Best Bitcoin Wallet for UK Traders in June 2025 – Pros & Cons

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

If you’re looking to invest in Bitcoins in the UK, you will need to hold a crypto wallet that can be used to store the tokens safely.

In this case, it is important for you to be aware of the different crypto wallets that are available for you to choose from, in addition to knowing the various peculiarities of different Bitcoin wallets that you can choose from. In this guide, we review the various Bitcoin wallets and provide you with a bit of background information on how these Bitcoin wallets work.

-

- 1. Coinbase – The Best Bitcoin Wallet for iPhones and iOS Devices

- 2. ZenGo – Best Bitcoin Wallet With Strong Security Level

- 3. Crypto.com – Top Crypto Exchange in the UK with Native Wallet for Bitcoin

- 4. Margex – Best Bitcoin Wallet For Beginners With Educational Material In The UK

- 5. Revolut – Excellent Trading Platform and Wallet to Buy Bitcoin in the UK

- 6. Binance – The Best Bitcoin Wallet for Android Devices

- 7. CoinJar – Best Bitcoin Wallet UK for Long-Term Investors

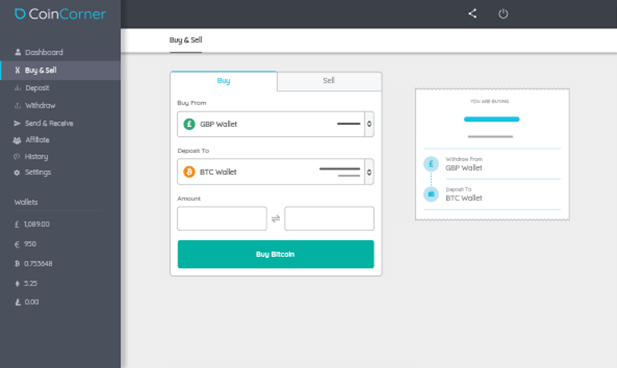

- 8. CoinCorner – The Best Bitcoin Wallet UK for Beginners

-

- 1. Coinbase – The Best Bitcoin Wallet for iPhones and iOS Devices

- 2. ZenGo – Best Bitcoin Wallet With Strong Security Level

- 3. Crypto.com – Top Crypto Exchange in the UK with Native Wallet for Bitcoin

- 4. Margex – Best Bitcoin Wallet For Beginners With Educational Material In The UK

- 5. Revolut – Excellent Trading Platform and Wallet to Buy Bitcoin in the UK

- 6. Binance – The Best Bitcoin Wallet for Android Devices

- 7. CoinJar – Best Bitcoin Wallet UK for Long-Term Investors

- 8. CoinCorner – The Best Bitcoin Wallet UK for Beginners

How to Sign Up for a Bitcoin Wallet in the UK

You can sign up for a Bitcoin wallet in the UK in 3 steps:

- Choose a Wallet: While there are a lot of different wallets that you could choose to use for the purpose of storing your Bitcoins, we recommend using Coinbase’s cryptocurrency wallet. It supports over 200 currencies and allows you to interchange between them using Coinbase’s exchange service.

- Download the Wallet: Once you have selected the wallet that you wish to use, the next step is for you to search for ‘Coinbase Wallet’ in the Apple App Store or Google Play and download it to your mobile device. You can also download the wallet as a browser extension on Chrome or Edge.

- Create a Wallet Account: Once you have downloaded the app, create a new Coinbase wallet account with your email. Use the same email that you used to set up your Coinbase trading account. Once your wallet is set up, you’re ready to start storing and sending Bitcoins and the other supported cryptocurrencies through your wallet.

Bitcoin Wallets in the UK 2025

- Coinbase – Coinbase provides a comprehensive wallet which is functional with thousands of tokens, NFTs and can be used to access web3 applications across various blockchains. The Coinbase Wallet allows users to explore decentralized web applications via desktop and mobile devices. It is a self-custody wallet which can be linked to users’ Coinbase accounts.

- Zengo – A self-custodial wallet without vulnerability of a seed phrase. Zengo uses multi-party computation (MPC) technology which is one of the safest cryptographic techniques for wallet security. The Zengo wallet currently supports 120+ cryptocurrencies including Bitcoin.

- Crypto.com – The Crypto.com DeFi wallet allows users to store, manage and swap over 1000+ tokens across 30+ different blockchains. This wallet is primarily available for mobile devices on iOS and Android, with a browser extension available for desktop. Users can swap tokens within the app and migrate assets between different chain through its in-app bridging feature.

- Margex – An exchange platform with a dedicated wallets page where users can manage their crypto asset holdings. Margex is limited in the number of tokens it supports, however, users can manage and store some of the most popular cryptos including Bitcoin, Ethereum and USDT.

- Revolut – Revolut is a global neobank providing an all-in-one finance and money management mobile application. Users can buy, sell and store over 80+ popular cryptocurrencies including Bitcoin, Ethereum and Solana. Revolut is a convenient way to purchase crypto using fiat directly within the app due to its banking features with the platform supporting 36 global fiat currencies.

- Binance – Binance is one of the leading cryptocurrency exchanges where users can buy, sell, trade and store over 350+ crypto assets. Binance has a wallet section where users can store popular cryptos such as Bitcoin, Ethereum and others which are listed on their platform. The platform uses secure encryption for their wallets and assets are stored 1:1 off-chain in cold storage.

- Coinjar – An all-in-one crypto wallet on Android and iOS. Users can send and receive 50+ cryptocurrencies with dee-dree transfers between CoinJar wallets. The platform uses BitGo and Fireblocks which are trusted institutional grade crypto custodians.

- CoinCorner – A cryptocurrency brokerage firm that allows users to send money via the Bitcoin Lightning network to 8 African countries and the Philippines. Users can store, manage and transfer Bitcoin and other cryptocurrencies, while also setting up recurring buys for regular instant crypto purchases.

Bitcoin Wallets UK 2025

In order to buy Bitcoins and store them, the first thing you need to do is to identify a good wallet provider. Often, wallet providers are also trading brokers, and you can simply trade through them, upon which point your cryptocurrencies will be stored on their wallets. On the contrary, some crypto trading platforms do not have their own wallets, and you can connect your own wallets to their platform and trade through that. A list and a detailed review of some of the top Bitcoin wallets that you can trade through have been given below.

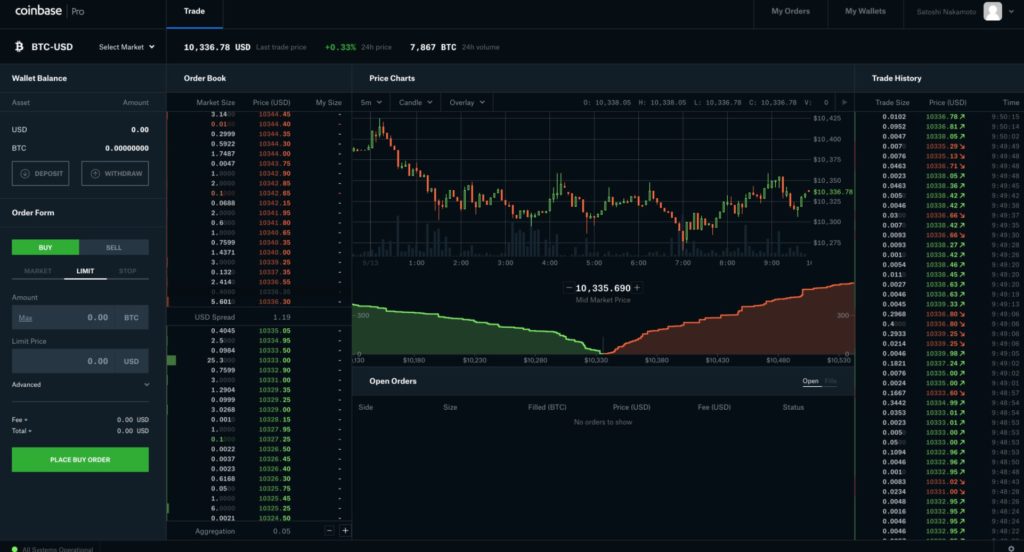

1. Coinbase – The Best Bitcoin Wallet for iPhones and iOS Devices

Over 100 tradable cryptocurrencies such as Bitcoin, Ethereum, and Cardano are offered through Coinbase, a cryptocurrency trading, and investing platform. Over 73 million users access Coinbase, which has more than $255 billion in assets under management. You can use Coinbase primarily for its digital wallet. This is available in two forms – through the Coinbase website or via a native mobile app. If opting for the former, it’s just a case of sending your Bitcoin into the unique wallet address that Coinbase gives you.

Alternatively, if you want the convenience of being able to access your Bitcoin on the move, then the Coinbase wallet app is likely to be more up your street. You can download the wallet onto your Android or iOS phone free of charge. The wallet is backed by heaps of security features – including two-factor authentication. This requires you to enter a code that is sent to your mobile phone before you can access your Bitcoin wallet.

Simple buy and sell orders are likely to be preferred by beginners on the original Coinbase platform. However, Coinbase Pro, available to all Coinbase users, offers more advanced features and order types.

In general, digital currencies are an emerging asset class that can be risky and volatile, making them unsuitable for all investors. Nevertheless, if you’re into cryptocurrencies and wish to trade Bitcoin in the UK, Coinbase is an excellent option for both beginners and veterans.

Cryptoassets are highly volatile. Please make sure that you can afford to lose your investment.

2. ZenGo – Best Bitcoin Wallet With Strong Security Level

Our next option behind Coinbase is ZenGo, a multi-chain non-custodial mobile wallet that uses MPC technology which eliminates seed phrase vulnerability. There are 120+ cryptocurrencies which are supported in this wallet, including Bitcoin, Ethereum and Polygon.

The big difference between ZenGo and other wallets is that this wallet does not require a password to access your digital assets, so the holdings of cryptocurrencies such as Bitcoin can be at your fingertips. In addition, the platform implements a three-factor authentication system (3FA), which includes facial detection and backs up the decryption code in the cloud to provide greater security to its users and prevent fraudulent activity.

Some transactions with ZenGo carry fees, although they are minimal. For example, with ZenGo, you can buy cryptocurrencies with a bank transfer for 1.99% or with a credit or debit card for 5.99%. Trading and selling cryptocurrencies carry a commission fee of 1.99% and 0.75%.

We recommend that you calculate these fees before investing so that you are not taken by surprise. Finally, it is important to emphasise that ZenGo has a mobile application available for all operating systems. Therefore, you can constantly track, buy, sell bitcoin and receive money in just a few seconds.

Cryptoassets are highly volatile. Please make sure that you can afford to lose your investment.

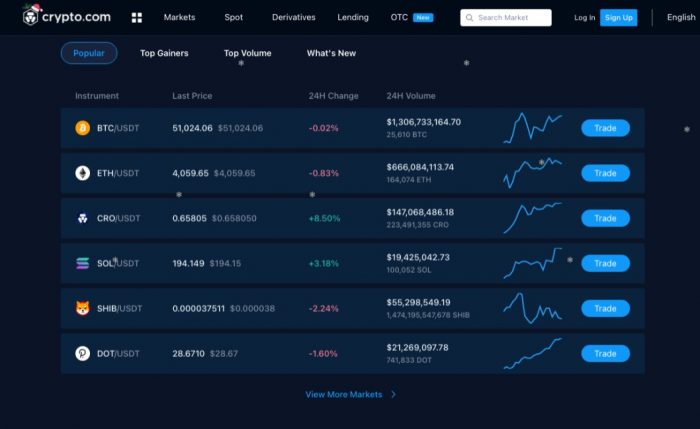

3. Crypto.com – Top Crypto Exchange in the UK with Native Wallet for Bitcoin

One of the world’s most secure and fast cryptocurrency exchanges, Crypto.com was founded in 2016. Thanks to a strong marketing team and several developers, Crypto.com has grown rapidly over the past few years. There are more than 250 currencies that can be traded on Crypto.com, and holders of its token (CRO) can benefit from reasonable fees and discounts.

It is an ideal place to invest in cryptocurrencies because Crypto.com provides multiple ways to store digital assets. Users can link their Crypto.com accounts to multiple digital wallets at once. One such wallet is their native DeFi Wallet which supports over 1000 crypto assets across 30 different blockchains. Moreover, this app will offer users the opportunity to earn rewards by locking up tokens or coins, similar to those associated with decentralised finance (DeFi) applications built on blockchain technology.

Because Crypto.com only requires a $1 deposit to open a position, it is one of the most accessible cryptocurrency trading platforms. In addition, those who wish to leverage their position on the platform can also access cryptocurrency trading and derivative products.

Cryptoassets are highly volatile. Please make sure that you can afford to lose your investment.

4. Margex – Best Bitcoin Wallet For Beginners With Educational Material In The UK

Margex has been providing cryptocurrency brokerage and trading services globally since its founding in 2020. Because of this, Seychelles is an ideal market for launching this platform. You do not have to provide KYC information to operate the exchange, but there is another important point you should know.

Because you can access the service from anywhere globally, it is more convenient and helps keep your financial information private. Margex’s security program offers users the unique capability to create a personal MP Shield (Listener Protection Shield) with data encryption to protect themselves from financial risks. It is also important to note that the platform does not keep track of crypto assets that have been impacted by price manipulation in terms of liquidity trading pairs. In addition, several security options are available for withdrawals and deposits to ensure the security of your account.

The verification of step two is not required for other similar platforms. However, this will prevent you from taking advantage of some of the benefits when using the service.

Margex’s trading website has an intuitive interface that novice cryptocurrency traders can use for gaining information. Of course, this is before they start trading immediately. Furthermore, beginners can also benefit from reading material, such as articles and video guides, from helping them succeed in crypto trading. In case you are a beginner cryptocurrency trader, you can use Margex’s website for information before you begin trading. Margex’s trading website has an easy-to-use interface. It is possible to find a variety of useful reading material, such as articles and video guides, for beginners interested in crypto trading.

Cryptoassets are highly volatile. Please make sure that you can afford to lose your investment.

5. Revolut – Excellent Trading Platform and Wallet to Buy Bitcoin in the UK

Revolut is a neobank FinTech platform that provides an all-in-one finance and money management mobile application. Users are able to use Revolut similar to a bank account with the platform supporting 36 global fiat currencies and payment processing in over 150 countries. The platform was founded in 2015 and started to support cryptocurrency trading in the EEA regions within 2 years of its launch.

Revolut was granted a banking license in Lithuania which enabled it to process fiat on-ramps for cryptocurrency purchases. The platform supports over 80+ different cryptos including Bitcoin, and users are able to swap between various crypto tokens and 36 different fiat currencies.

Purchasing cryptocurrencies with Revolut is seamless and can be done swiftly within the app. The platform has reasonable fees, charging the higher of either £1.49 flat-fee or 1.49% of the transaction total. Due to Revolut being a banking application, customers are able to instantly deposit fiat currency from their linked bank account without having to wait for transfers to appear. This makes it easy for users to trade their fiat into cryptocurrency within minutes at their desired optimal buying time.

The Revolut wallet interface is user-friendly in design and customers can manage, trade and withdraw their crypto tokens using the sleek interface. One downside is that Revolut does not provide users with charting tools for analysis, and the price charts simply show price action in different time frames without any oscillators or indicator tools. However, Revolut is not primarily a crypto trading app and allowing customers to purchase crypto tokens is merely one of the extra services they provide.

Registering with Revolut is quite a quick process and they simply require KYC information such as identity verification and proof of address. Users can then receive their Revolut card which can be used for spending in the same way as a normal debit card. What is great about this is that users can easily switch between cryptocurrency and fiat currency to spend on their card immediately. However, unlike traditional crypto spending cards, Revolut does not allow you to spend directly from your crypto holdings and users will have to trade their tokens for fiat, as appose to the fiat equivalent being deducted from their balance.

Cryptoassets are highly volatile. Please make sure that you can afford to lose your investment.

6. Binance – The Best Bitcoin Wallet for Android Devices

Binance

is one of the most popular cryptocurrency platforms in the world, and it boasts of the highest selection of altcoins. If there is any altcoin you wish to invest in, whether it is small-cap or large-cap, there is a very high chance that Binance lists it. The platform allows users to exchange BTC, not just for fiat currencies, but also with BNB, ETH, and a variety of other cryptocurrencies. Binance is one of the leading cryptocurrency exchanges by trading volume. Usually, you will be able to deposit funds into Binance via credit/debit card or a bank transfer, making for a convenient experience.

If you wish to store your cryptocurrencies through the Binance wallet after buying them through the platform, you can do this directly. If you do, you won’t control your private keys as it is a custodial wallet within the platform interface. However, Binance can be considered one of the safest centralised exchanges to hold funds on and users can benefit from a range of safeguards. This includes the vast majority of client funds being held in cold storage, alongside two-factor authentication and email confirmation on key account features being accessed.

Alternatively, for users that feel more comfortable having full control over private keys, the Binance Trust wallet is a non-custodial wallet to consider. Trust Wallet is downloadable as a mobile app and supported on both Android and iOS devices. This allows users to take custody of their crypto holdings and store Bitcoin on the app in a completely decentralised manner. However, when using non-custodial wallets it is important to securely store the seed phrase and private key offline.

The platform charges high fees for deposits and withdrawals – between 2% and 3%. However, they have very low trading fees and are known for being one of the cheapest crypto trading platforms in terms of their fees. Usually, the fee is 0.1%, and it is even lower if you have an allocation of the Binance Coin (BNB). They also have a wide variety of trading tools and features available specifically for cryptocurrencies, which makes them a suitable option for highly experienced crypto traders.

Cryptoassets are highly volatile. Please make sure that you can afford to lose your investment.

7. CoinJar – Best Bitcoin Wallet UK for Long-Term Investors

CoinJar’s global cryptocurrency platform has won numerous awards over the years. The company is one of the largest digital currency brokers in Australia and allows users to buy over 50 cryptocurrencies and supports payments in AUD, EUR, GBP and USD. Customers in the UK can buy and sell Bitcoin among other cryptocurrencies through CoinJar using a variety of payment methods including Visa, Mastercard and the platform also supports ApplePay and GPay.

CoinJar also allows users to convert crypto to crypto and offers instant withdrawals to bank account as it uses the Faster Payments Service (FPS). CoinJar has a custodial wallet interface that allows users to store and view their crypto holdings on the exchange. While some may be skeptical about holding funds on centralised exchanges, CoinJar’s crypto storage is allocated to trusted custodian providers BitGo and Fireblocks. CoinJar’s mobile application is currently available for both Android and iOS.

Cryptoassets are highly volatile. Please make sure that you can afford to lose your investment.

8. CoinCorner – The Best Bitcoin Wallet UK for Beginners

If you are a beginner and have little to no knowledge of how wallets or cryptocurrencies work, then CoinCorner is the perfect platform for you. This is because the platform has been designed specifically with beginners in mind, who might not be very aware of the peculiarities that afflict the cryptocurrency world. The platform also serves as both a broker and a wallet, with users being allowed to purchase Bitcoin through a UK debit/credit card or bank account transfer, and providing the functionality of being able to store it on the CoinCorner wallet app.

The app can be downloaded from Google Play or Apple Store. Whilst this is likely the be the most convenient option on the table for beginners, the CoinCorner wallet isn’t as secure as the other entrants we have discussed thus far. As such, for the benefit of increased convenience and ease of use, there is a slight trade-off with security.

Finally, we should also mention that CoinCorner is worth considering if you are looking to make small but regular Bitcoin investments. This is because it supports recurring payments that are automated to your preference – for example, £20 per week or month.

Cryptoassets are highly volatile. Please make sure that you can afford to lose your investment.

What is a Bitcoin Wallet?

If you are looking to invest in Bitcoin, then one of your biggest considerations should be about how you plan to keep your coins safe. In this regard, you need to understand that, unlike traditional money, Bitcoins cannot be stored in a bank account. Instead, they have to be stored in a ‘digital wallet’. There are several Bitcoin wallets that you can use for this purpose, and each of them differs from the others in its own way. Some people might choose to go for a mobile wallet since it allows them to monitor and manage their cryptocurrency investments on the move. On the other hand, some people might choose to have a wallet that is only available on desktop devices.

Regardless of the different types of wallets, which are discussed below in detail, the primary purpose of the wallet is to allow you to send, receive, and store digital currencies. Each of these wallets has a unique address that you can use in order to send and receive cryptocurrencies from other wallets. When you want to send funds to your personal Bitcoin wallet, you will need to enter your public address. In terms of safety, your Bitcoin wallet is protected by a ‘private key’. This is like the password and pin codes that you use to access your online bank account.

Most Bitcoin wallets in the UK allow you to easily access your wallet without having to remember the private key, simply by setting up a password or a biometric login for your convenience.

Bitcoin Paper Wallet vs Bitcoin Hardware Wallet

As mentioned above, there are several types of Bitcoin wallets that you can use in order to store your Bitcoins. Each of these has its own set of advantages and disadvantages, and therefore are chosen by different people based on their preferences. For example, two of the biggest categories of Bitcoin wallets are paper wallets and hardware wallets. Both of these categories have been discussed below in detail.

A Bitcoin paper wallet is an old-school way of storing cryptocurrencies because your Bitcoin wallet address will be printed onto a piece of paper in the form of a QR code. In order to do this, you will need to use an online platform that has the capacity to generate a free Bitcoin wallet address. Then, it’s just a case of transferring the Bitcoin to the respective address, and printing the credentials. In theory, it’s virtually impossible for somebody to hack your Bitcoin paper wallet. After all, the funds are kept offline at all times. However, the main drawback here is that when it comes to transferring your Bitcoin out to another wallet (for example, if you wanted to cash out your coins), the process can be cumbersome.

On the other hand, on a hardware wallet, your coins are stored via a physical device. Hardware wallet providers offer top-notch security on your Bitcoin funds. To get started with a hardware wallet, all you need to do is to buy a Bitcoin hardware wallet from your chosen provider, set up a PIN number via the device that arrives with your wallet, and transfer the Bitcoin to your unique hardware wallet address. Opting for a hardware wallet to store your Bitcoin is a really safe option to consider. For example, funds can only be sent if you have access to the physical device – which requires your PIN for authorization. If you forgot your PIN or the device was stolen, you can remotely access your Bitcoin wallet with the previously mentioned passphrase.

Cryptoassets are highly volatile. Please make sure that you can afford to lose your investment.

How to Choose the Right Bitcoin Wallet for You

As mentioned earlier, there are a variety of factors to consider when you are trying to choose to right kind of wallet for your needs. In this regard, each of these factors has been discussed below in detail.

Different Types of Wallets to Store Bitcoin

When trying to choose the right kind of wallet, it is important to understand which different types of wallets are available. The different wallets present varied levels of security and have their own properties as presented below:

- Web-Wallet: Web based wallets are found on exchanges, and is where users can access their Bitcoin holdings among other crypto assets. Funds are in held on the brokerage platform and storage is maintained by the exchange. This is usually the least secure option among all the other options that are available as users do not retain full custody of their cryptocurrency.

- Desktop-Wallet: There are lots of Bitcoin wallets in the market that can be downloaded on a desktop device. Although, these are a little more secure than a mobile wallet, users will need access the desktop software wallet every time in order to send funds. This makes it slightly more inconvenient if transferring cryptocurrencies more frequently.

- Mobile-Wallet: This wallet type offers the perfect balance between convenience and security. Regarding the former, you can send, receive, and trade cryptocurrencies by simply opening the wallet app. In terms of security, the best mobile wallets offer two-factor authentication, biometric login, and email confirmation on withdrawals.

- Hardware-Wallet: Hardware wallets offer the highest level of security for storage of Bitcoin funds. These are cold storage devices with crypto assets being held offline. In order to transfer funds users need to physically enter their PIN onto the device. On the flip side, hardware wallets are the least convenient when it comes to transfers. Some providers will offer a few of these, like the exodus wallet as a mobile, desktop and hardware wallet.

Custodian or Non-Custodian

There are two types of Bitcoin wallets that are available: custodian and non-custodian wallets. They differ solely in the sense that custodian wallets are responsible for keeping your Bitcoins safe in the wallets, whereas when you use a non-custodian wallet, the onus is on you to keep the crypto you store in the wallet safe and sound. In other words, when you use a custodian wallet, you don’t need to worry about storage as this role is reversed for the entity behind the wallet.

Features

Bitcoin storage wallets are usually limited in features as they are simply methods to store crypto assets. As mentioned, there are different benefits and drawbacks of using the various wallet types. While non-custodial wallets allow users to store crypto more securely, it is merely a method of holding and transferring tokens. Web-based wallets are found on an exchange which allows users to interact and trade with crypto assets promptly. Mobile wallets allow cross-currency transactions and users can swap one crypto currency to another from within the app and can be used to access web3 dApps.

Supported Coins

The number of supported cryptocurrencies that can be stored will vary dependant on which wallet is being used. Some desktop wallets will only support Bitcoin, and users will not be able to store other blockchain tokens. This means for users who wish to store other cryptos such as Ethereum or Litecoin, a secondary wallet that supports them will need to be used. Mobile wallets will support a multitude of crypto assets, and each coin will have its own wallet address, however, it is important to not send Bitcoin to the Ethereum wallet address as tokens will be lost and unrecoverable.

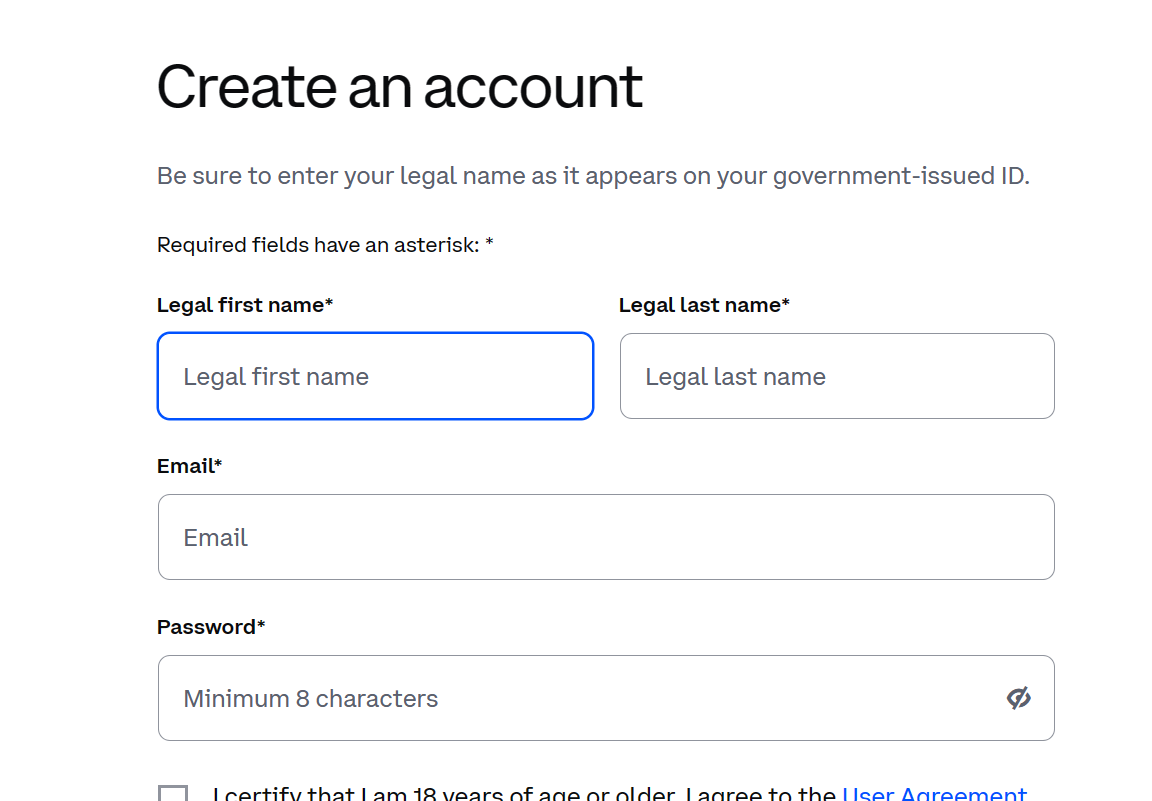

How to use the Coinbase Bitcoin wallet

Step 1: Open a Trading Account

Cryptoassets are highly volatile. Please make sure that you can afford to lose your investment.

Before you can use the Coinbase wallet, you will need to register for a Coinbase trading account. This process is fairly simple and can be completed in less than 30 minutes. You can create an account with your email, phone number, Google account or Apple account.

You will also be asked to connect a payment method to the account and verify your ID by uploading relevant documents.

Step 2: Download the Coinbase Wallet app or extension

Once you have created a Coinbase account, download the wallet as a mobile app or browser extension.

Now, you will be able to log in to the wallet using your Coinbase credentials. The wallet will be connected to your account however, it will have a different address to your Coinbase trading account.

Step 3: Add Bitcoins to your Coinbase Wallet

Now that you have access to your Coinbase wallet, you will be able to store your Bitcoins. You can either send BTCD to the wallet from an external address or buy BTC directly via Coinbase Pay.

If you choose the latter option, it is possible to purchase Bitcoin with debit card, bank transfer or e-wallet. Once you have purchase the coins, they will be sent to your wallet within minutes.

Cryptoassets are highly volatile. Please make sure that you can afford to lose your investment.

FAQs

What is the best Bitcoin wallet for iOS?

The best Bitcoin wallet for iOS will differ largely based on your requirements and trading preferences, but overall, Coinbase is definitely the platform most optimised for iOS use.

What is the best Android Bitcoin wallet?

Most wallets are functional on both iOS and Android, with the main functionality being the same with different user-interfaces. For a user friendly wallet on Android, Binance’s Trust Wallet is a good non-custodial wallet which supports a wide variety of tokens.

How do I check my Bitcoin wallet address?

This depends on the type of wallet you have opted for. If it’s a desktop wallet, then you can usually view your address as soon as you log in to the wallet. When opting for a web wallet, you can find your address from within your account dashboard on the exchange. If using a mobile wallet that supports many different tokens then each token will have a unique wallet address that can be viewed and copied.

What is the safest Bitcoin wallet?

Cold wallets are considered to be the safest wallet option because they are not connected to the internet which means that funds are stored offline and more protected from cyber criminals. Also, custody is maintained by the crypto owner, however, for the extra security users must store their private keys safely.

What is the best anonymous Bitcoin wallet?

The vast majority of Bitcoin wallets allow you to store your funds anonymously. The exception to this rule is if you are using a wallet provider that also supports purchases with a debit/credit card or other fiat currency method. If it does, you will be required to verify your identity before you can start using the wallet.

How do I keep my wallet private keys safe?

The easiest way to keep your wallet safe and secure is to write down your private keys on a piece of paper and keep them securely somewhere. It is also good practice to have two written forms stored securely in different places. If you lose the private key you will not be able to access your wallet and Bitcoin holdings.

Can you store Bitcoin and Ethereum in the same wallet?

Yes, if you are using a multi-currency wallet, then you can store Bitcoin, Ethereum, and a variety of other cryptocurrencies in the same wallet. However, each blockchain’s currency will have its own unique wallet address and users should not send Bitcoin to the Ethereum address.

Nishit Kumar Finance Writer and Analyst

View all posts by Nishit KumarNishit is a NGL Trader Analyst at Akari Trading. He has also worked as an analyst for Morgan Stanley and Onyx Commodities.

Before starting his career in finance, Nishit studied at the University of Warick where he was an active member of the Hedge Fund society. Due to his qualifications and experience, Nishit is considered an industry expert and enjoys writing content that could help traders to make informed decisions.

As well as writing, Nishit worked as Associate Editor for The Economic Transcript until 2021. He has also written for Newsweek and has good knowledge of current events that could affect the financial markets.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

By continuing to use this website you agree to our terms and conditions and privacy policy.Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Registered Company number: 103525

© tradingplatforms.com All Rights Reserved 2023

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up