5 Best Automated Trading Platforms in June 2025

Automated trading is favored by both full-time and part-time traders. Many investors want to inject money into the financial markets – but they are hindered by the fact that they have little to no understanding of where to start.

Others may not have the time for trading and researching the markets. One solution is to opt for auto trading, an algorithm that determines what to buy and what to sell based on a predetermined trading strategy.

The trading algorithm can be custom-built or purchased from market professionals. Some companies specialize in automated trading in different market sectors. A team of developers is often seen behind successful trading bots.

In this guide, we discuss some of the top automated trading platforms in 2025.

-

-

5 Best Platforms for Automated Trading In 2025

Check out which automated trading platforms to be considered for automated trading. We review each provider in great depth below.

- AvaTrade – AvaTrade provides the MT4 platform, enabling traders to develop their automated trading strategies. Traders can optimize the algorithm to trade on their behalf or alert when a potential setup is present.

- Dash2Trade – Dash2Trade offers 2 crypto trading robots, a DCA bot, and a Grid bot. Both bots are programmed with pre-set strategies. The automated trading can be used in multiple exchanges such as Binance and Kraken.

- Learn2Trade – Learn2Trade is offering trading signals and copy trading. The markets in focus are forex and cryptocurrencies. The algorithm (L2T Algo) does all the work on your behalf.

- Forex.com – A well-known forex broker is providing access to both the MT4 and MT5. With over 20 Expert Advisors (EA’s), MetaTrader’s automated trading is available to deploy.

- NinjaTrader – NinjaTrader is designed for futures and options on futures. Stocks can be traded too via supported brokers. NinjaTrader script, the programming language, enables the trader to develop their very own algorithmic trading strategies.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

What Is Automated Trading?

Automated trading is when trades are executed on your behalf by an algorithm. The algorithm can be developed, rented, or purchased.

The majority of automated strategies are based on technical analysis where multiple time frames are analyzed. When a buy or sell signal is derived from the technical strategy, the algorithm places a trade.

Likewise, based on the price movements, the trade will automatically close based on the predefined strategy. Some advanced automated strategies also place trends based on live market news.

The benefit of automated trading is that a preset trading strategy is executed on your behalf without the need to constantly monitor the market.

Automated Trading Software and Brokers Tested and Reviewed

In choosing the best automated trading platform for your needs, there are many things to consider.

For example, are you looking for a 100% automated process, or are you looking to retain some control of your portfolio? You also need to consider the legitimacy of the platform, fees, and which assets you will be gaining exposure to.

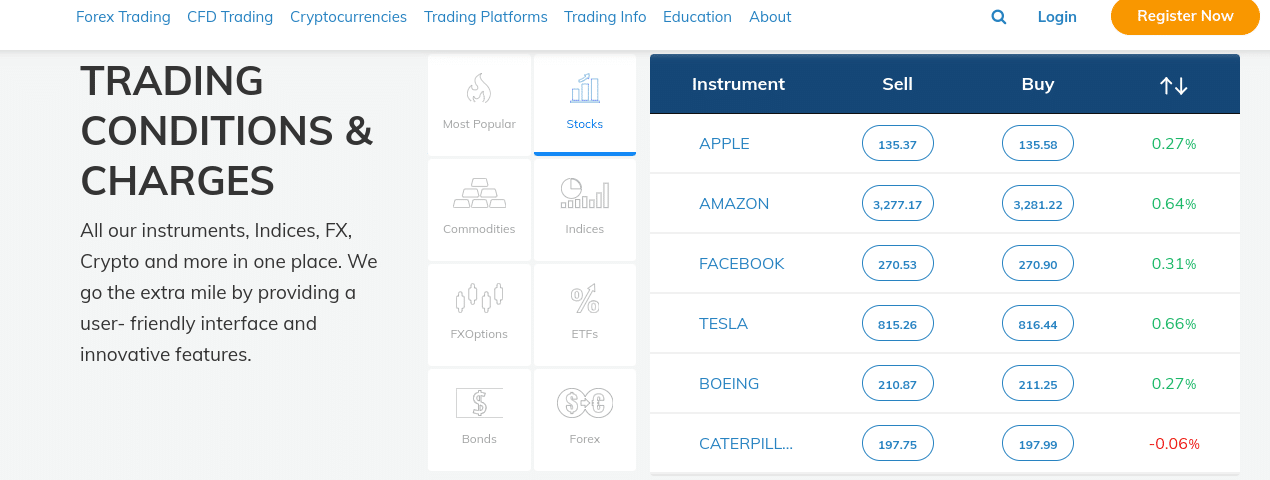

1. AvaTrade – Access EAs through MetaTrader 4 and trade over 1,200 CFDs on a licensed platform

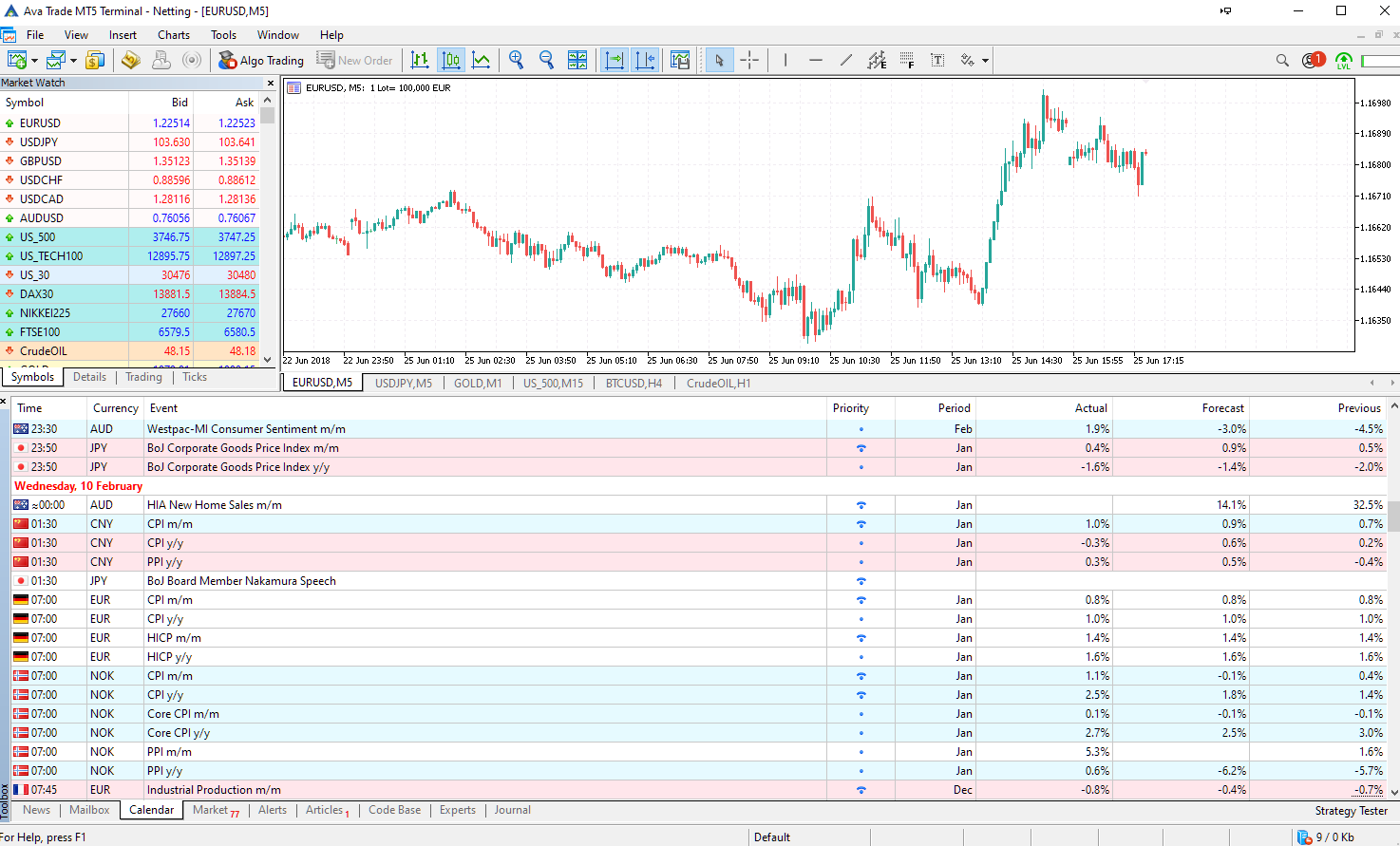

AvaTrade is primarily an online trading platform that allows you to buy and sell on a do-it-yourself basis. However, the provider also offers exposure to MetaTrader 4 (MT4)- making it a good automated trading solution.

MT4 supports automated trading platforms and forex EAs (expert advisors). The automated trading software/expert advisors are pre-programmed files that are tasked with following a set of advanced trading rules and market conditions.

The main concept here is that the EA will trade on the users’ behalf.

Once the robot has been set up and given authorization via MT4, it will then scan the markets and place orders 24 hours per day, 7 days per week.

In the case of AvaTrade, the provider supports thousands of instruments – covering forex and CFDs in the form of stocks, metals, crude oil, cryptocurrencies, and more. The platform is a 100% commission-free broker, so the only fees applicable are the spread.

AvaTrade is regulated by reputable financial bodies. The main drawback of taking the robot/EA route is that you need to find a suitable provider. This is because there are thousands of websites selling automated trading software for the MT4 – so you need to do lots of research and backtesting before taking the plunge.

AvaTrade fees

Fee Amount CFD trading fee Variable spread EURUSD spread 0.9 pip Crypto trading fee Commission. 0.25% (over-market) for Bitcoin/USD Inactivity fee $50 per quarter after three months of inactivity Withdrawal fee Free Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

2. Dash2Trade – Access automated crypto trading platform, signals and social trading on a blockchain-based application

Dash2Trade is a crypto social trading and analytics platform that aims to revolutionize the way that traders navigate the market. The platform offers everything that you need to make informed trading decisions, including advanced trading signals that can automate your trading strategy.

Dash2Trade is in beta but it is set to be a popular option amongst investors when it becomes available.

The expertise of the project’s team mixed with the overall aim to provide as much value to users as possible puts Dash2Trade in a strong position to be the next best automated trading platform for cryptocurrencies.

As well as signals, users of the platform will have access to in-depth token analysis, token listing alerts, strategy builder, discord channels and exclusive trading competitions amongst several other helpful tools.

To access the platform, users will need to hold the tax-free D2T token. D2T is an ERC20 utility that will act as the main currency of the Dash2Trade ecosystem. The token will have real-world value and will be given to traders as a reward. The token is currently available to buy via presale. Buying now is the best way to take advantage of future price increases.

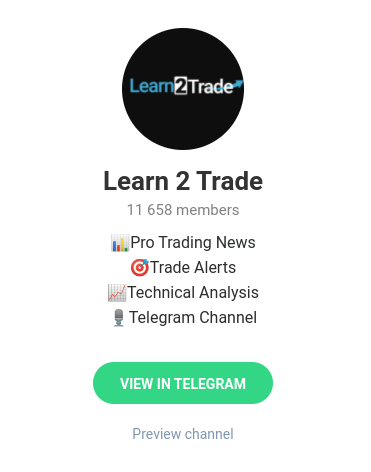

3. Learn2Trade – The best automated trading software based on Telegram

You might not feel comfortable about not having any say in where your money goes and thus – you want a bit more control.

If this sounds like you, then you might be more suited for a platform like Learn2Trade. In a nutshell, Learn2Trade is one of the most established and reputable trading signal providers in the online space. For those unaware, signals relate to real-time suggestions that tell you what trades to place and when.

Signal providers like Learn2Trade based these suggestions on advanced technical and fundamental research via a team of in-house traders. Once a trading opportunity has been identified,

Learn2Trade will then send a signal out via Telegram. These signals provide everything you need to know to act on the trade. The key attraction of opting for signals as opposed to a fully automated trading system is that users have full control over their funds.

That is to say, users are under no obligation to act on any of the signals that Learn2Trade distributes. In terms of what assets the signals are related to, Learn2Trade primarily specializes in automated currency trading and cryptocurrency trading.

However, the provider also sends out signals relevant to stocks, gold, and indices.

Learn2Trade premium account example

If you like the sound of Learn2Trade but want to test the waters out first, the provider offers 3 free signals per week. Alternatively, you can opt for the Premium Account on a 30-day moneyback guarantee basis – which gets you around 3-5 signals per day.

The Premium Account comes for £35 per month, albeit, you can reduce this by signing up for a longer plan.

Crucially, Learn2Trade has not only been involved in the trading signal and automated strategies scene for several years, but it now has a Telegram group following of over 11,500 members.

Finally, it’s also worth checking out the Learn2Trade website – where you will find hundreds of free educational guides and courses.

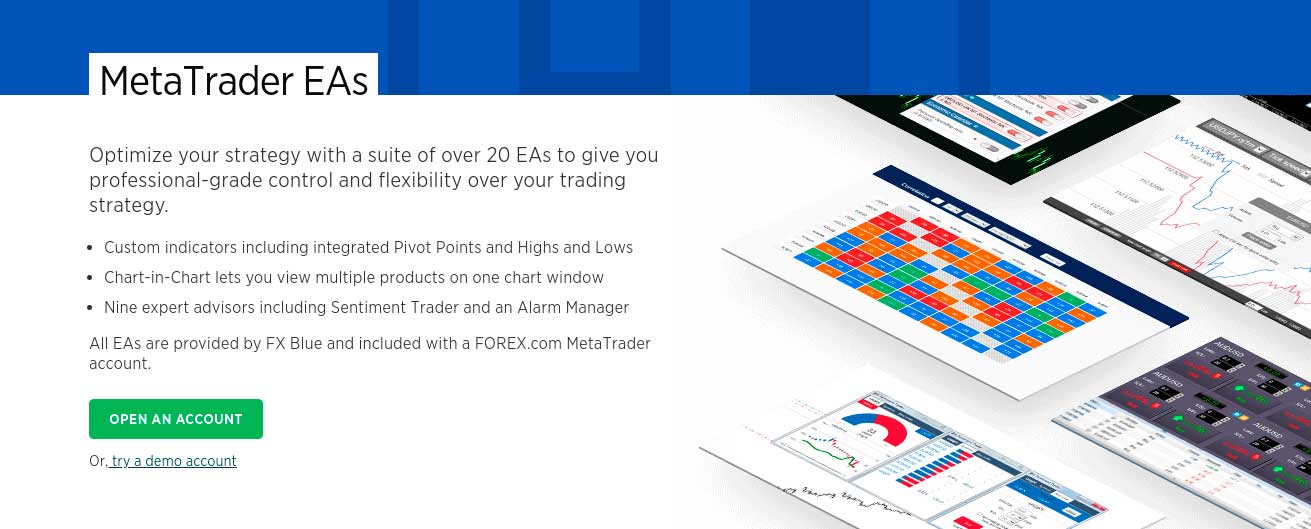

4. Forex.com – Top automated Forex trading platform with over 20 EAs, custom indicators, and access to advanced charting tools

Forex.com is a major player in the forex trading scene. This heavily regulated online broker allows you to trade over 80 forex pairs – covering a wide variety of majors, minors, and exotics.

In a similar nature to AvaTrade, Forex.com offers the MT4 and MT5 including web and mobile support – meaning, users can install an automated trading file with ease.

These EAs are based on technical tools such as pivot points, moving averages, and an Alarm Manager. These popular forex EAs are fully customizable. In addition to this, Forex.com also offers a fully-fledged MT4 Virtual Private Server (VPS) hosting facility.

A VPS improves latency in automated trading. Additionally, if your internet connection is disrupted, the VPS assures the EA will continue running.

For those unaware, this is a crucial requirement if you plan to have your automated trading platform operational 24/7. After all, automation requires an obscene amount of processing power. Plus, by utilizing a VPS, you can keep track of your forex trading platform robot via the MT4 app in real-time.

In terms of the specifics, Forex.com – which is US-friendly, has no minimum deposit in place when finding your account via bank wire. If opting for a debit/credit card, the minimum stands at $100. Either way, you can choose from several accounts – one of which offers commission-free trading.

Forex.com fees

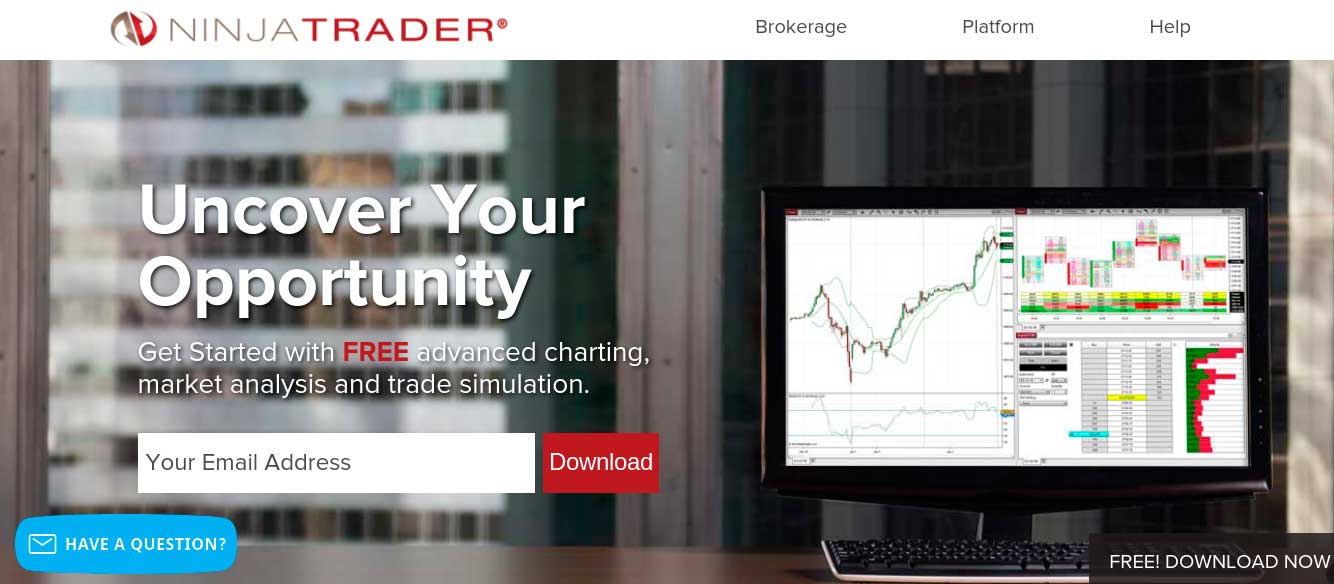

Fee Amount CFD trading fee Variable spread EURUSD spread 1.2 pips Crypto trading fee N/A Inactivity fee $15 a month after 365 days Withdrawal fee Free 5. NinjaTrader – Futures automated trading broker with advanced tools curated by over 600 expert developers

NinjaTrader offers brokerage accounts and services for futures and options and is also home to one of the most extensive automated trading software libraries in the space.

In fact, the platform offers over +1,000 trading software add-ons – covering everything from charting tools, technical indicators, simulators, and more. With more than +600 app developers using NinjaTraders, the platform is particularly useful for programmers and those looking to build an advanced trading process from the ground up.

The platform is targeted at experienced traders rather than beginners. With that said the NinjaTrader Ecosystem does contain over 100+ automated trading strategies that can be installed directly into the platform via an API.

These strategies are based on historical data and pre-build trading conditions – meaning that the auto trading software will buy and sell on your behalf without any manual trading requirement.

Although the strategies are provided by third-party vendors – there is a simple, risk-free way to test them out. Use the NinjaTrading demo account facility and see how the automated platform performs.

Users can view reports in real-time, allowing you to amend, be interactive, and tweak the algorithm until it meets the desired strategy.

When the strategy is ready to start trading in live conditions, this can be facilitated via the NinjaTrader brokerage platform. With that said, many top-rated trading platforms – including the likes of AvaTrade, offer full integration with NinjaTrading’s automated strategies.

This will provide access to a much larger asset base at more competitive fees.

How to use a platform for automated trading – AvaTrade guide

You can start using an automated trading platform in minutes to streamline your trading. Most platforms will ask for personal details, proof of ID, and a payment method to get started.

In this guide, we will walk you through how to use the AvaTrade automated trading features.

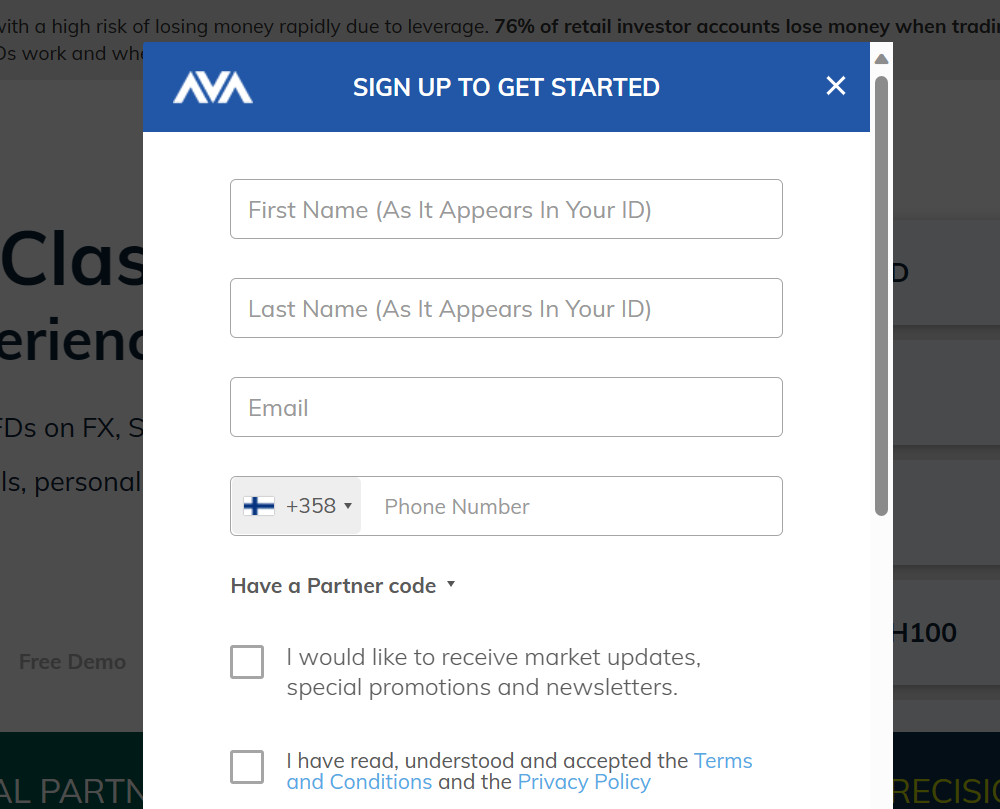

Step 1: Create an account

To use AvaTrade’s automated trading, you will need to first register with the broker. The registration process takes a few minutes to complete but it can take up to 48 hours for your ID to be verified. If you already have an account, you can skip this step.

To register, simply fill out the form with your details including an account username and password. Then, you will be asked to upload two forms of ID: one will be used to verify your ID and the other will be used to verify your address.

Make sure that the photos you upload are clear. This will speed up the verification process.

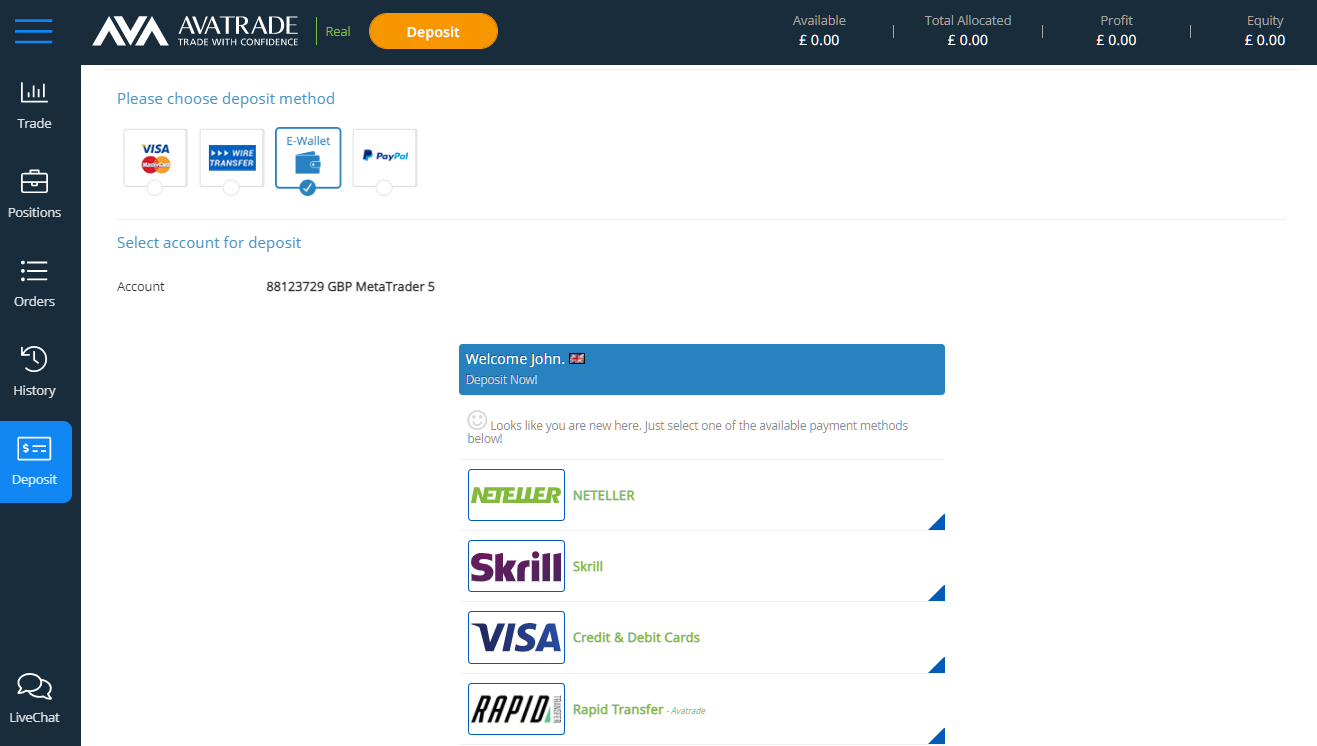

Step 2: Deposit funds

Once your account is verified, you will be able to deposit funds into your account. You cannot use the platform features without doing this. The minimum deposit for Avatrade is $100.

You can deposit funds with several payment methods including debit card, credit card, bank transfer, PayPal, Skrill and Neteller. There are no fees for depositing funds into your AvaTrade account.

After a few minutes, the funds should appear in your account balance.

Step 3: Switch to demo trading

After depositing funds, it is a good idea to switch to the AvaTrade demo trader so that you can practice using the auto features without putting any real money at risk.

On the web platform, simply go to the left side navigation bar and click ‘switch to demo’. You will then be given virtual funds to practice trading with.

Step 4: Download MT4 or MT5

To start auto trading with AvaTrade, you will need to use MetaTrader.

You can download Mt4 or Mt5 on desktop or mobile and connect your Avatrade account to the platform. From here, you will be able to access the automated features that are available through the charting tool.

Step 5: Test out auto trading features

The next step is to use your demo trading account with MetaTrader to test out different APIs. You should test as many tools as possible before putting any real money at risk.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

What are automated trading platforms?

Automated trading platforms, otherwise referred to as EAs (Expert Advisors) or simply ‘bots’, allow you to trade assets in a 100% passive nature. The main concept is that the trading platform will make decisions based on pre-programmed code.

The underlying algorithm will therefore autonomously perform technical analysis – making it perfect for inexperienced traders or those who lack the time to actively research the markets. When the system spots a trading opportunity, it will then proceed to place a series of orders.

The best automated trading platform will not only place buy/sell and limit orders but also stop-loss and take-profit orders. In doing so, this ensures that the system trades in a risk-averse way and thus – doesn’t burn through your balance in one fell swoop. In most cases, the platform will come via a downloadable software file that you need to install into a third-party platform.

MT4 is usually preferred by developers, albeit, MT5 and cTrader are often compatible too. More on this shortly. In terms of supported markets, the best trading platform providers will cover everything from forex and stocks to commodities and Bitcoin.

How do automated trading platforms work?

As we briefly noted in the section above, the best automated platforms usually come in the form of a software file. You would then be required to install this into a platform like MT4.

Then, you would need to link your MT4 account with an online broker. Once you activate the file, it will then be able to trade on your behalf.

In terms of how the system makes trading decisions, everything is based on pre-programmed code. The developer behind the system will have a specific strategy in place.

For example, you might opt for a platform that scalps the forex markets 24/7 or one that targets high-volatility instruments like crypto.

To clear the mist here’s a quick run-through of how the best automated trading platforms work

- You purchase an automated trading platform that is compatible with MT4

- You download the file to your desktop computer

- You open a live account with an MT4 broker like Libertex and deposit some funds

- You log into MT4 with your Libertex credentials and install the file

- You activate the file via MT4 and it begins placing orders on your behalf – 24/7

The process above is pretty much the same as other platforms – such as cTrader and MT5. With that said, some providers do not require you to download any software. Instead, they allow you to activate the system through the provider’s website which in turn – will trade at a broker that has partnered with the developer.

Different types of automated trading software

The term automated trading platform is somewhat of a loose one. The reason for this is that it can refer to several types of automated trading tools.

This generally includes:

Fully automated trading brokers

A full-automated trading platform allows users to trade passively. These platforms use algorithms, ML, and AI to conduct research, spot trading opportunities, open positions, and close positions on the trader’s behalf.

Fully automated trading platforms are sometimes called ‘robots’. This is because the tools work independently, without any need for intervention by the trader.

Fully automated trading platforms make it possible to trade around the clock, even if you are busy doing other things. However, these platforms come with high risks and are not 100% accurate.

Automated trading signals

Most investors seeking the best automated trading platforms like to take a fully hands-off approach.

This means choosing a trading strategy and investment amount – and then sitting back passively. On the other hand, many investors like to retain an element of control over their trading funds.

As such, another option to consider in the world of automated trading is that of a signal service provider. As we covered earlier, signal platforms like Learn2Trade have the functionality to send trading suggestions throughout the day.

These suggestions are sent out by a team of experienced traders that manually scan the markets via chart reading tools and technical indicators.

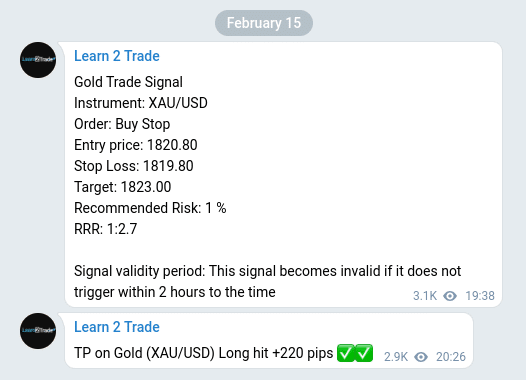

A Learn2Trade signal would look like the following:

- Asset: EUR/AUD

- Order: Buy

- Entry Price: 1.5573

- Take Profit: 1.5609

- Stop Loss: 1.5502

As per the above, once you receive the signal in real-time via Telegram, it’s then simply a case of heading over to your chosen broker and placing the suggested orders.

Users can, of course, decide to perform some independent market data research of their own before acting or ignoring the signal altogether.

Automated trading via MT4

The third option is to use MT4, supported by hundreds of online brokers. It allows users to install robot files to automate their trades. Once the files are installed into MT4, it will then buy, sell, and trade financial instruments automatically.

Everything is fully automated, as the file is only tasked with following pre-built algorithms installed within the software file. The key problem here is that there is no way of knowing whether or not the strategy has what it takes to make consistent profits.

After all, their are thousands of providers selling their so-called ‘expert’ files – but rarely do they have the capacity to outperform the market. As such, if you do opt for an automated trading platform via an MT4 broker, just make sure that you do some backtesting on the robot for at least a month in demo account mode before risking any capital.

Note: Automated trading robots are also known as forex EAs. The former covers all asset classes while the latter is currency trading specific.

Can you make money with automated trading?

It is possible to make money with automated trading if you manage risk, conduct your research, and only invest funds that you can afford to lose. However, profits aren’t guaranteed even with automated trading tools. This is because market volatility is very difficult to predict.

Nevertheless, automated trading can increase your chances of making a successful trade and can help to ensure that you don’t miss out on profitable opportunities when you are away from the trading screen.

The best way to make money with automated trading tools is to use them as a guide alongside your research and analysis.

For example, you could use a tool to search for profitable opportunities. Then, conduct your analysis to verify the trading opportunity before choosing whether or not to take it. When used this way, automated trading tools can help to filter the weak technical setups.

It is also important to have a strict risk management strategy in place to profit from automated trading. A risk management strategy might include setting stop loss and take profit targets, managing your emotions and only placing a handful of trades each day to avoid overconfidence.

How to choose the best automated trading software

The process of installing and deploying an automated trading system is actually very simple. The difficult part comes in choosing a trading platform that has the potential to make consistent gains. With thousands of such providers marketing their services online – knowing which one to opt for can be challenging.

To ensure you choose the best trading platform for your needs – be sure to consider the following recommendations:

- Win rate and performance: In selecting the best trading platform, you need to have a firm idea of how it has performed since it launched. Most providers publish a win rate and ROI in percentage terms. You do, however, need to see if there is a way for you to verify the provider’s claims.

- Reputation: You will come across many automated trading platform websites that make bold claims of unprecedented financial returns. However, many of these providers are scams – so you need to do some homework about the system’s reputation.

- Price: You will likely need to pay a fee to obtain your chosen automated trading platform. In most cases, this is a one-time fee. With that said, some providers will instead charge a monthly subscription.

- Assets: To choose the best trading platform for your financial goals – you should think about what asset you wish to target. For example, while some systems focus on forex, others will target stocks, commodities, or even cryptocurrencies.

- Strategy: It’s also wise to have a firm grasp of the strategy being utilized by the trading system. For example, does the algorithm scalp small gains throughout the day, or does it look to enter the market when an asset breaks out?

There are many other factors that should be considered when searching for the best trading platform. But, these are the most important.

Conclusion

Those with little to no experience are attracted to automated trading, as there is no requirement to perform any technical or fundamental research.

Similarly, even those who know how to invest well will often opt for an automated copy trading platform – as they simply don’t have the time to actively invest. The most challenging part of the process is finding a suitable automated trading platform for you and your financial goals.

FAQs

Is Automated trading profitable?

It can be, but there are no guarantees and you should always proceed at your own risk. The key problem is that it is often difficult to verify the results of an automated trading system without testing it out yourself. This is why you should always test the trading product before risking your own capital. .Can you automate day trading?

Yes, there are several ways in which you can automate day trading. One option is to obtain a trading robot and install it into MT4. The robot will then trade on your behalf 24 hours per day. Another option is to use a signals provider that will alert you of potential trading opportunities.Are automated trading platforms a scam?

Unfortunately, many automated trading platforms are a scam. This is because they promise unprecedented financial returns or guaranteed profits, but in most cases, rarely is this the case. There are, however, a number of transparent automated trading platforms that are worth looking into. Notably, this includes AvaTrade, and Forex.com - all of which are regulated.What is a forex EA?

A forex EA (expert advisor) is another term for an automated trading robot. You will install the forex EA into a third-party platform like MT4, MT5, or cTrader. In doing so, the EA will buy and sell on your behalf.Is bot trading legal?

Yes, bot trading is legal in most jurisdictions. You must, however, ensure that your chosen platform allows bot trading.What is the best automated trading platform for signals?

If you're looking for a top-rated signal provider, Learn2Trade seems to very popular in this space. With more than 11,500 Telegram group members, Learn2Trade specializes in crypto and forex signals.Matti Williamson

View all posts by Matti WilliamsonMatti Williamson is a capital markets and crypto analyst with +15yr experience. He was among Saxo Bank's analysts, providing in-depth market coverage and assisting traders in live webinar sessions. Matti's knowledge is spread across multiple markets. He masters the top financial assets including forex, stocks, indices and commodities. In the crypto sector, he is well-versed with the current blockchain technology and has been researching cryptocurrencies since the collapse of MTGox in 2014, the biggest bitcoin exchange at the time. His previous articles can be found at Finance Magnates. From traditional finance to DeFi, expect Matti to cover and simplify the latest trends, research and analysis.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up