Best Altcoin Trading Platforms in 2024 – Beginner’s Guide

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

If you’re looking to trade cryptocurrencies safely and securely, then it is of the utmost importance that you find the right broker that suits your needs. However, most major brokers only provide you with access to trading bitcoin and its derivatives, instead of also providing access to the altcoins market. The altcoins market is highly untapped and provides a lot of opportunities for high gains.

In this guide, we review some of the top platforms that you can easily perform altcoin trading in the UK.

Best Altcoin Trading Sites 2024

There are several platforms and exchanges wherein you can easily trade Bitcoin. However, the process of finding the right broker that also allows you to trade altcoins is much more complex, since they are only available with a select few brokers. The list of major brokers that provide altcoins access has been given below:

- OKX– Altcoin Trading Platform With Low Fees and Great Features

- Libertex – The Best Altcoin Trading Platform for Tight Spreads ‘

- Binance – The Best Altcoin Trading Platform for Regular Day Traders

- AvaTrade – The Best Altcoin Trading Platform Using MT4

Best Altcoin Trading Platforms Reviewed 2024

1. OKX – Altcoin Trading Platform With Low Fees

When dealing with cryptocurrency trading, it can help to use a platform that offers everything in one easy place. OKX is an excellent example of this. The platform offers crypto trading, staking, yield farming, P2P trading, algorithmic trading swapping and crypto education.

OKX offers a number of popular altcoins including Dogecoin, SHIB, XRP and Litecoin, amongst many others. In fact, there are over 250 coins available on the platform. This means that you can diversify your portfolio and invest in a number of different projects.

OKX charges a 0.10% crypto trading fee but does not charge an inactivity fee or withdrawal fee. The minimum deposit to trade with OKX is $100, which is affordable for most beginner traders.

Furthermore, OKX has a very simple registration process that takes just a few minutes to complete. Once registered, users can access the platform from both desktop and mobile devices. This is perfect for tarders who want to use OKX on the go and trade throughout the day.

Pros

- Numerous educational resources available

- Over 250 coins available

- Low fees

- Offer staking and lending

- Built on the native OKExChain

- Accepts a range of payment methods

Cons

- Relatively high minimum deposit

- Limited trading analysis tools

Cryptoassets are speculative and carry high volatility levels. Always consider the risks involved.

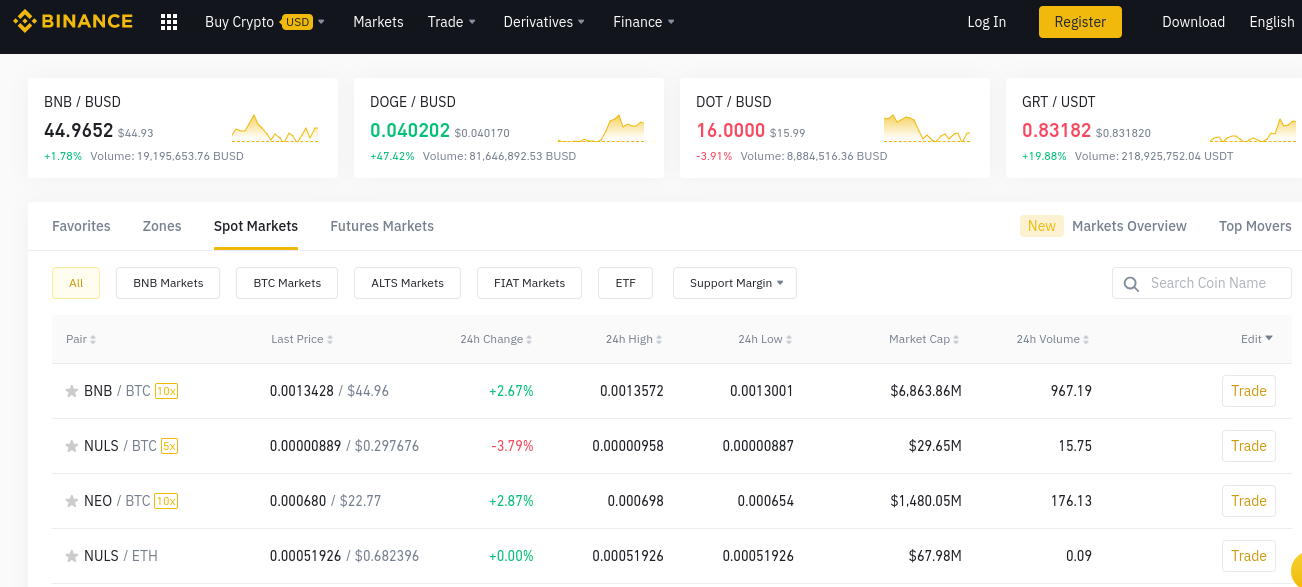

3. Binance – The Best Altcoin Trading Platform for Regular Day Traders

Despite the platform’s high deposit and withdrawal fees – between 2% and 3% – they have very low trading fees and are known for being one of the cheapest crypto trading platforms. They also offer a wide range of tools and technologies designed specifically for cryptocurrencies, which makes them a good option for experienced crypto traders. Binance’s fee is 0.1%, and it is even lower if you have an allocation of its Binance Coin (BNB).

Pros

- Advanced charting platform with numerous technical indicators

- Hundreds of pairs supported

- Very low commissions

- Supports fiat currency deposits

- Low fees, with additional discounts for using BNB

- Security measures are very tight and proven to be among the best in the industry

Cons

- Charges up to 2% on credit/debit card deposits

- Customer service responses can be delayed at times

Cryptoassets are speculative and carry high volatility levels. Always consider the risks involved.

What is an Altcoin?

In the cryptocurrency world, any coin that is not Bitcoin (BTC) is called an altcoin. They are similar to Bitcoin in a few ways but usually differentiate themselves from BTC in one or more ways. For example, some altcoins use a different consensus mechanism to produce blocks. Some other altcoins provide additional capabilities that Bitcoin does not offer, such as lower price volatilities and smart contracts. At present, there are over 10,000 altcoins in the market that are being traded on a variety of wallets and platforms.

According to CoinMarketCap, over 60% of the total cryptocurrency volume being traded in November 2021 was altcoins trading. A lot of altcoins are derived from Bitcoin, hence their price trajectory tends to mimic the trajectory of Bitcoin prices. However, as cryptocurrency markets evolve and newer ecosystems are created in markets, the degree of correlation between the prices of Bitcoin and other altcoins will gradually reduce.

There are several different types of altcoins that you can find and trade on cryptocurrency markets, and these have been explained and discussed below in detail.

Mining-based altcoins

There are two main ways in which an altcoin can come into existence: it can either do so through mining or through an ICO. Mining-based altcoins are mined via computer systems around the world through the concept of PoW or Proof of Work. in this case, computer systems generate new coins by solving complex problems to create blocks. As the number of altcoins in circulation increases, gradually the rate of mining slows down to avoid glutting the market with these altcoins. Examples of such coins include Litecoin, Monero, and ZCash.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more. "

The other way in which an altcoin can come into existence is via an ICO. in this case, pre-mined coins are released and sold to investors in much the same way as an IPO for stocks. These coins are not produced through an algorithm but are distributed in the markets. An example of such an altcoin is Ripple’s XRP.

Stablecoins

The cryptocurrency markets are usually known for the high degree of volatility that plagues them. Stablecoins are the solution to this. They reduce the overall volatility of the coins by pegging themselves to a particular asset that has an intrinsic value. This could include precious metals, fiat currencies, or even other cryptocurrencies. Stablecoins are pegged to a basket of goods that are meant to act as a reserve that can be used to redeem holders in case the cryptocurrency fails. There is usually a very small degree of volatility that can be observed in stablecoins, and their prices cannot exceed a certain range.

There are a variety of popular stablecoins that are used by cryptocurrency traders. This includes Tether’s USDT and the USD Coin (USDC), both of which, as the name suggests, are pegged against the US$. there has been a greater acceptance for stablecoins recently, especially since Visa announced that it would begin settling some of its transactions using USDC.

Security tokens

Security tokens are among the easiest form of altcoins to understand because they are quite similar to stocks except for the fact that they have a digital provenance. They resemble transitional stocks and promise equity in the form of either ownership of a part of the venture, or regular dividend payments. The possibility of the value of these tokens increasing exponentially over a small period of time is part of the reason why such security tokens are heavily sought by traders.

Memecoins

As the name suggests, meme coins are created as a joke or a silly take on other cryptocurrencies or a particular world event. They typically gain popularity over a short period of time owing to high amounts of volatility and a general speculative nature regarding the meme coin. Prominent and famous examples of meme coins include DOGE and SHIB coins, both of which have seen huge gains in the past on the backs of heavy speculation.

Often, these meme coins are hyped by prominent crypto influencers and retail investors who are looking to make huge short-term gains on the back of speculation. There is very little fundamental value associated with these coins, and in the long run, their high prices are usually not justified. There are highly volatile and unpredictable but represent an opportunity to make high gains in a very short span of time. It is recommended to be extremely careful whenever investing in meme coins.

How Can I Trade Altcoins?

There are three main ways in which altcoins can be traded: in the spot market, in the futures market, or via CFDs. The first way is to trade altcoins via the spot market. In order to be able to do this, you need to sign up for a platform that allows you to hold cryptocurrencies in a wallet. Binance is one such platform. Then, once you have signed up and created a cryptocurrency wallet in your name, you will then be able to buy and sell altcoins that are available on the platform. Most of these platforms charge very small spreads and make a majority of their revenues via deposit and withdrawal fees that they charge. Therefore, there are no spreads or commissions, and you can easily trade hundreds of altcoins in the spot market. You will be allowed to buy and sell altcoins at their current prices.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more. "

The second way of trading altcoins is via the futures market. Most cryptocurrency platforms provide you with the option of trading cryptocurrency futures, Binance being one of such platforms. The concept works in a very similar way to how stock and commodity futures work. When you buy an altcoin future, you are buying the right to purchase a Bitcoin at a particular price when the futures contract expires. You can trade in the futures market as a hedge, or simply in order to profit from expected movements in the altcoins market.

The third way of trading altcoins is to do so via CFDs. one of the most popular CFD platforms for trading altcoins is AvaTrade. Altcoin CFDs work in the same way as normal stock CFDs, wherein the CFD tracks the price of the underlying asset but does not give you access to it. The major difference between buying altcoins and buying altcoin CFDs is that in the former, you will have the actual coins in your cryptocurrency wallets. This will allow you to do a lot of things with them besides selling them, such as transferring them or staking them to earn interest. On the other hand, when you buy an altcoin CFD, you do not own the underlying asset and can therefore only profit from a favourable change in the price of the altcoin. Some platforms also have CFDs for cryptocurrency options and futures contracts, however, these are rare.

List of the Largest Altcoins By Market Cap

Some of the largest altcoins by market cap, as of 14th November 2021, have been listed below:

| Name of Altcoin | Price | Market Cap |

| Ethereum (ETH) | $4651.97 | $551 billion |

| Binance Coin (BNB) | $647.03 | $108 billion |

| Tether (USDT) | $1 | $74 billion |

| Solana (SOL) | $235 | $72 billion |

| Cardano (ADA) | $2.05 | $68 billion |

| XRP (XRP) | $1.19 | $56 billion |

Risks of Trading Altcoins

Trading the best altcoins offers the possibility of high profits in a short span of time, and this makes them a very attractive investment avenue for most cryptocurrency traders. However, at the same time, it is also important for you to be aware of the various risks that are associated with trading altcoins. The first and biggest risk is that they have a much smaller investment market as compared to Bitcoin. Bitcoin alone commands around half of the share of the cryptocurrency market, which makes certain altcoins a tad less liquid than Bitcoin.

Secondly, there is an absence of any regulations or defined criteria in the altcoins market, which makes it a very risky investment. As opposed to the stock market, there are no regulatory agencies that regulate the cryptocurrency markets to make sure that the investors are not being defrauded in any manner. This means that you will have to do your own due diligence and make sure that you make the right decisions in terms of investing in the right assets.

Lastly, there is always an inherent risk when investing in altcoins that the coin as a whole will fail, sinking the money of all its investors. This has happened numerous times in the past, either because the altcoin was a scam or for a variety of other factors. The increasing prevalence of altcoins increases the degree of risk in an already volatile cryptocurrency market.

Altcoin Trading Strategy

The strategies for trading on altcoins are not very different from some of the more prominent strategies that you can use to trade Bitcoin. As such, there are several different ways in which you can trade altcoins, and some of the popular strategies have been discussed below. Even if you do not follow them, they can serve as a useful starting point for you to refine and create your own strategy. At the end of the day, it is important that your strategy incorporates your risk appetite and ensures that you’re in a good position to profit consistently.

Altcoin Trading Signals

Another method of trading that is popular with relatively inexperienced traders is that of using trading signals. This strategy is quite similar to copy trading, except that instead of automatically buying and selling what someone else is trading, you will instead receive an alert about their order. This will allow you to decide whether or not the trade is a good opportunity before you follow through. You can also set up signals for a particular set of conditions, and you will then be notified whenever these conditions are satisfied. This is a good middle-ground as it allows you to trade semi-passively.

Trading signals can either be sent to you by the platform you trade on if you choose to program it to ping you with certain conditions, or by other traders. Usually, experienced traders who perform complex technical analyses on altcoins to identify trading opportunities provide other traders with signals in exchange for a small monthly fee.

Altcoin Trading Robots

Some traders also use altcoin trading robots. These are automated trading programs that will trade whenever a particular set of conditions are satisfied. They automatically place buy and sell orders whenever they identify a trading opportunity. These programs are usually developed or incorporated onto MT4, and they are given two things: the first is a sample set of altcoins that they can trade on, and the set of conditions under which they should execute buy and sell orders.

Once the program has been developed and incorporated with a trading platform such as the MT4 trading platform, then the next step is to simply observe the performance of the robot in the market and make incremental changes as and when necessary. This will allow you to improve the condition of the program and boost its profitability.

Are Altcoins Legit Cryptocurrencies?

Due to the lack of regulation or any particular set of rules governing the cryptocurrency markets, there is a high degree of fear as to whether altcoins are actually legitimate cryptocurrencies. The answer is, for the most part, yes. There are a few altcoins that are a scam and are only designed to dupe investors with the promise of unlimited short-term gains. On the other hand, most altcoins are legitimate investments and trading opportunities.

The easiest way to identify whether an altcoin is a legitimate investment or a scam is to look at the platforms it is available to trade on. If an altcoin is available on trusted and regulated platforms such as OKX, then you can rest assured that it is a legitimate cryptocurrency and can go ahead with trading it.

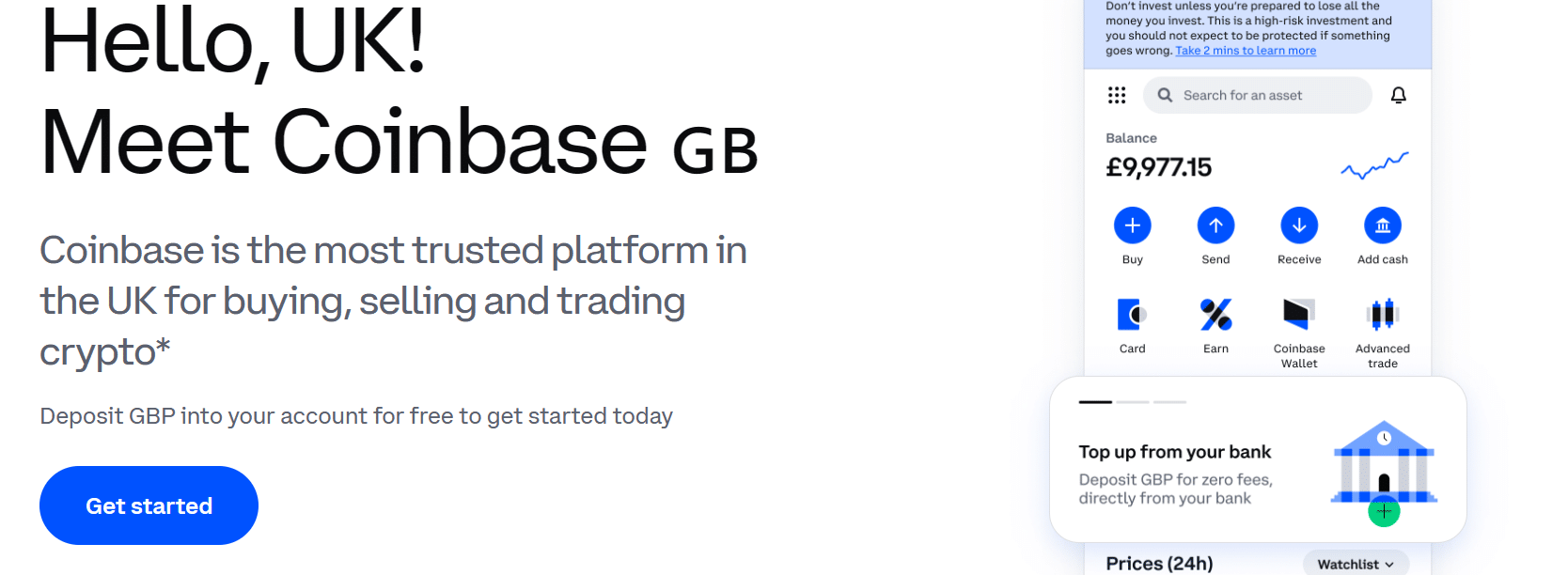

How to Get Started with an Altcoin Trading Platform

In order to assist you with trading altcoins, here is a list of steps that you need to follow in order to begin trading altcoins on Coinbase. The process of opening an account and trading on Coinbase is quite straightforward and involves 4 main steps.

Step 1: Open an Account

The first thing that you need to do is to navigate to the Coinbase homepage and click on “Create account”. Then, you will be asked to fill a short form that asks for your contact details and makes you set up your login credentials. Alternatively, you can also sign up via your Facebook or Google account for easier sign-ins and to avoid having to remember your username and password.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more. "

Step 2: Upload ID

The next step is for you to verify your identity by uploading a copy of your ID. Since Coinbase is a regulated platform, they have to complete the KYC (Know Your Customer) process before they allow you to trade. This verification process has two parts to it. The first part involves verifying your identity. For this, you can upload a copy of any government-issued ID, such as a passport, driving license, or visa. The next part is an address proof, for which you can either upload a bank statement or utility bill.

Step 3: Deposit Funds

The third step is to then deposit funds into your account. Coinbase customers in the UK can add money to their Coinbase account via bank transfer or via debit card. The minimum deposit on Coinbase is $1 when using a debit card, with bank transfers requiring a minimum deposit of $10. Users can add funds in different currencies such as USD, GBP, and EUR, however all non-USD deposits are subject to a currency conversion fee.

Step 4: Trade Altcoins

The last step is then to begin trading altcoins. Simply head over to the search bar, search for the altcoin you wish to trade, enter the amount you wish to buy or sell, and click on the order button.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more. "

Conclusion

While there are several UK trading platforms on which you can trade altcoins, OKX is easily the overall best platform for this purpose. This is true for a variety of reasons. OKX provides and intuitive and user-friendly interface allowing users to invest in a variety of altcoins by navigating the crypto trading terminal.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more. "