Where to Buy Bitcoin UK in June 2025 – Beginner’s Guide

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Due to the extreme levels of growth that cryptocurrencies such as Bitcoin have seen in the recent past, more and more people are wondering about how they can invest in Bitcoins through the UK. The process is now simple, and all you need to do is find a good online broker that offers competitive fees, deposit some funds with a debit/credit card and decide how much you wish to invest.

In fact, some platforms allow you to buy just $25 worth of Bitcoin – which is about £18. But many people in the UK still haven’t invested in Bitcoin because they simply don’t understand how this innovative technology works, read on for our full guide to buy bitcoin UK.

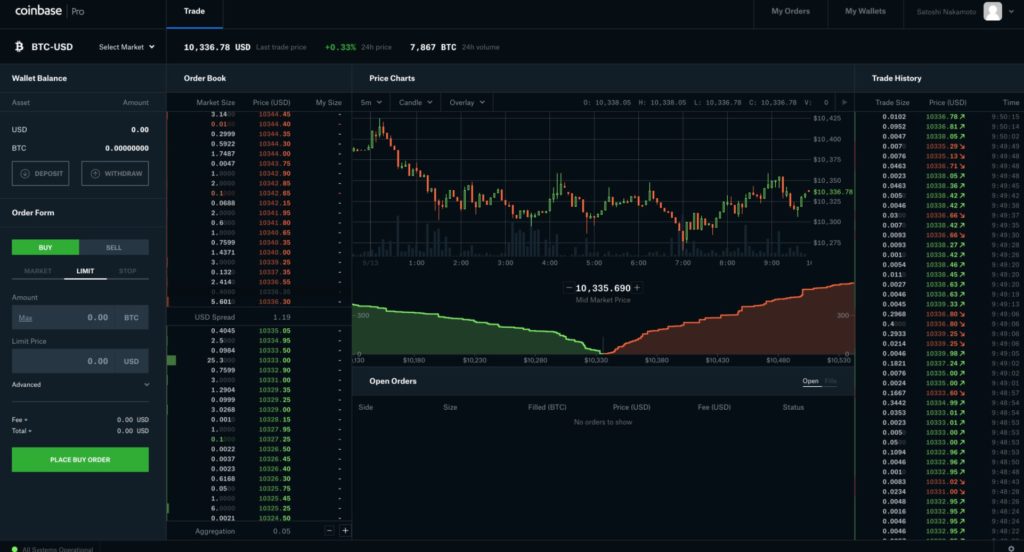

How To Buy Bitcoin in the UK on Coinbase

Below is an overview of how to use Coinbase to buy Bitcoin in the UK.

- Open an account with Coinbase– Open an account by providing your personal details, two forms of ID and a payment method.

- Upload ID – Upload a copy of your passport or driver’s license to verify your identity

- Deposit – Deposit funds with a UK debit card or bank transfer.

- Buy Cryptocurrency – Buy cryptocurrency from $1.

1. Coinbase – The Best Bitcoin Trading Platform for Beginners

Trading through Coinbase, you can either place simple orders on the original Coinbase platform. However, If you wish to place specific order types or perform advanced technical analysis, then you will have to use the Coinbase Pro platform, which is also available to all the users.

Coinbase has made cryptocurrency trading accessible to a variety of retail traders, and despite the inherent volatility and risk associated with investing in crypto, investors and traders alike prefer the platform for its ease of use. If you’re into cryptocurrencies and wish to trade Bitcoin in the UK, Coinbase is an excellent option for both beginners and veterans.

Your money is at risk.

3. Kraken – One of The Largest Cryptocurrency Exchanges to Trade Bitcoin UK

The safety and security features that Kraken provides are also among the very best in the industry, and the platform allows traders to even trade on futures of cryptocurrencies, a change from most other platforms in this list. In addition to this, it is quite easy to get started with and allows users to trade on high margins depending on the currency they wish to trade. For example, you can trade BTC through Kraken with leverage as high as 10x.

Your money is at risk.

4. OKX

OKX is a popular platform that is available in over 100 countries around the world. The platform is appealing because it charges very low fees and provides traders with the opportunity to earn passive income from their assets via staking or lending. As well as Bitcoin, there are over 250 different coins available on the OKX platform.

If you are limited for time, OKX also offers algorithmic trading which will automatically execute Bitcoin trades on your behalf. This is appealing to those who don’t want to spend hours conducting research and placing trades.

OKX also offers P2P trading which cuts out any third party, making transactions faster and more efficient. OKX is decentralized and built on the native OKExCahin. Decentralized exchanges are popular amongst traders who value autonomy and fast transaction speeds.

The minimum deposit for OKX is $100 and the platform accepts a variety of payment methods. The registration process takes less than 10 minutes which means you could start trading Bitcoin today!

Your money is at risk.

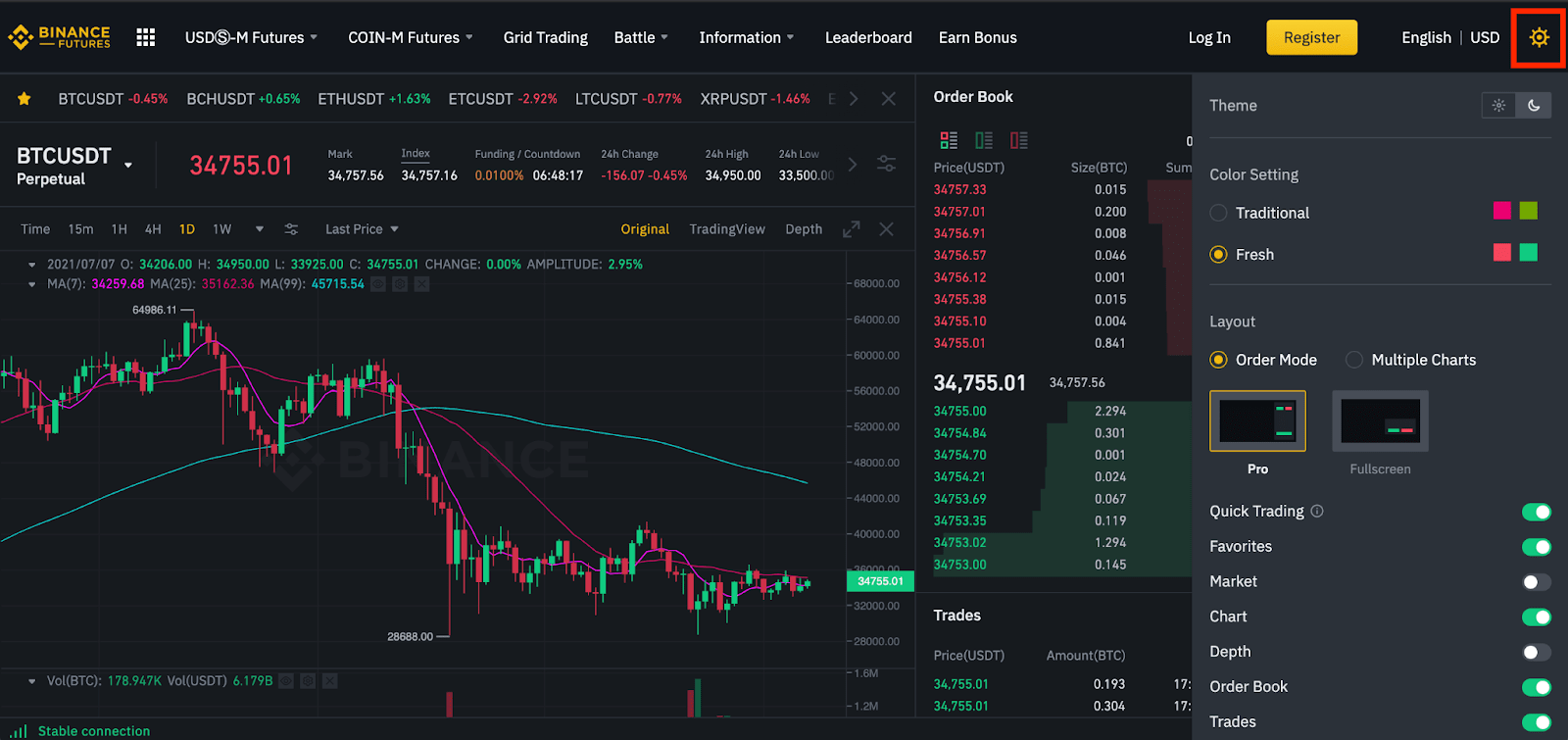

5. Binance

Binance

The fee structure of Binance is such that while the platform charges quite high non-trading fees in terms of withdrawals, their trading fees are among the lowest in the industry. The platform’s fees are as low as 0.1% of the value of the trade, but it can be even lower if you have an allocation of the Binance Coin (BNB). Since the platform specializes in cryptocurrency trading, they have a variety of tools and charting methods that are specific to crypto, which explains why Binance is preferred by professional crypto traders.

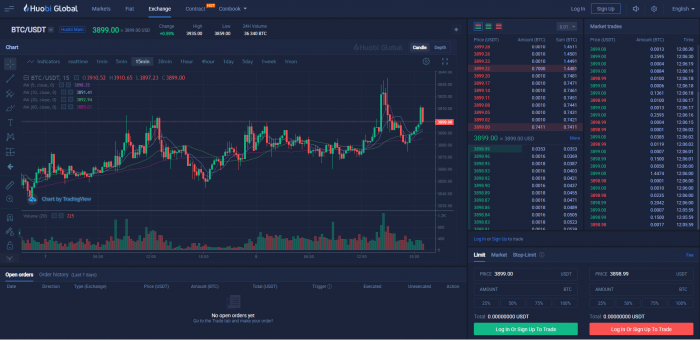

6. Huobi – The World Largest Crypto Exchange To Buy Bitcoin

As a UK cryptocurrency exchange and online financial services company, Huobi is based in Singapore. Huobi offers users a means of acquiring initial coin offerings (ICOs) before they become mainstream, as well as an opportunity to trade in Bitcoin, Ethereum, and XRP. Hong Kong is the birthplace of Huobi, but the company was founded in Beijing, China. China barred cryptocurrency exchanges from participating in the crypto market in 2017 after the government expelled three exchanges.

In neighboring Singapore, crypto laws are more friendly, so the company moved there later. It’s no secret that Huobi is the world’s largest crypto exchange today, supporting more than 355 cryptoassets. There are 130 countries represented on the platform, and the platform boasts over 5 million active users. According to Coinmarketcap, Huobi ranks third among the top cryptocurrency exchanges based on its daily trading volume. Another prominent exchange on the list is Coinbase, followed by Bithumb.

Huobi’s popularity is rooted in the fact that it is a platform that is accessible to both seasoned and new traders.

At the click of a button, you should be able to complete your account setup in about two minutes, and you should have no trouble with this process at all.

There have not been any security breaches on the Huobi platform since it launched its company wallets. In order to achieve such an enviable record and maintain it for such a long time, there have been several security protocols adhered to. Furthermore, since Huobi’s crypto funds are kept in an off-chain cold storage facility, the bad actors have no way of getting their hands on these funds, as they are not shown on Huobi’s public blockchain. This makes hacking them impossible.

Your money is at risk.

What is Bitcoin?

Bitcoin (BTC) is a highly speculative asset that is the leading cryptocurrency in the world. It is important for you to completely understand what Bitcoin is and how it works before you begin investing in it. It was launched as a digital currency in 2009 by an unknown developer known as Satoshi Nakamoto, who is also credited with creating the technology that has resulted in the popularity and scalability of Bitcoins. The concept of Bitcoin rests on the fact that it is not owned by any single person, organisation, or central bank. Instead, it is a decentralised currency, and as such is free from manipulation

This means that unlike traditional fiat currencies – like the British pound or US dollar – Bitcoin cannot be manipulated or printed. Instead, a new Bitcoin is created by code every 10 minutes. This will incur continuously until the digital currency reaches 25 million Bitcoin – which is expected to happen in 2140. By holding Bitcoin, you can transfer your coins to another user. However, the vast majority of people that buy Bitcoin UK do so as an investment vehicle. That is to say, they hope that the value of Bitcoin will increase over the course of time, and thus – they cash out at a much higher price.

Why Buy Bitcoin?

As we noted above, the vast bulk of people buy Bitcoin in the UK as an investment. Make no mistake about it – it is a high-risk investment at that, not least because the price of Bitcoin is super-volatile. If you had invested just £100 in Bitcoin back in 2009, your investment would now be worth over £400 million! More recently, had you bought Bitcoin in March 2020 – you would have paid around $5,000. Just a year later, Bitcoin’s price had increased by a factor of 10! By comparison, the FTSE 100 is worth less now than it was 5 years ago. This potential for huge quick gains has made BTC a very attractive asset for speculators. Bitcoin’s growth far outpaces almost every other traditional asset class, like stocks, bonds, and even real estate. So, if you’re looking to get an ultra-high return on your investment, Bitcoin is one of the best assets to consider.

An additional factor that many newbie investors in the UK are unaware of is that Bitcoin is a finite asset class like gold. As noted earlier, this is because there will only ever be 21 million Bitcoin in circulation. In theory, this means that over the course of time, the value of Bitcoin should continue to rise indefinitely. For example, when you invest in stocks, the respective company has the ability to issue new shares. When it does, this dilutes your investment, as there are more shareholders in circulation. Once again, this isn’t possible with Bitcoin and its underlying blockchain technology.

In addition to this, as Bitcoin is a digital currency it can easily be ‘fractionalized’. This means that you can buy a fraction of 1 Bitcoin. In fact, Bitcoin can be broken down to 0.00000001 – meaning a $50,000 coin turns into just a few cents. However, the minimum amount of Bitcoin that you can buy in the UK will be dependent on your choice of brokerage site. Coinbase, for example, allows you to invest just $1. This is crucial, as Bitcoin is speculative and volatile – so you’ll likely want to start off with smaller amounts before you understand how things work.

How Much Does It Cost to Buy Bitcoin?

At the time of writing in early December 2021, a single Bitcoin trades for around $47,351. With that said, it is important to understand that like any other tradable asset – the Bitcoin price will change throughout the day. It is also important to remember that Bitcoin – like all cryptocurrencies, operates in a highly speculative and volatile arena. However, as we have seen with many other hyped-up crypto assets, what goes up can often come crashing straight back down – and quickly. As such, if you are wondering how to buy BTC in the safest way possible, make sure you keep your stakes modest.

Buying Bitcoin Safely

As far as investing in Bitcoins is concerned, there are no guarantees. Even though it has more use cases than most other cryptocurrencies such as Ethereum and Shiba, it does not mean that it will perform better than these, because, by definition, cryptocurrencies are a highly speculative asset class. Bitcoin will definitely still struggle to reach its all-time highs again soon, especially given the fact that blockchain technology is expanding every day and it is very difficult to be able to say when another cryptocurrency that is more energy-efficient and technologically advanced than Bitcoin will be launched, making it redundant and thereby dropping its prices.

Investing in anonymous projects like BTC also presents distinct security risks since a critical flaw in the code may allow the developers to steal cryptocurrency from investors by scamming them. Unfortunately, in the wild west that is DeFi, some scams are causing users to lose millions of dollars with increasing frequency. If experienced code auditors had access to the code, this possibility could be ruled out, but the Bitcoin network hasn’t yet been audited so that they couldn’t do this.

Your money is at risk.

Risks of Buying Bitcoin

As such, cryptocurrencies have a strong community function as opposed to their utility. Because of this, the success and growth of the community are pivotal in determining how successful they are, explains Boneparth, who has been investing in cryptocurrencies since 2014. However, there is still an inherently high degree of risk associated with investing in digital currencies, as experts warn that there is a higher chance that you will lose your money. Authorities generally recommend that you should only invest what you can afford to lose regardless of which cryptocurrency you choose

Bitcoin was created in 2009 to serve as a peer-to-peer electronic cash system. In addition to its blockchain, the company has carefully designed an ecosystem to support the blockchain. Using the fact that Bitcoins are a limited supply allows for a certain amount of built-in scarcity through the design. The fact that it can be used for this purpose makes it such a valuable investment for its holders, with the hope that it will be recognized as a prominent decentralized digital currency. However, all this rests on the central assumption that Bitcoins will still be out and about over the long run, which is not an assumption heavily rooted in fact.

While this is true, Brett Harrison, president of cryptocurrency exchange FTX US, warns that “cryptocurrencies can be extremely risky, and may not always have inherent value as investments, and that individual retail investor should always conduct research and diligence before trading these assets.” Harrison looks for assets that offer specific utility rather than investing in a booming cryptocurrency based on hype to make money from crypto-assets.

Crypto assets are a growing area of interest for investors. They provide a store of value, facilitate an efficient mechanism for the transfer of funds, or serve as an algorithm that enables the construction of blockchain-based applications, writes Marcus. He says many assets can be suitable for retail users. However, a degree of caution should always be exercised whenever you decide to invest in digital currencies, especially given the unique nature of BTC, which makes it much harder for investors and speculators to be able to accurately price in the technology associated with BTC.

Selling Bitcoin

Depending on what platform you are trading through, the process of selling Bitcoins will be very straightforward. For example, you can simply head over to your portfolio on Coinbase and click on sell. After selecting the amount and the type of order you wish to place, then the next step for you is to simply click on place order and this will result in your cryptocurrencies being converted into the fiat currency that you use to operate your platform. On the other hand, if you are using a sole cryptocurrency exchange, then you will have other options too. For example, you might wish to convert your BTC into other cryptocurrencies such as Cardano, Etheruem, or Binance Coin, alongside a variety of fiat currencies. Once you have done this, these cryptocurrencies will then be stored in your wallet on the platform.

Bitcoin Price Forecast

It’s difficult to say with any certainty where the price of Bitcoin could be headed next. On the one hand, experts have agreed that Bitcoin is not a short-lived fad. The cryptocurrency is used around the world and has proven at least as durable as traditional financial systems. In addition, many companies now accept Bitcoin for payment and a number of banks and financial firms are working on ways to offer Bitcoin-based transactions. So, over the long term, the price of Bitcoin could continue to rise. Supply is ultimately limited thanks to the cap of 21 million Bitcoin that can ever be mined, and demand will only increase if financial institutions make it easier for everyday people to use Bitcoin alongside fiat currency.

On the other hand, the short-term outlook for Bitcoin’s price is difficult to predict. The cryptocurrency has been on a meteoric rise in the past year, and it’s not clear that current prices can be sustained throughout 2025. So, the most likely scenario for the remainder of 2021 and going into 2025 is that Bitcoin enters a holding pattern around the $50,000 level. The price of the coin could fluctuate by 10% or more – Bitcoin remains extremely volatile, after all – but the rest of the year could represent a period of consolidation after all the recent gains.

Your money is at risk.

Where to Buy Bitcoin

Over the past few years, there have been many, many Bitcoin scandals. Whether that’s cryptocurrency exchanges getting hacked for millions of dollars worth of coins or Bitcoin-related Ponzi Schemes, a small minority of this industry are nothing short of unsavoury. With this in mind, it is absolutely fundamental that you know how to buy Bitcoin UK safely. In fact, the best thing to do would be to make sure that you only use a licensed platform.

How to Buy Bitcoin from Coinbase

In order to assist you with trading BTC, here is a list of steps that you need to follow in order to begin trading cryptos on Coinbase. The process of opening an account and trading on Coinbase involves 4 main steps.

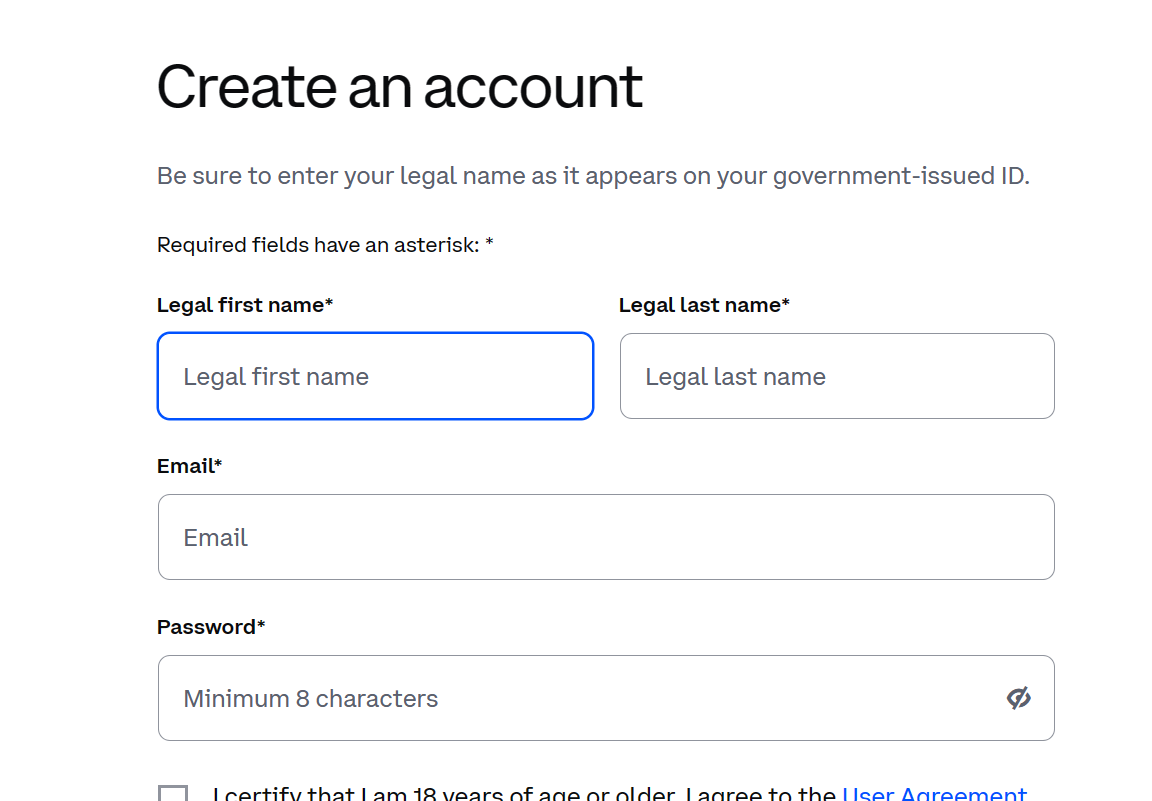

Step 1: Open an Account

The first thing that you need to do is to navigate to the Coinbase homepage and click on “create account”. Then, you will be asked to fill a short form that asks for your contact details and makes you set up your login credentials. Alternatively, you can also sign up via your Facebook or Google account for easier sign-ins and to avoid having to remember your username and password.

Your money is at risk.

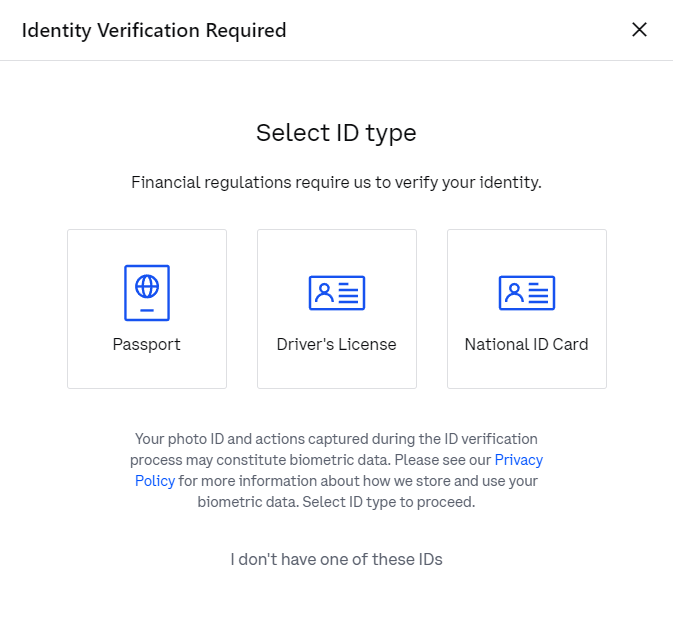

Step 2: Upload ID

The next step is for you to verify your identity by uploading a copy of your ID. Since Coinbase is a centralized platform, they have to complete the KYC (Know Your Customer) process before they allow you to trade. This verification process has two parts to it. The first part involves verifying your identity. For this, you can upload a copy of any government-issued ID, such as a passport, driving license, or visa. The next part is an address proof, for which you can either upload a bank statement or utility bill.

Once you have uploaded the documents, Coinbase will verify your account within a few hours.

Step 3: Deposit Funds

The third step is to then deposit funds into your account. The minimum deposit on Coinbase is 1 USD. This can be done via debit card or bank transfer. It is also possible to deposit crypto funds from an external wallet.

Step 4: Buy Bitcoin

The last step is then to begin trading Bitcoins. Simply head over to the search bar, search for Bitcoin or BTC, enter the amount you wish to buy or sell, and click on the order button.

Your money is at risk.