Fidelity Review 2025 – Pros & Cons Revealed

Are you new to the world of online trading but want to start investing in tradable assets and gaining exposure to the financial markets? To do this you will need a top-rated broker that suits your trading goals.

In this Fidelity review 2025, we will explore all the key metrics from fees and payments to accounts and security, so that you can start investing with a trading platform that is tailored to your needs.

What is Fidelity?

In 1943 Edward C. Johnson was appointed as president and director of Fidelity Fund. Three years later Fidelity Management & Research Company was established to function as investment adviser to Fidelity Fund.

As a privately held company, Fidelity has become home to more than 36 million investors while also facilitating around 3.5 million daily trades. With over 47,000 associates, Fidelity’s global presence covers nine countries including the US, North America, Europe, Australia, and Australia.

Your capital is at risk.

Fidelity offers US ETFs and stock trading on a commission-free basis. Additionally, it provides a wide range of advanced research tools, such as Active Trader Pro, technical analysis, charting, trading ideas, and technical indicators. Whatever your trading objectives and needs are, Fidelity offers an array of account types from standard trading to Roth IRA accounts.

The web trading platform is user-friendly and features a well-designed, interactive, and intuitive interface. Moreover, the account opening process is fully digital which makes for a streamlined trading experience.

When it comes to tradable assets Fidelity provides access to mutual funds, commission-free US stocks and ETFs, fixed income, Bonds and CDs, and options. Furthermore, you can adopt passive trading strategies with Fidelity’s robo investing and wealth management services.

Fidelity Pros & Cons

- Straightforward pricing structure with no account fees, 0% commission trades

- No account minimums to open a trading account

- Extensive market research from 20+ providers

- Zero expense ratio index funds

- Customer service representatives available 24/7

- Invest in 7,000+ US stocks and ETFs with $0 commission

- Provides fractional share trading

- Active Trader Pro demo account

- Wide range of payment methods including digital wallets and bank transfers

- No deposit or withdrawal fees

What we don’t like

- Does not support forex or cryptocurrency trading

- Lack of CFD derivatives trading

- Not suitable for investors looking to trade with leverage on a speculative basis

- Credit/Debit cards not accepted as payment methods

- Wire transfers in non-USD currencies incur a 3% withdrawal fee

- The account verification process can be slow

Your capital is at risk.

What Can You Trade on Fidelity?

Stock and ETF Trades

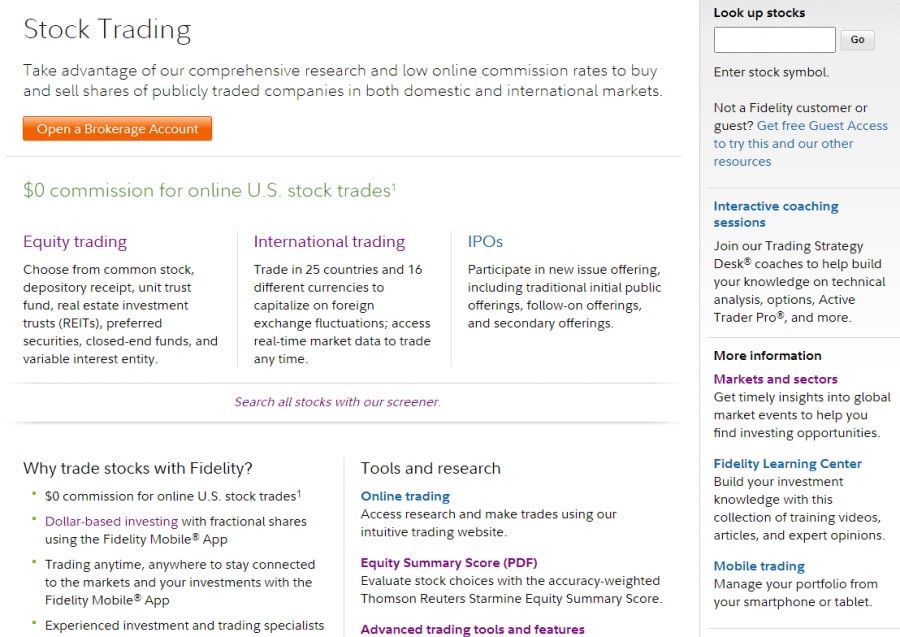

At Fidelity, you can take advantage of in-depth market research and low commission charges to invest in shares of major stock listed on top US and international exchanges.

- Equity trading – browse through common stocks, depository receipts, real estate investment trusts (REITs), closed-end funds, unit trust funds.

- International stock trading – access to 25 markets and 16 base currencies to take advantage of price movements in the forex markets, as well as use real-time market analysis to trade around the clock.

- Participate in initial public offerings (IPOs)

What is a stock screener?

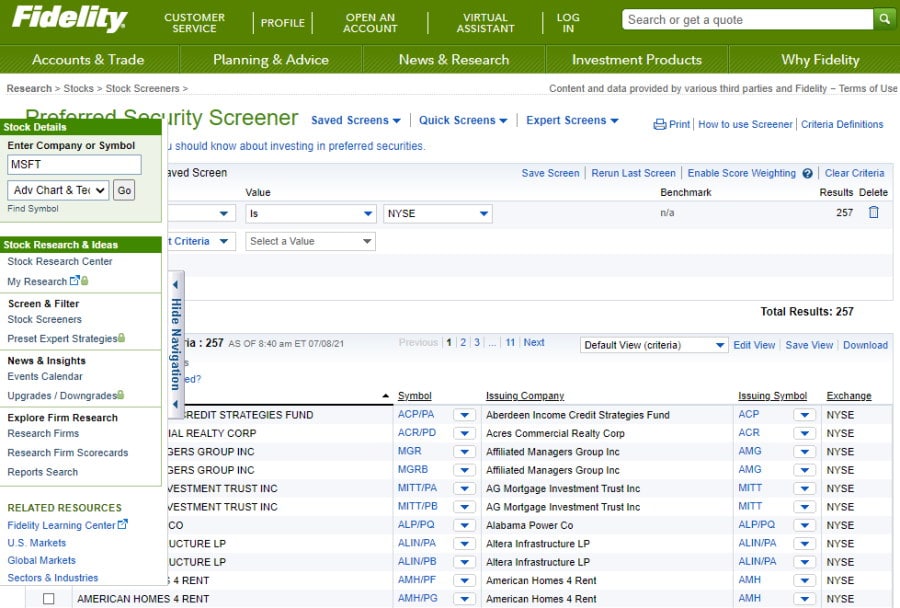

A stock screener is a selection of tools that enable traders to filter through heaps of accessible stocks and ETFs based on their own preferences and trading goals.

Fidelity provides a useful screener tool that allows you to sort through the thousands of available stocks with the click of a button.

What are some of the benefits of trading stocks with Fidelity?

Aside from the most prominent advantage of commission-free trading, at Fidelity, you can also invest in shares with as little as $1 with fractional share trading. This means you can access more than 7,000 US stocks and ETFs including Apple, Amazon, Tesla, iShares S&P 500 ETF, Fidelity Info Tech ETF, Fidelity Nasdaq Composite Index, Fidelity MSCI Health Care ETF.

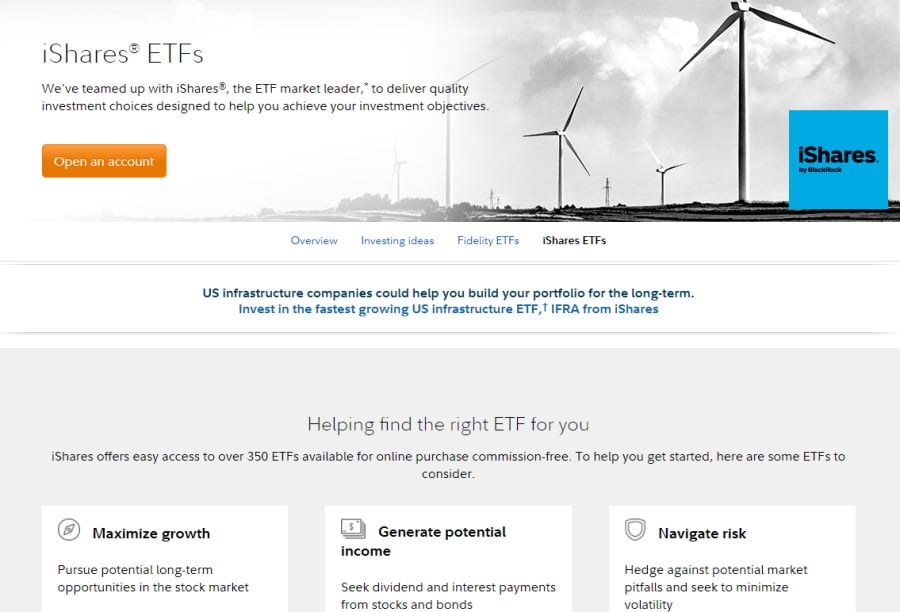

Commission-free Fidelity and iShares ETFs

Exchange-traded funds, more commonly referred to as ETFs, come with a basket of benefits when compared to traditional open-end funds. Stock ETFs give you diversified exposure to US and international exchanges, as well as trading flexibility, risk management, lower trading costs, and tax benefits.

At Fidelity, you can access a myriad of ETFs such as:

- Fidelity® MSCI Real Estate ETF

- Fidelity® Low Volatility Factor ETF

- Fidelity® Value Factor ETF

- Fidelity® Quality Factor ETF

- Fidelity® International High Dividend ETF

- Fidelity® International Value Factor ETF

- iShares Core S&P 500 ETF

- iShares Core MSCI Total International Stock ETF

- iShares Core US Aggregate Bond ETF

As you can see from the list, Fidelity has partnered with BlackRock which means that iShares provides direct access to more than 350 ETFs for online purchase without having to worry about paying a penny in commission charges.

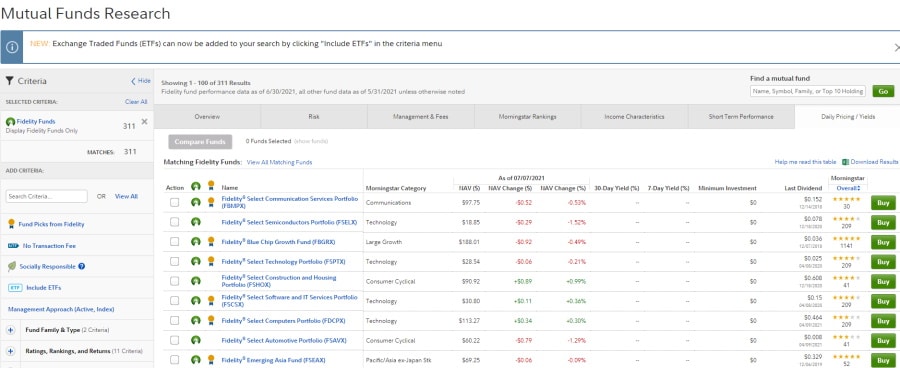

Mutual Funds

Mutual funds are a cost-efficient, feasible way to create a diversified investment portfolio of bonds, stocks, and short-term investments. At Fidelity, you can invest through the FundsNetwork and access more than 10,000 mutual funds from a wide variety of fund companies. You can also access a range of extensive offerings with zero transaction fees.

Browsing through 10,000 funds from a pool of fund companies may seem like a daunting task, especially for beginner traders, but with Fidelity’s market-leading tools you can find the right funds to suit your trading style.

Finding the right mutual funds can be done by:

- Fund Picks from Fidelity – professional traders select the top mutual funds in each investment category

- NTF (No Transaction Fee) funds – a large number of funds are accessible with no transaction fees.

- Browsing through Morningstar’s top-rated mutual funds

- Using the Evaluator tool you can filter your searches by fund groups and categories

The types of mutual funds supported by Fidelity include US equity funds, sector funds, international equity funds, asset allocation funds, municipal bond funds, taxable bond funds, and index funds.

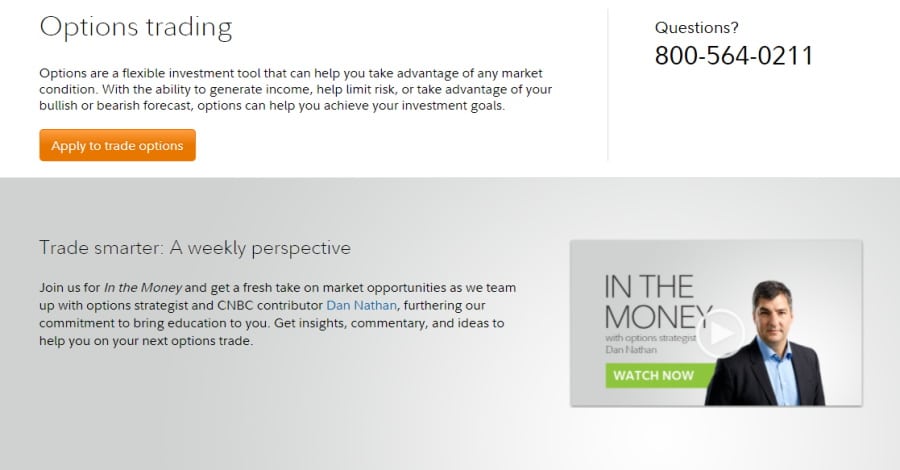

Options trading

An option, commonly referred to as a stock or equity option, is a contract between the buyer and seller relating to an underlying asset. The option’s buyer gains the right to make the seller do whatever the contract instructs before the expiration date. After the buyer has exercised the option, the seller is required to do whatever the contract specifies.

For instance, a put option on a US stock gives the buyer the right to sell a set number of shares at a preset cost within the timeframe set by the option itself. The seller is required to buy the stock from the buyer if the option is exercised.

Whether you are an experienced investor or new to options trading, Fidelity provides a wide range of research and trading idea tools, as well as educational resources to help optimize your options trading.

When it comes to the trading costs, these are transparent and straightforward, at $0.65 per options contract and no commissions, Fidelity offers a cost-effective way to trade options without busting the bank.

Moreover, with the Fidelity Rewards+, eligible Wealth Management traders can benefit from $0 contract fees when trading options up to 100,000 over a one-year period.

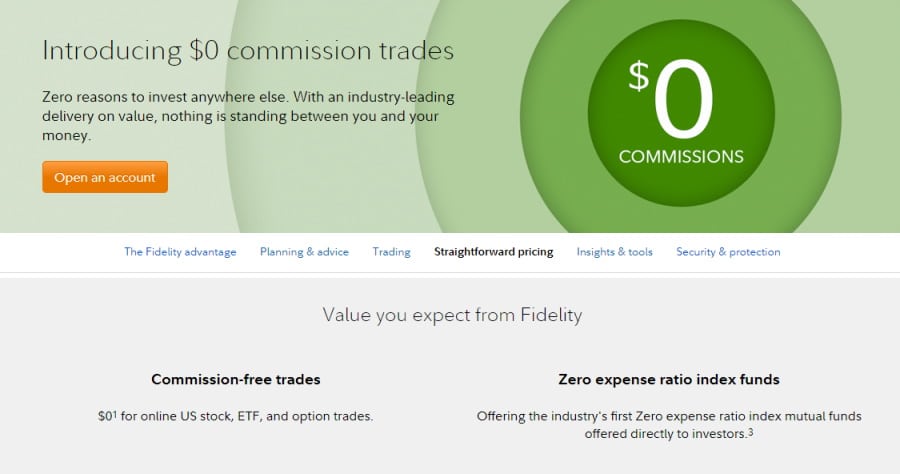

Fidelity’s Fees & Commissions

Arguably the best selling point is Fidelity’s offering of commission-free US stock, ETF, and options trading. This has become common practice amongst the best online trading platforms, including the likes of eToro and Robinhood.

For a more detailed look at Fidelity’s trading fees check out the table below.

| Tradable Asset | Commission |

| Stocks – all online US equity trades | $0 |

| Options | $0 commission + $0.65 per contract |

| ETFs | $0 |

| Bonds and CDs | New Issues $0 |

| Mutual Funds (Fidelity Funds) | $0 |

| No Transaction Fee (NTF) non-Fidelity funds | $0 on purchase. $49.95 on redemption if held less than 60 days |

| Transaction Fee non-Fidelity funds: | $49.95 per purchase, $0 on redemption |

Non-trading fees

| Non-trading fee | Charge |

| Account service fee | $0 |

| Account transfer out | $0 |

| Minimum initial investment | $0 |

| Bank wire | $0 |

| IRA closeout fee | $0 |

| Stop payment | $0 |

From this data, we concluded that Fidelity’s trading fees are low and traders will appreciate the transparent fee model. Fidelity does not charge commission for US ETF and stock trades. When it comes to trading shares of stock listed on non-US markets, Fidelity charges a fixed commission that varies depending on the exchange. For example, buying shares of stocks listed on the London Stock Exchange will lead to a commission of £9 per online trade, and £30 if the trade is placed with the help of a Fidelity representative.

Margin fees

Before we have a look at Fidelity’s margin fees, let’s address the question of what is margin trading? With a margin account, you can borrow capital from the broker based on the amount you have deposited. Simply put, this means that you can open positions with funds borrowed from your chosen brokerage firm.

Fidelity’s current base margin rate is 7.075%.

| Debit balance | Margin rate | Effective rate |

| $1M+ | Base – 3.075% | 4.000% |

| $500,000-$999,999 | Base – 2.825% | 4.250% |

| $250,000-$499,999 | Base – 0.500% | 6.575% |

| $100,000-$249,999 | Base – 0.250% | 6.825% |

| $50,000-$99,999 | Base – 0.200% | 6.875% |

| $25,000-$49,999 | Base + 0.750% | 7.825% |

| $0-$24,999 | Base + 1.250% | 8.325% |

Fidelity User Experience

If you’re new to online trading and have an interest in gaining exposure to US and international markets but are hesitant because of a lack of trading experience, Fidelity is an ideal place to start. Fidelity offers a user-friendly web trading platform, mobile trading app, and the Active Trader Pro desktop platform.

For example, opening an account is fully digital and simple, and with no account minimums, you can start trading fractional shares with as little as $1. Furthermore, with the stock screener and stock research tools, you can navigate your way through thousands of stocks to find the ones that are best suited to your trading goals. Alternatively, you can use the search bar at the top of the fidelity.com website and enter the ticker symbol for your preferred assets.

Moreover, by clicking on the News & Research tab on the main menu you can access a range of features from daily news updates and webinars, to a comprehensive Learning Center designed to help beginner traders and experienced investors develop and improve their investment strategies.

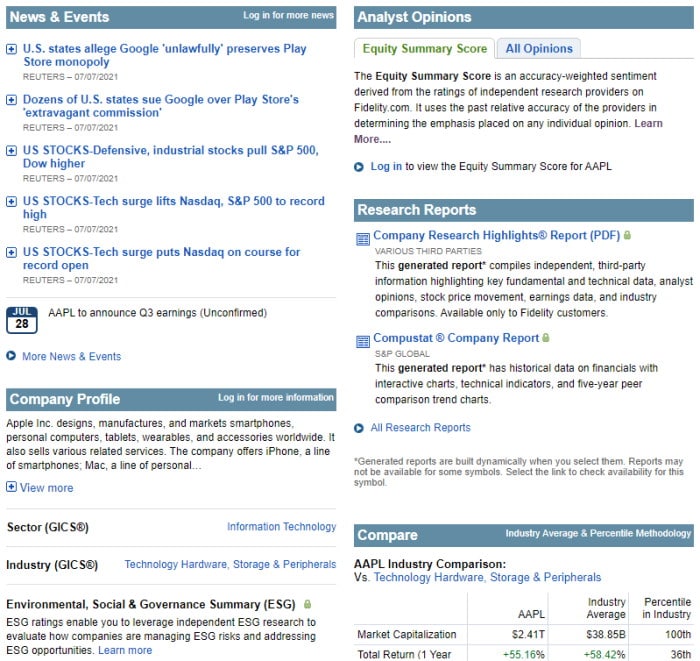

Fidelity Features, Charting, and Analysis

The charting experience on Fidelity is pretty basic with all the standard features. You can integrate technical indicators including Bollinger Bands, EMA, MACD, Parabolic SAR, and many more with the click of a button. You can also access drawing tools such as trendlines and notes, as well as having the option to compare up to 10 different assets on the same chart.

Underneath the charts, you can find a huge selection of useful data from news and events to analyst opinions and research reports.

Fidelity provides thorough fundamental data, that allows you to research and find key information for all supported assets, such as stocks and ETFs. For example, for Apple Inc you can find key statistics such as the market cap, P/E 5-year average, enterprise value, and more.

Fidelity Account Types

While there are no minimum deposits for basic trading accounts, there are minimum deposits for margin accounts, day trading accounts, and Fidelity Managed Accounts. These are as follows:

- Basic trading accounts – $0

- Margin accounts – $2,000

- Day trading accounts – $25,000

- Fidelity Managed Accounts – $10 – $500,000

Fidelity offers a huge variety of account types which we have broken down into this convenient table below:

| Category | Account types |

| Investing and Trading | Brokerage Account – The Fidelity Account, Cash Management Account – Fidelity Cash Management Account, Brokerage and Cash Management, The Fidelity Account for Businesses. |

| Retirement accounts | Rollover IRA, Traditional IRA, Roth IRA, Inherited Roth IRA, SEP IRA, Self-Employed 401(k), SIMPLE IRA, Investment-Only plans for small business, 401(k) plan for small businesses. |

| Managed accounts – robo advisors | Fidelity Go, Fidelity Personalized Planning & Advice, Portfolio Advisory Services Accounts, Fidelity Tax-Managed U.S. Equity Index Strategy, Fidelity Equity-Income Strategy, International Equity Strategy, Tax-Managed International Equity Index Strategy, U.S. Large Cap Equity Strategy, Core Bond Strategy, Intermediate Municipal Strategy, Breckinridge Intermediate Municipal Strategy. |

| Saving & investing for a child | 529 Account, Fidelity Youth Account, Custodial Account, Roth IRA for Kids, The Attainable Savings Plan. |

| Saving for medical expenses | Health Savings Account (HSA) |

| Charitable giving | Fidelity Charitable |

| Estate planning and trusts | Trust account, Estate |

| Annuities | Personal Retirement Annuity, Deferred Fixed Annuities, Immediate Fixed Income Annuities, Deferred Income Annuities. |

| Life Insurance | Universal Life, Term Life Insurance |

The account opening process is streamlined and is usually fully digital. Depending on your country of residence the account opening and verification process can take up to 3 business days, which is slower than other online brokers, such as eToro.

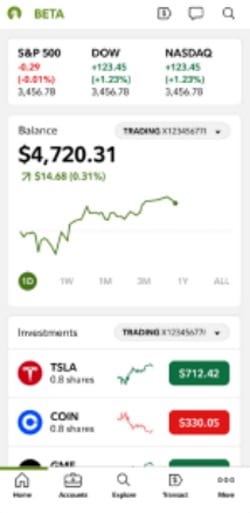

Fidelity Mobile App Review

The Fidelity mobile trading app allows you to monitor and manage your investment portfolios and watch lists wherever you are 24/7. The trading app is compatible with a wide range of devices including:

- iOS iPhones and iPads

- Android mobile devices

- Apple Watch

- Kindle Fire

With key financial features like real-time quotes, news, price alerts, and advanced charting, you can stay in the market loop without being stuck to your desktop monitor.

You can even access dollar-based investing with fractional shares of major US stocks with as little as $1. This not only allows you to improve your portfolio diversification on a low budget, but you can do it anytime and anywhere from your mobile smartphone.

Furthermore, you can deposit funds, execute trades, track your open positions, and receive real-time push notifications.

If you are an Apple enthusiast you will be pleased to know that you can use Touch and Face ID, otherwise known as biometric authentication, to swiftly and conveniently log into your trading account without having to remember passwords.

Active traders will greatly appreciate the option to set up price alerts and push notifications. As such, you can take advantage of unique trading opportunities with real-time alerts on your mobile device.

As the digital era continues to evolve, the financial sector is also finding innovative and convenient ways to make online trading more accessible and streamlined as possible. Fidelity’s mobile trading app provides users with both the flexibility and convenience to trade anywhere and at any time.

Fidelity Payments

You can deposit and withdraw funds into and out of your Fidelity trading accounts via a range of e-payment methods and bank transfers. Payment apps such as PayPal, Venmo, Apple Pay, Google Pay, and Square Cash, are a user-friendly, and secure way to transfer capital into your Fidelity account, usually done instantly with a couple of taps.

Fidelity also offers a free online service called Bill Pay that allows you to pay for goods and services and manage your bills with your trading account or Cash Management account. This service comes with the added benefit of being able to schedule and make payments wherever you are.

It is also important to note that there are no deposit or withdrawal fees when you transfer money in and out of your Fidelity brokerage account.

What about Fidelity’s Subsidiary – UK-based Fidelity International?

Launched in 1969, Fidelity International is the subsidiary of Fidelity Investments and is regulated by the UK’s Financial Conduct Authority. This UK-based stockbroker is ideal for new traders and long-term investors interested in gaining exposure to the UK market. As such, you can only buy and sell stocks and ETFs that are listed on the LSE. There is, however, an extensive selection of mutual funds available from 150+ third-party providers such as BlackRock and Vanguard.

While the non-trading fees are low, Fidelity International charges a fixed commission when trading stocks and ETFs. Furthermore, the minimum deposit is £1,000 when opening an account which is rather high when compared to other free trading platforms out there, such as eToro, that offer commission-free stock trading as well as low minimum deposits.

Fidelity Contact and Customer Service

Fidelity’s customer support is amongst the best in the industry, with several options available 24 hours a day 7 days a week, you can contact a customer service representative at any time whenever you need.

You can contact customer support via:

- Virtual assistant (chatbot)

- Telephone (800-343-3548)

- Mailing address – if you need to mail a form or other documents for verification purposes, US-based clients can find the right US mailing address that suits them.

- Multiple Fidelity Investor Centers that offer in-person consultations as well as virtual and phone appointments.

According to the Fidelity.com website, the call volumes are currently very high, meaning waiting times may be longer during exceptionally busy times. Alternatively, there is a useful FAQs page that can help with basic inquiries and troubleshooting.

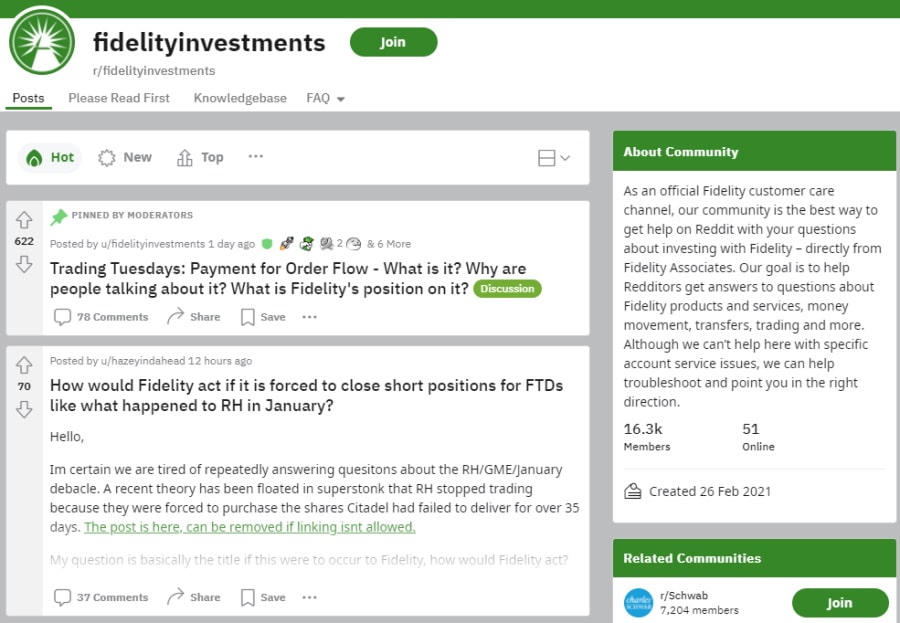

Fidelity Review Reddit – See What Other Users Have to Say

The Fidelity Reddit group, r/fidelityinvestments, is home to 16.3k members and is a great social platform to gain support and answers to your questions. As an official Fidelity customer support channel, Fidelity’s Reddit community offers customer services directly from the broker’s associates.

The aim is to help Redditors find relevant answers to queries about investment products and services and more.

Is Fidelity Safe?

Fidelity is regulated by the US Securities and Exchange Commission and is a member of the Financial Industry Regulatory Authority (FINRA).

Fidelity offers a Customer Protection Guarantee, which means that you will be reimbursed for losses from unauthorized activity in your trading accounts. Moreover, Fidelity also participates in asset protection programs like the FDIC and SIPC which protect against the loss of cash and securities if the broker goes into insolvency. The limit of the SIPC protection is $500,000.

The web trading platform also supports two-factor authentication (2FA) and the mobile trading app offers biometric authentication for added security and convenience when logging in and out of your Fidelity brokerage account.

How to Start Trading with Fidelity

In this section of our Fidelity Investments review, we will guide you through the process of getting started with Fidelity.

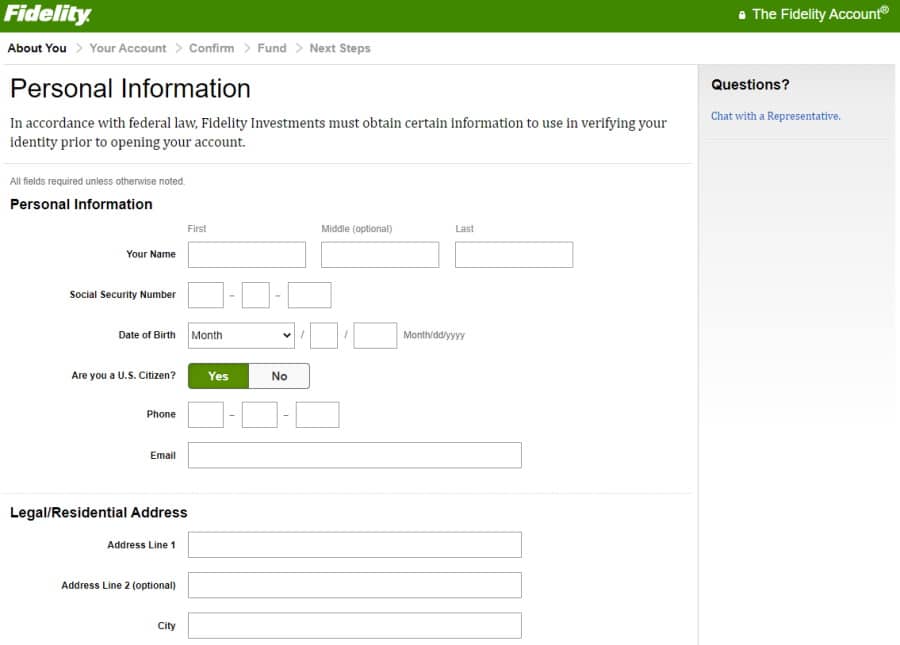

Step 1: Join Fidelity

First of all, you will need to open an account with Fidelity. To do this simply click on the Open Account link at the top of the screen, then choose the account type you want and enter your details such as name, email address, date of birth, social security number, and address.

Step 2: Verify your account and deposit funds

To verify your account you will need to upload copies of your passport and address as proof of identity and residency. Once your account has been verified you can go ahead and deposit funds into your account via any of the supported payment methods.

Step 3: Start trading

To trade with Fidelity start by selecting the account you want to trade in. Then search for the asset and choose either Buy or Sell. Choose either USD or Shares and enter the amount you wish to trade.

Fidelity vs eToro

Before opening an account with Fidelity, we would recommend considering eToro. After extensive research and reviewing heaps of the best online brokers, eToro secures the top spot on our list for the following reasons:

67% of retail investor accounts lose money when trading CFDs with this provider.

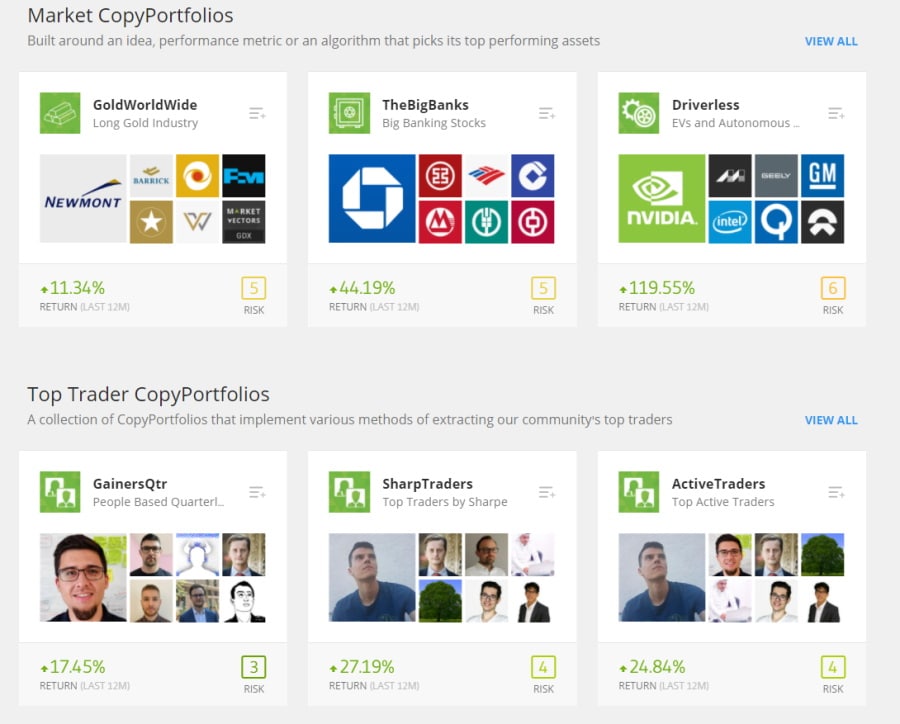

- Copy trading and social trading – eToro facilitates passive investing via its CopyTrader and CopyPortfolio tools. eToro allows you to browse through the public profiles of experienced traders and pick your favourites to copy their trading strategies for an effortless automated trading experience. Alternatively, you can invest in specific themes such as crypto portfolios or a combination of eToro traders via a single investment portfolio. You can pick traders based on fundamental data such as past performance and risk ratings. In terms of social trading, you can interact and communicate with the rest of the trading community on the free trading platform with the click of a button.

- Fractional share trading – fractional shares have become a key element of the modern stock trading scene. At eToro, the minimum investment is $50 which means that you can invest in popular stocks such as Apple and Amazon with an investment that suits your account balance and budget. Fractional share trading helps to improve your portfolio diversification with relatively low costs.

- Fully regulated broker – eToro is regulated by the UK’s FCA, CySEC, and ASIC.

- Cryptocurrency Trading – At eToro you can trade and store 19 different cryptos including Bitcoin and Ethereum. eToro also conveniently provides its proprietary secure crypto wallet for you to store your crypto coins in one place.

- You can access 17 stock exchanges, and trade stocks and ETFs without paying a penny in commissions.

- Wide range of CFD derivatives including forex, commodities, indices, stock CFDs and ETF CFDs, and Crypto CFDs. As there are no trading commissions eToro charges market-leading spreads on forex pairs as low as 1 pip, and stock CFDs from 0.09%.

Fidelity Review – The Verdict

If you’re a beginner looking to trade financial assets, such as commission-free US stocks and ETFs, then Fidelity is likely a great option. The broker provides heaps of stocks, ETFs, mutual funds, and options trades, as well as heaps of educational resources and technical tools.

However, we found that eToro allows you to gain exposure to stocks, ETFs, forex, cryptos, and more on a commission-free basis. Furthermore, with CFD trading you can speculate on the price movements without taking ownership of the underlying asset.

So, to start copy trading with a top-rated and regulated broker, simply follow the link below and open an eToro account today!

eToro – Best Copy Trading Platform for Commission-free Stock Trading

67% of retail investor accounts lose money when trading CFDs with this provider.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.