7 Best Options Trading Platforms in the UK in 2025

Options trading is one way to speculate on the future price of assets in order to profit from fluctuations in the market. Interest in options trading has peaked recently, which has encouraged trading platforms to facilitate the trading strategy. There are now numerous platforms available to UK traders that support options trading.

In this guide, we will take a closer look at the available UK options trading platforms to establish the key features that are offered by each one.

-

- 1. XTB – Options trading platform with low fees and no minimum deposit

- 2. Ava Trade – Options Trading Platform for Forex Pairs

- 3. Alvexo – A UK-Regulated Options Trading Platform

- 4. IG – Options Trading Platform With One Of The Most Comprehensive Asset Offerings

- 5. CMC Markets – Established Options Trading Platform for UK Traders

- 6. Webull – Commission-Free Options Trading Platform In The UK

-

- 1. XTB – Options trading platform with low fees and no minimum deposit

- 2. Ava Trade – Options Trading Platform for Forex Pairs

- 3. Alvexo – A UK-Regulated Options Trading Platform

- 4. IG – Options Trading Platform With One Of The Most Comprehensive Asset Offerings

- 5. CMC Markets – Established Options Trading Platform for UK Traders

- 6. Webull – Commission-Free Options Trading Platform In The UK

Our List of Best Options Trading Platforms in the UK

- XTB– XTB Broker is a popular trading platform in Europe, offering over 2100 trading instruments and 400,000 subscribers worldwide. XTB offers two platforms: XStation 5 and XStation Mobile, with the latter ideal for mobile trading.

- Ava Trade – AvaTrade is a UK-based trading broker offering forex options trading with over 40 pairs. The platform offers direct options for purchase and selling as well as a CFD platform for other assets.

- Alvexo – Alvexo is a top options trading platform with competitive spreads, multiple platforms, and tools for market timing. With over 450 tradable assets, it offers a proprietary web trading platform, MetaTrader 4, a mobile app, and the Alvexo Plus feature.

- IG – IG offers comprehensive options trading coverage across 17,000 markets, including CFDs and spread bets. It offers diverse asset selection, adapts trading strategies to market conditions, and doesn’t impose commissions.

- CMC Markets – CMC Markets, an industry-awarded broker with over 11,500 trading instruments, offers a platform for options, international shares, and other share trading products with tools for in-depth analysis.

- Webull – Webull is a user-friendly UK options trading platform with a narrow asset range, offering free trades and no per-trade or per-contract fees, and offering a wide range of technical indicators and drawing tools.

What Is Options Trading?

When you trade binary options, you are buying a contract that gives you the right to buy an underlying asset at a pre-arranged price at a set date in the future. Traditionally, these options were traded in person, but are now traded mostly online. However, the fundamental concept remains the same.

If the buyer of the option wishes to realize the contract, the seller of the option is the contracting party who needs to fulfill his contractual obligation. Option buyers are entitled to exercise their options but are not required to do so, meaning they may give up on their obligation to execute the deal.

If an option represents the right for the holder to purchase a certain asset, it is referred to as a call option, and if it represents the right for the holder to sell a certain asset, it is referred to as a put option.

The underlying asset of the option is the subject of the contract contained in the option. The asset can be commodities, cryptocurrencies, interest rates, futures contracts, stock indices, or forex. According to the source, the UK market is known as the largest in the world, with over 40% of forex trading transactions happening in London.

The premium, the strike price, and the expiration date are the three components of an option contract, and they are all equally important. A premium is a fee you pay when you enter any options trade, which is the cost of the options contract itself. As for the strike price, it is the amount at which you agree to pay if you exercise your option. Finally, when it comes to a contract’s expiration date, this is the date by which you are permitted to exercise your right to terminate the contract. Upon expiration of this date, the options contract is no longer valuable and becomes valueless.

As an options trader, you should remember that you are not required to hold your contracts through expiration. The option contracts you own can also be sold to another trader in exchange for the current premium price. If the contract’s value increases or decreases since you purchased it, you can exit the trade and generate profit or loss.

Types of options trading in the UK

In the UK, there are several types of binary options trading that investors can participate in.

The first type of options trading in the UK is the call option. This type of option gives the investor the right to buy a specific stock at a predetermined price within a certain time frame. Investors who believe that the price of a stock will increase can buy call options and potentially profit from the price appreciation.

Another type of options trading is the put option. This option gives the investor the right to sell a specific stock at a predetermined price within a certain time frame. Investors who believe that the price of a stock will decrease can buy put options and potentially profit from the price decline.

In addition to call and put options, investors in the UK can also engage in the trading of index options. These options are based on the movements of a particular stock market index, such as the FTSE 100. Index options allow investors to speculate on the overall movement of the market, rather than focusing on individual stocks.

Our Reviews of the Best Options Brokers in the UK

In the following section, we will take a closer look at the best options trading brokers that are available to UK institutional investors. Our team spent time researching and reviewing several different platforms before deciding on the top 7 brokers. We chose user-friendly brokers, offer low fees, and have great educational resources and research tools that can be sued by traders to make informed decisions.

1. XTB – Options trading platform with low fees and no minimum deposit

In Europe, XTB Broker is a well-known trading platform for stocks, currencies, and commodities that accepts a variety of assets. The platform has more than 400,000 subscribers worldwide and has been available for more than 15 years.

In total, XTB offers more than 2100 trading instruments. For anyone looking to diversify their portfolio and broaden their market exposure, this makes it an alluring option. Additionally, XTB guarantees fair spreads and fees. The website states that overnight fees apply to anyone who holds positions after the market shuts down.

The platform provides users with a range of educational materials to increase their knowledge about trading. A whole trading academy and a ton of tutorials are also available. Users of XTB can also access extensive market analysis to aid in their trading decisions.

XTB also offers a demo account, which is a great method to test out the program before putting money at risk. The two trading platforms offered by XTB are XStation 5 and XStation Mobile. The second option is the ideal for trading on the go.

75% of retail investor accounts lose money when trading CFDs with this provider.

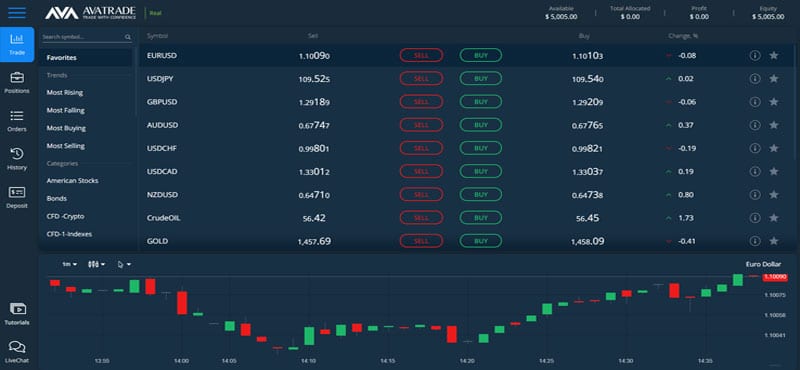

2. Ava Trade – Options Trading Platform for Forex Pairs

AvaTrade is a well-known trading broker in the UK, particularly in the field of forex options trading. They offer a variety of over 40 forex pairs for trading.

This broker provides the capability to both purchase and sell options directly, although it primarily serves as a CFD trading platform for various other types of assets. Therefore, if you decide to execute a contract, you’ll have the opportunity to do so instead of solely speculating on premiums.

AvaTrade has a platform dedicated to the trading of options called AvaOptions. Using the platform, you can calculate your profit, loss, and breakeven price and evaluate various options trading strategies. Stop-loss orders for option trades are also available from AvaOptions.

You can access the platform from your computer, mobile phone, or tablet. In addition, the commission-free trading of options through AvaTrade is guaranteed on all trades. Nevertheless, if you are planning to sell your positions instead of exercising your contracts, then you should be aware that the spreads can be high.

There is no guarantee that you will make any profits with this provider. Your money is at risk.

3. Alvexo – A UK-Regulated Options Trading Platform

Alvexo holds a notable position on our list of options trading platforms. Investing through this European broker offers access to competitive spreads, multiple trading platforms, and a range of tools designed to assist with market timing.

Within Alvexo’s selection of over 450 tradable assets, you’ll find various options, including currency pairs, indices, commodities, stocks, and cryptocurrencies. This diverse range of assets enables traders to effectively diversify their portfolios.

When you trade with Alvexo, you can choose between utilizing the company’s proprietary web trading platform and MetaTrader 4. With Alvexo’s Web Trader, you can access a wide variety of features that will assist you in analyzing price movements and putting orders. It is also possible to trade on the go with Alvexo’s mobile app on iOS and Android devices.

It should be noted that Alvexo also offers a premium service known as Alvexo Plus. With this service, traders have access to daily trading signals, market news, webinars, and an economic calendar, providing them insight into the market.

It is important to note that Alvexo is regulated by the Financial Services Authority of Seychelles.

76.22% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

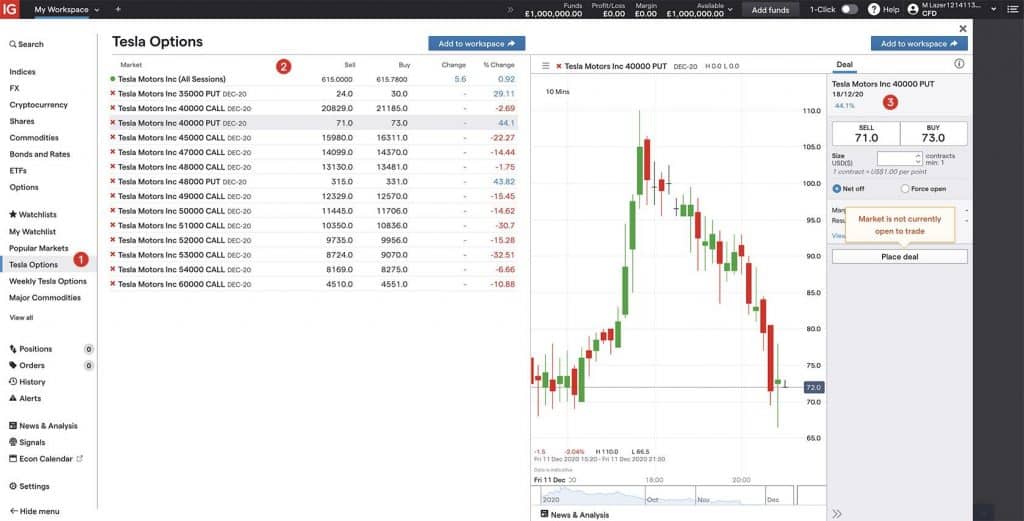

4. IG – Options Trading Platform With One Of The Most Comprehensive Asset Offerings

IG provides access to a substantial array of over 17,000 markets, making its coverage of the options market quite comprehensive within the industry. When opting to engage in options trading with IG, you have two alternatives: trading through CFDs or spread bets. These methods allow you to make predictions regarding the direction of option premiums without directly engaging in the buying and selling of options, thus managing your investment risk more effectively.

In addition to US and UK stocks, you can also speculate on global indices, commodities, forex, and a wide range of other assets. This diverse selection enables you to adapt your trading strategy to prevailing market conditions across multiple markets. Furthermore, IG does not impose commissions on CFDs and spread betting trades, although there may be spread costs associated with these transactions.

There is no guarantee that you will make any profits with this provider. Your money is at risk.

5. CMC Markets – Established Options Trading Platform for UK Traders

Due to its three decades of operation and more than 11,500 trading instruments, CMC Markets is well-established as a broker.

It is possible to trade options, international shares, and other share trading products on the CMC Markets platform using one account, either the standard account or the Pro account. In addition, the Pro platform also offers different tools to assist the trader in creating and executing different options strategies depending on their needs. As a result, the platform can be tailored to meet users’ needs according to their trading style.

The tools and software offered by CMC allow users to conduct in-depth analysis and make informed trading decisions. There are more than 115 technical indicators and drawings to choose from, along with 70 chart patterns and 12 types of charts built-in for the user. The variety of features CMC Markets offers, as well as a variety of industry awards, have contributed to the company’s success.

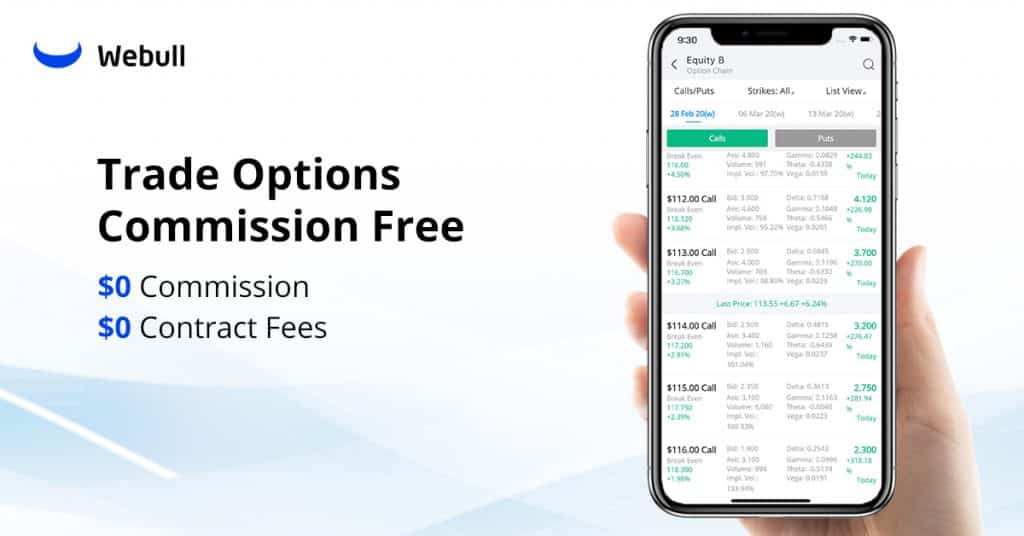

6. Webull – Commission-Free Options Trading Platform In The UK

Webull is a widely used options trading platform in the UK. The Webull app is user-friendly and doesn’t require extensive technical knowledge, making it accessible for users looking to invest smaller amounts.

Compared to other leading brokerage apps, Webull’s range of available assets is somewhat narrower. However, if your primary interest lies in stock trading, you’ll find an ample selection. Additionally, stock options trading is available, although it is predominantly focused on US stocks.

Webull distinguishes itself by offering free options trades with no per-trade commission or per-contract fees applied to customers. It’s important to note that there are no assignment or exercise fees either. These factors make Webull a reputable choice for options trading.

A large range of technical indicators and drawing tools is also available for experienced traders at Webull. It is possible to select from 50 indicators, including moving averages, momentum studies, and other commonly used indicators. Likewise, indicators can all be customized to allow you to select the time window during which you would like them to be calculated.

There is no guarantee that you will make any profits with this provider. Your money is at risk.

Guide To Choosing an Options Trading Platform

It is important to conduct your own research before making investment decisions. To help you, here is an overview of the ranking criteria by which our experts ranked the key features of options trading platforms.

Regulation

Options trading platforms in the UK are regulated by the FCA. Most platform will provide details about regulation and licensing on their website for traders to see. If a platform does not have this information, it may mean that they are not regulated.

While it is not illegal to use an unregulated platform in the UK, it is not advised.

Asset Availability And Supported Markets

To support a diverse trading strategy, options brokers should provide a range of supported markets.

There are usually options available on stocks, indices, commodities, and forex on the most popular options trading platforms. For instance, trading through options for stock trading and forex trading is particularly prevalent due to the volatility of these asset classes and the potential for price movements that can be strong.

In addition to these, some brokers may also offer access to options on cryptocurrencies and exchange-traded funds in some cases.

Trade Fees

In order to be able to trade options online, it is always necessary for you to pay a fee of some kind. This is what we have discussed throughout this guide on the best options trading platforms UK.

There is a wide range of fees that can be charged by providers. Therefore, we have listed a brief guide to the main fees that you should think about before choosing a provider.

- Commissions: the commissions you pay to perform a trade ultimately determine your profit or loss. When a trade is made where the only likely winner is the platform, it makes very little sense to place the trade. There are a few platforms that allow you to trade options without a commission, but others charge per-contract commissions.

- Exercise fees: When you buy or sell options, sometimes options brokers charge a fee. However, some brokers charge a fee if you exercise or assign the option you sell.

- Spreads: Depending on the platform, the asset class, and the platform you are trading, there can be a big difference between spreads. If the spread is low, then it means you will be able to earn more profit from your trading. Basically, regarding the trading platform you have chosen, the spread is the difference between the bid price and the ask price the platform offers you. The spread should be as tight as possible. As a result, you want the price to be competitive.

- Overnight Financing: An options trader is responsible for paying daily overnight financing fees on every position they hold while it is open.

- Payment options: There may be a fee that you will have to pay when you deposit or withdraw funds when you use an options trading platform. However, as bigger the number of different payment methods available, it enables users to fund/withdraw from their accounts with little to no fees and with more flexibility.

Research Tools

Since options are derivative products, they are subject to a wide range of factors that standard securities are not, which is why they are more volatile.

Therefore, most options trading platforms will provide users with research and analysis tools that can be used to make informed trading decisions. Without these tools, it could be difficult to trade responsibly.

Options trading platform fees

Options trading platforms will charge fees for using their services. Before deciding on a platform, it is important to familiarize yourself with the fees that are involved.

Minimum Deposit

Before registering an account with your chosen trading options platform, it is wise to check the minimum deposit required.

If the platform’s minimum deposit is too high for you, you might be trading with more than you can afford to lose in the long run.

Withdrawal Fees

Some platforms will charge a fee for withdrawing funds. This is typically taken automatically when you decide to withdraw funds from your options trading account.

Trading fees

Some options trading platforms will charge fees for trading. These come in the form of commissions or spreads. The higher the fees, the more expensive it will be to place a trade.

Demo Account

A demo, or paper trading, account is a virtual trading account that allows traders to practice strategies before putting any money at risk. Most demo accounts are free to use and should mimic real trading conditions.

Support

The most effective way to ensure you have the support you need with your trading account is by accessing professional and dedicated customer service. Several options trading platforms in this field offer 24-hour support regularly.

Both live chat support and telephone support are two methods through which you can access help in real-time when you need it. However, if you contact support by email, you will need to wait several hours before getting a reply to your inbox if you cannot reach them by phone.

Is Options Trading Risky?

Options trading comes with its fair share of risks. One of the main risks associated with options trading is the potential for loss. Unlike buying and holding stocks, options have a limited lifespan and can expire worthless if the underlying stock does not move in the desired direction. This means that traders can lose their entire investment if they make the wrong bet.

Another risk of options trading is that it can be complex and difficult to understand for beginners. Options involve a variety of different components such as strike price, expiration date, and volatility, which can make it challenging to accurately predict the outcome of a trade. Furthermore, options trading often involves leverage, which amplifies both potential profits and losses. This means that even a small price movement in the underlying stock can result in significant gains or losses for the options trader.

Additionally, options trading requires careful timing and market analysis. Traders must be able to accurately predict the direction of the stock price within a certain timeframe to reap profits. This can be especially difficult in rapidly changing market conditions where stock prices can fluctuate unpredictably. The inability to accurately predict market movements can result in substantial losses for options traders.

Is Binary Options Trading Legal in the UK?

Yes, binary options trading is legal in the UK. The Financial Conduct Authority (FCA) regulates all financial services in the UK, including binary options trading platforms. The FCA has implemented strict rules and regulations to ensure that traders are protected and that the industry operates in a fair and transparent manner.

It is worth noting that the FCA has banned the sale, marketing, and distribution of binary options to retail consumers. This means that retail investors are not able to invest in binary options. However, professional traders can still trade in binary options, provided they meet certain criteria.

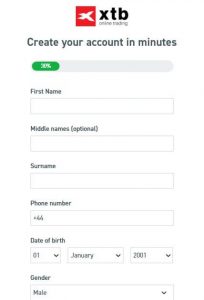

How to Start Trading Options

In order to start options trading in the UK, you first need to select the broker that is most suitable for you and follow the registration steps on its platform. We will further use the XTB broker as an example of how to register and get started with options trading.

1. Create an account

XTB allows users to create an account by providing their email address and phone number. To create an account, enter your personal information, such as name, phone number, and date of birth, and create a secure password.

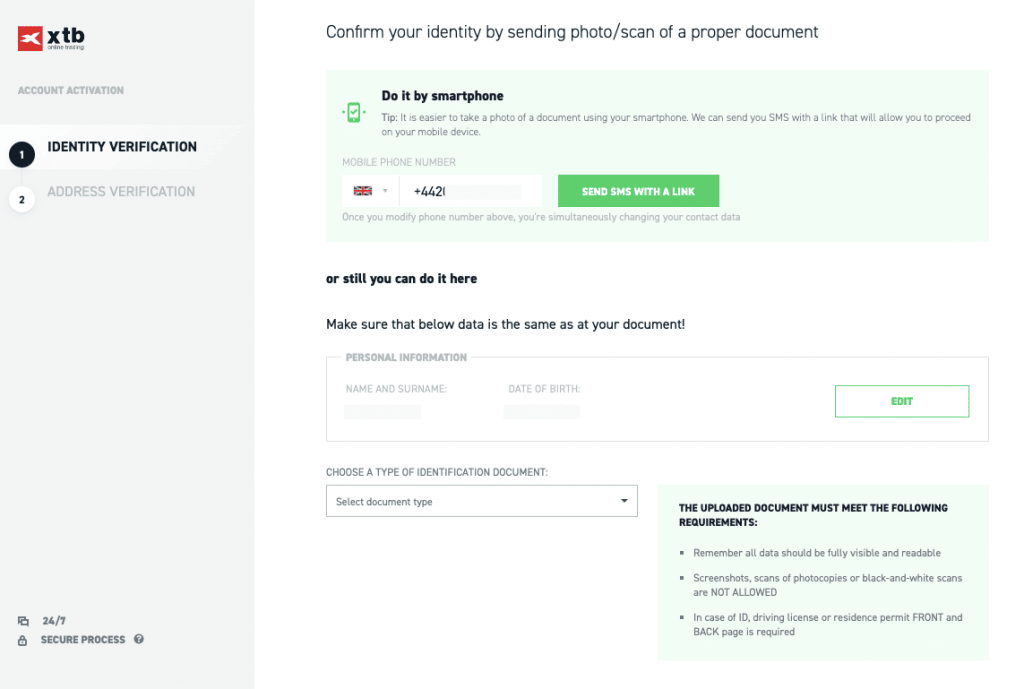

2. Verify your identity.

To start trading, verify your identity by uploading a scanned copy of your driver’s license or passport.

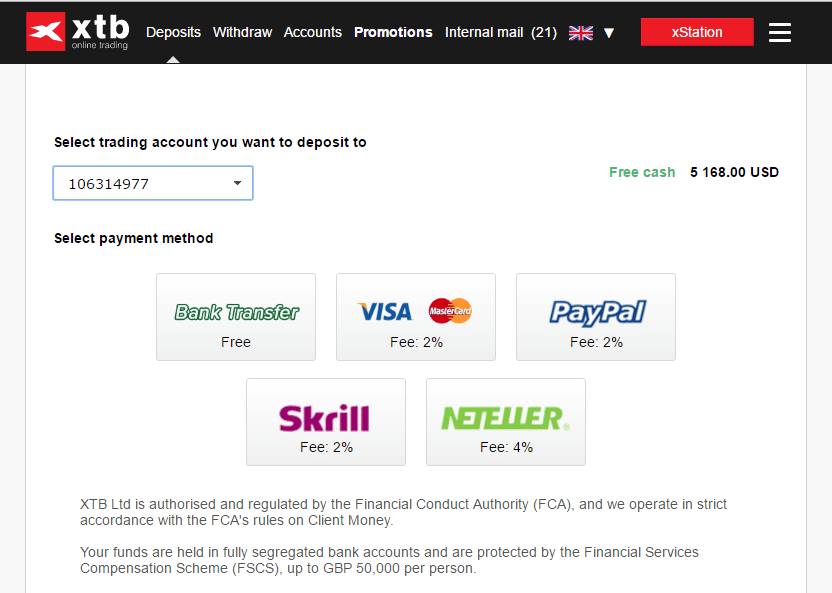

3. Fund your account

When you open an account with a new broker, you may be required to submit a minimum deposit before you can trade. Bank transfers, credit cards, and Skrill are the most prevalent payment methods accepted by brokers.

4. Start trading with options

You can start options trading as soon as you fund your XTB trading account. Once you’ve discovered the asset you want to trade, click the ‘Buy’ or ‘Sell’ button next to it in your dashboard. You will have the option to confirm the transaction as soon as you have entered your position size.

Conclusion

The market has a wide range of platforms available that traders can use to trade options. In this guide, we have reviewed several platforms that are available to UK traders. Each platform offers different tools and features that are worth researching in more detail before you make a final decision.

FAQs

Where to buy options UK?

Regarding buying options in the UK, there are many options available to traders, including the ones mentioned above. In addition, it will be possible for you to practice options trading on their demo account for free as long as you sign up. Moreover, each top-tier broker in the UK, such as AvaTrade, offers a wide range of educational materials, including text guides, videos, and even live webinars.Can you trade options in the UK?

Yes, It is absolutely legal and regulated to trade options in the UK. Trading options in the UK can now be done through spread bets and CFDs rather than directly trading the options themselves.What is the best options trading platform in the UK?

Among all of the trading platforms available in the UK, AvaTrade is the best recommendation for traders of all levels looking for well-designed investments and the latest features in trading and investing. It is under strict supervision by CySEC and offers a variety of educational materials to help you gain real experience in trading options. It is also considered one of the industry's best alternatives due to its wide range of assets available to trade.References:

Omar Ortiz Freelance Writer

View all posts by Omar OrtizOmar is a seasoned writer with a strong background in media. He has written for several high authority websites including Stockapps.com and Buyshares.co.uk, as well as TradingPlatforms.com.

Thanks to his strong investment knowledge, Omar is able to write in-depth stock trading and cryptocurrency articles that help readers to make informed decisions. He invests in the financial markets himself and is interested in sharing his expertise with others.

Before starting his career as a freelance writer, Omar studied at the Universidad de Bogotá Jorge Tadeo Lozano in Columbia.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

By continuing to use this website you agree to our terms and conditions and privacy policy.Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Registered Company number: 103525

© tradingplatforms.com All Rights Reserved 2023

In Europe,

In Europe,