Webull Review UK – Platform Features

The Webull trading platform, an online and mobile trading platform that is available to you on the web as well as on your mobile device allows you to invest commission-free. It is particularly popular with casual investors based in the United States since Webull does not charge monthly platform fees or brokerage account minimums.

Still, does Webull turn out to be the right platform for you? We have covered everything there is to know about Webull 2024 in this Webull review – from tradable assets, fees, and commissions to security, core features, and more – in this Webull review.

What is Webull UK?

Webull is an online brokerage platform that launched in 2017 and is accessible via a mobile application or online. In addition to offering a wide range of investment options, the platform offers a wide range of assets, including thousands of stocks and ETFs listed in the United States, options, cryptocurrencies, and ADRs (American Depositary Receipts).

People who want to invest a small amount of money can also use Webull. The platform permits fractional ownership as low as $1 per trade. Furthermore, Webull is also completely commission-free when it comes to fees, so you don’t have to worry about that. As a result, the company is directly competing with other platforms that offer no-fee options, such as Robinhood and CedarFX.

Having said that – and much like Robinhood, Webull charges a monthly fee for access to Level II market data. You will have access to this data for a monthly fee of $1.99. It is important to note that safety should be the primary concern at Webull, as the broker is regulated by the SEC and FINRA, in addition to being a member of the SIPC.

What Can You Invest in and Trade on Webull UK?

In this Webull review, we will take a closer look at the main investments that you can make from the platform.

Webull Stocks

A popular investment on Webull is to buy and sell stocks. There are thousands of companies listed on the Nasdaq and New York Stock Exchange (NYSE) that use the platform. Additionally, you can invest in several stocks listed on the American Stock Exchange (AMEX).

Despite Webull’s claim that it offers access to foreign-listed companies, the access comes in the form of an American depositary receipt. As a result of this limitation, the overall stock library at Webull is extremely limited – especially when you compare other commission-free brokers that are active in this space.

On the other hand, while Webull does not offer access to non-US stock markets, it does offer fractional shares for the majority of its stock markets. That essentially means that you can invest in any stock of your choice at a minimum of just $1 per trade.

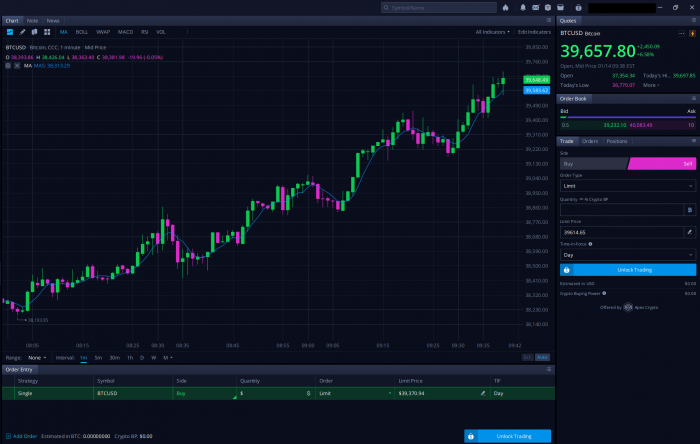

Webull Crypto

According to our Webull review, the platform allows you to invest in a selection of digital currencies starting at just $1 per trade.

Sponsored ad. Your capital is at risk.

Cryptocurrency trading is supported on the platform for the following markets:

- Bitcoin (BTC)

- Ethereum (ETH)

- Dogecoin (DOGE)

- Bitcoin Cash (BCH)

- Litecoin (LTC)

- XLM (XLM)

- ZEC (ZEC)

It should be noted that Ripple (XRP), Binance Coin (BNB), and EOS (EOS) are notable omissions from the above list.

Webull ETFs

The Webull platform also allows you to invest in exchange-traded funds. As all of these companies are listed on either the NYSE or Nasdaq, they are unable to diversify internationally. Instead, investors can purchase ETFs for as little as $1 per trade.

Based on our review of Webull, it appears that there is no support for mutual funds.

Webull Stock Options

In addition to offering stock options, Webull also provides a range of US-listed companies with stock options. Webull’s options consist of 100 shares, and you can use leverage to increase your position, which means you can trade with more than you have in your Webull account.

Webull Other Assets

It should be noted that Webull does not support any other asset classes outside of the above-mentioned financial instruments. The result of this will be that you will not be able to participate in transactions involving foreign exchange or commodities in the future. Likewise, you will not be able to trade bonds either.

Webull UK Fees & Commissions

Listed below are the Webull fees that apply to each of the supported asset classes.

| Asset | Commission |

| Stocks | 0% |

| Crypto | 0% |

| Forex | Not Supported |

| ETFs | 0% |

| Commodities | Not Supported |

| Indices | Not Supported |

| Options | 0% |

We outline the Webull fees associated with non-trading activities in the following sections.

| Fee Type | Charge |

| Open an account | FREE |

| Platform fee | FREE |

| ACH funding | FREE |

| Wire deposit | $8 |

| Wire withdrawal | $25 |

| Margin rate | It starts at 6.99% |

0% Commission Trading

Based on our Webull review, we found out that the platform enables you to buy and sell assets without paying any commissions. For instance, this is the case with stocks, options, ETFs, and cryptocurrencies.

Spreads

The spreads that Webull charges are not advertised on its website. The platform operates a variable spread system, which means the gap between the bid and asks price varies during the day.

Deposits and Withdrawals

If you fund your account with an ACH transfer, you will not be charged any fees for either a withdrawal or a deposit. Nevertheless, if you prefer to use a bank wire, you will have to pay $8 and $25, respectively, to deposit and withdraw funds.

Margin Rates

You’ll be charged 6.99% per annum for debit balances below $25,000 if you use the margin trading facility at Webull. Your margin rate will become more competitive as your debit balance increases. Currently, the lowest rate on offer is 3.99%; however, this does require a minimum debit balance of $3 million.

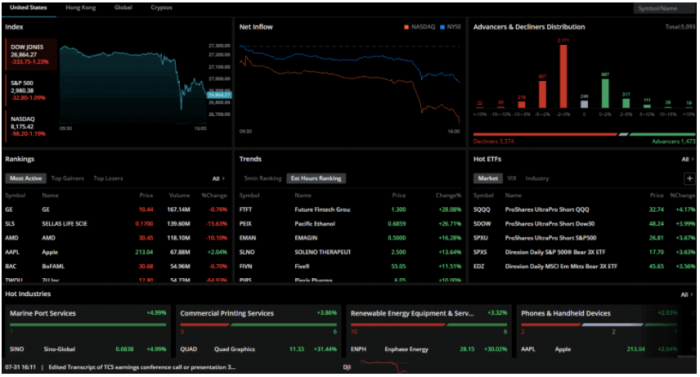

Webull UK User Experience

Webull provides users with both a smooth and simple user experience through its app and its online platform. The platform is very similar to its counterpart Robinhood because you don’t need to have any experience in online trading to use it. Moreover, Webull is aimed at those with little to no experience with online trading.

Because of this, if you’re an experienced investor, then the platform might seem a little too basic to you. However, if you’re planning to invest for the first time, the Webull company will probably be of interest to you. That is because Webull aims to make the process of choosing which assets are worth considering as simple as possible for investors by displaying ‘hot’ and ‘cold’ stocks in combination with a watchlist.

That will provide you with a list of the stocks that have had the highest gains or losses from the previous day. It is also possible to view which stocks are currently traded on the platform, which provides insight into the market’s sentiment in a sense. Finally, using the search bar, you can go directly to the trading area you wish to invest in if you already know which assets you wish to invest in.

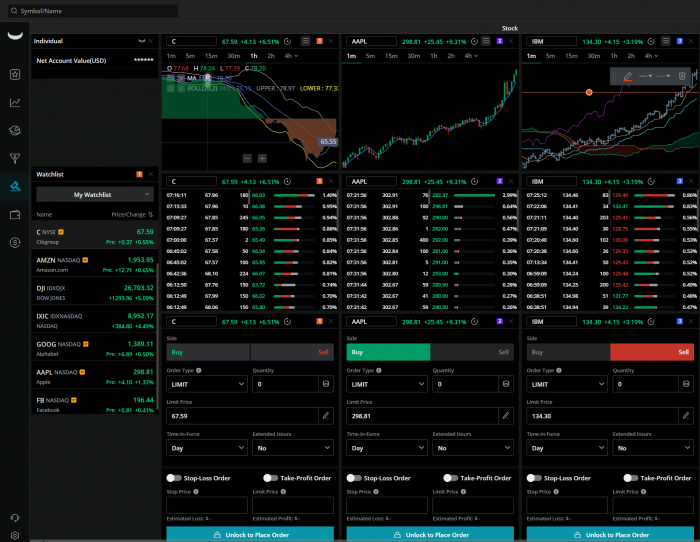

Webull UK Features, Charting, and Analysis

Even though Webull is a broker geared more towards newbies, in the course of our Webull review, we found that the platform is quite confident when it comes to chart analysis. For example, Webull provides its users with a real-time price chart for every single market supported, a chart that can be displayed over multiple timeframes.

There is a timeframe here that ranges from 1 minute to 1 year. Webull also provides you with the ability to deploy a variety of technical indicators, which was a surprise to us.

Your capital is at risk

In other words, it includes everything from the Exponential Moving Average, SAR, and VWAP, to the Keltner Channels, Ichimoku Cloud, and Bollinger Bands. Additionally, there is also an equity screener available on the Webull platform – which can help you to find equities to invest in.

Webull UK Account Types

In our review of Webull, we found that there are two types of accounts offered by the broker, which we will describe in greater detail below.

Cash Account

Cash Accounts are traditional investment accounts at Webull, but with a twist. They allow you to purchase assets up to an amount equal to your balance. So, as an example, if you have $500 in your account, you are only allowed to invest up to $500.

Margin Account

At Webull, you can trade with a Margin Account if you have more money in your account than you have in your account. In order to benefit from margin trading, a deposit of at least $2,000 is required. US securities laws require this. Unless you make a deposit of at least $25,000, you will be limited to 3-day trading positions every 5 business days.

However, if you make a deposit of at least $25,000, you will have no day trading limits. Therefore, the Margin Account is what you will need to engage in short-selling. With Webull, you will be able to open both a Cash Account and a Margin Account.

Retirement Accounts

When investing through your Webull Cash Account, you can also invest using a Traditional IRA, Roth IRA, or Rollover IRA. When using Webull, you can select only one of the retirement mentioned above accounts.

Webull UK Mobile App Review

As part of our Webull review, we found that the broker offers a free app that can be downloaded from the broker’s website that can be downloaded on a mobile device. In addition, the app is available for download from Google Play and the Apple Store. You can readily buy and sell assets using this app.

Your capital is at risk

If you use the app, you can immediately see your portfolio’s current value, which makes it well worth installing even if you prefer to trade online. In addition, Webull’s review of the app found that it is popular across both versions of the app, indicating that the app has a positive public opinion. The app has a 4.7 out of 5 rating on the Apple Store.

Across 197,000 individual reviews, the app has a relatively high rating. There are over 116,000 reviews of the app on Google Play, and the average rating is 4.4/5.

Webull UK Deposit and Withdrawal Methods

Webull was reviewed, and we found that the platform does not accept debit/credit cards or e-wallets for depositing funds. Rather, you will have to choose between ACH and a bank wire to complete the transaction. When it comes to the former, you may be able to deposit or withdraw money at zero fees, but with bank wire payments, this is not the case. On the other hand, a bank wire deposit costs $8 per transaction, and a withdrawal costs $25.

On the other hand, a bank wire deposit costs $8 per transaction, and a withdrawal costs $25. There is a reason for this, as the platform mentions that funds take between 1-5 working days to be credited to the user’s account.

Webull Minimum Deposit

With Webull, there is no minimum deposit amount, which makes it a suitable option for people looking to invest a small amount of money.

Webull UK Contact and Customer Service

The customer service at Webull is similarly rated poorly, much like that of its direct competitor Robinhood. Because of this, you will be encouraged to email the customer service department through an email address – which can result in slow response times.

In the course of our research, we have discovered that you can also contact the team by telephone at +1 (888) 828-0618 if you are based on the United States. The live chat facility is unfortunately not available at the moment.

Is Webull UK Broker Safe?

Here at TradingPlatforms.com, we get a lot of questions asking if Webull is safe. To answer that question, the short answer is yes – Webull is a very secure and safe trading platform that is heavily regulated.

The platform has been registered with the SEC and FINRA. If you are a member of the SIPC, you will also benefit from an investor protection scheme. Should the broker declare bankruptcy, the investor protection scheme will stand at $500,000. Concerning this figure, up to a maximum of $250,000 in cash reserves will be covered.

Webull UK Review – Conclusion

Webull is a bare-bones investment platform that doesn’t charge any commissions has proven popular with casual traders looking for a no-frills investment platform.

During our review of the platform, we were particularly impressed with the Webull mobile app that allows users to manage their portfolios on the go. The platform is most suitable for less-experienced traders who are looking for a platform that is easy to navigate and offers good educational resources.