8 Best Cryptocurrency Exchanges in the UK 2025

If you are looking to add cryptocurrencies to your investment portfolio in the UK, you will need to use an online crypto trading platform or exchange. These sites facilitate the buying, selling and trading of cryptocurrencies on a platform that is easily accessible, even to new traders. In this guide, we will analyze the best cryptocurrency exchanges and Bitcoin trading platforms on the market right now in the UK.

-

- 2. Coinbase – Regulated crypto exchange that offers staking and crypto interest

- 3. OKX – Trade more than 100 cryptos and stake your crypto for passive rewards

- 7. Binance – Centralized cryptocurrency exchange and NFT marketplace

- Binance fees

- 8. Revolut – Reputable UK banking app with access to 120+ cryptos

- ✔️ Trading Tools & Features

- ✔️ Support for Crypto Trading Robots

- ✔️ Copy Trading

- ✔️ Leverage and Short-Selling

- ✔️ Education, Research & Analysis

- ✔️ Liquidity

- ✔️ User Experience

- ✔️ Mobile App

- ✔️ Payment Methods

- ✔️ Customer Service

-

- 2. Coinbase – Regulated crypto exchange that offers staking and crypto interest

- 3. OKX – Trade more than 100 cryptos and stake your crypto for passive rewards

- 7. Binance – Centralized cryptocurrency exchange and NFT marketplace

- Binance fees

- 8. Revolut – Reputable UK banking app with access to 120+ cryptos

- ✔️ Trading Tools & Features

- ✔️ Support for Crypto Trading Robots

- ✔️ Copy Trading

- ✔️ Leverage and Short-Selling

- ✔️ Education, Research & Analysis

- ✔️ Liquidity

- ✔️ User Experience

- ✔️ Mobile App

- ✔️ Payment Methods

- ✔️ Customer Service

8 Best Cryptocurrency Exchanges UK in June 2025

The best cryptocurrency day trading platforms in the UK are shown in the list below. A mini-review is presented which covers some of the key features that each platform offers clients.

- eToro – eToro is a UK crypto exchange known for its user-friendly platform and social trading features. With a native crypto wallet, it allows trading in 80 popular cryptocurrencies, including Bitcoin, Ethereum, and Cardano. eToro is well-known for its copy trading feature, which supports crypto trading.

- Coinbase – Coinbase offers a wide range of over 200 cryptocurrencies, making it suitable for beginners and experienced traders. Coinbase also offers its own native wallet, which facilitates staking and earning interest on crypto. This makes it a suitable platform for long term crypto investors.

- OKX– OKX is a UK exchange offering trading of over 40 cryptocurrencies and crypto derivatives. As well as traditional crypto trading, users can trade with leverage of up to 125x on OKX. The platform offers low fees and users can also stake their crypto for passive rewards.

- Crypto.com – With a native token (CRO) and a 14% APY staking program, Crypto.com is a growing exchange. Users can access over 250 cryptocurrencies and DeFi coins. The platform also supports margin trading which is suitable for experienced traders.

- Margex – Margex is a cryptocurrency brokerage and trading platform with low trading fees. Users who want to increase their lot size can trade with leverage of up to 125x on Margex. The platform also prioritizes security and uses AI protection tools. Margex allows users to trade crypto FX pairs and offers advanced charting tools.

- Binance – Binance is the world’s largest crypto exchange by trading volume. The platform integrates its own native token BNB and launched its own blockchain, the Binance Smart Chain. Binance supports a diverse range of assets, with low trading fees on all cryptos. Binance also provides educational resources, making it suitable for traders who want to improve their knowledge.

- Revolut – Revolut is a mobile digital banking application that enables easy money exchange and provides personal financial management tools. The platform offers access to over 80+ cryptocurrencies and the possibility to transact in over 36 different fiat currencies. The wallet interface displays all currencies across chains in one easily viewable place and provides security by storing crypto assets on cold storage.

- Coinjar – Coinjar is a UK-based cryptocurrency platform with a strong presence in Australia. Coinjar supports 24 hour trading and can be used on mobile through the user-friendly mobile app.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more. "

What Is a Crypto Exchange?

A UK crypto exchange is an online platform that can be used to buy, sell and swap crypto assets in the United Kingdom. Crypto exchanges work similarly to traditional UK trading platforms meaning that the exchange works as a bridge (or third party) between a trader and the cryptocurrency market.

The easiest way to understand the concept of a crypto exchange is to think of it like any other marketplace platform. Users create an account, deposit funds and buy assets with the funds in their account.

In the UK, the revenue derived from the cryptocurrency industry is quite a significant amount. Data from Statista estimates that around 4.7 million people, 7% of the UK population, held Bitcoin or other crypto assets at the end of 2022. The same report expresses that the revenue in the UK crypto industry amounted to £1.5 Billion GBP, and this could significantly grow by 18.8% to £2.7 billion GBP by 2027. The data only represents figures from centrally operated service providers such as exchanges and neobanks and does not consider any web3 transactions from DeFi or decentralized exchanges.

Through exchanges, traders can easily access a variety of crypto trading tools and features such as crypto trading, selling, swapping, staking and lending. To facilitate this, most exchanges support crypto wallets which can be used by traders to store decentralized crypto tokens. For example, eToro and Coinbase both have their own native crypto wallets that support coins on multiple blockchain networks.

While all crypto exchanges follow this basic structure, there are two different types of crypto exchange that UK traders should be aware of: centralized exchanges and decentralized exchanges.

What is a centralized exchange?

A centralized crypto exchange is a crypto trading platform that is governed and secured by a third-party authority – similar to a UK bank. The authority regulates and secures the exchange to ensure that users are protected while trading crypto.

These platforms must meet regulatory requirements and collect data about users. The main advantage of using a regulated exchange is that it is possible to access your account even if you lose your password. Centralized exchanges have customer support teams that can access accounts on a customer’s behalf if they lose access. Customers that use centralized exchanges are also protected against fraud and malicious trading activities.

The main drawback of centralized exchanges is that they offer a limited variety of DeFi assets. Many centralized exchanges do not list new crypto projects that are considered to be more risky. As well as this, centralized exchanges require lengthy KYC processes and often take longer to verify transactions. This can be frustrating for some crypto traders in the UK.

Statista provided statistical data on centralized exchanges and which are the key players in the UK in 2025. See the chart below showing the most popular crypto exchanges in the UK represented in percentage of the market covered.

What is a decentralized exchange?

A decentralized exchange is a crypto trading platform that is built on and supported by blockchain technology. These platforms are not controlled by a third party which means that they are difficult to regulate in the UK. Instead, all transactions are facilitated through community funded liquidity pools, making the operation truly decentralized with no central authority taking custody of assets.

Once a transaction has been made on the blockchain, it cannot be changed, deleted or cancelled. This makes decentralized exchanges very transparent which some argue makes them more secure than centralized exchanges. However, it also makes them risky for traders who do not completely understand the underlying technology.

Because they are not regulated, decentralized crypto exchanges do not collect personal information about users. Instead, users create an account with an email address and a crypto wallet. Users must use an external crypto wallet to trade through a decentralized exchange in the UK. For example, MetaMask is a popular wallet that is compatible with UniSwap.

Key Features of UK Crypto Exchanges

Every UK crypto exchange will offer a slightly different experience. However, there are some key features that you are likely to come across no matter what exchange you choose to use. Here is an overview of the features that you may find.

- Crypto trading dashboard. The crypto trading dashboard is a database of all of the tokens that are offered by the exchange. Here, you can view prices and also place buy or sell orders.

- Price charts. Most exchanges will provide real-time price charts that can be used to conduct technical analysis and make predictions. Price charts will usually come with indicators and tools that can be used for this analysis.

- Education hub. The best UK crypto exchanges will provide an education hub in which users can find helpful resources and guides to learn about crypto trading.

- Real-time market data and news. It is common to find crypto news and real-time data in a crypto exchange. This can be used to stay on top of the market.

- Crypto swapping. Some exchanges provide a crypto swap. This allows investors to trade one currency for another.

- Crypto wallet. The top UK exchanges provide a native crypto wallet that can be used by traders to store their tokens. For example, eToro provides the eToro Money wallet which can be downloaded as a mobile app.

- Staking and lending. Some cryptocurrency trading platforms will also have a crypto staking or lending dashboard. Here, users can lock up their tokens in a pool and earn interest on their investment.

- Customer support. One of the most helpful features provided by the best crypto exchanges is customer support. Here, users can seek advice and ask questions about using the platform.

UK Crypto Exchange Fees Compared

[fin_table id=”97″]Broker eToro Coinbase OKX Crypto.com Trading Fees Spread, 0.75% – 2% for Bitcoin 0.10% per trade 0.10% per trade 0.04% per trade Overnight Fees Free Free Free Free Deposit/withdrawal fees £4.10 fee for every withdrawal request 1% to a bank account From 0.0002 BTC 0.0005 for BTC Account management fees Free Free Free Free Best Cryptocurrency Exchanges & Trading Platforms UK Ranked & Reviewed 2025

Let’s take a closer look at the best UK crypto exchanges and trading platforms that can be used for cryptocurrency trading in 2025. In the following section, we review each platform to reveal the key features. However, it is important to conduct your own research before making a final decision.

How we reviewed the best crypto exchanges and trading platforms

Our team of expert writers spent time meticulously reviewing and testing several crypto trading platforms to find the best options for UK traders. Each platform was rated based on the following criteria.

Asset availability: To facilitate a diverse trading strategy, UK crypto exchanges must offer a good variety of assets. Our writers looked at the number of cryptos available on each platform as well as the types of cryptocurrencies that are supported. UK crypto exchanges offer a range of stablecoins, altcoins and meme coins. It is important to look at the assets available before deciding whether or not a platform is suitable.

Demo account: Demo accounts allow traders to practice new strategies before putting any money at risk. These accounts are particularly helpful for crypto traders because the cryptocurrency market can be very volatile. The best crypto exchanges should offer a demo trading account that is free to use and can be accessed at any time.

Real-time market data: The crypto market moves very quickly. As a result, it is important that crypto platforms provide users with real-time data that can be used as part of their analysis. This could include news, price charts, alerts and signals.

Crypto wallet: The best crypto trading platforms provide users with a native wallet that can be used to seamlessly store tokens after purchasing them. Crypto wallets allow traders to interact with decentralized applications and support the swapping, staking and lending of cryptocurrencies.

Regulation: Cryptocurrencies are not currently regulated in the UK. However, it is possible to trade crypto through a regulated platform. In the UK, crypto exchanges are regulated by the Financial Conduct Authority (FCA). Trading platforms that are regulated should clearly state this on their website.

Analysis tools: To make informed trading decisions, cryptocurrency traders use technical analysis which is facilitated by advanced charting tools. These tools include APIs, signals, and indicators such as MACD, RSI and Oscillators. Our writers reviewed the tools that are offered by each platform during their research. Some platforms are compatible with third party tools including MT4 and MT5.

Customer service: The best crypto trading platforms in the UK have robust customer support services that can help traders around the clock. This is an important feature of any trading platform as it allows users to trade with confidence.

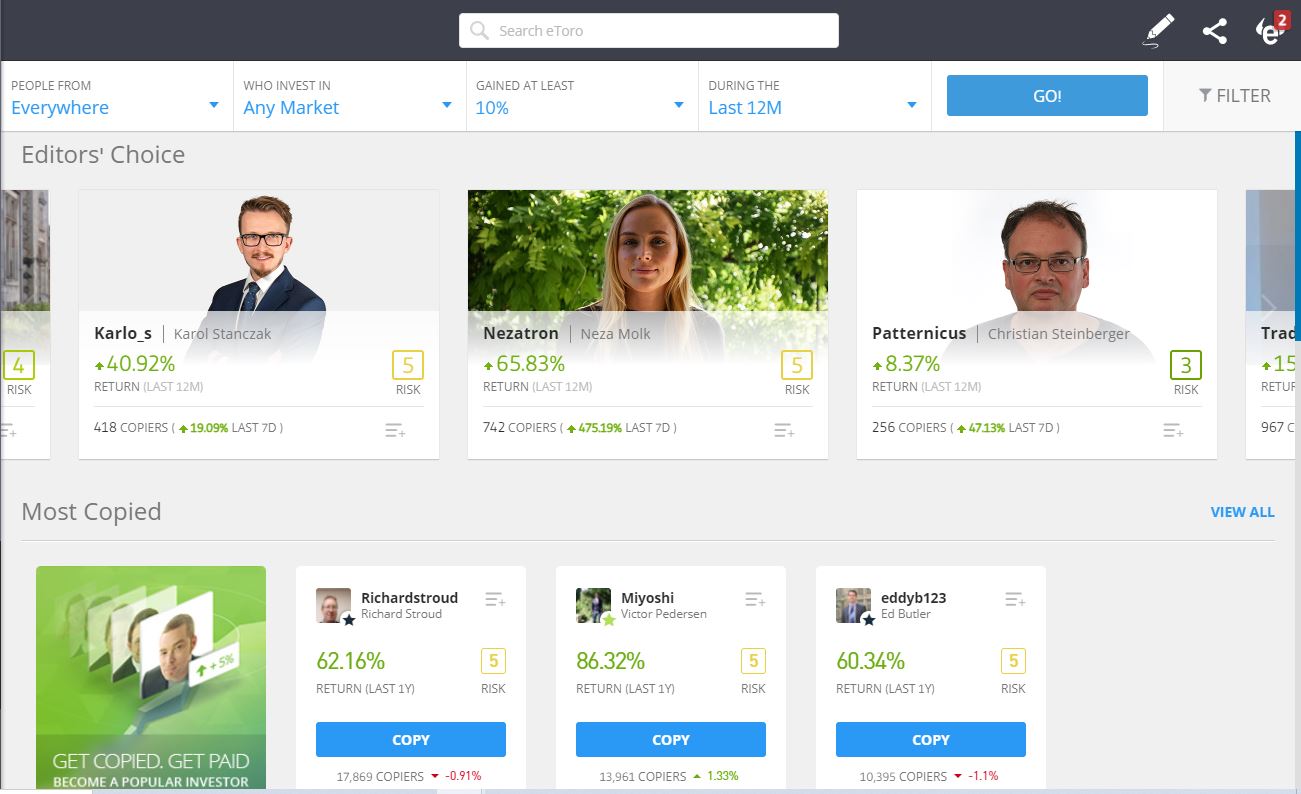

1. eToro – UK cryptocurrency exchange for social trading with a native wallet

eToro is a reputable cryptocurrency exchange in the UK that can be used for both long-term crypto investing and day trading. In terms of what assets can traded, eToro makes it possible for you to buy and sell 80 popular cryptocurrencies. These include Bitcoin, EOS, BCH, Ethereum, Solana, XRP, Cardano, and Binance Coin, among others.

There are no associated registration fees and payment methods expressed in US dollars are completely free of charge. Otherwise, clients will pay a foreign currency conversion fee. eToro also distinguishes itself as a comprehensive cryptocurrency day trading platform as it offers a set of passive trading tools in its user interface. Among them is the CryptoPortfolio, which is a diversified basket of digital currencies in various weights. It is managed by the eToro team, so there is no hesitation about portfolio rebalancing.

Another option is to buy and sell cryptocurrencies, such as the popular ERC20 coins using the Copy Trading tool. As the name indicates, users are able to copy the trades of experienced and proven cryptocurrency investors that are using eToro. In order to participate in copy trading users will need to have a minimum of $200 capital. If trading autonomously, the minimum cryptocurrency trading amount is only $10. Customers can start a trading account at eToro in minutes – and accepted deposit options include debit cards and bank transfer.

eToro fees

Fee Amount Crypto trading fee Spread, 0.75% – 2% for Bitcoin Inactivity fee $10 equiv in GBP a month after one year Withdrawal fee $5 / £4.10 Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more. "

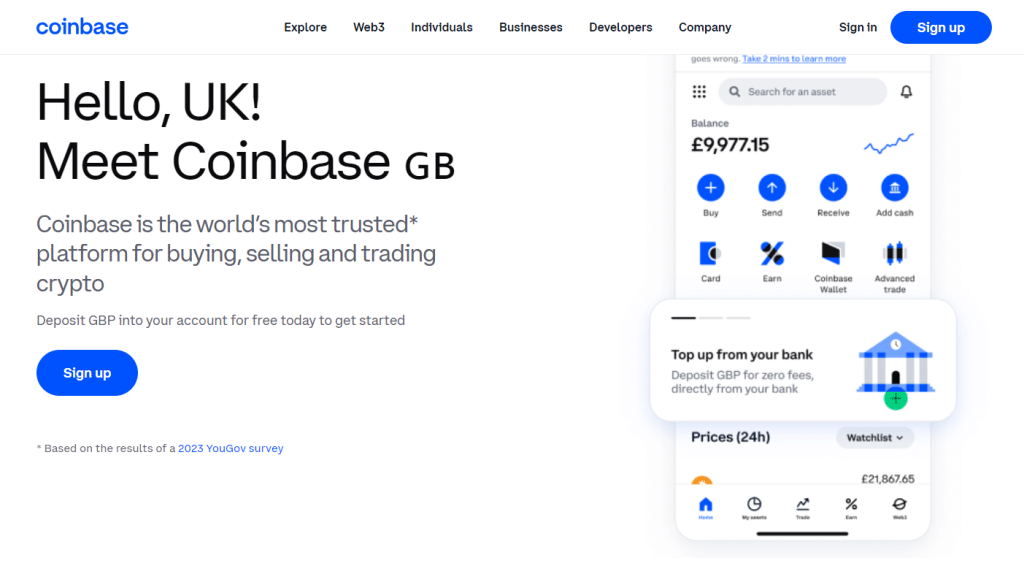

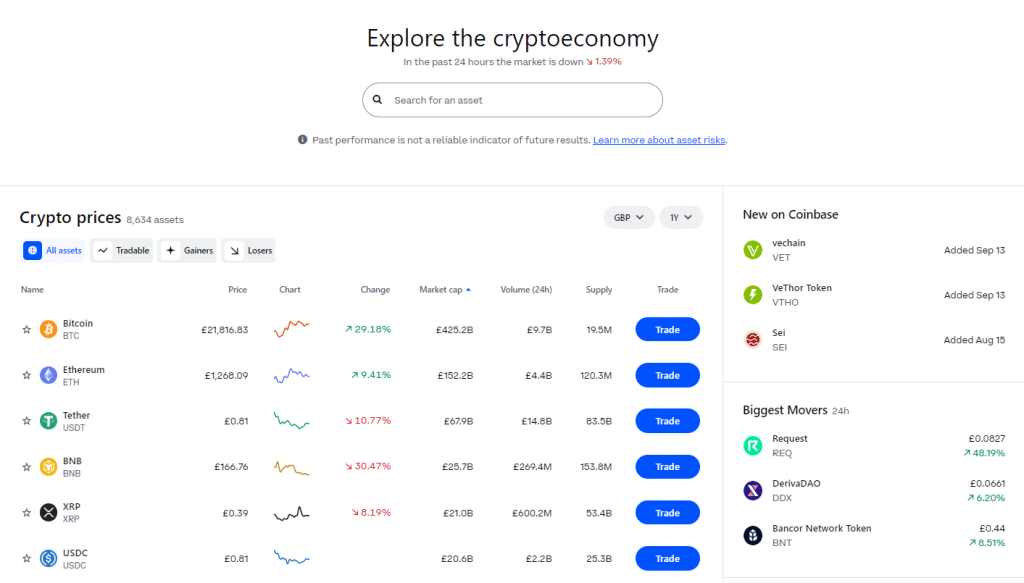

2. Coinbase – Regulated crypto exchange that offers staking and crypto interest

One of the largest crypto exchanges in the world was created in 2012 by Coinbase. This exchange works in the same way as a classical exchange, however, Coinbase present clients with various other crypto features and resources. Coinbase provides a crypto price explorer similar to CoinMarketCap, allowing users to view market data and track prices of over 8000 cryptocurrencies. The platform also has a web3 dApps discovery section, allowing users to explore more than 1900 web3 decentralized applications.

Coinbase provides a user-friendly simplistic trading interface offering access to over 200 cryptocurrencies for its UK client base. They also have a web3 non-custodial wallet which enables users to explore web3 dApps and access DeFi protocols. Essentially, Coinbase is a classical broker that operates on an offer and demand basis and it’s one of the best platforms for yield farming securely.

A unique feature of Coinbase is the Coinbase Visa crypto spending card. Users can apply for a Visa card which allows spending of cryptocurrency directly from users’ Coinbase portfolio, without having to convert crypto to fiat. Users who spend using the Coinbase card can earn cashback and rewards.

Coinbase also provides its Coinbase Advanced interface targeted at more professional traders and provides advanced trading tools and charts powered by TradingView with EMA, MA, MACD, RSI, Bollinger Bands, and drawing tools. Users benefit from lower fees on Coinbase Pro and access to over 550+ crypto markets.

For beginners, Coinbase is well-known for its learn and earn resource. This provides users incentives for completing mini-courses surrounding cryptocurrency basics and deep dives into technical knowledge for novices.

Coinbase fees

Fee Amount Crypto trading fee Commission, starting from 0.50% Inactivity fee Free Withdrawal fee 1% to a bank account Cryptoassets are highly volatile. Please make sure that you can afford to lose your investment.

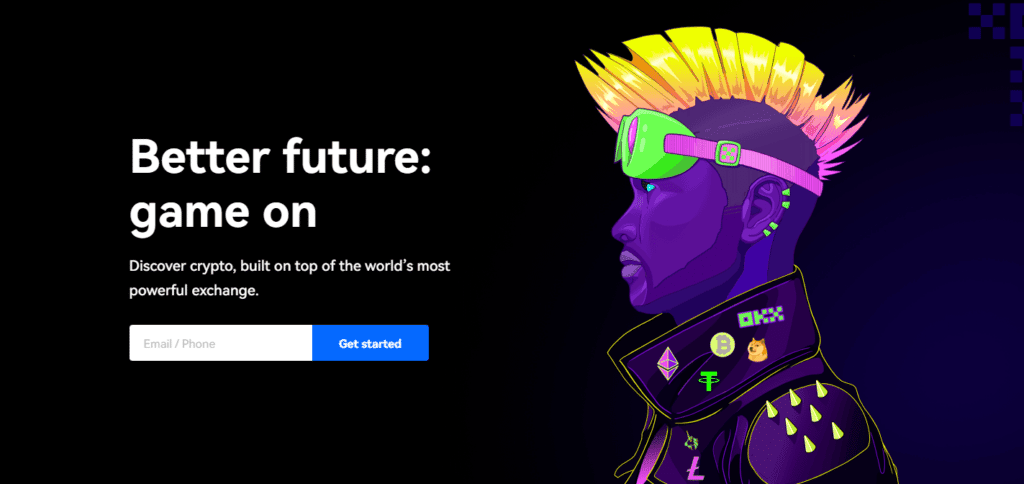

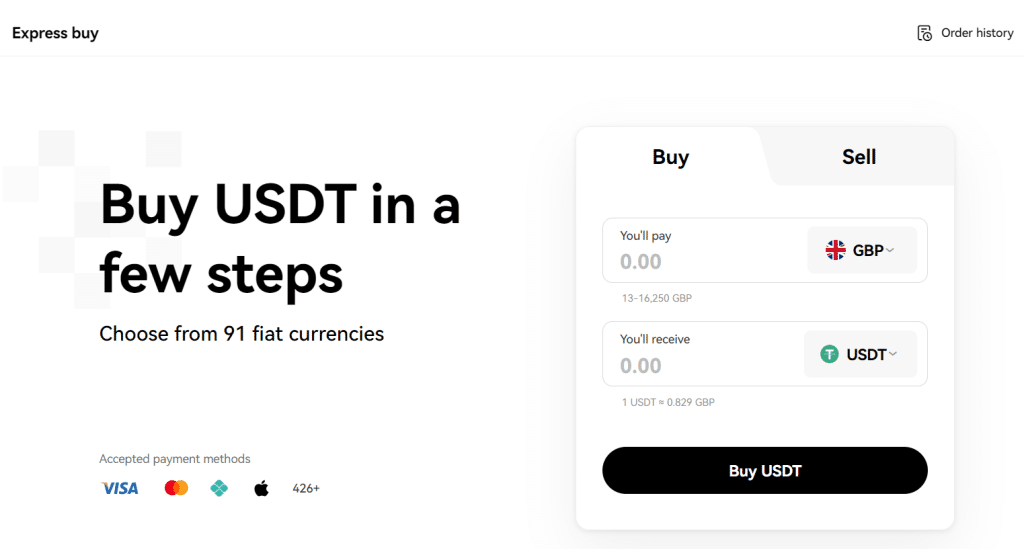

3. OKX – Trade more than 100 cryptos and stake your crypto for passive rewards

OXK is an exchange based in Seychelles that offers low exchange fees for crypto traders.

OKX offers its UK client base access to 40 different cryptocurrencies, including the most popular tokens such as Bitcoin and Ethereum. Notably, OKX also supports new cryptocurrencies including assets that have recently finished their presale.

For users wishing to trade cryptocurrency on OKX, there are two types of trading accounts: basic and leveraged. With either of these options, users have access to tools, chart analysis, and live order access. In the case of using leverage, OKX permits up to 125X. Therefore, this platform can be ideal for more experienced traders with a higher risk appetite.

If purchasing crypto with fiat, OKX offers a number of options. Users can buy over 90 cryptocurrencies using a credit/debit card via the Express Buy function. OKX allows purchasing crypto using 91 different fiat currencies and supports over 400+ global payment methods. OKX also offers a peer-to-peer (P2P) directory of users wishing to buy and sell crypto personally with other traders. Rates are usually better in P2P and users can evaluate trustworthy peers to transact with through their ratings. The platform also provides users a way to purchase crypto through regulated third-party providers such as Banxa and Simplex. These platforms have various crypto and banking licenses worldwide for fiat on-ramp, and provide a quick way to purchase cryptocurrencies. They offer quite a wide directory of coins, however, fees will be more using this method.

As far as security is concerned, OKX offers cold storage which allows traders to store their assets offline. This is considered to be safer than keeping your crypto on an exchange. The cold storage wallet can also be used to access dApps and infrastructure products on OKX native OKT Chain. Users are able to connect their wallet directly on the OKX exchange to access liquid staking, OKT Chain swaps and cross-chain bridging to Cosmos blockchain assets.

OKX UK crypto exchange Fees

Fee Amount Crypto trading fee 0.10% per trade Inactivity fee Free Withdrawal fee From 0.0002 BTC Cryptoassets are highly volatile. Please make sure that you can afford to lose your investment.

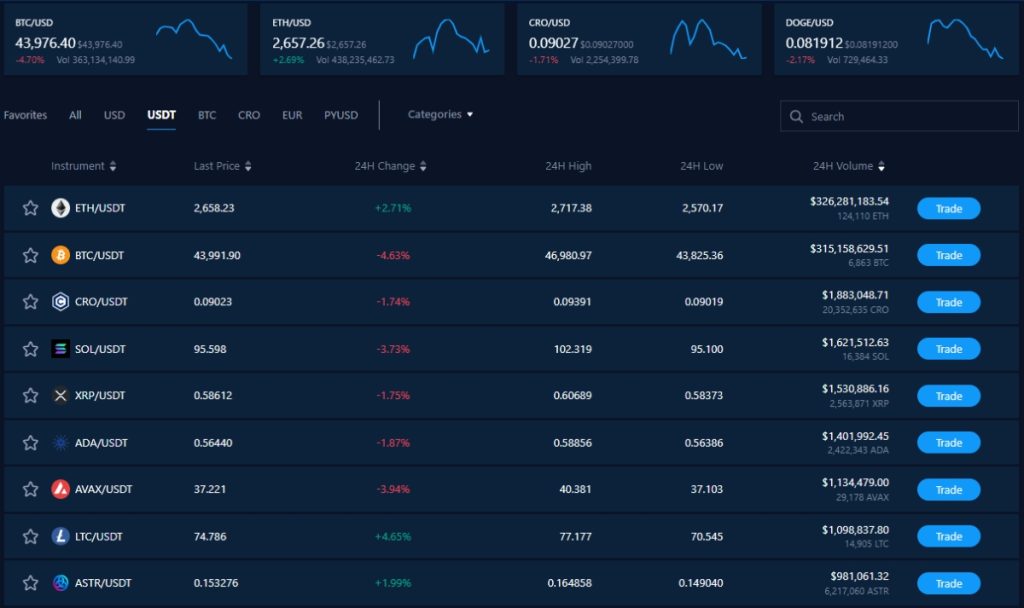

4. Crypto.com – Leading crypto exchange with it’s own native token that can be staked for rewards

The cryptocurrency exchange Crypto.com has seen rapid growth in recent years. Thanks to many developers and a strong marketing team, the exchange is fast and secure. Users are able to use the platform on desktop, alternatively, Crypto.com has a convenient and user-friendly mobile application for iOS and Android.

There are 18+ cryptocurrencies, DeFi coins, and stablecoins in the portfolio of the staking program, with a return of up to 14% annually.

The CRO coin from Crypto.com ranks in the top 50 of cryptocurrencies according to CoinMarketCap with a fully diluted market cap of $1.5 billion. The platform’s laddered staking feature allows users to stake CRO to qualify for rewards, discounted fees, perks and a spending card which makes it considered one of the best crypto lending platforms.

Furthermore, the company offers margin trading on derivatives and plans to move into non-financial trading. The minimum investment at Crypto.com is $1.

Crypto.com fees

Fee Amount Crypto trading fee 0.04% per trade Inactivity fee Free Withdrawal fee 0.0005 for BTC Cryptoassets are highly volatile. Please make sure that you can afford to lose your investment.

6. Margex – Trade crypto FX pairs with low spreads and commissions

Margex is a cryptocurrency brokerage and trading platform based in Seychelles that was founded in 2020. In the Seychelles, the market conditions for a platform of this kind are particularly favourable. The exchange does not require KYC information to operate, however, due to new regulatory framework in some jurisdictions, they may require to collect identity verification documentation.

Although it is based in the Seychelles, Margex is accessible from anywhere in the world. With the Margex security program, users have the unique ability to create an AI-Customized MP Shield with data encryption to protect them from financial risks. Furthermore, the platform does not record crypto assets affected by price manipulation in terms of liquidity trading pairs. Account security options during withdrawals and deposits are available in a wide variety.

Margex’s trading website has an easy-to-use interface that is suitable for both new traders and experts. Margex provides users a seamless way to buy crypto, offering 18 different currencies which can be purchased using a variety of payment methods including credit/debit card, bank transfer, SEPA, Apple Pay and GPay, among others. Currently, their spot trading feature is in development, however, users are able to trade crypto perpetual futures and utilise their copy trading feature. Margex also provides users with the option to stake BTC, ETH, LINK, USDC and USDT with up to 5% APY. In addition, to improve their trading skills, beginners can access useful educational materials, such as articles and video guides. For experienced traders, the platform supports a range of tools that can be used to enhance the trading process.

Margex fees

Fee Amount Crypto trading fee Maker Fee of 0.019% and a Taker Fee of 0.060 Inactivity fee Determined individually for each account Withdrawal fee Approved Crypto Network Fees Cryptoassets are highly volatile. Please make sure that you can afford to lose your investment.

7. Binance – Centralized cryptocurrency exchange and NFT marketplace

Binance is, without a doubt, one of the most well-known cryptocurrency exchanges. The platform was created in 2017 to provide users with an efficient way to trade crypto assets. The platform integrates its BNB token within the exchange which can be used to lower trading fees. Binance built its own blockchain called the Binance Chain which facilitates fast transactions and low fees. Subsequently, the platform created the Binance Smart Chain which powers various decentralized applications including DEX exchanges. Additionally, Binance has a large ecosystem of defi applications, hosted on the Binance Smart Chain, which includes one of the best NFT Platforms in the UK.

In terms of educational tutorials and videos, Binance offers quite a bit of content to choose from for beginners. For example, Binance provides in-depth tutorials on how you can buy cryptocurrency with a credit card and trade based on your experience. The platform also offers tips for developing strategies and implementing risk management. Binance is well-known for its learn and earn feature which rewards users for completing courses and successfully passing multiple choice questionnaires.

Using Binance’s exchange, you can purchase cryptos using credit cards and bank transfers. The exchange also provides a customer support team that users can contact if they need any assistance. The team is available via live chat, email or phone.

Binance fees

Fee Amount Crypto trading fee Maker/Taker is 0.1% or 0.075% if using BNB to pay for fees Inactivity fee Free Withdrawal fee 0.50 GBP (SEPA bank transfer) Cryptoassets are highly volatile. Please make sure that you can afford to lose your investment.

8. Revolut – Reputable UK banking app with access to 120+ cryptos

Revolut is a digital challenger bank launched in 2015 and their mobile application is an all-in-one personal finance money management tool. Revolut provides users a user-friendly app allowing banking features with foreign currency exchange and cross-border payment processing at favourable rates. Their platform allows users to manage savings, invest in various asset classes, earn rewards & cashback, foreign exchange across 36 currencies & transfer money internationally across 150+ countries. Their debit and virtual payment cards make it a perfect way to pay when travelling, shopping online and paying in international currencies. Revolut also provides access to cryptocurrencies and is a registered as a crypto asset firm with the UK’s Financial Conduct Authority.

Revolut offers one of the most simplistic ways to purchase cryptocurrencies and manage holdings collectively in one simple application interface. The platform provides access to 80+ digital currencies including Bitcoin, Ethereum, Litecoin, Ripple and Solana, among popular top 50 market cap coins. What is unique about Revolut is that it is a banking application, and within it users can manage 36 different foreign currencies from Europe, the Americas and South-east Asia. Users are able to swap these foreign fiat currencies to crypto also, making it an easy way to transfers funds directly in and out of crypto without having to manage different wallets and transfer in and out of exchanges.

Revolut fees:

Fee Amount Crypto trading fee £1.49 or 1.49% whichever is higher Inactivity fee Free Withdrawal fee

Crypto network fees, free for fiat Cryptoassets are highly volatile. Please make sure that you can afford to lose your investment.

9. Coinjar – Top crypto trading platform for 24 hour crypto trading

Coinjar is a global cryptocurrency platform that has won numerous awards. Even though it entered the Australian market, it is the biggest digital currency broker there. Users can purchase and sell Bitcoin and other digital assets through Coinjar.

It also offers 24-hour exchanges for cryptocurrencies. In addition, Coinjar lets you buy cryptocurrencies on its platform and provides a full-featured Bitcoin wallet in the UK. The app is available for both iOS and Android devices.

The app can be customised to fit your trading needs, which is ideal for both beginner and experienced crypto traders. Once the application has been installed, your crypto will appear in your unique Coin Jar wallet.

Coinjar Fees

Fee Amount Crypto trading fee Currently 0.2181% Inactivity fee Free Withdrawal fee Depending on amount Cryptoassets are highly volatile. Please make sure that you can afford to lose your investment.

How to Choose the Best Cryptocurrency Trading Platform in the UK for You

According to CoinMarketCap, approximately 200 crypto exchanges operate in the online space.

Choosing a provider should not be a particularly difficult task if you take some time to do some research on the key considerations when choosing a platform. You need to keep in mind everything related to security, tradable markets, payment systems and fees.

This guide will provide you with a little more information on these basic requirements.

✔️ Assets

Some cryptocurrency trading platforms offer a wide variety of markets, while others focus on just a few. When it comes to thinking about the preferred cryptocurrency pairing, it usually comes in one of two forms: crypto to fiat or crypto to crypto.

– Crypto to fiat: If you use a regulated platform, you will most likely have the ability to access crypto to fiat pairs. This means that you will trade the value of a cryptocurrency against a fiat currency. For example, BTC/USD comprises Bitcoin and the US dollar.

– Crypto-to-crypto: The vast majority of platforms in this field provide crypto-to-crypto pairs. This means that you will trade the exchange rate between two different digital assets. For example, the BTC/EOS pair consists of Bitcoin and EOS.

Aside from the above, you may also be interested in digital currency derivatives. For example, major cryptocurrency trading platforms offer Bitcoin futures and options markets. In addition, these platforms often offer leverage and the ability to short sell.

✔️ Fees

This guide has covered the best cryptocurrency trading platforms in the UK, but you will always have to pay a commission when it comes to buying or selling digital currencies.

Below is a list of the main commissions you should investigate before choosing a provider.

- Taker/Maker Fees: These fees apply to buying or selling crypto on the exchange order books. When trading there are bids and asks and exchanges implement taker and maker fees as a revenue stream for order execution. The taker fee is paid by a trader to the exchange when a trade order is executed. The maker fee is the fee paid by the trader to the exchange when placing a limit order.

- Crypto Purchases with Fiat: When purchasing crypto with fiat currencies exchanges will usually charge a commission to process the transaction. For instance, Coinbase charges 3.99% commission when purchasing crypto with a debit card.

- Fiat Withdrawal Fees: Some exchanges allow you to convert crypto back to fiat and withdraw the money to a bank account. If the platforms are UK regulated with electronic money licenses they can facilitate free bank transfer withdrawals that can take up to 3 days, usually processing through ACH. In some cases, withdrawing immediately or using Swift, Sepa or Wire to withdraw can incur extra charges.

- Crypto Withdrawals to External Wallet: Centralized platforms usually hold cryptocurrencies for you on the exchange wallet section, however, they may have secure cold storage for their treasury. Nevertheless, in most cases users' assets are held on the exchange. Users who wish to withdraw crypto assets to a non-custodial crypto wallet will usually be charged to do so. Some platforms just charge the standard network rate, while some will have fixed rate charges across the different currencies when wishing to withdraw.

Deposit and Withdrawal Fees

Before you can start trading with the best cryptocurrency platform, you will need to deposit funds into your account. If you don't already have access to certain digital currencies, you will need to choose a provider that allows you to make deposits in fiat currency. The most popular cryptocurrency exchange platforms will charge your debit card a huge amount of money for funding your account.

Ultimately, you need to recoup this amount in profit by paying such a high fee for depositing funds to break even. eToro provides zero conversion fees for depositing in USD, however, foreign exchange conversion fees apply when depositing GBP.

Bitcoin & Crypto Trading Commission Fees

Cryptocurrency traders always charge a commission like stock trading platforms, forex trading platforms, stock trading platforms, and CFD trading platforms. Unless you are trading really low amounts, it is usually a variable commission multiplied by the value of your trade.

Trading commissions are always charged on a "variable" basis, i.e., you pay when you buy a cryptocurrency and sell it. Therefore, the larger the trade, the more you pay.

Aside from commissions and deposits/withdrawals, one must also take into consideration the cryptocurrency trading platform fees that may intervene in the market.

- Markup for cryptocurrency: Many cryptocurrency trading platforms charge a markup fee. This is not dissimilar to your bank's foreign exchange fee when you use your debit card abroad.

- Margins: you should always be aware of the spread, especially when trading less liquid cryptocurrency pairs. As mentioned above, this is the difference between the bid and ask price.

-Margin costs: If you plan to trade cryptocurrencies with leverage, you will need to consider margin fees. These are the interest you pay for trading more than you have available in your account on the platform.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more. "

✔️ Trading Tools & Features

The crypto market is volatile which means that traders rely on advanced tools to conduct analysis and execute trades quickly. Helpful tools that are offered by the best cryptocurrency trading platforms include detailed price charts, automated trading tools, signals, social trading, trading portfolios, expert insight and real-time news.

✔️ Support for Crypto Trading Robots

Recent years have seen tremendous growth in cryptocurrency bots.

This robot buys, sells, and trades cryptocurrency on your behalf based on an algorithm that reacts to market conditions. You need not intervene at all during this process.

To understand how the robot works, you need to know that the process is as follows:

- You join a third-party cryptocurrency robot platform.

- You buy a previously programmed bot from the marketplace can build one from scratch.

- You then connect the bot to your preferred cryptocurrency trading platform via an API code.

- The bot will trade on your behalf.

Of course, there's a good chance that your cryptocurrency robot will end up losing money, so it's best to start in demo account mode.

And in such a case you want to invest, do it with small amounts to decrease the risks.

✔️ Copy Trading

If you enjoy automated cryptocurrency trading, we'd say it's best to use the Copy Trading feature offered by eToro. This way, you can select a more experienced and successful cryptocurrency trader. Then, you can copy trade on a peer-to-peer basis in a fully transparent environment.

All trades are proportional to the amount you invest in the trader.

This is a safer alternative for several reasons. First, you will be relying on a proven human trader, so there is no chance of the individual not performing correctly, as can happen with a robot.

Secondly, the human trader is fully updated with important news, whereas robots rely solely on technical aspects. Also, eToro offers you the possibility to invest only $200 in each crypto trader. Thus, with an investment of $1,000, you could diversify among five experienced professionals.

✔️ Leverage and Short-Selling

Beginners are usually interested in investing in their chosen cryptocurrency for the long term. It is better to choose a platform that offers sophisticated trading tools in case you consider yourself a beginner trader or someone with more experience. In this situation, you can leverage your cryptocurrency trading on platforms such as eToro and Coinbase.

✔️ Education, Research & Analysis

The best UK cryptocurrency platforms we have reviewed provide a wide variety of educational resources. These resources are very useful for those with little or no experience in the cryptocurrency industry.

Trading manuals and videos are available, for example, at eToro. Social trading functions, including webinars and podcasts, are also included. This feature enables you to communicate with other eToro traders in an environment similar to Facebook. In addition, you can use fundamental and technical analysis tools when researching cryptocurrency trading platforms.

For example, if you are planning to trade actively, it is in your best interest to choose a provider that provides tools for the analysis and interpretation of charts and indicators. In addition, it is recommended that the provider includes market commentary and trading tips.

✔️ Liquidity

Suppose you sign up for a cryptocurrency trading platform that you are unfamiliar with and completely unfamiliar with the cryptocurrency world. In that case, it is almost obvious that liquidity rates will be below. This can be detrimental, as it could be quite difficult to enter and exit your chosen cryptocurrency market.

For those who don't know, liquidity is defined as the capital held by a Bitcoin exchange in a given pair. In other words, if there is a lot of liquidity, the platform benefits from large trading volumes.

Therefore, it will have access to much smaller spreads, which will reduce its trading costs. More importantly, when you use a bitcoin trading platform with high liquidity levels, you will always be able to find a buyer when you are thinking of exiting a position.

✔️ User Experience

We reached several providers that didn't offer the most favorable user experience while searching for the best cryptocurrency trading platforms. In addition, sometimes it isn't easy to locate the preferred marketplace, as the search system is not working.

Also, we were confronted with providers that offered a trading platform for bitcoin that was too complicated, especially when it comes to placing orders. Do not forget that you will risk your hard-earned money, so you need to choose a cryptocurrency trading platform that will make the investment process simple and not a hassle.

We find that eToro offers an excellent user experience. For example, you need to enter it in the search box to trade BTC. You will then be presented with a drop-down box asking you to enter your trade details. However, if you are looking to stick to the basics, all you need to enter on eToro is the amount of your bet in US dollars and click on the "Open Trade" button.

✔️ Mobile App

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more. "

The UK's largest and most popular cryptocurrency trading platforms have a native mobile crypto app. Typically, this allows you to access the same features and tools that can be found on the main desktop trading platform.

The eToro app, for example, allows you to deposit funds instantly with a debit card and check the value of your wallet in a matter of seconds.

In addition, you can buy, sell and trade cryptocurrencies seamlessly, even on a small mobile screen.

If the cryptocurrency trading platform you have selected offers an app, it is usually compatible with iOS and Android operating systems.

That said, you should check what the mobile trading experience is like, as there are also apps that are not very helpful when it comes to using them.

✔️ Payment Methods

This guide provides detailed information about payment methods. Top crypto trading platforms accept debit cards and eWallets, but you must add funds to your account in order to trade crypto online.

Other platforms only accept deposits from bank accounts. Many platforms only support crypto as a means of depositing and withdrawing money. There are some reasons for this, such as the provider does not have the legal authority to accept fiat currency.

✔️ Customer Service

Millions of traders are active on some cryptocurrency trading platforms. However, this does not imply that the provider offers excellent customer service. This is because some trading platforms do not have the resources to employ a full-time customer support team.

In this case, email may be the only support channel available. Therefore, you may have to wait a few days for a response. You will access eToro's live chat support service when you log into your account.

How to Start Crypto Trading on a UK Cryptocurrency Exchange

For those who have never delved into the world of crypto before, the idea of using an exchange can be daunting. Nevertheless, buying crypto from a exchange requires just a few simple steps. In this article, we will offer you an in-depth walkthrough of how it works with eToro.

In less than 10-15 minutes, you will be able to place your first cryptocurrency trade by following the information below.

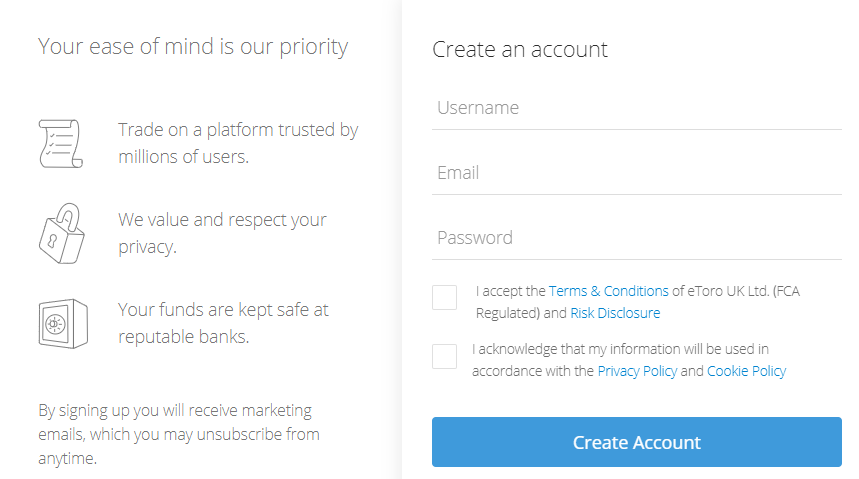

Step 1: Open an Account

You can join eToro online or through your mobile device by clicking on the 'Join Now' button on the website.

The next step is to provide some personal information. You must provide your name, residence, date of birth, mobile number, and email address.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more. "

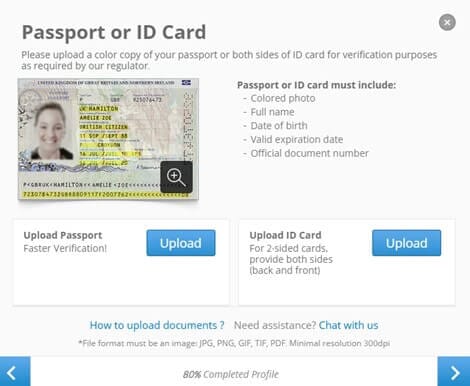

Step 2: Upload ID

A deposit can be made once you have registered. The minimum deposit at eToro is $50 for US residents and $200 for those outside the United States.

The following payment options are available to you:

- Debit Cards

- E-wallets (Paypal, Skrill, Neteller)

- Bank Wire

Step 3: Deposit Funds

eToro allows you to search by market, so you should search for the crypto asset you want to access once you have funded your account. You're sure to find a market on eToro that interests you given that it supports many crypto-to-fiat and crypto-cross pairs.

Step 4: Trade Cryptos

Now you have to decide whether you want to buy or sell, based on if you think the pair will rise or fall. If you want to short, you must change this to a sell order on eToro.

Your next step is to enter your stake - ensuring you meet a $20 minimum. Setting up stop-loss, limit, and take-profit orders might also be helpful if you want to enter and exit the trade at a specific price.

Click on the 'Open Trade' button on eToro to complete your trade.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more. "

Conclusion

In this guide we have taken a look at the best cryptocurrency trading platforms and exchanges that are available to UK traders. When choosing an exchange, you should not be guided by low commissions alone, as there are many more important factors to consider, for example, security, customer support, tradable markets, payments, etc.

In conclusion, we have found eToro to provide an intuitive crypto exchange platform that offers a sizeable range of crypto assets and a secure trading environment.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more. "

FAQs

Which crypto trading platforms offer the most leverage in the UK?

Whether or not you plan to use a regulated crypto trading platform depends on whether or not you are planning on trading. As a result, your access to leverage will be determined by the country in which you live. In addition, there is now a possibility to get leverage of up to 1:100 if you choose to use a provider that is not licensed.Which UK exchange has the lowest fees?

The Binance platform is often regarded as a low-cost trading platform in the UK, as it has a commission rate of just 0.10%. However, when using a debit card to deposit funds, you will have to pay a fee of up to 4.5%. Therefore, one of the most cost-effective options is to use a platform such as eToro or CoinbaseWhat is the most comprehensive crypto exchange in the UK?

We found it to be eToro because it provides low fees and has a free demo trading account.How do I start crypto trading in the UK?

When using platforms such as eToro, you can start trading crypto in as little as 10-15 minutes. To get started, you can register an account by uploading your ID, and make a deposit immediately with your debit card. Once you do that, you will start trading crypto immediately.Can I trade Bitcoin using CFDs?

The UK recently banned crypto derivatives trading, including using CFDs to trade Bitcoin. So, you must use a cryptocurrency exchange in order to buy and sell Bitcoin in the UK.How much money do I need to trade Bitcoin?

The minimum amount of money you need to trade Bitcoin is just your exchange’s minimum required deposit. However, you should plan to set aside at least 500 GBP to trade Bitcoin and earn a reasonable amount from your trades.Do I need to verify my identity to trade Bitcoin in the UK?

Although Bitcoin can be bought and sold anonymously, most trustworthy Bitcoin brokers follow Know Your Customer (KYC) rules. So, you will need to verify your identity to trade Bitcoin.What are maker and taker fees?

You are considered a ‘maker’ when you add liquidity to an exchange’s order book. You are considered a ‘taker’ when you remove liquidity from the exchange.Do I need a cryptocurrency wallet to trade Bitcoin?

Yes, you need a crypto wallet to buy and sell Bitcoin. Many of the best Bitcoin brokers in the UK have their own built-in wallets. Alternatively, you can download a third-party wallet for free.Which UK bank is the most crypto friendly?

The most crypto friendly bank is Revolut which is an online UK bank that can be used on mobile and desktop devices. High street banks that are crypto friendly in the UK include Nationwide, Royal Bank of Scotland, Lloyds, Barclays and HSBC.References:

- https://www.fca.org.uk/investsmart/crypto-basics

- https://koinly.io/blog/crypto-margin-trading/

- https://www.etoro.com/customer-service/regulation-license/

- https://www.coinbase.com/legal/user_agreement/payments_europe

- https://www.binance.com/en/feed/post/611478

- https://freemanlaw.com/cryptocurrency/united-kingdom/

- https://academy.binance.com/en/articles/liquidity-explained

- https://www.statista.com/outlook/fmo/digital-assets/cryptocurrencies/united-kingdom

Carlos Sereno Freelance Writer

View all posts by Carlos SerenoCarlos is an experienced content writer who specializes in cryptocurrency and forex content. After spending time as an active trader himself, he has a good understanding of TradingPlatforms and best practices and uses this to create informative content for TradingPlatforms.

Carlos has also written for Rather Labs Inc., Daily Forex Ltd., and Tradeview Markets. He has a plethora of experience in both forex and cryptocurrency and is able to explain complex terms in a user-friendly way.

As well as writing content, Carlos is a skilled researcher who regularly investigates new crypto projects to understand their potential. He uses these skills within his content writing work to provide an analytical overview and helpful insight to readers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

By continuing to use this website you agree to our terms and conditions and privacy policy.Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Registered Company number: 103525

© tradingplatforms.com All Rights Reserved 2023

One of the largest crypto exchanges in the world was created in 2012 by

One of the largest crypto exchanges in the world was created in 2012 by