4 Best Copy Trading Platforms to Use in the UK June 2025

If you are an investor looking for a convenient way to participate in stock market growth without the need for extensive analysis and market study, copy trading offers a potential solution. Copy trading allows you to replicate the trading strategies of experienced investors, potentially mirroring their gains.

In this guide, we review some of the best copy trading platforms that are available in the UK for 2025 and the process of copy trading.

-

-

[stocks_table id=”1783″]

4 Best Copy Trading Platforms in 2025

After researching the market to find the best copy trading platforms, we came across 4 options that accept UK traders and offer appealing copy trading tools and features. Here is an overview of the platforms that we found. For a more detailed review of each platform, keep reading.

- AvaTrade: A commission-free broker compatible with multiple trading platforms. It offers competitive spreads on major forex pairs and commodities. A minimum deposit of £500 is required. Avatrade recommends ZuluTrade as the primary copy trading platform.

- Trade Nation: Trade Nation offers a copy trading service that enables traders to follow and copy the trading strategies of other traders in the network. This feature is geared towards providing a user-friendly experience for traders looking to diversify their investments.

- Admiral Markets: Admiral Markets offers a copy trading service called “Admiral.Invest.” This service allows users to invest in portfolios created by professional traders, giving them exposure to a diversified range of assets.

- IG: IG Markets is renowned for its extensive range of tradable assets, including over 16,000 shares, commodities, currencies, indices, and cryptocurrencies. A minimum investment of £250 is required to copy trade with the provider.

What is Copy Trading?

Copy trading is exactly what its name suggests: it is a mechanism that allows you to copy another trader. For example, if the trader you are copying decides to buy stocks such as Facebook shares, your portfolio will buy Facebook shares too. The amounts will differ in direct proportion too.

Copy trading is a way for you to actively trade without being an active trader because you outsource research, market analysis, and placing orders to another trader, and enjoy all the profits from their analysis. This is done in the same proportion as the trader’s portfolio. For example, suppose you invest $2000 in a copy trading platform with a trader.

If that particular trader invests 10% of their portfolio going long on Facebook, the same proportion will be applied to your account. Hence, you will spend $200 going long on Facebook.

Copy trading platforms vs social trading platforms

Copy trading and social trading platforms are two types of online trading tools that provide users with insight into the trading strategies of experts. Most brokerages that offer copy trading also offer social trading however, the two types of platforms are not the same.

Copy trading platforms allow users to automatically replicate the positions and trades of professional traders. These platforms typically require investors to invest a specific amount of money, and the platform will allocate it proportionally based on the selected trader’s activity. The advantages of copy trading platforms include the ability to mirror successful traders’ strategies without extensive market knowledge or experience. This method also allows for hands-off investing, as trades are executed automatically.

On the other hand, social trading platforms focus on creating a community of traders who share insights, strategies, and ideas. These platforms provide a space for traders to interact, share their trades, and discuss market trends. Unlike copy trading platforms, social trading platforms offer investors the autonomy to select which traders to follow, giving them more control and flexibility. This approach is particularly beneficial for those who want to enhance their trading skills and engage in deeper market analysis.

Determining the right platform ultimately depends on individual preferences. Copy trading platforms cater to those who desire a passive approach, seeking to replicate other traders’ success without extensive involvement. Social trading platforms, on the other hand, offer a more interactive experience and are well-suited for individuals who enjoy the community aspect of trading and wish to engage in active discussions.

Is Copy Trading Safe?

Copy trading allows novice investors to automatically replicate the trades of more experienced traders to potentially achieve similar results. Like any investment strategy, copy trading carries its own set of risks. The success of your investments ultimately depends on the performance of the traders you choose to follow. While there are many skilled and reputable traders out there, not all of them are reliable. It is crucial to conduct thorough research and choose traders with a proven track record of consistent profitability.

Moreover, the safety of copy trading depends on the platform you use. It is essential to select a reputable and well-regulated platform to minimize the risk of fraud or manipulation. Look for platforms that provide transparency, offer comprehensive risk management tools, and have a strong community of traders who actively share their strategies and insights.

Additionally, it is important to set realistic expectations when engaging in copy trading. Though it can potentially lead to profits, it is not a guaranteed way to make money. Market conditions, fluctuations, and unforeseen events can impact the performance of both the original traders and those replicating their trades.

How Does Copy Trading Work?

The process of copy trading is straightforward. Investors choose a trusted copy trading platform, where they can browse and select experienced traders to copy. These platforms provide comprehensive data on past performance, allowing investors to analyze the track records of potential traders. Once a trader is selected, the copy trading platform automatically executes the same trades as the chosen trader, allocating the same proportion of funds.

Copy trading can be implemented in several different ways in the UK. Some platforms offer all-in-one systems that enable traders to copy trade directly through the broker. Other platforms require traders to connect the platform to a third-party application that can be used to facilitate copy trading.

Programming Your Own Copy Trading Software

Experienced traders may prefer to program their own copy trading software that meets their meeds. Harnessing the power of programming can give you more control and customization options for your trading journey.

By programming your own copy trading software, you can tailor it to your specific trading strategies and preferences. Whether you prefer a conservative approach or like to take more risks, you can adjust the software accordingly. You can also incorporate advanced analysis techniques, such as backtesting and algorithmic trading, to make more informed trading decisions. To opt for this method, you will need to choose an advanced copy trading platform that provides the necessary tools for programming and backtesting.

What Is The Best Security to Copy Trade?

Since copy trading involves copying another trader’s trades, there is no restriction on the assets that you can use for copy trading. Whatever assets are available at your copy trading platforms can be used for this purpose. Most copy trading platforms allow you to trade forex, stocks and sometimes crypto.

When it comes to the best security for copy trading, investors should consider the risks that are involved with trading different financial instruments. For example, securities such as forex and crypto can produce short-term returns however, these markets are more volatile. On the other hand, stocks and ETFs are considered to be more stable asset classes but are usually held for a longer period.

Diversification is also an important factor to consider. It may be wise to choose portfolios that cover a diverse range of securities. This will reduce risk and allow you to benefit from different markets.

4 UK Copy Trading Platforms Reviewed

In the next section of our guide, we take a closer look at the copy trading platforms that are available to UK traders. It is important to read through each review carefully and conduct your own research before making any trading decisions. Remember, your money is at risk.

How we choose the best copy trading brokers

Before delving into our mini-reviews, it is helpful to understand how we choose the best copy trading providers for our guide. Our team spent time carefully reviewing different platforms to find the most suitable options for copy traders in the UK.

- Demo account availability: The best copy trading accounts provide a demo trader that can be used to test copy trading without putting any real funds at risk.

- Low fees: We looked for platforms that charge low trading and non-trading fees so that they are accessible to novice traders.

- Risk management tools: Copy trading apps should provide users with tools that can be used for risk management. These include stop losses, trailing stops, the ability to limit your position, and market alerts.

- Copy trader availability: To support a diverse trading strategy, platforms should provide a good selection of traders that can be copied. This will ensure that users can find a trader that meets their criteria.

1. Avatrade – Best copy trading platform for forex and CFD trading

Avatrade is a broker that is compatible with a variety of trading platforms and allows you to trade on several financial markets on a commission-free basis. They have very light spreads on the major forex pairs such as USD/GBP and EUR/GBP as well as the principal commodities such as gold.

Once you have created and verified your account, the minimum deposit that you need is £500. After that, you need to select a trading platform, find a trader to copy, and then sit back. Your chosen trader will then buy and sell assets, and the profits of this trading will be reflected in your own account.

The main trading platform to use with Avatrade is ZuluTrade. The process of using the platform involves choosing a trader to copy from a selected list of traders. They provide a host of information that will assist you in selecting the trader whose trading patterns match your financial goals. There are more than 10,000 copy traders to choose from.

The major drawback of using Avatrade through ZuluTrade is that it is not a regulated trading platform, so your capital might be at some risk.

Avatrade fees:

Fee Amount CFD trading fee Variable spread Forex trading fee Spread. 0.9 pips for EUR/USD Crypto trading fee Commission. 0.25% (over-market) for Bitcoin/USD Inactivity fee $50 per quarter after three months of inactivity Withdrawal fee Free 2. Trade Nation – Copy trade using advanced charting tools

Trade Nation offers a versatile platform that caters to both copy trading and traditional trading enthusiasts. For those looking to engage in copy trading, Trade Nation provides a straightforward yet robust system that allows traders to replicate the strategies of experienced investors. With a diverse range of traders to choose from, users can access a network of skilled strategy providers, each offering unique trading approaches.

In terms of fees, Trade Nation stands out with its competitive and transparent fee structure. The platform prides itself on offering tight spreads, which is crucial for traders aiming to optimize their profits. Moreover, Trade Nation doesn’t charge any commission on trades, making it a cost-effective choice for traders of all levels. Whether you’re engaging in copy trading or traditional stock trading, these fee conditions can enhance the trading experience.

Trade Nation equips traders with an array of tools and resources to make informed decisions. The platform provides risk management tools, including the ability to set stop-loss and take-profit orders, ensuring traders can protect their investments. Additionally, the comprehensive charting tools and technical analysis resources empower traders to conduct in-depth market analysis. This is invaluable for traditional traders who rely on chart patterns and technical indicators to formulate their strategies.

Key features that distinguish Trade Nation include its user-friendly interface and emphasis on customer support. The platform’s intuitive design ensures that both novice and experienced traders can navigate the system effortlessly. Furthermore, Trade Nation’s commitment to customer service is evident through its 24/5 support, ensuring that traders can seek assistance whenever they need it.

77% of retail investor accounts lose money when trading CFDs with this provider.

3. Admiral Markets – Replicate the forex trading skills of experienced traders on MT4

Admiral Markets is a versatile brokerage that caters to both copy trading and traditional trading enthusiasts, offering a wide range of assets and a plethora of features to enhance the trading experience. For those interested in copy trading, Admiral Markets’ copy trading service is a standout feature. It allows traders to replicate the strategies of experienced investors, making it an excellent choice for traders looking to learn and profit simultaneously. The platform provides access to a diverse pool of skilled strategy providers, each with their own unique trading approach, enabling users to diversify their portfolios. Copy Trading on Admiral Markets is available via the MT4 charting tool.

In terms of fees, Admiral Markets maintains a competitive fee structure. The platform offers tight spreads, which is crucial for traders looking to maximize their profitability. Additionally, Admiral Markets doesn’t charge commissions on trades, making it cost-effective for traders of all levels. Whether you’re engaged in copy trading or traditional trading, the favorable fee conditions contribute significantly to a trader’s overall success.

Admiral Markets equips traders with a robust suite of tools and resources. The platform boasts a variety of risk management tools, including stop-loss and take-profit orders, ensuring traders can protect their investments. Moreover, the platform offers an array of technical analysis tools, including chart patterns and indicators, to help traders make informed decisions. These tools are especially valuable for traditional traders who rely on in-depth market analysis to formulate their strategies.

74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

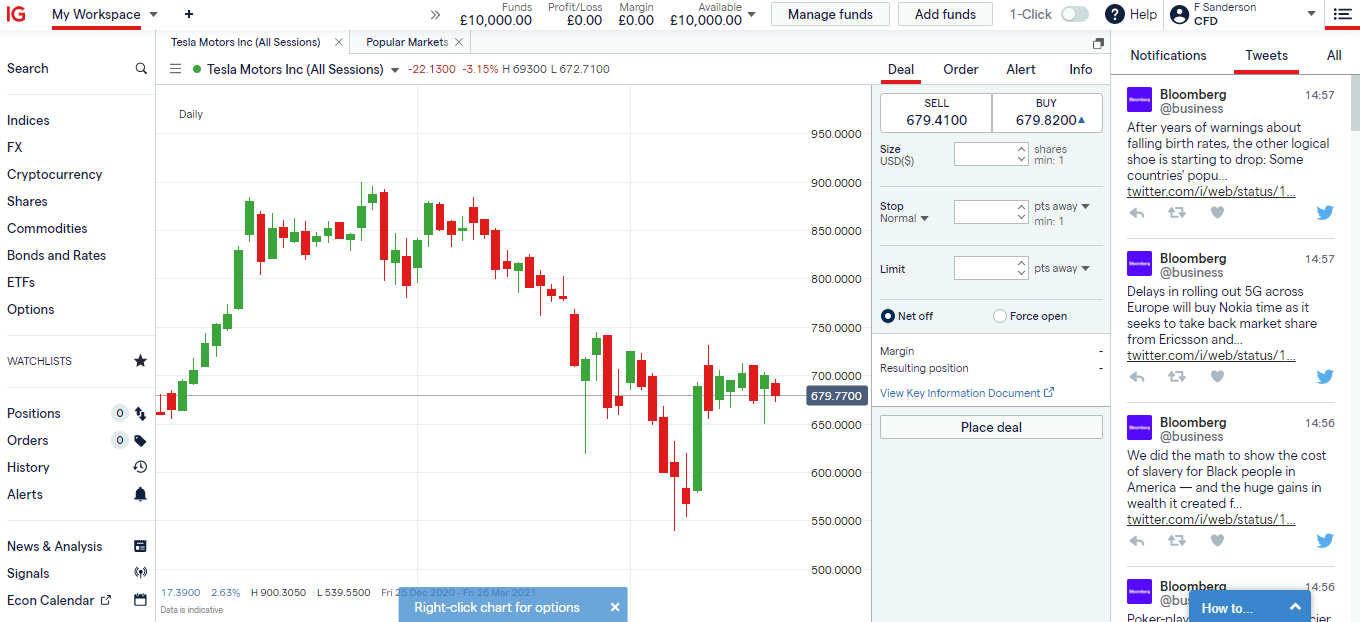

4. IG – Copy trading account with access to the MT4 charting platform

IG Markets offers perhaps the widest choice of financial instruments that you can trade with. With over 16,000 shares from companies across different countries and sectors combined with commodities, currencies, indices, and cryptocurrencies, they offer the opportunity to invest in assets worldwide.

Their copy trading service works in much the same way as AvaTrade, wherein you can create an account, deposit money through your credit/debit card or bank transfer, and then you are presented with a list of traders that you can copy.

After researching the traders, you can then select the one that matches your needs, and begin trading. The minimum investment required on IG Traders is £250. They also allow you to set up a demo account and see how you would perform with a particular strategy or trader without investing real money. They have minimum commissions on most asset classes, and the IG platform is compatible with MT4 as well.

IG fees:

Fee Amount Stock trading fee Commission. 2 cents per share for US stocks, 0.10% for UK and EU stocks. Forex trading fee Spread. 1.4 pips for GBP/USD. Crypto trading fee Spread. 36 pips for Bitcoin. Inactivity fee £12 a month after 24 months. Withdrawal fee Free Copy Trading Platforms in the UK Compared

To better understand the differences between each of the platforms discussed above, here is an overview of copy trading fees.

Avatrade IG CFDs, Forex, Commodities, Cryptocurrency Stocks, Cryptocurrency, Forex, Commodities, Indices Fee for trading Amazon 0.6 pips 2 cents per share Fee for trading USD/GBP Spread, 0.9 pips 0.6 pips Fee for trading BTC Commission, 0.25% Commission, 2.58% How to Copy Trade in the UK 2025

In the section below, we will outline the steps involved with starting copy trading in the UK.

Step 1: Create an account

Sign up for a free account with a copy trading platform UK investors are accepted at.

At a regulated broker, you will need to enter your information and your contact details.

You will also have to provide your ID and address proof. For your ID proof, you can use any form of government-issued ID. For address proof, you will need to either upload your utility bill or a bank statement.

Step 2: Deposit funds

The next step is to deposit funds which you can add through your debit/credit card, bank transfer, or any e-wallets. Other than a bank transfer, both the other means will ensure that the funds are visible in your bank account immediately. The minimum investment per copy trader is $200.

Step 3: Select a trader

The next step for you is to select a trader that you wish to copy. Click on the “Copy People” button, and begin filtering based on your requirements. For example, you could choose to only look at people who trade cryptocurrencies or have a minimum gain of 8% p.a. in the past 5 years. There are thousands of traders to choose from, and by clicking on any trader you can get more insights into how their trading history and pattern.

Step 4: Invest

The last step once you have identified the trader(s) that you wish to copy, is to simply invest. By clicking on the invest button, you can decide what amount you wish to invest with them, and then sit back and enjoy your gains.

Conclusion

This guide has reviewed several copy trading platforms that UK traders are accepted at, from all-in-one platforms to brokers that can be connected to MT4. They have been judged on the basis of the asset classes they offer, the fees they charge, and the number of traders they offer.

Before choosing a platform to use, conduct thorough research into the options that are available. Copy trading does not guarantee returns and your money is at risk. Some platforms offer a demo account that can be used to test out copy trading features before using any real money.

Overall, copy trading is a strategy that is used by traders who want to mimic the trades of experienced traders. While the strategy does not guarantee returns, it can reduce time spent on research and analysis while ensuring that trades are backed by informed decision making.

FAQs

What is Copy Trading?

Copy trading involves copying another trader and taking on the same positions that they do so that you can benefit from their analysis and research. There are several platforms that allow you to choose from a host of traders to copy from, and this can be done across a variety of asset classes.

How does Copy trading work?

The copy trading process requires users to choose a trader (or trading strategy) to copy, and then their traders are executed in the same manner and proportion. For example, if you invest $2000 with a trader, and they spend 10% of their portfolio shorting Tesla, then 10% of your portfolio ($200) will also be used to short Tesla. You will then get gains and losses in the same ratio.

Can you make money from copy trading?

Some traders have made money from copy trading however, profits are never guaranteed and past performance does not indicate future results. It is important that you do your research and due diligence before selecting a trader to copy. When you choose to copy trade, you are ultimately investing money at your own peril, so you should be careful.

How do you copy a trade?

Once you have selected to copy a trader, your platform will automatically open and close positions in sync with the trader that you have chosen to copy.

What is a widely-used Copy trading platform?

While there are several copy trading platforms that offer competitive services, AvaTrade is the most well-known trading platform for this purpose, because they are regulated and offer the widest variety of assets to trade from at no commission. It also gives you access to thousands of verified copy traders that you can choose from based on your needs.

Is copy trading legal in the UK?

Copy trading is perfectly legal in the UK, as long as it is done through a regulated and licensed broker or trading platform. The Financial Conduct Authority (FCA) oversees and regulates the financial markets in the UK, and they have set out guidelines for copy trading platforms.

References:

Alan Lewis Senior Editor

Alan Lewis Senior Editor

View all posts by Alan LewisAlan is Head of Content at TradingPlatforms.com and also contributes as a writer specializing in stocks and cryptocurrency trading. Alan earned an MA in English Literature from the University of Sussex in 2017. Since then, he has used his exceptional writing skills to create and edit content in the finance space for several reputable platforms.

Before working at TradingPlatforms, Alan worked as a content writer for IvoryResearch.com and Seven Star Digital. He is a skilled writer who is able to cover complex topics in a way that is easy to understand.

As well as creating content, Alan actively invests in the financial markets. This helps him to create insightful and actionable content and provides him with first-hand experience with many of the platforms that are covered by TradingPlatforms.com.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

By continuing to use this website you agree to our terms and conditions and privacy policy.Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Registered Company number: 103525

© tradingplatforms.com All Rights Reserved 2023

Scroll Up

Avatrade is a broker that is compatible with a variety of

Avatrade is a broker that is compatible with a variety of

IG Markets offers perhaps the widest choice of financial instruments that you can trade with. With over 16,000 shares from companies across different countries and sectors combined with commodities, currencies, indices, and cryptocurrencies, they offer the opportunity to invest in assets worldwide.

IG Markets offers perhaps the widest choice of financial instruments that you can trade with. With over 16,000 shares from companies across different countries and sectors combined with commodities, currencies, indices, and cryptocurrencies, they offer the opportunity to invest in assets worldwide.