Best Margin Trading Platforms & Exchanges of June 2025

Margin trading offers online traders with the ability to trade with more capital than they have in their balance. The best margin trading platforms are those that provide competitive fees while following trading regulations.

Below you will fine the top brokers for margin trading in various markets such as stocks, futures, ETFs, CFDs and forex.

-

-

Best Brokers For Margin Trading in 2025

For a quick overview of the best margin trading brokers in the business, see our list below. For in-depth analysis of each, you can also scroll down for more information:

- Plus500: Plus500 is a CFD trading platform with a user-friendly interface and excellent customer support. It is also possible to do margin trading on the app, however the leverage offered is not as high as some other brokers

- eToro: It is possible to trade limited margins on eToro, which means that you can trade margins without leverage. This is considered to be less risky than traditional margin trading and more suitable for beginners. eToro also offers CFD trading, crypto trading, forex trading as well as copy trading features. The platform is regulated in a number of jurisdictions which makes it one of the most trusted platforms for US traders.

- Libertex: Libertex offers both margin and leverage trading to US traders. The platform has been running for more than 23 years and is available on both mobile and desktop devices. Traders can take advantage of advanced analysis tools to inform their trading decisions.

- Robinhood: Robinhood offers trading in US stocks including a beginner-friendly mobile app. The platform facilitates margin trading with a focus on risk management and careful decision-making.

- TD Ameritrade: To margin trade on TD Ameritrade, you must have at least $2,000 in your trading account. 30% of this will be used as equity for margin trading. The platform is an established stock broker for experienced investors. It offers a range of educational resources and analysis tools for informed decision-making.

- Fidelity: The Fidelity trading platform offers two types of margin trading accounts: standard and limited margin. Furthermore, the platform offers a great range of research and analysis tools as well as excellent customer service.

- Interactive Brokers: Interactive Brokers offers low rates for margin trading which makes it an appealing choice for both beginner and advanced traders. The platform also supports ETFs and US stocks, which can be traded on a commission-free basis.

- Charles Schwab: Charles Schwab offers margin trading to clients who are looking to purchase additional securities. This involves borrowing funds from the broker. Charles Schwab does not offer as many trading features as some platforms but is well-established and has a strong reputation.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

What is Margin Trading?

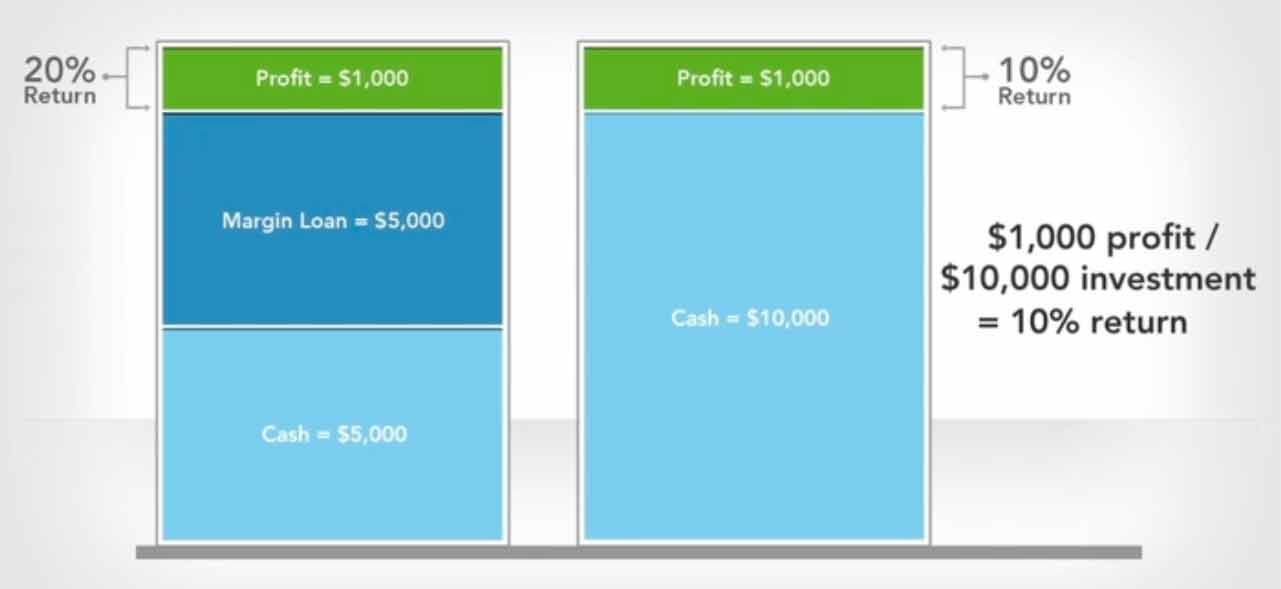

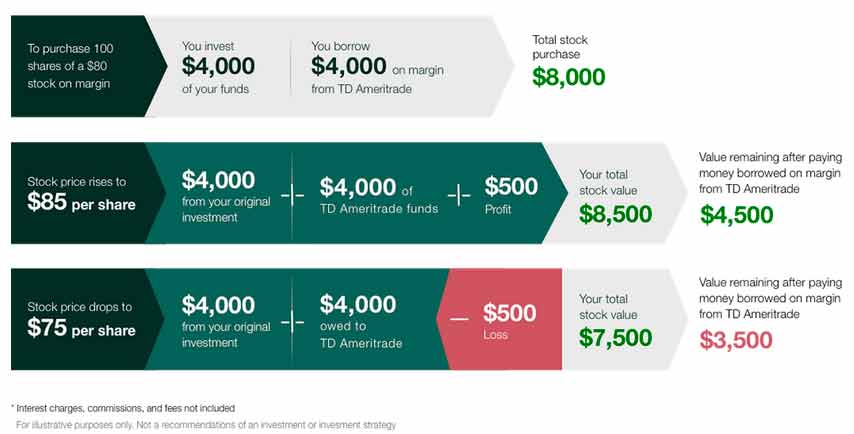

Margin trading is an efficient way to increase returns and grow your portfolio. Whether you trade cryptocurrencies, stocks, ETFs, commodities, or currencies, you can increase the dollar value of your positions by borrowing money from your broker. For example, when using 2:1 leverage (50% margin), you can open up a $10,000 trading position with only $5,000 of your own funds.

How Does Margin Trading Work?

To enjoy the benefits, you first need to open up a margin-eligible account. Thereafter, you can borrow funds from your broker (which is easily done using any of the above brokers’ online platforms) and use the financing to purchase nearly any asset.

Remember though: if your position increases in value, the return is much higher than an all-cash purchase. However, if your equity value falls below the brokers’ maintenance margin (often 25% to 35% of the total position), the broker can issue a margin call and ask you to deposit more money. If you don’t, the broker has the right to sell all of your holdings.

Is There Much Risk Involved In Margin Trading?

Yes, there is a significant amount of risk involved in margin trading. Margin trading allows traders to use borrowed funds to increase their trading position, which can amplify potential profits but also increases the risk of losses.

One of the biggest risks of margin trading is the potential for margin calls, which occur when the value of the assets being traded falls below a certain level. When this happens, the broker may require the trader to deposit additional funds into their account to cover the loss or risk the liquidation of their position.

Additionally, margin trading can be more volatile and unpredictable than traditional trading, as the use of leverage can result in large swings in profit or loss in a short period of time.

Margin trading can be a useful tool for experienced traders who are able to manage their risks effectively, but it is not recommended for beginners or those who are not comfortable with taking on additional risk. It is important to thoroughly understand the risks involved in margin trading and to use it judiciously and with caution.

Top Margin Trading Platforms Reviewed

Separating the wheat from the chaff, it takes more than a pretty face to make our list of the best margin trading platforms. Excelling in everything from margin limits, financing rates, account fees, and platform features, our nine candidates continue to outperform the competition.

1. Plus500 – The Best Broker for Margin Trading CFDs

Plus500 is the best margin trading platform for CFDs. Offering a $100 account minimum and no withdrawal fees, Plus500 offers 30:1 leverage (3.33% margin) on nearly all of its tradable assets. What’s more, if you become a Professional Client, you can increase your maximum leverage to up to 300:1 (0.33% margin). However, to qualify, you must meet the following requirements:

- Maintain sufficient trading activity over a 12-month period

- Have a portfolio of at least €500,000

To support advanced trading strategies, Plus500 offers a free paper trading account that can be used to trade with up to $50,000 in virtual funds. Users can switch between live and demo trading easily and the demo account provides access to the entire Plus500 trading platform.

Likewise, all of Plus500’s platform features work seamlessly on Apple iOS and Android devices. This makes it a suitable option for active traders who are looking to manage their portfolio on the go.

Pros:

- Plus500’s demo trading account allows you to practice trading CFDs with zero risk

- Customer support is available 24/7 through live chat and email

- Plus500 is regulated by the UK Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC)

Cons:

- Plus500 does not allow scalping where positions are held for two minutes or less

- Futures are restricted to US-based traders

- Only CFDs, no traditional stocks

80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

2. eToro – Overall Best Margin Trading Exchange

Whether it’s currencies, commodities, ETFs, or cryptocurrencies, eToro can finance your positions with the maximum available leverage. Far and away from the best margin trading platform, not only are eToro’s margin limits exceptional, but the broker strictly adheres to regulations set forth by the European Securities and Markets Authority (ESMA). The overall features, safety, and regulation also make it a site for beginner traders.

See for yourself:

- 30:1 leverage for major currency pairs (3.33% margin)

- 20:1 leverage for non-major currency pairs, gold, and major indices (5% margin)

- 10:1 leverage for commodities (ex. gold) and non-major equity indices (10% margin)

- 5:1 leverage for CFDs, stocks, and ETFs (20% margin)

- 2:1 leverage for cryptocurrencies (50% margin)

Crypto CFDs/ Leverage is restricted for US/ FCA users.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

In addition, not only does eToro provide access to more than 2,400 stocks and 17 international markets with trades that always execute commission-free, but overnight lending fees are calculated using a standardized formula. More than just lip service, instead of surprising you with hidden charges and random fees, eToro clearly displays all charges BEFORE you finalize your trade.

Pros:

- Trade stocks, indices, ETFs, Bitcoin, commodities, and currencies with maximum leverage and the lowest fees

- Putting clients first, equities listed on the London Stock Exchange (LSE) often incur a stamp duty tax of 0.50%. However, eToro waives this fee

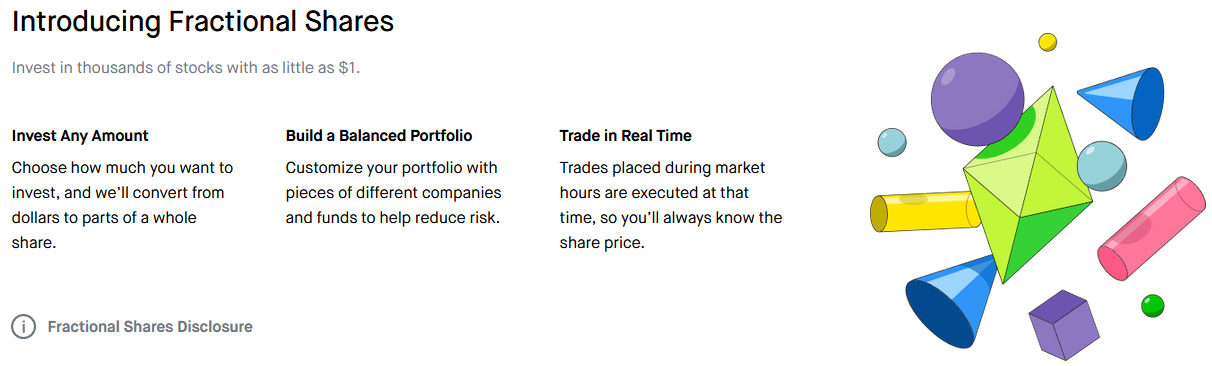

- Fractional shares allow you to purchase high-priced stocks with little upfront investment

- eToro is fully regulated by the U.K. Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), the CySEC, and U.S. FINRA

Cons:

- eToro’s platform lacks the necessary tools to conduct advanced technical analysis

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

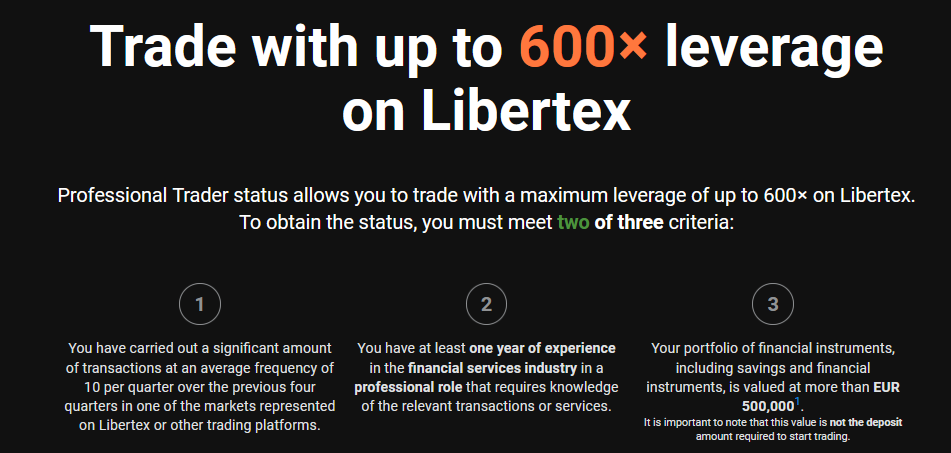

3. Libertex – Best Margin Trading Platform for US Professional Investors

Clearly in the running for the best online broker for margin trading, Libertex ensures that all clients that are active traders can trade with maximum leverage. Providing access to online stocks, ETFs, commodities, currencies, CFDs, and cryptocurrencies, Libertex makes margin trading a breeze.

Like eToro, its margin limits are as follows:

- 30:1 leverage for major currency pairs (3.33% margin)

- 20:1 leverage for minor currency pairs, gold, and major indices (5% margin)

- 10:1 leverage for commodities other than gold and minor indices (10% margin)

- 5:1 leverage for individual equities and other reference values (20% margin)

- 2:1 leverage for cryptocurrencies (50% margin)

What’s more, if you become a Professional Client – which requires that you make an average of 10 trades per quarter, have a portfolio value of more than €500,000 and/or have at least one year of experience in the financial services industry in a professional role – you can access leverage of up to 600:1 (0.167% margin).Libertex is unavailable to US and UK traders.

Pros:

- Sporting more than 23 years of operational experience, Libertex’s platform is fully functional on desktop, laptop, Apple iOS, and Android devices for charting

- Libertex’s demo trading account allows you to trade CFDs with zero risk

- You have free access to Libertex’s educational webinars, blog articles, financial news, and economic data

- Libertex is regulated by the CySEC

Cons:

- Commission-free trading is not available, but Libertex does off commission discounts in terms of trading costs

- Despite being one of the best margin trading brokers, Libertex is best suited for accounts of €5,000 or more

- Libertex does not accept US and UK traders

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 85% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

4. Robinhood – Best Margin Trading Exchange for American Depositary Receipts (ADRs)

With no account minimum and 0% commissions, Robinhood is home to quality execution, transparent fees, and the highest security standards. Case in point: while the broker is a member of the Securities Investor Protection Corporation (SIPC) – which protects accounts up to $500,000 (including $250,000 for claims for cash) – Robinhood also insures 100% of direct losses that occur due to unauthorized account activity.

In addition, because best-in-class security is embedded on one of the best margin trading platforms, managing your investments on Robinhood never felt so good when you open a brokerage account with them.

Regarding margin limits, Robinhood adheres to the U.S. Federal Reserve Board’s Regulation T – which requires a $2,000 minimum account balance and allows for 2:1 leverage (50% margin). And while Robinhood’s maintenance margin – the equity value of your position that needs to be maintained at all times – varies depending on “volatility and market liquidity,” typical percentages range from 25% to 35%.

Pros:

- As one of the best margin trading brokers, Robinhood provides access to more than 5,000 stocks and 650 global American Depositary Receipts (ADRs)

- On Robinhood’s platform, you can trade stocks, options, ETFs, and cryptocurrencies commission-free

- In terms of pricing, Robinhood Gold members ($5 per month). receive access to stock research reports, Level II market data, and larger instant deposits

- Robinhood is regulated by the U.S. Securities and Exchange Commission (SEC) and maintains membership in U.S. FINRA, according to its legal disclaimer

Cons:

- Robinhood‘s platform does not offer access to bonds, mutual funds, preferred shares, futures trading, or joint accounts

- It might be friendly in a first instance just for experienced traders

- Restricted to US traders

There is no guarantee that you will make money with this provider. Proceed at your own risk..

5. TD Ameritrade – Best US Margin Trading Broker for Advice and Support

Increasing your buying power with more leverage than a standard margin account, TD Ameritrade is one of the best margin trading platforms and stock brokers in the USA.

Dubbed ‘portfolio margin’, TD Ameritrade uses -15% and +15% risk bands for stocks and options and -12% and +10% risk bands for large and small-cap broad-based indices. Doing a little math, this works out 6.7x leverage for stocks and options, and 8.33x to 10x leverage for large and small-cap indices. However, to qualify for portfolio margin, you must have a minimum account balance of $125,000 and maintain a 30% maintenance margin at all times.

For accounts that are less than $125,000, TD Ameritrade adheres to the U.S. Federal Reserve Board’s Regulation T, which again, requires a minimum account balance of $2,000 and allows for up to 2:1 leverage (50% margin).

On TD Ameritrade’s platform, you can trade stocks, ETFs, bonds, CDs, options ($0.65 commission per contract), non-proprietary mutual funds, futures, and currencies. For the majority of assets, trades execute commission-free, and TD Ameritrade also provides free access to interactive courses, webcasts, and the most advanced technical analysis tools.

Pros:

- On top of 0% commissions on all major assets, TD Ameritrade charges zero platform fees, zero data fees and there are no trade minimums.

- In the running for the best margin trading platform, TD Ameritrade is the only stock broker on our list that offers in-person customer support at more than 175 U.S. branches

- TD Ameritrade is regulated by U.S. FINRA

Cons:

- To access portfolio margin, you need a minimum account balance of $125,000

There is no guarantee that you will make money with this provider. Proceed at your own risk..

6. Fidelity – Best Platform for Margin Trading for Research & Analysis

Home to both standard margin and portfolio margin (for account balances of $100,000 to $150,000), Fidelity is clearly one of the best margin trading brokers in the USA and one of the best online brokers in the business.

Like Robinhood and TD Ameritrade, Fidelity adheres to the U.S. Federal Reserve Board’s Regulation T. As such, a minimum account balance of $2,000 can access up to 2:1 leverage (50% margin). However, like TD Ameritrade, portfolio margin accounts enjoy much higher leverage.

But in a unique fashion, Fidelity offers ‘limited margin’ for retirement accounts. To qualify, you need a minimum account balance of $25,000.

And instead of borrowing directly from Fidelity, the broker allows you to finance new trades with funds from unsettled transactions (which would otherwise trigger a good faith violation).

Pros:

- Fidelity offers standard margin, portfolio margin, and limited margin accounts that are tailored to your specific needs

- All U.S. stocks, ETFs trade commission-free, while options are $0.65 per contract

- Bitcoin and Ethereum trading is available

- As one of the best margin trading platforms, clients also receive access to analyst reports that cover more than 4,500 stocks and span more than 20 independent, third-party research firms.

- Fidelity is a registered broker-dealer with the U.S. Securities and Exchange Commission (SEC) and its U.K. operations are regulated by the Financial Conduct Authority (FCA)

Cons:

- Fidelity does not list futures

- High broker assistance trade fee

There is no guarantee that you will make money with this provider. Proceed at your own risk..

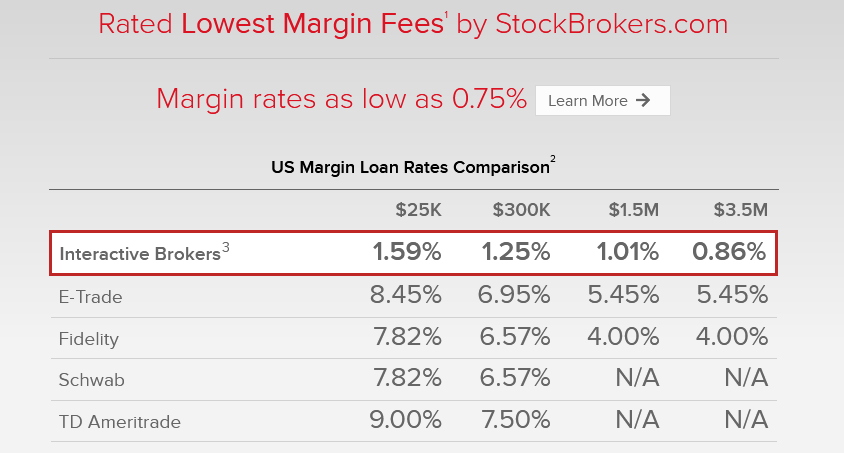

7. Interactive Brokers – The Best Starter Margin Trading Platform with Cheap Financing

Like TD Ameritrade and Fidelity, Interactive Brokers offers both standard margin and portfolio margin accounts. Within a standard margin account, clients are subject to the margin limits of the U.S. Federal Reserve Board’s Regulation T ($2,000 account minimum and 2:1 leverage/50% margin). Likewise, to be eligible for a portfolio margin account, you must have a minimum account balance of $110,000.

However, Interactive Brokers allows you to trade U.S. listed stocks and ETFs commission-free and you can access tradable assets on 28 exchanges across 14 countries. What’s more, while commissions on options ($0.15 to $0.65 per contract) and futures ($0.25 to $0.85 per contract) are extremely competitive, even lower margin rates make Interactive Brokers the best margin trading platform for cost-conscious investors.

Pros:

- Interactive Brokers platform is accessible across a wide variety of countries, including the U.S., U.K., Germany, and France.

- Interactive Brokers margin rates are up to 50% less than comparable brokers

- You can lend out your securities to short sellers and earn extra income

- Interactive Brokers is regulated by the Securities and Exchange Commission (SEC) and the Commodities Futures Trading Commission (CFTC), while its U.K. operations are regulated by the Financial Conduct Authority (FCA), and regulated products are covered by the UK FSCS

Cons:

- Designed for advanced traders, less experienced investors may find Interactive Broker’s platform intimidating

There is no guarantee that you will make money with this provider. Proceed at your own risk..

8. Charles Schwab – The Best Broker for Margin Trading Futures

Also adhering to the U.S. Federal Reserve Board’s Regulation T, standard margin accounts at Charles Schwab requires a minimum deposit of $2,000 and allow for 2:1 leverage (50% margin).

However, for long positions in stocks, ETFs, preferred shares, and warrants that are priced at less than $3.00, you need to maintain a 100% maintenance margin at all times.

But still in the running for the best margin trading platform, stocks, ETFs, preferred shares and REITs always trade commission-free on Charles Schwab’s StreetSmart Edge platform, while futures ($1.50 per contract) and options ($0.65 to $1.50 per contract) are also priced competitively.

Even better, Micro E-mini futures – which are 1/10th the size of normal futures contracts – also come with lower margin requirements.

Pros:

- At Charles Schwab, you can trade thousands of products, including stocks, fractional shares, ETFs, bonds, futures, options, and mutual funds

- Charles Schwab’s Idea Hub can be used to find bullish and bearish trade ideas in real-time

- Charles Schwab is a registered broker-dealer with the Securities and Exchange Commission (SEC) and is regulated by the Commodities Futures Trading Commission (CFTC)

- Charles Schwab’s platform is available in the U.S., U.K., Hong Kong, and other international jurisdictions

Cons:

- Charles Schwab does not list cryptocurrencies among its tradable assets

There is no guarantee that you will make money with this provider. Proceed at your own risk..

Best Margin Trading Platforms Fee Comparison

For a breakdown of our brokers’ fee structures, please see the table below:

margin interest rate of 12% and a margin interest rate of 8% for customers who subscribe to Gold

Platform Trading Fees Non-Trading Fees Margin Fees eToro 0% commissions for stocks and ETFs, variable spreads for cryptocurrencies and CFDs Free deposits $5 withdrawal fee

$10 inactivity fee

Conversion fee from 50 pips

Overnight fee for CFDs (company rate + LIBOR) Robinhood 0% commissions for stocks and ETFs, ADR fee of $0.01-$0.03 per share No deposit, maintenance, or inactivity fees 12% margin interest

8% margin interest for gold subscribersLibertex 0%-0.46% commissions Free deposits €1 to 1% withdrawal fee

Overnight fee for CFDs (company rate + LIBOR) TD Ameritrade 0% commissions on stocks and ETFs, options ($0.65 per contract), futures ($2.25 per contract plus exchange & regulatory fees), currencies (variable spreads) No deposit or withdrawal fee via ACH transfer $75 outbound transfer fee

$25 wire transfer fee

7.50% (for margin > $250,000) to 9.50% (for margin < $10,000) Fidelity 0% commissions on stocks and ETFs, options ($0.65 per contract) No deposit, withdrawal, transfer, or wire fees 9.25% (for margin > $1,000,000) to 13.57% (for margin < $25,000) Interactive Brokers Commissions are tiered and range from as low as $0.35 per transaction to 1% of the trade value No deposit or transfer fees 1 free withdrawal per month

To avoid an inactivity fee, you must spend $10 or more per month on commissions

7.830% for IBKR LITE Varies for IBKR PRO clients.

Plus500 0% commissions but variable spreads for CFDs No deposit, withdrawal, or account fees $10 inactivity fee (if you don’t log in to the platform for at least 3 months)

2.70% (for margin on major currencies) to 18.6% (for margin on stock CFDs) Charles Schwab 0% commissions on stocks, ETFs, preferred shares, REITs, and Schwab mutual funds (all other mutual funds are $49.95), options ($0.65 per contract), futures ($1.50 per contract) No account, deposit, or withdrawal fees $15 online wire transfer fee

11.825% (for margin > 250,000) to 13.57% (for margin < $25,000) How to Get Started with a Margin Trading Broker

Easily winning the platform wars, margin trading on eToro is as easy as 1.2.3. To get started, simply follow the steps below:

Step 1: Open an Account and Submit Your ID

By clicking the “Join Now” button at the top of eToro’s homepage, you’re only a few steps away from accessing the best margin trading platform available.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Next, you’re prompted to enter a username, password, and email address. You also have to provide your first and last name, date of birth, home address, and mobile number. For security purposes, eToro also confirms your mobile number via text message.

Step 2: Confirm Your Identity

To verify your identity, you need to submit a copy of a valid driver’s license or passport, plus a utility bill or bank statement issued within the last three months. Most often, verification takes less than a few minutes and you can begin margin trading immediately.

Step 3: Deposit Funds

Requiring a minimum despot of $200, you can choose from the following U.K. payment methods:

- Debit/Credit Card (Visa, MasterCard, Maestro)

- PayPal

- Skrill

- Neteller

- UK Bank Transfer

Even better, apart from a U.K. bank transfer, the above deposit methods are processed instantaneously.

Step 4: Choose an Asset and Click TRADE

Whether it is EUR/USD, Bitcoin, or Netflix, after choosing your desired target, follow the steps below to easily finance your position:

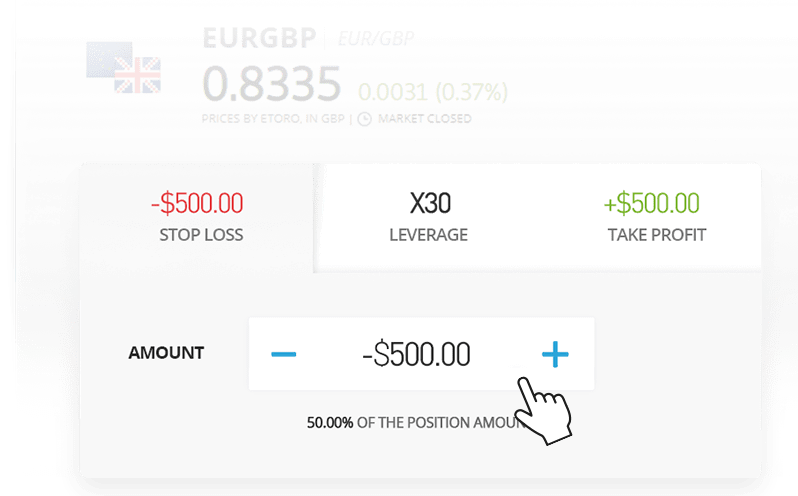

- Click on the asset’s logo and a popup window with the trade parameters will appear

- Select the appropriate tab at the top for Sell (short) or Buy (long) for your trade

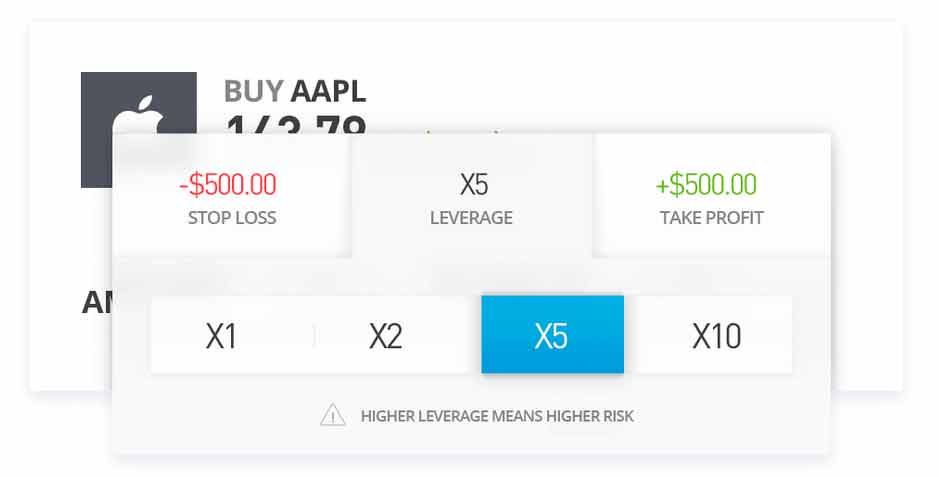

- Set the amount of capital that you wish to invest and set your leverage multiplier. For example, a 2:1 leverage multiplier implies a 50% margin.

- Set your Stop Loss and Take Profit parameters. A Stop Loss limitation is required in order to mitigate risk.

- Click SET ORDER to place your trade. Trades are executed immediately when the market is open.

Also, be aware that leveraged trades are processed as CFDs.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Conclusion

While the marginal buyer is often viewed as the sucker in financial markets, margin trading is the exact opposite. Allowing you to increase your exposure with little upfront costs, margin trading can be a gateway to a more prosperous future.

However, before taking the plunge, it’s important to hitch your wagon to the right horse. Offering the unparalleled combination of 0% commissions, maximum leverage, cheap financing rates, and best-in-class service, if it wasn’t clear before, it should be clear now, that eToro is this year’s best margin trading platform.

What’s more, sign up is a breeze and you can begin trading with as little as $20.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Frequently Asked Questions

Which broker gives the most margin?

Out of the brokers that we have reviewed, Interactive Brokers offers that most margin and eToro takes second place. The margin loan rate on Interactive Brokers in 5.228% which is the lowest option available to traders.

Which crypto exchange allows margin trading?

eToro is a crypto exchange that offers margin trading however, this service is not available to US citizens. Instead, Binance is a good option to consider. Binance offers crypto margin trading with leverage up to 125x on Bitcoin.

What exchanges offer 100x leverage?

Libertex is an exchange that offers 100x leverage on CFDs. Other options to consider include Binance, KuCoin and ByBit.

Is leverage trading legal in the US?

Leverage trading is legal in the US however, traders are limited to leverage of up to 1:50 for all markets. This limit was put in place by regulators to protect traders against excessive risk.

References:

Michael Graw Freelance Writer

View all posts by Michael GrawMichael Graw is a freelance journalist who covers finance, trading, and technology. His work has been published on numerous high-profile websites that cover the intersection of markets, global news, and emerging tech such as TechRadar and Top10.com. Michael has also written for StockApps, Buyshares and LearnBonds.

Before starting his career as a freelance writer, Michael studied at Cornell University where he obtained a BA in Microbiology. He then went on to recieve a Ph.D in Philosophy from Oregon State University. With 6 years of finance writing under his belt, Michael is an expert in his niche and has built up significant industry knowledge during his time as a writer. Michael writes informative content with the goal of supporting readers to make better financial judgements.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up

Regarding margin limits, Robinhood adheres to the U.S. Federal Reserve Board’s Regulation T – which requires a $2,000 minimum account balance and allows for 2:1 leverage (50% margin). And while Robinhood’s maintenance margin – the equity value of your position that needs to be maintained at all times – varies depending on “volatility and market liquidity,” typical percentages range from 25% to 35%.

Regarding margin limits, Robinhood adheres to the U.S. Federal Reserve Board’s Regulation T – which requires a $2,000 minimum account balance and allows for 2:1 leverage (50% margin). And while Robinhood’s maintenance margin – the equity value of your position that needs to be maintained at all times – varies depending on “volatility and market liquidity,” typical percentages range from 25% to 35%.

But in a unique fashion, Fidelity offers ‘limited margin’ for retirement accounts. To qualify, you need a minimum account balance of $25,000.

But in a unique fashion, Fidelity offers ‘limited margin’ for retirement accounts. To qualify, you need a minimum account balance of $25,000.