Webull Review 2025 – Pros & Cons Revealed

Webull is an online and mobile trading platform that allows you to invest on a commission-free basis. With no brokerage account minimums or monthly platform fees – Webull is especially popular with casual investors based in the US.

But, is Webull the right trading platform for you?

In this Webull review 2025 – we cover everything there is to know about the broker – including tradable assets, fees and commissions, security, core features, and more.

-

-

Webull History & Background

Launched as recently as 2017 – Webull is a user-friendly brokerage platform that can be accessed online or via a mobile app. The platform allows you to invest in a variety of assets – including thousands of US-listed stocks and ETFs, options, cryptocurrencies, and ADRs (American Depositary Receipts).

There are several core reasons why Webull is now one of the most popular trading platforms in the US. Firstly, irrespective of whether you invest online or through the Webull app – the main interface is simple and burden-free. This makes it an ideal choice for inexperienced investors.

Webull is also used by those wishing to invest small amounts. This is because the platform permits fractional ownership from just $1 per trade. And of course, when it comes to fees, Webull is a 100% commission-free broker. This means that it is in direct competition with other zero-fee platforms like Robinhood, eToro, and CedarFX.

With that said – and much like Robinhood, Webull charges a monthly fee to access Level II market data. This will cost you $1.99 per month. Safety should be no concern at Webull, as the broker is regulated registered with the SEC and FINRA, as well as being a member of the SIPC.

Webull Pros & Cons

Below you will find the main pros and cons that our Webull review team found. We discuss each of these core metrics in detail further down in this Webull review.

Pros:

- Trade thousands of stocks and ETFs

- Foreign companies supported via ADRs

- Cryptocurrencies and stock options trading

- 0% commission trading

- Very simple and user-friendly interface

- Available online or via an iOS/Android mobile app

Cons:

- Monthly platform fee of $1.99 for Level II pricing data

- Not supported for debit/credit cards or Paypal

- A bit too basic for experienced investors

- No commodity, indices, and forex trading facilities

- Customer support response times are slow

What Can You Trade and Invest in on Webull?

To begin our Webull review we will outline the main investments that you can make on the platform.

Webull Stocks

Most investors use Webull to buy and sell stocks. The platform supports thousands of companies listed on the Nasdaq and New York Stock Exchange (NYSE). You can also invest in a selected number of stocks listed on the American Stock Exchange (AMEX).

Although Webull claims to offer access to foreign-listed companies, this comes in the form of an ADR. As such, the overall stock library at Webull is extremely limited - especially when you look at other commission-free brokers that are active in this space. For example, eToro offers access to 17 US and international stock trading markets.

On the flip side, while access to non-US stock markets is limited on Webull, the platform does offer fractional shares. This means that you can invest in any stock of your choosing at a minimum of just $1 per trade.

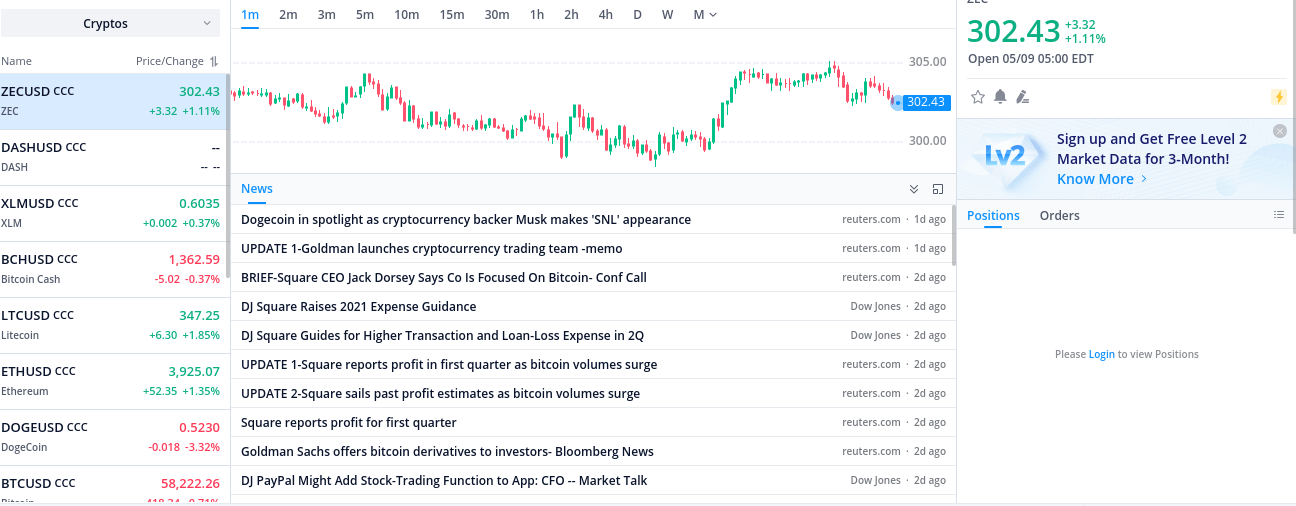

Webull Crypto

Our Webull review found that the platform allows you to invest in a selection of digital currencies from just $1 per trade.

The crypto trading department on Webull supports the following markets:

- Bitcoin (BTC)

- Dogecoin (DOGE)

- Bitcoin Cash (BCH)

- Ethereum (ETH)

- Litecoin (LTC)

- ZEC (ZEC)

- XLM (XLM)

Notable absentees from the above list include Ripple (XRP), Binance Coin (BNB), and EOS (EOS).

Webull ETFs

Webull also allows you to invest in ETFs. These are all listed on either the NYSE or Nasdaq so again, international diversification is not possible. You can invest in ETFs from $1 per trade.

Our Webull review found that there is no support for mutual funds.

Webull Stock Options

Webull also offers a stock options facility that supports a range of US-listed companies. Each option consists of 100 shares and you can apply leverage to your position - meaning you can trade with more than you have in your Webull account.

Webull Other Assets

Other than the financial instruments discussed above - there are no other asset classes supported by Webull. This means that you won't be able to engage in forex trading or commodity trading. There is no support for bonds, either.

Webull Fees & Commissions

Below we outline the Webull fees applicable to each supported asset class.

Asset Commission Stocks 0% Crypto 0% Forex Not Supported ETFs 0% Commodities Not Supported Indices Not Supported Options 0% Below we outline the Webull fees applicable to non-trading activities.

Fee Type Charge Open an account FREE Platform fee FREE ACH funding FREE Wire deposit $8 Wire withdrawal $25 Margin rate Starts at 6.99% 0% Commission Trading

Our Webull review found that the platform allows you to buy and sell assets without paying any commission. This is the case with stocks, options, ETFs, and cryptocurrencies.

Spreads

Webull doesn't advertise the spreads that it charges. The platform operates a variable spread system - which means the gap between the bid and ask price will vary throughout the day.

Deposits and Withdrawals

If you are using ACH to fund your account, there are no deposit or withdrawal fees. However, if bank wire is your preferred option, you'll pay $8 and $25 to deposit and withdraw funds, respectively.

Margin Rates

By using the margin trading facility at Webull, you'll pay 6.99% per year for debit balances below $25,000. As your debit balance increases, your margin rate gets more competitive. The lowest rate on offer is 3.99%, albeit, this requires a debit balance of over $3 million.

Webull User Experience

Both the Webull app and online platform offers a smooth and simple user experience. Much like its counterpart Robinhood, you don't need to have any experience of online trading to use the platform. Crucially, Webull is clearly aimed at those with little knowledge of online trading.

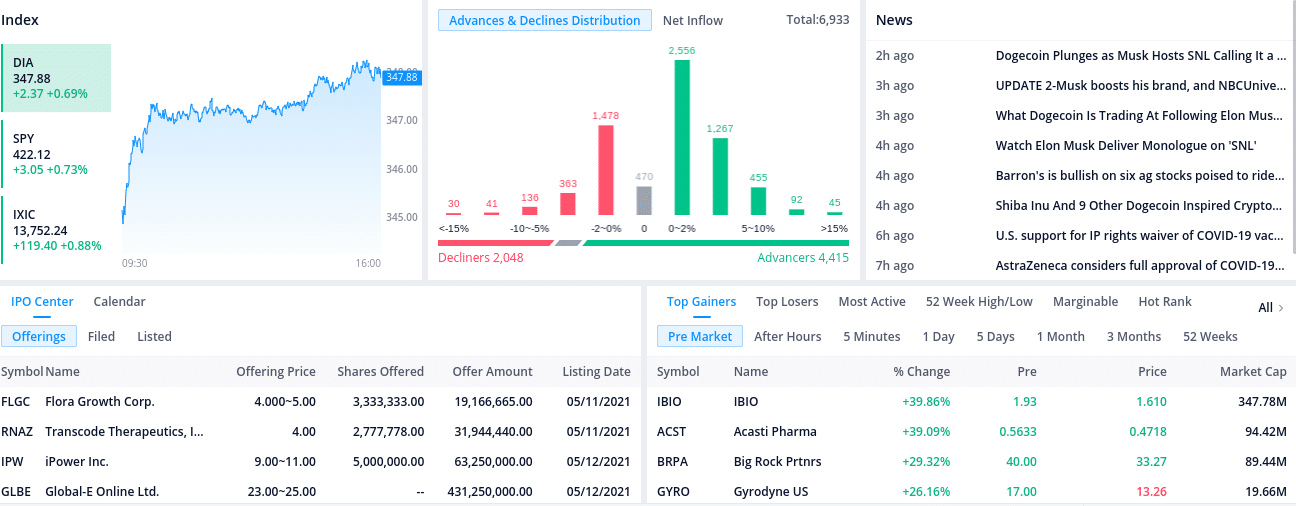

As such, if you're an experienced investor then you might find the platform a little too basic. On the other hand, if you're looking to invest for the very first time - Webull is likely to be of interest. If you're unsure which assets are worth considering, Webull aims to make the process simple by displaying 'hot' and 'cold' stocks alongside a watchlist.

This will show you the stocks that ended the day with the highest gains and losses. You can also view which stocks currently the most traded on the platform - which in some ways, allows you to gauge market sentiment. If you already know which assets you wish to invest in - you can use the search bar to go straight to the respective trading area.

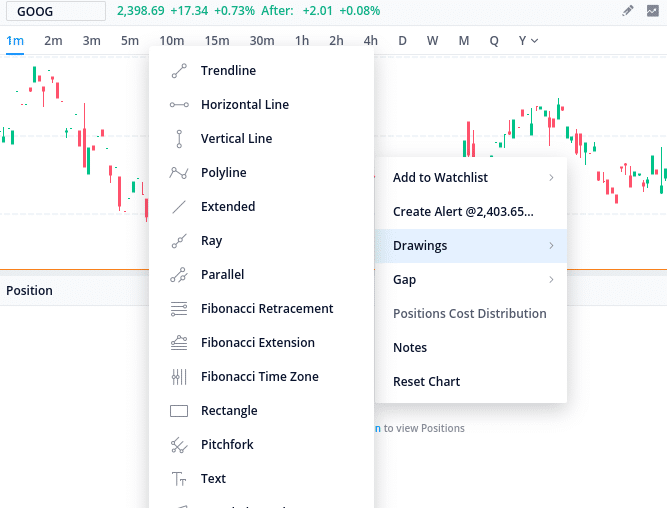

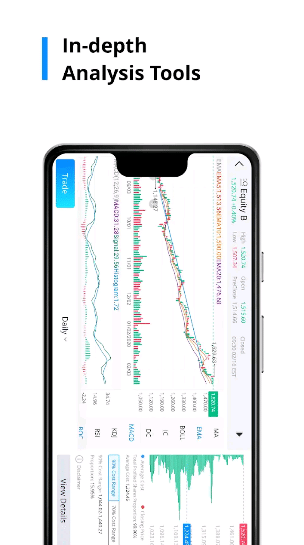

Webull Features, Charting, and Analysis

Although the broker is generally more suited to newbie traders, our Webull review found that the platform is actually relatively strong when it comes to chart analysis. Each and every supported market on Webull comes alongside a real-time pricing chart with multiple timeframes to choose from.

This goes from a 1-minute timeframe all the way to 1-year. To our surprise, Webull also allows you to deploy a range of technical indicators.

This includes everything from the Exponential Moving Average, SAR, and VWAP to the Keltner Channels, Ichimoku Cloud, and Bollinger Bands. There is also a stock screener available on the Webull platform - which can help you to find a suitable equity to trade.

Webull App Account Types

Our Webull review found that the broker offers two main account types - which we explain in more detail below.

Cash Account

The Cash Account at Webull is simply a traditional investment account that allows you to purchase assets to an amount equal to your balance. For example, if you have $500 in your account, you can invest no more than $500.

Margin Account

The Margin Account at Webull allows you to trade with more than you have in your account. You'll need to deposit at least $2,000 to benefit from margin trading - as per US securities laws. You will be capped to 3 day trading positions every 5 business days unless you deposit more than $25,000.

If you do, there is no day trading limits. If you want to engage in short-selling, you'll need the Margin Account. You can have both a Cash Account and a Margin Account at Webull.

Retirement Accounts

Through your Webull Cash Account, you can also invest via a Traditional, Roth, or Rollover IRA. You can select only one of the aforementioned retirement accounts when using Webull.

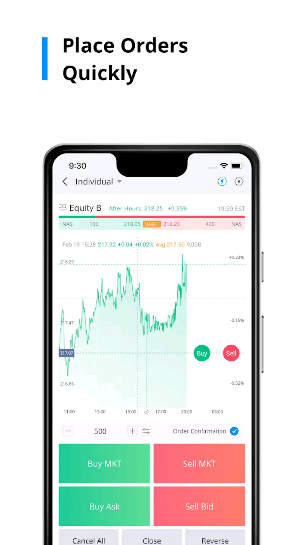

Webull App Review

Our Webull review found that the broker offers a popular mobile app that is available to download free of charge. You can access the app from Google Play or Apple Store. As noted earlier, the Webull app is super user-friendly and allows you to buy and sell assets with ease.

You can view the current value of your portfolio as soon as you load the app - so it's well worth installing even if you prefer trading online. In terms of public opinion, our Webull review found that the app is popular across both versions. On the Apple Store, for example, the app has a rating of 4.7/5.

This is across more than 197,000 individual reviews. Over on Google Play, the app has a rating of 4.4/5 across over 116,000 reviews.

Webull Payments

Our Webull review found that the platform does not accept debit/credit card or e-wallet deposits. Instead, you'll need to choose from ACH or a bank wire. While the former permits zero-fee deposits and withdrawals, this isn't the case with bank wire payments. On the contrary, bank wire deposits cost $8 per transaction and $25 on withdrawals.

In terms of deposit times, the process is slow at Webull. This is because the platform notes that it takes between 1-5 working days for the funds to be credited.

Webull Minimum Deposit

There is no minimum deposit amount at Webull, which is great for those wishing to invest small amounts.

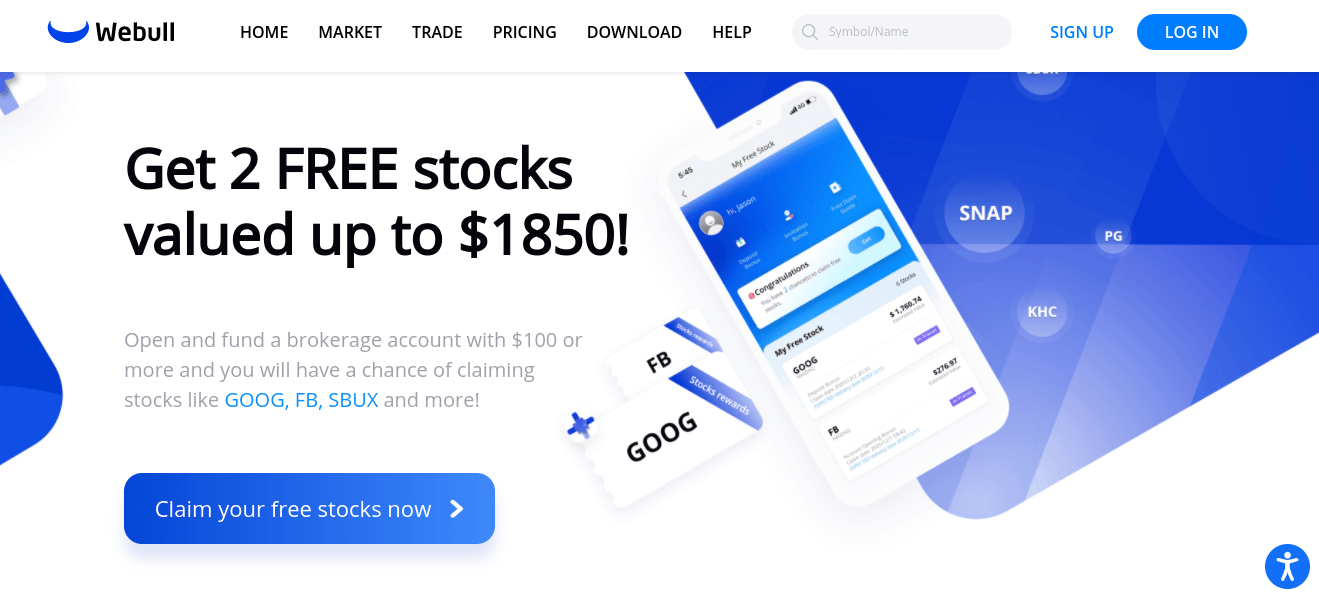

Webull Bonus

If you are opening an account for the very first time, our Webull found that you will benefit from its promotion of 2 free stocks. The first free stock will be credited when you first open an account - and will be valued between $2.50 and $250.

Once you meet a minimum deposit of $100 - you will receive your second free stock. This will be valued between $8 and $1,600. As such, by opening an account and making a deposit - you'll receive two stocks with a minimum collective value of $10.50 and a potential maximum of $1,850.

There is also a referral program that allows you to earn additional free stocks when somebody signs up with your unique link. This consists of 2 free stocks on the first referral and 8 free stocks on the second. You will get 2 additional free stocks upon each subsequent referral.

Webull Contact and Customer Service

Much like its direct competition Robinhood - customer service at Webull is poorly rated. This is because you will be encouraged to email the support team at [email protected] - which can result in super-slow response times.

After doing a bit of digging, we found that you can also contact the team by telephone at +1 (888) 828-0618. There is no live chat facility.

Is the Webull App Safe?

We get a lot of messages here at TradingPlatforms.com asking is Webull safe? The short answer is yes - Webull is a safe and secure trading platform that is heavily regulated.

This includes registration with FINRA and the SEC. As a member of the SIPC, you will also benefit from an investor protection scheme. This stands at $500,000 should the broker enter bankruptcy. Of this figure, up to the first $250,000 in cash reserves is covered.

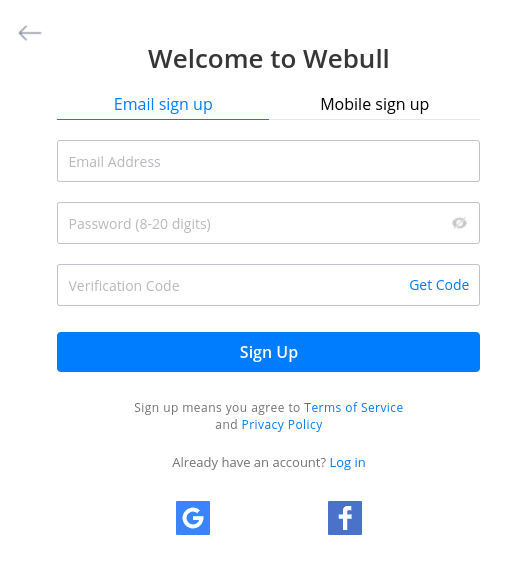

How to Start Trading with Webull

In this section of our Webull review, we are going to walk you through the process of getting started with an account.

Step 1: Join Webull

Visit the Webull website and elect to open an account. You'll be asked to provide some personal information such as your name, address, residency status, and telephone number.

You'll also need to confirm your email address and enter your social security number. The latter is how Webull is able to verify your identity.

Step 2: Link Bank Account

Webull supported both ACH and bank wire for deposits. However, we would suggest the former, as the latter will set you back $8 and $25 on deposit and withdrawals, respectively.

Before you can make a deposit via ACH, you need to link your bank account to Webull. To do this, Webull will send two micro-deposits to your bank account. This can take up to 48 hours to show up in your account. Once the two payments arrive, head over to your Webull account and enter the specific amounts of each deposit.

Step 3: Transfer Funds

Once your bank account has been linked to Webull, you can proceed to make a deposit. Once again, expect to wait between 1 and 5 working days for the funds to arrive.

Step 4: How to buy on Webull

As soon as your Webull account is funded you can start trading. Search for the asset you wish to buy and set up an order. The latter requires you to enter your stake and confirm the position. Once you do, your investment at Webull is complete.

Step 5: How to Sell on Webull

Your investment will appear in your Webull portfolio. You can cash out at any time (during standard hours) at the current market rate. In doing so, the money will appear in your Webull Cash Account.

Webull vs eToro

Our Webull review team found that the platform is great for newbies that wish to invest without paying any commission. With that said, in reviewing a number of other popular trading platforms, we found that eToro is the better option.

Past performance is not an indication of future results

This is because:

- Supported Stock Markets: Webull is great if you only want to invest in US-listed stocks but below-par when it comes to international companies. At eToro, you can invest not only in US stocks but 15 international markets. This includes companies based in the UK, Hong Kong, Suadi Arabia, and multiple European nations.

- Cryptocurrencies: Webull is a bit thin on the ground when it comes to crypto assets. eToro offers a much wider library of digital currencies. Notable additions that you won't find at Webull include Ripple, Cardano, EOS, Binance Coin, and Uniswap.

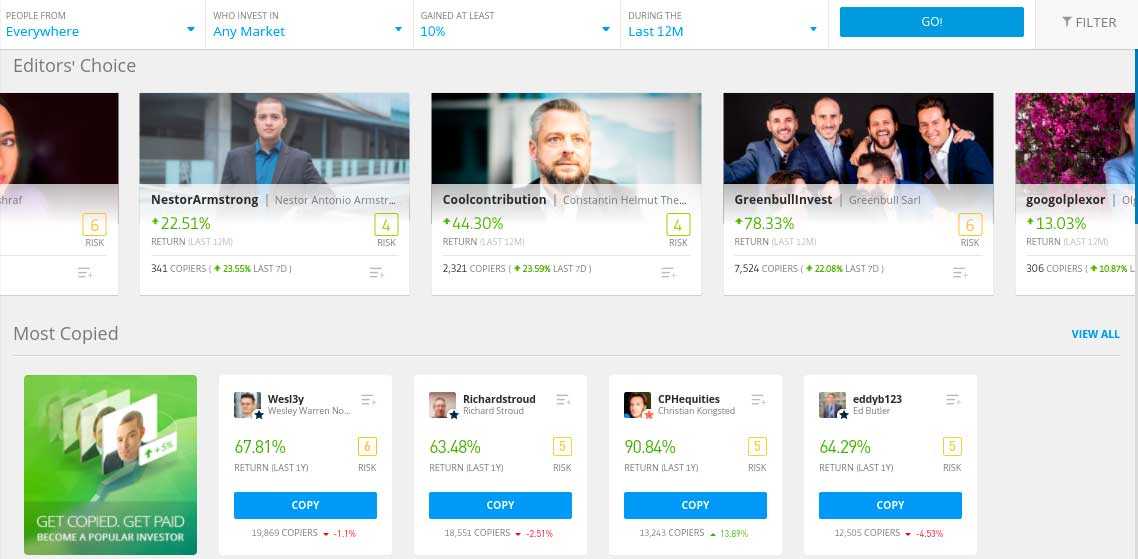

- Passive Investing: eToro offers two core passive investment products - while Webull offers nothing in this department. First, you have the Copy Trading tool - which allows you to mirror the buy and sell orders of your chosen eToro investor. Second, you can also invest in CopyPortfolios - which are professionally managed portfolios. The latter covers everything from cryptocurrencies, dividend stocks, and growth stocks.

- Payments: Getting started at Webull can take over a week when you consider the cumbersome process of linking your bank account. At eToro, you can open an account and deposit funds in less than 10 minutes. This is because the broker supports debit/credit cards, Paypal, and Neteller - all of which are credited instantly.

We should also add that much like Webull - eToro allows you to trade on a commission-free basis. The platform does not charge any ongoing platform fees and USD-deposits are fee-free.

Webull Review: The Verdict

Webull has proven popular with casual traders in the US that want a bare-bones investment platform without paying any commission. Our Webull review team did, however, fund that a much better option is available in the form of eToro.

eToro is home to over 20 million investors and gives you access to 17 international stock exchanges - alongside ETFs, indices, commodities, forex, and more. There are no commissions to pay on eToro and best of all - you can invest in a 100% passive nature via the Copy Trading and CopyPortfolio tools.

Unlike Webull - the process of opening an account, making a deposit, and placing your first investment will take you no more than 10 minutes!

eToro - Best Trading Platform with Zero Commission to Trade Stocks

Past performance is not an indication of future results

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

FAQs

Does Webull have a demo account?

Yes, Webull offers a paper trading account to all users. You'll need to open an account to gain access to the demo facility.

How does Webull make money?

Our Webull review team found that although the broker is commission-free, it makes money from margin trading services, Level II pricing data, and via the spread.

What is Webull?

Webull is an online and mobile trading platform that allows you to trade stocks, ETFs, cryptocurrencies, and options without paying any commission.

Is Webull really free?

Yes, as long as you are not trading with margin or attempting to access Level II data, our Webull review found that the app is free. This is because there are no fees to sign up and buying and selling is commission-free.

How much are Webull deposits?

If you deposit funds via ACH - there are no fees. However, our Webull review found that you will pay $8 to deposit funds with a bank wire. Withdrawals with this payment method cost $25. As such, it's best to stick with ACH.

How long does it take to withdraw money from Webull?

Webull notes that withdrawals can take 1-5 working days to reach your bank account.

How do you open a margin trading account on Webull?

To use the Webull margin trading service, you need to deposit at least $2,000 into your account.

What cryptocurrencies does Webull support?

Webull supports the following cryptocurrencies - Bitcoin (BTC), Dogecoin (DOGE), Bitcoin Cash (BCH), Ethereum (ETH), Litecoin (LTC), ZEC (ZEC), and XLM (XLM).

Is Webull safe?

Yes, Webull is safe. The platform is registered with the SEC and FINRA, and is also a member of the SIPC.

Kane Pepi Finance Writer

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Kane has also written for websites such as MoneyCheck, InsideBitcoins, Blockonomi, Learnbonds, Buyshares n and the Malta Association of Compliance Officers.

Before starting his career as a writer, Kane studied at the University of Central Lancashire where he received a Masters Degree in Financial Investigation and then a Research Doctorate in Criminal Justice. Pepi is passionate about helping people to make informed decisions through high-quality, educational content.

Visit eToroeToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.eToro: Best Trading Platform with 0% Commission

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up