Where & How to Buy NIO (NIO) Stock in 2024

Electric vehicle sales in the US are expected to reach historic highs in 2023 (9% of all passenger vehicle sales). Against this backdrop, the race for market share is also stepping up a gear. Launched in 2014, Chinese automaker NIO is one such participant, capturing the attention of investors with its commitment to innovation and luxury design.

Having listed on the New York Stock Exchange for the first time in 2018, NIO now boasts a market capitalization of more than $11bn. And while its growth pales in comparison to market leader Tesla, its ambitious expansion plans and growing presence in China spell promise for the firm.

These factors may also suggest that the stock is highly undervalued at $7.40 per share. In this guide, we will examine this and many other factors in determining whether NIO is a worthwhile buy for retail investors today, in addition to addressing the question of where and how to buy NIO stock in 2024 on a commission-free basis.

-

-

How to Buy NIO Stock Overview

Here is a quick over of how to buy NIO shares in 2024. For a more in-depth guide, keep reading.

Step 1: Spend time researching different brokers to find one that suits your investment strategy. The best platforms to buy NIO have low fees and a variety of tools for research and analysis.

Step 2: Sign up for a trading account and upload two forms of valid ID to confirm your registration.

Step 3: Connect a payment method to your account and deposit funds. Start with the minimum deposit requirement until you feel confident using the broker.

Step 4: Search for the NIO ticker and select the stock to view price information.

Step 5: Fill out the order form and confirm the order. Nio shares will then appear in your portfolio.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

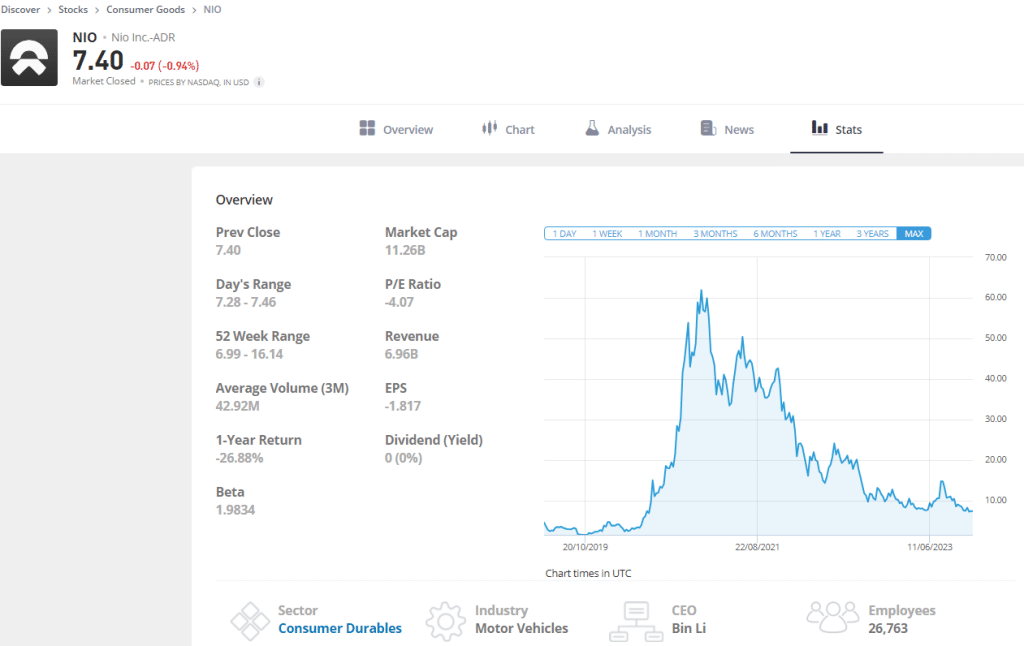

NIO (NIO) Stock Data July 2024

What is NIO (NIO)?

NIO is another player in the booming global electric vehicle market. Often hailed as China’s answer to Tesla, the Shanghai-based firm has gained popularity for its attractive, affordable EVs, in addition to its innovate approach to EV technology.

In particular, the firm is credited with the development of battery-swapping technology, providing a partial solution to the persistent issue of battery capacity in EVs. The firm has even launched a network of ‘swap stations’, allowing users to replace a battery in under five minutes.

Beyond this, NIO’s product suit includes a full range of all-electric coupes and SUVs, such as the ES6, ES8 and EC6 models. The firm has also been involved in the increasingly popular all-electric single-seater racing series, Formula E, enjoying a stint as one of the team’s title sponsors.

NIO (NIO) Stock Price 2024

The headline figure when it comes to NIO stock is that share prices have fallen by 85% since its peak of $61.90, dramatically underperforming versus an increase of roughly 15% for the S&P 500 during this period. Bleaker still, this downturn has persisted in 2023, with the automaker’s share price down 23% since the turn of the year.

Somewhat confusingly, these figures do not quite square with NIO’s productivity and financial performance. The company has delivered more than 126,000 vehicles this year, a yearly increase of 36%, while revenue for the 12 months to June 2023 was $6.8bn (up 9% year on year).

What appears to have hamstrung NIO is the competitor landscape. For instance, XPeng, a fellow Chinese EV maker, almost quadrupled its vehicle output in October compared to 2022, delivering more than 20,000 vehicles. Li Auto, another Chinese automaker, also saw a near fourfold yearly increase in productivity as it delivered 40,422 vehicles in October.

These results have had a detrimental effect on NIO’s share price. The stock has now underperformed the S&P 500 for three consecutive years, with returns down 19% compared to 14% for the broader market.

At the time of writing (November 2023), NIO stock sits at $7.40, only marginally above its all-time low of $7.21.

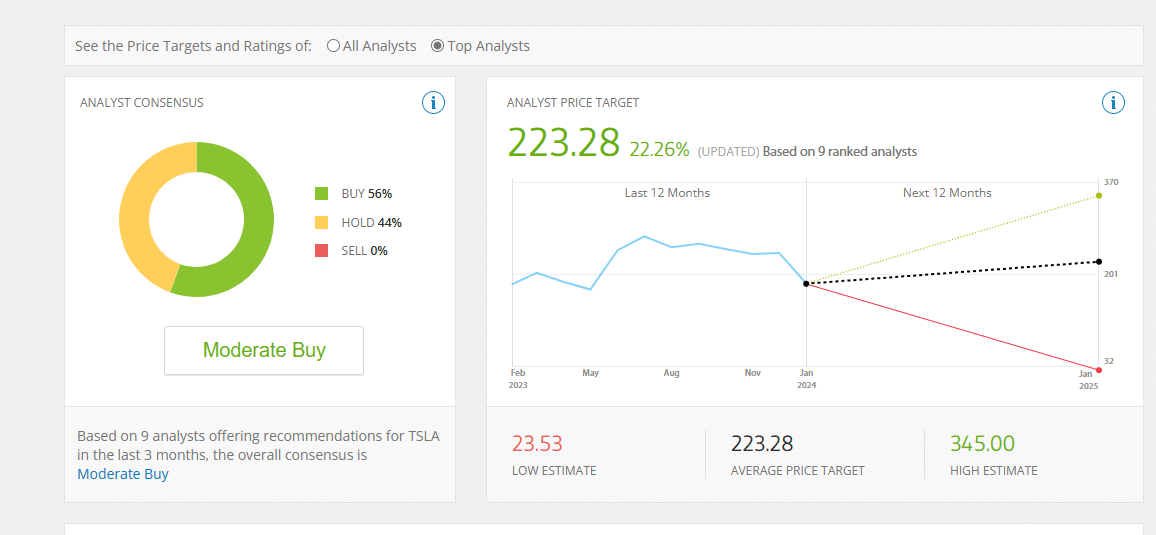

Is NIO (NIO) a Good Investment in 2024?

Despite respectable financial performance and ambitious expansion plans, NIO’s share price has seen a brutal downturn in recent years.

The stock initially floated at $6.26 in September 2018, selling around $1bn in shares and reaching a valuation of $100bn by January 2021, far surpassing its $20bn target. Having peaked at $61.90 on January 17, the stock has since experienced an exponential slump – it currently sits at $7.35, with earnings per share (EPS) down to -1.7 and price earnings ratio (P/E) at -4.07.

This bearish sentiment can be largely attributed to the tricky competitor landscape – a likely point of concern for prospective investors. For instance, EV ownership in China jumped by more than 67% between 2021 and 2022, but NIO’s revenue growth for the same period was just shy of 26%.

Similarly, though often described as China’s answer to Tesla, NIO made up just 2% of the nation’s EV market share in 2022, falling far behind rivals Tesla, BYD, Wulling and others.

However, there is still reason to be optimistic. NIO has said that it expects up to 80% year-on-year growth for vehicle deliveries in Q3 2023, owing to its new ET5 Tourer and ES8 SUV, and EC6 SUV, all of which launched earlier this year.

Investor confidence may also be spurred by NIO’s ambitious expansion plans. The automaker revealed earlier this year that it will target demand for smaller and cheaper EVs in the European market by offering two new sub-brands, ALPS and Firefly. Both are expected to emerge in 2024.

Beyond this, NIO has also expanded its brand equity through projects away from the consumer car space, most notably as a long-term engine supplier for the all-electric racing car series, Formula E.

Taking into account NIO’s growth prospects combined with its highly affordable price, the automaker could prove to be a smart investment in 2024.

Where to Buy NIO (NIO) Stock in 2024

NIO stock is available to buy through the most reputable stock brokers. In the section below, we take a look at four potential options to consider.

1. eToro – Overall best brokerage account to buy NIO shares

eToro is one of the best platforms to invest in NIO stocks because it offers an extensive range of consumer goods portfolios and ETFs. Furthermore, users can invest in NIO itself with 0% commissions from just $10.

The platform’s Smart Portfolios are a good way for investors to gain exposure to NIO as well as a selection of other promising stocks in the consumer goods space. For example, the EVs and Autonomous Cars portfolio includes NIO as well as other prominent names such as Tesla, Rivian Automotive, XPeng Inc., and WolfSpeed Inc.By investing in NIO through a Smart Portfolio, you can diversify your holdings.

There are three Nio stocks available to trade on eToro; NIO, NIO.EXT and 9866.HK. NIO.EXT provides access to extended hours trading.

eToro provides an easy-to-use interface, real-time data and market updates, and market-leading social trading features that allow investors to communicate with each other about their positions.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

2. Robinhood – Commission-free investment app to buy Nio shares

Robinhood is a mobile investment app that can be used to build a US stock portfolio from your phone. The app is suitable for long-term investors who are looking to invest small amounts of capital regularly. On Robinhood, it is possible to buy Robinhood shares for just $1.

The app is easy to use, making it a good option for less-experienced traders. We were also impressed with the platform’s management tools and research resources that make it possible for users to analyze the market before investing in NIO.

The main appeal of Robinhood is that it can be used on your phone.

3. Charles Schwab – Buy Nio stock from the New York Stock Exchange with the help of professionals

Charles Schwab is a reputable investment platform that stands out because of its 1-to-1 investment advice offerings. Users can access professional investors for free and receive advice on how to achieve their goals. As well as this, the brokerage provides a good range of research resources, market insight, and real-time data to support informed decision-making.

Charles Schwab charges zero commissions for US-listed stocks however, broker-assisted trades come with a $25 fee. There are no charges involved with opening or maintaining an account at Charles Schwab.

The platform is most suitable for long-term investors who are looking to build a strong portfolio.

4. Webull – The best platform to buy NIO stock for day traders

Webull is a leading trading platform that caters to active trading as well as trading with leverage and options. Through the platform, it is possible to implement advanced trading strategies to take advantage of short-term price movement in NIO stock.

Webull offers its own proprietary trading interface but can also be connected to MT4. This means that users can access a wide range of indicators, APIs, and risk management tools, as well as paper trading.

Before implementing any advanced strategies, users can practice trading NIO stock with the Webull demo trading account. This account is free of charge for all Webull users and can be used as and when traders need to practice new strategies.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

How To Buy NIO Shares on eToro in 2024

Out of the brokers that w have covered in this article, eToro stands out as being the best all-round platform for buying NIO stocks in 2024. Therefore, here is an in-depth guide on how to use the platform to invest in Nio shares.

Before you start the process, make sure that you are using a secure internet connection in a private space.

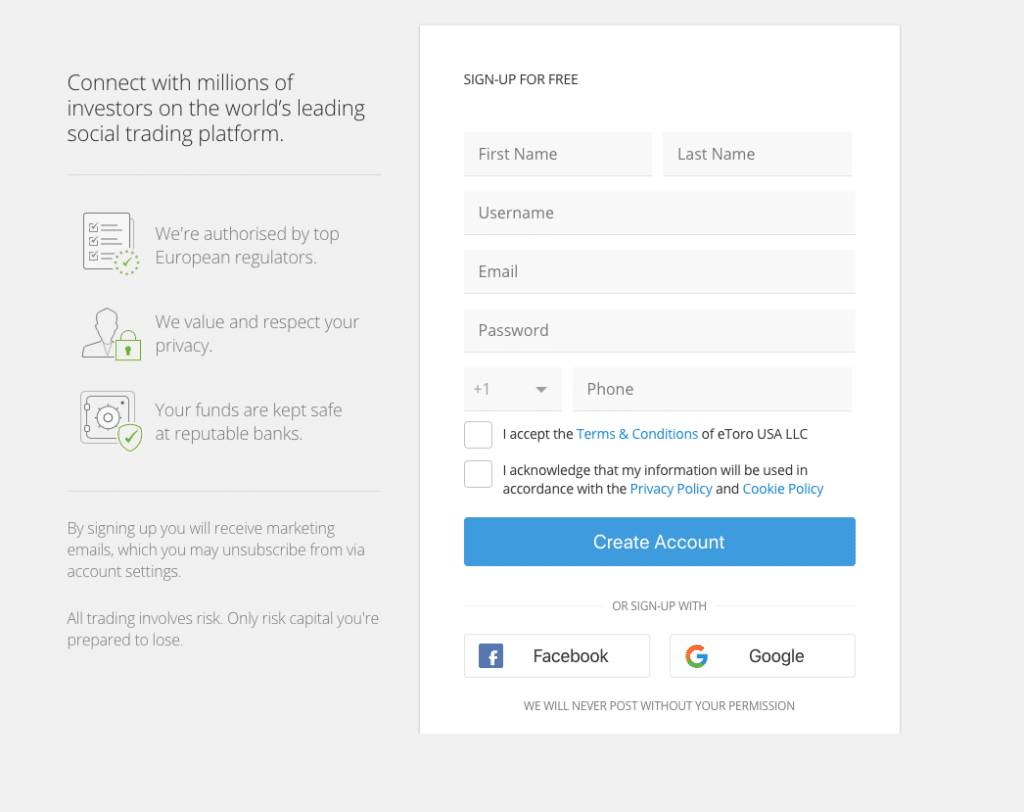

Step 1: Sign up for an eToro brokerage account

To buy Nio shares through eToro, you must create an account. To do this, head to the official eToro website and click ‘create account’. You will be taken to the registration portal which should appear automatically on your screen.

You will need to fill in your details including your name, mobile number, and email address. Make sure to use an email that you have access to because eToro will send important confirmation notifications to this address.

Account Verification

To comply with KYC policies, eToro asks all new users to submit two forms of ID. This is used to verify your brokerage account. Take clear photos of each document and upload them to the platform as prompted.

It is possible to skip this step however, users who do not verify ID will be unable to withdraw funds from their account. The ID verification can take up to 24 hours but most users are verified within 30 minutes.

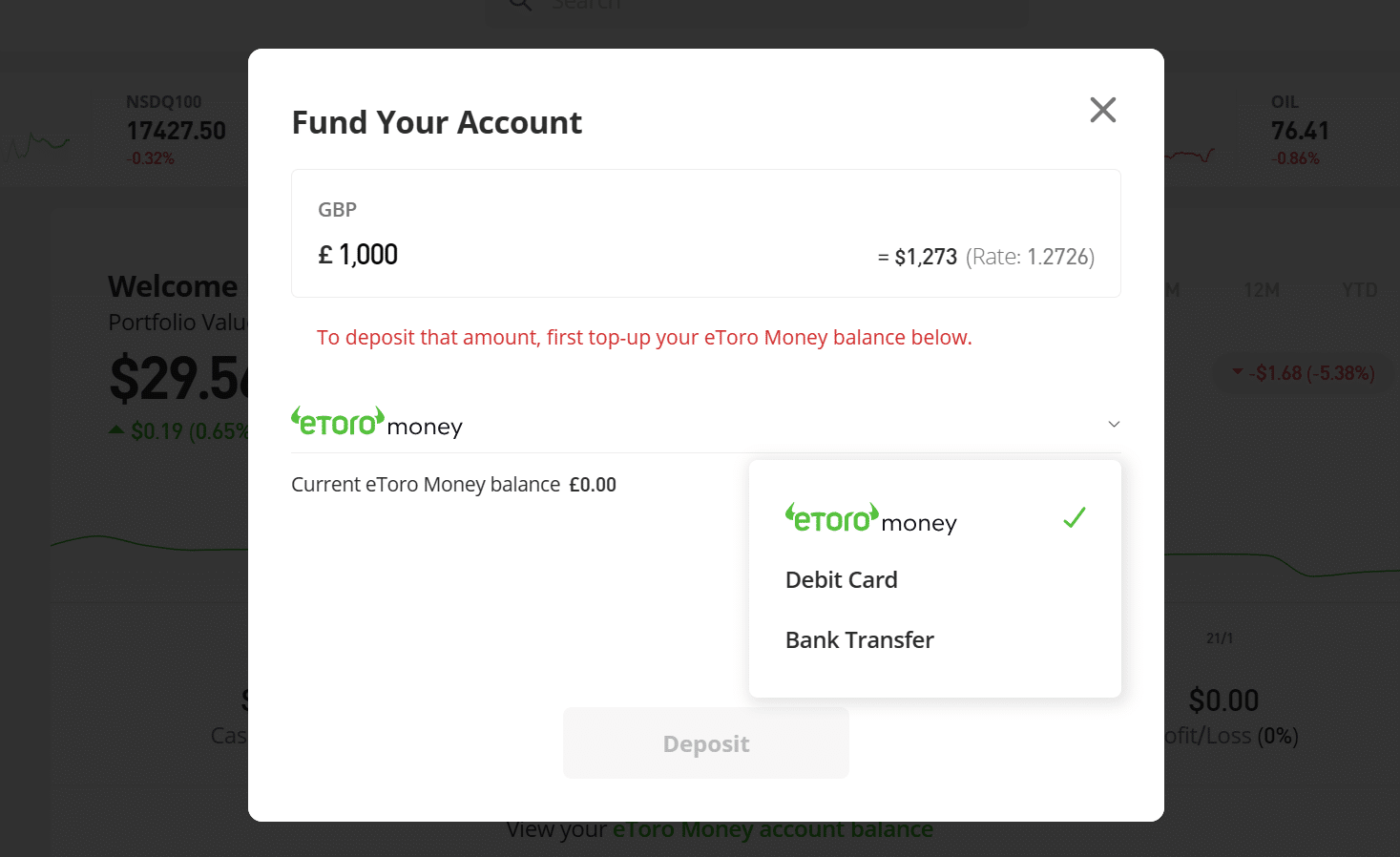

Step 2: Fund your account

The minimum amount of Nio stock that you can buy on eToro is $10. However, if you want to invest in Nio through an ETF, the minimum is $50, and for smart portfolios it i $500. To deposit funds into your account, click the blue ‘deposit’ button.

eToro accepts deposits with debit card or bank transfer. There are no fees charged by the platform for depositing funds however, your bank may charge external fees for the transaction. it is a good idea to make your bank aware before investing any money so that your account doesn’t get frozen.

Step 3: Research NIO stock

Before investing any funds into Nio, it is important to spend time researching the market. The eToro brokerage account provides a social trading feed that can be used to gain insight into what other investors are doing. The platform also provides a range of analysis tools and resources such as market news, price predictions, and sentiment analysis.

If you’re looking to invest long-term, you should focus on fundamental analysis. This involves looking at factors that could affect the asset’s long-term growth and potential.

eToro’s simple interface makes it easy for less-experienced investors to understand the stock market. It is also a good idea to use external resources, such as financial news and educators, to gain further insight into NIO stock.

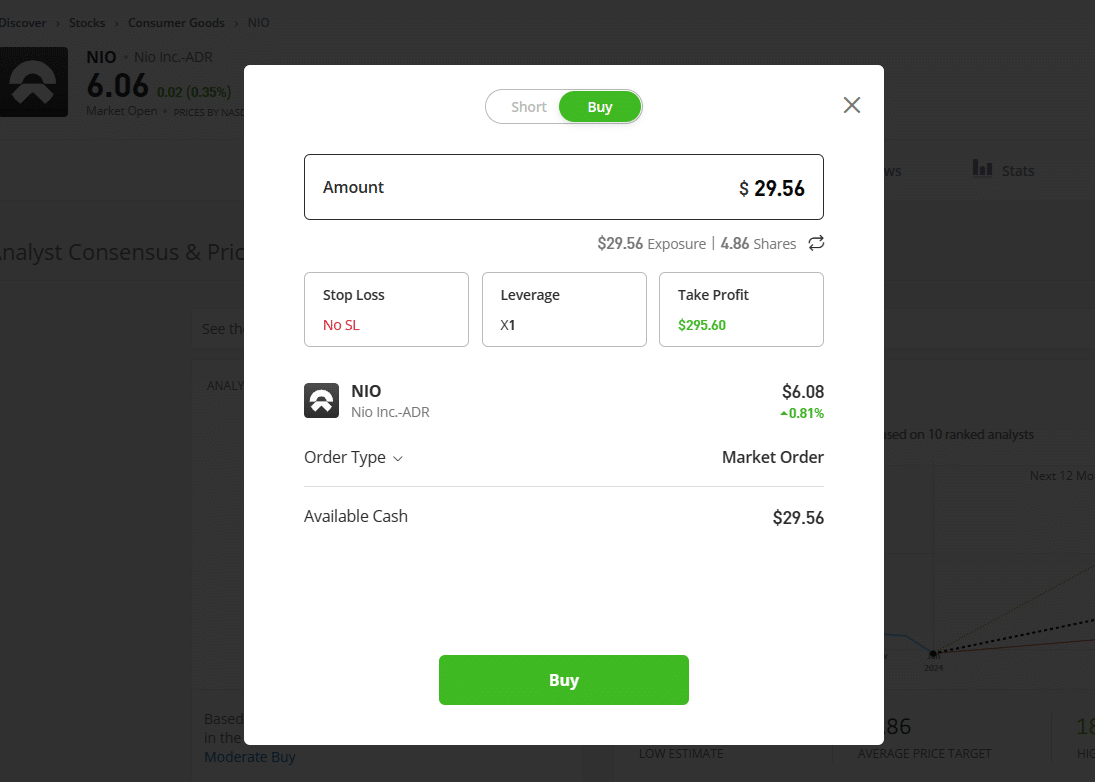

Step 4: Place a market order

After you have spent time researching Nio stocks, you can place a market order. The process of buying stocks through eToro is fairly simple. Select the asset that you would like to invest in and then click ‘trade’.

Here, you will be able to specify the amount of NIO stock that you would like to buy as well as stop loss, take profit, leverage, and order type. It is a good idea to familiarize yourself with these parameters before investing.

Click ‘buy’ to execute the trade. NIO stock will appear in your portfolio after a few minutes. From here, you will be able to manage your open positions and close orders if necessary.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

How To Sell NIO Stock

Investors may want to sell their NIO shares for several reasons including a change in investor sentiment, increased volatility, or macroeconomic factors. Moreover, some investors may choose to sell Nio stock when the asset has appreciated in value and generated returns.

Follow the steps below to sell your NIO shares on eToro:

- Open up your eToro portfolio and select NIO stock. If you have invested in Nio through a fund, select this instead.

- Click ‘close’ on the right hand side of the screen (if using desktop).

- Confirm the trade and then click ‘close trade’ to sell your Nio stock.

- The funds from your investment will be transported to your cash balance.

- Click ‘withdraw funds’ to remove the money from your brokerage account and into your bank account.

Our Verdict on NIO (NIO) Stock in 2024

The global EV market is expanding rapidly, but NIO faces substantial competition on domestic terms too. As a result, the small automaker faces tough conditions – its growth and innovations has been undeniably impressive, but its relatively inferior standing in the industry has generated overwhelmingly bearish sentiment towards the stock, its price plummeting by over 85% since 2022.

However, with ambitious expansion plans, affordable pricing, and a pioneering role in the development of battery-swapping technology, NIO remains a potentially smart sub-$10 bet in 2024.

For those keen to buy NIO stock, TradingPlatforms recommends eToro as a great all-rounder for most retail investors.

NIO stock FAQs

How do I buy NIO shares?

Potential investors can explore various online brokerage platforms, including eToro, Robinhood, Charles Schwab, and Webull. These platforms offer diverse features, from social trading to commission-free structures. In TradingPlatforms’ view, eToro is the best all-round choice for most investors.

How much does it cost to buy NIO stock?

At the time of writing (November 2023), NIO’s share price sits at $7.40, a 52% downturn from its August peak.

Is NIO a high risk investment?

While NIO’s stock market performance has been poor in recent years, the low cost of the stock can mitigate this. As a rule of thumb, never invest more than you can afford to lose.

Does NIO pay a dividend?

NIO does not pay a dividend. Companies decide whether to distribute dividends based on various factors, and NIO, being a relatively new public company, has not established a history of dividend payments.

References:

- https://apnews.com/article/automakers-electric-vehicles-us-china-sales-d121c09a61f50e7357f5675af4b6056b

- https://www.statista.com/outlook/mmo/electric-vehicles/china#unit-sales

- https://www.macrotrends.net/stocks/charts/NIO/nio/revenue

- https://www.china-briefing.com/news/chinas-electric-vehicle-supply-chain-and-its-future-prospects/

Sam Alberti

View all posts by Sam AlbertiSam Alberti has recently joined Trading Platforms as a content editor, having spent the past four years working as a journalist across various financial and business niches. He graduated from the University of Kingston in 2019 with a Master’s Degree in Journalism and an NCTJ Diploma, and has since developed a passion for both consumer and corporate finance. He now specializes in producing engaging and thoroughly-researched web content on all things finance.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up