8 Best Algorithmic Trading Platforms in the UK June 2025

Algorithmic trading is a novel approach that removes the emotional aspect of trading that typically weighs on the performance of even the most experienced players. This approach uses technology and advanced artificial intelligence features to identify potential trading signals, while bots can be set up to open and close trades automatically by following pre-set parameters defined by the human user.

In this article we will dive deep into how algorithmic trading works and how users can get started. The following is a review of the algorithmic trading platforms UK based traders can create an account with.

A List of 8 Best Algorithmic Trading Software in 2025

The following is a algorithmic trading platforms for UK residents:

- XTB: The XTB trading platform enables algorithmic trading on both the MetaTrader 4 and MetaTrader 5 platforms. This feature grants users the ability to utilize various pre-existing algorithmic trading systems, also referred to as Expert Advisors or EAs, which have been created by third-party providers.

- AvaTrade: AvaTrade provides various avenues for algorithmic trading, including MetaTrader 5, DupliTrade, and ZuluTrade. To use MetaTrader 5, users must register and connect their account to AvaTrade.

- Trade Nation: Trade Nation offers a comprehensive algorithmic trading platform that is suitable for both experienced and beginner traders. The system is functional 24/5 and eliminates emotions from the decision-making process.

- Admiral Markets: Admiral Markets provides a user-friendly platform that facilitates algorithmic trading through the concept of copy trading or social trading. This unique approach allows traders to automatically replicate the trades of experienced traders or pre-built trading systems.

- Pepperstone: Pepperstone supports automated trading via their API (Application Programming Interface), making it ideal for those using automated trading strategies. With these offerings, Pepperstone caters to the growing demand for algorithmic trading among retail traders.

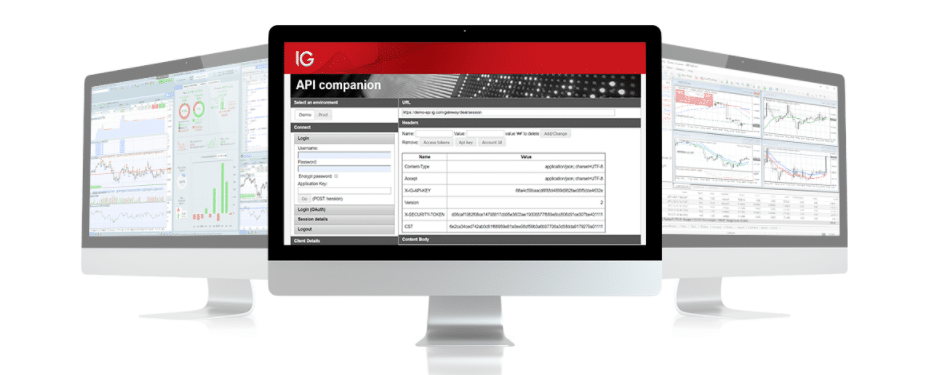

- IG: IG, a UK-based broker, offers algorithmic trading through ProRealTime, MetaTrader 4, and its native API. Users can seamlessly connect their IG account with these platforms to automate trades based on specific algorithms.

What is Algorithmic Trading and How Does it Work?

Algorithmic trading, also known as automated or algo trading, has become increasingly popular in recent years. It refers to the use of advanced mathematical models and computer algorithms to make trading decisions in the financial markets. These algorithms are programmed to analyze vast amounts of data and make predictions about the movements of stocks, currencies, or other assets, and then execute trades automatically based on these predictions.

The main advantage of algorithmic trading is the speed and efficiency it offers. By using computers to make trading decisions, traders can react to market changes within milliseconds, something that is simply impossible for humans. Additionally, algorithms can process and analyze more data than any human ever could, resulting in more accurate and informed trading decisions.

How it works

So, how does algorithmic trading actually work? It starts with building a trading strategy and coding it into an algorithm. This strategy can be based on various factors such as price movements, volume, technical indicators, or even news sentiment.

Once the algorithm is built, it is back-tested using historical market data to see how it would have performed in the past. If the results are satisfactory, the algorithm is deployed and connected to a trading platform, which then executes trades according to the algorithm’s instructions.

Algorithmic trading has become the predominant method of trading in many financial markets, thanks to its speed, efficiency, and ability to analyze large amounts of data. However, it is important to note that algorithmic trading carries its own risks. The reliance on machines and algorithms means that any coding errors or glitches can lead to significant losses. Additionally, the use of complex algorithms can sometimes result in strategies that are difficult to understand or explain. Therefore, it is crucial for traders to have a deep understanding of both the markets and the algorithms they are using in order to be successful in algorithmic trading.

Types of Algo Trading Software

Different types of algorithmic trading programs and software can be used to engage in algorithmic trading. The following is a summary of the most popular ones.

Bots

A bot is a program that is designed to execute trades automatically following a set of parameters established by the human trader. These parameters include, among many others, some of the following variables:

- A buy and sell signal.

- A maximum position size.

- A stop and exit price.

The benefit of a bot is that they can execute traders objectively by following a certain strategy and this removes the psychological and emotional side of trading that often weighs on the performance of even the most experienced players.

Alert Bots (semi-automated)

Another approach to algorithmic trading that involves a degree of human intervention is the use of alert bots. An alert bot is constantly scanning the market for trading signals following the parameters established by its human user.

Every time the alert bot identifies a setup or a signal that matches these parameters, a notification will be sent to the user so they can make the final decision on whether or not to open a position in the instrument.

These alerts could be related to price action signals (trend line breaks, support and resistance breaks, volume spikes) or to more complex indicators such as the MACD, Relative Strength Index (RSI), and simple moving averages.

Trading signals

Even though signals are intimately involved with the use of automated bots, algo trading strategies could also rely on external or third-party signals that are not necessarily related to a certain technical setup.

One example of this would be to trade a certain index once an important economic report comes out and if the report misses the consensus estimate. Moreover, trading signals could also come from Level II market data such as bid/ask spreads, buy and sell order volumes, and other similar variables.

In essence, anything that has the power to move the price of a particular financial instrument can be considered a variable to trade on. The signal would alert an event in which the variable changes in a way that the price will be directionally influenced by the said change.

There are also third-party services that provide signals for algorithmic trading purposes. These can come in the form of a newsletter, RSS feed, or even a Telegram message. The signal will be received and processed by the bot to execute a transaction accordingly.

Platform-based Algo Trading

Certain brokerage firms have introduced proprietary trading signals services, bots for algorithmic trading, and alert bots to lure traders who prefer to have everything in one place rather than having to rely on the services of multiple parties to execute their algo trading strategy.

One example of this is the algorithmic trading feature offered by IG, which is brought forward through a partnership with ProRealTime and MetaTrader 4. These programs use an API integration with IG’s proprietary trading platform to provide a hassle-free algorithmic trading service.

Copy Trading

Copy trading is an automated feature that allows users to copy the exact trading activity of other traders and fund managers using the platform. It can be considered a form of algorithmic trading as a copy portfolio will be adjusted immediately once the source portfolio is modified. Some brokers have social trading networks and users are able to browse details about investors that can be copied. The networks are usually comprised of professional traders and experienced money managers. This makes it easy for beginners to build and manage a portfolio with the assistance of seasoned investors, who are likely already conducting technical analysis and using algorithmic indicators at a professional level.

Best Algorithmic Trading Platforms in the UK Reviewed

In the following section, we take a closer look at which algorithmic trading platforms are available to residents of the UK. Each review aims to look at what each of them has to offer, its key features, and any relevant details to assist traders choose the right platform according to individual needs.

Our Ranking Criteria for Algorithmic Trading Platforms

In order to present an unbiased and objective review, our team of experts spend time to research the numerous platforms and test out the algorithmic trading features, explore the user-interface and look at the fees, minimum deposits and commissions of each option. Our team of experts then rates each platform considering these various factors.

- Seamless User Experience: Trading platforms can be difficult to navigate, and novice traders may find difficulty knowing how to use the platform. It is crucial for treading platforms to have a seamless user interface which can provide the best trading experience for users.

- Backtesting & Demo Account: With algorithmic trading it is important for traders to be able to backtest in order to trial their trading strategies, identify any flaws and tweek any parameters to ensure better performance. Demo accounts or simulators are a key feature that algorithmic trading platforms incorporate. This allows traders to trial their automated trading practices under real-time market conditions without initially risking any funds.

- Fees, Minimums & Commissions: Some platforms have minimum deposit requirements in order to start trading, and may also have a minimum investing requirement to start using the algorithmic trading feature. Spreads, commissions and fees are also looked at to establish the most cost effective option.

- Charting and Analytics: Algorithmic trading relies on traders setting parameters for the algo to follow. It is crucial for trading platforms to offer extensive charting tools and indicators. Traders can then apply them to their strategy and fine tune the algorithm to follow specific technical analysis methods. Analytics are also important as data such as financial performance info, company insights, asset characteristics and historical trends are provided.

- Regulation: Platforms offering trading services in the UK are regulated by the Financial Conduct Authority (FCA). This ensures their commitment to compliance and provides a safe, secure and fair trading environment for UK based investors.

1. XTB – Multiple Award Winning Algorithmic Brokerage; Implement Expert Advisors via MetaTrader Interface

XTB is a well-established trading platform in the UK market, known for its user-friendly features that cater to algorithmic trading. The platform’s interface attracts beginners and experienced traders alike who are interested in algorithmic trading. Traders appreciate the platform’s seamless process for developing, backtesting, and deploying algorithms. Additionally, XTB provides a variety of educational resources that greatly facilitate the learning curve for individuals new to algorithmic trading.

XTB enables algorithmic trading on both the MetaTrader 4 and MetaTrader 5 platforms, providing users with the ability to utilise various pre-existing algorithmic trading systems. Additionally, the brokerage offers API access, allowing traders to connect their own custom algorithmic trading systems. The platform’s execution speeds are exceptional, reducing slippage and enabling traders to take advantage of rapidly changing market opportunities.

In terms of product offerings, XTB offers a diverse range of financial instruments, allowing traders to access and explore various markets. In addition to the forex market, traders can engage in trading indices, commodities, cryptocurrencies, and more. The platform provides competitive spreads and transparent pricing, ensuring that clients benefit from fair and competitive trading conditions.

With its strong regulatory standing and user-friendly platforms, XTB provides a reliable and professional trading experience to its clients. First and foremost, XTB is regulated by the Financial Conduct Authority (FCA), one of the most stringent financial regulatory bodies in the UK. This regulatory oversight ensures that XTB operates in accordance with strict guidelines, providing security and peace of mind to its clients.

75% of retail investor accounts lose money when trading CFDs with this provider.

2. AvaTrade – Multiple Options for Algorithmic Trading; Duplicate Trades of Authorised Strategy Providers; Join Social Trading Community on ZuluTrade

To conduct algorithmic trading via MetaTrader 4 with AvaTrade platform users will first have to register with this provider. MetaTrade 4 trading interface must be downloaded and users should connect their AvaTrade account to MT4. Traders can then create or download Expert Advisors, which are programmed auto trading robots, and then upload them to MT4.

With DupliTrade users can opt-in to copy trades of authorised “strategy providers” in order to automate the trading process. Strategy providers are experienced asset managers with a proven track record, and have been vetted through a critical auditing process. There are only 13 strategy providers, all with different trading methods, styles and characteristics that are continuously monitored and evaluated. Each strategy provider option presents a description and in-depth details about asset focus, trading frequency, previous trades and historical financial performance statistics. Trades are executed automatically once a portfolio has been selected, however, in order to access the DupliTrade feature a minimum deposit of $2,000 is required.

AvaTrade also supports a similar platform called ZuluTrade, which is an innovative social trading and wealth management platform. Users are able to copy over 10,000 seasoned traders that are registered with ZuluTrade. There is a wide selection of signals providers to choose from and all have an allocated risk score with details presenting information on financial performance, trading statistics, portfolio insights and amount of copiers.

AvaTrade integrates with ZuluTrade as a nominated broker and trades will be settled via the AvaTrade platform. However, in order to use ZuluTrade users must connect the platform to the MetaTrader 4 or 5 trading interfaces via API. Users are also able to simulate copying of traders before fully allocating funds, allowing backtesting of strategies and evaluation of performance. The minimum deposit to access this platform is much lower at £200 and ZuluTrade states that 73% of investors see positive returns when copying top leading performers correctly.

There is no guarantee that you will make any profits with this provider. Your money is at risk.

3. Trade Nation – Popular User-Friendly Algorithmic Trading Platform; Use Expert Advisors on MetaTrader 4

Trade Nation has become a popular choice for UK traders, with its comprehensive range of features and user-friendly interface. The platform has gained recognition among traders seeking to engage in algorithmic trading strategies. Trade Nation boasts of some special features that enhance a trader’s overall algorithmic trading experience. These features include advanced charting tools, effective backtesting, and real-time market data and insights to provide users with a seamless trading experience.

One method of conducting algorithmic trading on Trade Nation is by using Expert Advisors (EAs) on MetaTrader 4. Users can opt to use one of the built-in EAs or download and import their own. A crucial feature of algorithmic trading using MT4 on Trade Nation is the backtesting capabilities. Backtesting allows users to test EAs strategies to pre-determine the performance and identify potential flaws or areas for improvement. Users are able to backtest the EAs to analyse and fine tune trading ideas, while also having the option to adjust parameters to their own trading strategies.

Trade Nation stands out as a favoured trading platform due to its extensive coverage of thousands of markets, spanning stocks, bonds, commodities, forex and indices. The platform has a intuitive user-friendly interface and offers the option of trading via mobile application for iOS and Android. Trade Nation is fully regulated in the UK by the (FCA) Financial Conduct Authority and is also covered by the (FSCS) Financial Services Compensation Scheme. This makes it a secure, safe and trustworthy broker for traders based in the UK.

77% of retail investor accounts lose money when trading CFDs

with this provider.

4. Admiral Markets – Full Suite of MetaTrader Interfaces; FCA Regulated Brokerage with Numerous Algorithmic Trading Options

Admiral Markets is a comprehensive investment ecosystem that provides users with access to over 8000 financial instruments and a suite of different trading platform interfaces to choose from. Since establishment in 2001, it has grown into a global company with numerous regulatory licenses, which includes being authorised and regulated by the Financial Conduct Authority in the UK.

Admiral Markets offers various alternatives when choosing a trading interface and users can opt for algorithmic trading on all MetaTrader options. The platform supports both MetaTrader 4 & 5, and uniquely provides free access to MetaTrader Supreme Edition. Users can import Expert Advisors (EAs) on MetaTrader 4 & 5 to conduct algorithmic trading. Alternatively, on MetaTrader Supreme Edition users have access to two algorithmic trading features, Forex Featured Ideas and Technical Insight which both operate alongside Expert Advisors.

Forex Featured Ideas is a chart pattern recognition software that is only available for currency trading. Users are able to automate and personalise settings based on preferred currency pairs, holding times and technical analysis parameters. The interface will provide users with alerts when a technical event occurs, and users are able to tweek the Expert Advisors to follow a desired strategy, or customise filters to only receive ideas that match the desired trading style.

The Technical Insight feature operates in a similar fashion, however, there is no automated trading process and users must manually execute trades. This feature aims to help traders optimise their strategies by providing actionable technical analysis on all types if financial instruments. Each instrument is given a score based on which technical analysis method is applied and users receive educational commentary on the directional outlook and expected impact on price action. Technical Insight is a patented pattern recognition software and incorporates one of the industry’s largest library of technical analysis methods and indicators.

Admiral Markets aims to provide clients with functional software, high-quality offerings, transparent pricing, and fast execution as part of its overall goal. The trading process caters to high trading frequency and low latency, employing a system that aggregates liquidity from multiple banks and venues into a single liquidity pool. These efforts have paid off, as the broker has garnered recognition from various industry awards and received numerous positive client reviews for its algorithmic trading services.

74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

5. Pepperstone- Algorithmic Trading Platform Suitable for High-Volume Traders; Backtest & Simulate Strategies using Smart Trader Tools

Pepperstone is a reputable and secure forex and CFD broker, regulated by esteemed authorities such as the UK’s Financial Conduct Authority. It provides competitive spreads with fair commissions and low fees. Pepperstone offers a wide range of third-party trading platforms and provides numerous options for algorithmic trading.

This broker does not have its own proprietary trading interface, but it offers a diverse range of third-party platforms. Traders can access the full suite of cTrader (Windows) and MetaTrader (Windows, Mac OS) platforms. The web platform, powered by MetaTrader, boasts exceptional customisation options and language support. For mobile trading, Pepperstone provides apps for MT4, MT5, and cTrader on iOS and Android. Users are also able to connect their account directly to TradingView through an integration powered by cTrader.

For algorithmic trading, Pepperstone offers numerous options to its clients. Capitalise.ai is a code-free trading automation tool that Pepperstone traders can use at no extra cost. Users are able to browse through various strategies while also backtesting and simulating them using text commands. This feature is an easy way for users to create, test and automate trading without any coding experience.

For more experienced traders, the cTrader Automate feature is an algorithmic trading solution that is natively integrated with cTrader. It allows users to optimise trading strategies and build trading robots using the cTrader API. Users will need to have knowledge of the C# coding language in order to use this feature and it is specifically designed for margin trading.

Alternatively, users also have access to a wide range of Expert Advisors (EAs) and traders can backtest the strategies using the trading simulator in the Smart Trader Tools package offered by Pepperstone. Smart Trader Tools are a suite of Expert Advisor tools that allow users to optimise trading strategy and better assist with risk management practices.

The trading platform generally offers low fees, making it particularly suitable for active traders who frequently engage in multiple trades. The standard account has average trading fees, whereas the Razor account provides more favourable fees for active traders. By using multiple liquidity providers, Pepperstone ensures that its traders receive competitive quotes and benefit from low spreads on various instruments and assets. However, it’s worth noting that the spreads are variable and subject to market conditions.

The research and educational offerings surpass the industry average. The website features an extensive section dedicated to education and analysis, providing valuable resources for traders. They conduct webinars with professional analysts, offer guides, market news, insightful analysis, and an economic calendar. Additionally, there is a dedicated section catering to beginner traders, providing guidance on how to trade forex and CFDs effectively. These comprehensive educational resources contribute to a well-rounded trading experience for users.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.3% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

6. IG – No-Code Algorithmic Trading using ProRealTime; Access over 100 Custom Indicators; Trade over 17,000 Market Instruments

ProRealTime is one of the most well-known algorithmic trading software tools in the world. It supports backtests going back more than 30 years and multiple technical analysis tools including a trend screener (ProRealTrend) and over 100 custom indicators. It provides traders with assisted creation tools to build trading strategies without the need of coding knowledge. Using ProRealTime is free for users who trade at least 4 time per month.

Meanwhile, MetaTrader 4 is a widely-used trading interface that supports algorithmic trading through the use of Expert Advisors (EAs). It has a large community of users who create and refine trading algorithms. Users can browse the marketplace to find suitable Expert Advisors that match up with the desired trading strategy. Alternatively, it is possible for traders to build their own trading algorithms, create indicators and place a range of orders for a more customised strategy approach.

IG offers a wide range of Contracts for Difference (CFDs) covering a large number of financial asset classes including stocks, commodities, indices, forex and ETFs. The platform offers access to over 17,000 market instruments and uniquely offers clients non conventional investment opportunities. These include investing into bonds, options, futures, IPOs, sector specific and thematic asset baskets and interest rate investments. For UK residents, there is no minimum deposit when funding the account via bank transfer which can take between 3-5 working days. Otherwise, users can fund their account via debit/credit card or PayPal, however, a minimum deposit of £250 is imposed.

There is no guarantee that you will make any profits with this provider. Your money is at risk.

Algo Trading Platforms Comparison

|

Platform |

Minimum Deposit | Algorithmic Trading via: |

| XTB | £250 for first deposit (no minimum after) | MT4/ MT5 |

| AvaTrade | £100 | MT5/ DupliTrade/ ZuluTrade |

| Trade Nation | No minimum | MT4 |

| Admiral Markets | $25 equivalent in GBP | MT4/ MT5/ MetaTrader Supreme |

| Pepperstone | No minimum | MT4/ MT5/ cTrader/ Capitalise.ai |

| IG | £250 (no minimum via bank transfer) | Native API/ ProRealTime/ MT4 |

Algorithmic Trading Strategies

Once you have chosen a platform for algorithmic trading, the next step is to develop a strategy that works with current market conditions and is suitable for your goals. A good idea is to use demo accounts to practice different strategies before putting any money at risk.

Here is an overview of some popular strategies that are used by algo traders in the UK.

Arbitrage Trading

Arbitrage is an activity that takes advantage of small temporary differences in the price of an asset between different brokers at the same time. Arbitrageurs profit from buying the asset on the broker that has the lowest ask price, to then sell it at a profit on another broker that offers a higher bid price.

This algorithmic trading strategy is mostly successful for illiquid securities as their bid/ask spreads tend to be wider and that increases the chances of identifying potential arbitrage opportunities.

One example of arbitrage would involve:

- Buying GBP/USD pair at 1.2105 with Broker A

- Selling GBP/USD pair at 1.2127 with Broker B

An arbitrage algorithmic strategy can be used for forex algorithmic trading or Bitcoin algorithmic trading. In particular, this latter asset tends to be a frequent target of arbitrageurs amid the high number of cryptocurrency exchanges that are now available.

Signal Trading

Signal trading involves scanning and identifying certain trading signals that are established by the human trader as a parameter for the bot to execute when spotted. Signals can either be identified upon performing a technical analysis of multiple instruments, or they can be sourced from a third-party service that is constantly surveying the market to spot these setups.

When it comes to technical analysis, signals can be derived from the use of price action or volume-derived indicators like the accumulation/distribution chart, Relative Strength Index (RSI), MACD, and Bollinger Bands.

Price Action Trading

Price action trading is an approach that involves assessing potential bullish and bearish technical setups upon scanning multiple different financial instruments.

These price action setups include:

- Horizontal support and resistance levels.

- Trend lines.

- Complex patterns (head and shoulders, cup and handle).

- Price channels.

- Double tops and double bottoms.

Some algorithmic trading platforms include a pattern scanner. In some cases, human traders could rely on these scanners to identify setups, which once confirmed can be considered a trading signal.

Can Algo Trading Beat the Market?

As with any trading or investment strategy, the performance of an algorithmic trading strategy will be determined by the win rate of the trading system, the reward-to-risk rate of each individual trade, and the implementation of adequate risk management procedures.

An example of this would be a strategy that has a 50% win rate. In that case, the reward-to-risk ratio must be in all instances at least 1.5 to guarantee that the positive results earned on winning trades will outpace the losses caused by the losing half.

Therefore, beating or not the market is not determined by the platform used as the system followed by the trader plays a more important role in achieving this particular objective.

It is important to note that setting realistic expectations is also crucial for a successful algorithmic trading strategy to work. Considering the risks assumed, this approach should yield at least twice the return that a passively-managed index fund would in a relatively similar period.

The Pros and Cons of Using an Algorithmic Trading Platform

Pros:

- Using algorithmic trading software eliminates emotional decision-making. This could lead to a more disciplined and data-driven approach.

- Algo trading systems can execute trades at high speeds which makes it possible to take advantage of small price fluctuations.

- Trading bots make it possible to trade passively which is suitable for traders who are unable to access their portfolio around the clock.

Cons:

- Algorithmic trading systems are prone to glitches which could result in losses.

- Strategies are based on historical price data which cannot be used to predict future price movement.

- It is easy for traders to get too comfortable and cross the line between trading and gambling when using algo software.

Conclusion

Algorithmic trading may sound complex at first glance but, in essence, it is method of solidly implementing trading strategies using a pre-determined set of criteria. It removes the emotional side of trading ensuring strictness in following technical analysis, and trades based off of indicated events when conditions are met. The various platforms we have reviewed above support different forms of algorithmic trading from copying other traders, following moves strategy advisors and using Expert Advisors on MetaTrader. For all types of algorithmic trading, the platforms reviewed offer a free demo account and backtesting simulation allowing users to trial strategies and options.

For less experienced traders there might be a bit of a learning curve with using Expert Advisors as it can take a while to become experienced with the MetaTrader interface. Users will need to find out how to source, upload and deploy Expert Advisors on MetaTrader which is quite technical. MQL5 is a popular marketplace that allows users to source EAs and indicators. More information about how to upload EAs in MetaTrader can be found here.

Our top ranked choice for accessing algorithmic trading functionality is XTB because it provides easy access to advanced trading features as well as a demo account. XTB makes it easy for people with limited knowledge of trading or time for managing a portfolio of assets.

Another good option which presents alternative methods is AvaTrade. The platform has a feature called DupliTrade and offers users the option to copy the moves of Strategy Providers. Strategy Providers must apply to AvaTrade and are audited in order to evaluate their trading systems. Strategy Providers have either fully-automated, semi-automated or robotic trading methods, meaning the user is able to copy a pre-deployed trading algorithm. We liked the fact that Strategy Providers must go through an application process and are continuously monitored and evaluated. The fact there are only 13 Strategy Providers to choose from proves that applicants are rigorously vetted before providing their tools on DupliTrade.