Best Crypto Lending Platform in the UK – With Highest Interest Rates

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Crypto lending is a way of decentralizing finance through cryptocurrencies, and it’s taking over the cryptocurrency world! A cryptocurrency lending platform enables investors, developers, and platforms to borrow cryptocurrency from each other for a fee and give interest on the loan. Due to this, regardless of what happens to the crypto price from day to day, you will be able to earn money from your crypto holdings.

This guide aims to review the five best crypto lending platforms in the United Kingdom for the year 2025. In addition, we’ll show you how to get started right away with crypto lending and explain how it works.

Crypto Lending Platforms in the UK List 2025

- DeFi Swap – Up to 75% APY

- AQRU – Up to 12% APY

- Crypto.com – Earn APY up to 14% on more than 50 Different Stablecoins by Lending Crypto

- Nexo – Crypto Lending Platform to Earn Up to 36% APY Paid Out Every Day

- YouHodler – Simple crypto lending across 50 coins

Would you like to find out more about crypto lending platforms? The following article provides you with a brief overview of each of the top 5 sites so you can get a better idea of what each has to offer and decide which is the best match for you.

1. DeFi Swap – Up to 75% APY

DeFi Swap makes it possible to do lending, swaps, and performance farming. The DeFi token is known in the market as DEFC and has been available since its launch and the DeFi Swap exchange in May 2021.

DeFi Swap makes it possible to do lending, swaps, and performance farming. The DeFi token is known in the market as DEFC and has been available since its launch and the DeFi Swap exchange in May 2021.

With DeFi Swap, investors can use the token to make loans or exchanges for other decentralized currencies. DeFi Coin has a system that works based on static rewards, which generates a steady income stream, especially for DEFC owners. A 10% tax will be charged if you want to either buy or sell. As for what is collected, it is split 50/50. The first half is used as a reward to DEFC owners, and the other half is for the DeFi Swap liquidity funds.

In DeFi Swap, it is possible that by using the lending services, you can get APY on your tokens. The first thing, once you know the platform’s farming offer, you can get different interest rates that vary depending on the token you can lend.

Additionally, it is possible that on the platform, you can choose the lock-in period. So with that said, the longer you block, the more interest you can get. If you use the maximum term, 365 days, you can get an APY of 75%, the highest possible. Although there are also 90-day terms which are 45%, and 180-day terms, which are 60%. At the end of the chosen term, DeFi Swap will return the amount with interest earned during the selected period.

There is a second lending tool available, and that is with DeFi Sawp’s swap liquidity. With this, you can earn commissions that are collected by the platform. All lending processes are made possible by smart contracts. Suppose you wish to use the platform. First, you need to connect your wallet to the DeFi Swap website. Then, the platform can be used with WalletConnect and MetaMask.

This aligns with the broader spirit of decentralized finance, which DeFi Swap follows. After all, a platform cannot claim to be a DeFi supporter if a centralized operator backs it. To start using this top-notch lending platform, you will first need to connect your wallet to the DeFi Swap website. It is so popular that it has a Telegram group with more than 6000 users who interact frequently.

| Maximum Interest Rate | Fees |

| 75% APY | 10% Buy an Sell Fee |

Your capital is at risk.

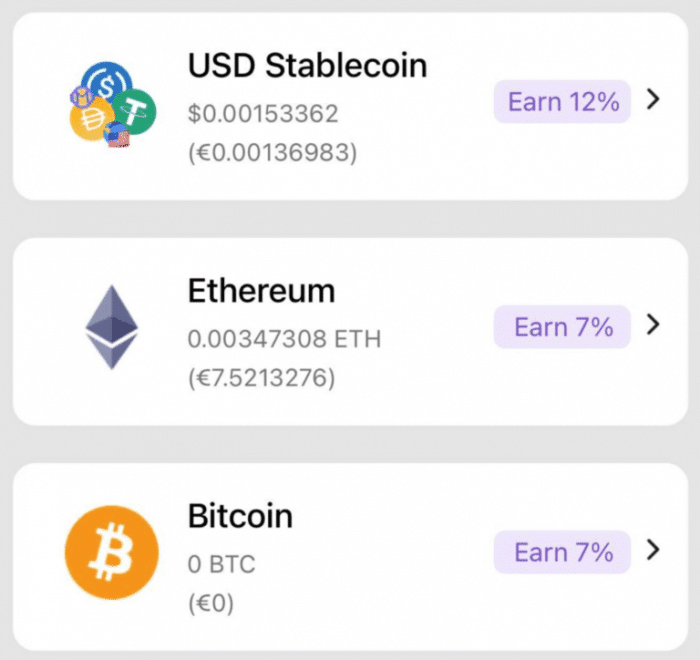

2. AQRU – Up to 12% APY

Using this platform, you can lend out Ethereum, Bitcoin, Tether, USD Coin, and DAI with up to 12.0% APY rates. In addition, each coin has a different interest rate in terms of risk profile, which makes it easy to create a mix-and-match portfolio of coins that consists of variable interest rates. Furthermore, AQUU never locks in your money, so if you want to withdraw or reallocate your portfolio at any time, you are free to do so.

A very exciting feature about AQRU is that it offers you the ability to go from fiat lending to crypto lending in a matter of seconds. The platform allows you to make a deposit using a credit card, debit card, or bank transfer and will use MoonPay to convert your deposits to crypto automatically. There is no additional deposit fee for the use of fiat currency and no withdrawal fee for fiat currency. There is no doubt, of course, that AQRU also accepts crypto deposits in any of the 5 cryptos that it supports.

AQRU is a very simple platform to use, and it has a mobile application that allows you to manage your crypto lending anywhere, anytime. In addition, you will receive interest payments every day, so you can start compounding your investments quickly. It is even possible to track how much interest you are earning on an hourly basis, making the money you earn even more real and tangible.

| Maximum Interest Rate | Fees |

| 12.0% APY | None |

Cryptoassets are highly volatile unregulated investment products.

2. Crypto.com – Earn Up to 14% APY on more than 50 Tokens By Lending Crypto

Crypto.com is one of the most popular crypto-lending companies that you can use to earn interest on your altcoin holdings. The reason for this is that the platform accepts more than 50 different tokens and offers a rate of 14.0% APY for USD Coins. Ethereum and Bitcoin are both earning 8.5% APY at Crypto.com.

We particularly like Crypto.com because we can choose a flexible loan period or lock in our cryptocurrency for 1 or 3 months. If you decide to lock in your cryptocurrency, you are rewarded with higher interest rates, but you are penalized if you decide to withdraw early.

You should be aware that Crypto.com reserves its best Bitcoin lending rates for users who are also staked with a minimum of $4,000 in CRO, Crypto.com’s native cryptocurrency token. With the help of a simple online calculator, you can calculate how much you might be able to earn from lending out coins with different lock-in periods and CRO stakes when using Crypto.com. For AQRU, it’s relatively easy to create a diversified crypto portfolio by using many different coins and interest rates in one portfolio.

It is worth mentioning that Crypto.com pays out interest every week, and you can keep an eye on your earnings online or on your mobile device via the Crypto.com mobile app. In addition, the app offers access to Crypto.com’s exchange and other offerings, including a crypto-back rewards credit card, making it a one-stop-shop for everything cryptocurrency.

| Maximum Interest Rate | Fees |

| 14.0% APY | None |

Cryptoassets are highly volatile unregulated investment products.

3. Nexo – Crypto Lending Platform to Earn Up to 36% APY Paid Out Daily

Nexo Crypto lending is a unique product designed for aggressive investors looking to get the highest interest rate on their crypto assets. For Axie Infinity, you will find promotions in Nexo of up to 36% Annual Percentage Yield, and for Terra, you will find APY rates of up to 20%. In addition, polygon and Polkadot have regular interest rates of up to 16% APY for Polygon and 15% APY for Polkadot.

With Nexo, you can lend on 32 cryptocurrencies in total, and you will receive interest for each one every day. The benefit of this is that you get the chance to take advantage of these high Bitcoin lending rates with daily compounding growth.

It would be helpful if you kept it in mind for Nexo because all interest is paid out in NEXO tokens instead of the cryptocurrency you lent out. While this is good if you like the NEXO token, it does mean that you may incur swap fees if you wish to switch back to another cryptocurrency in the future.

Nexo crypto lending accounts are free of charge, and the platform uses multiple layers of insurance to protect clients’ funds. More than £170 million in interest has been paid out by Nexo to date.

| Maximum Interest Rate | Fees |

| 36.0% APY | None |

Cryptoassets are highly volatile unregulated investment products.

4. YouHodler – Simplified Crypto Lending Across 50 Coins

In the UK today, YouHodler is another one of the biggest and most trusted Bitcoin lending sites. In terms of versatility, it is comparable to Crypto.com as it allows you to lend across 50 different coins. Currently, Tether’s top rate of 12.3% APY is available, while USD Coin earns 12.0% APY and Bitcoin earns 4.8% APY.

YouHodler has a few unique features that make it stand out from its competitors. For example, you can first use the crypto in your savings account as collateral for a crypto loan. The significance of this development is that you now can use your crypto twice – once as a means of earning interest and another time as collateral for a loan – all from the same account.

YouHodler also provides fully flexible loan terms, which means that you can adjust your portfolio at any time or withdraw your funds if you need to. In addition, the Crypto Interest is paid out on a weekly basis so that compound interest can be generated without any delay.

Another advantage of YouHodler we like is that it has an insurance policy of $150 million in place. As a result, that contributes to a lot of peace of mind regarding lending through the platform since you can feel confident that your funds will be covered in the event of a hack.

| Maximum Interest Rate | Fees |

| 12.3% APY | None |

Cryptoassets are highly volatile unregulated investment products.

Types of Cryptocurrency Lends

The process of lending out cryptocurrency can be accomplished in a variety of ways. Check out the most popular methods and find out what makes them different.

Lending Crypto From a Site

The crypto lending platforms that we reviewed are all part of those that lend crypto from websites. The platforms do not hold your crypto on your behalf, but keep it in a custodial account and lend it out on your behalf by taking a cut of the interest that borrowers pay.

You can lend crypto from a beginner-friendly site, and the interest rates can be quite competitive as well.

Lending Crypto to a Platform

The practice of lending crypto to a platform is more commonly referred to as staking. With this type of crypto loan, you are pledging your cryptocurrency as the stake required to ensure that new transactions are validated on a crypto blockchain. After a transaction is validated, the blockchain releases newly minted coins to the participants. A portion of this blockchain reward is returned to you as interest as a reward for your stake.

As a result of staking, your cryptocurrency is locked for several days or even several weeks at a time. In the event that you withdraw your crypto before the end of the lock-in period, you will not be paid any interest. Therefore, the best time to stake a cryptocurrency is generally when you plan to earn more of the currency since you are expecting its value to rise.

Peer-to-Peer Crypto Lending

You are essentially lending your crypto directly to another individual in peer-to-peer Bitcoin lending. The risk involved in this type of crypto lending is one of the highest since if the borrower defaults, you will have little recourse if you need your money back. However, a major advantage of peer-to-peer crypto lending is that it offers some of the lowest crypto lending rates available in the market. As a result, it’s one of the best yield investments available today.

You can search for potential borrowers on a decentralized lending exchange and set up a loan repayment schedule.

Bitcoin Lending Interest Rates Explained

If you are comparing Bitcoin lending platforms and which coins to lend, one of the key things to consider is what rate you will get on your loan. The Crypto lending rates vary widely from platform to platform, and they can even change over time as the demand for borrowing crypto increases and decreases.

In most cases, crypto lending rates are APY or annual percentage yield. Based on the interest rate on your cryptocurrency, you would be able to earn a profit if you lent your crypto out for the whole year. However, it is important to note that you will receive a fraction of the APY if you loan out your crypto for less time.

What Cryptocurrencies Can Lend?

There are some cryptocurrencies that cannot be loaned out. These are usually popular cryptocurrencies for which there is a high demand for lending. If there is a greater demand for a coin, more investors and developers will want to borrow it, which will raise interest rates – a win-win situation for the lending platform and any crypto holders who are lending out their coins.

The top crypto lending platforms are also aiming to cover a wide selection of altcoins simultaneously. That is because the price of altcoins can continue to grow for many years to come, so investors often want to earn interest in them to realize a profit without selling them. Because of this, sites like Crypto.com and YouHodlr now offer lending on 50 different cryptocurrencies.

There are a number of popular cryptocurrencies that are used for lending, among them:

- Bitcoin

- Ethereum

- Tether

- USD Coin

- PAX USD

- Maker

- Uniswap

- Chainlink

- Avalanche

- Tezos

- Cosmos

- Terra

Check out the table above for a full list of coins available at each lending site.

How to Lend Cryptocurrency in the UK

Are you ready to lend out your cryptocurrency to earn interest? In this post, we’ll show you how to get started with AQRU, our top-rated website for lending Bitcoin, and more in 2025.

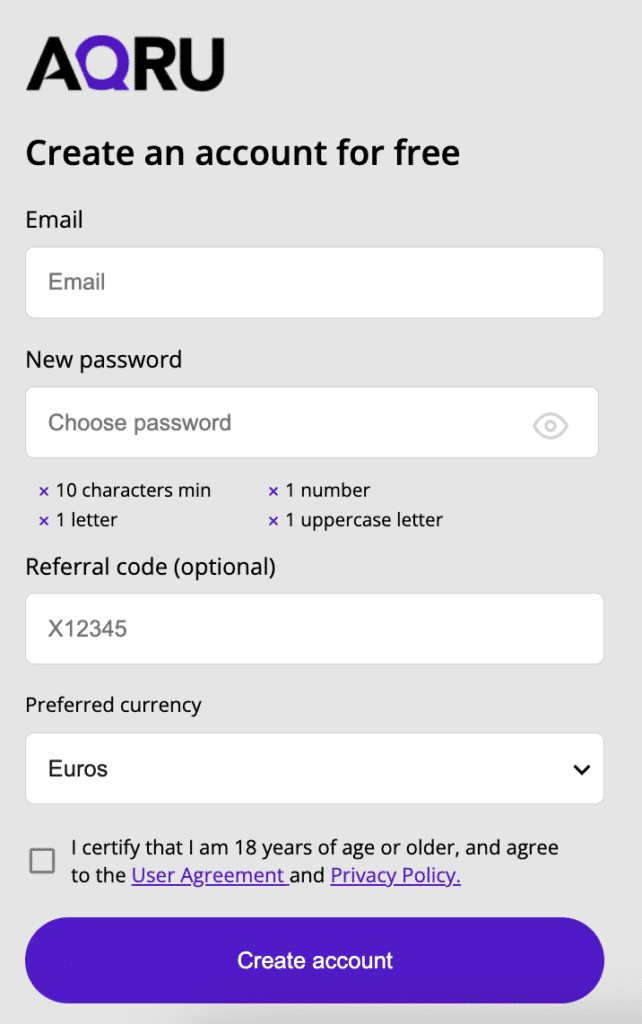

Step 1: Open an Account

You can create a new lending account by going to AQRU.io and clicking on Sign Up. Next, enter your email address, choose a password, and click Create Account.

Cryptoassets are highly volatile unregulated investment products.

Step 2: Deposit Funds

The AQRU accepts fee-free deposits by credit card, debit card, bank transfer, or cryptocurrency. Select the deposit method that best suits you and enter the amount. If you intend to deposit crypto, you will need to initiate a transfer from your crypto wallet before you can deposit.

Step 3: Lend Cryptos

As soon as you have completed the steps above, you are ready to lend out your cryptocurrency to AQRU. Please select a coin you would like to lend based on the interest rates displayed, and then choose how much you would like to lend. Keep in mind that AQRU allows you to lend multiple coins simultaneously so that you can create a portfolio of crypto lends with different interest rates and risk profiles.

Cryptoassets are highly volatile unregulated investment products.

Is it Safe to Lend Crypto?

In general, lending crypto is relatively safe, although it should not be as safe as lending traditional fiat currency via a bank. There is no protection under the Financial Services Compensation Scheme for crypto lending accounts instead of savings accounts.

However, the best crypto lending platforms ensure that your funds are as safe as possible by taking great measures to protect them. For example, most companies use secure crypto wallets to store client funds during the lending process. There are also platforms like AQRU that have insurance policies that will replace your money in a hack or other loss.

Furthermore, it is also essential that you consider that if you loan out cryptos, you could lose money. As a result, repayments are not guaranteed, and you may lose some or all of your principal if lenders default – especially when it comes to peer-to-peer lending for Bitcoins, where you are dependent on one borrower to make repayments. In addition, it is possible that the value of the coins you are holding can also fall, which may cause you to lose money even though you may be earning interest on your crypto loan.

Conclusion

The cryptocurrency lending companies make it easy to earn interest in your cryptocurrency holdings. With the help of 5 of the best crypto lending platforms in the UK, you can use your crypto today to start earning your interest.

Our recommendation is AQRU, which accepts fiat deposits and offers up to 12.0% APY rates. You can get started today at AQRU.io.

Cryptoassets are highly volatile unregulated investment products.