How to Invest in Stocks in July 2025 – Beginner’s Guide

To the uninitiated, investing in the stock market can seem a daunting prospect. After all, it is a topic steeped in specialist knowledge and can take a lifetime to master.

But often overlooked is the fact that, particularly in the modern era of technology, investing in stocks can be perfectly accessible for beginners. Besides a basic level of education and a degree of discipline, an intuitive online brokerage platform is all that is required.

In this guide, we will examine all the fundamentals of investing in the stock market for the first time, in addition to some of the best online trading platforms available today.

-

-

A Quick Guide To Investing in Stocks in 2025

Below is a quick step-by-step guide that covers the basics of stock investing in 2025. For a more detailed tutorial, keep reading through our guide.

Step 1: Research different stock brokerages to find a platform that suits your trading strategy. Then, create an account by filling out the required form.

Step 2: Verify your trading account with two forms of ID and connect a payment method. Most platforms accept bank transfers or debit card payments.

Step 3: Fund your account. Make sure to deposit enough funds to buy stocks and cover any platform fees.

Step 4: Explore the available stocks and investment products. Spend time conducting research into the different options before making any investment decisions.

Step 5: Buy stocks by selecting an asset and clicking ‘BUY’. Then fill out the order form and confirm the purchase.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Investing in Stocks in the US – Stock Market Basics

As a professional and academic field in its own right, there is a world of knowledge to attain on the financial markets and how to buy stocks. But for a rookie investor, a basic grasp on risk, reward and regulation is all that is required to take the first steps.

With that in mind, here is an overview of some of the fundamental concepts of buying stocks as a first time investor.

What are stocks?

The stock market is a marketplace like any other, in that it accommodates the buying and selling of a purchasable item or service. In the case of the stock market, investors can buy and sell shares in public companies.

The stock market is designed to benefit the buy-side and the sell-side equally. For companies, it serves as an often much-needed sources of capital, while for investors, it presents the opportunity for profit. Like many of the world’s markets, stock prices rise and fall based on supply and demand.

Beyond monetary terms, listing on the stock market affords companies the opportunity to expand their public profile, which in itself can bring about new investment and business opportunities.

When investors purchase shares, they technically become partial owners of that business, entitling them to a portion of the company’s profits, which usually comes in the form of dividends. In addition investors, can generate returns by choosing to sell their shares if the company’s stock price rises.

Taxes and regulations

The taxation of stocks in the US is a simple relatively affair. The buying and selling of shares is primarily subject to capital gains tax, the rate for which is variable based on how long the position has been held. The exceptions to this rule are for positions held for less than a calendar year, which are taxed at an ordinary income rate, and longer-term positions, which can receive preferential rates. Furthermore, investors have the option of offsetting any losses against any gains in order to reduce tax liabilities.

The regulation and taxation of stocks in the US is the remit of the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). The role of these bodies is to supervise and regulate the financial markets, ensuring that investors are protected from fraud.

Types of stock investments

Before you start stock market investing, it is helpful to understand the different types of stock investments that are available. Buying individual stocks is not the only way to build a stock portfolio in 2025 and looking into alternative stock funds is a good way to ensure that your investment stratgey meets your goals.

Individual stocks

Individual stocks refer to portions of a company. When you buy individual stocks, you are investing directly into the company and become a shareholder. This means that the value of your investment will go up or down depending on the performance of the company.

Index funds

Index funds are a basket of different stocks and shares that tracks the performance of a market benchmark. There are two types of index funds:

- Exchange traded funds

- Stock mutual funds

An Exchange Traded Fund (ETF) is a passive investment that tracks the performance of a specific index. On the other hand, mutual funds are actively managed by a human investment manager. These fund are regularly balanced based on market conditions.

How To Invest in Stocks and Shares in 2025

In the following section, we will provide a detailed look at how to invest in stocks and shares in 2025. We will cover the best platforms to use, the different strategies that you could use, and the basics of executing an order.

Step 1: Choose an online brokerage account

The first step to building a stock portfolio in 2025 is to choose a brokerage that offers the stocks and shares that you would like to invest in.

There are numerous options available to US investors and the most suitable platform will depend on your strategy and experience. Less-experienced investors may want to look for a broker that provides a range of educational tools, professional support, and a simple interface.

On the other hand, investors with more experience may be better suited to a platform that supports advanced trading strategies, offers price charts for technical analysis, and offers a wider range of asset classes.

How to choose a brokerage account to invest in stocks

There are hundreds of online brokerages available to US investors. This can make the process of choosing one to use overwhelming. To narrow down the available options, consider these key factors.

✔️ What is your budget?

The first thing that you should consider is your budget. Some brokerages have higher minimum deposit requirements that make them unsuitable for investors who want to start with a small amount of capital.

Furthermore, investors with a small budget should look for a platform that offers fractional investing – this allows you to buy part of a stock instead of the entire asset.

✔️ What type of instruments would you like to invest in?

It is possible to invest in shares through traditional stocks, stock CFDs, ETFs, indices, and ready-made portfolios. Spend time researching each instrument and decide what type you would lie to invest in before choosing a platform.

Not all platforms will support all of the instruments mentioned above. Some brokerages are limited to stock CFDs, for example, which could prevent you from exploring other asset types in the future.

✔️ Mobile or desktop?

Another important aspect to consider before making a decision is whether you would like to manage your portfolio on your desktop or your smartphone. Some brokers facilitate both however, we found that some mobile investment apps are quite limited.

From the options above, eToro and Robinhood provide the best mobile apps for investors who are looking to manage their positions on the go.

To help you find the best broker to use, here is a look at four reputable platforms that suit a variety of investing needs.

1. eToro -Top stock broker for social trading and smart portfolios

eToro, is one of the best platforms to consider if you are looking to build a diverse stock portfolio by investing in a basket of different products.

eToro offers ready-made smart portfolios, ETFs, and indices that allow investors to gain exposure to a professionally selected group of assets.

eToro is also a market-leading trading platform that offers social trading services. This includes a real-time feed on which users can post their insights and trades. Furthermore, the platform facilitates copy trading which includes mirroring your trading account to that of a certified expert.

In addition to social trading, eToro offers copy trading – a feature allowing the user to copy the trades of professional investors.

The minimum deposit for US-based investors is just $50, and there are no deposit or account fees. This means the entry point for buying stocks is highly accessible and suitable for beginners. This is possible because eToro supports fractional share trading, meaning that traders can acquire a portion of a more valuable stock.

eToro fees

Fee Amount Stock trading Free for US stocks and ETFs. Forex trading Spread, 2.1 pips for GBP/USD Crypto trading Spread, 1% for Bitcoin Inactivity $10 a month after one year Withdrawal $5 Pros:

- Easy to use

- Copy-trading feature

- Spreads are low

- 0% commission

- Diverse assets

- Depositing funds is simple

Cons:

- Not suitable for advanced traders that like to perform technical analysis

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

2. Robinhood – Commission-free stock app

Robinhood is one of the best stock trading apps to consider if you are looking to manage your portfolio on the go. The app provides a range of tools and resources that can be used to conduct research, keep up with the market, and manage orders.

Further more, the broker does not charge any commissions for investing in US stocks or ETFs. This makes it an affordable investment account option for new investors who want to start with a small amount of capital before gradually building up their investments. To suppor

Featuring a low minimum deposit, accessible fractional share trading, and the absence of account fees, Robinhood serves as a cost-effective entry point for investors. This makes it especially suitable for beginners, providing an affordable and user-friendly platform for those initiating their investment journey.

Robinhood fees

Fee Amount Stock trading Free Forex trading Not supported Crypto trading Free Inactivity No Withdrawal No Pros:

- Over 5,000 stocks listed in the US

- Commission-free

- No minimum balance requirement

- Intensively regulated

Cons:

- Limited number of international stocks supported

- Neither forex nor commodities are traded

3. Charles Schwab – Top investment account for educational resources and research tools

Charles Schwab is a reputable online brokerage that is suitable for long-term investors. The platform provides an extensive range of educational resources and materials for new investors to learn the ropes and build a robust strategy.

Charles Schwab also offers a free financial advisor service through which users can access 1-to-1 investment support from professionals. The financial advisor service itself is free but broker-assisted trades come with a fee of $25 per trade.

Accommodating different account types, Charles Schwab’s platform caters to both beginners and advanced investors. With a dedicated focus on customer service and a commitment to innovation, Charles Schwab emerges as a prominent choice for those in search of a well-rounded online brokerage experience. For the latest information, please verify current details on their official website.

Fee Amount Stock trading Free Forex trading Not supported Crypto trading Not supported Inactivity No Withdrawal $50 for full transfer out of assets Pros:

- A wide range of stocks and investment options

- Educational and research tools available

- Zero commission trading

- Mobile apps available for iOS and Android

Cons:

- Debit and credit cards not supported

- Futures fees higher than industry average

- Limited number and regions for international stocks

4. Webull – The best day trading platform for stocks

Webull is a good platform to consider for day trading stocks. This is because the platform provides excellent charting tools and indicators for technical analysis. The platform also offers a demo trading account that can be used to test different day trading strategies before putting any real funds at risk.

The appeal of Webull is further enhanced by its accessible mobile app and desktop platform, complemented by the absence of minimum deposit requirements. These features collectively position Webull as an attractive choice for individuals seeking a contemporary and cost-effective trading experience.

Fee Amount Stock trading Free Forex trading Not supported Crypto trading Free Inactivity No Withdrawal $25 Pros:

- A wide range of stock options

- Support for foreign companies via American Depository Receipts (ADRs)

- Zero commission trading

- Simple interface

- Mobile apps available for iOS and Android

Cons:

- Platform fee of $1.99 per month for Level II pricing data

- No support for PayPal or debit/credit cards

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

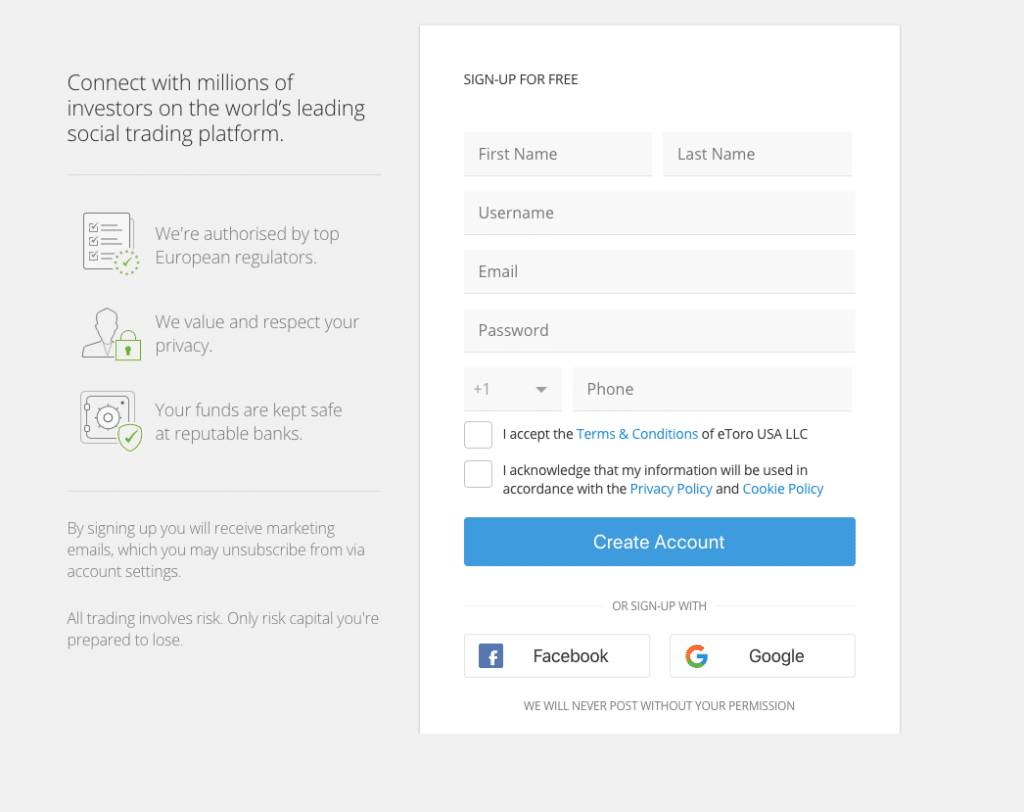

Step 2: Create an account

Once you have chosen a broker that meets your requirements, you will need to create an account.

For this guide, we will use eToro as an example. However, the registration process is similar across most US brokerages.

To create an account with eToro, you will need to head to the official website and navigate to the registration form. You will be asked to enter your name, contact details and password.

eToro account verification

As a licensed broker, eToro must follow KYC processes. This means that all new customers are required to verify their ID by uploading images of two forms of ID. This part of the signup process can take up to 24 hours however, most accounts are verified within 30 minutes of uploading the documents.

To pass the verification, make sure that you take clear photos in natural lighting. Also, make sure that all information is readable so that the platform can process the documents quickly.

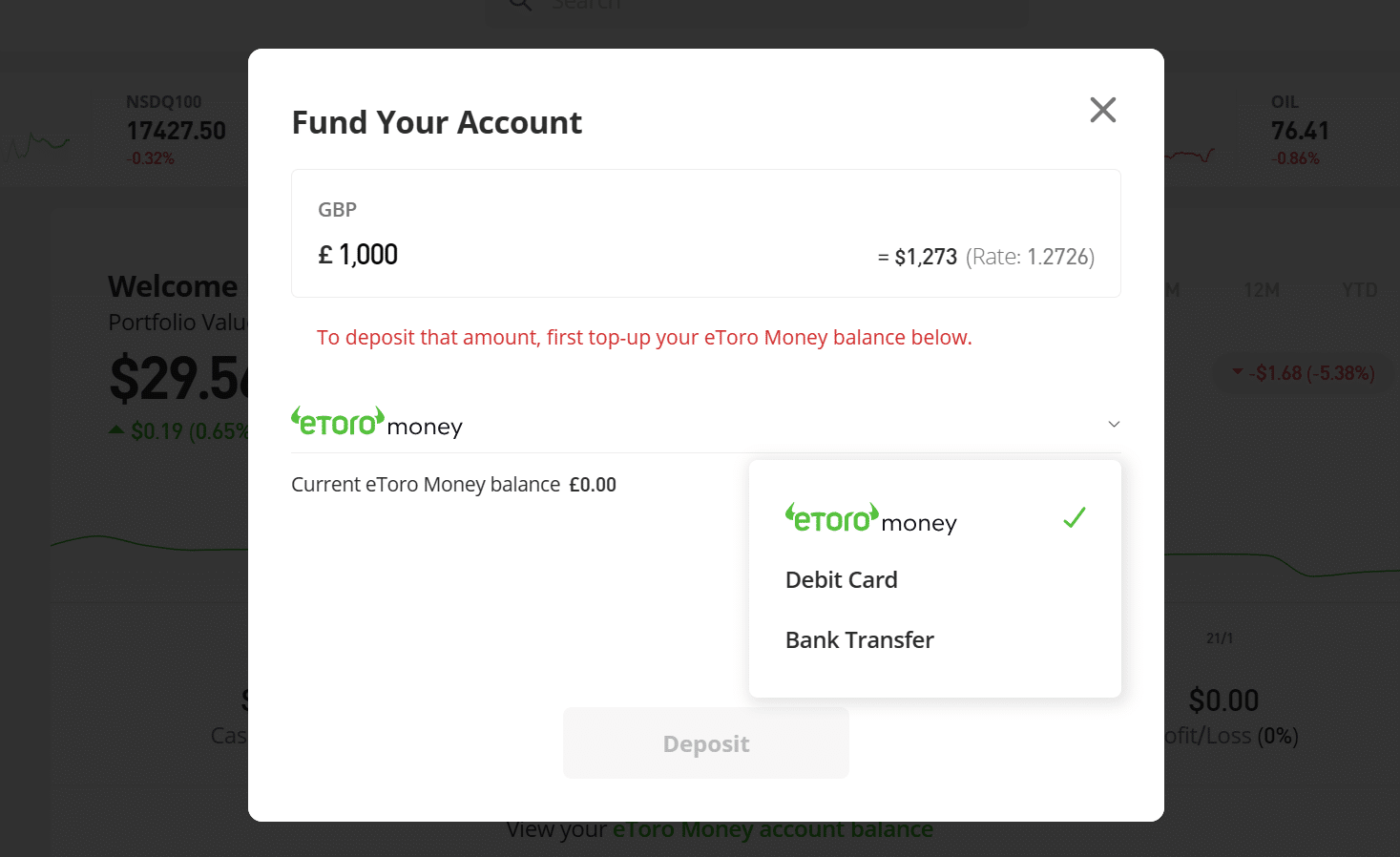

Step 3: Fund your brokerage account

Once you have completed the verification process, the next step is to fund your trading account.

Some platforms allow users to access a demo trading account before they deposit real funds. This is a good way to familiarize yourself with the platform and test out different investment strategies before risking any of your capital. If your chosen broker offers a demo trader, spend time using this to practice investing before adding funds to your account.

Before funding your brokerage account, make sure that you are using a secure internet connection. Then, navigate to the deposit page for the broker that you are using.

eToro accepts deposits with debit cards or bank transfers. The minimum deposit is $20 and the minimum trade amount for investing in stocks is $10. If you would like to invest in smart portfolios you will need to invest a minimum of $500 and to invest in indices the minimum deposit requirement is $50.

Step 4: Research the stock market

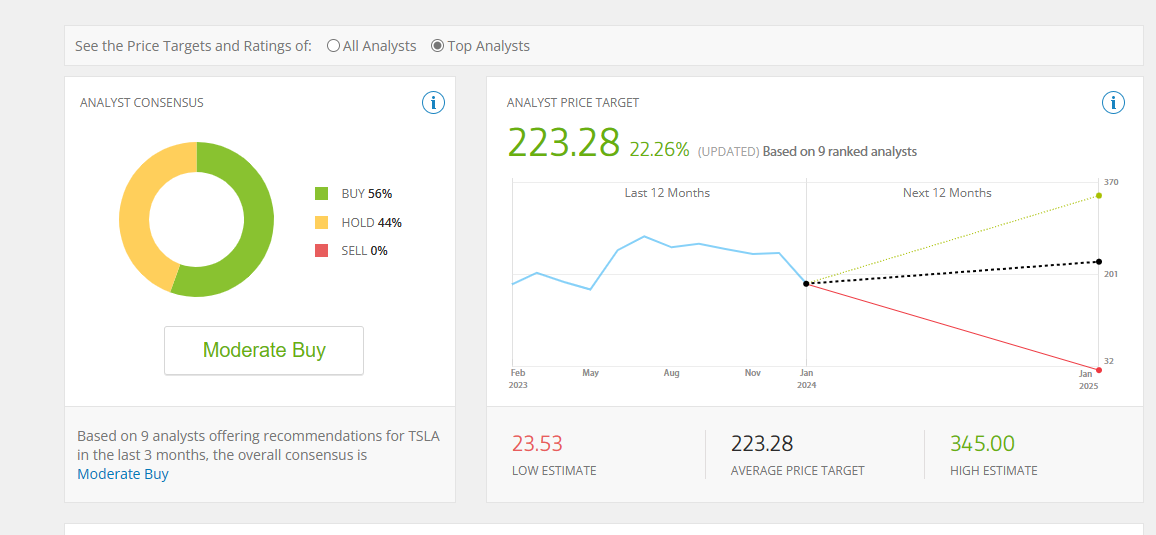

Most reputable US brokerage accounts will provide users with tools and resources that can be used to conduct research into different stocks before making any investment decisions. You should spend time carefully assessing various options before executing any trades.

For example, eToro provides live market news, valuable stats, and a detailed analysis of each stock that is available on the platform.

By using the available resources, you can make sure that your decisions are backed by data which could reduce your chances of placing a bad trade. It is also a good idea to use external resources to conduct research. This could include financial newsletters, performance reports, and expert insight.

Step 5: Speak to a financial advisor

If you are new to investing, it is a good idea to consult a financial advisor before making any investment decisions.

A financial advisor is a professional who can provide valuable guidenace around how to reach your fnancial goals. Advisors can also assist investors with managing their long-term portfolios and are able to provide helpful market insight based on analysis.

Some brokerage accounts provide in-house financial advisor services. This is something to coniser when choosing an investment platform.

Step 6: Place a BUY order

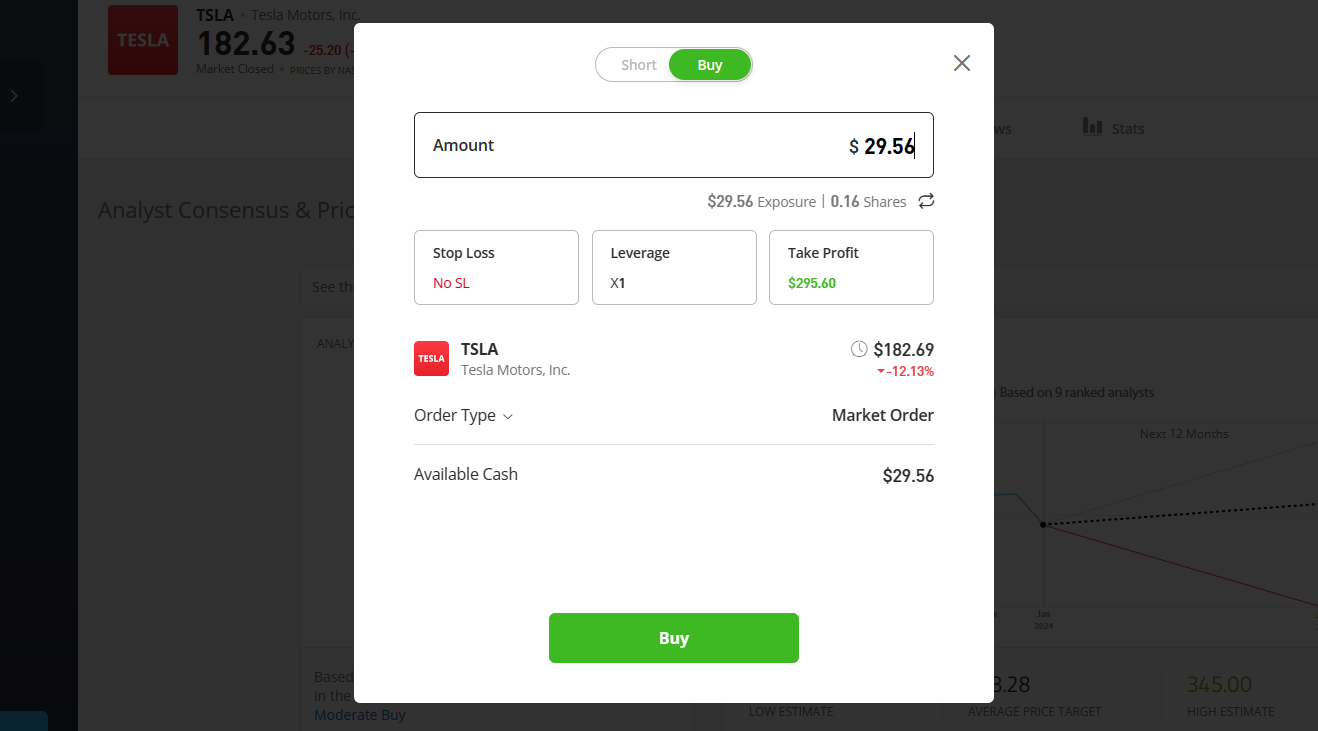

To buy stocks and shares from an online broker, select the asset that you would like to invest in and click ‘trade’. You will be taken to an order box.

Most brokers will give users the option of placing ‘buy’ or ‘short’ orders. BUY orders involve buying an asset that you believe will appreciate over time. Short orders involve selling an asset that you believe will depreciate over time.

Most long-term stock investors place BUY orders for assets that have long-term potential.

In the order form, you will be able to select the amount of stock that you would like to buy, the stop loss target, take profit target, leverage, and order type. The last two features are suitable for experienced traders who understand how to manage risk when trading with leverage and different order types.

Fill in the required fields and then double-check the order form before confirming the trade.

After a few minutes, the stock will appear in your account portfolio. From here, you can manage your positions and close orders.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Things To Consider Before You Invest in Stocks

While investing in the stock market can be an accessible and rewarding endeavor for beginners, it is crucial to approach it with caution and prudence.

From understanding your financial goals to selecting the right investment vehicle, here are some considerations to take before you start investing to build a successful and sustainable investment strategy.

Set clear goals

Understanding why you want to invest will guide every aspect of your investment strategy. Some have sights set on a retirement plan or a specific milestone (such as purchasing a house), while others may simply be seeking a source of passive income.

Crucially, an individual’s goal will directly inform the timeline. Short-term goals might include saving for a vacation or a down payment, while long-term goals could involve building a nest egg for retirement. Each goal may necessitate a different investment approach, aligning risk and return with the timeframe.

Working towards clear objectives may also encourage a greater degree of prudence in some investors. For instance, those saving for a specific goal are less likely to make aggressive decisions.

Understanding your investment goals can help you to develop a robust investing strategy. Here are some popular strategies that are used by long-term investors:

- Dividend investing: Investing in stocks that make regular interest payments to investors.

- Growth investing: Investing in stocks that will appreciate over time.

- Value investing: Buy the shares of companies that seem undervalued.

Assess risk tolerance

Another key element of goal setting is assessing risk tolerance. In order to make sensible and informed decisions in the stock market, one must possess a strong understanding of their own financial circumstances and appetite.

This not only requires an initial assessment, but continual reassessment throughout an investment journey, particularly as life circumstances change. These conclusions should directly inform which stocks you pick, and how much capital you commit to them.

If in doubt, a good rule of thumb is to never invest more than you can afford to lose.

Understand investment vehicles

Buying stocks through a platform such as eToro is fairly self explanatory. However, it is important to develop a basic understanding of the various other investment avenues there are available.

Some key examples included bonds (a low-risk, fixed-income investment) pooled investments such as mutual funds (a diversified portfolio of stocks, bonds and other securities), and cryptocurrencies.

Understanding a range of investment vehicles provides a foundation for building a diversified portfolio tailored to your financial goals and risk tolerance. As you gain experience, you can refine your strategy and explore additional investment options that align with your evolving investment objectives.

Choose the right brokerage account

As the platform through which you buy and sell stocks, manage your portfolio, and access research tools, selecting the right brokerage account is a pivotal decision that significantly influences your investing experience.

But this is a market rife with options, so its critical to weigh up factors such as transaction costs, user interface, educational resources and the capacity for mobile trading.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Top Growth Stocks to Buy in 2023

Growth stocks are shares in companies expected to have above-average earnings growth compared to other firms. Investors gravitate toward these stocks for the potential of significant capital appreciation.

While inherently riskier due to volatility, successful investments in growth stocks can lead to substantial gains, attracting those with a risk-tolerant investment approach.

Here are some of our top growth stocks to buy in 2023.

Apple (AAPL)

While growth stocks often come in the form of fresh, disruptive companies, Apple continues to epitomize this category, having tripled its earnings per share (EPS) since 2016 and seen share price increases of more than 200%.

The Silicon Valley giant also stood alone among rivals Amazon, Alphabet, Meta and Microsoft in not falling short of analysts’ revenue projections in 2022.

However, with the outlook for the holiday quarter looking relatively weak, and share prices coming at a premium ($189), opportunistic investors may wish to look elsewhere.

T-Mobile US (TMUS)

One of the Unites States’ foremost cell service providers, T-Mobile has seen exponential growth in recent years. This is captured neatly by its stock market performance – the firm listed on the NASDAQ in 2019 at $75 per share, and has since doubled, sitting at $149 at the time of writing.

The firm also looks poised for strong growth in the coming years, with analysts predicting at least a 255% year over year EPS increase in 2023, and 35% in earnings growth in 2024.

In addition, there is a good chance of T-Mobile stock breaking the $150 barrier before the end of 2023. As part of a recent merger deal with fellow telecommunications firm Sprint, parent company Softbank relinquished 48.8 million T-Mobile shares that were rightfully theirs. The return of these shares to Softbank by T-Mobile is contingent upon the stock price remaining above $150 for 45 days before December 31, 2025. It is likely then, that many people are selling shares once they break that barrier.

Abercrombie & Fitch (ANF)

Speciality clothes retailer Abercrombie & Fitch has bounced back emphatically after years of slowed growth, and is having an exceptional year. The firm’s share price is up more than 200% since January, and currently sits at its highest value since 2011.

This can largely be attributed to significant financial overachievement, with the retailer achieving a profit margin of 9.6% in Q2, nearly doubling expectations. Similarly, Q3 figures saw the company outperform expectations, earning $1.06bn versus $981m expected.

In Q4, Abercrombie & Fitch expects its net sales growth to reach double digits, and is projecting an operating margin of at least 12%, versus the 7.7% achieved during the same period in 2022.

Top Value Stocks To Buy in 2025

Value stocks represent shares in companies perceived to be undervalued by the market, often trading below their intrinsic worth. Investors in value stocks seek potential returns as the market corrects its pricing oversight.

Value investing is favored for its patient, disciplined approach, making it an attractive strategy for investors aiming for long-term growth and income with a lower risk profile.

Here are some of our top value stocks to buy in 2023.

NIO (NIO)

NIO is a burgeoning competitor in China’s rapidly expanding electric vehicle (EV) market. Its growth pales in comparison to market leaders such as Tesla and BYD, however the firm has said that it expects up to 80% yearly growth for vehicles delivered in Q3 2023.

The automaker has also revealed ambitious expansion plans, including two new sub-brands targeting lower cost markets in Europe, and the development of its innovative battery-swapping technology.

At a little over $7 a share, NIO could be the ideal choice for an investor seeking low risk and high reward.

Toyota Motor Corp (TM)

Toyota has enjoyed another year of success despite already being the world’s largest automaker. Its stock is up 38% since the beginning of 2023, owing partly to the growing popularity of hybrid vehicles in North America.

As a result, the automaker has forecasted $291bn in revenue for FY23 – a 13% uptick from previous projections.

Despite this, Toyota stock is still trading at 10 times below its earnings, making it a potentially excellent value stock in 2023.

Amazon (AMZN)

With a market capitalization of nearly $1.5tr, e-commerce giant Amazon is one of the largest and most successful businesses in the world today.

And it many ways, it still qualifies as a growth stock, with net income more than tripling in Q3 2023. Moreover, this impressive growth looks set to continue, with Amazon comfortably leading the cloud infrastructure market with AWS. The firm also looks poised to be a beneficiary of the modern era’s AI boom.

Despite this, the failure to match the productivity levels of the pandemic-era boom, coupled with creeping tax and regulatory concerns, has rendered Amazon’s stock price about even with its summer 2020 level. Based on this, Amazon stock is arguably highly undervalued in 2023

Our Verdict On How to Invest in Stocks As a Beginner

Entering the world of stock trading may initially appear complex, but with the right resources and a commitment to learning, beginners can navigate this financial landscape successfully. Notably, an understanding of key concepts such as goal setting, assessing risk tolerance and the taxation of investment returns are crucial aspects of responsible trading.

Whether opting for growth stocks like Apple or Value stocks like Toyota, investors are encourage to align their choices with wider financial goals. The same rule applies to choosing a brokerages, with options such as Robinhood, Charles Schwab and Webull all offering different features.

With its range of EFTs, social trading and education features, TradingPlatforms recommends eToro as a good all-rounder for beginner investors.

FAQs

Can I invest $100 in stocks?

Yes, you can invest $100 in stocks. Many online brokerage platforms allow investors to start with small amounts. Look for platforms with low minimum investment requirements and fractional share trading, enabling you to buy a portion of a stock even if its full share price exceeds your budget.

How do I invest in stocks for the first time?

Potential investors can explore various online brokerage platforms, including eToro, Robinhood, Charles Schwab, and Webull. These platforms offer diverse features, from social trading to commission-free structures. In TradingPlatforms’ view, eToro is the best all-round choice for most investors.

What is the best US stock to invest in?

Determining the best US stock to invest in depends on individual financial goals, risk tolerance, and market conditions. Popular choices include established companies like Apple, Microsoft, and Amazon.

How many people invest in stocks?

In 2023, 61% of adults in the US invested in the stock market

Sam Alberti

View all posts by Sam AlbertiSam Alberti has recently joined Trading Platforms as a content editor, having spent the past four years working as a journalist across various financial and business niches. He graduated from the University of Kingston in 2019 with a Master’s Degree in Journalism and an NCTJ Diploma, and has since developed a passion for both consumer and corporate finance. He now specializes in producing engaging and thoroughly-researched web content on all things finance.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525

© tradingplatforms.com All Rights Reserved 2024