Best ECN Forex Brokers – Cheapest Platforms Revealed

The forex market has always been the biggest and most liquid market in the world, but as trading is becoming more and more popular, forex has grown to an impressively massive size.

If you want to join in on that action but you want to trade against other traders, then ECN forex brokers are what you need.

Best ECN Forex Brokers 2025 List

If you wish to see a quick list of the best forex brokers available globally right now, here are our top 5 suggestions:

- eToro — The best ECN forex broker overall

- Libertex — Offers extremely high leverage

- AvaTrade — An ECN forex broker that supports multiple platforms

- Forex.com — An ECN forex broker with over 90 pairs and tight spreads

Best ECN Forex Brokers Reviewed

If one of the mentioned platforms sounds interesting to you, read the following reviews to learn more about them and find out if one or more might be a good fit for you and your trading needs.

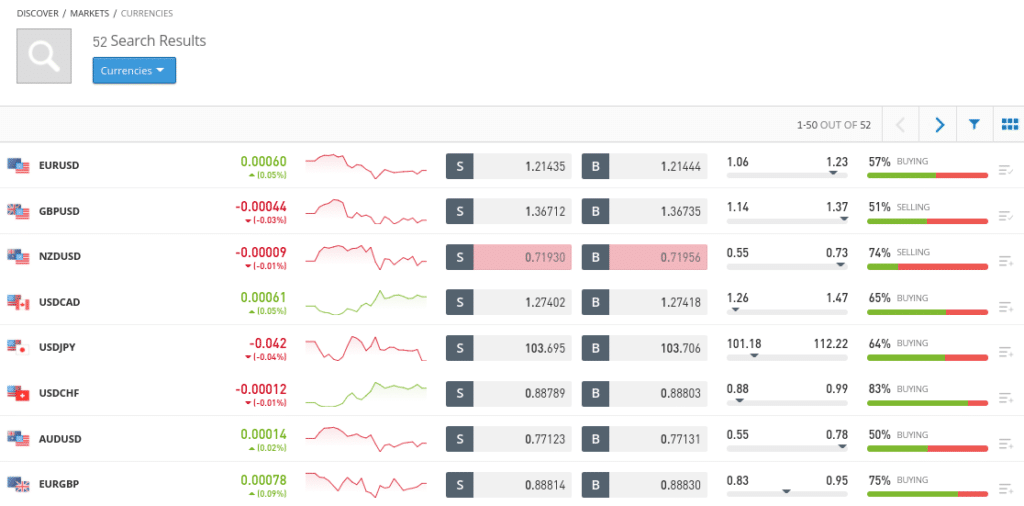

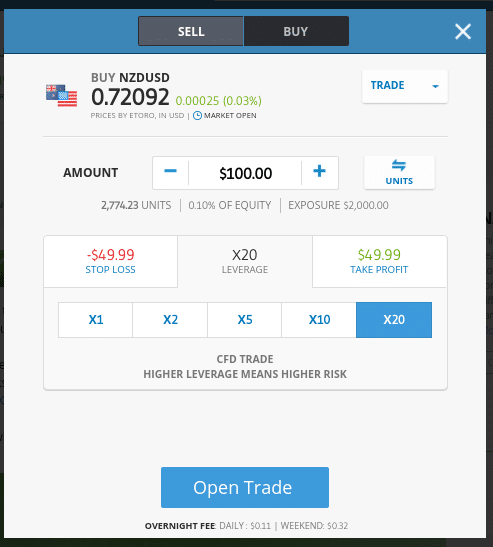

1. eToro — The best ECN forex broker overall

The company has grown to be as popular as it is for a variety of reasons. For example, it offers a selection of around 50 forex pairs, all of which can be traded with leverage. The leverage is 30:1 for major pairs and 20:1for all others.

eToro also has built-in managed portfolios that users can invest in, based on their market strategy. These could be market copy portfolios, partner copy portfolios, or top-trader copy portfolios.

eToro is also among the favorite platforms of forex traders due to the fact that it is licensed and regulated by some of the most respected regulatory authorities around the world, including the CySEC, FCA, and ASIC.

And, let’s not skip the fact that the platform is extremely user-friendly and perfect for newcomers. Its minimum deposit is only $50, which is affordable to everyone, and far user-friendlier than some other platforms that require you to deposit hundreds, or even thousands of dollars in order to be able to make a deposit at all.

Speaking of user-friendliness, eToro is also extremely popular for its social trading section of the platform, which is where its copy-trading feature is located. Copy-trading is just what it sounds like — traders can use the platform to identify expert high-profile traders with the highest ratios of success, and then copy their actions. Since these traders know the market by heart, they know how to identify all upcoming opportunities and make profits, and with the copy trading feature, you can do it too even without prior knowledge.

Pros:

- High leverage for professional forex traders, and quite a decent one for retail forex traders

- Heavily regulated

- User-friendly platform

- No commission fees for any trading instruments

- More than 50 currency pairs

- Copy-trading

Cons:

- Has a small withdrawal and inactivity fee

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

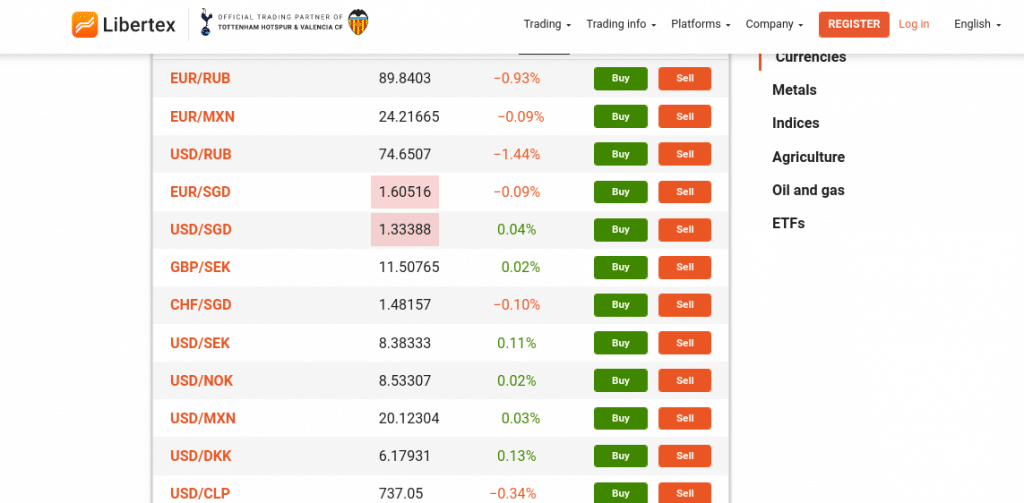

2. Libertex — Offers extremely high leverage

Retail traders still only enjoy a 30:1 leverage ratio, which is still more than enough for beginners. This platform is also strongly regulated, and it supports both MT4 and MT5. In terms of forex pairs, there are 51 of them, which include minor, major, and even exotic pairs. However, its greatest advantage for newcomers to forex is the fact that the minimum deposit is only $10, which is likely one of the lowest minimums in the industry.

Pros:

- Extremely competitive spreads

- $10 minimum deposit

- Leverage ratio of 600:1 for experts and 30:1 for retail traders

- Heavily regulated

- Supports multiple platforms

- 51 forex pairs

Cons:

- Limited range of products outside of FX

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 85% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

4. AvaTrade — An ECN forex broker that supports multiple platforms

Traders should note that leverage for FX pairs depends on the traders’ country, but 400:1 is the maximum that can be obtained for trading foreign currencies. Other than FX, the platform also offers commodities, ETFs, bonds, forex options, and stocks. Also, it grants users access to AvaOptions, AvaSocial, AvaTradeGo, MetaTrader 4, as well as MetaTrader 5, so traders have plenty of options when it comes to choosing the right platform. Lastly, it is worth noting that it doesn’t charge commission and that it has rather tight spreads.

Pros:

- Low spreads

- A wide range of trading platforms

- Heavily regulated

- Offers automated trading solutions

- Up to 400:1 leverage ratio for experts

Cons:

- There is a margin fee

71% of retail CFD accounts lose money with this provider.

5. Forex.com — An ECN forex broker with over 90 pairs and tight spreads

As such, it also allows users access to liquidity providers, which can result in even better spreads. But, as a primarily forex trader, most of its tools and platforms are FX-oriented. Still, that doesn’t mean that it doesn’t support other assets — on the contrary. With Forex.com, traders also get to access ETFs, stocks, commodities, indices, and even cryptocurrencies.

Pros:

- Among the most trusted forex platforms in the world

- Offers over 90 FX pairs

- Heavily regulated, even has US license

- Supports a range of trading platforms

- Has mobile app

- Fast market execution

Cons:

- Pricing structure is not clear

There is no guarantee you will make money with this provider.

What is An ECN Broker?

ECN brokers are forex brokers that work in a specific way — by connecting market participants with one another directly, using an ECN (Electronic Communication Network). This is essentially a computer-based system that constantly monitors the market, looks for the clients’ buy and sells orders, and matches them by using a network of forex liquidity providers.

As a result, it is basically impossible for ECN brokers to manipulate the market or “make” it the way traditional brokers can sometimes do. In a sense, they are the purest form of brokers, and they act as real brokerage services between traders.

ECN Forex Brokers vs Market Makers

The difference between ECN forex brokers and market makers is something that every trader needs to understand before they decide to enter the market.

If we compare the two types of brokers, it is clear that ECN brokers have a slight downside due to their fixed commissions that must be paid whenever traders enter and exit positions, which tends to pile up and end up costing you a lot if you do it too often. Market makers, on the other hand, do not do this, which many see as an advantage.

However, market makers do charge a spread, which is usually fixed also, as well as an overnight fee for any position that doesn’t get closed by the end of the trading day. On top of that, market makers also bring another advantage, which is the fact that you always get an execution, no matter the conditions in the market. ECN brokers cannot guarantee the same.

Other than that, however, ECN brokers are better in every other way. They do not trade against the clients, and they cannot choose to display any price they want. Instead, they display the prices offered by other traders that use their platform. ECN brokers also offer tighter spreads, sometimes even zero spreads, as well as no slippage, instant execution, and alike. This makes them ideal for people who wish to engage in automated trading through various tools.

Lastly, ECN brokers typically make your connection to the forex market seem more professional through a number of features, such as level 2 order books, tight spreads in times of high volatility, and more, which makes them ideal for professionals to whom every advantage means a lot. Novices, on the other hand, might find market maker brokers to be easier to handle until they get some experience.

Benefits of ECN Forex Brokers

ECN forex brokers come with a number of benefits, many of which we already listed. But, for the purpose of practicality, let’s summarize them once more:

- Tight spreads, often going down to zero

- Fast market executions

- ECN brokers do not manipulate prices and trade against their clients

- They are more beneficial for short-term trading, such as day trading

- ECN brokers offer better prices

- Spreads remain tight even during periods of high volatility

- They are more transparent

How To Get Started With an ECN Forex Broker?

If you are determined to start trading at an ECN forex broker, then you should know that getting started with one is rather simple, and all you need to do is go through a handful of simple and quick steps.

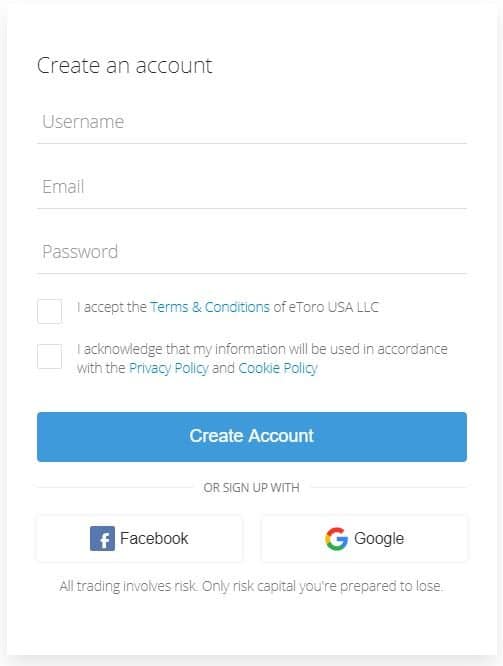

Step 1: Open an Account and Verify Your ID

The first thing you need to do is select a broker that you are going to use. Once you decide on that, head over to their website and sign up for an account. On many of these platforms, you don’t even need to create an account from scratch, and can instead log in with your Facebook, Google, or some other pre-existing account.

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

If you want to, you can still make a brand new account and don’t have it connected to any other account that you might be using. Finally, you will also have to verify your identity. These brokers are regulated, and as such, obligated to request that you go through a KYC procedure, so you will have to upload documents such as your ID, driver’s license, bank statement, or passport and wait for your account to be approved.

Step 2: Deposit Funds

Once you are approved, you will be ready to deposit funds. Just look for the deposit option on your broker of choice, enter the desired payment method and the amount you wish to deposit, and hit the deposit button. This works very similarly on all ECN forex brokers, with the only difference being the minimum deposit and supported payment methods, so make sure to check those out before you choose a broker.

Step 3: Choose a Trading Platform

Once your money is deposited, you will need to select a trading platform. Most traders choose MetaTrader 4 or MetaTrader 5, although you can also go for cTrader, or some other professional traders on the web, or in the form of desktop and/or mobile apps.

Step 4: Start Trading

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Finally, all that is left to do is for you to select a forex pair that you wish to buy or sell, enter your position, and wait for the system to match you to another trader that wishes to do the opposite of you. As mentioned, the forex market is huge, and you likely won’t have to wait long for the platform to find a suitable trader for you to work with.

eToro — An Alternative to ECN Forex Brokers

ECN brokers offer plenty of benefits, as we have listed above. However, new traders are still recommended to go to market makers until they get the chance to learn more about forex trading and develop the necessary skills to do it on their own, without the help of a third party. However, even then, many choose to use market makers as it is simply more convenient, even though ECN traders offer a number of advantages.

Whether you fall under the first or the second category, we can recommend eToro as the best option that will serve as an alternative to using an ECN forex broker. The company has over 20 million users, 50 forex pairs, low minimum deposits, and many other benefits that we explored above, including the copy-trade feature. You are free to use one of the other brokers if you so desire, but keep in mind that eToro is the biggest one out there, and not without a good reason for it.

Conclusion

In the end, all that matters is that you get a good trade while using a broker platform that feels the most convenient and profitable. For some, ECN brokers are just that, while others would rather turn to the convenience of market makers.

Regardless of which platform you choose, remember to not risk more money than what you can afford to lose, and to always keep learning more. Not only will it let you spot new opportunities, but it will also allow you to avoid plenty of pitfalls that traders usually do not notice in time.

eToro – Best ECN Forex Broker

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.