Best Yield Farming Crypto Platforms UK – How to Yield Farm Cryptos

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

There are many ways to earn interest on idle cryptocurrency holdings, including yield farming. In addition, your funds will be paid an attractive APY on your digital assets when you lend them to a liquidity pool.

This guide discusses the best yield farming platforms for 2025 regarding interest rates, security, lock-up terms, supported tokens, and more.

Best Yield Farming Crypto Platforms UK List 2025

On the yield farming crypto-list below, you will find an overview of the best platforms on the market right now.

- DeFi Swap – One Of The Best Crypto Yield Farming Platform Using DeFi Coins

- AQRU – Best Crypto Yield Farming Platform for 2025

- OKX– Excellent Platform For Staking and Yield Farming To Earn Passive Income

- Crypto.com – A Great Place to Earn High APY on Stablecoins

- BlockFi – A Popular Bitcoin Yield Platform

- Coinbase – A Top Yield-Generating Platform for Beginners

Below you will find reviews of the providers on the above high yield farming crypto list.

Best Yield Farming Crypto Platforms UK Reviewed

Reviewing the very best yield farming crypto platforms for 2025, we have found that the top providers provide a perfect blend of safety, attractive yields, and reasonable lock-up terms.

user-friendliness, customer service, and supported tokens were also considered.

1. DeFi Swap – One Of The Best Crypto Yield Farming Platform Using DeFi Coins

DeFi Swap is one of the best cryptocurrency exchange platforms in the UK. It has yield farming that provides cryptocurrency investors with returns close to 75% APY. Its main feature is that it has a high DeFi Swap if you use its original token, known as DeFi Coin, as it is the only one you can use if you want to bet on the platform. It is necessary to block your coins for at least 30 days and a maximum period of one year. Depending on the selected period, the APY rate varies from 30% to 75%.

DeFi Swap is one of the best cryptocurrency exchange platforms in the UK. It has yield farming that provides cryptocurrency investors with returns close to 75% APY. Its main feature is that it has a high DeFi Swap if you use its original token, known as DeFi Coin, as it is the only one you can use if you want to bet on the platform. It is necessary to block your coins for at least 30 days and a maximum period of one year. Depending on the selected period, the APY rate varies from 30% to 75%.

This is a completely new platform that has earned a place among the best yield platforms in 2022. It must be said that DeFi is completely decentralized where there is the possibility to exchange DeFi Coins using recognized cryptocurrencies in addition to stablecoins. DeFi Swap seeks to become the first in decentralized finance, that is why its high investment rates and the possibility of performance farming.

If you are looking for a crypto that will give you great returns, in the long run, DeFi Coin may stand out as one of your options because of its transactional tax, which is around 10% on purchase and purchase orders. 50% of that amount is transferred to DEFC owners as a reward, and the remainder goes to DeFi Swap liquidity funds seeking to simplify the exchange of tokens and yield farming. It is worth mentioning that DeFi has a large community on the Telegram platform, where there are currently more than 6,000 members.

| Feature | Amount |

| Minimum Yield for DeFi Coins | 30% |

| Maximum Yield for DeFi Coins | 75% |

Your capital is at risk.

2. AQRU – Best Crypto Yield Farming Platform for 2025

Furthermore, unlike most yield farming crypto sites, Aqru allows you to earn a high yield without having to lock away your tokens for an extended period. AQRU offers flexible accounts so that you can request a withdrawal at any time. AQRU crypto interest accounts also offer stablecoins in addition to Bitcoin and Ethereum. USDC and Tether, for instance, offer an APY of 12%.

With your deposits, Aqru can offer such attractive rates of return since it provides crypto loans to retail and institutional borrowers. Furthermore, AQRU also supports fiat currency deposits, which is another plus. In other words, you can start earning interest in crypto even if you do not currently possess any digital tokens. Additionally, AQRU offers a mobile crypto app for both Android and iOS, so you can access your account while you’re on the go.

| Feature | Amount |

| Maximum Yield for Stablecoins | 12% APY for USDT, USDC, DAI |

| Maximum Yield for Non-stablecoins | 7% APY for BTC and ETH |

Cryptoassets are highly volatile unregulated investment products.

3. OKX – Excellent Platform For Staking and Yield Farming To Earn Passive Income

If you are looking to earn passive income with a reliable exchange, OKX is certainly worth considering. The exchange offers crypto buying, selling, swapping, staking, yield farming, algorithmic trading and much more. OKX’s ‘earn’ program allows users to make passive income with their crypto assets by either staking, yield farming or lending.

The ‘earn’ program is built on the native OKExChain, which provides access to the DeFi space. Crypto holders can also join the platform’s native mining pool and collectively mine tokens on the Proof of Work consensus. Joining a mining pool is a great option for those who do not have enough computational power alone to partake in the process.

As well as offering numerous opportunities to earn from crypto, OKX is a platform with a variety of appealing features. These include: a wide range of educational resources, P2P trading, trading bots, block trading and exclusive insight into upcoming decentralized projects.

Furthermore, the platform accepts a variety of payment methods and the registration process takes less than 10 minutes to complete. OKX charges a small 0.10% crypto trading fee which is affordable for most traders. This is a great all-round platform to consider if you are interested in yield farming and other earning opportunities.

Your money is at risk.

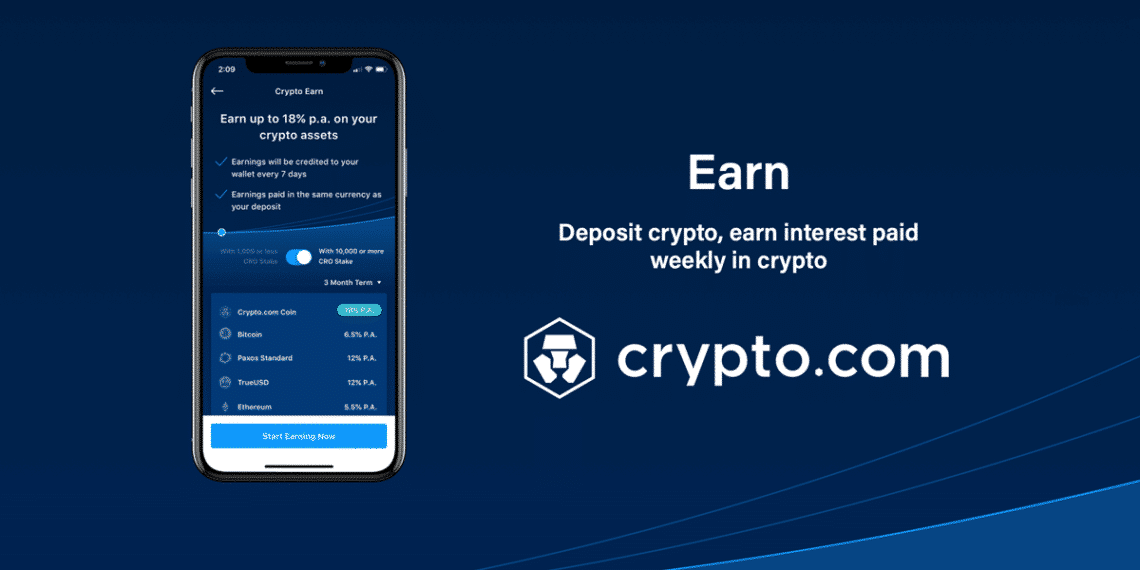

5. Crypto.com – A Great Place to Earn High APY on Stablecoins

As an example, if you want to earn the full 14% APR on Tether, you must lock up your tokens for three months. Furthermore, you must stake at least 40,000 CRO tokens. Alternatively, the APY falls to 6% if you deposit Tether on a flexible withdrawal or without staking any CRO tokens. Therefore, Crypto.com offers a variety of APYs to suit different needs.

More than 250 digital currencies on Crypto.com earn interest, most of which do not fall under stablecoin categories. The list includes everything from Bitcoin, Ethereum, and Litecoin to Solana, Shiba Inu, and Decentraland. Of course, if you choose to stake CRO tokens, the APY you can earn will depend on the lock-up period. In addition, Crypto.com offers a popular mobile app that allows you to access your account wherever you are.

| Feature | Amount |

| Maximum Yield for Stablecoins | 14% APY for 3-month fixed USDT, USDC, and more |

| Maximum Yield for Non-stablecoins | 14.5% APY for 3-month fixed DOT |

Capital at risk. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk. The price or value of cryptocurrencies can rapidly increase or decrease at any time.

5. BlockFi – Popular Platform for Bitcoin Yields

If you want to generate a return on your Bitcoin investment, the highest rate is 4.5%. This rate is paid on the first 0.10 BTC. The rate drops after that to 1%. With Ethereum, the rate is 5%, although this is only paid up to the first 1.5%. This is because BlockFi keeps the vast majority of digital client funds in cold storage. The digital tokens are also kept on leading third-party exchanges, such as Gemini.

BlockFi also has the policy to cover the risk of a remote hack. The company also offers traditional trading accounts competitive fees for buying and selling digital currencies. Consequently, once you have purchased a crypto asset on the BlockFi platform, you can start generating yields immediately. Besides offering top-notch customer service, BlockFi also offers phone support.

| Feature | Amount |

| Maximum Interest Rate for Stablecoins | 8% APY for USDT, USDC, BUSD, DAI, PAX |

| Maximum Interest Rate for Non-stablecoins | 11% APY for MATIC |

Digital currency is not legal tender, is not backed by the government, and crypto accounts held with BlockFi are not subject to FDIC or SIPC protections. Digital currency values are not static and fluctuate due to market changes.

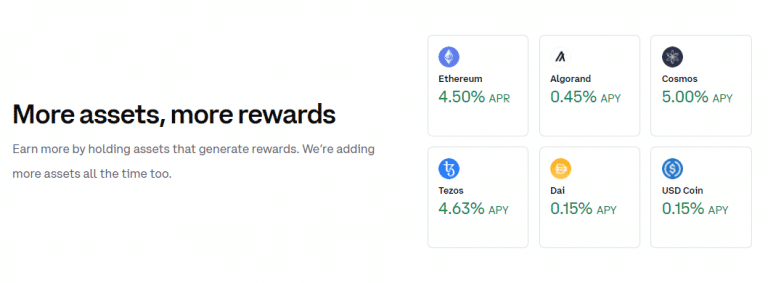

6. Coinbase – Top-Rated Yield-Generating Platform for Beginners

Currently, Coinbase supports tens of millions of users – making it one of the world’s largest cryptocurrency exchanges. With Coinbase, you can easily buy digital currencies with a debit or credit card, and the trading platform itself is perfect for beginners. In addition, you can start earning interest as soon as you have crypto in your Coinbase account.

It offers this via its automated staking tool that does not require a lock-up period. Due to Coinbase’s recent entry into the crypto yield space, the platform only supports six tokens as of writing. Cosmos (5%), Ethereum (4.5%), Tezos (4.63%) and Algorand (4%) are included. Dai (2%) and USDC (0.15%) are stablecoins. The APYs offered by Coinbase are not as competitive as those offered by other platforms, although it is a good platform for newbies.

Additionally, Coinbase offers some of the best security protocols in this space, including cold storage, two-factor authentication, and IP address/device whitelisting. Coinbase is regulated in the US, but it is also listed on the NASDAQ. In addition to supporting more than 50 digital tokens, Coinbase is also a good option if you want to diversify your crypto portfolio.

| Feature | Amount |

| Maximum Yield | 5% APY for ATOM |

Your money is at risk.

What is Crypto Yield Farming?

You earn passive returns and rewards when you stake or lend your crypto holdings. Recently, decentralized finance, also known as DeFi for short, has gained traction due to new features such as liquidity mining.

How Does Yield Farming Crypto Work?

The main purpose of a yield farming crypto site is to earn interest on your digital assets.

That is similar to putting money into a traditional savings account with an annual percentage yield (APY).

The concept of yield farming crypto sites is much more complex than a conventional savings account, but the risks involved are much higher.

Capital at risk. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk. The price or value of cryptocurrencies can rapidly increase or decrease at any time.

Best crypto savings accounts

We will cover the fundamentals of crypto yield farming in the sections below to have a solid understanding of how this niche sector works.

Crypto Yield Farming Explained – The Basics

To begin your crypto yield farming journey, you will need to deposit funds into your chosen platform. A smart contract will then deposit the digital tokens into a liquidity pool provider.

Since the smart contract works decentralized, crypto yield farming does not need an intermediary to generate interest.

As a result, the liquidity pool into which your crypto funds are deposited allows you to borrow capital. In many cases, this can be for speculation or to access liquidity.

A newly launched digital token often requires additional levels of liquidity so that buyers and sellers can access smooth market conditions.

APYs

How much you can earn from a crypto yield farming platform will depend on various factors. However, the respective digital token you are providing liquidity is at the forefront of this.

In the case of a newly launched cryptocurrency with a small market capitalization, a smart contract is likely to offer highly attractive APYs.

It is not unusual for tokens of this type to offer triple-digit yields.

However, if you are depositing funds into a crypto yield farming pool that provides liquidity for an established, large-cap project, then the APYs will be much lower.

A classic example of risk and reward since the higher the APY, the more volatility you should expect.

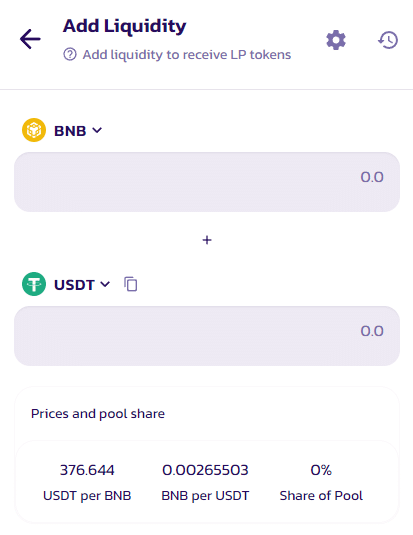

Yield Farming Pairs

A second important aspect of yield farming crypto sites is that each liquidity pool comes as a trading pair. For example, let’s assume the smart contract deposits funds into a Bitcoin/Ethereum pool. As a result, you provide liquidity for both Bitcoin and Ethereum, ensuring that this trading pair is adequately capitalized.

Liquidity is likely provided to an exchange that offers a BTC/ETH trading market. With this in mind, you need to consider the volatility levels for both digital tokens in the respective pair when you engage in yield farming crypto services.

Reward Coins

Traditional savings accounts pay interest in the corresponding currency when you deposit funds. By depositing $1,000 into a Wells Fargo savings account with an APY of 1%, you would earn $10 per year in interest.

However, there are some clear differences to consider when it comes to yield farming crypto sites.

- In the beginning, your interest payments will be distributed in digital assets instead of fiat money.

- Secondly, the digital asset to which your interest is paid will vary from time to time.

- Crucially, it depends on the platform you decide to use for crypto yield farming.

- If a yield farming site specializes in digital assets operating on the Binance Smart Chain, your rewards may be paid in BNB.

- Alternatively, the yield farming site might distribute rewards in its native token.

That is something to consider when looking for the best yield farming crypto platform for your needs.

Lock-Up Period

In this guide, we have mentioned lock-up periods several times. To put it simply, this refers to the amount of time you will need to lock up your tokens before being able to withdraw them.

When you lock up your stablecoins for at least three months (CRO staking requirements apply as well), Crypto.com offers up to 14% per year on stablecoins.

In a similar manner to traditional bonds, you will not receive your initial principal investment back until the lock-up period has concluded.

Additionally, there are platforms like Aqru that specialize exclusively inflexible accounts.

As a result, you won’t have to lock up your tokens for a minimum amount of time. Therefore, you can withdraw your tokens from the platform at any time.

Before signing up, you should carefully consider the lock-up terms stipulated by your chosen yield farming crypto platform.

Ultimately, if you need access to your digital assets, but they’re locked away in a smart contract, you won’t be able to withdraw them until the minimum redemption period has passed.

Distribution Frequency

Considering the distribution frequency of your interest payments is another factor when searching for the best yield farming crypto platform.

Platforms like AQRU, for instance, distribute interest payments daily. The funds can then be re-injected into an interest-paying account, which will allow you to benefit from compound growth.

However, some crypto yield farming sites will distribute interest at the end of the lock-up period. Unfortunately, this means that until the lock-up period is over, you will not be able to access any funds – including your rewards and initial investment.

Capital at risk. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk. The price or value of cryptocurrencies can rapidly increase or decrease at any time.

Is Yield Farming Crypto Profitable?

A crypto yield farming site’s primary objective is, of course, to make money. Nevertheless, that raises the question of how profitable crypto yield farming is.

Considering the number of variables involved, there is no clear-cut answer to this question. For example, the first thing to consider is the specific APY you will pay for lending your tokens to a liquidity pool.

For example, if you lend $2,000 worth of crypto at an APY of 10%, then your digital asset portfolio would now be worth $200 more after 12 months.

This is not the case in crypto yield farming since you are paid in digital tokens rather than fiat money.

As a result, the value of the digital tokens being invested and received as interest will fluctuate according to the market forces.

Here is a simple example to help clear the mist:

- Assume you decide to invest in an Ethereum pool with an annual APY of 6%

- You deposit 1 ETH, which is worth $3,000 at the time of the deposit

- After 12 months, your 1 ETH investment has generated 0.06 ETH in interest payments, giving you a total balance of 1.06 ETH

- At a price of $3,000 at the time of your investment 12 months ago, your balance of 1.06 ETH would be worth $3,180

- As Ethereum now trades at $4,000 per token, your balance of 1.06 ETH is now worth $4,240

- As the above example illustrates, a core objective of crypto yield farming is to earn a high APY and see the value of the token increase in the open market.

- You will earn money on both sides – interest and capital gains if this occurs.

As we explain further below, if the value of the token drops when you are engaged in crypto yield farming, your investment may be worthless at the time of withdrawal.

What Cryptos Can You Yield Farm?

As we briefly mentioned earlier, crypto yield farming allows you to earn interest on virtually any digital asset.

That is because the main goal of yield farming is to provide a specific trading pair with adequate levels of liquidity.

When considering that all crypto trading pairs require liquidity to maintain optimal market conditions, you have several options when selecting a token. The liquidity pool you deposit your tokens into will have a major impact on how much interest you can earn.

For example:

If you offered liquidity for major pairs such as ETH/BTC or BNB/ETH, the APYs offered would be modest.

However, rates will be more competitive if funds are added to a less liquid pool like AAVE/ETH.

On the other hand, if the liquidity pool includes a newly launched digital token with a little market capitalization, you may be able to earn a triple-digit APY.

Choosing the cryptocurrency to farm should be based on your risk tolerance. If you want to mitigate the long-term risks of crypto yield farming, spread your investments across various pairs.

Crypto Yield Farming Taxes in the UK?

As you probably know, many countries tax cryptocurrency profits as capital gains. So essentially, if you purchased $1,000 of Ethereum and cashed out at $1,500, then $500 of this amount will be subject to tax as part of your withdrawal.

You may also have to pay tax on any gains that you make from interest-earning tools such as crypto yield farming. But, again, depending on your country of residence, you may be taxed the same way as if you were earning through interest accounts or dividend payments.

That being said, crypto-related taxes – especially those related to yield farming – are extremely complex. Therefore, it is best to consult a qualified advisor specializing in digital currency taxes.

Crypto Yield Farming vs. Staking

There is a common misconception that crypto yield farming and staking are the same. However, although both tools allow you to generate interest on idle cryptocurrency tokens, some differences exist.

Where you deposit your tokens is one of the most important differences.

Yield farming involves depositing your crypto into a smart contract. The smart contract will then distribute your funds into a liquidity pool.

Your digital tokens are often deposited directly into the blockchain in crypto staking.

Both crypto yield farming and staking have their benefits and drawbacks, so you should consider which tool will suit your investment goals and risk tolerance.

The use of crypto staking, for example, has the potential to be safer than the use of yield farming since the tokens are locked onto the blockchain network rather than being tied to third-party smart contracts.

Due to this, the yield on offer when staking crypto is typically much lower than yield farming. Additionally, you can only do so on a blockchain network that uses the proof-of-stake consensus algorithm when you stake crypto.

Yield farming, however, can generally be done with any cryptocurrency.

Is Crypto Yield Farming Safe?

Before beginning your crypto yield farming journey, it is important to consider the risks.

Many liquidity pools offer double- and triple-digit APYs, so the risk of loss will be much higher than conventional savings accounts.

During our review of the best crypto yield farming platforms, we identified the following risks:

Token Price Volatility

Crypto yield farming involves the first risk of considering the token’s market value when engaging in the strategy.

For instance:

- Imagine that you invest $1,000 into a liquidity pool of a newly launched token – which yields 50% annually

- You will have 50% more tokens at the end of the first year than you started with

- Theoretically, your $1,000 is worth $1,500 now

If the token’s value has since dropped by over 80% – your original investment is worth considerably less than it was. This is because your $1,500 worth of tokens now has a market value of just $300.

Therefore, it might be best to only invest in liquidity pools that include established, large-cap tokens as a result of this.

Even though there is still a risk that the token will lose value while being farmed, the risk is much lower than with less liquid projects.

Platform Risk

Some of the best tools for crypto yield farming are available on third-party platforms. However, regardless of whether the platform operates on a centralized or decentralized basis, your funds are never completely safe.

If you invest funds into a centralized yield farming site, you trust the provider with your money.

You must trust that the provider will keep your funds safe and secure from remote hackers. Furthermore, you should also be able to trust that the centralized platform will pay you the interest it owes you and that it will honor your withdrawal request when you are ready to cash out.

The smart contract with a decentralized platform will ensure your agreement is honored, and you’ll be compensated. However, despite their immutability and transparency, smart contracts are not 100% foolproof.

This means that there is a reasonable chance that a bad actor will find a vulnerability in the code that underlies the application. If this happens, your funds could be at risk.

Rug Pulls

Rug pulls are digital token projects created with the sole purpose of stealing cryptocurrency.

That can happen when the developer behind the project runs off with the digital assets collected during the fundraising campaign.

Therefore, if you inject funds into a high-yielding crypto farming project that turns out to be a scam, you will likely lose your entire investment.

Liquidity Risk

Before investing, the liquidity risk of investing in a crypto yield farming pool should also be considered.

If a pool comes with a minimum lock-up period, you won’t be able to access your funds until the redemption period has expired.

Having funds locked up in a liquidity pool can cause problems if you need access to fast cash.

Conclusion

This beginner’s guide has covered every possible benefit and drawback of crypto yield farming.

In summary, the best yield farming crypto platforms in the market allow you to earn interest on idle digital assets safely and flexibly.

Overall, one of the best providers on this market is Aqru – which offers an APY of 7% on Bitcoin/Ethereum and 12% on stablecoins. Moreover, it takes just minutes for you to open an interest-bearing account. Moreover, the account does not require any lock-up period for activation.

AQRU – Best Platform to Yield Farm Cryptocurrencies in the UK

Capital at risk. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk. The price or value of cryptocurrencies can rapidly increase or decrease at any time.