eToro Review UK 2025 – Low Fees Trading Platform

eToro has more than 20 million users and offers low-fee trading across thousands of assets. In our eToro review UK, we discuss the key features of the broker, including the proprietary platform, user experience, and account types. We’ll also cover the key metrics such as fees, financial instruments, commissions, payment options, regulations, and more.

To maintain an unbiased position, we tried the platform out for ourselves. The information provided below is based on our experience as well as the experiences of other eToro users. However, there is no guarantee that your experience will be the same. It is a good idea to research trading platforms thoroughly before putting any money at risk.

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

What is eToro?

eToro is an all-in-one online trading platform that provides social trading features as well as traditional trading tools. First and foremost, the broker is regulated by the Financial Conduct Authority and the Financial Services Compensation Scheme and strictly follows the Markets in Financial Instruments Directive (MiFID), meaning the platform follows proper financial.

First launched in 2007, eToro has been a pioneer in online trading after popularizing social trading and copy trading. Being one of the first platforms to offer these features, eToro has paved the way for other brokers to follow suit.

Additionally, eToro customers have the option of trading among thousands of stocks, cryptocurrencies, commodities, forex currency pairs, indices, and ETFs. Not only is there a wide range of markets available for investing in through eToro but users can trade many of them with low commissions.

With so many different financial assets available for trading, eToro also makes sure to couple the trading experience with excellent educational resources and market analytics.

Finding assets to trade is simple and the charts and tools provided are clear and sufficient. Furthermore, all accounts come with a demo trading account that starts with $100 thousand in virtual equity for anyone to learn how to trade or test out new trading strategies. These options are both available on the web platform and on the mobile app.

eToro supports both short term and long-term trading strategies. For long term investors, the platform provides ready-made investment portfolios and ETFs.

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

What Can You Invest in and Trade on eToro UK?

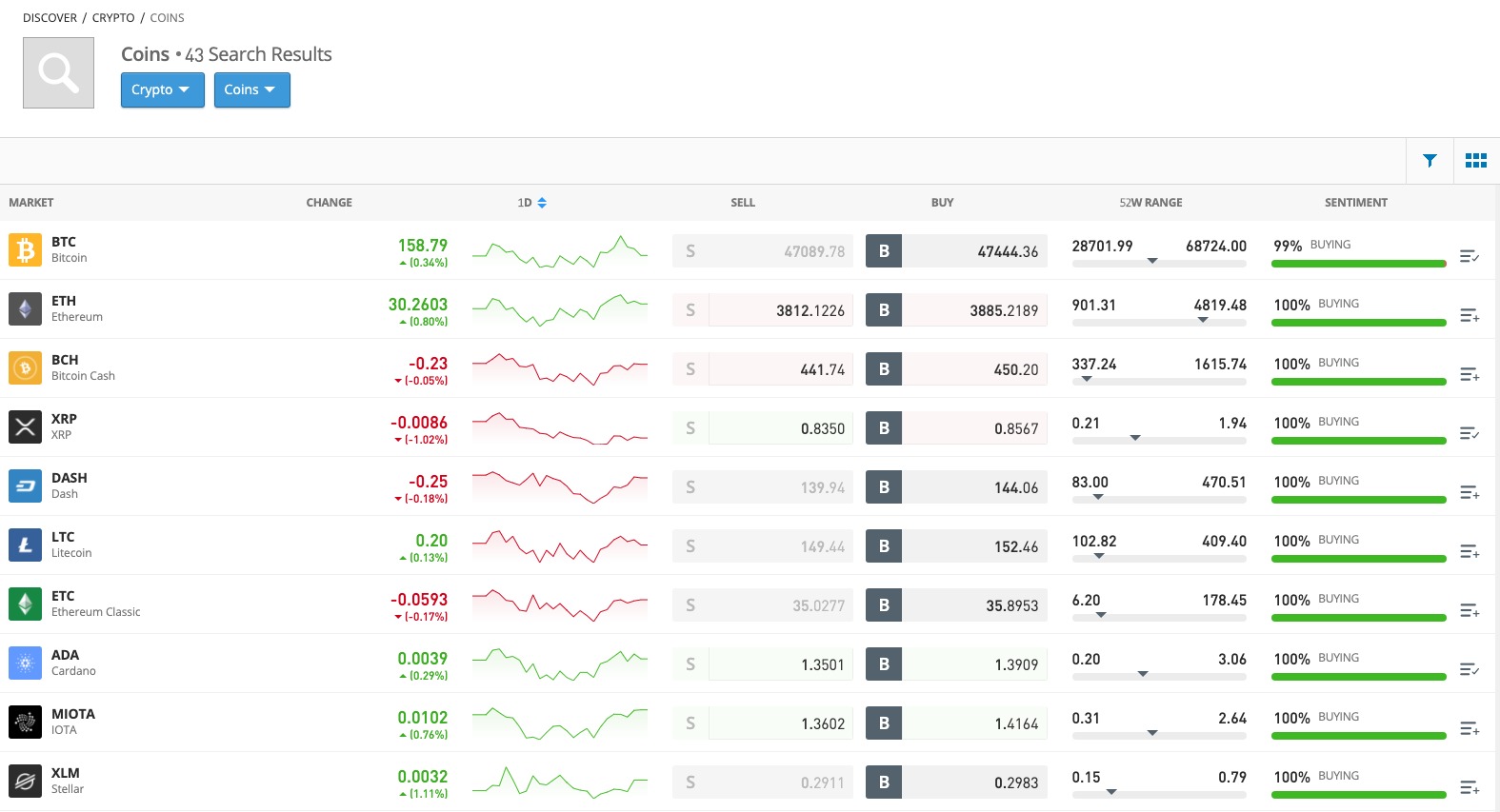

eToro supports the trading of 2,689 shares, 13 indices, 32 commodities, 49 forex pairs, and 42 different cryptocurrencies. In this section of our review, we take a closer look at the different assets that are available to trade on eToro.

eToro also gives users the option of trading with leverage through CFDs. This means that users can bet on the price difference of an asset using borrowed capital from the platform. This allows users to place higher stakes that could potentially lead to higher profits. However, leverage also increases trading risk.

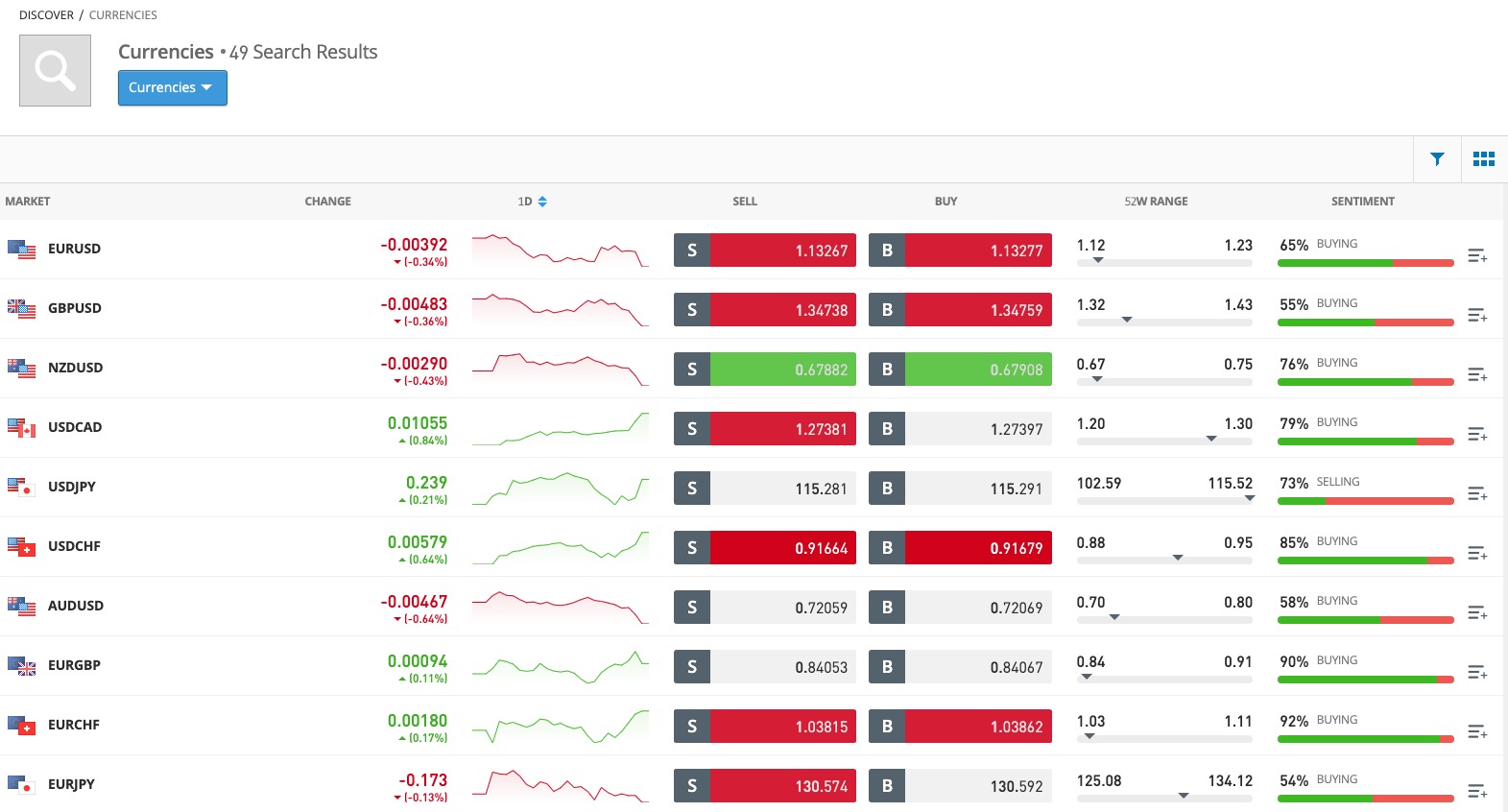

Forex

Forex is the largest traded market to date with over $6 trillion worth of assets being exchanged every day. Of course, eToro UK review found out that eToro has some financial instruments in forex, namely its 49 forex pairs available for trading. These include major pairs such as EUR/USD and USD/JPY and minor pairs such as GBP/CAD and USD/TRY.

Leverage of up to 20:1 is available in forex trading for the standard toro account. Those looking to trade forex should note the spread for eToro which starts at 1 pip for EUR/USD but usually increases with other pairs.

Alternatively, there are copy traders and copy portfolios that dabble in currency pairs, so another option for those looking to invest in Forex is to find a copy trader with a suitable portfolio for you. All forex trading with eToro is through CFDs and incurs daily overnight and weekend fees.

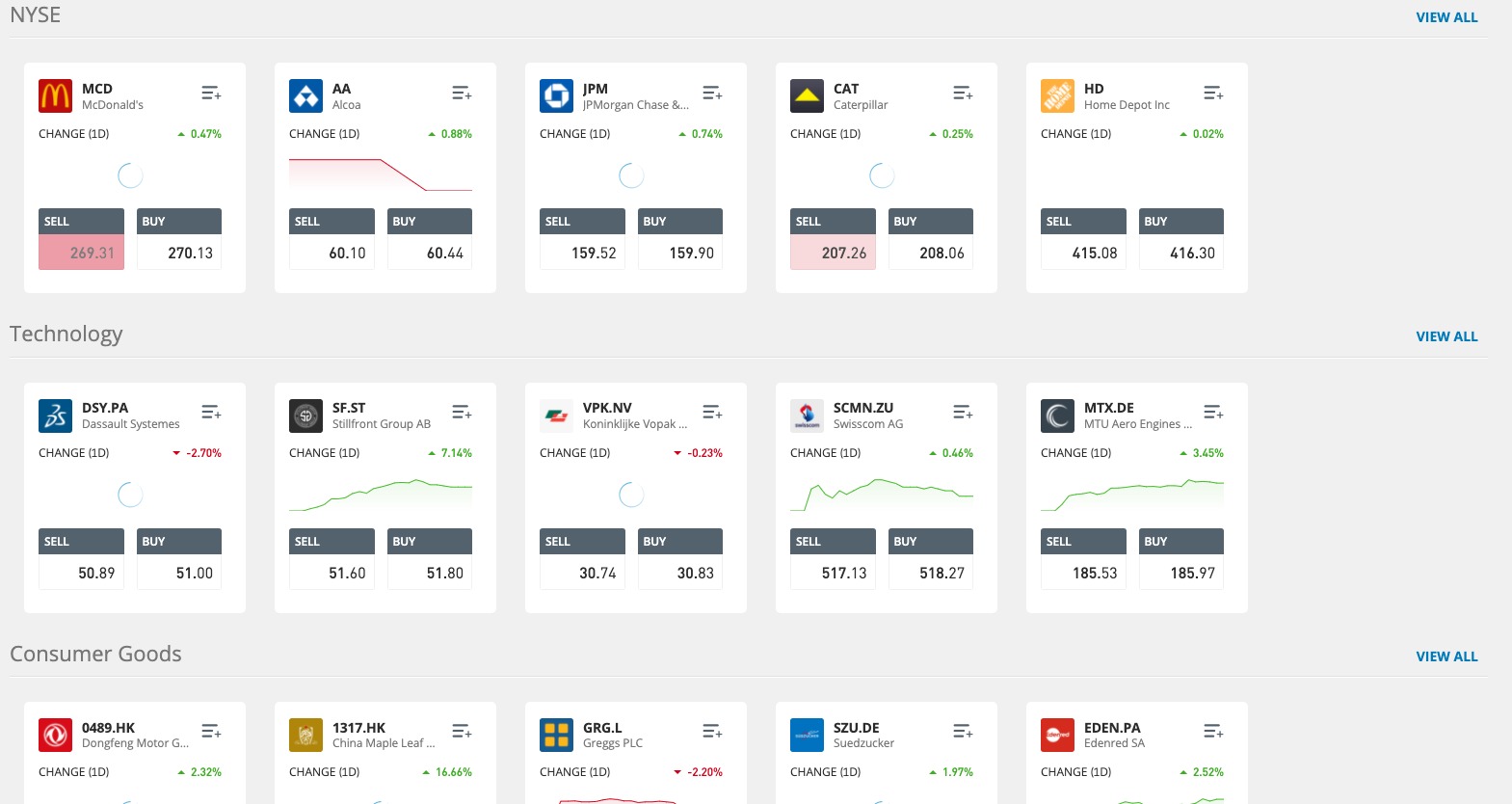

Stocks

Aside from the NYSE and NASDAQ, eToro offers stock trading from 15 other international markets. Among them are markets from Frankfurt, London, Paris, Madrid, and Milan. Of course, you’ll only be able to trade in these markets during their respective market hours.

eToro supports traditional stock trading whereby traders buy the underlying asset. This means, users can hold that stock without any additional cost, which is suitable for long term trading strategies.

In this eToro UK review, we found that both leveraged and unleveraged trading is available for stocks in eToro, users can use different trading strategies when it comes to share trading. They may opt to buy stocks for the long term as well as buying for the short term.

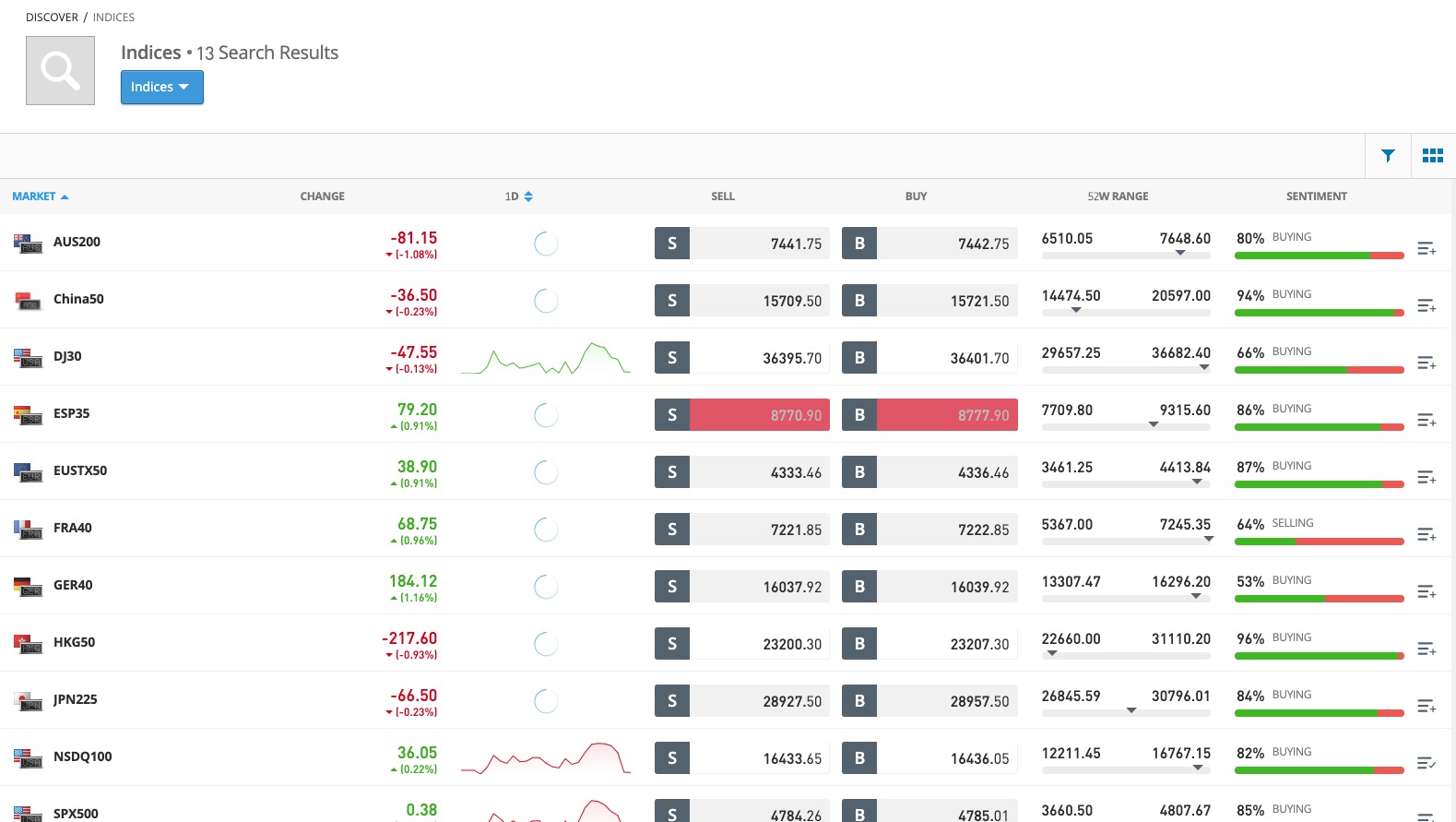

Indices

There are 13 available indices to trade from, including SPX500, DJ30, and the China50. The maximum leverage that’s possible for these assets in a standard account is 10:1. Only CFD trading is available for indices, so users have the option of going long or short but must pay overnight fees for held positions.

eToro provides a range of educational materials and analytics that are relevant to indices trading. The platform explains what you need to know when trading the index including what drives the price, current volatility, and demographics involved. However, the content is for educational purposes and should not be taken as investment advice.

Users can also look for copy traders that invest in indices. Usually, indices are held long term but they can also be traded in the short term depending on the market and news.

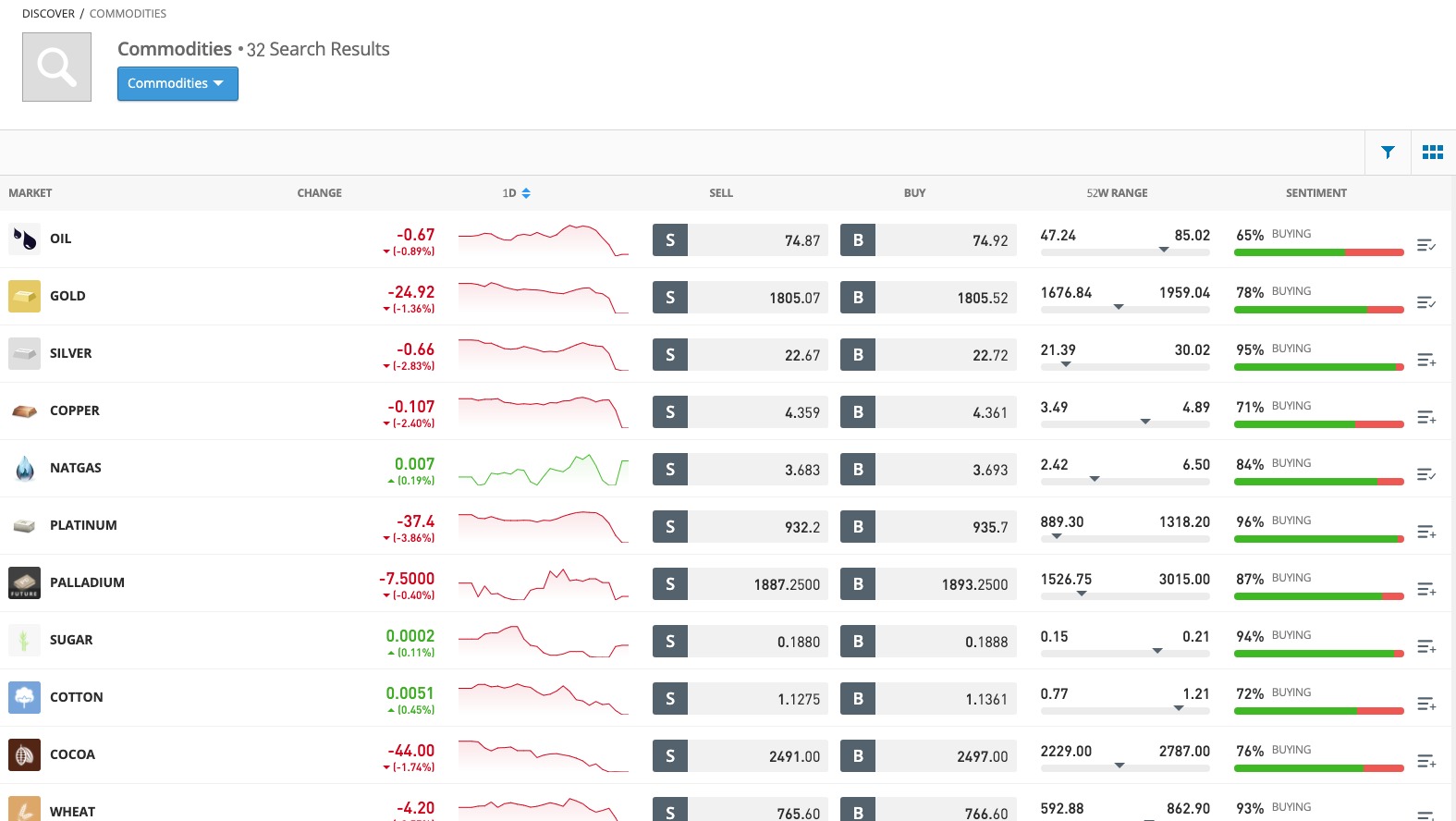

Commodities CFDs

There are 32 tradable commodities on eToro, traders looking to diversify their portfolios will have many different options to choose from. Copper, Aluminum, Gold, Oil, and Natural Gas are among the available commodities.

All commodities trading on eToro is done through CFDs with leverages of 2:1, 5:1, and 10:1. Additionally, all tradable commodities come with some technical analysis as well as educational resources. The content is for educational purposes and should not be considered investment advice.

Cryptocurrencies

A lot of trading platforms have already incorporated cryptocurrencies into their systems and eToro is no different. In our eToro crypto review, we found there to be 42 cryptocurrencies on the platform such as Bitcoin, Ethereum, and Litecoin.

In addition to having cryptocurrency trading, eToro also has a crypto wallet that allows for the storage of digital currencies. As stated on their site, the eToro crypto wallet is one of the safest crypto wallets available, with several high-level security features to protect against unauthorized access, including multi-signature facilities, DDoS protection, and standardization protocols.

There are currently no CFD options when trading cryptocurrencies, meaning all digital coins being traded can only be bought long and no options for shorting coins exist as of the moment. Despite this, there are many copy traders who incorporate cryptocurrency trading in their portfolios.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more. "

eToro UK Fees & Commissions

When it comes to any trading platform, one of the key things to look out for is the trading fees and commissions. High costs can make it difficult to make a return on investment.

As mentioned above, eToro offers relatively low fees across the platform. The fees that you may come across while using eToro are listed below.

| Trading Fee | Charge |

| CFD trading | Varying spreads; Overnight on leverage is not included in the spread |

| Forex trading | From 1 pip spreads; Overnight on leverage is not included in the spread |

| Crypto Trading | 1% Commission |

| Share CFD leverage | Up to 5:1 |

| Indices CFD leverage | Up to 20:1 |

| Commodities CFD leverage | Up to 10:1 |

| Forex CFD leverage | Up to 30:1 |

Here’s a breakdown of the non-trading fees:

| Non-trading fees | Charge |

| Overnight Fee | Overnight fee charge of CFD traded stocks, indices, commodities, and forex is based on the total value of the position and amount of leverage used. |

| Deposit Fee | Varying commissions |

| Withdrawal Fee | $5 |

| Inactivity Fee | $10 per month after 1 year of inactivity |

| Account Fee | None |

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more. "

eToro UK User Experience

With its own proprietary trading platform, eToro provides users with a clear platform design. Their platform has an intuitive interface that is straightforward to navigate. As for security, they have two-factor authentication and KYC requirements which have been put in place to protect users.

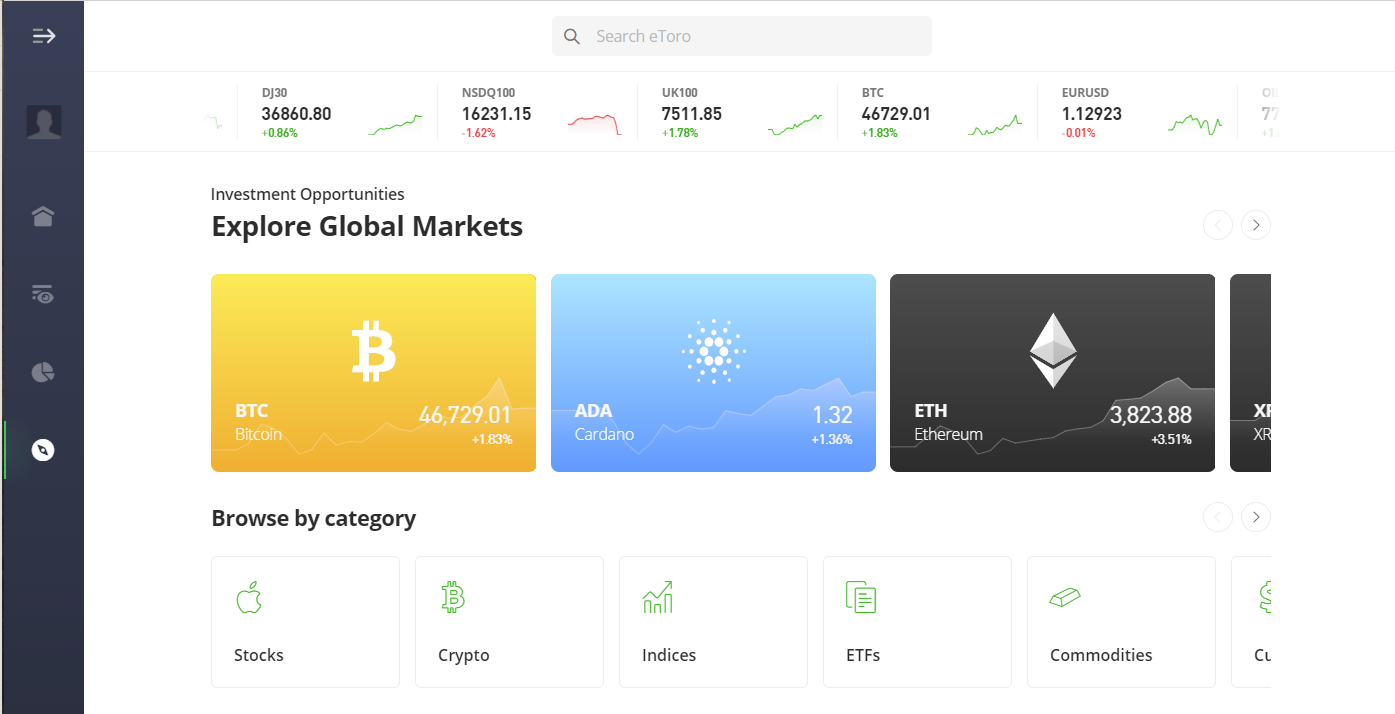

The eToro homepage is clear and user-friendly, it features investment opportunities in different global markets.

eToro’s search function not only shows relevant information but also gives access to the different public users as well. This means that users can search more than assets and find the potential copy portfolio or copy trader they’re looking for.

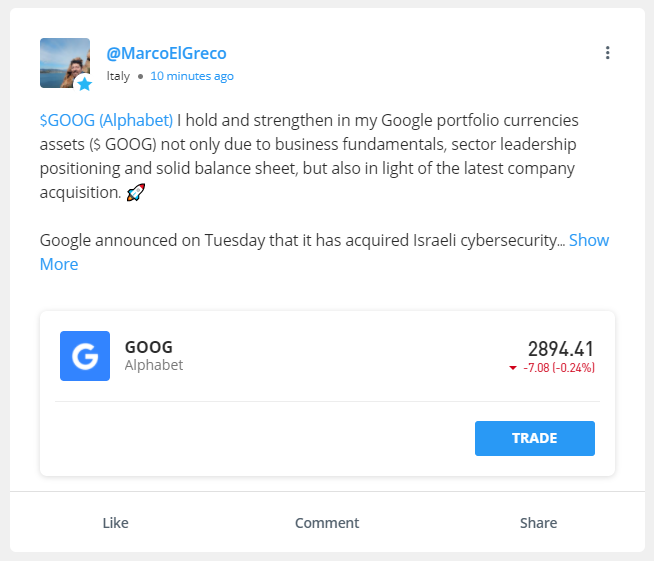

Users can keep their accounts open to the public, meaning anyone in the eToro platform can view their trade positions and whether or not they create new ones. In fact, eToro gives its users the option of automatically posting whenever they start a trade. This creates a sense of community and transparency.

eToro UK Features, Charting, and Analysis

eToro UK offers copy trading, which allows its users to copy the portfolios of other investors who have been picked by the platform. These are usually professional traders or investors with financial backgrounds.

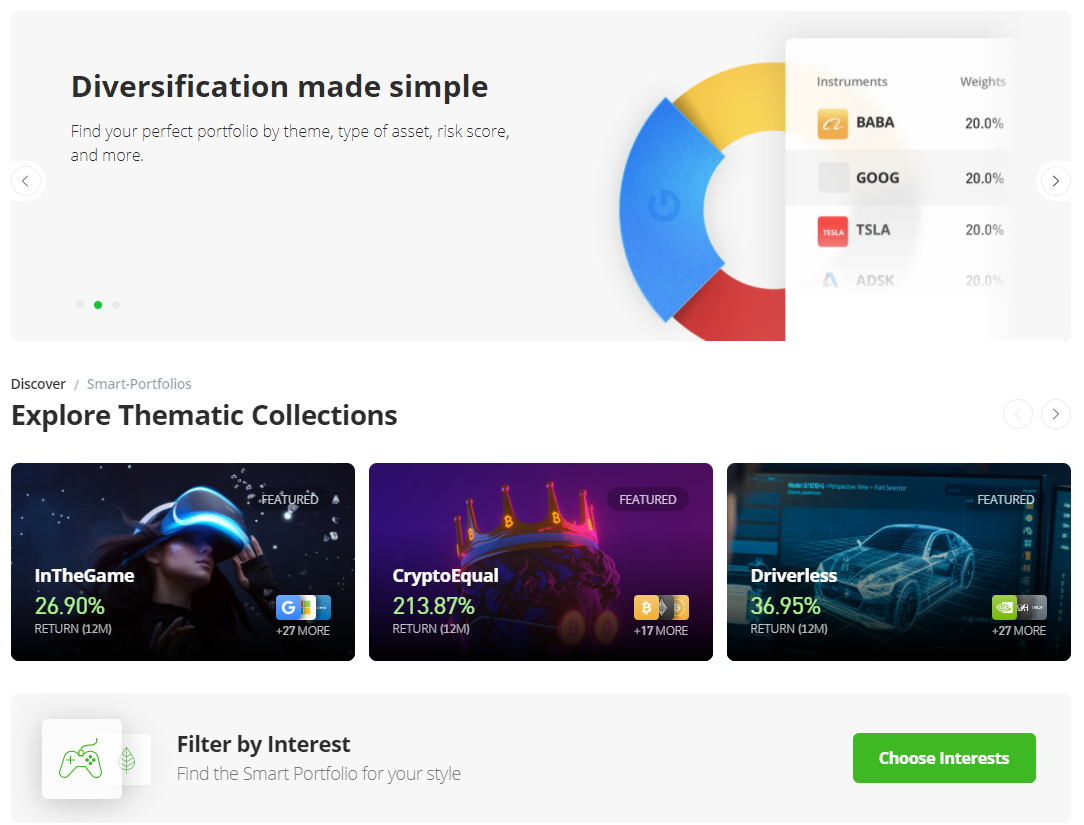

Additionally, eToro also offers Smart Portfolios. Smart Portfolios are a pre-selected portfolio of assets that are suitable for long-term investors. These portfolios are created by experts and make it possible for users to diversify their investments with the help of professional analysis. However, Smart Portfolios do not guarantee returns.

When it comes to charting, eToro has a range of tools and technical indicators for trading. Aside from being able to choose the style of the chart which is usually either the candlestick pattern or the simple line, review eToro has also fount other tools that are available such as being able to view the Relative Strength Index (RSI), Moving Averages (MAs), and Fibonacci sequences to name a few. More tools are available in eToro’s Procharts.

Finally, eToro’s professional analyses can be seen by users to assit there own research. To view them, simply click on the Stats tab of that asset to see the educational resources available. For example – when looking at Amazon’s stats, eToro shows a financial summary, stock overview with some technical analysis, and a stock profile. All of this information can help users in their investment decision-making.

There’s also a corporate account available in eToro but it is reserved to be the trading account for companies. On the other hand, eToro’s Islamic Account is a special account for Muslim traders or anyone who wishes to trade swap-free in Forex.

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro UK Mobile App Review

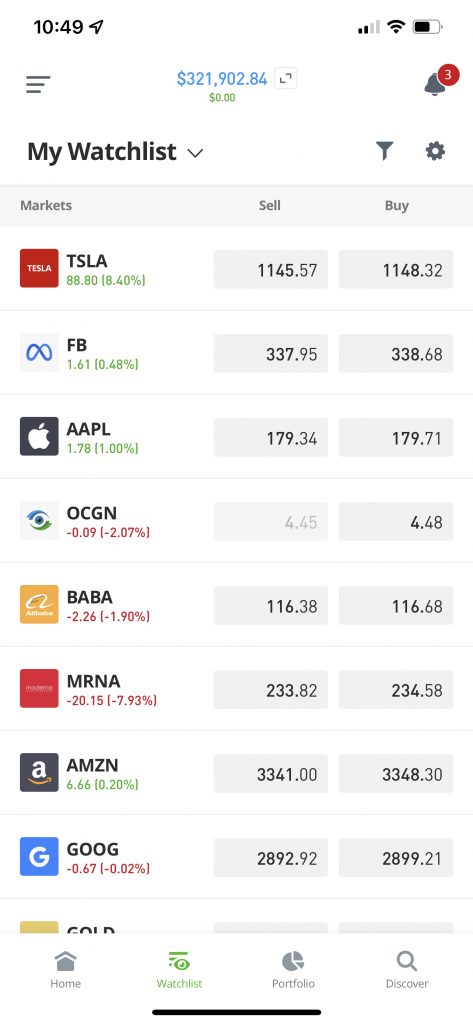

The financial markets are volatile and can move quickly. This means that many users will need to check their positions and possibly make new ones on the go. eToro has a mobile trading app that is compatible with iOS and Android devices and provides a clean interface and design.

Everything that can be done through the desktop platform can be performed in the mobile app. In our eToro app review, we found that one of the useful features for the mobile app is price updates and trends. When your positions have reached their respective stop loss or take profit levels, you’ll be duly notified if you have notifications enabled on the device.

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro UK Deposit and Withdrawal Methods

The minimum deposit for standard accounts on eToro is $50 for US and UK residents.

Supported payment types include:

- Debit cards

- Bank transfer

For withdrawals, a $5 fee is charged per withdrawal, unless you have a platinum-level account or above which is exempt from such fees.

eToro UK Customer Service

eToro has customer support that operates at the industry standard, 24 hours a day, 5 days a week. You can contact the support team via their live chat facility which is accessible by logging into your account. Higher-tiered accounts even have access to a dedicated account manager that you can personally email and schedule calls with.

For issues that can be resolved by the user, there is also a detailed FAQs page on the platform. If the help or information provided isn’t sufficient, users can open a ticket about their issue and send it to the eToro Help Center where it will be addressed during operating hours.

Our Verdict on Etoro

Our eToro review has provided an in-depth look at the features offered by this trading platform. eToro is a all-in-one online trading platform that facilitates traditional stock trading as well as social trading and copy trading.

eToro offers low commissions and access to multiple markets including forex, cryptocurrencies and ETFs. eToro is also available on mobile which makes it suitable for trading on the go.

Opening an account with eToro requires some personal details and a valid form of ID. You must also make a minimum deposit of $50 to use the platform in the UK.

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

FAQs

Can eToro be trusted?

What is the downside to eToro?

Is it easy to withdraw money from eToro?

How much money do I need to start on eToro?

References:

- https://www.etoro.com/customer-service/help/598006/what-is-etoro/

- https://en.wikipedia.org/wiki/EToro

- https://www.youtube.com/@etoro

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.