Best Stock Trading Platforms for June 2025

If you want to trade stocks from the comfort of your home – you may want to use a popular trading platform that can offer low transaction fees, multiple asset classes and various tools & features to facilitate your investments.

In this guide, we review the popular stock trading platforms for 2025. We also discuss some core stock trading and risk-management principles and walk you through the process of getting started.

-

-

Popular Online Stock Trading Platforms 2025

Below you find a list of the popular stock trading platforms in 2025. You can scroll down to read a full review of each platform to see which ones fit your personal trading goals.

- eToro: eToro is a fully-regulated broker that offers stocks, forex, indices, cryptos, ETFs and ready-made investment portfolios. The platform is popular due to its market-leading social trading features which allow users to see the trading activates of others. This is particularly helpful for beginners who can view the trading strategies of experts. eToro is available on both desktop and mobile app. The main drawback of the platform is that it is not compatible with any third-party trading platforms such as MT4.

- XTB Broker: XTB offers 0% commissions on stock CFDs and ETFs. The platform provides excellent customer services and market insights to assets users with their trading and focusses on informed decision making. It is possible to test the platform by using the free demo trading account that is available to all traders.

- Robinhood: Robinhood is a popular trading app that has a good reputation in the US. Through the app, users can invest in stocks and manage portfolios from their phones. The broker also offers cryptos, ETFs, options and retirement plans.

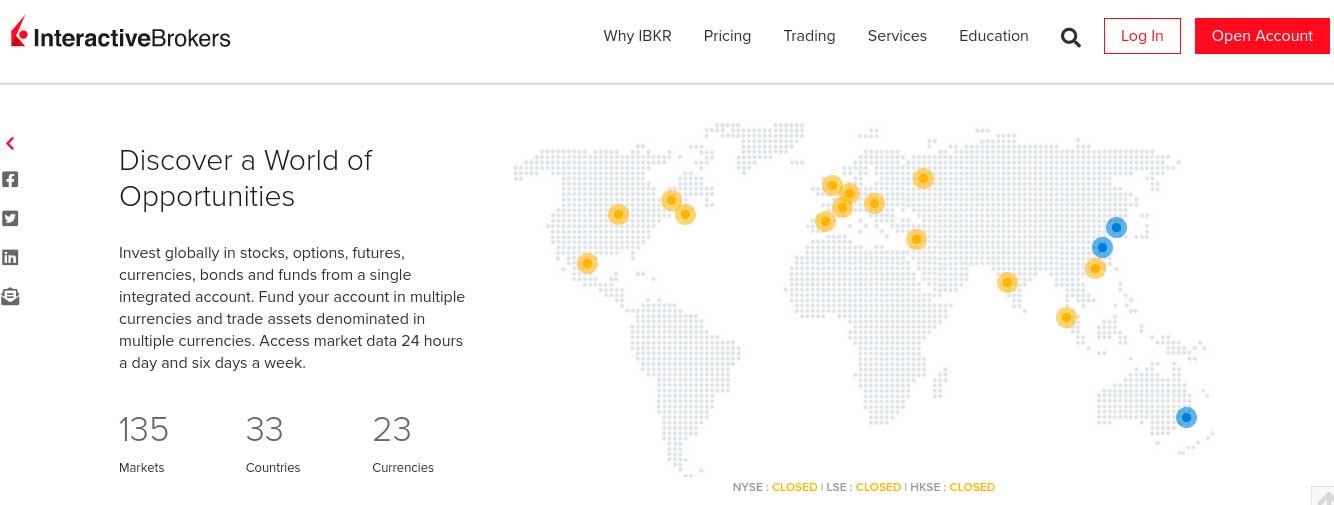

- Interactive Brokers: Interactive Brokers caters to experienced traders who want to conduct advanced analysis using charting tools. The platform supports traditional stock trading as well as stock options trading. Users can analyze the markets with the IBKR GlobalTrader app which is available on mobile and desktop.

- TD Ameritrade: TD Ameritrade is an established US brokerage firm that facilitates stock trading. The platform is catered towards long-term investors and provides several options for building a strong investment portfolio. TD Ameritrade offers fantastic customer support and a good range of educational resources.

- IG: IG is a CFD trading platform that provides access to over 17,000 markets including global stocks. The platform can also be used for spread betting, which is suitable for experienced traders. It is possible to test the platform with the demo account that is free to use for all traders.

- Fidelity: Fidelity is a reputable financial brokerage firm that supports long-term stock investing. The platform also offers financial advice and market-leading support to help investors to create a profitable long-term portfolio.

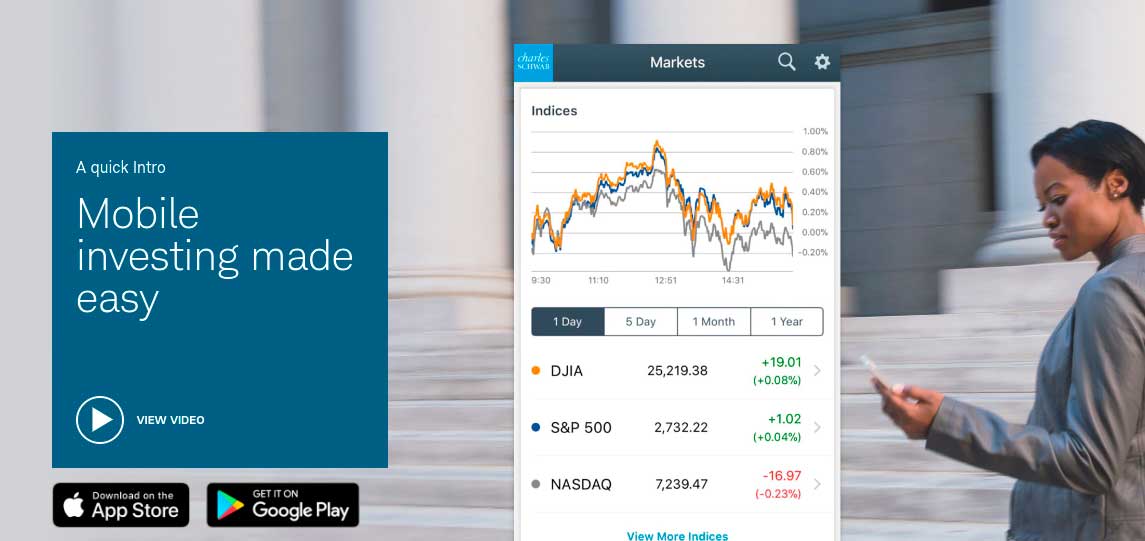

- Charles Schwab: Charles Schwab is a US trading platform that provides market-leading education and expert support. You can sign up without depositing any funds and explore the various platform features for free.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Factors to Look at When Choosing a Stock Broker

You may want to compare and review popular platforms before you begin your investing process. If so, you’ll want to perform lots of research to ensure the platform is right for you and your stock trading goals, for example, if you want to invest in Amazon $250 or purchase cannabis stocks.

To point you in the right direction, below you will find a list of key metrics and factors which may be looked at to assess trading platforms.

Regulation

Even in 2025, you would be surprised by just how many unregulated stock trading platforms are active in the online arena.

Many of the popular stock trading regulators include the likes of the FCA (UK), FINRA (US), CySEC (Cyprus), and ASIC (Australia). These financial bodies – although located in different jurisdictions, have many things in common.

Some of the demands they have on the online stock trading platforms they regulate include:

- Ensuring that the free stock trading platform identifies all account users. This keeps financial crime away from the platform.

- Client funds must be stored in segregated bank accounts. This ensures that the platform doesn’t use your money to fund its own liabilities.

- Leverage must be kept in line with regulations imposed by the trader’s country of residence.

- Regular audits of the platform ensure that traders can buy and sell assets in a safe environment.

Crucially, all of the popular trading platforms that we reviewed on this page are heavily regulated by reputable financial bodies.

Assets

After ensuring the security of your trading funds on the platform, it’s essential to investigate the range of supported assets. Typically, popular free stock trading platforms encompass listings from the NYSE and NASDAQ in the US. This allows for trading in stocks such as Facebook, Amazon, Visa, Virgin Galactic, Johnson & Johnson, and Tesla.

Additionally, these platforms commonly provide access to the London Stock Exchange and various European marketplaces.

Shares or Traditional CFDs

Many stock platforms allow users to invest in shares and CFDs. While a share investing platform allows you to purchase and hold the asset, a CFD platform will also allow you to apply leverage and trade on the future movements of an asset.

Stock CFD sites are also known to offer really competitive spreads, too. Depending on your investing goals, you can choose a platform that allows you to trade in shares, CFDs, or even both.

Fees

Stock trading platforms – even though offering a commission-free service, will always charge a fee of some sort. They are business to make money, so this makes sense.

The main fees that you may want to look at are are follows:

Stock Trading Commission

Most stock trading platforms charge a commission when you enter and exit the market. This is usually a variable commission that is multiplied against your stake.

For example:

- Let’s suppose your chosen stock trading platform charges a commission of 0.15%

- You stake $1,000 on this trade

- Your commission, therefore, amounts to $1.50

- When you decide to exit the trade, your position is worth $1,400

- You again pay a commission of 0.15%. Only this time, your commission amounts to $2.10

Stock Trading Spreads

When trading stocks online, many platforms charge a spread. In its most basic form, this is the difference between the ‘bid’ and ‘ask’ price of the stock you are trading.

The bid price is the highest price a new buyer will pay for the stock, while the ask price is the lowest amount a seller will accept. While at first glance this might seem inconsequential, this gap in pricing is how stock trading platforms ensure they make a profit.

This can be another feature which you can use while assessing the popular stock brokerages.

Leverage Fees

If you want to trade stocks online with leverage, then you will be required to do so via a CFD instrument. This is fine, but it is important to note that leverage CFD products attract ‘overnight financing’ fees. As the name suggests, this is a few for each night that your stock trade remains open.

The amount that you will pay on overnight financing when trading stock CFDs can vary depend on on the:

- Specific stock

- Amount of leverage you apply

- Size of your stake

- Whether your trade remains open over the weekend

Other Fees

On top of commissions, spreads, and overnight financing – there are several other fees that your chosen stock trading platform might charge.

This includes:

- Transaction Fees: Most of the stock trading platforms that we have discussed today allow you to deposit and withdraw funds without incurring a fee. However, some do charge transaction fees, so check this out before opening an account.

- FX Fees: You might need to pay an FX fee when you trade a stock that is priced in a currency other than your own. FX fees are sometimes charged on deposits, too.

- Inactivity Fees: If you fail to place a trade for a certain period of time (usually 12 months), the platform might start charging you an inactivity fee. This is usually debited from your account until you place a trade or your balance hits zero.

As per the above, having a full understanding of what fees your chosen stock trading platform charges is a crucial part of the research process.

Trading Tools & Features

There can be a vast disparity in what trading tools online platforms offers. For example, while some platforms offer an abundance of features that can enhance your trading experience, others provide a skin and bones service.

Nevertheless, some of the most notable features that the popular trading stock platforms offer include:

Fractional Shares

Fractional sharing allows users to purchase a percentage of a stock, instead of the whole share. This may be of note for users looking to diversify their investments and invest with a limited budget.

Short-Selling

The stock markets will always go through trends – both northwards and southwards. As such, some stock trading platforms will give you the option of going long and short on your chosen market.

Going long simply means that you think the stocks will increase in price. As such, this is no different from buying shares in the traditional sense. But, going short means the opposite, insofar that you think the stocks will decrease in price.

Depending on the features you are looking to access, you can compare the popular brokers accordingly.

Education, Research & Analysis

Many platforms may provide users with educational and research tools to assist you in your investment process.

At the forefront of this is a full suite of educational materials that can take your stock trading endeavours to the next level.

This might include:

- Trading guides

- Video explainers

- Blogs and articles

- Market insights

- Trading tips

- Webinars

- Courses

In addition to educational resources, the popular free stock trading platforms come packed with research and analysis tools. Regarding the former, this might include financial news stories that can be accessed directly on the platform.

There are also many data resources available outside of brokerages to consider. For example, AltIndex provides comprehensive alternative data as well as stock indicators and alerts to help inform your investing.

Mobile App

Many popular platforms allow users to access their investments via a mobile app. The convenience of mobile trading will allow users to access trades without having to be in their homes – this can be important if you are keen on investing when the market opens or closes in a convenient way.

Payments

Some of the online stock trading platforms discussed on this page allow users to deposit currency in multiple ways. Depending on your preferred payment option, you may be able to begin trading with one or more of the options listed below:

- Credit/Debit card

- Online bank transfers

- Wire transfers

- e-wallets such as PayPal, Neteller, etc.

Customer Support

The popular stock trading platforms operate in a smooth and burden-free manner – and provide assistance to users on a 24/7 basis. For users who are keen to start trading with a reputable platform that works around the clock to respond to customer enquiries, you can compare the available options accordingly.

Best Stock Trading Brokers Reviewed

We spent countless hours reviewing the most prominent free stock trading platforms in the online arena. The research process focused on everything from supported stock markets and trading commissions to licensing and customer support.

As such, below you will find a selection of some of the popular trading platforms in 2025 and beyond. You can use these to purchase stocks in almost any sector from solar energy stocks, wheat stocks, corn stocks to inflation stocks.

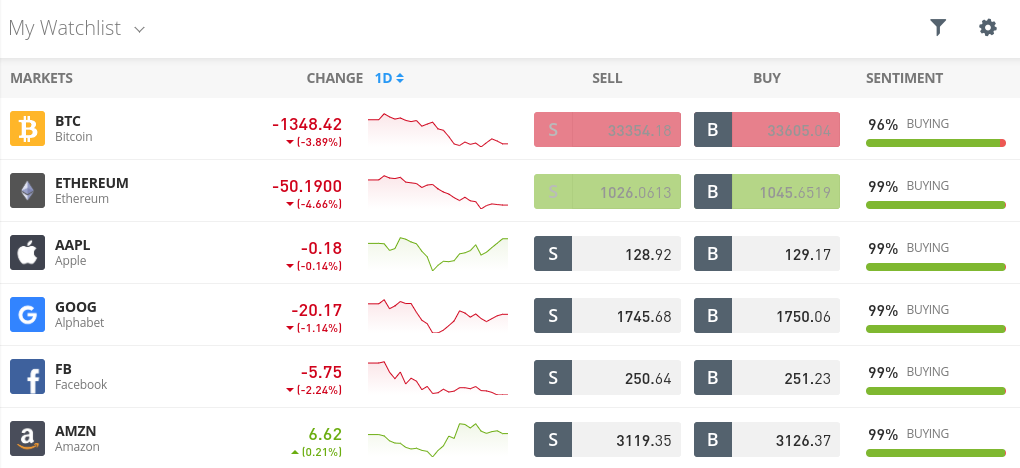

1. eToro

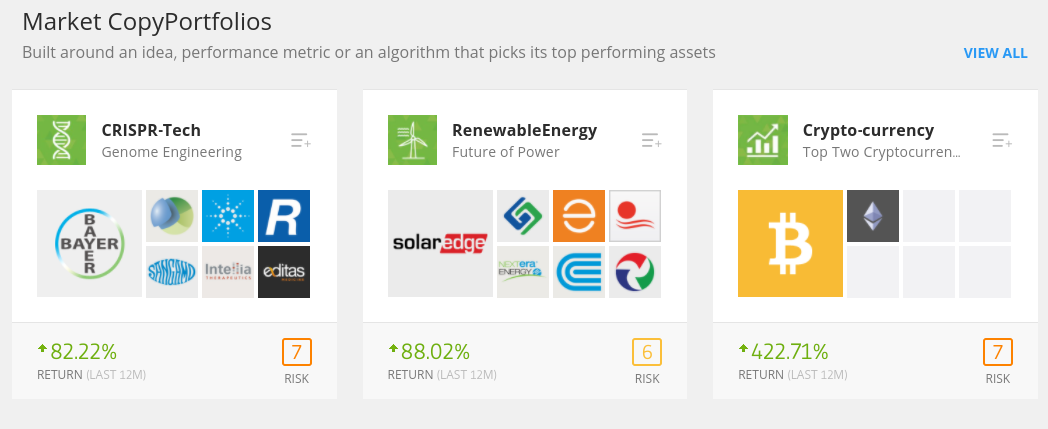

eToro is a popular global brokerage with over 15 million users. Using this platform, you may buy, sell, and trade over 2,400 stocks from 17 international markets.

On top of major exchanges like the NYSE, NASDAQ, and London Stock Exchange – you can also trade companies listed in Germany, France, Sweden, Hong Kong, and many others. Furthermore, this stock trading platform is commission-free.

At eToro, the minimum amount required for a stock trade is only $50, regardless of the share price. This applies universally, thanks to eToro’s support for fractional ownership, even when buying stocks like Palantir.

eToro is also perfectly suited for first-time stock traders who are searching for a popular stock broker. The platform is simple to use, it takes just minutes to open an account, and it even offers automated trading services. At the forefront of this is the platform’s innovative Copy Trading feature. As the name implies, this allows you to copy the portfolio of an experienced stock investor. You can find everything pharmaceutical stocks, energy stocks, to popular commodities like coffee stocks or sugar stocks to trade in eToro as well.

This Copy Trading feature can be accessed at a minimum of $10 per investor and comes with no additional charges for online trading. In terms of funding, eToro supported debit cards, credit cards, bank transfers, and e-wallets like Paypal and Neteller. Finally, in terms of regulation, eToro is licensed with the FCA, ASIC, and CySEC, and registered with FINRA in the US.

To learn more about eToro, check out our eToro review.

Stock Broker Minimum Deposit Fractional Shares? Pricing System Cost of Buying Stocks Fees & Charges eToro $10 Yes – $10 minimum 0% commission on ALL real stocks, spreads for CFDs Market spread is not included when purchasing real stocks No Deposit fees, $5 withdrawal fee, $10 inactivity fee, no account management fees. Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

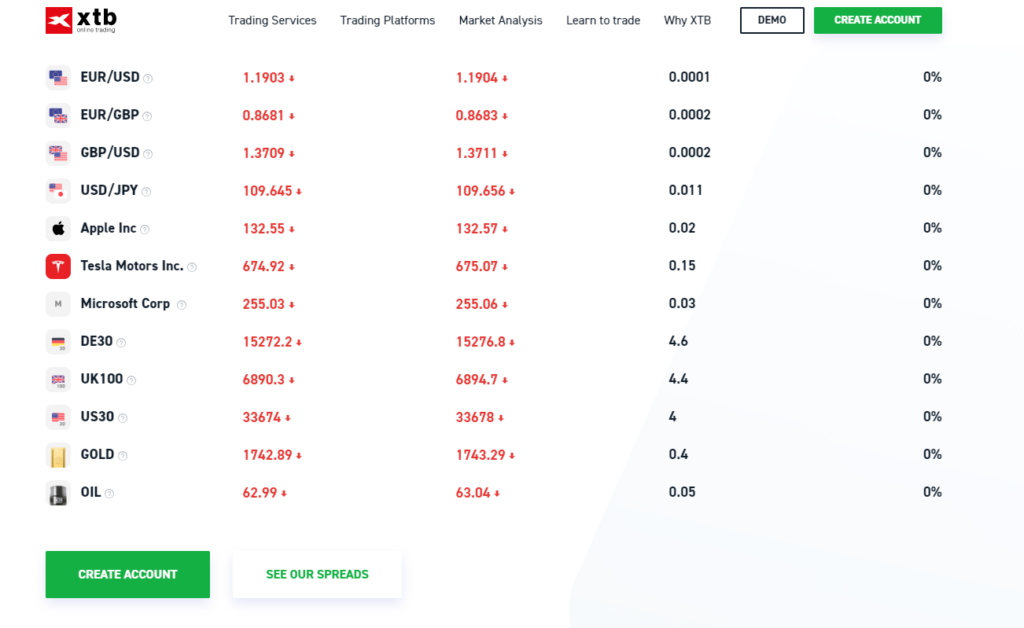

2. XTB

In 3rd place is XTB- an excellent broker to consider if you are looking to trade CFDs. The broker has won a number of awards for its top-rated services and is considered to be one of the best options for both beginner and advanced traders alike.

In addition to its top-rated trading features, XTB provides a variety of remarkable educational resources designed to aid new traders in understanding the market while also supporting experienced traders in refining their existing skills. These resources encompass market news, informative articles, and comprehensive e-books. Moreover, users can access an array of advanced technical analysis tools.

XTB has made a name for itself and has patterned with some big names as a result. Most noticeably is current brand ambassador Connor McGregor who regularly advertises the platform to his fans. Partnerships such as this suggest that the broker is reliable and has a great reputation.

The broker offers two platforms for trading: xStation 5 and xStation mobile. Both platforms are renowned for their fast execution seeds, top-range market analysis tools and accurate indicators. For forex trading, spreads start from just 0.1 pips and 48 currency pairs are available to trade.

Traders can use XTB to place trades 5 days a week for 24 hours. This excludes weekends. This means that it is possible to access the market in the evenings and mornings, which is ideal for traders who want to fit trading around a 9-5.

Further more, XTB offers fast deposit and withdrawals. This makes it easy to access your funds and begin trading. The sign up process can be completed in minutes and requires only a few personal details as well as a deposit of $250.

XTB does not determine the amount of the minimum initial deposit. In practice, this means that you can open a real account and start trading from any deposit.

The only limitation will be the minimum transaction volume and the resulting minimum margin deposit.

75% of retail investor accounts lose money when trading CFDs with this provider.

3. Robinhood

Robinhood is a US-centric free stock trading platform that is now home to over 10 million American investors. The main attraction of Robinhood is that it allows you to trade over 5,000 stocks without paying any commission.

Apart from a small selection of foreign companies, all stocks hosted at Robinhood are US-listed. This means that you can trade some of the largest stocks in the world without breaking the bank.

After all, Robinhood supports fractional ownership, meaning that you can invest in stocks with just a few dollars, such as GameStop shares, among others. Outside of the core stock trading department, Robinhood also offers financial products such as ETFs, cryptocurrency assets, and even options. A lot of Robinhood users will trade online, albeit, the platform also offers a fully-fledged mobile app.

There is also no minimum deposit policy at Robinhood, which may suit users with a tight budget.

The main drawback with Robinhood is that it only supports debit cards issued by a US bank in the Visa and Mastercard networks.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

4. Interactive Brokers

Interactive Brokers provides users with a desktop platform that comes packed with an abundance of supported markets and trading tools.

Interactive Brokers gives you access to more than 135 markets in 33 countries. This means that you can trade stocks that are listed in the US, Canada, Europe, Asia, and more.

In other words, if there is a low-cap international stock that you wish to trade, there is every chance that you will find it on this popular platform.

Interactive Brokers (IBKR) comes highly recommended for individuals seeking a brokerage that offers excellent services across the board at minimal fees.

Distinguished by its unparalleled array of asset types sourced from global exchanges, IBKR provides numerous trading platforms known for their exceptional functionality and advanced research tools.

The IBKR Global Trader app serves as an ideal entry point for novice traders looking to venture into stocks, ETFs, options, and cryptocurrencies. Simultaneously, seasoned users can leverage the intricate capabilities of Trader Workstation, catering to more complex trading strategies.

However, the broker does have its drawbacks, such as a lengthy and cumbersome account opening process, potential complexity of certain platforms for beginner traders, and occasionally busy customer service.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

5. TD Ameritrade

In a similar nature to International Brokers, TD Ameritrade is an established online brokerage firm that has been operational since the 1970s. The platform is now home to every tradable asset class imaginable.

On top of a huge stock trading library, this also includes thousands of ETFs and mutual funds, as well as bonds and digital currencies. In terms of what stocks you can trade, TD Ameritrade supports tens of thousands of shares across dozens of marketplaces.

In fact, this popular trading platform also gives you access to initial public offerings (IPOs) – both in the US and overseas. If you decide to trade stocks listed on the NYSE or NASDAQ, TD Ameritrade will not charge you any commission.

This is also the case for US-listed ETFs and options. International stock markets come with different commission rates depending on the exchange. TD Ameritrade is also useful if you are looking for an abundance of research and analysis tools. This includes real-time quotes, third-party stock reports, and a super-advanced trading platform that comes packed with technical indicators.

As is often the case with so-called old-school brokers, TD Ameritrade only supports bank account transfers – so no debit/credit cards.

However, this financial firm headquartered in Omaha, Nebraska, enables its clients to deposit funds into their accounts via a debit card stored in their Apple Pay digital wallets. Through the wallet and utilizing Apple Business Chat, TD Ameritrade customers using Apple devices can swiftly transfer up to $10,000 daily to their accounts, gaining instant access—a pioneering feature within the brokerage industry, as claimed by the firm.

With that said, bank transfers are typically processed very quickly at this free stock trading platform – so you won’t need to wait long before you can start placing orders.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

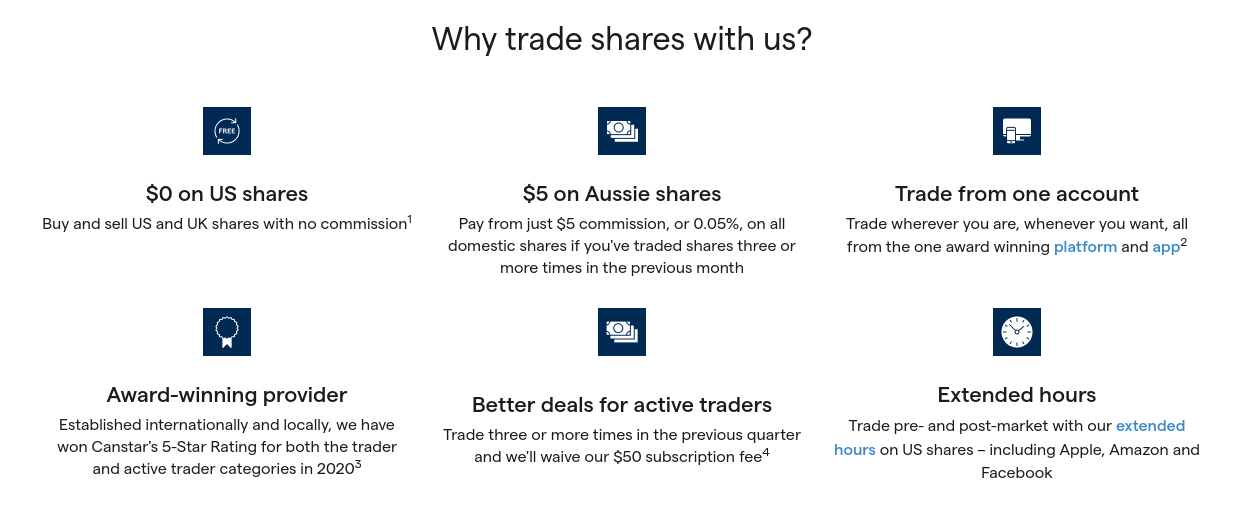

5. IG

IG is a UK-based trading platform and online broker that was first launched in 1974. This popular platform accepts account registrations from most countries – which has resulted in a global customer base of over 239,000 traders.

On top of forex, commodities, cryptocurrencies, and ETFs – IG allows you to trade stocks at the click of a button. This includes markets in the US, UK, Australia, New Zealand, South Africa, Asia, and heaps of European exchanges.

In terms of trading commissions, this will depend on where you are based. For example, some countries benefit from commission-free trading on US and UK stock CFDs, while others will pay a small commission that averages 0.10%. Each specific marketplace usually carries a variable commission that comes with a minimum charge.

IG also offers two trading platforms. This includes its own proprietary platform and MT4, where you can do mobile trading as well.

The latter is suitable for advanced traders that want access to technical indicators and chart drawing tools, as well as the ability to deploy an automated robot. Depending on your location, you’ll likely be offered leverage on your stock trading endeavors. Finally, IG is regulated in several jurisdictions, so you should have concerns regarding safety.

.There is no guarantee that you will make money with this provider. Proceed at your own risk..

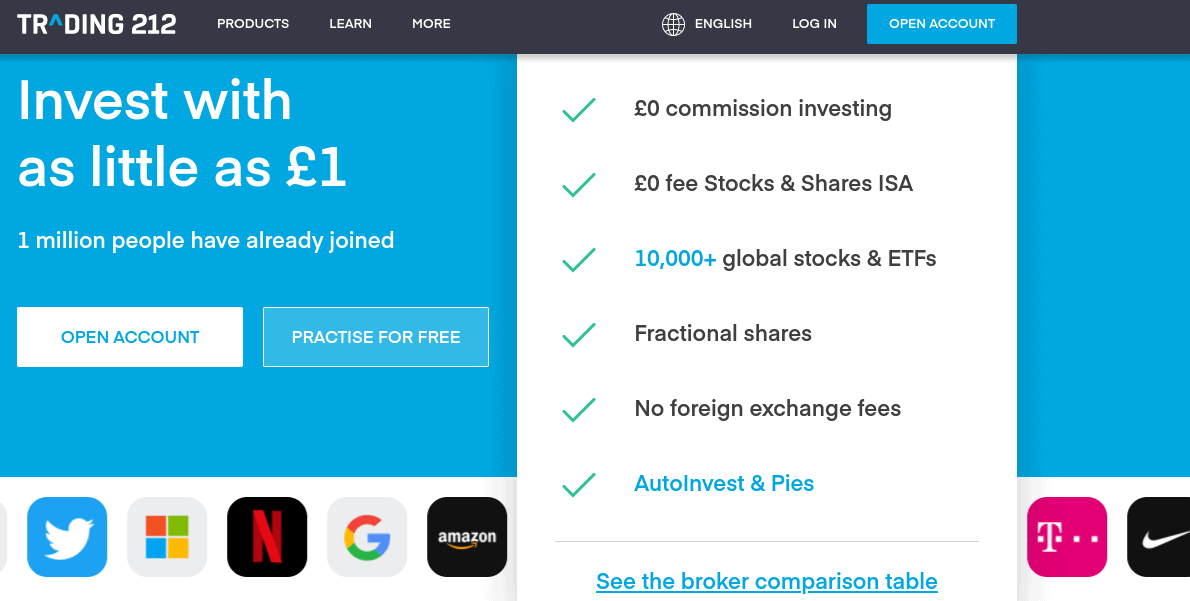

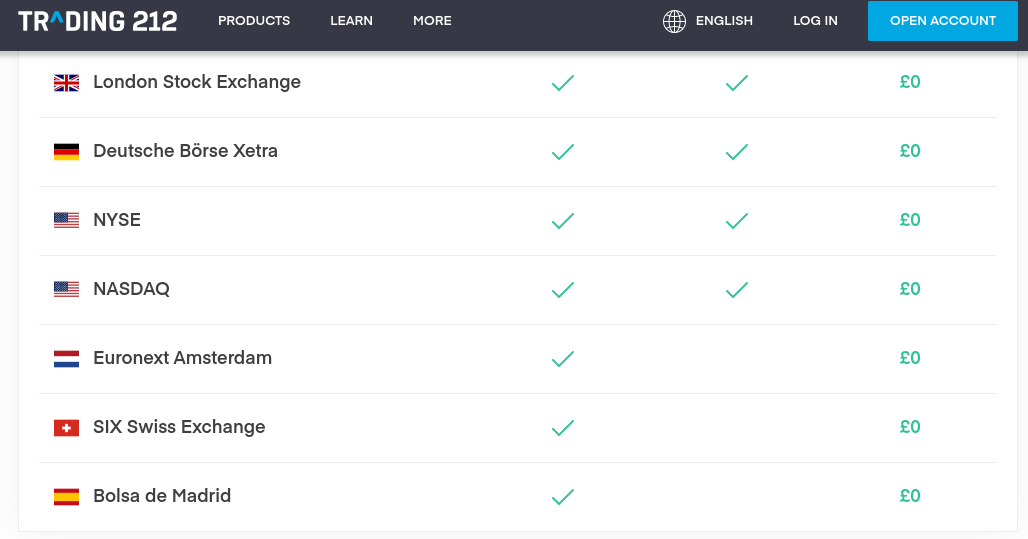

6. Trading 212

Using Trading 212, it takes just minutes to open an account and you don’t need to have any prior experience to navigate around the trading arena.

This popular broker allows you to invest in over 10,000 global stocks and ETFs – all on a commission-free basis. Notbaly, as Trading 212 supported fractional ownership, the minimum investment is just £1 (or currency equivalent).

This makes it suitable if you want to trade stocks for the first time without risking too much money. In terms of supported exchanges, Trading 212 focuses on the UK, US, and several European markets. What we also like about Trading 212 is that you also have the option of trading stock CFDs.

This comes with the added feature of being able to short-sell your chosen stock as well as apply leverage. Regarding the latter, stock CFD leverage is typically capped at 1:5 on Trading 212, meaning you can trade with five times your current account balance. On top of stock CFDs, you can also trade forex and commodities.

In terms of funding your account, you can make an instant deposit with a debit/credit card or e-wallet. There are no fees to deposit or withdraw funds. The main drawback with Trading 212 is that you will be charged a 0.5% FX fee on CFD instruments that are not priced in your primary account currency.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

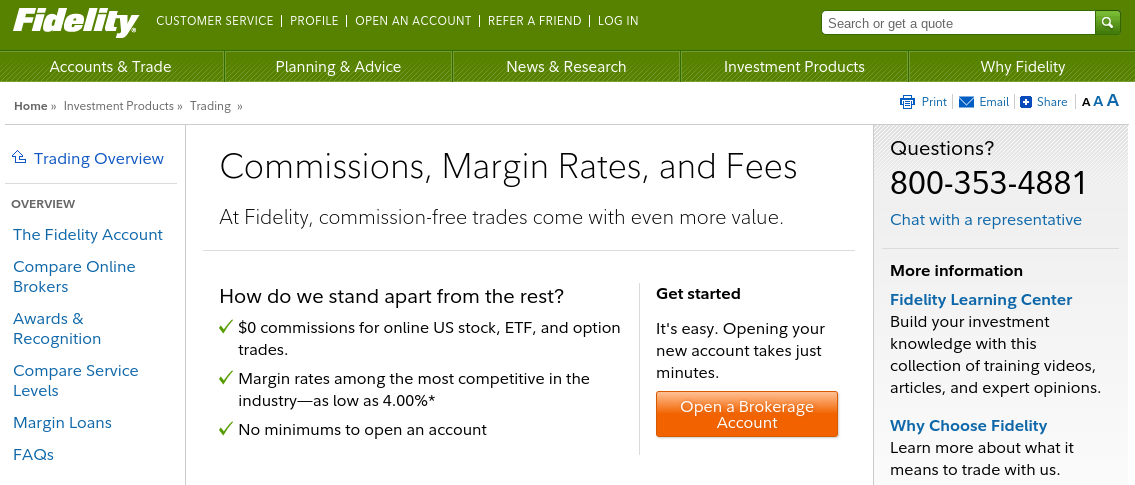

7. Fidelity

Fidelity is a popular US-based trading platform that covers stock markets in over 25 countries – giving you ample opportunity to diversify. You can also invest in newly-listed US IPOs, which is ideal if you want to purchase shares in a company that is just starting its corporate journey.

Fidelity also allows you to invest in mutual funds and ETFs – as thousands of instruments are supported. In terms of pricing, Fidelity has since jumped on the commission-free bandwagon. This is the case with all US-listed stocks, ETFs, and options.

International shares will come with a dealing fee that will vary from exchange to exchange. Fidelity also provides margin trading option and does not require any minimum deposit to get started. Still, it has relatively high broker-assisted trade fee.

This means that you can get started with a few dollars and test out the waters before making a larger financial commitment. Finally, Fidelity can be also accessed in the US and can be used to combine your stock trading endeavors with a long-term IRA retirement plan.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

7. Charles Schwaab

If you are a seasoned stock trader, then you will know the importance of having access to the financial markets 24/7. That is to say if you need to enter or exit a trade at the click of a button – you’ll want to be able to do this no matter where you are located.

Charles Schwab is an established online brokerage firm allows you to trade thousands of stocks.

This covers US-listed companies as well as those based overseas. Through the Charles Schwab ‘Stock Slice’ feature, you can trade your chosen shares from just $5 upwards. Charles Schwab is also one of the very few retail client platforms that allow you to access the OTC (Over-the-Counter) markets.

For those unaware, this is where you will find the majority of US-listed volatility penny stocks as penny stock trading platform. When using the Charles Schwab stock trading app, you will find it simple to find your chosen market. On top of a search facility, you can also narrow the stock library down via the built-in filter.

Crucially, the Charles Schwab app has been fully optimized for both iOS and Android. Using the platform, you can access real-time financial news throughout the day – which is provided by the likes of Morningstar and Thompson Reuters.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

How to Start Stock Trading

If you’ve read this review on the popular stock platforms of 2025 and choose to invest using the popular stock trading platforms, you may want to find out on how to do so as well.

In the sections below, we will show you how to begin the trading process with a suitable broker of your choice.

Step 1: Open Your Account

Head over to the homepage of your chosen broker and begin the account set-up process. You will be required to fill in your personal details – including your full name, email address and mobile number. Create a username and password for the platform to continue.

Step 2: Complete the Verification Process

Most popular brokers are regulated- which is why users may be required to verify their accounts. To do this, simply upload proof of ID (a copy of your driver’s license or passport) and proof of address (a copy of a bank statement or utility bill). Once these documents have been uploaded, your broker should verify them in a couple of minutes.

Step 3: Deposit funds

The next step is to deposit funds into your trading account. Most brokers may support 1 or more of the following payment methods:

- Credit card

- Debit card

- Bank transfer

- e-wallet

Choose your preferred payment option and deposit the funds into your account.

Step 4: Invest

Once your account has been funded, proceed to search for any stock or other asset you wish to purchase. Search the name of the asset on your platform’s navigation bar and hit ‘enter’. Fill in the amount you want to credit into the trade, and confirm your transaction.

What Is The Cheapest Stock Trading Platform?

When searching for the cheapest stock trading platform, there are several different types of fee to consider. The majority of stock trading platforms are free to use but charge a commission on every trade that you place to make profit. Others may charge zero commissions on stock trades but may charge a platform subscription fee, account management fee or withdrawal fee instead.

The cheapest stock trading platform is one that provides the best return for the fees that you pay. If you plan on making a large number of trades each month, it may be cheaper to use a platform that charges one flat fee rather than commissions on each trade. However, traders who plan on making a smaller number of traders may get better value by using a free platform that charges a small fee on each trade that is placed.

eToro- our recommended platform- is completely free to use and charges low commissions on stock trading. The broker is widely considered to be one of the cheapest platforms on the market. Furthermore, it is possible to use the demo trading account free of charge so that you can decide whether or not the platform works for you before depositing any funds.

Conclusion

With so many stock trading platforms striving for your business, users may want to compare and review which platform can cater to their needs and preferences. In this guide, we have reviewed some of the factors which users can use to make their analysis, along with popular brokerage options for you to analyse.

Make sure to conduct your own research while picking a preferred stock trading platform.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

FAQs

How do stock trading platforms make money?

Much like traditional brokerage firms, the popular stock trading platforms make money by charging fees. This might come via trading commissions and/or the spread. Some stock trading platforms also make money by charging deposit/withdrawal fees, overnight financing fees, and inactivity fees.How do you short stocks online?

The easiest way to short stocks online is to use a trading platform that supports CFD instruments. This means that you simply need to place a sell order on the stock you wish to speculate against.Kane Pepi Finance Writer

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Kane has also written for websites such as MoneyCheck, InsideBitcoins, Blockonomi, Learnbonds, Buyshares n and the Malta Association of Compliance Officers.

Before starting his career as a writer, Kane studied at the University of Central Lancashire where he received a Masters Degree in Financial Investigation and then a Research Doctorate in Criminal Justice. Pepi is passionate about helping people to make informed decisions through high-quality, educational content.

Visit eToroeToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.eToro: Best Trading Platform with 0% Commission

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up

In 3rd place is XTB- an excellent broker to consider if you are looking to trade CFDs. The broker has won a number of awards for its top-rated services and is considered to be one of the best options for both beginner and advanced traders alike.

In 3rd place is XTB- an excellent broker to consider if you are looking to trade CFDs. The broker has won a number of awards for its top-rated services and is considered to be one of the best options for both beginner and advanced traders alike.

If you are a seasoned stock trader, then you will know the importance of having access to the financial markets 24/7. That is to say if you need to enter or exit a trade at the click of a button – you’ll want to be able to do this no matter where you are located.

If you are a seasoned stock trader, then you will know the importance of having access to the financial markets 24/7. That is to say if you need to enter or exit a trade at the click of a button – you’ll want to be able to do this no matter where you are located.