Best Day Trading Platform in 2025 – Cheapest Platform Revealed

If you want to day trade financial assets like stocks, commodities, or crypto – you will need to find a suitable platform.

Your chosen platform must not only offer heaps of markets alongside low commissions and spreads, but plenty of trading tools, technical indicators, and real-time data. You also need to think about payments, customer support, and of course – regulation.

In this guide, we review the best day trading platforms to consider in 2025

Best Day Trading Platforms in 2025

Looking to download the best trading app right now? If so, below you will find the best day trading platform we think you should consider. You can find out more about each provider by scrolling down!

- Plus500 – One of the Biggest CFD Brokers in the UK

- eToro – Overall Best Day Trading Platform with Zero Commissions

- Libertex – Best Broker for Day Trading CFDs with Tight Spreads

- VantageFX – Overall Best Day Trading Platform 2025

- Robinhood – Best Platform for Day Trading US Stocks and Options

- TD Ameritrade – Best Day Trading Platform for Advanced Traders

- Interactive Brokers – Best Day Trading Platform for Asset Diversity

- TradeStation – Best Day Trading Platform Mobile App

Etoro Stocks

Visit siteeToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.......

Trading 212

Visit siteYour capital is at risk. Investments can fall and rise and you may get back less than you invested.......

Interactive Brokers

Visit siteThe risk of loss in online trading of stocks, options, futures, currencies, foreign equities, and fixed income can be substantial.......

Webull

Visit siteAll investments involve risk, and not all risks are suitable for every investor. The value of securities may fluctuate and as a result, clients may lose more than their original investment.......

What Is Day Trading?

Day trading is a type of trading in which a trader buys and sells financial instruments such as stocks, options, currencies, or futures within the same trading day, with the aim of making a profit from the fluctuations in the price of the asset. Day traders typically hold their positions for a few seconds, minutes, or hours, and they close their trades by the end of the day.

The goal of day trading is to take advantage of small price movements in a security, as these can add up to significant profits when multiplied by large trading volumes. Day traders often use technical analysis tools such as chart patterns, trend lines, and technical indicators to identify potential trading opportunities and to make buy and sell decisions.

Day trading can be a high-risk, high-reward activity, and requires a lot of discipline, experience, and knowledge. Successful day traders must be able to control their emotions, manage their risk, and adapt quickly to changing market conditions. It is also important to note that day trading is not a guaranteed way to make money and can result in substantial losses.

How do Day Trading Platforms Work?

The main concept with day trading platforms is that you will be buying and selling financial assets with the view of making money. This is facilitated by a third-party broker that can connect you to your chosen marketplace.

The end-to-end process typically works like the following:

- You open an account a day trading platform that meets your needs

- You deposit funds with a debit/credit card, e-wallet, or bank transfer

- You choose a financial instrument to trade – such as GBP/USD, gold, or Apple stocks

- You enter a buy or sell order – depending on which way you think the price of the asset will go

- You close the position before the end of the trading day

Your chosen day trading platform will charge a variety of fees and commissions. This might come via the spread, deposit fees, or overnight financing. More on this shortly.

Is Day Trading Profitable?

Day trading can be profitable for some traders, but it is important to note that it is a high-risk, high-reward activity that requires a lot of experience, knowledge, and discipline to be successful. Many day traders lose money, and only a small percentage of them consistently make profits over the long term.

The profitability of day trading depends on a variety of factors, such as the trader’s skill level, the quality of their trading strategy, the amount of capital they have to invest, and the volatility of the markets they are trading in. Day traders who are skilled at reading market trends and using technical analysis tools to make informed trading decisions may be able to generate consistent profits over time, but they also need to be able to manage their risks and control their emotions to avoid making impulsive trades that could result in losses.

It is important for anyone considering day trading to thoroughly educate themselves on the risks and potential rewards before getting started, and to start with a small amount of capital that they can afford to lose while they gain experience and refine their trading strategy.

Best Day Trading Platforms in 2025 Reviewed

There are hundreds of day trading platforms available in the online space. Some are great, while others are lacking in key departments.

We find that the Best trading platform for day traders are those that offer thousands of financial instruments, low commissions, and an abundance of tools and features.

To help clear the mist, below we review the best day trading platforms of 2025 and beyond.

1. Plus500 – One of the Biggest CFD Brokers in the UK

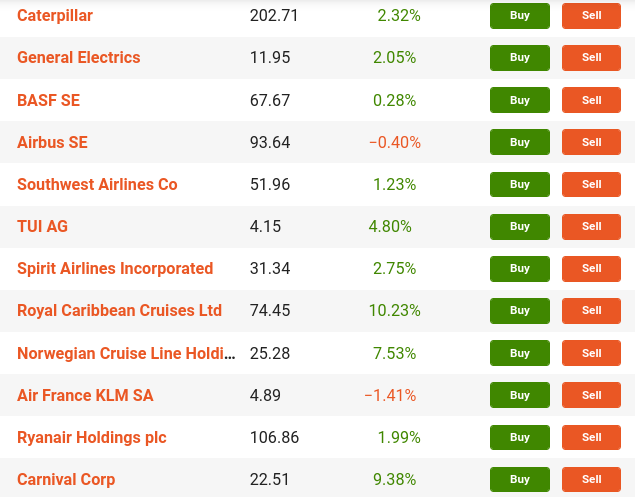

Plus500 is another day trading platform that is popular with those that like to buy and sell CFD instruments. The provider is home to over 2800 instruments- including stocks, indices, ETFs, and commodities.

Perhaps the most appealing part of the Plus500 asset library is that of its forex CFD offering. Here, you can trade an abundance of forex pairs without paying a single cent in commission. Across more than 60 pairs, this includes a great selection of majors and minors, as well as less liquid currencies.

As all fees are built into the spread at Plus500, which is convenient for active traders.

On top of offering tight spreads and zero commissions, Plus500 also supports high leverage trading. In accordance with the ESMA regulations, the maximum leverage that Plus500 offers is 1:30.

Although Plus500 has a strong following in the UK and Europe, clients use this platform from all over the world. This is evident in the number of regulatory licenses the provider holds. Trading is not easy as it requires knowledge and experience, and risks are involved.

Plus500 fees

| Fee | Amount |

| Stock trading fee | Spread. 23.51 pips for Amazon. |

| Forex trading fee | Spread. 1.3 pips for GBP/USD. |

| Crypto trading fee | Spread. 4.11% for Bitcoin. |

| Inactivity fee | £10 per month after three months |

| Withdrawal fee | Free |

Pros:

- 0% commissions for stocks and forex CFDs

- Thousands of CFD trading markets

- In-house trading platform, available on web browsers and mobile phones

- Trade with leverage to increase your position

Cons:

- No social trading tools

- Limited to CFD trading, which is not available in the US

80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

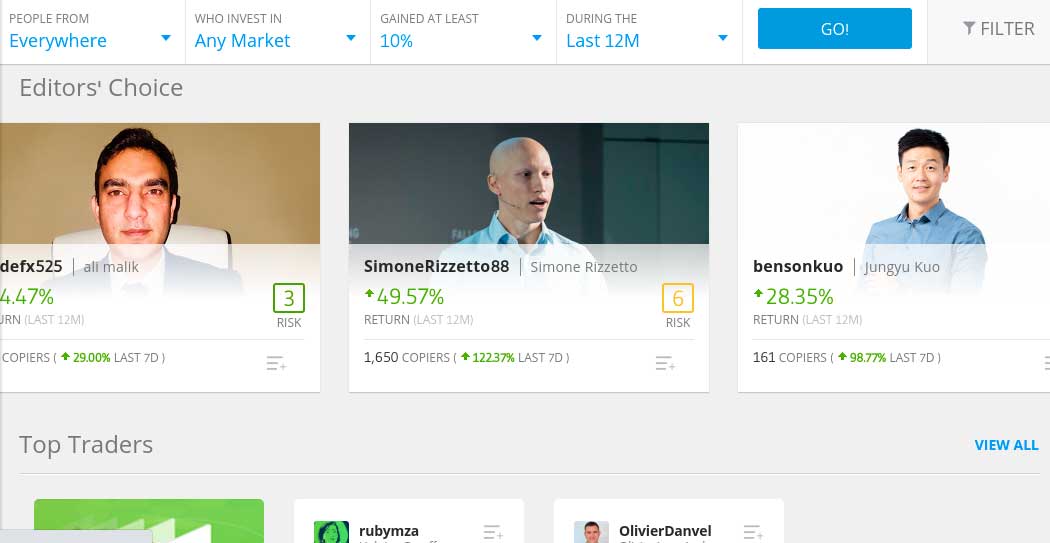

2. eToro – Overall Best Day Trading Platform with Zero Commissions

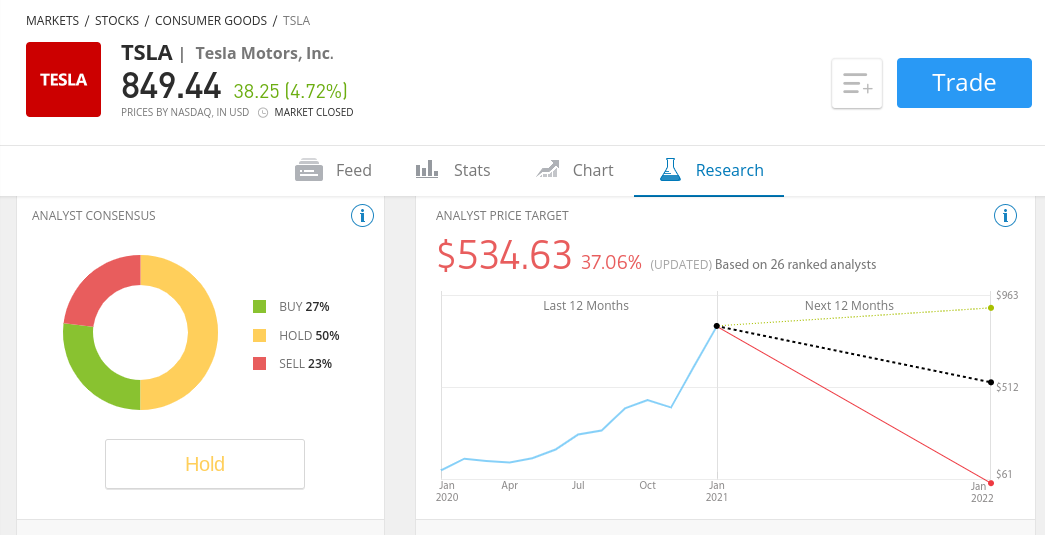

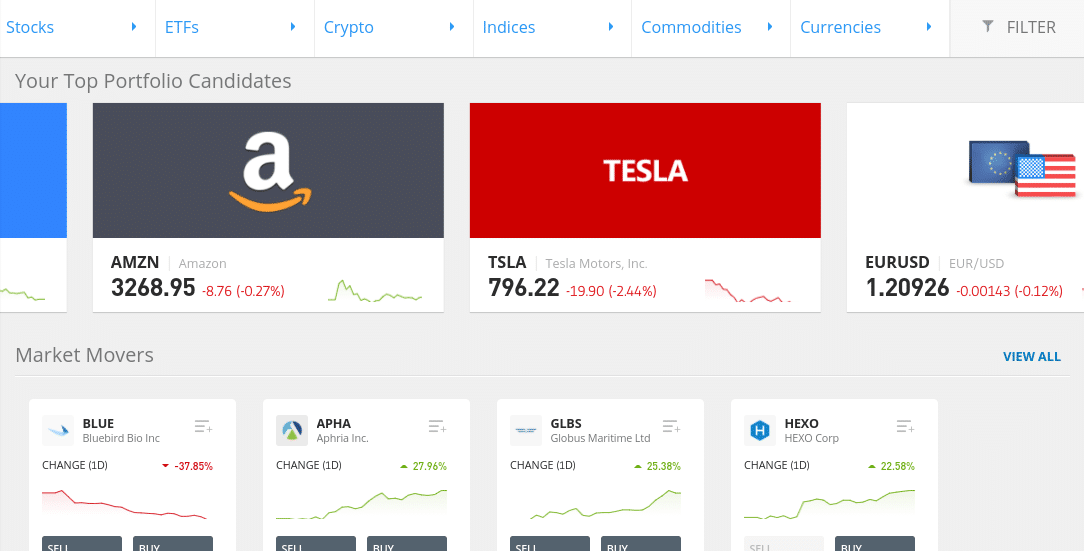

In reviewing dozens of providers, we concluded that eToro is the best day trading platform of 2025 for many reasons. Firstly, you will have access to thousands of markets across several key asset classes.

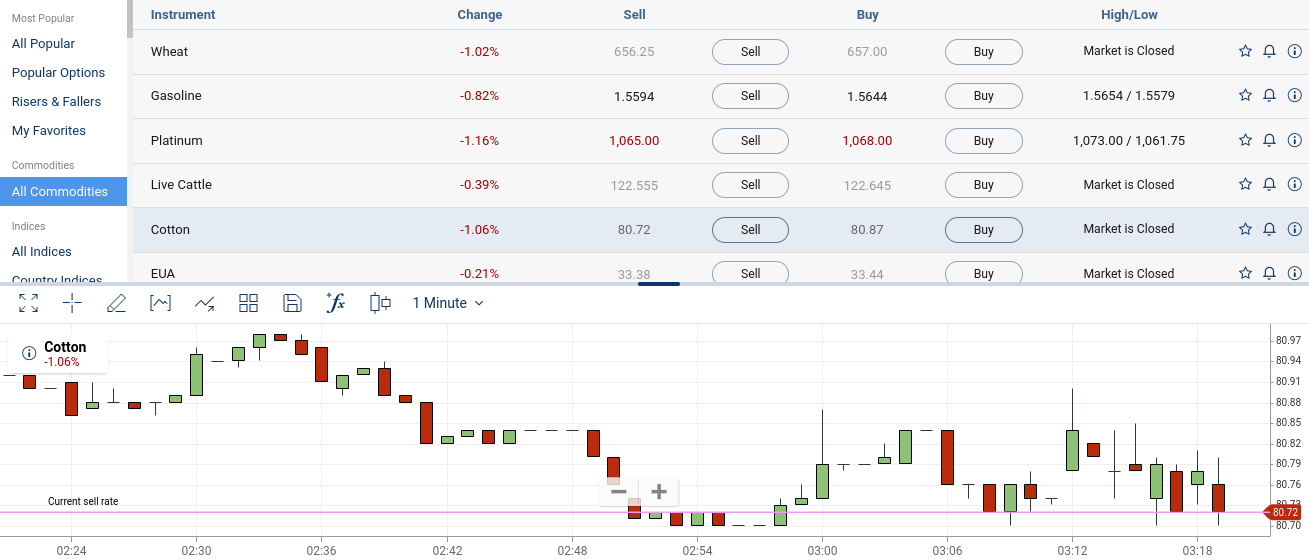

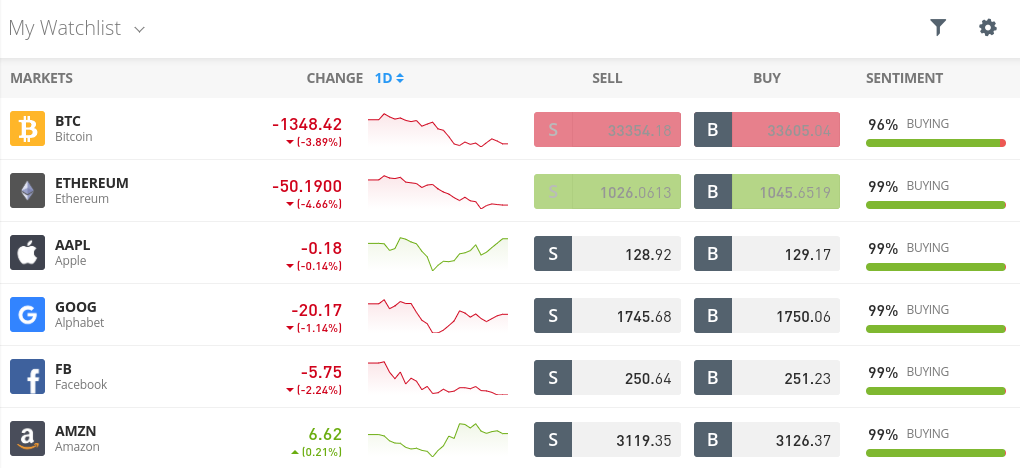

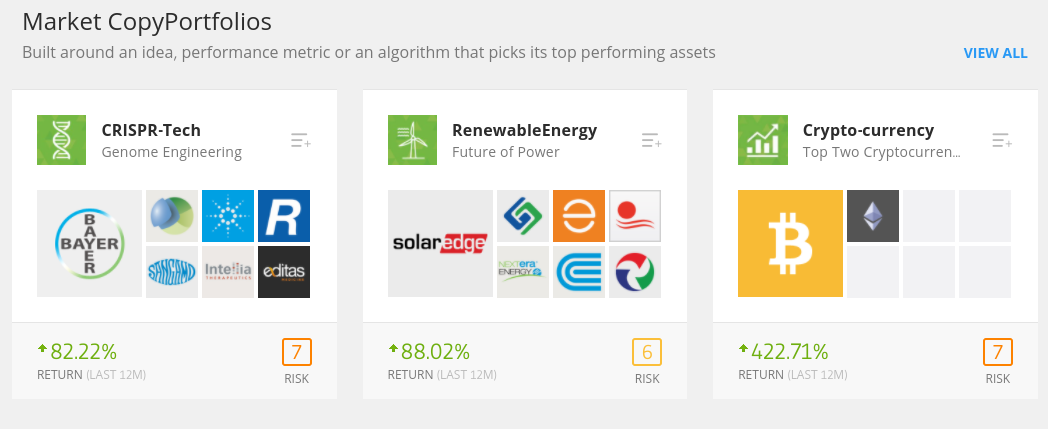

This includes over 2,400 shares, ETFs, indices, cryptocurrencies, hard metals, energies, agricultural products, and forex. As such, if you’ve got a specific financial asset that you like to trade, you’ll likely find it at eToro.

We also think that eToro is the best broker for day trading because it is one of the most competitive in the fee department. You won’t pay a single cent in commission when you place buy and sell orders, nor are there any ongoing platform fees. This allows you to target small day trading margins without getting your profits eaten away at.

Additionally, spreads are also very competitive on eToro – especially in the case of forex, gold, and stocks. We should note that eToro is unlikely to be suitable if you are a seasoned pro that relies on advanced technical analysis. Instead, this top-rated day trading platform is great for those that are just starting out in the space.

After all, eToro allows you to place orders at a stake of just $25 on crypto day trading and $50 when trading stocks. An additional day trading tool that is popular with those with little to no experience is that of the Copy Trading platform feature. This allows you to mirror a seasoned day trader like for like. If the trader risks 1.5% of their portfolio on a forex trade, as you will. This comes at no extra cost.

On top of low fees, tight spreads, and a huge asset library – we also think that eToro is the best platform for day trading for its strong regulatory standing. This includes FINRA registration and a regulatory license from the FCA, CySEC, and ASIC. Supported payment methods at this top-rated day trading platform include debit/credit cards, e-wallets, and a bank transfer.

eToro fees

| Fee | Amount |

| Stock trading fee | Free |

| Forex trading fee | Spread, 2.1 pips for GBP/USD |

| Crypto trading fee | Spread, 0.75% for Bitcoin |

| Inactivity fee | $10 a month after one year |

| Withdrawal fee | $5 |

Pros:

- Super user-friendly trading platform

- Buy stocks without paying any commission or share dealing charges

- 2,400+ stocks and 250+ ETFs listed on 17 international markets

- Trade cryptocurrencies, commodities, and forex

- Deposit funds with a debit/credit card, e-wallet, or bank account

- Ability to copy the trades of other users and day trading simulator

- Regulated by the FCA, CySEC, ASIC and registered with FINRA

Cons:

- Not suitable for advanced traders that like to perform technical analysis

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

3. Libertex – Best Broker for Day Trading CFDs with Tight Spreads

Next up on our list of the best day trading brokers of 2025 is Libertex. This provider is a CFD trading site, so you’ll have access to long and short-selling capabilities, as well as leverage.

With that said, perhaps one of the biggest draws to Libertex is that it charges no spreads on any of its markets. You might find that some financial instruments come with a low commission, albeit, many assets can be traded fee-free.

In terms of what you can trade on Libertex, the CFD broker covers hundreds of popular markets. This includes indices like the Dow Jones and CAC 40, dozens of forex pairs, commodities like WTI Crude Oil and natural gas, and heaps of stocks.

If you’re wondering what type of day trader Libertex is suitable for, we would argue that the platform will appeal to investors of all shapes and sizes. For example, if you’re a seasoned day trading pro, you’ll likely want to use Libertex via MT4. If you’re just starting out in the world of day trading, Libertex also offers its own web platform.

This is a lot easier to use – making it perfect for newbies. In terms of safety, this top-rated day trading platform has more than 2.9 million clients worldwide and has been active in the brokerage scene for over two decades. Additionally, the platform is licensed by CySEC. Finally, Libertex supports debit/credit cards, e-wallets, and bank transfers – and the minimum deposit is $100.

Libertex fees

| Fee | Amount |

| Stock trading fee | Commission. 0.034% for Amazon. |

| Forex trading fee | Commission. 0.008% for GBP/USD. |

| Crypto trading fee | Commission. 1.23% for Bitcoin. |

| Inactivity fee | $5 a month after 180 days |

| Withdrawal fee | Free |

Pros:

- Tight spread CFD trading

- Very competitive commissions

- Good educational resources

- Long established broker

- Trade stocks and indices like the Dow Jones

- Compatible with MT4

- Great choice of markets

Cons:

- Only offers CFDs

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 85% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

4. VantageFX – Best Overall Day Trading Platform 2025

For day traders who want to leverage their accounts, VantageFX makes it easy. The broker allows you to trade major forex pairs on margin up to 500:1. Stocks can be traded with leverage up to 20:1.

VantageFX uses commissions for share trading, which can be favorable for traders who buy and sell in large volume. The broker charges $6 per trade for US stock CFDs. For forex trading, VantageFX offers a commission-free account with spreads starting from 1.4 pips.

One of the best things about this broker is its variety of trading platforms. You can use VantageFX’s built-in web trader and mobile app, or integrate your trading account with MetaTrader 4 or 5. The platform also supports social trading and copy trading with DupliTrade, ZuluTrade, and Myfxbook. All of these platforms are easy to use and the integration with VantageFX is seamless.

VantageFX is regulated by the UK Financial Conduct Authority (FCA) and the Australian Securities and Investment Commission (ASIC). The broker offers 24/7 customer support and you can open a new account with as little as $200.

VantageFX fees

| Fee | Amount |

| Stock trading fee | $6 commission for US stocks |

| Forex trading fee | Spread, 1.4 pips for GBP/USD |

| Crypto trading fee | N/A |

| Inactivity fee | Free |

| Withdrawal fee | Free |

Pros:

- Very large and diverse asset range

- Up to 500:1 leverage

- Includes MetaTrader 4 and 5 platforms

- Supports social trading and copy trading

- Speedy trade execution

- $200 minimum deposit

Cons:

- Fixed commissions for share CFD trading

- No cryptocurrency trading

There is no guarantee that you will make money with this provider. Proceed at your own risk..

5. Robinhood – Best Platform for Day Trading US Stocks and Options

If you're a US resident and you're looking for a day trading platform to buy and sell stocks, Robinhood is well worth considering. Much like eToro, Robinhood is best suited for those of you that are looking to keep things simple.

That is to say, you won't find an abundance of chart drawing tools or technical indicators. You will, however, have access to over 5,000 US-listed stocks and ETFs. And best of all - Robinhood allows you to buy, sell, and trade these instruments on a 100% commission-free basis.

This is also the case with cryptocurrencies like Bitcoin. In addition to stocks, Robinhood is also a great day trading platform if you want to access options. Robinhood covers a wide variety of stock options with various maturity dates - all of which can be traded commission-free.

As a user-friendly day trading platform that is aimed at causal investors, Robinhood does not have a minimum deposit in place, nor will you be charged when you fund your account. You can also trade stocks on a fractional basis - meaning you only need to invest a few dollars into your chosen equity.

We should also note that Robinhood offers margin trading facilities. To be eligible for this, you will need to open a Gold Account and meet a minimum margin requirement of $2,000. Although this does come at a cost of $5 per month, you will be able to make instant deposits at a larger amount than the Standard Account permits.

In terms of the negatives, Robinhood does fall short in the asset department. Sure, you can trade stocks, Bitcoin, and options - but you won't have access to commodities like oil and natural gas. There is no forex offering, either. Finally, you won't be able to deposit funds with a debit card or e-wallet, as Robinhood only supports ACH and bank wires.

Robinhood fees

| Fee | Amount |

| Stock trading fee | Free |

| Forex trading fee | N/A |

| Crypto trading fee | Free |

| Inactivity fee | No inactivity fee |

| Withdrawal fee | No withdrawal fee |

Pros:

- Hugely popular trading platform in the US

- Buy over 5,000 US-listed stocks

- ETFs, cryptocurrencies, and stock options also supported

- Does not charge any commissions

- No minimum deposit in place

- Very simple to use and ideal for newbies

- Heavily regulated in the US

Cons:

- Only 250-ish international stocks offered

- No debit/credit card or e-wallet deposits

- Confusing margin rates

There is no guarantee that you will make money with this provider. Proceed at your own risk..

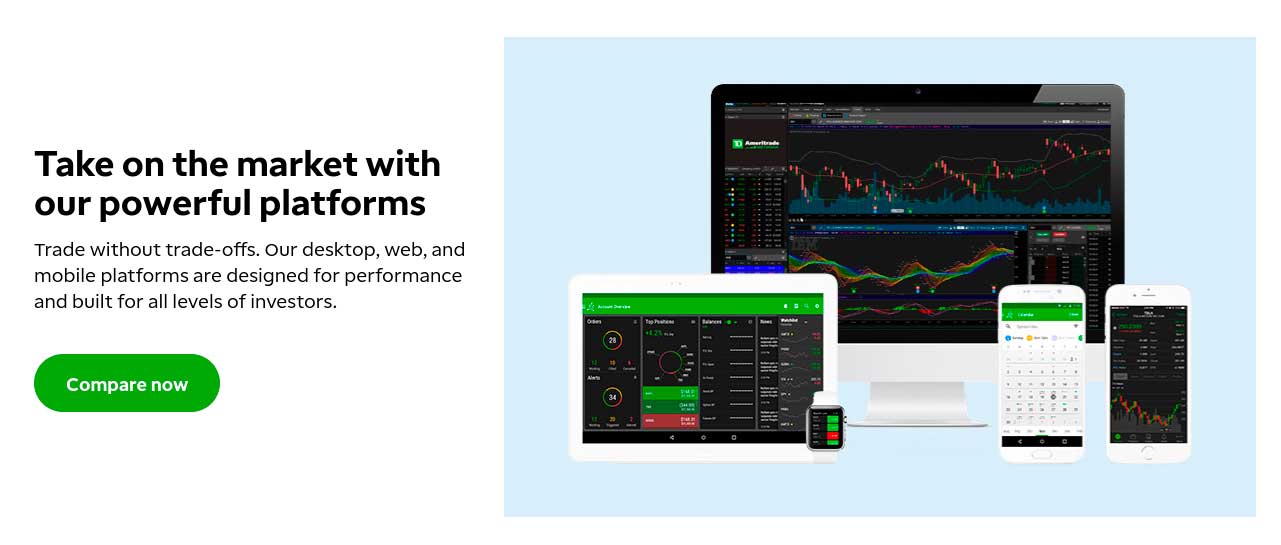

6. TD Ameritrade – Best Day Trading Platform for Advanced Traders

eToro and Robinhood are arguably the best day trading platforms for beginners. However, if you are an experienced pro that seeks a highly advanced trading arena - we would suggest looking at TD Ameritrade. Launched in 1975, the US-brokerage offers a huge asset library.

This includes thousands of stocks - both US-listed and international. You can also access ETFs and mutual funds, as well as bonds. If you're looking for more volatile assets, TD Ameritrade also covers financial derivatives like options and futures.

In terms of the day trading platform itself, TD Ameritrade offers one of the most unparalleled options in the markets. In what it calls thinkorswim®, the platform can be downloaded as desktop software for full functionality. You can also access thinkorswim® through your web browser and even a mobile app.

To give you an idea of the tools you will have access to on the native TD Ameritrade platform, which includes more than 400+ technical studies, sopthictaed pricing charts that can be customized to the 't', and more than 20 drawing tools. If you are an experience day trading pro and wish to take things to the next level, you might also find the thinkScript tool of interest.

Integrated with thinkorswim®, this allows you to build code-based trading strategies. As such, you can test out automated trading algorithms and create your own order execution model - all in a risk-free environment. TD Ameritrade even allows you to set up bespoke stock screening attributes.

This will can the markets in real-time based on your own technical and fundamental attributes. In terms of the fundamentals, there is no minimum deposit requirement at TD Ameritrade. Your trading fees and commissions will vary depending on which asset you are trading and the account plan you are on.

US-listed stocks and ETFs can be traded commission-free, and options start at $0.65 per contract. There is both a tiered and fixed commission plan, so choose one that suits your trading volume and frequency. Finally, as great as TD Ameritrade is, we should reiterate that the day trading platform is suitable only for seasoned pros.

TD Ameritrade fees

| Fee | Amount |

| Stock trading fee | Free |

| Forex trading fee | Spread. 1.2 pips average during peak hours. |

| Crypto trading fee | N/A |

| Inactivity fee | Free |

| Withdrawal fee | Free for ACH, $25 for wire transfer |

Pros:

- Trusted US brokerage firm

- App is available on iOS and Android devices

- Buy stocks and ETFs commission-free

- Options can be traded at just $0.65 per contract

- Fully-fledged paper trading account

- More than 11,000 mutual to choose from

- No account minimums

Cons:

- Not as user-friendly as other investing apps in the market

- The sheer size of tradable markets on offer can appear overwhelming

There is no guarantee that you will make money with this provider. Proceed at your own risk..

7. Interactive Brokers - Best Day Trading Platform for Asset Diversity

Some day traders will look to focus on a specific niche of the financial markets - such as USD-denominated forex pairs or blue-chip stocks. However, if you're the type of trader that wants access to a wide variety of markets, assets, and economies - look no further than Interactive Brokers.

Put simply, this trusted platform covers over 135 markets, 33 countries, and 23 currencies. In other words, if there is a financial market that you wish to trade - no matter how big or small, there is every chance that this trading platform supports it.

To give you an idea of the asset breakdown, you'll find everything from stocks, options, and currencies to funds, bonds, and IPOs. In a similar nature to TD Ameritrade, we would suggest that Interactive Brokers is a better option for experienced traders. This is because its proprietary trading platform is packed with advanced tools and indicators.

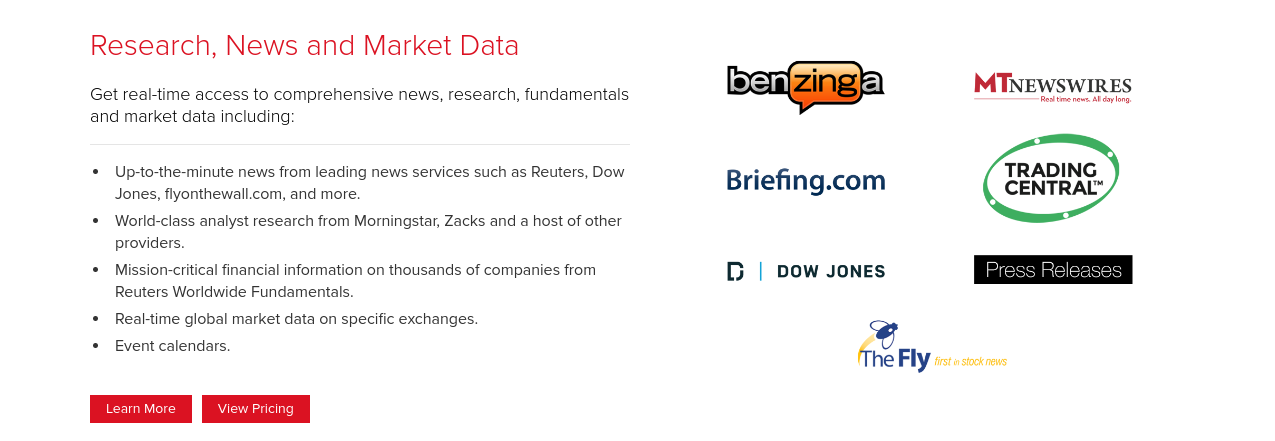

For example, the provider's flagship platform Trader Workstation - which is available via desktop software, covers advanced order types and risk management tools, as well as research, news, and market data. You can monitor key pricing trends in real-time with the aid of technical indicators and chart drawing tools.

On top of watchlists, customizable charts, and live quoting, the platform also offers a fully-fledged paper trading facility. This is great for testing our new day trading strategies and order types in a risk-free manner. When it comes to commissions, this will vary depending on your account type and the asset you wish to day trade.

As is standard in the US brokerage scene, you can buy and sell American-listed stocks and ETFs commission-free. Other stock markets come with either tiered or fixed commissions, so be sure to check this before opening an account. Finally, although Interactive Brokers is best suited for experienced traders, there is no minimum deposit in place.

Interactive Brokers fees

| Fee | Amount |

| Stock trading fee | Free |

| Forex trading fee | Commission + spread. Commission is 0.08 to 0.20 basis points. 0.1 pip GBP/USD. |

| Crypto trading fee | Commission. $15.01 per Bitcoin futures contract. |

| Inactivity fee | $20 per month |

| Withdrawal fee | Free |

Pros:

- Huge library of traditional stocks, index funds, and ETFs

- Really advanced trading features and chart analysis tools

- More than 135 markets across 33 countries

- Trade CFDs, futures, options, forex, and more

- No minimum deposit

- Buy US-listed stocks and ETFs commission-free

Cons:

- Not suitable for newbie investors

- Fee structure is a bit confusing

There is no guarantee that you will make money with this provider. Proceed at your own risk..

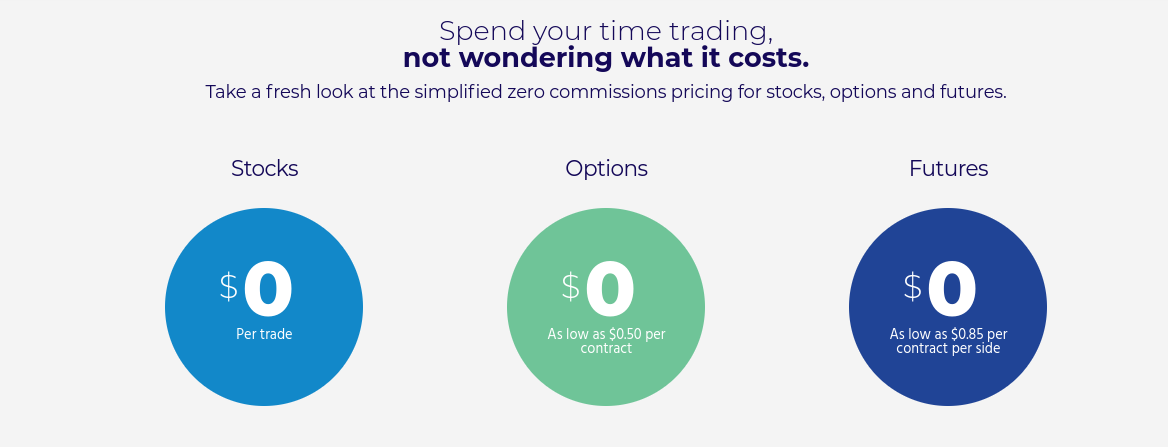

8. TradeStation – Best Day Trading Platform Mobile App

Make no mistake about it - if you're looking to day trade online then you will need a sophisticated desktop platform. This can either come in the shape of a browser-based platform or desktop software. With that said, some traders also like to access the markets while on the move.

After all, the trading arena can change on a second-by-second basis, so it's crucial that you are able to enter and exit positions at the click of a button when you are away from your main device. One of the best day trading apps that we have come across is offered by TradeStation.

Available on both iOS and Android devices, this top-rated day trading app comes with an abundance of advanced day trading features. This includes real-time streaming quotes on thousands of instruments and the ability to monitor market depth and volume. You can also place entry and orders with ease, and check on the status of active and pending positions.

The TradeStation app is also great for setting up and receiving alerts directly to your phone. Some of the alerts attributes that you can create include trading volume, price triggers, and even the VWAP. When it comes to tradable markets, TradeStation doesn't disappoint. This includes thousands of stocks, ETFs, and options - as well as futures, bonds, crypto, and mutual funds.

The TradeStation platform also gives you access to IPOs In terms of fees, TradeStation doesn't charge any commissions, although there is a small contract fee on options and futures. This varies from $0.50 to $1.50 depending on the market. If you want to trade non-US stocks, you will pay $5 per trade.

Although this might sound attractive, it won't be if you are looking to day trade and target small margins. If you're planning to trade crypto and you are a market taker, you'll pay a commission of 0.60% per slide. Cheaper rates are available for larger trading volumes, but this requires a minimum balance of $100k.

TradeStation fees

| Fee | Amount |

| Penny stocks trading fee | Free only for the first 10,000 shares |

| Forex trading fee | N/A |

| Crypto trading fee | 0.15% |

| Inactivity fee | $50 per year |

| Withdrawal fee | Free |

Pros:

- $0 commission on stocks

- Options charged at just $0.50 per contract

- Thousands of stocks including access to the OTC markets

- Great mobile trading app

- Excellent reputation

- Suitable for newbies and experienced pros

Cons:

- International assets not as extensive as other platforms in the space

There is no guarantee that you will make money with this provider. Proceed at your own risk..

Day Trading Platform Comparison

| Cryptocurrencies | Forex | Demo trading | Automated trading | Social trading | MT4/MT5 | 24/7 customer support | Multiple deposit methods | Regulated | |

| eToro | ✅ | ✅ | ✅ | ✅ | ✅ | ❌ | ✅ | ✅ | ✅ |

| Libertex | ✅ | ✅ | ✅ | ✅ | ❌ | ✅ | ❌ | ✅ | ✅ |

| VantageFX | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ |

| Robinhood | ✅ | ❌ | ❌ | ❌ | ❌ | ❌ | ✅ | ✅ | ✅ |

| TD Ameritrade | ❌ | ✅ | ✅ | ✅ | ❌ | ❌ | ✅ | ✅ | ✅ |

| Interactive brokers | ✅ | ✅ | ✅ | ✅ | ❌ | ❌ | ❌ | ✅ | ✅ |

| Plus500 | ✅ | ✅ | ✅ | ❌ | ❌ | ❌ | ✅ | ✅ | ✅ |

| Tradestation | ✅ | ✅ | ✅ | ✅ | ❌ | ❌ | ❌ | ✅ | ✅ |

How to Choose the Best Day Trading Platform for You

We have reviewed a selection of the best trading platforms available in 2025. If you read through each review, you might have noticed that no-two platforms are the same.

For example, some are suited for seasoned pros that seek highly advanced analysis tools, while others are great for first-timers.

It’s important to choose a day trading platform that is right for you and your skill-set, so check out the sections below to find a suitable provider.

Day Trading Tools

When investing in traditional assets like stocks, the process is relatively straightforward - even for newbies.

This is because in most cases, you will be investing in your chosen company for several years, meaning you won’t be overly concerned with short-term price shifts. Plus, there is rarely a need to perform technical analysis.

However, day trading is a completely different kettle of fish. After all, you will be opening a position and closing it within a few hours or minutes. This means that you need to choose a day trading platform that offers a variety of tools.

We would suggest looking out for the following tools in your search for the best trading platform for day traders:

Charts and Technical Indicators

Perhaps the obvious starting point is to check what charting tools the day trading platform offers. If you're an experienced trader, then you'll be looking for a good selection of technical indicators and chart drawing tools.

You'll also want a fully customizable trading screen and the ability to sent up price-related alerts.

Leverage

Even those with a substantial amount of trading capital will utilize leverage. This is especially the case when day trading forex. After all, forex is traded in lot sizes, which is usually 100,000 units of the base currency. By choosing a day trading platform that offers leverage facilities, you'll be able to enter much larger positions.

Auto Trading

Auto trading platforms are popular with both experienced and newbie investors. They allow you to buy and sell assets in a completely autonomous manner, meaning you can sit back and invest passively.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

The best day trading platform that we have discussed today - eToro, offers an automated tool called Copy Trading. This allows you to select a successful day trader that uses the eToro platform and then copy all of their positions.

Real-Time Data

Real-time data feeds are crucial for day traders, not least because the financial markets move at an alarming pace. As such, not having access to accurate and up-to-date asset prices can be devastating. This is why the best online brokers for day trading offer real-time quotes.

Fundamental Research

Although the vast majority of day trading is based on technical price movements, you should discount fundamental data. This refers to financial news that can impact the value of an asset.

For example, if the Federal Reserve announces that it is hiking interest rates, you'll want to know about this the very second the story breaks.

Execution Speed

Active traders will look to enter and exit a position in a matter of minutes. The only way to do this in a viable manner is if your chosen provider offers super-fast execution speeds. The Best trading platform for day traders will execute your order in a fraction of a second.

Assets

If you have a particular asset class in mind, make sure that your chosen day trading platform supports it. You should also take a closer look at what markets are on offer to ensure you have access to your preferred instrument. For example, you might opt for a forex trading platform because you want to trade currencies.

But, you still need to explore what pairs are on offer. This is also the case when trading stocks. That is to say, most day trading platforms offer US-listed equities.

However, if you want to trade markets in the UK, Europe, or elsewhere - make sure that it is supported before signing up. At eToro, you can trade over 2,400 stocks from 17 international markets, dozens of commodities, 55+ forex pairs, ETFs, indices, and more. As such, this top-rated day trading platform covers all bases.

Fees

As noted earlier, all day trading platforms charge fees in return for giving you access to the financial markets. This can come in various forms, so we've broken down the main fees to look out for below.

Commission

Many of the best day trading platforms discussed on this page allow you to trade on a commission-free basis. This means you won't pay a fee to enter or exit the position. However, many day trading platforms do a charge a commission - which is often a variable percentage.

For example:

- Let's say that you are day trading crypto at TradeStation

- The platform charges a commission of 0.6%

- You stake $1,000 to enter the market - so that's a commission of $6

- If you exit the trade when it's worth $1,400 - you'll pay a commission of $8.40

The same trade at eToro would have cost you nothing in commission.

Spreads

Apart from the odd exception like Libertex, all day trading platforms charge a spread. In fact, this is one of their main revenue sources. The spread is simply the difference between the buy and sell price of the asset you wish to trade. This gap in pricing ensures that the day trading platform always makes money. It is, therefore, an indirect cost to you.

- Spreads can vary wildly - not only depending on the day trading platform but the specific asset, too.

- For example, the best day trading platforms will often offer spreads of less than 1 pip on major forex pairs.

- But, at less competitive platforms, you might find the spread at 2-3 pips.

In most cases, the platform will display the spread (either in pips or percentage), which allows you to assess how much you need to factor into your trading costs.

Overnight Financing

If you are day trading, this means that you will always exit outstanding positions before the market closes. However, there might come an occasion where you decide to keep a position open overnight. If you do, this will attract an overnight financing fee. This is charged on each day that you keep the position open past market hours.

Regulation

In choosing a day trading platform that is licensed by one of the aforementioned bodies, you know that you are using a legitimate provider that does everything by the book.

For example, eToro is licensed by three of the above regulators, meaning that you will benefit from several investor protections. Not only does this include regular audits and KYC controls, but client funds must be held in segregated bank accounts.

If you come across a day trading platform that isn't regulated by a reputable financial body, you should not open an account with the provider.

Customer Service

In a time not so long ago, customer service was reserved for telephone support during standard market hours. However, we found that the best day trading platforms now offer a Live Chat facility that operates on at least a 24/5 basis - sometimes 24/7. This isn't the case with all platforms though - so you'll need to check what support channels are available before signing up.

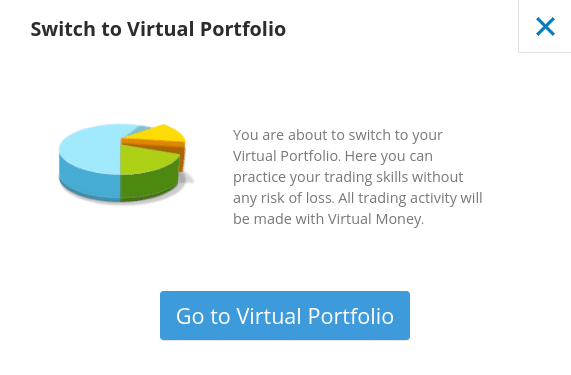

Demo Account

If you're new to the world of day trading, it's best to sign up with a platform that offers a demo account. At eToro, for example, you can trade with paper money in live market conditions. This not only means that you can get used to how day trading works, but the platform itself.

There is no requirement to deposit any funds to use a demo account facility, but you usually need to open an account first. We should also note that demo accounts are great for seasoned day traders, as they allow you to test out new strategies and technical indicators in a risk-free manner.

Payments

Even if you plan to start off with a demo account facility, you will likely want to trade with real money at some point. When you do, you'll want to ensure that your chosen payment method is supported. Some of the best day trading platforms discussed on this page allow you to instantly deposit funds with a debit/credit card or e-wallet.

Others only accept bank transfers. This can delay the funding process, so do bear this in mind if you want to start trading straight away. You also need to check what payment fees are applicable and whether or not an FX charge will apply.

How to Start Day Trading

Once you have chosen a day trading platform that meets your needs, you will need to go through the formalities of opening an account and making a deposit. After that, you'll need to set up a day trading order.

If this will be your first time joining a day trading platform, below we walk you through the process with eToro.

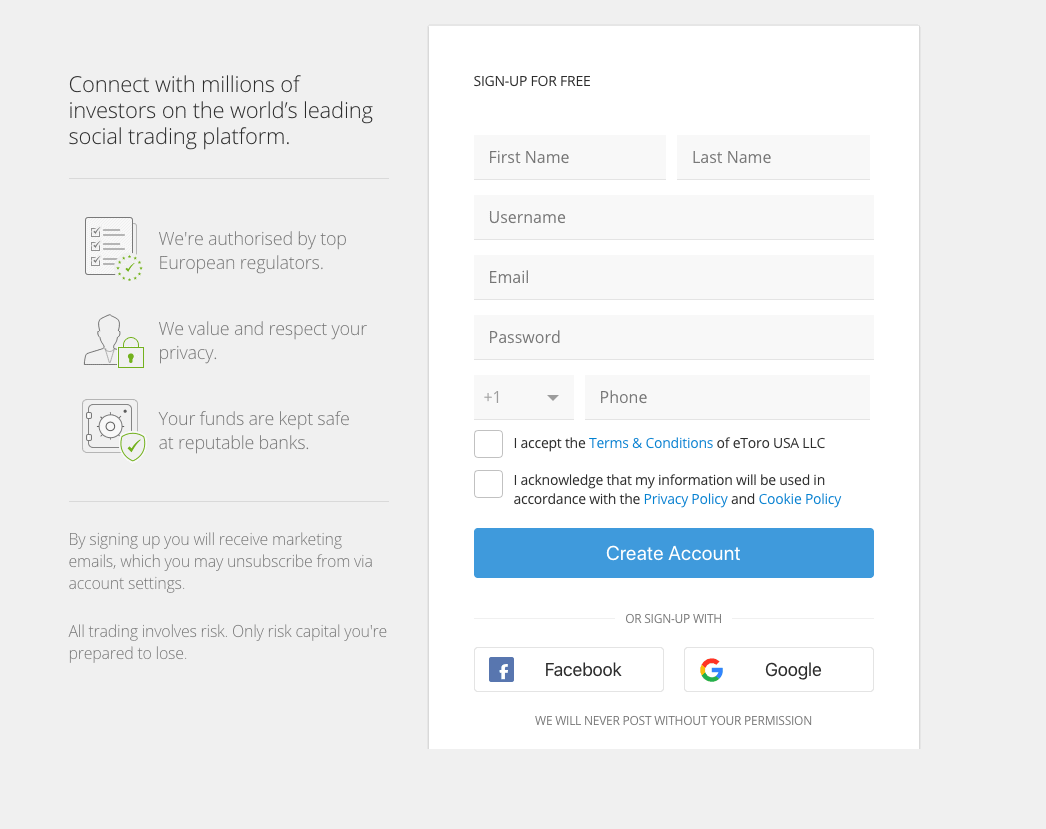

Step 1: Open an Account and Upload ID

Opening an account at eToro takes minutes. Simply head over to the eToro website, click on 'Join Now', and follow the on-screen instructions.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

You will be asked to provide some personal information and contact details, as well as verify your mobile number.

Step 2: Confirm Identity

All eToro users must go through a quick KYC process, as the platform is heavily regulated.

You will need to upload a copy of the following:

- Valid passport or driver's license

- Utility bill or bank account statement (issued within the last 3 months)

Step 3: Deposit Funds

As soon as you have opened an account and verified your identity, you can then start using the eToro demo account. This will allow you to day trade without needing to risk any capital.

If, however, you want to start day trading with real money, you need to meet a minimum deposit of $200 ($50 for US traders). You can choose from the following payment methods:

- Debit cards

- Credit cards

- E-wallets (Paypal, Skrill, or Neteller)

- Bank transfer

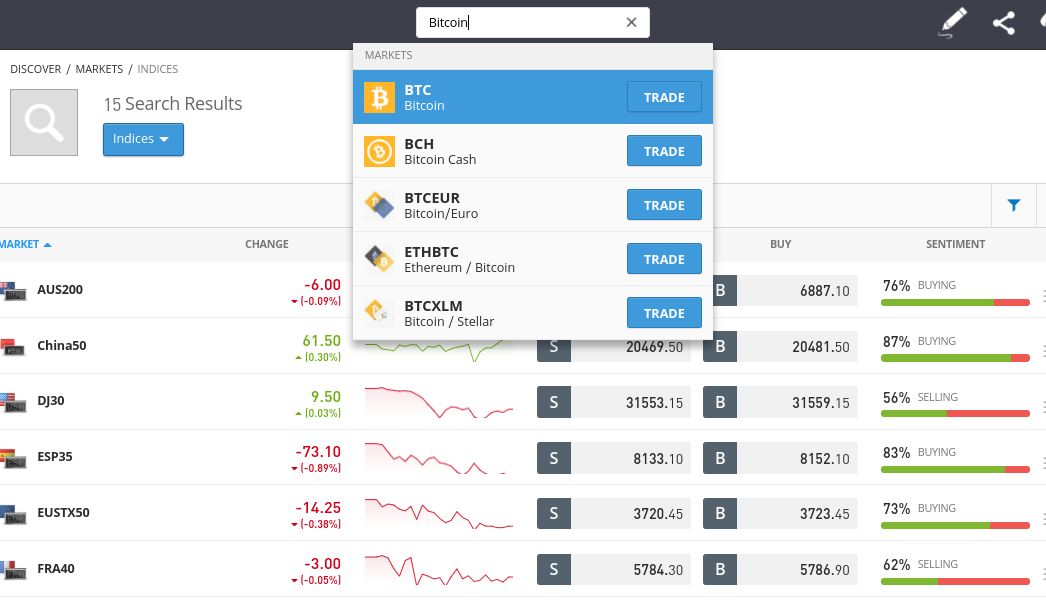

Step 4: Search for an Asset to Day Trade

If you're an experienced day trader then you likely have an asset class in mind. If so, you search for the specific instrument that you wish to trade. As you can see from the below, we are looking to trade Bitcoin.

If you want to see what markets are supported by eToro, click on the 'Trade Markets' button.

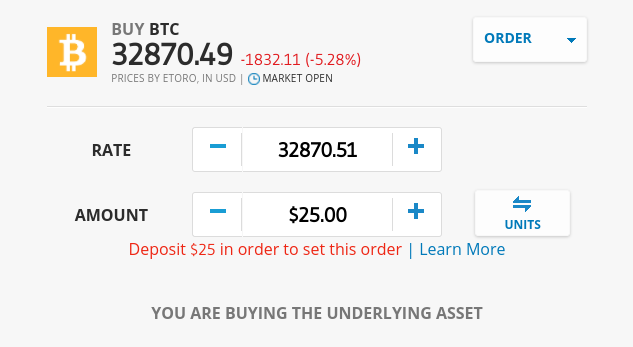

Step 5: Start Day Trading

Once you have an asset to trade, it's time to place an order. First, you need to choose from a buy or sell order. In our example, we are opting for a buy order, as we think the price of Bitcoin will rise. If you think the price of the asset will decline, change this to a sell order.

By default, you will be placing a market order - meaning that eToro will execute your position instantly. However, if you want to specify the price that you enter the market, change this to a limit order. You can also set up a stop-loss and take-profit order.

To complete your commission-free trade, click on the 'Open Trade' button!

Our Verdict on The Best Day Trading Platforms

In summary, choosing the right day trading platform for you is crucial. As we have discussed, you need to look at what assets the platform supports, fees and commissions, licensing, customer support, and payments. You also need to explore what trading tools you will have at your disposal.

After reviewing dozens of providers, we found that the best day trading platform in the market is that of Plus500. On top of offering thousands of commission-free markets, this regulated day trading platform is simple to use and comes packed with useful tools - such as its proprietary charting platform.

80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.