How To Spread Bet on Shares in the UK 2025

If you are buying shares in the traditional sense – this is a long-term strategy that requires little in the way of research and analysis. However, if you’re looking to trade stocks on a short-term basis, it’s worth considering spread betting shares UK.

You can go long or short on your chosen stock, use leverage of up to 1:5, and your profits are exempt from capital gains tax. In this guide, we will explain the ins and outs of how spread betting shares UK works and how you can start trading commission-free today.

-

- 1. Pepperstone – The most suitable broker for advanced spread betting

- 2. XTB – Best platform for spread betting share CFDs

- 3. Avatrade – Leading trading platform with access to MT4 and MT5

- 4. Trade Nation – User-friendly spread bet broker with a regulated signals service

- 5. Admiral Markets – The best broker for spread betting on a variety of markets

-

- 1. Pepperstone – The most suitable broker for advanced spread betting

- 2. XTB – Best platform for spread betting share CFDs

- 3. Avatrade – Leading trading platform with access to MT4 and MT5

- 4. Trade Nation – User-friendly spread bet broker with a regulated signals service

- 5. Admiral Markets – The best broker for spread betting on a variety of markets

6 UK Spread Betting Providers

- XTB – one of the largest stock exchange-listed FX and CFD brokers in the world. As a constantly improving trading platform, it has undergone multiple upgrades and developments to remain competitive.

- Avatrade – has advanced trading tools and real-time market data, making it suitable for both beginners and experienced traders. This app allows users to trade on more than 1,000 markets, including foreign exchange, commodities, cryptos, indices, and stocks, commission-free.

- Trade Nation – provide low fixed-cost spreads that make it one of the most affordable options on the market. Trade Nation gives all the tools investors need to make wise trading choices

- Admirals – offers a highly diversified range of trading products and assets. This is especially helpful for traders who prefer to keep all of their positions in a single brokerage account.

- Pepperstone – another popular spread betting company that is regulated by the Financial Conduct Authority. You can access CFD shares markets at Pepperstone via MT4, MT5, or cTrade.

What Does it Mean to Spread Bet on Shares?

Spread betting is a widely used derivative tool used to speculate on the price movements of various financial markets, including foreign exchange, indices, commodities or shares, without taking direct ownership of the underlying asset. Instead, the approach involves betting on the expected direction of price movement, whether the market moves up or down.

In other words, an investor makes a bet by predicting the direction of the market, speculating whether it will move up or down from the moment the bet is accepted. They also have the autonomy to determine the amount they are willing to bet on their prediction.

How Does Financial Spread Betting Work?

The main concept when using a spread betting on shares is to determine whether a stock will rise or fall in value. However, you need to understand the underlying metrics of how financial spread betting works because it is different to traditional trading. Let’s start with ownership.

Financial Derivatives

Spread betting on UK stock markets is based on financial derivatives. This means that you are trading a derivative stock – you do not own the underlying asset. Of course, this also means that you have no shareholder rights – such as receiving dividends or voting at annual general meetings (AGMs). Instead, your trading platform simply allows you to speculate on the future value of the stock.

Spread Markets Move in Points

Spread betting markets move in points.

For example:

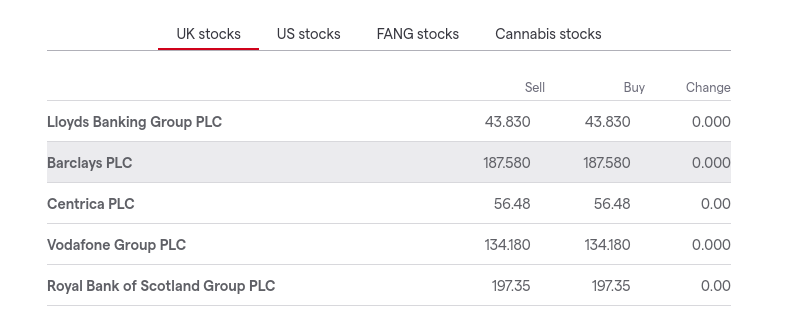

- Let’s say you are trading a UK-listed stock like Barclays – which is currently priced at 187p

- A few hours later─ Barclays stocks are priced at 190p

- This is a price movement of 3p – or 3 points

- If you had staked £2 per point – that would be a profit of £6

As you can see, in this example, 1 point movement amounts to 1p. In another example:

- Let’s say you are trading a US-listed stock like Apple – which is currently priced at $132.50

- The US markets are priced in dollars – so in spread betting, 1 point movement amounts to $0.01

- A few hours later─ Apple stocks are priced at 133.40

- This is a price movement of 90 cents – or 90 points

- If you had staked £2 per point – that would be a profit of £180

You need to check your chosen broker to assess how much one point movement amounts to – as this can and will vary.

Spread Betting Stakes

So now that you know that shares spread betting markets move in points, we now need to explain how stakes work. In a nutshell, you will be staking an amount for each point movement.

For example:

- If IBM stocks move by 10 points and you stake £3 per point – that’s a profit or loss of £30.

- Or, if AstraZeneca shares move by 100 points and you stake 50p per point – that’s a profit or loss of £50.

Once again, this is why it is important to know how the respective asset is priced. For example, there is a big difference between the market being priced at ‘1 point per 1p movement’ and ‘1 point per £1 movement’. In fact, this difference amounts to a factor of 100x.

Trade Duration

Spread betting is a short-term form of trading. This is because all markets come with an expiry date. This is what allows the sector to remain free from capital gains tax – as it is viewed as gambling in the eyes of HM Revenue and Customs. In most cases, day trading platforms hosting will offer the following trade durations:

- Daily Funded Markets: This market will expire on the same day that you place the position. Typically, this will close when the respective stock exchange closes.

- Quarterly Funded Markets: This market will close in three months’ time. This allows you to place trades with a longer-term strategy in mind.

When your trade does expire – it will be closed by the broker. Any profits or losses that you make from the trade will depend on the price that the position was opened and closed at.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.3% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

Spread Betting on Shares Explained

The main premise with spread bets is that you need to decide whether you think your chosen stock will increase or decrease in price. For example:

- You want to trade Tesla shares – which are priced at USD $730.50 at your chosen broker

- You think the share price will increase – so you place a buy order

- You enter a stake of £2 per point

- Later in the day – Tesla shares are worth USD $732.50

- As 1 point equates to 1 cent – this is a price movement of 200 points

- On a stake of £2 per point – you made a profit of £400

If you use a UK stock broker – you can always go long or short on your chosen stock. For example, if you think Tesla shares are overvalued – you could go short instead. This means that you will make a profit if the share price falls.

Spread Betting on Shares vs Investing in Stocks

Spread betting is very different from traditional stock investing. With the latter, for example, you buy a share and then hold it in your portfolio for months or years. Along the way, you may receive dividend payments from the company.

In the case of spread betting on UK stocks – you will be trading on a short-term basis. You may keep a position open for a few days, or in other cases, a few hours. Either way, you’ll be trying to make small profit margins from ever-changing stock market prices. For a better understanding what the difference is between spread betting and traditional stock investments – check out the bullet points below.

- Ownership: As noted above, when you spread bet shares – you do not own the underlying market shares. For this, you would need to buy the shares in the traditional sense via a stock broker.

- Stakes: When you buy shares, you will enter a total stake. For example, you might decide to buy £500 worth of Apple shares. You need to enter your stake per point.

- Margin: Many brokers allow you to trade on margin. This stands at just 20% – meaning you can trade with five times the amount you have in your account. This is not possible when you buy traditional shares.

- Long or Short: You can only go long when you buy shares at a traditional UK broker – meaning you think the stocks will increase in value. Most platforms also allow you to go short – meaning you can profit if the stock price declines.

- Duration: In most cases, the longest you can keep a position open is three months. When you buy shares in a conventional way – you can keep your investment open for as many years as you wish.

[stocks_table id=”1783″]How to Start Spread Betting Shares in the UK

The main concept of spread betting can be a bit confusing at first glance – which is why we suggest reading our guide in full. In summary:

- Step 1: First, join a commission-free broker. Pepperstone allows you to trade thousands of spread betting shares markets from 18 UK and international exchanges.

- Step 2: Meet the minimum deposit requirement of £200. Supported payment methods include debit/credit cards and e-wallets.

- Step 3: Search for the shares you wish to trade. For example, enter ‘Apple’ into the search box if you wish to spread bet Apple shares.

- Step 4: If you think the share price will rise or fall – place a buy or sell position, respectively.

- Step 5: Specify your stake per point and confirm the order at Pepperstone!

The Best Brokers for Spread Betting in the UK

To start betting on shares, you need to choose a broker that is available in the UK. Make sure that the broker is regulated by the Financial Conduct Authority, offers your preferred stock market and has competitive commissions. We discuss a selection of UK stock trading platforms that offer spread betting markets. Below is a list of some of the most trusted stock trading platforms on the market, where you can be confident in your stock bets.

1. Pepperstone – The most suitable broker for advanced spread betting

Pepperstone is another popular spread betting broker that is regulated by the Financial Conduct Authority. You can trade heaps of shares here – all on a commission-free basis if you opt for a Standard Account.

Alternatively, if you are a seasoned trader – it’s worth considering the Razar Account. This will get you the tightest spreads in the industry and a competitive commission of just $3.50 per slide.

You can access derivtaives markets at Pepperstone via MT4, MT5, or cTrade. This is particularly useful if you want to benefit from automated trading or deploy advanced technical indicators. There is no minimum deposit requirement at Pepperstone and the provider accepts Visa, MasterCard, Paypal, and bank transfers. On top of shares, Pepperstone also offers derviatives on commodities, currencies, indices, and if you’re a professional client – cryptocurrencies.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.3% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

2. XTB – Best platform for spread betting share CFDs

As one of the largest stock exchange-listed FX and CFD brokers in the world, XTB provides retail traders with instant access to hundreds of global markets. As a constantly improving trading platform, it has undergone multiple upgrades and developments to remain competitive.

Jakub Zablocki launched the XTB broker, which now has some of the most notable public figures as brand ambassadors. Connor McGregor, Joanna Jdrzejczyk, and Ji Procházka are among the XTB brand ambassadors. In 2002, it was launched as X-Trade, the first leveraged foreign exchange broker on the Polish market. Due to new regulations introduced by Polish markets, it was later rebranded as XTB.

Today, there are more than 525k users within the company’s network of branches located in over ten countries around the world. According to the XTB team, they have placed emphasis on technology development and the expansion of their product offerings, making it one of the most popular and successful online investment platforms of the present day.

In addition, it provides users with access to over 5700 financial instruments, and there are 1,850 stock CFDs available on XTB, making it extremely safe and secure. According to the source, in the first half of 2023 XTB reported a consolidated net profit of PLN 421,0 million compared to PLN 479,6 million a year earlier.

75% of retail investor accounts lose money when trading CFDs with this provider.

3. Avatrade – Leading trading platform with access to MT4 and MT5

Avatrade is another user-friendly spread betting platform that comes highly appreciated on Google Apps and was awarded the best forex trading app in 2020. Avatrade is also quite popular because it has advanced trading tools and real-time market data, making it suitable for both beginners and experienced traders.

This app allows users to trade on more than 1,000 markets, including foreign exchange, commodities, cryptos, indices, and stocks, commission-free. With its fully complete AvaOptions platform and its full support for MetaTrader 4 and Metarader 5, AvaTrade is considered one of the most popular trading platforms in the UK.

Furthermore, the AvaProtect feature provides an added layer of security and peace of mind for investors, minimizing potential losses and maximizing potential gains.

Even if there is a £100 minimum deposit required, many investors consider AvaTrade to be a relatively secure stock trading platform in the UK because no commissions are charged on CFD positions. This applies to all of AvaTrade’s stocks, bonds, currencies, commodities, and ETFs, with leverage of up to 5:1 for stock CFDs and 30:1 for currency CFDs. AvaTrade’s account opening process is also fairly quick, with six base currencies (including GBP) supported.

There is no guarantee that you will make any profits with this provider. Your money is at risk.

4. Trade Nation – User-friendly spread bet broker with a regulated signals service

Among the leading platforms offering stock trading and spread betting in the UK, Trade Nation has stood out for providing low fixed-cost spreads that make it one of the most affordable options on the market.

Trade Nation gives all the tools investors need to make wise trading choices. It contains a variety of learning supplies on day trading, MT4, technical tools and indicators, precise market signals, and current market information.

Both mobile and web devices are compatible with Trade Nation. The app offers all of the features found on the desktop trading platform and is accessible to both Apple and Android users. Trading professionals can use this platform to easily manage their portfolios while on the go.

Investors will be able to trade at as little as 0.0 pips thanks to its three-tier account system: Common, RAW, and TN Trader. The EUR/USD pair has a fixed spread of 0.6 pips, resulting in low broker fees. The rollover period has the potential to boost spreads by up to 1.4 pip. If you’re a trader in the UK searching for an app with an all-inclusive price structure, Trade Nation may be a good option to consider. Trade Nation was established in 2014 and provides more than 25 forex pairs, equities, commodities, and other products.

77% of retail investor accounts lose money when trading CFDs with this provider.

5. Admiral Markets – The best broker for spread betting on a variety of markets

As a broker specializing in CFD currency trading, Admirals offers a highly diversified range of trading products and assets. With nearly 4000 CFDs and 8400 tradable symbols to choose from, traders are likely to find exactly what they are looking for. This is especially helpful for traders who prefer to keep all of their positions in a single brokerage account, making portfolio management a lot simpler and more effective.

Admiral Markets has grown into an international financial group with access to over-the-counter markets in over 130 countries over the course of more than 20 years. The platform has 16 offices around the world that provide multilingual customer service. The company’s name was changed to Admirals after a rebranding in 2021, which allowed the platform to gain new integrated risk management solutions.

When selecting a trading platform or broker, any investor prioritizes the security of their funds. One distinguishing feature of Admiral Trading is that it prioritizes client security. Client funds are always accessible and kept separate from company capital in segregated accounts with the most reputable and secure banks.

Admiral’s provides additional fund cover of up to €100,000 for its clients’ protection. Investors can also trade shares in fractions with Admirals, allowing them to invest in stocks at a lower cost.

74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

How We Rated the Best UK Spread Betting Platforms

Our experts have selected the above platforms according to a number of important criteria. Some of these are:

- Access to hundreds of global markets – For example, XTB, as well as other platforms described in the guide, offer broad access to many global markets, as well as digital assets.

- Easy to use spread betting platform – We have selected options that are suitable for both beginners and advanced traders.

- Low fixed cost spreads – Trade Nation has distinguished itself by offering low fixed cost spreads, making it one of the most affordable options on the market. Trade Nation provides all the tools investors need to make smart trading decisions.

- Security and Regulation – All platforms are regulated and authorised by the FCA in the UK – the conduct regulator for thousands of financial services firms and financial markets in the UK.

How To Spread Bet on Shares in 2025

We are now going to walk you through the process of spread betting on shares using Pepperstone. This is inclusive of opening an account, depositing funds, and placing your first position.

Step 1: Create an Account

Open a free account at a reputable trading platform. All you need to do in this step is provide some personal information and contact details. This should take no more than a few minutes.

Step 2: Upload ID

You will now be prompted to provide a copy of your government-issued ID (passport or driving license). This is part of the KYC (Know Your Customer) process demanded by the Financial Conduct Authority.

Step 3: Deposit Funds

To access the live market – you will need to deposit some funds into your account. You can use a debit/credit card or e-wallet to fund your account instantly. When using the aforementioned payment types – the minimum deposit is just £20.

Step 4: Search for Shares

Hover your mouse over the ‘Markets’ button at the top of the page and click on ‘Shares’. You can now find your chosen market by using the filter button. This can be broken down by the location of the market (e.g. UK, US), or the industry the company operates in (e.g.energy, healthcare).

If you already know which shares you want to trade – you can use the search box.

Step 5: Place Spread Bet

You now need to set up an order.

- Buy/Sell: Choose from a buy order if you think the share price will rise. Or, place a sell order you think the share price will decline.

- Stake: You need to enter your stake for each point movement. For example, £2.50 per point.

Finally, confirm the order the platform will execute your position instantly.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.3% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

Advantages of of Trading with Spread Bets

If you’re still on the fence about whether or not spread betting is right for you – below we discuss the key benefits that could see you make the switch.

UK tax benefits

Many inexperienced investors in the UK are unaware of their tax obligations when buying shares. In fact, you will potentially need to pay tax on three fronts.

- Stamp Duty: When you purchase shares listed on the London Stock Exchange – you need to pay stamp duty tax. This stands at 0.5%. For example, if you buy £10,000 worth of Vodafone stocks, you’ll pay £50.

- Dividends Tax: Every time you receive a dividend, you’ll need to pay a tax. The first £2,000 is tax-exempt each year in the UK – so anything over this figure will be taxed by HMRC.

- Capital Gains Tax: If and when you sell your shares at a profit – this will be liable for capital gains tax. For example, if you bought the shares for £2,000 and sold them at £3,000 – tax would be liable on the capital gains of £1,000.

Now, all three of the above tax obligations can be alleviated in their entirety by using broker. This means no stamp duty to enter the market and no dividend or capital gains tax on your profits!

Rising and Falling Markets

As we briefly noted earlier, spread betting allows you to profit from both rising and falling markets. For example, if you think that Babcock shares are overvalued – you simply need to enter a short position. Or, if you think that Royal Mail shares are undervalued, you’ll be placing a long position. This gives you lots of flexibility as you can target profits irrespective of how the wider stock markets are performing.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.3% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

Leverage of 1:5

UK retail clients can enter positions with leverage of up to 1:5. This means that you can trade with five times the amount you have in your spread betting account. For example, if you stake £10 per point and your position grows by 7 points – this would ordinarily result in a profit of £70. But, with leverage of 1:5 applied to this position – your 370 profit is amplified to £350.

Spread Betting Strategies

In many ways, investing in shares in the traditional way is relatively straightforward. For example, you can have a diversified basket of blue-chip stocks to your portfolio and leave them sitting idle for many years or even decades.

However, as you will be approaching the markets on a short-term basis – you’ll need to have a number of strategies at your disposal. This will ensure that you have clear financial goals and most importantly – an entry and exit strategy on each position you place.

Below we discuss different strategies UK traders could potentially use, and things to consider for newbies entering this marketplace for the first time.

Earnings Reports

A popular way to carry out spread betting is to focus on earnings reports. This is something that all publicly-listed companies must provide to the general public – which is on a quarterly basis. The earnings report essentially gives us a snap-shot overview of how the company has performed over the past three months.

This will include figures surrounding profits, revenues, debt, and more. Put simply, if the earnings report exceeds market expectations – you might consider entering a long position at your chosen broker. On the other hand, if the earnings report does not meet expectations – you’d want to enter a short position.

Dividend Announcements

Another strategy to consider is to look out for company dividend announcements. This is because there is a very strong correlation between the size of the planned dividend yield and the company’s stock price. That is to say – and in theory at least, if the company announces a dividend yield of 2% – the stock price will decline by 2%.

This is because the company is effectively worth 2% less – as it is distributing money to shareholders at 2% of the firm’s current stock price. This means that you can attempt to profit from this by entering a short position at your chosen trading platform once the dividend announcement has been made.

Note: You can view upcoming dividend announcement dates here.

Short-Term Dips

We would also suggest keeping an eye on short-term stock price dips. By this, we mean a stock price decline that is not warranted. Instead, this decline might be an overaction of a recent news development.

- For example, when it was announced that the Chinese government would be investigating Alibaba for breaching anti-monopoly laws – its stock price tumbled.

- This was based on nothing more than fear and uncertainty.

- However, those that spent the time researching and analyzing the fundamentals of Alibaba’s business model and balance sheet would have known that the stock price decline was not warranted.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.3% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

Top Tips for Spread Betting on Shares in 2025

Before you start spread betting in 2025, it is a good idea to familiarize yourself with spread betting best practices. Here are some top tips for spread betting in the UK.

Only Trade During Standard Market Hours

In many cases, shares betting brokers UK allow you to trade stocks 24 hours per day. This means that you can spread bet outside of standard market hours. However, we would suggest avoiding this – as during the evening and weekend volatility is much higher. Additionally, the spreads are also less competitive – meaning that you are paying more to access the market.

Start With a Demo Account

Demo accounts are a way to learn how spread bets work without needing to risk any of your capital. This will usually mirror live market conditions – in terms of pricing, volatility, and liquidity. Stay in demo mode until you feel ready to start trading with real money and you have the correct risk management tools in place.

Prioritize Blue-Chip Stocks

It’s also an idea to stick with blue-chip stocks when you first start out. This is because blue-chip stocks are a lot more stable and a lot less volatile. As such, you’ll want to focus on FTSE 100 shares listed on the London Stock Exchange. Similarly, both the New York Stock Exchange and NASDAQ in the US are home to hundreds of established blue-chip companies.

Conclusion

If you’re interested in trading stocks on a short term basis, then you’ll probably be interested in shares spread betting. This trading arena comes with 1:5 leverage, the ability to go long or short on your chosen stock, and all profits are tax free. In this article we have discussed some of the popular platforms where you can spread betting on shares. All the options we have chosen are safe and regulated, so it is important that you choose the broker that suits your needs.

FAQs

What is shares spread betting UK?

When you 'spread bet shares' - you are simply looking to predict whether the stock price increases or decrease in the near future. You won't own the actual shares - as financial spread betting instruments are derivatives.How much can you make from spread betting shares UK?

There are two key metrics that will determine how much money you can make from a spread betting on shares trade. Firstly, this will depend on the amount you stake per point. Secondly, your profit will be dictated by how many points the shares moved in your direction. For example, if you staked £10 per point and the shares increased by 20 points - that's a profit of £200.What are the risks of spread betting shares?

The risks involved when you spread bet shares are the same as any other trading sector. That is to say, if you speculate on a stock incorrectly - you will lose money.Is shares spread betting tax-free?

Yes, in the UK and Ireland, spread betting is tax-free. This means no capital gains tax on your spread betting profits! These favorable tax laws also mean that you won't pay any stamp duty.How much do you need for spread betting shares UK?

There are two minimums you need to look for when choosing a shares spread betting platform. Firstly, you need to check the minimum deposit. At Pepperstone - this is just $200. Secondly, you need to check the minimum stake per point. This is usually just 10p - but do check this before signing up with a broker.Who regulates spread betting in the UK?

Spread betting brokers in the UK are regulated by the Financial Conduct Authority.What is margin in spread betting?

Margin allows you to enter a spread betting position at a greater amount than you have in your trading account. For example, if you are spread betting shares in the UK - the margin requirement is just 20%. This means that you only need to put up one-fifth of the total stake size.References:

“https://www.youtube.com/watch?v=55JgR3FI_GA”

“https://www.youtube.com/watch?v=V6cNJyurbyA”

“https://www.investopedia.com/terms/p/portfoliomanagement.asp”

“https://www.yourmoneyfurther.com/personal-money-solutions/investing/7-types-of-traditional-investments-to-consider”

“https://www.financemagnates.com/thought-leadership/spread-betting-a-way-to-trade-the-markets-in-the-uk/”

“https://ir.xtb.com/en/xtb-financial-results-for-the-1st-half-of-2023/#:~:text=In%20the%20first%20half%20of,PLN%20267%2C8%20million).”Kane Pepi Finance Writer

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Kane has also written for websites such as MoneyCheck, InsideBitcoins, Blockonomi, Learnbonds, Buyshares n and the Malta Association of Compliance Officers.

Before starting his career as a writer, Kane studied at the University of Central Lancashire where he received a Masters Degree in Financial Investigation and then a Research Doctorate in Criminal Justice. Pepi is passionate about helping people to make informed decisions through high-quality, educational content.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

By continuing to use this website you agree to our terms and conditions and privacy policy.Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Registered Company number: 103525

© tradingplatforms.com All Rights Reserved 2023

Trade Nation gives all the tools investors need to make wise trading choices. It contains a variety of learning supplies on day trading, MT4, technical tools and indicators, precise market signals, and current market information.

Trade Nation gives all the tools investors need to make wise trading choices. It contains a variety of learning supplies on day trading, MT4, technical tools and indicators, precise market signals, and current market information.