility to trade and invest in over 8000 different market instruments.

These comprise of CFDs for forex, commodities, indices, stocks, ETFs and bonds. Admiral Markets has many account types that offer different trading instruments, and varied parameters for leverage, account currencies and deposit & trade amounts.

Users will want to evaluate which account type is best suited to their requirements before signing up. Admiral’s trading platform connects through both MetaTrader 4 and MetaTrader 5, and also offers spread betting exclusively to UK clients.

Admiral Markets Fees

Fee Amount Stock trading fee $0.02 per US share, 0.1% – 0.15% for other markets Forex trading fee £1.4 – £2.4 per 1.0 lots / Zero.MT4 account type spreads start from 0 pips Inactivity fee €10 per month after 24 months of inactivity Withdrawal fee One free withdrawal request per month for all payment methods and 1% thereafter. For bank transfer 10 EUR/USD/GBP/CHF thereafter. What we like:

- Traders can access over 8000 financial assets.

- CFD and spread betting is available.

- Low commissions on stock trading.

What we don’t like:

- Does not provide advanced price charts for technical analysis.

- The selection of crypto assets is limited.

- No leverage trading is available.

- Traders are charged for withdrawals.

74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

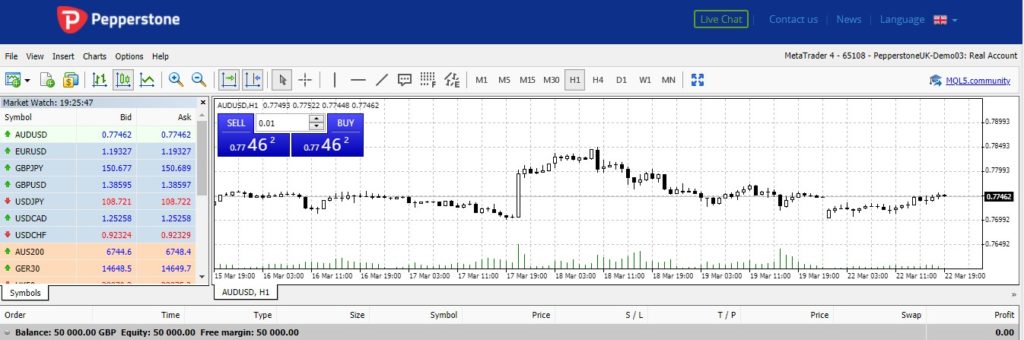

5. Pepperstone – Best spread betting platform in the UK for tax-free trading

Pepperstone is a popular platform for CFD trading and spread betting. The platform is most suitable for experienced traders who are looking to implement an active strategy.

To support this, Pepperstone provides access to MT4, MT5 and cTrader. The broker also offers a demo account as well as live market data.

Pepperstone Fees

Fee Amount Stock trading fee $0.02 per US stock Forex trading fee Spread, 1.59 pips for GBP/USD Crypto trading fee Spread, 50 pips for Bitcoin Inactivity fee Free Withdrawal fee Free What we like:

- Access to MetaTrader and cTrader charting tools.

- Pepperstone allows traders to trade multiple asset classes at one time.

- Low stock trading fees and spreads.

- Regulated by the Financial Conduct Authority in the UK.

What we don’t like:

- The platform mainly offers CFDs and crypto assets are limited.

- No copy trading is available.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.3% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

6. Trade Nation – Spread betting broker that offers regulated signals software

Trade Nation is a regulated broker that offers spread betting, CFD trading, forex trading and access to major indices.

Traders can choose between the TN Trader platform or MT4 to conduct analysis and place trades. Trade Nation is available on both desktop and mobile for a seamless trading experience that suits all traders.

The platform provides traders with numerous educational resources and charting tools to help users make informed trading decisions. Trade Nation also provides real-time market insights from experts. Users can access Trade Nation’s customer support services 24/5.

Trade Nation Fees

Fee Amount Stock trading fee Variable spread. 0.1% for UK stocks, 0.2% for European Forex trading fee Variable spread. 0.8 pips average for GBP/USD Inactivity fee None Withdrawal fee Free What we like:

- Trade Nation prioritizes protection and will never mix customer’s money with its own money.

- Low commissions and tight spreads.

- No withdrawal or inactivity fees.

- Free demo trading account available to UK traders.

- Compatible with MT4.

What we don’t like:

- It is not possible to trade cryptocurrencies on Trade Nation in the UK.

- The platform is limited to CFD trading.

77% of retail investor accounts lose money when trading CFDs with this provider.

7. Eightcap –MetaTrader4 broker that offers a user-friendly mobile app

Eightcap is a relatively new broker that has quickly become the go-to choice for many online traders. For starters, it offers a fantastic range of assets, including CFDs for forex, indices, stocks and commodities, so it accommodates traders of all preferences.

Another highlight is that Eightcap is compatible with both MT4 and MT5, allowing users to have access to the wide range of advanced trading tools available on these two platforms.

Eightcap Fees

Fee Amount Stock trading fee From 0 pips + £3.5 commission, or from 1 pip and no commission Forex trading fee From 0 pips + £3.5 commission, or from 1 pip and no commission Crypto trading fee From 0 pips + £3.5 commission, or from 1 pip and no commission Inactivity fee Free Withdrawal fee Free What we like:

- Fixed trading fees on stocks, crypto, and forex.

- Traders can access CFDs as well as stocks, indicies, commodities, and popular cryptocurrencies.

- Compatible with MT4 and MT5.

- There are a variety of payment methods available on the platform.

What we don’t like:

- High minimum deposit of £100 for UK traders.

- Limited account types available.

- EightCap charges withdrawal fees.

There is no guarantee that you will make any profits with this provider. Your money is at risk.

8. Fineco Bank – Best long-term trading platform for stock and ETF trades

For traders looking to create a portfolio that covers both UK and international assets, Fineco Bank could be the way to go. Fineco Bank offers a huge library of financial markets. This covers traditional assets, like stocks, ETFs, and funds. Not only does this include companies on the FTSE 100 and FTSE 250, but AIM stocks, too.

Further afield, Fineco gives access to dozens of non-UK exchanges. This includes markets in the US, Canada, Asia, Europe, Australia, and more. For traders interested in a shorter-term day trading strategy, Fineco offers thousands of CFD markets. As well as stocks, this includes forex, hard metals, energies, indices, and more.

Fineco Bank Fees

Fee Amount Stock trading fee £2.95 per trade in UK stocks Forex trading fee Variable spread Crypto trading fee N/A Inactivity fee Free Withdrawal fee Free What we like:

- Fineco Bank offers a diverse asset selection.

- Fineco Bank offers investment accounts for long-term investors in the UK.

- Regulated by the Financial Conduct Authority in the UK.

- Multiple customer support options are available.

What we don’t like:

- High minimum deposit of £100.

- Limited payment methods are supported by Fineco Bank.

- Fineco Bank charges an account maintenance fee.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63.28% of retail investor accounts lose money due to CFD trading with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

9. IG – UK trading platform with more than 17,000 assets available and commissions from 0%

IG Trading is a UK trading platform that supports long-term trading. Launched in 1974, the brokerage firm is one of the most established in the UK trading scene. In fact, the platform is listed on the London Stock Exchange with a market valuation of approximately $3 billion. By opening an account with IG, traders will have access to thousands of traditional assets.

IG Fees

Fee Amount Stock trading fee £3 per trade in UK stocks Forex trading fee Spread, 0.9 pips for EUR/USD Crypto trading fee Spread, 40 pips for Bitcoin Inactivity fee $18 for two years of inactivity Withdrawal fee Free What we like:

- IG is listed on the London Stock Exchange and has been running since 1974.

- Regular traders can trade commission-free on some financial assets.

- Access over 17,000 financial instruments.

- Compatible with MT4 and MT5.

- IG is available on mobile.

What we don’t like:

- High trading fees for UK stocks of £3 per trade.

- IG charges an inactivity after 2 years of inactivity.

- High minimum deposit requirement of £250.

There is no guarantee that you will make any profits with this provider. Your money is at risk.

10. Hargreaves Lansdown – Reputable brokerage account for long-term stock market investing

Like IG, Hargreaves Lansdown is a long-standing, reputable UK broker. It’s slightly different from newer online platforms in that it’s mainly focused on stock trading and investing.

Hargreaves Lansdown offers a wide range of services – share dealing accounts, stocks, and shares ISAs, including stocks ISAs, lifetime ISAs, junior ISAs, and cash ISAs, and pensions. Traders can invest in everything from stocks and ETFs to investment trusts, funds, bonds, and gilts. There’s a huge range of shares, ETFs, and funds to choose from, allowing users to invest in companies from all around the world.

Hargreaves Lansdown Fees

Fee Amount Stock trading fee Variable spread Forex trading fee N/A Crypto trading fee N/A Inactivity fee Free Withdrawal fee Free What we like:

- Hargreaves Lansdown is an established UK brokerage that is regulated by the Financial Conduct Authority.

- Traders can access stocks, ETFs, investment funds, bonds and savings accounts.

- Hargreaves Lansdown offers a range of educational tools and professional advice.

- Available on mobile app.

What we don’t like:

- High trading fees of £5.95 per trade.

- Traders cannot access cryptocurrencies or forex.

There is no guarantee that you will make any profits with this provider. Your money is at risk.

11. Saxo Markets – Uk based trading platform with over 40,000 instruments

Saxo Markets is authorised by the UK Financial Conduct Authority (FCA) and is a popular trading platform for CFDs. Users can trade forex, ETFs, CFDs, commodities, futures, forex options, listed options, stocks, and bonds, with Saxo Markets offering up to 1:30 in leverage.

Saxo Markets also offers its own proprietary charting tools: SaxoTraderGO and SaxoTraderPRO. The difference between them is that the PRO version allows the possibility to place algorithmic orders.

Saxo Markets Fees

Fee Amount Stock trading fee £5.00 for UK stocks Forex trading fee Spread, from 0.8 pips in EUR/USD Crypto trading fee N/A Inactivity fee In the UK, £25 after one-quarter of inactivity Withdrawal fee Free What we like:

- Regulated by the Financial Conduct Authority.

- Trade over 40,000 global assets including ETFs, CFDs, forex, futures, and options.

- Saxo Markets provides leverage trading for UK customers.

- The platform is available on mobile devices.

What we don’t like:

- UK stocks have a £5 trading fee.

- Cryptocurrency trading isn’t available.

- Saxo Markets doesn’t support automated trading.

There is no guarantee that you will make any profits with this provider. Your money is at risk.

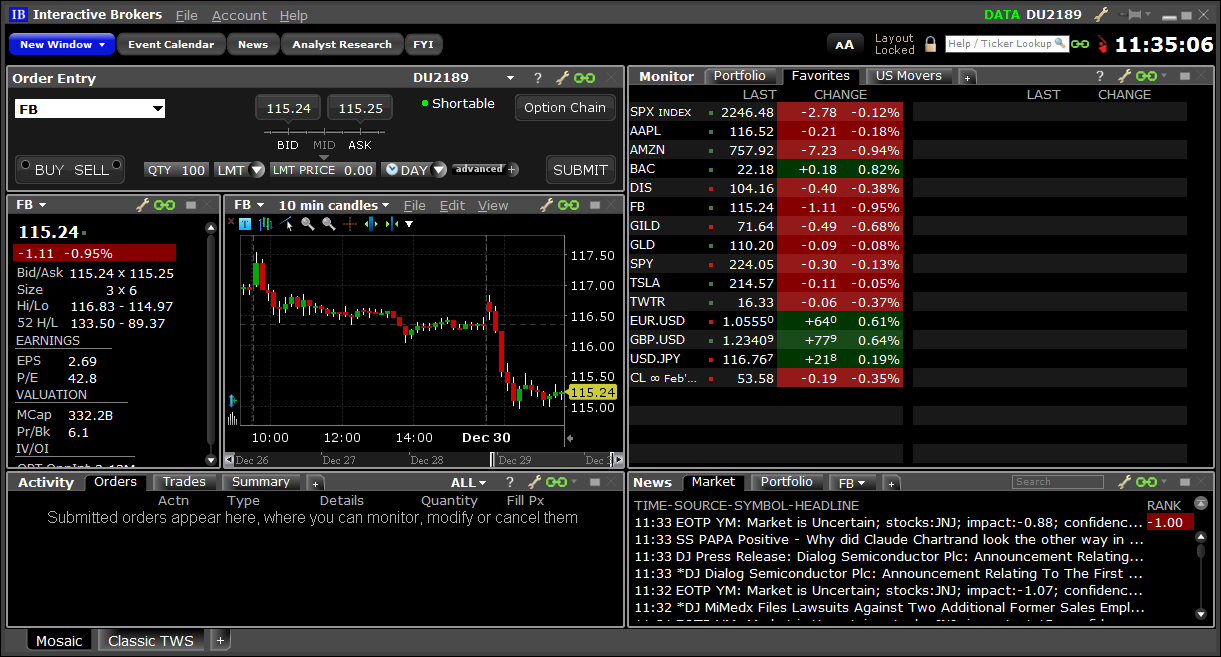

12. Interactive Brokers – The best UK trading platform for advanced trading strategies

Interactive Brokers is a popular brokerage for active traders who are looking to implement advanced trading strategies. This is because the platform comes packed with an abundance of supported markets and trading tools. Interactive Brokers gives you access to more than 135 markets in 33 countries. This means investors can trade stocks listed in the US, Canada, Europe, Asia, and more.

Interactive Brokers Fees

Fee Amount Stock trading fee $0.02 per US stock Forex trading fee Spread, 1.59 pips for GBP/USD Crypto trading fee Spread, 50 pips for Bitcoin Inactivity fee Free Withdrawal fee Free What we like:

- Access over 135 markets in 33 different countries.

- It is possible to trade a variety of financial asset classes including ETFs, stocks, mutual funds and more.

- US-listed stocks can be traded commission-free.

What we don’t like:

- High spreads for forex and crypto trading.

- Not compatible with MetaTrader.

- Does not support social trading.

There is no guarantee that you will make any profits with this provider. Your money is at risk.

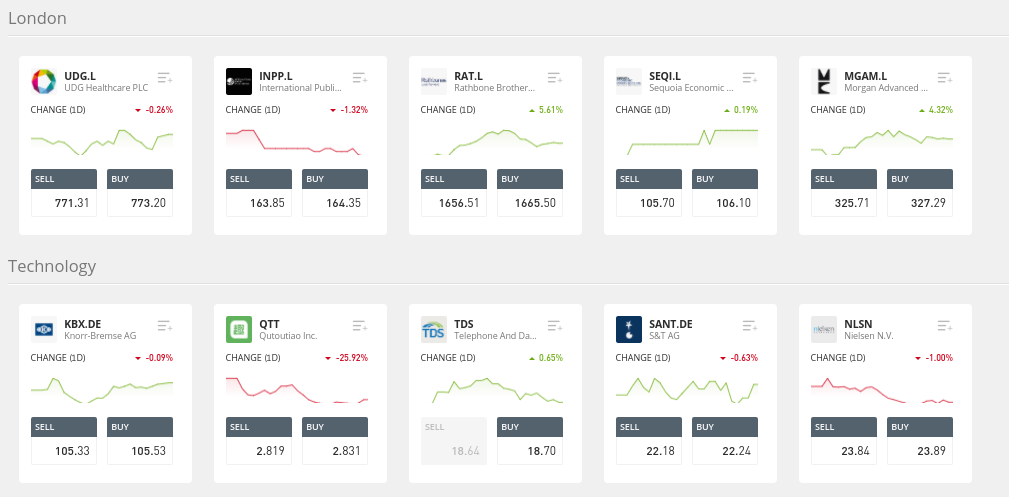

UK Trading Platform Assets & Software Comparison

Fees aren’t the only thing you’ll need to consider when choosing the right trading platform for you. Let’s take a look at how UK brokers match up in terms of tradable assets, software, and features.

Trading Platform Assets Software Features eToro Shares, ETFs, forex, commodities, indices, cryptocurrencies Proprietary Social trading, copy trading, CopyPortfolios XTB Forex, shares, indices, metals, commodities, cryptocurrencies Proprietary xStation5, MT4 Market news, market calendar, live webinars AvaTrade Forex, stocks, indices, commodities, options, ETFs, bonds Proprietary web & mobile platform, MT4, MT5 Social trading, copy trading, spread betting, options trading, education articles & videos Trade Nation Indices, forex, stocks, commodities Proprietary TN Trader, MT4 Insights hub, trading tools, market information, dividend projections Admiral Markets CFDs for forex, commodities, indices, stocks, ETFs and bonds MT4, MT5, MetaTrader Supreme, proprietary mobile webtrader Fractional shares, spread betting, StereoTrader panel access in MetaTrader, education & tutorials, vast analytics section Eightcap Shares, ETFs, forex, commodities, indices MT4, MT5 Economic news, market analysis Fineco Shares, ETFs, forex, indices, futures, funds Proprietary Technical analysis, historical reports, multi-charts IG Shares, ETFs, forex, commodities, indices, options, futures Proprietary, MT4, ProRealTime Spread betting, free signals, algorithmic trading Hargreaves Lansdown Shares, ETFs, funds Proprietary Ready-made portfolios, expert insights Pepperstone Shares, forex, commodities, indices cTrader, MT4, MT5 Spread betting, market analysis Saxo Markets Forex, ETFs, CFDs, commodities, futures, forex options, listed options, stocks, bonds SaxoTraderGO, SaxoTraderPRO Algorithmic orders, one-click trading, options chains, charting packages. Interactive Brokers ETFs, mutual funds, stocks, futures, options, forex IBKR Trading Platform, Workstation OptionTrader and Probability Lab for simplified single and complex multi-leg option trading {etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

What Are The Different Types of Online Brokers and Trading Sites?

After reading through our mini-reviews, you may have noticed that not all online brokers offer the same services, features, or instruments. In the UK, there are several different online brokerages available and the best ones for you will depend on your strategy and goals.

Stocks and shares brokerage accounts

For those looking to build a long-term stock portfolio, it is best to look for a stocks and shares broker that facilitates a long-term strategy. These platforms often provide tools for portfolio management, ready-made investment portfolio options, and professional advisors who can offer advice for building wealth over time.

The best brokers for long-term stock investing will also offer zero inactivity fees, which is important for investors who are looking to hold their positions for a long period.

Day trading accounts

Day trading platforms are used by active traders who are looking to take advantage of small price movements. These platforms often provide advanced price charts, tools for technical analysis, and live market data.

Most day trading brokers also offer CFD instruments, which allow customers to trade without buying the underlying asset. CFDs are suitable for short-term strategies because they allow traders to take a leveraged position.

Cryptocurrency exchanges

Not all UK brokerages will offer crypto assets. Instead, crypto traders may choose to use dedicated cryptocurrency exchanges which provide access to the decentralized finance market. Cryptocurrency exchanges provide traders with tools that can be used to research and analyze the crypto market. These platforms are also compatible with crypto wallets, which can be used to store crypto safely.

Are Online Brokers Free?

Most platforms don’t charge users to sign up, however, they do require users to pay some trading fees. So ultimately no, online broekrs are not free and charges can include commissions, spreads, deposit/withdrawal and maintenance fees. Below we outline some of the fee types, which are covered in greater detail at the fees section.

- Commissions – One of the main methods that these platforms make money is by charging users commissions on trades.

- Spreads – The spread is the difference between the bid (sell) price and the ask (buy) price.

- Overnight Fees – Overnight fees mainly apply to CFDs and some leveraged products. In order for platforms to keep positions open after daily trading hours, they will need to pay a cost and administration fee.

- Foreign Exchange Fees – Platforms will charge currency exchange fees when buying foreign currency stocks or when depositing funds that are not in the primary currency of the account.

- Inactivity Fees: For trading accounts that remain inactive the platforms will charge a monthly fee. Most platforms enforce this after 3 months for inactivity.

How To Choose An Online Broker in The UK

With hundreds of online trading sites available to UK residents, it is important to consider certain factors before opening an account. It is understandable that users may have different requirements and priorities when selecting the most viable platform. For example, some traders may wish to access specific markets such as UK forex or stocks, while others may have a preference for lower fees and commissions. Some traders may specifically be looking for a platform that can accommodate algorithmic trading.

Regardless of the preference there are many different features on offer when considering the right UK trading brokerage platform. To save our readers time, below we list some important features to consider that UK trading accounts present.

Regulation and Safety

To be regarded among the best UK brokers, a trading platform would need to be licensed by at least one reputable financial body. Ideally, this should be with the British Financial Conduct Authority (FCA) – which is responsible for keeping the United Kingdom trading and investment industry safe and transparent. By sticking with an FCA broker in the UK, users will benefit from a range of safety nets.

This includes:

- Segregated Funds: UK trading platforms that are regulated by the FCA keep client funds in segregated bank accounts. This means that the platform cannot touch its clients’ money to service its own debt.

- Risk Warnings: All FCA-regulated platforms must clearly present the risks associated with trading. This is usually displayed on the homepage with a percentage outlining the number of retail clients that lose money.

- Regular Audits: UK brokers that are FCA-regulated will need to have their books audited on a regular basis. This ensures that investors can trade in a safe and secure environment.

In addition to the above, those regarded as the safest trading apps also tend to be covered by the FSCS. This means that user funds are protected up to the first £85,000 – should the platform cease to exist.

Assets

There are thousands of financial instruments across dozens of asset classes that can be traded online. But not all UK trading brokers will give access to every single global marketplace.

To be considered among the leading trading sites in the UK, traders expect access to the following tradeable markets:

- Stocks

- Bonds

- ETFs

- Indices

- Funds

- Commodities

- Cryptocurrencies

- Forex

Furthermore, and perhaps most importantly, users should be considerate of whether the platform provides trading CFDs or allows users to buy the asset outright. If it’s a CFD instrument, the trader does not own the underlying asset. In turn, this does allow traders to short-sell with ease and apply leverage of up to 1:30.

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

CFDs may not be suitable for users taking a more traditional approach to investing. This is particularly the case for investors wanting to build a long-term investment plan, as CFDs attract overnight financing. To ensure access to both types of instruments, traders may consider choosing a trading platform in the UK that gives access to both traditional assets and CFDs.

For example, eToro offers 2,400+ stocks, 250+ ETFs, and 25 cryptocurrencies. It also allows trading of thousands of CFD markets, which in addition to the aforementioned, include forex, commodities, and indices.

Trading Platform Fees

Before choosing an online trading platform, it is important to understand the fees and commissions charged by the platform. Some platforms charge fees for trading, while others may have no fees, but instead charge a commission on each trade. It is important to compare the fees and commissions of different platforms to determine which one offers the best value. After all, the amount that traders need to pay to trade online can vary quite considerably.

The main fees to consider when seeking a suitable broker for UK traders are covered below:

Share Dealing Fees

Share dealing fees not only relate to the purchase of stocks, but other traditional assets like ETFs, mutual funds, and investment trusts. In all but a few rare cases, a chosen trading platform in the UK will charge a flat dealing fee.

This means that irrespective of how much is invested, the fee will remain the same. It goes without saying that this benefits investors that are looking to trade larger amounts.

- For example, let’s suppose that you signed up with popular UK stock broker Hargreaves Lansdown.

- If you purchased £150 worth of BT shares, the provider would charge you a flat dealing fee of £11.95.

- This means that in percentage terms, you’re paying a commission of almost 8%.

- Then, when you cash out your BT shares, you’d need to pay the £11.95 fee again.

Trading Commission

If users decide to trade assets via a CFD instrument, then the chosen platform will charge a variable fee. This is more beneficial to entry-level traders, as they won’t be penalised for placing small orders.

As always, the amount of commission to pay can vary depending on rates offered by different UK trading apps.

- For example, let’s say your chosen trading platform charges a CFD commission of 0.2% per slide

- If you stake £500, you will pay a commission of £1 to enter the position

- If you close the trade when it is valued at £750, your 0.2% commission will amount to £1.50

Sure, this might not sound like a lot to pay. However, these costs can quickly add up – resulting in profitable trades becoming somewhat unviable. This is especially the case when you use a trading platform that has a minimum commission policy in place.

Spreads

If you’re wondering how UK brokers make money when they don’t charge a commission – this comes via the spread. This is simply the difference between the buy and sell price of the financial instrument being traded.

- For example, let’s say a trader is trading Apple stocks on eToro

- The trading platform is currently quoting a ‘buy price’ of $135.10

- It is quoting a ‘sell price’ of $134.85

- Calculating the difference between the two prices gives us a spread of 0.18%

This means that when the trader opens the Apple trade on eToro, the position is instantly 0.18% in the red. In other words, the trade needs to increase in value by 0.18% for you to get back to the break-even point. In this example, a spread of 0.18% is very competitive.

Other Trading Platform Fees

The main costs to explore in depth are related to share dealing fees, commissions, and spreads. However, there are other charges that your chosen platform might have in place, which includes:

- Overnight Financing: When trading CFDs, traders will always need to pay an overnight financing fee if the position remains open past a certain time of the day. For example, at eToro, this kicks in after 10 pm UK time. This is why CFDs are only suitable for short-term strategies, as they are charged by all UK trading platforms

- Transaction Fees: Some UK online brokers allow traders to deposit and withdraw funds fee-free, while others will implement a charge. This might be based on the chosen payment method or because traders are using a platform that is denominated in a currency other than GBP.

- Inactivity Fees: Certain UK brokers charge a fee if your account remains inactive for a certain amount of time.

- FX Trading Fees: In a lot of cases, UK brokers charge an FX fee when traders wish to buy, sell, or trade a non-UK-listed asset. For example, Hargreaves Lansdown will charge its standard share dealing fee of £11.95 to buy US stocks, plus a 1% FX mark-up.

All in all, fees and commissions can and will have a major impact on the ability to make gains, so users should make sure they understand what they are paying before opening an account.

Research and Analysis Tools

Online Brokers in the UK should provide users with a range of research and analysis tools that can be used to make informed trading decisions. This is helpful for novices when looking for trading sites that offer both beginner and advanced research tools as well as educational guides about how to use them.

For example, eToro offers real-time market insight, a financial news feed, expert analysis and helpful price charts that can be used to determine profitable trading opportunities. Advanced traders may also want to look for platforms that offer advanced charting tools and indicators for technical analysis.

Some good research and analysis tools to look for when choosing the most feature rich UK trading platform include:

Market News

Market news is helpful for determining potential trading opportunities. The news can have a huge impact on the price of stocks so it is important to be aware of influential news stories. Reliable platforms should provide real-time news that is updated to reflect the most recent stories.

Real-time Market Data

Trading platforms should provide real-time market data that can be used to analyse stocks. The financial markets move quickly so it is essential that any data provided by platforms is up-to-date.

Price Charts

Most trading platforms will provide easy-to-navigate price charts. It is possible to use these charts to conduct analysis and make predictions about future price movements.

Guides and Educational Resources

Whether you are new to trading in the UK or you are an experienced trader who wants to improve your skills, it is helpful to choose a platform that provides educational materials such as in-depth guides. This can help improve trading skills and navigate the different functionalities of the platform.

Automated Trading

Automated trading is getting more and more popular in the online space. The main concept is that users can actively trade without needing to do any research. In fact, some automated trading tools will go one step further by placing orders on traders’ behalf. Not only does this suit traders with no experience, but those with little time to analyse the markets.

There are several ways in which trades can be automated. Some in the UK opt to purchase a trading robot, which is then installed into a platform such as MT4. In order to do this, traders will need to ensure that your chosen provider supports this third-party platform.

Demo Account

Demo accounts are invaluable to traders in the UK. These are offered by many platforms and allow traders to gain access to real market conditions without risking any money. Instead, users will be trading with paper funds.

For example, eToro offers demo accounts that come pre-loaded with $100,000. Traders will still have access to the same markets, prices, and trading volume – which is for testing the waters before making a real deposit. Even for users who have some experience of online trading, demo accounts are also used to try out new trading strategies.

Customer Service

It’s always good to consider what customer support channels are offered by the trading platform. Ideally, the provider should offer a live chat feature. Telephone support is also a notable feature as users can speak with a live agent in real-time. If, however, the platform only provides email support, then clients may have to wait several hours to receive a response.

How to Get Started with a UK Trading Platform in 2025

This section of our guide will show users how to get started with an online trading platform. We provide a walk-through of the process of opening an account, making a deposit, and placing first trades.

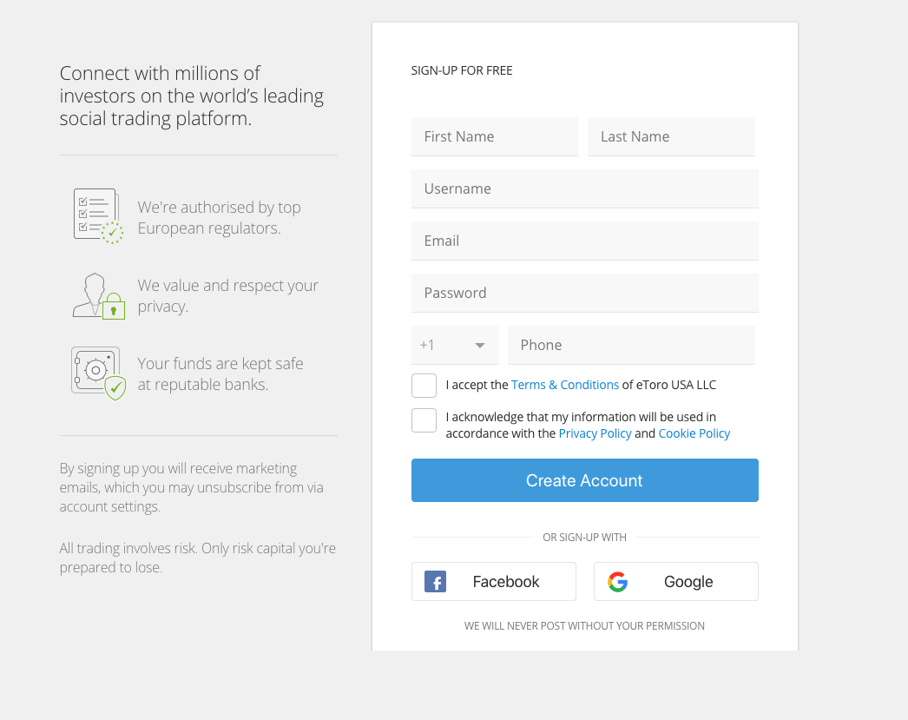

Step 1: Open a Trading Account

Head to the official trading platform homepage and navigate to the account set up option. You’ll first enter your name, email and choose a password.

Read the terms and conditions, privacy policy and accept those.

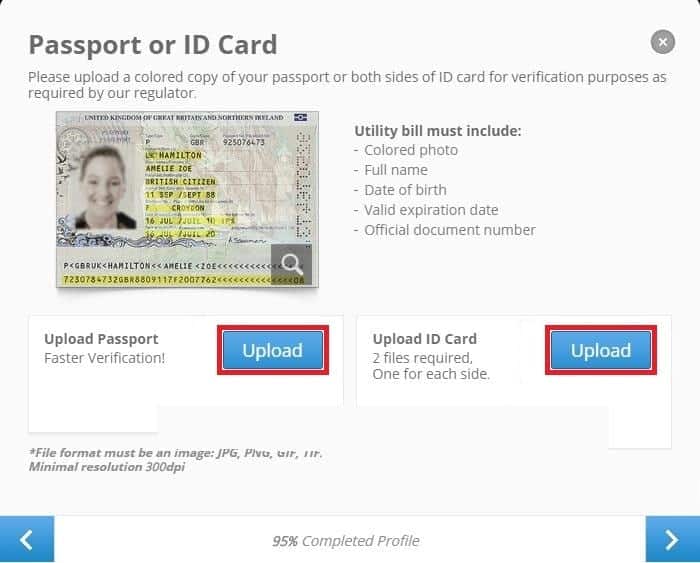

Step 2: Confirm Identity

You will need to verify your identity to meet anti-money laundering (AML) and KYC regulations.

To do this, upload a copy of your:

- Valid passport or driver’s license

- Utility bill or bank account statement (issued within the last 3 months)

You can upload these documents at a later date as long as you are not depositing more than $2,250 (about £1,700).

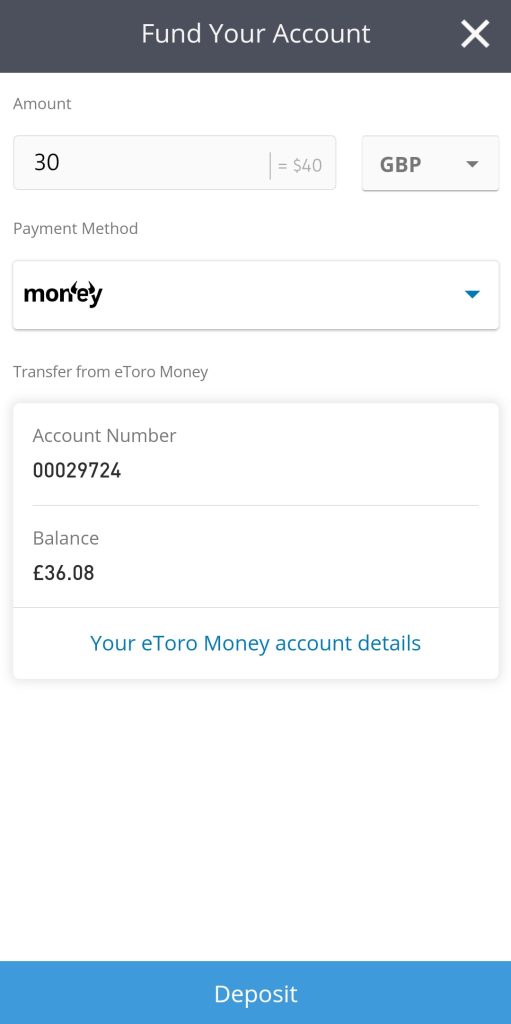

Step 3: Deposit Funds

If you want to use a demo account first, you can do this to get comfortable with how the trading platform works.

When you’re ready to trade with real money, you can choose from the following payment methods:

- Debit card

- Bank Transfer

Step 4: Search for a Trading Market

Once your deposit has been processed you can start. On the dashboard, click on the ‘Trade Markets’ button to see what assets are supported. Or, if you already know which asset you want to trade, search for it.

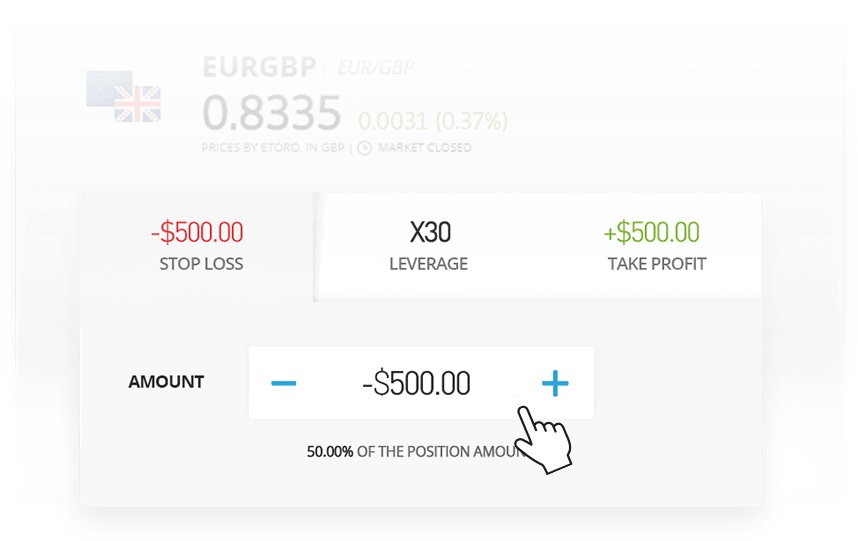

Step 5: Place a CFD Trade

Once you click on the ‘Trade’ button next to your chosen asset, an order box will appear.

You then need to fill in the following fields:

- Buy/Sell: If you think the asset will rise in value, place a buy order. Or, place a sell order if you think the asset will fall in value.

- Amount: Enter your stake into the ‘Amount’ box.

- Leverage: Apart from cryptocurrencies.

If you wish, you can also place stop-loss, trailing stop-loss, and take-profit orders on your trade.

To complete your trade, click on the ‘Open Trade’ button.

The Verdict

There is quite a bit of choice when selecting a suitable UK trading platform. Many of them have long entered the online trading marketplace and it is becoming increasingly accessible to invest online. Whether it’s stocks, forex, cryptocurrencies, or CFDs, online brokers in the UK provide access to thousands of global markets across different asset classes.

eToro has a wide user base in the UK and is available on both desktop and mobile. The platform offers access to a variety of asset markets, has substantially low fees, and offers copy trading.

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

FAQs

What is a free trading platform in the UK?

If you want to trade for free, then you’ll need to use an online platform that doesn’t charge a sign up fee. eToro does not charge any fees for creating an account and it is possible to use the demo trading feature without depositing any funds.

Which UK brokerage accounts offer US shares?

Lots of UK trading platforms now give you access to US shares. However, users need to keep an eye on fees – as most charge a premium when buying non-UK assets. eToro, on the other hand, allows users to purchase hundreds of US shares with low commissions.

Are online trading platforms safe?

As long as the chosen UK trading platform is registered with the FCA, investors will be protected by AML and KYC requirements. Many also prefer platforms that are covered by the FSCS.

Which trading platform can UK traders use to buy Bitcoin?

Although the FCA banned crypto-CFDs in January 2021, users can still buy digital currencies in the traditional sense. eToro offers Bitcoin and 24 other cryptocurrencies, with the minimum investment standing at just $20.

How do commission-free brokers make money?

Commission-free trading platforms in the UK make their money from the spread.

How much leverage do UK trading platforms offer?

Retail investor accounts in the UK are capped to leverage of 1:30 on major currency pairs, and less on other assets. In order to trade with leverage, you need to use a platform that offers CFD markets.

Can I start trading with £100?

Yes, many platforms allow clients to start trading in the UK with £100. In fact, eToro allows its users to trade with a minimum of just £10.

What apps do professional traders use in the UK?

In the UK, professional traders use apps such as Meta Trader to conduct technical analysis and also use a broker app such as eToro to place trades. The exact apps professional traders use will depend on their strategy. For example, eToro is better suited to long-term traders whereas XTB is a good app for short-term UK professional traders.

References:

- https://www.shiftingshares.com/spread-betting-tax/

- https://www.fca.org.uk/news/press-releases/fca-bans-sale-crypto-derivatives-retail-consumers

- https://www.fca.org.uk/publications/multi-firm-reviews/financial-promotions-high-risk-investments

- https://www.futuremarketinsights.com/reports/automated-algo-trading-market

Michael Graw Freelance Writer

View all posts by Michael GrawMichael Graw is a freelance journalist who covers finance, trading, and technology. His work has been published on numerous high-profile websites that cover the intersection of markets, global news, and emerging tech such as TechRadar and Top10.com. Michael has also written for StockApps, Buyshares and LearnBonds.

Before starting his career as a freelance writer, Michael studied at Cornell University where he obtained a BA in Microbiology. He then went on to recieve a Ph.D in Philosophy from Oregon State University. With 6 years of finance writing under his belt, Michael is an expert in his niche and has built up significant industry knowledge during his time as a writer. Michael writes informative content with the goal of supporting readers to make better financial judgements.

Find The Best Broker For You

Best UK Stock, Forex, CFD, Crypto, Social or Day Trading Platform that meets your needs.

Visit eToroYour capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

By continuing to use this website you agree to our terms and conditions and privacy policy.Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Registered Company number: 103525

© tradingplatforms.com All Rights Reserved 2023

Scroll Up

XTB Online Trading

XTB Online Trading