Best Social Trading Platforms with Low Fees in July 2025

Social trading platforms allow you to communicate with other investors online. The main concept is that you get to share and discuss potential investment opportunities with traders of the same platform. In many cases, the best social trading platforms allow you to ‘copy’ successful traders, paving the way for a passive investment experience.

In this guide, we review the best social trading platforms to consider in 2025 and how to get started with an account today!

-

-

Best Social Trading Brokers in 2025

Looking to start investing with the best social trading platform of 2025 right now? If so, check out the list below to see which providers made the cut. You can scroll down to read for a full review of each social trading platform.

- eToro: eToro is considered to be a leader in the social trading sphere and was one of the first platforms to introduce the feature. As well as social trading, eToro offers copy trading, Smart Portfolios and demo trading that can be used to practice new strategies.

- NAGA: NAGA is another good social trading platform to consider that is suitable for beginner traders. On NAGA, traders can interact with each other and view informative trader profiles to learn more about successful traders on the app. NAGA is compatible with MT4 and MT5 for technical analysis.

- FXTM: FXTM is a well-known trading platform that is compatible with a number of third-party trading tools. It is possible to also use the platform for social trading on the mobile app. FXTM supports leverage trading of up to 1000x which makes it appealing to experienced traders.

- Zulu Trade: Zulu Trade has followed in the footsteps of eToro and provides excellent social and copy trading features. The platform must be accessed through a third-party broker, such as AvaTrade. It offers a good range of indicators and analysis tools for traders who wish to conduct in-depth analysis.

eToro is a multi-asset investment platform. Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.Past performance is not an indication of future results.

What Is Social Trading?

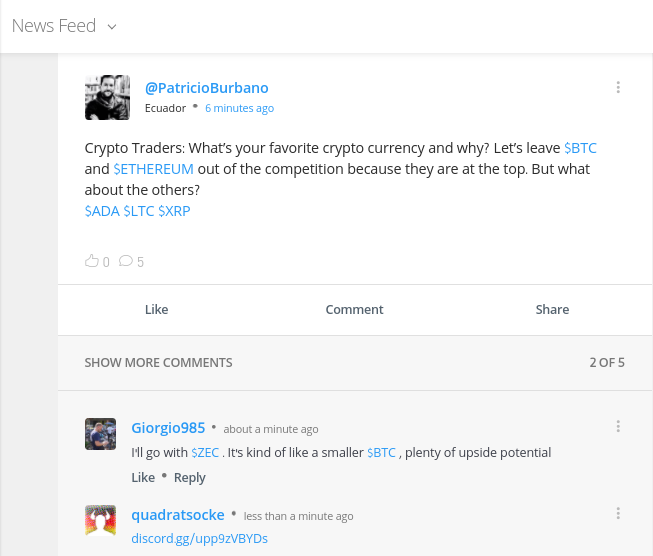

Social trading is a type of online trading that allows investors to communicate with each other, share their trades and provide insight into their strategies. Through social trading, investors can share fundamentals and technical analysis which is helpful for less-experienced users who can learn from experts.

Social trading platforms typically provide users with a feed that displays recent posts from other traders on the exchange. Some platforms also offer direct messaging and forums which allows traders to send messages to other users.

Some platforms restrict post sharing to verified ‘expert’ traders to ensure that all posts are helpful. However, other sites allow all users to share their trades, analysis and thoughts. If you choose to use one of these platforms, it is wise to be wary of less-experienced traders who may not know exactly how to navigate the market.

How does social trading work?

The trading element of social trading works similarly to a regular trading account. Users execute trades by selecting a trade size, stop loss targets and order type. Traders can then manage their trades through their portfolio.

The main difference between a regular trading site and a social trading platform is that traders can automate the trading process by copying other user’s trades. In this case, traders will not need to manually execute the trades that they place. Instead, their account will use parameters set by other traders to place orders passively.

It is also possible to use social trading to guide a manual trading strategy. In this case, traders might follow the decisions of others and use these as signals for their own trading. For example, a user may notice that a significant number of other traders have placed a ‘buy’ order for AMZN. The user might then use this as a signal and conduct their own analysis to decide whether the order is worth placing.

Pros and Cons of Using a Social Trading Platform in 2025

Social trading platforms provide insight into the strategies and decisions of other traders which can be used to guide research and analysis. However, the platforms also come with several risks that should be understood before signing up. Here is an overview of the pros and cons of using a social trading platform in 2025.

Pros:

- Social trading provides traders with education based on real life scenarios. It is possible to follow other traders to learn best practices, analysis methods and different trading strategies.

- Traders can connect with likeminded others who share similar interests and goals.

- Social trading platforms provide access to experts. Learning from an expert in any other case would be quite expensive.

- It is possible to employ automated trading strategies through social trading platforms which is suitable for traders who have little time to manage their trades.

Cons:

- Not all traders are experts. While it is possible to find helpful advice, some posts my be inaccurate or misleading.

- Some traders may stop conducting their own research and analysis and rely solely on information provided by others. This increases the risks involved with trading and leaves you vulnerable to other people’s mistakes.

- Traders are more likely to share their wins than they are to share their losses. This could lead to false hope and cause users to become over confident that they will be successful.

Best Social Trading Platforms Reviewed

Although social and copy trading is getting more and more popular, the number of top-rated platforms active in this space is still relatively small.

After all, not only do you need to focus on the platform’s social trading features – but other key metrics such as regulation, tradable markets, fees, payments, and more.

Taking all of this into account, below you will find a selection of the best social trading platforms to consider in 2025. Whether you’re looking for a social forex trading platform, stock trading platform, or Bitcoin trading platform, we reviewed platforms that cover all trading needs.

1. eToro – Social trading platform with over 20 million users that can be used to trade stocks, ETFs, CFDs, cryptos, commodities and more

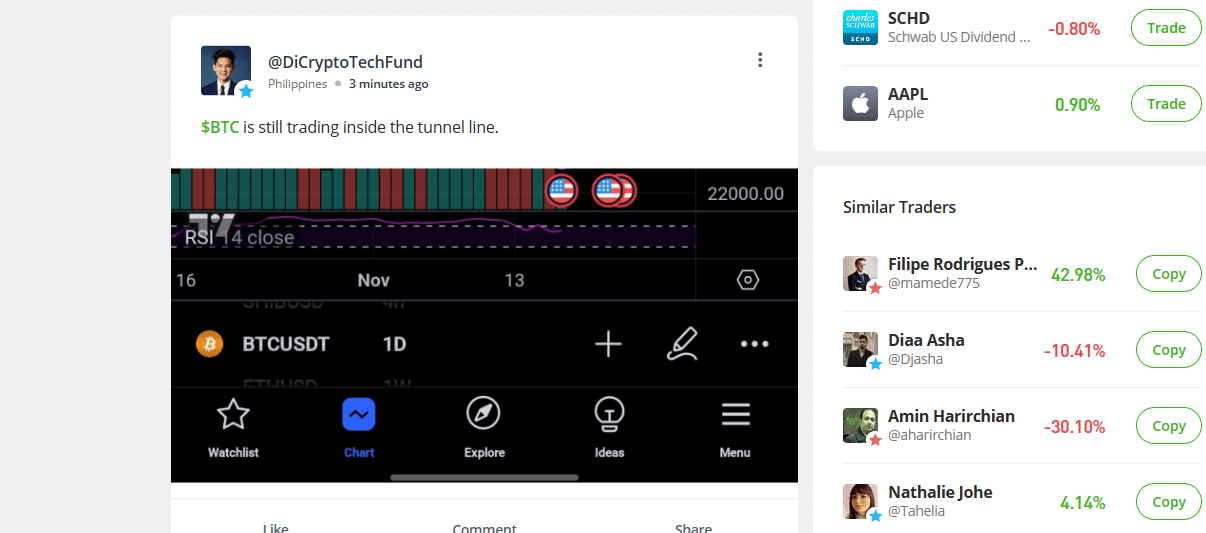

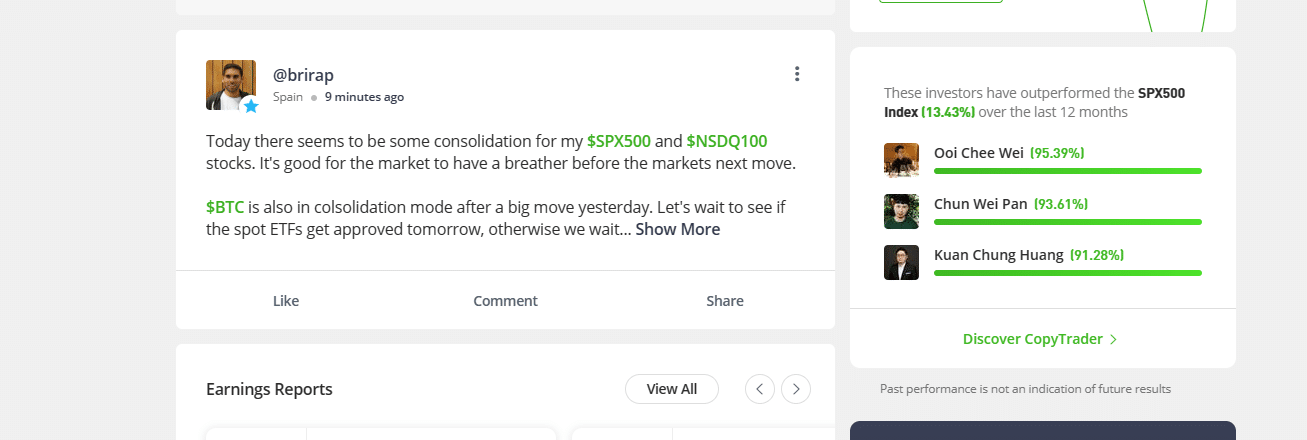

eToro is considered to be one of the best social trading platforms – with more than 20 million clients now using the social trading platform to invest. Investors are able to see view a feed of posts, posted by other investors which shares similarities to the feed available on X.

Users can like, comment and share helpful posts and copy professional traders. The platform also provides live market data and news updates to help users stay on top of the market.

eToro is a multi-asset investment platform. Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.Past performance is not an indication of future results.

As well as stocks and ETFs, the platform also supports cryptocurrencies, commodities, forex, and more. Each and every market supported by eToro has a “social element” to it. For example, if you click on Apple stocks, you’ll see a list of relevant threads that have been posted by other eToro traders. Each thread allows you to ‘Like’ and ‘Comment’, much like you would on social media! Additionally, you can elect to ‘Follow’ eToro traders that you like the look of.

With that said, the most attractive and perhaps innovative social feature offered by eToro is that of its Copy Trading tool. This takes things to the very next level, as you can copy an eToro trader like-for-like. There are thousands of verified eToro users that have joined the Copy Trading program, so you find an investor that meets your financial goals and appetite for risk. There’s heaps of data to draw from too – such as past performance, historical trades, risk profile, average trade duration, and preferred assets.

Past performance is not an indication of future results

Once you copy a trader on eToro – which requires a minimum investment of $200, everything that the individual does moving forward will be reflected in your own trading account. For example, if the trader risks 15% of their portfolio buying IBM stocks and you invested $1,000 into the trader, $150 worth of IBM stocks will be added to your portfolio.

In terms of getting started, eToro supports an assortment of payment methods – including debit/credit cards, e-wallets, and bank transfers. Finally, there are no fees to deposit if you’re an American using a USD payment method. Otherwise, there is a small 0.5% FX charge.

eToro fees

Fee Amount Copy-trading fee Free Forex trading fee Spread, 2.1 pips for GBP/USD Crypto trading fee Spread, 0.75% for Bitcoin Inactivity fee $10 a month after one year Withdrawal fee $5 Pros:

- User-friendly online broker and trading platform

- Trade thousands of assets with tight spreads

- 100% commission-free

- You can also trade stocks, indices, ETFs, cryptocurrencies, and more

- Deposit funds with a debit/credit card, e-wallet, or bank account

- Social trading and copy trading

- Regulated by the FCA, ASIC, and CySEC, according to its legal disclaimer

Cons:

- Not suitable for experienced traders that like to perform technical analysis

eToro is a multi-asset investment platform. Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.Past performance is not an indication of future results.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

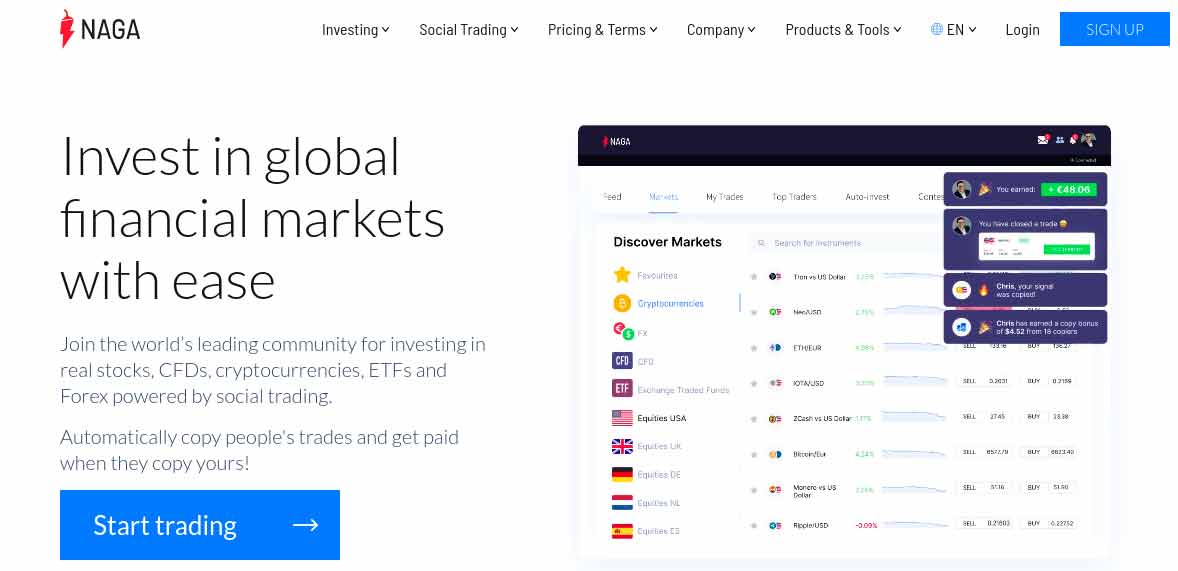

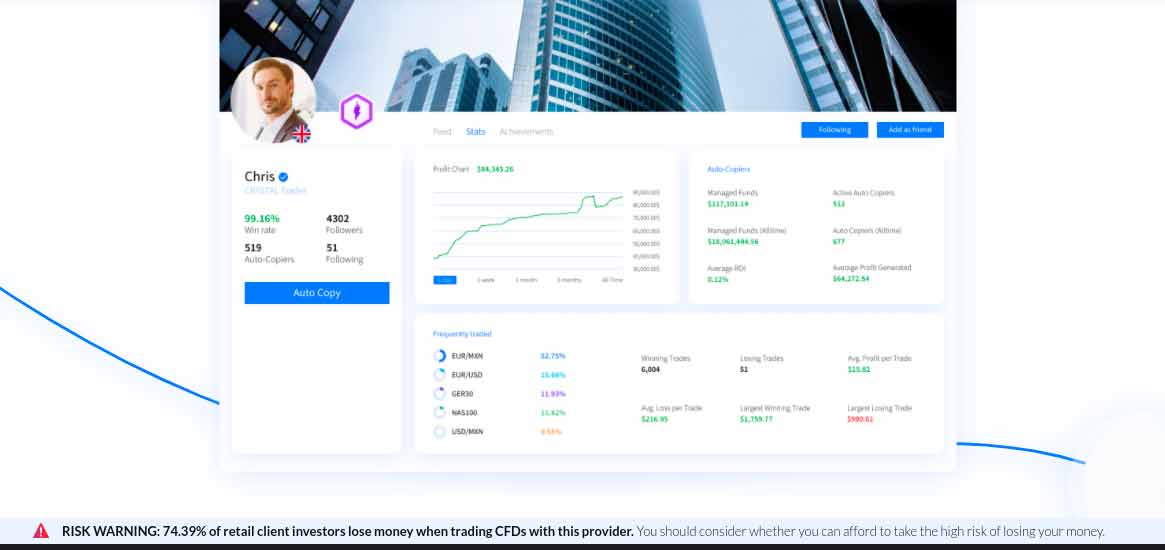

2. NAGA – Leading copy trading platform that is compatible with MT4/5

NAGA is a social trading platform that covers 750+ assets. This includes CFDs, stocks, forex, and cryptocurrencies. In a similar nature to eToro, this top-rated social trading platform allows you to discuss and share ideas with your fellow traders.

In terms of finding a trader on NAGA, you can view a full host of useful information to help you decide whether or not they are worth copying. For example, you can view each and every trade that the individual has made since joining NAGA, and what this amounts to in terms of profitability and loss.

You can also dig a little deeper to see how much risk the trader likes to take and whether they prefer short-term or long-term trading strategies. Once you have selected a trader that you like the look of, NAGA offers two options in the terms of executing your position.

You can either use the proprietary NAGA Web Platform, which is simple and thus perfect for new traders. Or, you can also connect NAGA to third-party trading platforms MT4 and MT5, which you can use on your iOS and Android devices. This option is best suited for more experienced online traders. Much like eToro, NAGA also offers a top-rated mobile social trading app, so you’re never more than a click away from checking in on your copied traders.

When we explored the fee department, NAGA offers commission-free trading on forex, crypto, indices, commodities, and futures. However, there is a variable commission charged on stock CFDs and ETFs. This averages 0.20% per slide on most markets. There are no fees to deposit funds, which is another bonus.

However, unlike eToro, NAGA charges a commission when you utilize the copy trading tool. If you make less than €5 profit from a trade, this amounts to a fixed copy fee of €0.50. If the trade yields a profit of more than €5, then this changes to a variable commission of 5% – which is huge.

For example, if you stake €1,000 and trade makes you €200 – you’d pay a 5% commission of €10. There is, of course, no copy trading commission applicable on losing positions. Withdrawals are charged at €10 per transaction and the minimum cashout amount is €50. Finally, NAGA is authorized and regulated by CySEC.

NAGA fees

Fee Amount Copy-trading fee 5% per order Forex trading fee Spread, 1.2 pips for EUR/USD Crypto trading fee Free (variable swap) Inactivity fee Free Withdrawal fee $10 Pros:

- Easy to use social trading platform

- Copy your preferred trader like-for-like

- Discuss and share trading ideas, as well as your trading systems ideas

- Deposit funds with a debit/credit or e-wallet

- No commissions on most asset classes

- Regulated by CySEC

Cons:

- Charges a commission of 5% on profitable trades above €5

- Average social stock trading commission of 0.20% per slide

- Only 750 markets supported

There is no guarantee that you will make money with this provider. Proceed at your own risk..

3. FXTM – Social trading platform for advanced traders, trade for than 60 FX currency pairs

FXTM is primarily an online trading platform that specializes in forex and CFDs. Regarding the latter, this includes stocks, indices, commodities, and more. If, however, you’re looking for a top-rated platform that also offers social trading features, FXTM has you covered.

Much like the other social platforms we have included in this social trading review thus far, FXTM allows you to select a trader based on your financial goals, according to your projected investment decisions. For example, if you’re looking to trade currencies in a completely passive nature, FXTM allows you to filter your search by the asset class – in this case, that’s forex.

Then, you can sort the list of suitable forex market traders by specific metrics – such as monthly average returns. When it comes to the platform itself, FXTM supports MT4 as well as its own web-trader. Either way, FXTM offers some of the best trading fees n the industry. For example, if you opt for the Cent Account, you can trade commission-free.

There are also accounts suited for large-scale traders that come with zero spreads and a low flat commission. Leverage of up to 1:1000 is also offered by FXTM, albeit, your personal limits will be determined by whether or you are a retail or professional trader. Finally, FXTM is heavily regulated in multiple jurisdictions, which includes a license with the FCA and CySEC.

FXTM fees

Fee Amount Copy-trading fee Free (Variable profit share scheme) Forex trading fee Spread, 0.1 pips for EUR/USD Crypto trading fee Free (variable swap) Inactivity fee $5 per month after six months Withdrawal fee $10 Pros:

- Provides heaps of educational resources

- Great for market insights and market research

- Several account types supported

- Extensive forex department

- No commissions when trading currencies

- Great reputation and heavily regulated

Cons:

- Does not support US traders

- Copy trading service is a bit thin on the ground compared with other providers

There is no guarantee that you will make money with this provider. Proceed at your own risk..

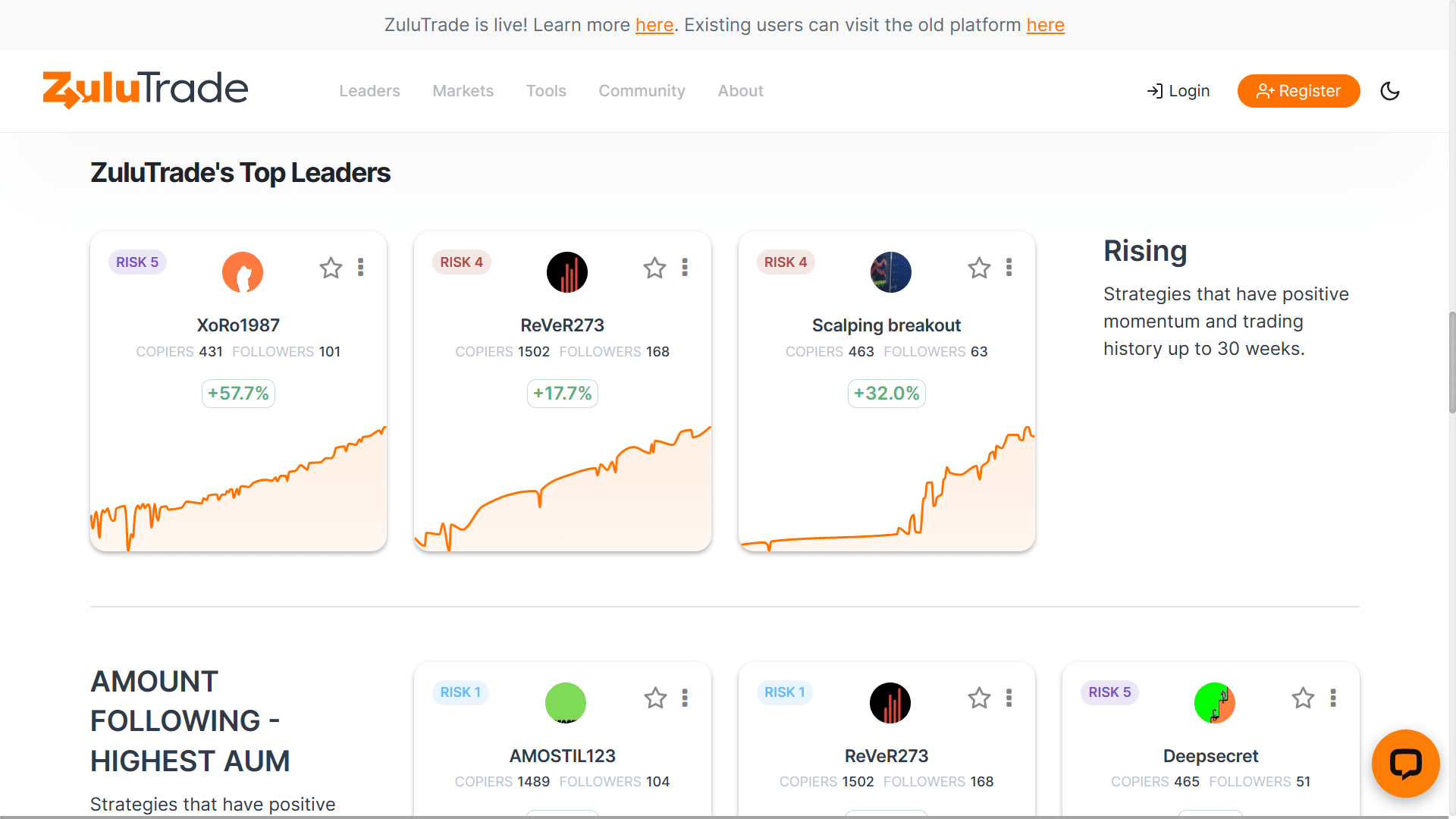

Zulu Trade- A user friendly social trading platform for forex, stocks, crypto, indices and more

Zulu Trade is a powerful copy trading platform that allows investors to easily follow the trades of successful traders. With Zulu Trade, investors can select from a wide range of experienced traders and allocate their funds to automatically mimic their trades in real-time. This means that even those who lack the knowledge or time to trade themselves can potentially earn profits by following the strategies of others. Additionally, Zulu Trade offers features such as risk management tools and performance analytics, which can help investors make informed decisions about which traders to follow.

Furthermore, Zulu Trade has a user-friendly interface that makes it easy for investors to navigate and find the traders that fit their investment goals. The platform allows investors to filter through a variety of parameters, such as performance history, risk level, and asset class, to find the most suitable traders to follow. This flexibility is particularly useful for investors who want to diversify their portfolio across different markets and asset classes. Zulu Trade also provides a community feature that allows users to connect with other traders and share insights, which can be valuable in helping investors make better trading decisions.

One potential downside of using Zulu Trade for copy trading is that there is always a risk of losses. Even experienced traders can have losing streaks, and investors who follow them can also experience losses. Therefore, it is important for investors to conduct their due diligence and carefully consider the risks involved before allocating their funds to any particular trader.

Nonetheless, Zulu Trade offers a comprehensive platform that can help investors gain exposure to a variety of markets and trading strategies. With its advanced features and user-friendly interface, Zulu Trade is a strong option for those looking to explore the world of copy trading.

Zulu Trade fees

Fee Amount Copy-trading fee $30 per month Forex trading fee Spreads vary depending on FX pair Crypto trading fee 0.2% Inactivity fee Free Withdrawal fee $0 for USD withdrawals Pros:

- Considered to be the best copy trading platform for crypto and forex traders.

- Low fees and tight spreads.

- Offers an easy-to-use interface.

- Excellent educational resources available.

- Free to use demo trading account of up to $100,000.

- Investors has a profit rate of 73%.

Cons:

- Is not regulated in the US.

- Limited variety of crypto assets available.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

Key Features of a Social Trading Platform

Although eToro is the industry leader in this space by some distance, there might come a time when you come across a social trading platform that we haven’t discussed today.

If this is the case, you’ll want to ensure that the platform is right for your trading goals before you open an account.

The most important factors that you need to explore when searching for the best social trading platform are discussed in more detail below.

✔️ Social Features

First and foremost, you need to check how ‘social’ your chosen platform is. For example, while some online brokers simply offer a copy or mirror trading service, others go one step further by offering a complete social experience. For example, eToro allows you to see what your fellow traders are speculating on once you click on an asset.

For example, if you’re thinking about trading Bitcoin, you’ll find heaps of threads and discussions on the respective trading page. You can join in the conversation by replying to specific posts, ‘Like’ your preferred viewpoints, and even follow an eToro trader that you like the look of.

✔️ Proprietary Platform or MT4

It is also important to assess whether your chosen social trading provider offers a proprietary platform. By this, we mean that you can access social and copy trading features directly from the provider’s website, so there’s no need to download or install any software.

On the other hand, some platforms will advertise social trading tools, but in reality, you’re simply using a broker that supports MetaTrader 4 (MT4). For those unaware, MT4 is a third-party trading platform that is particularly popular with seasoned pros that use trading signal providers.

The platform essentially sits between you and your chosen broker. In addition to advanced trading tools, MT4 also offers social trading features. At the forefront of this is the ability to copy other traders that are using the MT4 platform.

✔️ Copy Trading Tools

The best platforms allow you to ‘copy’ other members into the trading community. This is something that more and more brokers are starting to offer, as they understand that some individuals want to invest passively. There are a wide variety of factors that will determine whether or not the copy trading feature offered is worth considering.

This includes:

- Choice of traders

- Minimum investment

- Control of your portfolio

Past performance is not an indication of future results

✔️ Social Trading Fees

Like all trading platforms, social trading providers charge fees for placing trades. It is important to understand what fees are applicable before signing up to a platform.

- Commissions: Even if you elect to copy a trader, your chosen social trading platform might still charge a commission. If they do, this is usually a percentage of the amount you trade. For example, you might need to pay 0.10% every time your chosen trader buys and sells an asset. In the case of eToro, all markets offered by the platform can be traded commission-free.

- Deposit and Withdrawal Fees: A lot of social trading platforms charge a fee when you deposit or withdraw funds. The specific amount will often vary depending on your chosen payment method.

- Overnight Financing: If your chosen copy trader keeps a leveraged CFD position open overnight, additional fees will apply. This will be reflected in your own social trading account – at an amount proportionate to what you invested into the copy trader.

Ultimately, if your chosen copy trader incorporates fees when buying and selling assets on your behalf, you should expect to pay a proportionate amount.

✔️ Demo Account

When searching for social traders to copy, you’re likely going to base your decision on their historical trading results. Although this makes sense, it’s important to remember that past performance is never a sure-fire indicator of future results. As such, it’s best to test the trader out before risking any money.

Past performance is not an indication of future results

Without a doubt, the best way of doing this is to copy the trader via a demo account. The best social trading platforms offer demo accounts that mirror real-world market conditions. eToro, for example, offers demo accounts with a pre-loaded balance of $100,000 to all registered members.

How to Start Social Trading

In the next section of our guide, we will take a look at how to start social trading on our recommended platform eToro.

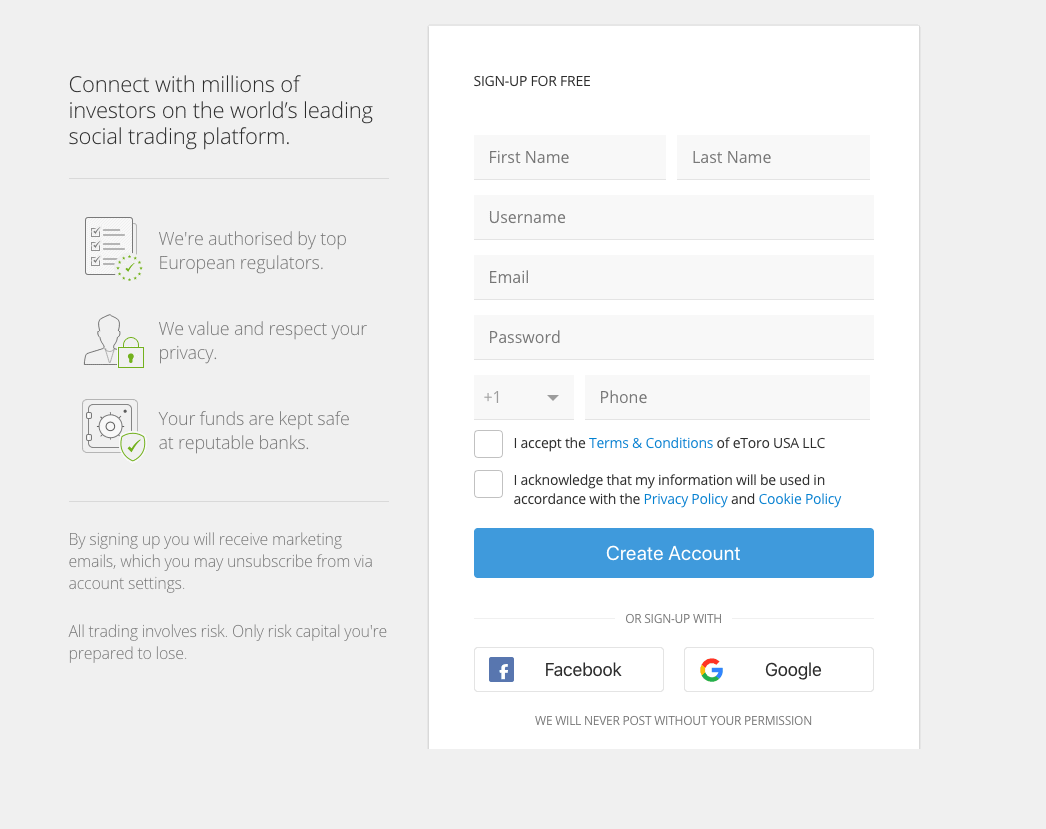

Step 1: Open an Account and Upload ID

To create an account, head over to the eToro homepage and click on the ‘Join Now’ button.

eToro is a multi-asset investment platform. Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.Past performance is not an indication of future results.

Here, you’ll be asked to enter some personal information and contact details. Additionally, you’ll be asked to upload a copy of your government-issued ID and proof of address (utility bill or bank account statement).

In most cases, eToro can validate your document instantly – meaning the end-to-end account opening process should take less than 10 minutes.

Step 2: Deposit Funds

You will now be asked to make a minimum deposit. For regular trading, the minimum deposit is $20 however, for copy trading the platform requires a deposit of $200. This amount mirrors the minimum copy trading investment, so do bear this in mind. For example, if you want to copy three different traders, you’ll need to deposit at least $600.

You can choose from the following payment methods on eToro:

- Debit cards

- Credit cards

- E-wallets (Paypal, Skrill, or Neteller)

- Bank wire

As noted above, unless you opt for a bank wire, all other deposit methods are processed instantly.

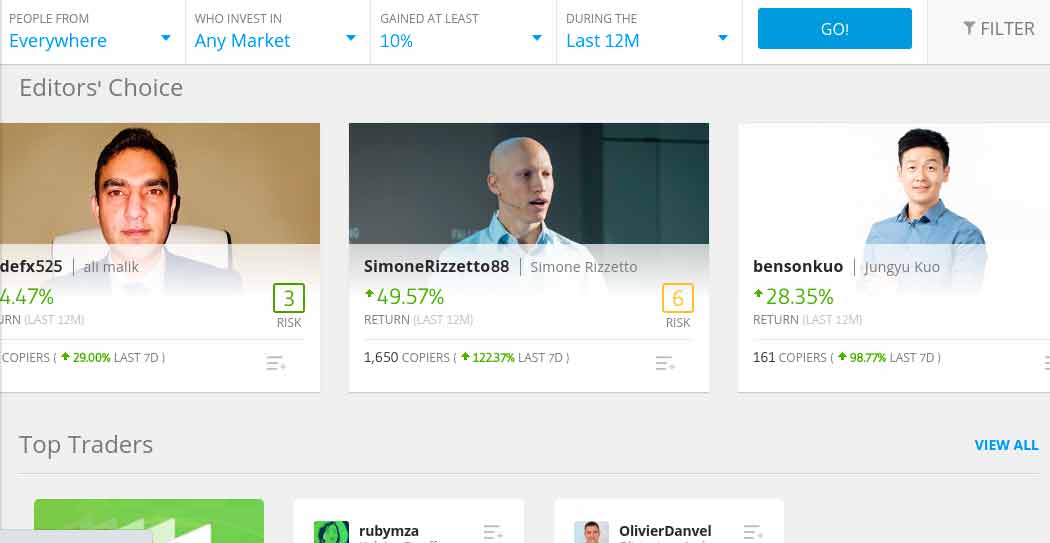

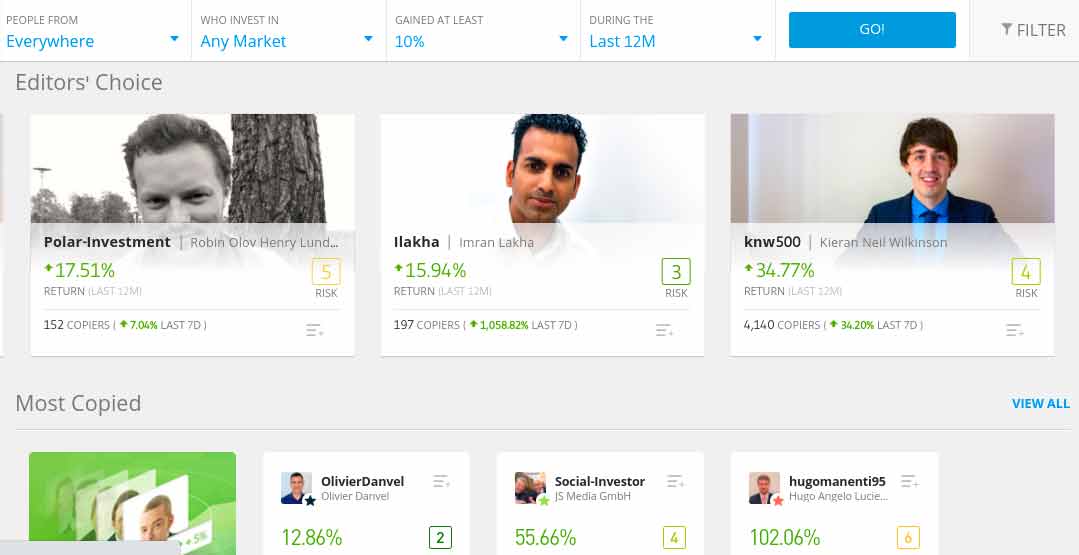

Step 3: Search for a Copy Trading

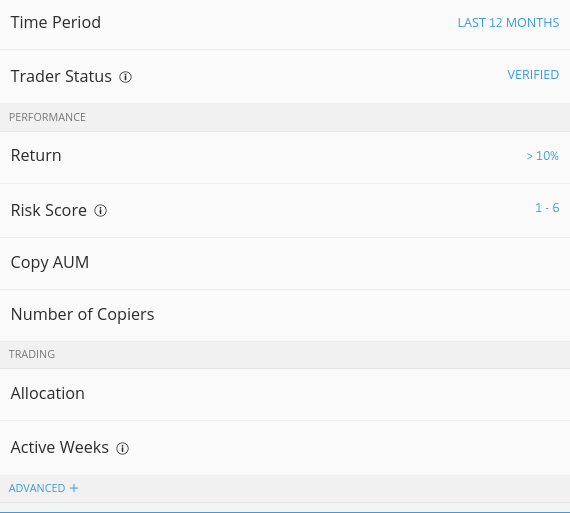

Now that you have made a deposit, it’s time to browse through the many verified copy traders available on eToro. To do this, you’ll first need to click on the ‘Copy People’ button. Baring in mind there are 700,000+ traders to choose from, it’s best to use some of the filters at the top of the screen.

This includes:

- ‘Who Invest In‘: You can choose the asset class that you wish to trade via your selected investor – such as stocks or forex.

- ‘Gained at Least‘: You can select the minimum amount of profit that the copied trader has made in percentage terms.

- ‘During the‘: Leading on from the above metric, you can select the time period for your target profit percentage. For example, you might want a trader that has made at least 10% over the past 12 months.

Once you are happy with your filters, click on the ‘Go’ button.

After that, you are best advised to select additional filters so that you can find a social trader that meets your financial goals.

This includes:

- Risk Score: eToro automatically assigns a risk score to reach copied trades based on historical trades. This runs from 1 to 6 – with 1 being the lowest risk.

- Copy AUM: The AUM (Assets Under Management) illustrates how much money has been invested into the trader

- Average Trade Duration: This is an important filter as it tells you the type of trading strategy that the individual takes. For example, if the average trade duration is 5 hours, you know you are investing in a day trader. If the average duration is 10 months, then you are backing a longer-term investor.

There are many other filters available, so spend some time exploring the platform to find a trader that meets your needs.

Step 4: Invest in Social Traders

On the respective profile page of your chosen eToro trader, you’ll need to click on the ‘Copy’ button to proceed with an social trading investment.

Then, an order box will populate like the image below. First, you need to select the investment amount – which needs to be at least $200. By default, you will only be copying ongoing trades placed by the individual.

But, if you want to get the full social trading experience, you might want to tick the ‘Copy Open Trades’ box. This means that you will also be copying the ‘current’ portfolio of the trader.

Past performance is not an indication of future results

Don’t forget, you can add and remove assets to and from your social trading portfolio on eToro, so you always maintain full control over your investment funds.

Finally, confirm the order to start copying your preferred social trader!

Conclusion

Social trading platforms provide an insight into the trades, analysis and strategies of other investors. These platforms are becoming increasingly popular amongst both beginner and expert traders who use the tools to guide their own trading strategy.

There are a number of social trading platforms available to use in 2025 which can make choosing the best one a difficult task. In this guide, we have taken a look at 4 different providers to help you find a platform that suits your trading goals.

With that said, you need to spend some time researching a social trading platform yourself before signing up. We found that eToro stands out from the crowd for several reasons. The platform – which is now home to over 20 million clients and 700,000+ verified copy traders – is heavily regulated, offers thousands of markets, and doesn’t charge a cent in trading commission!

eToro is a multi-asset investment platform. Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.Past performance is not an indication of future results.

FAQs

What is the best social trading platform?

eToro is often regarded as the leading social trading platform of choice. With more than 20 million clients, investors are attracted by the platform’s simple interface, commission-free offering, and support for thousands of tradable markets.

Is Social Trading legit?

Yes – in a similar nature to robo advisors, social trading allows you to invest in the financial markets in a relatively passive nature. This is great for those with little to no experience of trading or simply because you don’t have the time to perform in-depth research.

Are social trading platforms regulated?

Most social trading platforms are online brokerage firms. As such, you’ll find that they are usually regulated by a reputable financial body. In the case of eToro, this social trading platform is regulated by the FCA, ASIC, and CySEC

Who is the best copy trader on eToro?

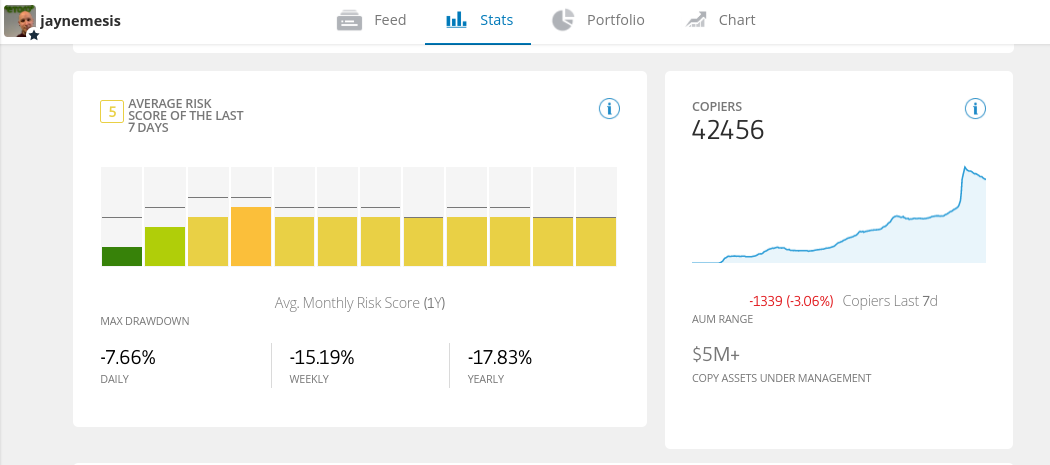

One of the most successful copy traders on eToro is Jay Edward Smith. The UK-based trader made gains of 52% and 103% in 2019 and 2020 respectively. In the first 5 weeks of 2022, the trader is up 16%. In turn, Jay Edwards Smith now has an AUM of over $5 million.

What is the difference between social trading and copy trading?

Although the two terms are used interchangeable, there is a slight difference in what they refer to. Social trading refers to the ‘social’ side of investing, meaning you can discuss, share, and ‘Like’ trading ideas in a public manner. Copy trading, on the other hand, refers to the process of ‘copying’ a trader like-for-like. That is to say, if your chosen trader risks 10% of their portfolio on Facebook shares, you’ll do the same.

What are the social trading platform fees?

This will vary depending on your chosen social trading platform. eToro charges no additional fees to use its Copy Trading feature. NAGA charges 5% on all trades that make more than €5 in profit.

How much do you need to copy a social trader?

Most social trading platforms have a minimum deposit in place when it comes to copying a trader. At eToro, this stands at just $200 per trader.

References:

Kane Pepi Finance Writer

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Kane has also written for websites such as MoneyCheck, InsideBitcoins, Blockonomi, Learnbonds, Buyshares n and the Malta Association of Compliance Officers.

Before starting his career as a writer, Kane studied at the University of Central Lancashire where he received a Masters Degree in Financial Investigation and then a Research Doctorate in Criminal Justice. Pepi is passionate about helping people to make informed decisions through high-quality, educational content.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up