10+ Best CFD Trading Platforms in the UK July 2025

CFD brokers facilitate CFD trading by providing users with the tools and features that they need to implement a robust CFD trading strategy. In the UK, there are numerous CFD trading platforms to choose from which can make it tricky to decide on just one.

Many CFD brokers in the UK offer low trading fees, a large range of available markets to trade, quality customer support, and tight regulation by the FCA in the UK.

In this in-depth guide, we review different CFD trading platforms in the UK to help you find a trading site that suits your trading strategy and needs.

-

- 1. eToro – Social trading platform with numerous CFD trading opportunities

- 2. AvaTrade – CFD trading platform with competitive fees

- 3. XTB – Award winning CFD broker with advanced charting tools

- 4. Trade Nation – CFD trading platform with fixed spreads

- 5. Admiral Markets – CFD trading platform with MT4 and MT5

- 6. Pepperstone – Low-cost CFD trading platform for UK traders

- 7. Alvexo – Trading platform that offers educational resources to new users

- 8. IG Markets – Global CFD trading platform with over 17,000 markets

-

- 1. eToro – Social trading platform with numerous CFD trading opportunities

- 2. AvaTrade – CFD trading platform with competitive fees

- 3. XTB – Award winning CFD broker with advanced charting tools

- 4. Trade Nation – CFD trading platform with fixed spreads

- 5. Admiral Markets – CFD trading platform with MT4 and MT5

- 6. Pepperstone – Low-cost CFD trading platform for UK traders

- 7. Alvexo – Trading platform that offers educational resources to new users

- 8. IG Markets – Global CFD trading platform with over 17,000 markets

10+ Best CFD Brokers in the UK

We’ll review various CFD trading platforms in the UK in full further down this page, but if you’re looking for a quick summary, check out the list of UK trading platforms and CFD brokers below.

- eToro: eToro is a versatile CFD platform that caters to various trading styles, including social trading. Users can copy professional traders’ strategies and access a range of products, from ETFs and cryptocurrencies to forex and indices.

- AvaTrade: AvaTrade provides multiple CFD trading platforms like MetaTrader 4 and AvaTradeGO, offering advanced charting tools and educational resources such as webinars and trading guides.

- XTB: Award-winning CFD and forex broker that has been serving retail clients since 2002. It features the technologically advanced xStation 5 trading platform, offering a wide range of instruments and research tools.

- Trade Nation: Trade Nation, an FCA-regulated broker, offers CFD, spread betting, and forex trading with low-cost fixed spreads starting at 0.6 pips for CFDs. It provides a wealth of research materials and technical analysis tools, including signals for guided trading.

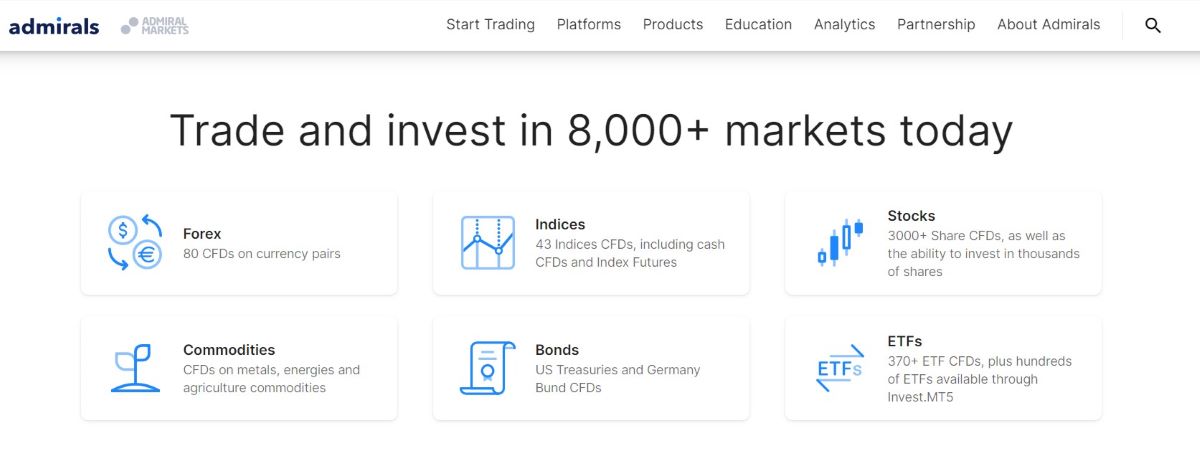

- Admiral Markets: Admiral Markets provides access to over 8000 financial instruments, including CFDs for forex, commodities, stocks, ETFs, and bonds. Its “xStation 5” trading platform features advanced tools, research materials, and analytics, with additional add-ons like MetaTrader Supreme Addition and StereoTrader.

- Pepperstone: Pepperstone is voted best MetaTrader 4 brokerage in the Good Money Guide Awards 2023. It provides traders with access to CFDs for stocks, indices, forex and commodities, while also offering tax-free spread betting for UK clients.

- Alvexo: Alvexo is a regulated CFD broker on commodities, indices, stocks, and ETFs to traders worldwide. Founded in 2014, it provides intuitive CFD trading platforms, real-time quotes, and various trading tools.

- IG Markets: Regulated by multiple tier-one regulators, including the FCA, CFTC, and ASIC, it offers access to 17,000+ markets, from Forex to cryptocurrencies. IG provides various CFD trading platforms, including Metatrader, IG’s proprietary platform, and ProRealTime.

*not available for existing ECN clients, other fees may apply.

What is CFD Trading?

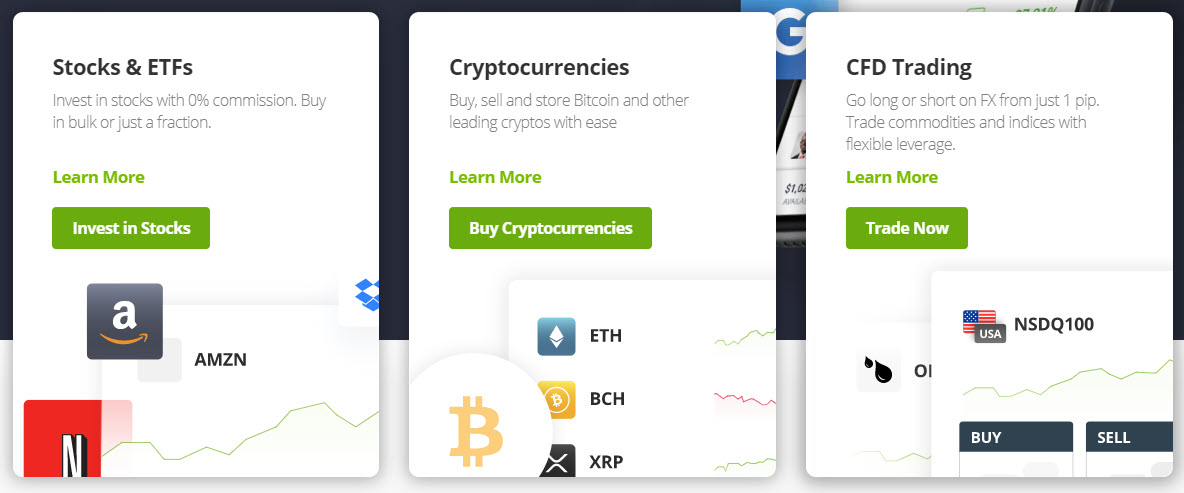

CFD trading is a method of speculating on the underlying price of an asset such as stocks, indices, commodities, cryptocurrencies, forex and others on a trading platform. CFD is short for Contract for Difference, which is a financial commitment based on the difference in value of an asset between the opening and closing of the trade. CFDs allow traders to buy or sell various asset classes, including stocks, currencies and commodities.

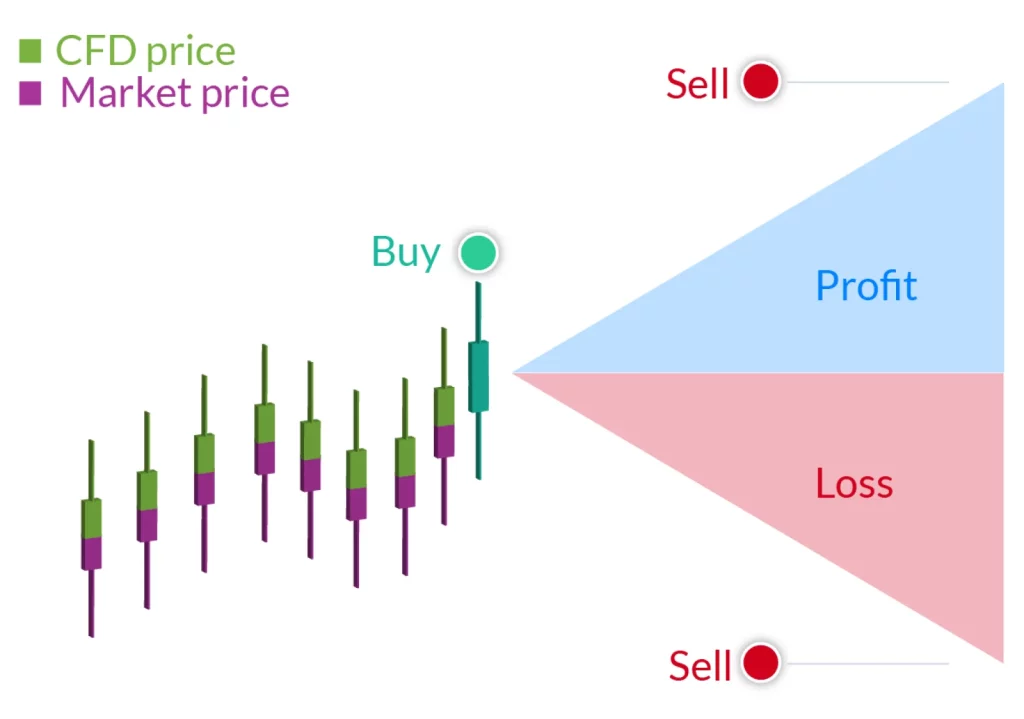

One of the benefits of CFD trading is the ability to speculate on asset price movements in either direction. You can decide to buy or sell a contract based on your view of the asset’s price movement, opening a long or short position. It is important to remember that the use of leverage trading can amplify both potential gains and potential losses, so a careful approach and a sound understanding of the risks involved is required.

How Does CFD Trading Work?

Trading with UK CFD brokers allows investors to buy or sell a number of units of a financial instrument linked to an underlying asset, rather than the asset itself. CFD providers, similar to long-term bookmakers, typically offer exposure to a wide range of global markets, including currency pairs, stock indices, commodities and shares. A CFD trader sets the number of contracts they wish to buy or sell.

But how does trading actually work? Traders make or lose money depending on market movements. If the market moves in the trader’s favour, his position will make a profit. If the market moves in the opposite direction, the trader will make a loss. Profits or losses are made when a position is closed and the contracts originally bought are sold. Similar to traditional stock trading, the outcome of a trade depends on the size of the trader’s position and the number of points the market has moved in one direction or the other.

CFD Trading Strategies

CFD trading has become very popular in recent times as a way for traders to make money. However, as with almost any type of trading, CFD involves certain risks. Here are 3 CFD trading strategies to help you better understand the process.

CFD News Trading

Tracking the latest CFD trading news and updates is a common short-term CFD strategy that involves taking advantage of the volatility surrounding economic announcements. This is one of the more fundamental strategies as it involves constantly monitoring the news and analysing how the market has reacted to similar events in the past.

Most news trading strategies focus on major macroeconomic events, such as interest rate announcements and economic data releases, as these events are scheduled and offer more predictability than unforeseen events that can surprise the market.

CFD Hedging

One popular strategy that can help you manage risk is CFD hedging, which involves opening multiple positions to offset the risk of an ongoing trade. Hedging with CFDs is a common tactic among traders as it allows them to open a short position on a stock they own. This strategy can also be used for the long term but is most commonly used in the short term as it can reduce the risk of loss over shorter periods of time.

Best CFD Brokers and Trading Platforms in the UK Reviewed

Let’s now take a more detailed look at the CFD trading platforms that are available to UK traders in 2025.

1. eToro – Social trading platform with numerous CFD trading opportunities

eToro has a wide offering of CFD assets available to UK traders and is one of the top CFD brokers to consider in 2025.

Whilst it is possible to trade yourself on their CFD platform, eToro is also a social trading platform where users can also copy other professional traders.

eToro has a range of products to suit all styles and trading strategies. One of the main reasons they are considered to be one of the best CFD brokers is because of their copy trading feature. This feature allows trades to automate their trading according to the trades that are placed by experts.

The platform provides a performance overview for each professional trader so that users can make informed decisions about which trader to copy. After choosing a trader to copy, trades will be placed automatically every time that the expert makes a move.

eToro offers their own online CFD trading platform. It is available to use and trade on both desktop and mobile and allows you to quickly make and manage your trades. The broker’s CFD trading platform lets you see your risk level and the potential profits or losses of each trade, depending on whether or not it goes in the predicted direction.

An extensive range of markets can be traded on the eToro CFD broker from ETF’s, cryptocurrencies, Forex, indices, oil, Gold, Silver, and thousands of different stocks.

All of these markets can be traded with low-commissions and the platform does not impose any extra fees. eToro makes money through the spread they charge for each trade (the difference between the market price and the ask price).

eToro is strictly regulated by the Financial Conduct Authority in the UK. It also carries other tier-one licences throughout the world making it a very tightly regulated CFD provider.

eToro is also accessable to traders through a user-friendly interface and has a range of deposit and withdrawal options that include e-wallet, bank transfers, and debit cards.

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

2. AvaTrade – CFD trading platform with competitive fees

AvaTrade is a well-known broker that offers Contracts for Difference (CFD) trading on a wide range of financial instruments, including forex, stocks, commodities, and cryptocurrencies. CFD trading with AvaTrade allows traders to speculate on price movements without actually owning the underlying asset. This means that traders can go long or short on an asset, depending on their market outlook.

AvaTrade provides its clients with a variety of CFD trading platforms, including the popular MetaTrader 4 and AvaTradeGO, both of which offer advanced charting tools and technical indicators. The broker also provides traders with access to educational resources, such as webinars and trading guides, to help them make informed trading decisions. Moreover, AvaTrade offers competitive trading conditions, such as tight spreads, high leverage, and no hidden fees, making CFD trading with AvaTrade a compelling choice for traders of all levels of experience.

On AvaTrade, traders can experience flexible trading conditions, with the ability to open and close positions quickly. The broker offers competitive spreads on a wide range of instruments, which allows traders to keep their trading costs low. Additionally, AvaTrade provides its clients with high leverage ratios, which means that traders can increase their trading power and potentially boost their profits.

However, it’s important to remember that trading CFDs with high leverage can also increase the risk of losses, and traders should always exercise caution when using leverage. AvaTrade also offers risk management tools, such as stop-loss orders and trailing stops, which can help traders manage their risk effectively.

There is no guarantee that you will make any profits with this provider. Your money is at risk.

3. XTB – Award winning CFD broker with advanced charting tools

As an award-winning CFD broker UK, XTB has been in business online since 2002. The company has built a strong reputation over the past two decades by offering advanced charting tools and CFD trading features.

It is known for its technologically advanced trading platform known as the “xStation 5”, which has a large number of features that make it accessible to different types of traders, as well as providing access to research and trading tools, as well as advanced features for experienced traders. You can find all the essential features of any financial service, such as a news service and an economic calendar.

Furthermore, XTB is a highly specialized brokerage firm that offers its clients a wide range of trading instruments such as stocks, commodities, metals, indices, and cryptocurrencies, as well as an interface with a high level of user-friendliness and competence in a highly specialized industry.

When protecting users’ information, XTB follows a strict set of standards. XTB places high importance on the platform’s encryption and the security of clients’ funds. Due to this, all client funds for traders are kept in segregated bank accounts at all times to assure that the client funds are secure.

XTB is regulated by the Financial Conduct Authority (FCA). Moreover, with an XTB account, you can deposit and withdraw funds quickly and seamlessly. The platform supports bank transfers, debit cards, credit cards and e-wallets.

75% of retail investor accounts lose money when trading CFDs with this provider.

4. Trade Nation – CFD trading platform with fixed spreads

Next on our list of CFD brokers in the UK is Trade Nation, an FCA regulated CFD broker UK that offers CFD trading, spread betting, forex trading and more. Trade Nation provides low cost fixed-spreads that start from 0.6 pips for CFDs. This means that traders won’t run into any unexpected fees while using the platform to trade.

Furthermore, Trade Nation provides a range of research materials and technical analysis tools that can be used by both experienced and less-experienced traders to make informed decisions. Amongst the tools available include indicators, real-time market insights and in-depth educational articles.

It is also possible to use Signals through Trade Nation. The signals provider is one of the only regulated signals platforms in the UK and provides Trade Nation users with accurate market signals that can be used to guide trading. While the signals are a useful tool, it is important to conduct market research and analysis.

Traders can use the Trade Nation demo account to practice using the platform before trading with real funds. The demo account is free to use and there is no minimum deposit requirement.

Trade Nation fees:

Fee Amount Stock trading fee Fixed spreads from 0.6 pips Forex trading fee Fixed spreads from 0.6 pips Inactivity fee Free Withdrawal fee Free 77% of retail investor accounts lose money when trading CFDs with this provider.

5. Admiral Markets – CFD trading platform with MT4 and MT5

Admiral Markets is considered by many to be a trading and investment ecosystem. The platform provides traders with access to over 8000 different financial instruments. These include CFDs for forex, commodities, stocks, ETFs, bonds and indices, while also offering spread betting solely to its UK client base. Admiral Markets has a number of different account types and enables connectivity to MetaTrader 4 and MetaTrader 5.

Like many other CFD brokers UK, Admiral Markets provides clients with dedicated educational materials for guidance. This ranges from webinars, tutorials, video guides and trading & forex courses.

There is also a wide variety of analytics features that the CFD broker provides daily in order to help traders stay ahead of the curve. The analytics ecosystem features tools such as global market updates, market sentiment charts, forex calendar, and weekly trading podcasts more options available.

One of Admiral Markets’ unique features is that traders can get access to advanced trading tools through additional compatibility with interface add-ons. The two add-ons they support are MetaTrader Supreme Addition and StereoTrader. These add-ons enhance users’ trading experience loaded with advanced trading controls and features.

Admiral Markets Fees

Fee Amount Stock trading fee $0.02 per US share, 0.1% – 0.15% for other markets Forex trading fee £1.4 – £2.4 per 1.0 lots / Spreads start from 0 pips on Zero.MT4 accounts Inactivity fee Free Withdrawal fee Free 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

6. Pepperstone – Low-cost CFD trading platform for UK traders

Pepperstone is a brokerage regulated by the FCA that provides traders with access to CFDs for stocks, indices, forex and commodities. This brokerage boasts low CFD stock trading fees and the spreads on other assets are reasonable. Pepperstone also offers traders the option of spread betting, which is tax-free in the UK.

The CFD trading platform allows users to trade with leverage of up to 1:30 for both buy and sell orders. With Pepperstone, clients have the option of choosing from two different account types, Standard and Razor. The primary differences is with the Razor account users can use the trading interfaces with TradingView, while the Standard account has zero commission for forex CFDs, however has higher spreads.

Both account types offer access to over 1200+ CFD instruments and are compatible with MT4, MT5 and cTrader trading interfaces. It is noteworthy to mention that Pepperstone was voted the best MetaTrader 4 broker in the Good Money Guide Awards 2023.

Pepperstone offers traders to have daily market news and updates to assist them to keep informed on the latest trends. They also offer a variety of advanced trading tools from automated trading facilitation with their Captialise.ai product, to smart trader tools giving 28 add-on charting analysis and indicators for MetaTrader users.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.3% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

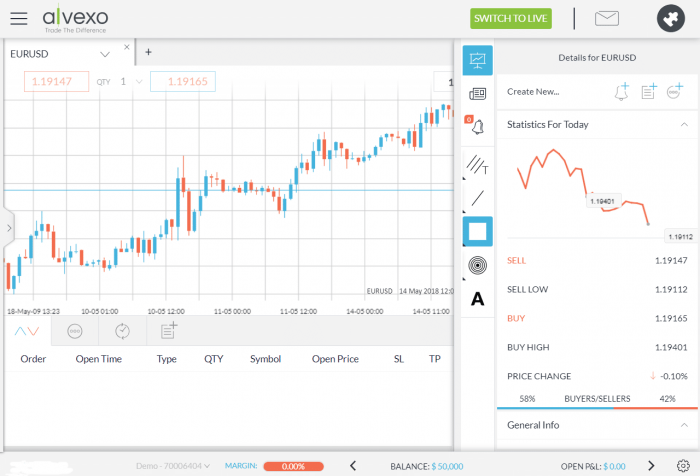

7. Alvexo – Trading platform that offers educational resources to new users

Alvexo

is a regulated online broker offering a wide range of products such as CFD on Commodities, Indices, Stocks and ETFs to over 650,000 traders worldwide. The company prides itself on being a “real broker for real traders.”

As a market veteran-founded company in 2014, Alvexo offers a selection of intuitive CFD trading platforms that provide real-time buy and sell quotes on over 450 assets. In addition, several trading tools are available to assist with market analysis.

For all traders, Alvexo is known for its education and service-oriented approach to trading. In addition to daily signals and market analysis, Alvexo clients have access to a wide range of economic News and a trading academy, as well as webinars and seminars.

Alvexo fees:

Fee Amount Stock trading fee Variable Spreads Forex trading fee Variable spreads. 2.9% for EUR/USD on its Classic account Inactivity fee $10 per month after three months Withdrawal fee Free 76.22% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

8. IG Markets – Global CFD trading platform with over 17,000 markets

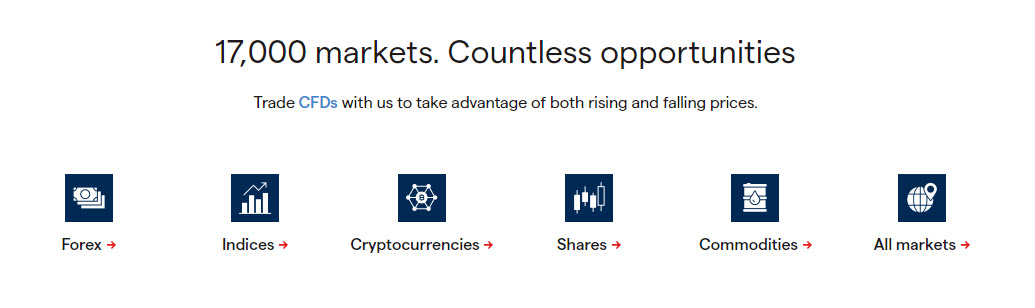

IG Markets is a truly global broker that has been a very dominant force in the finance and CFD space for many years.

IG Markets was founded in 1974 making it one of the oldest brokers in the market today. Whilst many UK CFD brokers have come and gone, IG Markets continue to offer their products all over the world.

IG Markets is regulated in many different jurisdictions including under tier one regulators. These include the FCA in the UK, the CFTC in the US, and ASIC in Australia.

Upon registering with IG, you gain access to their extensive array of CFD brokers, which encompasses Metatrader, IG’s proprietary platform, and ProRealTime.

IG enjoys worldwide appeal among traders for several reasons, with one standout feature being the vast range of trading opportunities it provides.

In fact, IG Markets offers access to 17,000+ markets, encompassing a diverse spectrum of assets such as Forex, indices, shares, cryptocurrencies, ETFs, and commodities. For traders based in the UK, there is also access to the spread betting platform.

Thanks to their extensive product range, global regulatory compliance, dedicated customer support, and industry-leading CFD trading platforms, IG Markets has firmly established itself as one of the preferred CFD providers amongst UK traders.

There is no guarantee that you will make any profits with this provider. Your money is at risk.

CFD Trading Platform UK Fees Comparison

According to the source, CFD trading offered the possibility to trade over 17,000 assets. Wondering how the UK’s CFD brokers compare in terms of fees? Look no further. As many derivative trading platforms have dynamic spreads, we’ve shown you fee fees for popular assets like Amazon and the GBP/USD forex pair to give you an idea of the cheapest CFD brokers UK with the lowest fees.

Trading Platform Fees Spread or commission? GBP/USD Overnight fees eToro Spread 2 pips Yes. Overnight fees for all CFD instruments. IG Commission for stocks, spread for other assets 1.4 pips Yes. Applies to forex, stocks, commodities, and indices. Pros and Cons of CFD Trading in the UK

Like any other form of trading, CFD trading has its own set of pros and cons that are important to consider before you start.

Pros:

- Flexibility: CFD trading allows traders to take both long or short positions which means it is possible to profit in both rising and falling markets.

- Leverage: CFDs allow traders to increase the size of their position without needing to deposit more funds.

- Diversity: A wide range of markets can be traded as CFDs which makes it easy to build a diverse trading strategy.

- Fractional trading: CFD trading allows traders to purchase parts of a share instead if the whole asset which is appealing to investors who want to start with a small amount of capital.

- Low fees: Many CFD brokers offer low commissions because the process of investing in CFDs is less expensive than buying traditional shares.

Cons:

- Significant losses: Trading with leverage means that losses are amplified. Small price drops can result in big losses if a trader chooses to use high leverage.

- Volatility: CFDs can experience more volatility than traditional stocks due to the fact that they attract active traders. This can lead to increased risk and make it more difficult to manage your portfolio.

How To Choose a CFD Broker

As you can see from our detailed reviews, there is a lot of competition and a lot of options when looking for a CFD trading platform in the UK.

With that said, you should keep in mind some of the important criteria when choosing your broker and trading platform. The broker and CFD trading platform you decide to trade with will be a huge factor in your trading success or failure.

Whilst some factors are important with whatever broker you use such as regulation and solid deposit and withdrawal methods, you will have to factor in the type of trader you are and the type of broker you need.

For example, if you are a scalper, you will be suited to a different style of broker compared to a longer-term swing trader. Or if you want to copy other professional traders, then you need to use a copy trading broker like eToro.

The main factors you should always take into account when selecting your CFD platform and broker include:

Assets

Obviously, the more markets and financial assets you have access to trade, the more trading opportunities you will have. However, not all brokers offer every market you would like to trade.

CFD platforms in the UK offer the following markets to trade:

- Commodities

- Cryptocurrencies

- Forex

- Stocks

- Bonds

- ETFs

- Indices

Fees

Some CFD brokers UK will deliberately hide or make their fee structure hard to understand.

These brokers will not show you upfront everything you will be paying to enter and exit your trades and this can end up costing you a lot of money.

You need to use a CFD trading platform that has very transparent fees and the fees are as small as possible. The fewer fees you are paying to make your trades, the more straightforward it will be to make a profit.

The main fees you will have to take into account are commissions are spreads.

Commissions will be charged by your broker for each trade you make. Often these brokers will also then charge you a spread on top of their commission charge.

Some of the brokers that we have reviewed will not charge commission. Instead, these brokers are make money by only charging the spread cost.

Some other fees to take into account include:

- Overnight Financing Fee: If you are trading CFDs and holding your trades overnight, then you will be subject to the overnight financing fee. The time this fee is charged is different for each broker so make sure to check with your broker.

- Deposit or Withdrawal Fees: When making a deposit or withdrawal some brokers will charge you a fee. This can often be dependent on the type of deposit or withdrawal method you are using.

- Inactivity Fees: Some UK platform providers will charge you an inactivity fee if your account remains inactive for a certain period of time.

Trading Tools & Features

CFD trading strategies often require charting tools and features. CFD brokers should provide an extensive range of tools that can facilitate different trading strategies.

The types of features you should be looking for are; a simple trading platform, a copy-trading function, and a free demo or virtual account.

A demo or virtual derivative trading account allows you to trade the markets without risking any real money. You make and manage your trades in the same way you would if you were risking real money and price moves the same, but you are trading with virtual money.

Whether you are an experienced pro or just starting out it is very important your broker offers a free CFD demo account.

Even if you are ready to live and start risking real money you will first want to test out the platform in demo mode to make sure you are comfortable with it.

A demo account can also be incredibly useful if you want to test out new strategies with virtual money in a no-risk situation.

Education, Research & Analysis

Some of the brokers in the UK will provide analysis and education materials.

This education will often come in the form of videos or trading guides.

Educational resources and market analysis can be extremely useful and can help you get on the right side of the market.

Another key feature that UK platform providers offer is direct access to the latest news and economic data from the United Kingdom that will help you stay ahead of the curve.

User Experience

The CFD trading platform that you use must be clear to navigate and operate.

You will be making trades risking real money in the financial markets. The last thing you need is to have a trading platform that is complicated or that constantly lags.

Some brokers offer either their own CFD trading platforms that they have spent a long time creating like AvaTrade, and others offer MT4 or TradingView.

The platform you use is going to play a huge role in your trading success. You need to be fully comfortable with it and be able to quickly enter and exit trades when you need.

Mobile App

Being able to manage your trades on your mobile phone with an app is crucial.

There will be times when you cannot be at your computer screen to monitor how your trade is going. Having a quality trading app that lets you manage and exit your trade if need be is a priority.

Mobile trading apps let you check your account portfolio quickly and if needed access customer support through live chat.

Payment Methods

Obviously being able to deposit and withdraw your money in a timely manner and in a way that suits you is very important.

UK brokers have many different deposit and withdrawal methods and they will have a whole department on hand to make sure these transactions go through smoothly.

The worst CFD providers will hold onto your money for days or weeks on end after you have made your withdrawal request which is why it is so important you use a reputable broker with fast withdrawal times.

Customer Service

The amount and quality of customer support your UK trading provider offers you is very important.

There could be times when you have a question about one of your trades or you need help with your account. You want to be able to quickly either get on the phone or live chat straight through to customer support. You also want this customer support to have a thorough knowledge of the markets.

CFD UK brokers have multiple channels you can reach them through. The worst can only be reached through email or will leave you waiting on live chat for hours on end.

Strong Reputation

Reputation in the Financial markets is a very important thing.

Whilst you will be able to spot the scam brokers pretty quickly, the other CFD brokers that sit on the fringe can be harder to recognise. A CFD broker that has been operating in the markets for many years shows that it has a strong track record and has been able to successfully service its clients.

With that said, you do need to keep in mind there are a lot of disgruntled traders who will lose money through their own bad trading and blame the broker.

How to Start CFD Trading

If you are ready to start trading in the markets, then you can follow this step-by-step walk-through to create a new account that will help you get all set up and ready to make your first trade.

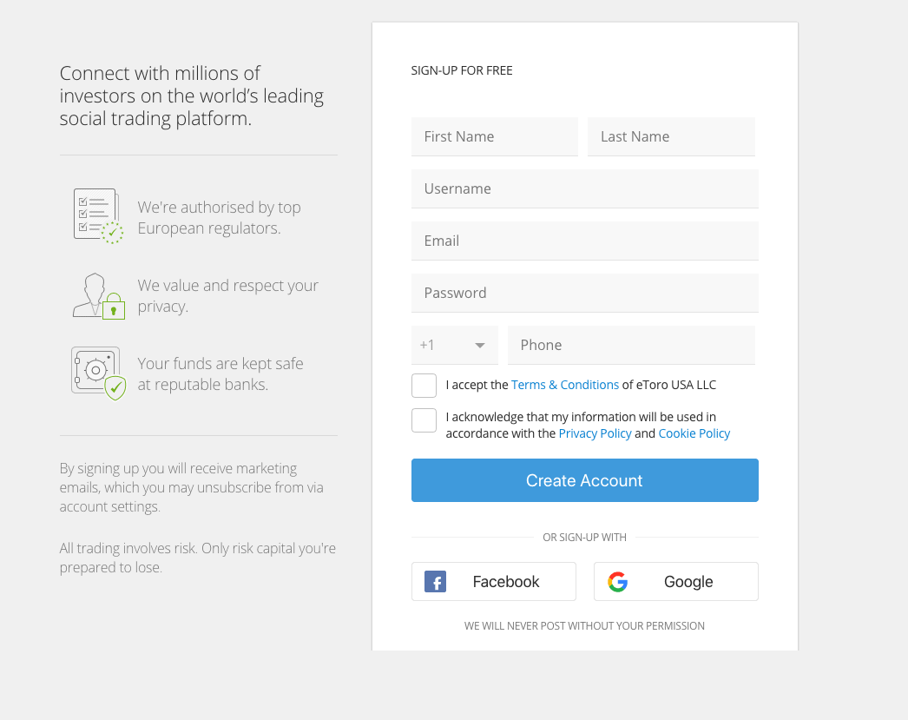

Step 1: Open a Trading Account

Opening a trading account is a quick process.

On the sign-up page, you will be required to create an account username and enter in your email and password to create your new trading account. You will also then have to confirm your email by clicking the confirmation link that gets sent to your email address.

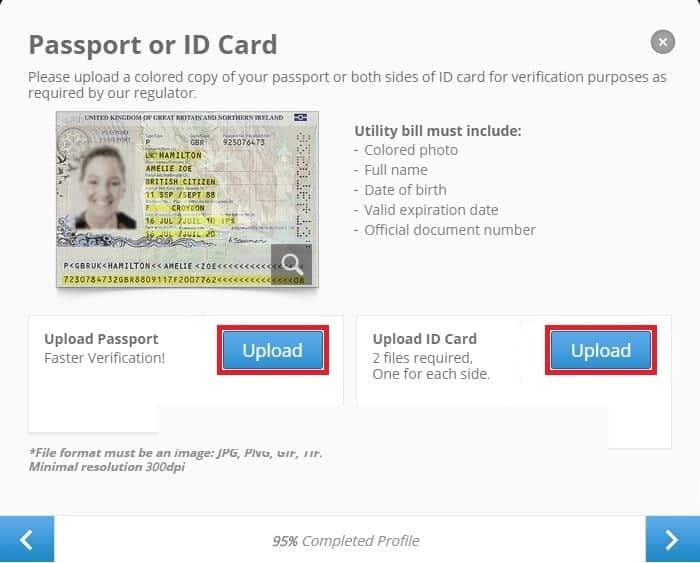

Step 2: Confirm Identity

To make sure you can verify your account and withdraw any profits quickly, you will need;

- Your driver's license or passport.

- A bank statement or utility bill that has been issued in the last three months.

The quicker you verify your account, the quicker you will be able to withdraw your profits and any deposit limits will also be removed.

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

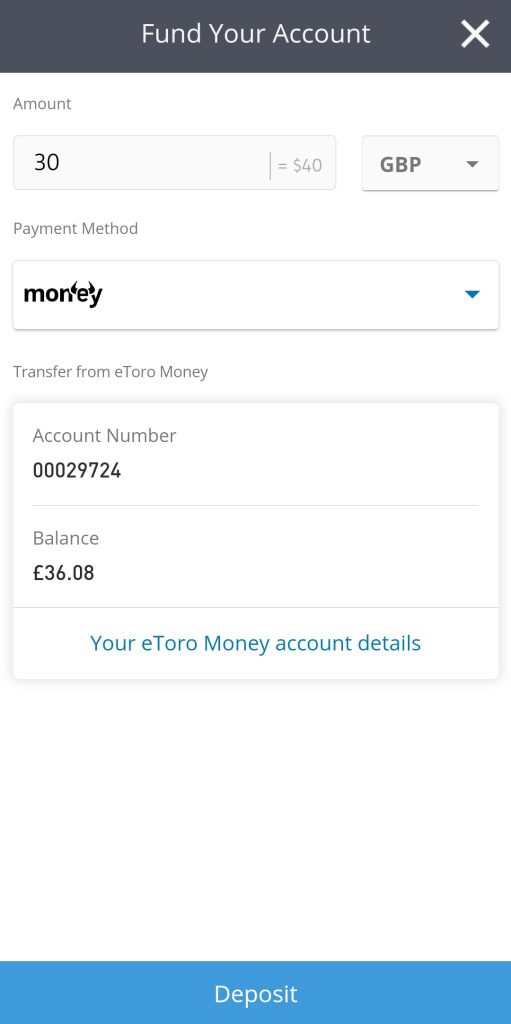

Step 3: Deposit Funds

When logged in, you will see a 'Deposit Funds' button. After clicking on this you will be given the available options to make your first deposit so you are ready to start making trades.

Step 4: Place a CFD Trade

To make a trade you will first need to find the Forex pair or asset you want to trade. You can do this by using the search function built into the platform.

Once you have selected the market you are going to trade you can hit the 'trade' button. This will bring up a box showing you all the parameters you will need to enter to execute your first trade. As the image below shows you will be shown exactly how much you could either profit or lose depending on the details you enter before executing the trade.

Conclusion

There are several CFD brokers and trading platforms available to UK traders. Each platform that we have covered in this article has been made to suit a different type of trader so it is important to research each option before deciding which one to use. Experienced CFD traders may opt for platforms that provide advanced charting tools. On the other hand, less experienced traders may prefer a platform that provides social trading and educational resources.

Nevertheless, there are many platforms to choose from for trading CFDs in the UK. Signing up for one takes a few minutes and allows you to start trading with 0% commission.

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

FAQs

What is CFD Trading?

CFD is short for 'Contract for Difference'. A CFD contract is a derivate contract that allows you to speculate on the price of a certain asset such as a Forex pair or a Stock. With a CFD you are not physically buying the underlying asset, you are simply making a trade on whether the price will go higher or lower.What is a CFD Trading Platform?

A CFD trading platform allows you to make trades on CFD products. These products could be Forex, Gold or cryptocurrencies. A CFD Product will let you quickly enter and exit your trades all from the comfort of your own home.What are some popular CFD Trading Platforms?

The popular CFD platforms have low trading costs and offer a large range of available markets. Some of these CFD platforms we reviewed above.What Broker Offers a CFD Platform?

eToro has a CFD trading platform. One reason eToro is favoured amongst many for their CFD trading is that you can trade a huge range of products and you can either be a trader or copytrader. This means you can either profit from your own trades, or copy other traders.How to Get Started Trading on a CFD Platform in the UK

The quickest way to get started with a CFD platform is to signup to one of the providers we reviewed above.References:

Johnathon Fox

Johnathon Fox

Johnathon is a Forex and futures trader with over ten years trading experience who has written for some of the biggest finance and trading sites in the world. Jonathan is also the founder of ForexSchoolOnline.View all posts by Johnathon FoxVisit eToroYour capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

By continuing to use this website you agree to our terms and conditions and privacy policy.Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Registered Company number: 103525

© tradingplatforms.com All Rights Reserved 2023

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

As an award-winning CFD broker UK,

As an award-winning CFD broker UK,