Spread Betting Strategies UK – Techniques for Beginners

If you’re thinking about spread betting online to benefit from tax-free profits – you will need to have a strategy in place. This will ensure that your spread betting endeavours are conducted in a risk-averse manner.

In this guide, we point you in the right direction by reviewing some spread betting strategies to consider before risking your hard-earned capital.

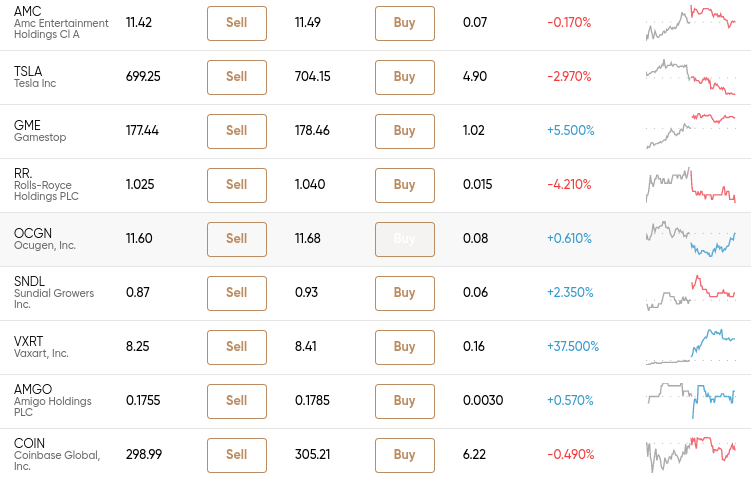

[stocks_table id=”65″]List of UK Spread Betting Strategies

We explain spread betting strategies in more detail further down. Below you will find an overview of each strategy that you might consider implementing.

- Spread Betting Strategy 1: One Demo Account is available on Pepperstone

- Spread Betting Strategy 2: Spread Bet the Financial News

- Spread Betting Strategy 3: Look for All-Time Highs on Popular Stocks

- Spread Betting Strategy 4: Consider Spread Betting Trading Signals

- Spread Betting Strategy 5: Learn About Consolidating Markets

Spread betting is only available for clients in the UK.

Spread Betting Strategy 1: Start With a Risk-Free Demo Account

One spread betting strategy to begin with for a newbie trader is to start off with a demo account facility. In doing so, you will be able to spread bet until your heart’s content without risking a single penny. This is because spread betting demo accounts allow you to trade in live market conditions – but using paper trading funds instead of actual capital.

To give an idea of where you can find spread betting demo accounts – you might want to consider Capital.com. This Financial Conduct Authority regulated broker not only offers share spread betting – but thousands of other financial instruments. Crucially, as soon as you have registered an account – you can start using the spread betting demo facility straightaway.

As a side tip, you should only use the demo account to spread bet with stakes that resemble your investment budget. For example, if you are looking to spread betting at an average stake of £1 per point – there is no benefit in using the demo account at stakes of £100 per point.

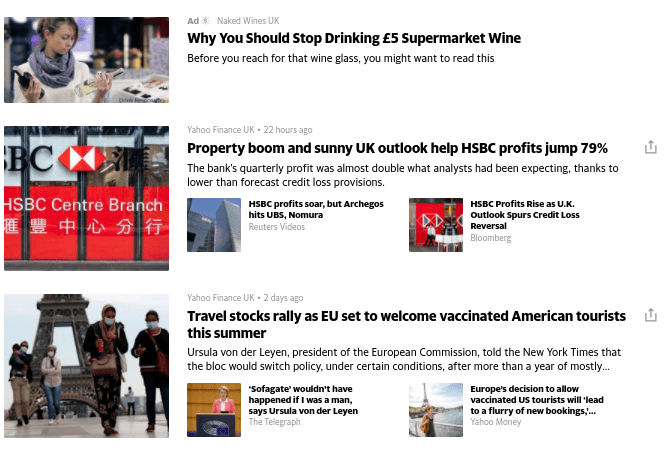

Spread Betting Strategy 2: Spread Bet the Financial News

The vast majority of spread betting strategies will focus on technical analysis. This means that you will be studying historical price movements charts on an asset with the view of finding a potential trend. As you can image, being able to do this effectively can take many years to master.

This is why one of the popular spread betting strategies for beginners is to trade the financial news. That is to say, when an important economic development is reported in the mainstream media – you will look to profit from this by entering a spread betting position.

Let’s look at a couple of examples of how this spread betting strategy might work in practice.

Example 1 – Going Long

Let’s say that you are looking at the FTSE 100 spread betting markets. At the time of writing, the FTSE 100 is priced at 6,944 points.

- A news story has just broken announcing that the UK is forecast to see GDP levels grow by 2.9%

- Initially, the previous forecast was at 2.2%

- It goes without saying that this is positive news for the UK economy and thus – this is all-but-certain to feed down to the FTSE 100 index

- In turn, you could head over to your chosen spread betting broker and enter a long position on the FTSE

- If the FTSE increases from its current price of 6,944 points – you will make a profit

Example 2 – Going Short

In this example, we will say that you are looking to access the forex spread betting markets – meaning that you will be trading currencies.

- The Bank of England has just decided to reduce interest rates

- This will in turn attract less foreign investors into the UK economy

- As such, pound sterling will also drop in value

- To profit from this financial new development – you might decide to enter a short spread betting position on GBP/USD

- If this forex pair does decline in value as you expect – you will make money

As you can see, spread betting the financial news is relatively straight forward. This is because it isn’t overly complicated to assess whether the news story is positive or negative and thus – ascertain which way the market moves. If it’s the latter, then you know to go short. If it’s the former, then you’ll be going long.

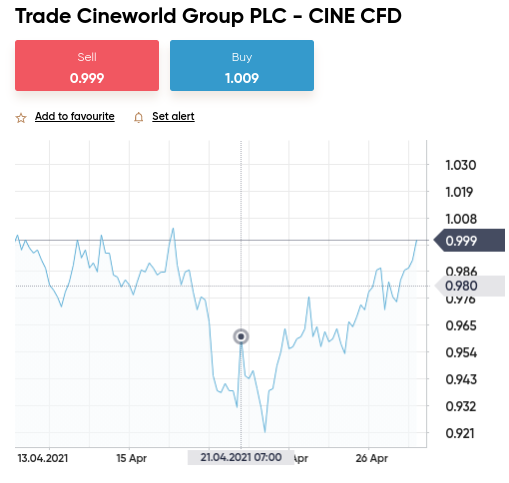

Spread Betting Strategy 3: Look for All-Time Highs on Popular Stocks

Another popular spread betting strategy with beginners is to look at stocks that are approaching all-time highs. In simple terms, this means that the stock is very close to its previous peak – which if it breaches, means that it has never been worth more.

- Now, although you will be basing your spread betting trade on technical data – you don’t need to deploy any indicators or chart drawing tools.

- Instead, it’s just a case of looking at the respective stock’s historical price action.

- The overarching concept here is that when a stock approaches its all-time high pricing level – it will often bounce back down.

- This is because investors are often keen to cash in their profits – just in case the stock isn’t able to push through.

A prime example of this is Amazon. As you can see from the stock price history below – Amazon hit an all-time of $3,531 in September 2020. However, since then, the stocks have been unable to break through this price point.

81.40% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

In fact, on many occasions, Amazon got close – but reversed on each occasion. As such, a seasoned spread betting trader would have likely made money from this – as they would have short-sold the stocks as they approach the aforementioned all-time high price.

Spread Betting Strategy 4: Consider Spread Betting Trading Signals

One of the spread betting strategies that newbies could also consider is that of trading signals. This means that you will be signing up for a subscription service – whereby the provider will be sending you trading tips.

These suggestions will tell you what market to access, whether you should place a long or short order, and what price to enter the market. In terms of risk management, you will also be told what stop-loss and take-profit orders to deploy.

For example:

- Let’s say that you sign up for a forex signal service

- The provider has identified a new trend on GBP/USD

- You receive a signal that tells you to go short at an entry price of 1.3950

- You are also told to deploy a stop-loss and take-profit order at 1.4109 and 1.3750 respectively

Once you have the above information, you then need to head over to your chosen spread betting broker and place the suggested orders. Crucially, as long as you are using a credible signal service with a verifiable history of results – this allows you to spread bet without needing to do any research or financial analysis.

Spread Betting Strategy 5: Learn About Consolidating Markets

This particular spread betting strategy is going to require you to learn the ins and outs of a consolidation period. As such, this will be your first in-depth attempt at performing technical analysis. Fortunately, this strategy is one of the simplest technical exercises for beginners to get a grasp of.

In a nutshell, a consolidation period is when an asset remains in a tight pricing range for a prolonged period.

For example:

- Let’s say that over the past 5 days – IBM has traded between $142.50 and $143.20.

- This means that IBM stocks have traded within a tight range of just 0.49%.

- In other words, IBM stocks have risen above $143.20 or below $142.50.

- As such, this is a prime example of a consolidation period.

Now that you have identified a consolidating market – you can trade it at your chosen spread betting broker.

- Sticking with the same example as above – you would initially be required to place two limit orders.

- First, you would want to enter a short position at $143.20 (or just below).

- Next, you would want to enter a long position at $142.50 (or just above).

- In doing so, for as long as the stocks remain in this trend, you can keep entering long and short positions to make small but frequent gains.

To trade in a risk-averse manner, you would also want to place stop-loss orders above the upper point of the range and below the lower end of the range. This protects your capital for the eventual ‘break out’ of the consolidation period.

Technical Analysis vs Fundamental Analysis

In the sections above – we covered some of the well-known spread betting strategies from the perspective of fundamental and technical analysis. However, we should make it clear that by truly mastering the art of technical analysis – you will have the ability to deploy a much larger number of strategies.

81.40% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

This is because charting analysis is facilitated by using technical indicators – of which there are over 100. For example, while some technical indicators looking at trends related to volatility and market depth, others focus on support and resistance levels.

You then have indicators that cover pricing averages over the past 50, 100, and 200 days – as well as trading volume and market sentiment. Taking this into account, it is strongly suggested that you spend the required time learning about technical analysis, if you want to give yourself the highest chance possible of making consistent gains from the spread betting markets.

Spread Betting Platforms UK

You will, of course, need to open an account with a broker before you can start spread betting online. Not only does the broker need to hold a license with the Financial Conduct Authority and support your preferred market – but it also needs to offer low fees and commissions.

We have reviewed a small selection of spread betting trading platforms below for your consideration.

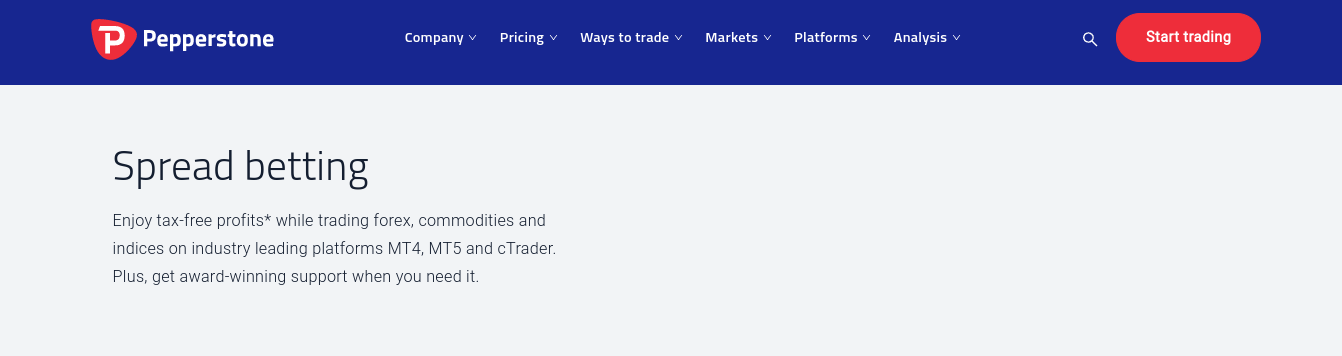

1. Pepperstone

This will be the case if you sign up for the Peppersonte Razor Account – which operates like a conventional ECN Account. This means that you will pay a small commission of $3.50 per slide – but in turn, get the tightest spreads available in the market. This is because Pepeprstone allows you to spread bet directly with market participants. Otherwise, you can opt for the commission-free Standard Account, but this comes with less competitive spreads.

Much like Capital.com, the Pepperstone spread betting platform comes packed with financial markets. This again covers stocks, commodities, forex, and indices. There is no minimum deposit at Pepperstone and the broker supports Paypal, debit/credit cards, and bank transfers. Pepperstone is also an option if you want to trade via a third-party platform. This is because the broker supports MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.3% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

Spread Betting Tips

Below you will a number of extra spread betting strategies that beginners could use.

Tip 1: Understand Risk Management

When spread betting online – having a risk management trading plan in place will ensure that you limit your potential losses. There are a few ways in which you can achieve this, such as:

- Limit the amount you risk on each stake. The golden rule of thumb for newbie traders is to never risk more than 1% of your balance.

- Always deploy a stop-loss order. This will automatically close your spread betting position if it goes down by a specified amount. For example, if you are trading at £1 per point and want to limit your potential losses to £10 – then set the stop-loss order at 10 points.

- You should also deploy a take-profit order – which will close your trade automatically when specified exit points reached. For example, you might decide to target a profit of 20 points on a particular trade.

Tip 2: Stick With High Liquid Markets

When you trade a high liquid market like blue-chip stocks, gold, or index funds – you will avoid uncomfortable levels of volatility. After all, volatile markets are not conducive for newbie traders. Instead, by sticking with a high liquid asset – your potential profits and losses will remain relatively steady.

Tip 3: Trade During Busy Market Hours

Another way to avoid the risks of volatile marketplaces is to only trade during standard hours. This means that you should never trade before the markets open in the morning or after they close in the evening. This is also the case with weekend trading.

The reason for this is that some spread betting platforms offer 24/7 or 24/5 trading – but outside of standard hours, there will be low levels of liquidity. In turn, asset prices will move in a more volatile manner.

Spread Betting Brokers UK – Conclusion

In summary, having a number of spread betting strategies in place will allow you to target the financial markets in a risk-averse way. You might want to start off with an easy-to-implement strategy – such as trading financial news. Then, as you progress through the learning journey – you can then move onto some more advanced strategies that are based on technical analysis.

Regardless of which spread betting strategies interest you – you’ll need to open an account with an Financial Conduct Authority-regulated broker to access the global markets. Capital.com is an option as the platform supports thousands of commission-free markets. Plus, the broker offers a free demo account and the minimum real-money deposit is just £20.

Sponsored ad. Your capital is at risk.