Forex Account Types – Find The Right Account For You

Choosing the right forex account type is an extremely important aspect of your trading that you need to consider. If you are just getting into trading currencies, you will need to decide upon the type of trading account that best suits you.

In this guide, we have laid out a step-by-step guide to the trading accounts. Read on to find out which forex account types are the best for you!

Forex Account Types List 2025

First of all, let’s look at the forex trading accounts that are available. There are many different ways you can trade forex through a broker. Here is a list of some of the various forex account types that you may come across:

- Spot forex vs Forex CFD Accounts

- Forex Demo Accounts

- Standard Forex Accounts

- Mini & Micro Forex Accounts

- STP Forex Accounts

- ECN Forex Accounts

- Managed Forex Accounts – MAM, PAMM, LAMM

- VIP Forex Accounts

- Islamic Forex Accounts

Forex Trading Accounts

We will now look at the various types of forex trading account types in more detail. The type of account depends upon several different factors:

- Your tolerance for risk

- How you like your trade execution

- Whether you are a passive forex trader

- Special accounts for more active traders

- Religious restrictions

So let’s have a look at the accounts available.

Spot Forex vs Forex CFD Accounts

Starting with the broad forex market. Spot forex is the primary market in foreign exchange. It is a market in which the participants are primarily big banks and for this reason, it is referred to as the “interbank” market. These are institutional traders buying and selling currencies between themselves. In the spot forex market, the transactions are settled for delivery between two counterparties on a T+2 basis (or today plus two days).

So if the spot market is between institutional traders, where does the retail trader fit in? Retail traders will trade forex through a secondary market. They can access the forex market through forex trading providers (in other words, the brokers).

A forex broker can offer retail clients the opportunity to trade currency pairs on margin through either spread betting accounts or forex CFD accounts. It is this opportunity for trading on margin which is so enticing for retail traders. The amount of leverage available through CFD brokers can range from maybe 20 or 30 times up to many hundreds of times.

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Forex Demo Accounts

If you are a beginner or relatively new to forex trading, you will make elementary mistakes in your trading. You will be surprised how many of them will be basic platform mistakes too. Accidentally clicking to trade when you are not ready. Trading the wrong instrument. Not putting to correct lot size in. Not adding in a stop-loss to the trade. These are all mistakes that can cost you money.

However, if you start trading forex by using a demo account, it gives you the freedom to play with the platform to see what it can do. It is also a good time to test out how well your trading strategy works. Most importantly it means that you can make these elementary trading mistakes free in the knowledge that they will not cost you a penny (or a cent). Demo accounts will tend to have all the functionality of the live trading platform but without the risk of mistakes.

We would always suggest to beginner traders (and often intermediate ones too) that trading on a demo account is a crucial step in learning how to trade forex. The Metatrader 4 demo account is seen as the benchmark and is very popular for forex traders. Once you have mastered the demo account, the training wheels can be removed and you can take the step up to a live trading account.

Standard Forex Accounts

A Standard Forex Account is the most basic form of forex trading account you can get through a forex broker. The reason it is referred to as a “Standard” account is historically due to the lot size of 1 Standard Lot (or 100,000 of the base currency) that was available to be traded. Traditionally the standard account would involve high commissions and needing large amounts of capital on account which would have restricted traders in the past. However, with the huge increase in popularity of forex trading, brokers have removed many of these restrictions.

The Standard lot size of 1 Lot means that for 1 pip of movement in the currency pair, the trader is exposed to 10 units of the underlying currency. For a currency pair traded in USD, this means $10 per pip. Trading 1 Lot on a Standard Forex Account can be a wild ride, especially for beginner traders.

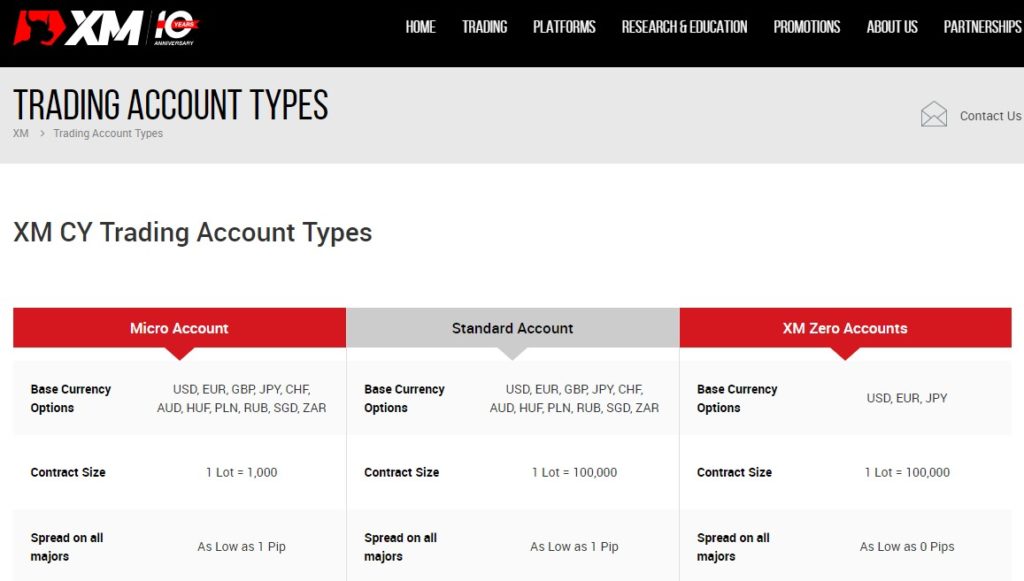

Mini & Micro Forex Accounts

Trading forex does not have to be done to such huge levels of exposure. It is possible to have accounts where the “lot size” is much lower. A Standard Forex Account allows you to typically trade in standard lots which is 100,000 units of the base currency (or 10 units per pip). However, for traders with a lower tolerance for risk, there are also Mini and Mico Forex Accounts available.

The Mini account reduces the exposure to 10,000 units (or one-tenth of the exposure of a Standard account). A Micro account has even lower exposure than a Mini account and is one-tenth of a Mini account (or one-hundredth of a Standard account). For a Micro account, 1 Lot is the equivalent of 1000 units of the base currency.

- Mini account – trading 1 Lot has the exposure of 1 unit per pip (or $1 per pip trading EUR/USD).

- Micro account – trading 1 Lot has the exposure of 0.1 unit per pip (or $0.10 per pip trading EUR/USD).

Having an account with reduced exposure will reduce the potential profit, but also reduces the risk of potential losses too. This can be vital for beginners who are just starting their trading journey. It can make a wild ride in the world of forex trading a far more smooth one.

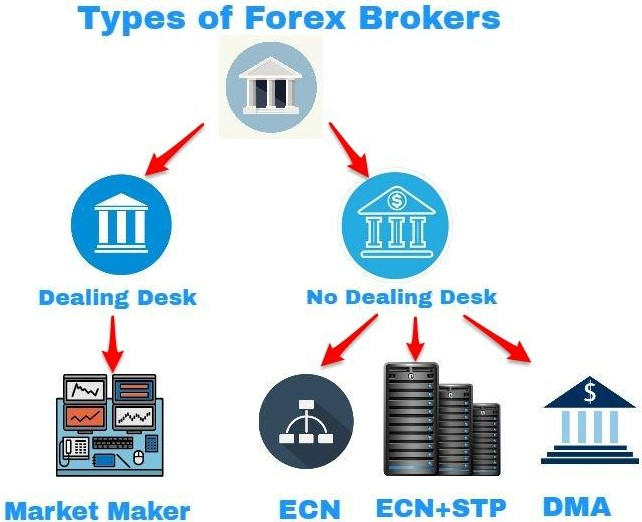

Standard Forex Accounts and Dealing Desk Execution

There is another aspect to consider when trading with a Standard Forex Account. Unless it is specified in some other way, the trade execution of this account will likely be done via a broker’s “dealing desk”. A dealing desk (or market maker) is the method of how the broker deals with their own risk or exposure of a trader’s position.

A broker’s dealing desk will usually try to match the risk it has on its book. For example, if they have one trader short of EUR/USD and one trader long of EUR/USD with the same trade size, the risk is matched. Most of the time, brokers will match positions across their books. There is then no trading exposure for the broker.

However, if one side of the trade is larger than the other, then the broker has an issue of what to do with the exposure. If the broker chooses to not push this risk out into the market and does not hedge the exposure, it is effectively taking the “other side of the trade”.

Trading accounts via a dealing desk can be a benefit for the trader as it will often mean lower spreads (especially compared to STP accounts).

STP Forex Accounts

Trading forex via a “Straight Through Processing” or STP account is a move away from the dealing desk broker model. It means that instead of the broker dealing with the risk of the position internally, the exposure for the trade is passed straight through to its liquidity providers. The broker becomes a middle man in the trade. The broker will make its money by adding an amount to the spread of the trade.

The benefit of an STP account is primarily one of increased trust and transparency. The trader can feel comfortable that the broker is not taking a position against them. The downside of this is that there will be wider spreads and therefore higher costs of trading.

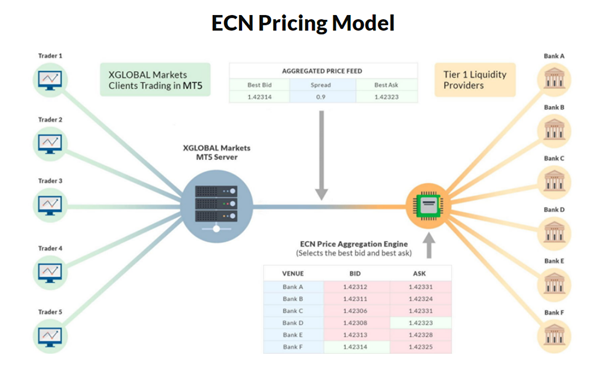

ECN Forex Accounts

An ECN (“Electronic Communication Network) account is effectively an extension of the STP model. Instead of the broker pushing the trade onto its liquidity providers (as with the STP account), the trade via an ECN account is pushed out into the broad market. The counterparty to trades are anonymous and could be institutions such as big banks or hedge funds.

For the trader, the benefit of this is that spreads can be razor-thin or perhaps even zero (zero spread accounts can often be ECN accounts). However, to offer these accounts and still make money, the broker will add a commission to each trade. As with the STP account, this is a more transparent way of trading forex. However, traders need to weigh the impact of the cost of commission before opening an ECN account.

Managed Forex Accounts – PAMM, LAMM and MAM

Forex markets trade round the clock. So for the conscientious trader, monitoring positions can be a 24-hour job. However, not many people have the time (or inclination) to do that. So to help with this, brokers have come up with managed forex accounts. This is the forex equivalent of passive investing.

In managed accounts, investors sign over control of their account to a forex fund manager who trades their account for them. Accounts are pooled in a fund. The investor still has an element of control as they retain the power to withdraw their money and opt-out whenever they choose to.

Managed forex accounts can be done through three different models:

- LAMM (Lot Allocation Management Module) – The investor can choose the number of lots that can be traded. The trade manager then would allocate the different leverages for different investors in the fund. LAMM is considered to be a form of copy trading.

- PAMM (Percentage Allocation Management Module) – This is where the fund performance (gains and losses) and fees are distributed through an equal percentage basis, according to the account size of investors in the fund.

- MAM (Multi-Account Manager) – This is a combination of the LAMM and PAMM models, allowing the investor greater flexibility and control over their account within the fund.

VIP Forex Accounts

Brokers make their money the more that traders trade. So they try hard to hold on to their big clients. Subsequently, experienced traders that take frequent positions in large size will often be given the VIP treatment by brokers. The benefits that VIP forex accounts will often see include:

- Better spreads – often this can mean tighter bid/offer spreads and/or fixed spreads

- Lower commissions – to help reduce costs

- Guaranteed pricing – for stop-losses and profit triggers.

- Free VPS hosting (Virtual Private Server) – which allows for faster trade execution and reduced latency (it is important to avoid slippage which can be costly when trading in large size)

- Access to private research content – help with trade recommendations

- Dedicated account manager – even experienced traders can benefit from having their own account manager to help deal with any queries quickly

To qualify for a VIP trading account, often there will be a minimum deposit on account (often an account size of over $50,000 is needed), but often minimum trade volumes too.

Islamic Forex Accounts

For Muslim traders, the payment of interest is considered to be “haram” (or forbidden). That is a problem in forex trading primarily because standard trading accounts are subject to interest charges. Overnight financing rates can subtract or add interest to positions held overnight. To overcome this issue and to cater to a vast pool of Muslim faith traders, brokers have devised Sharia-compliant Islamic Forex Accounts.

Instead of paying interest, Islamic trading accounts pay commissions and administrative fees to the broker.

Best Forex Brokers

Once you have made a decision on the type of account you would prefer to use, the next decision to make is of which broker you would like to trade with. Here are three brokers that Trading Platforms believe to be some of the best around.

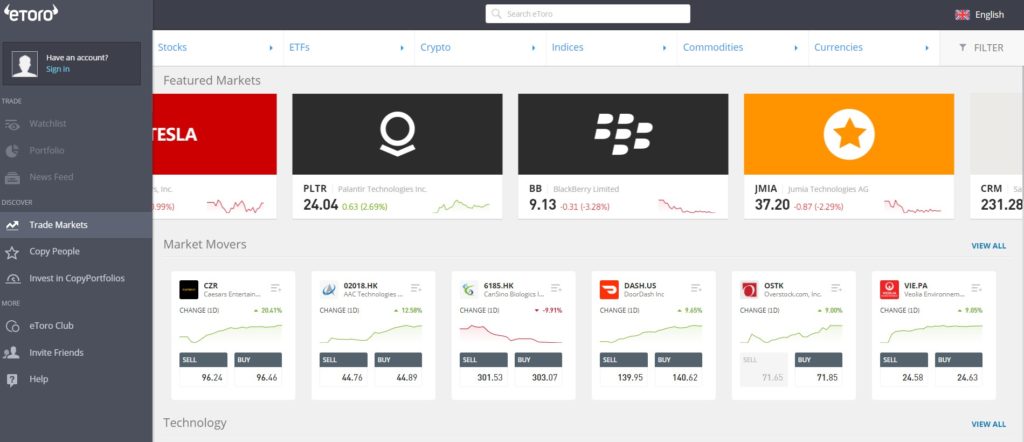

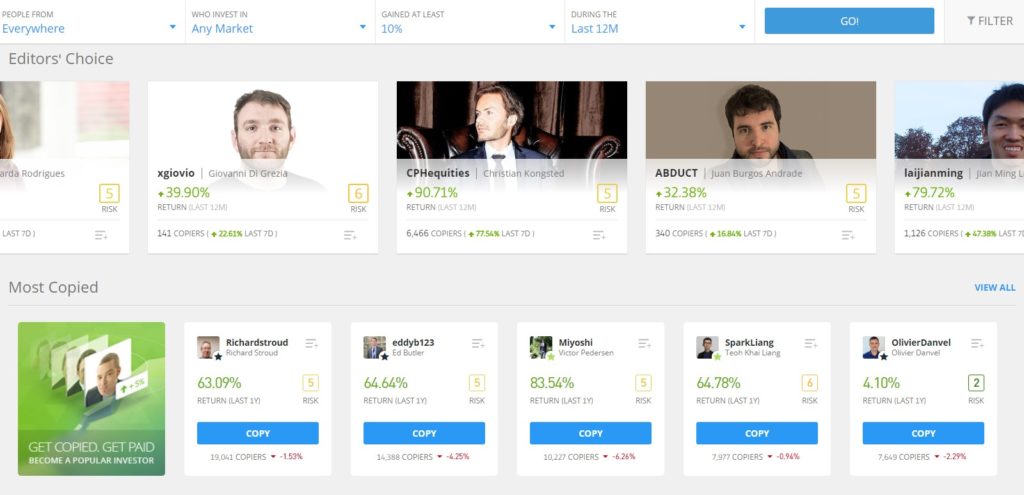

eToro – An Excellent Forex Broker With Social Trading

With over 20 million registered users, eToro has grown enormously over the years and is now a huge presence amongst the world’s largest forex brokers. There are several reasons why it makes the list on tradingplatforms.com including the huge variety of financial instruments, the information available on the platform, and the impressive Copy Trader function.

Forex traders can trade 49 currency pairs, but you will never be stuck for other markets to trade on eToro. An impressive instruments list includes over 2500 stocks and indices, 31 commodities, 249 ETFs, 94 Cryptocurrencies. eToro is one of the best platforms and most convenient ways of trading Cryptocurrencies through a broker.

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

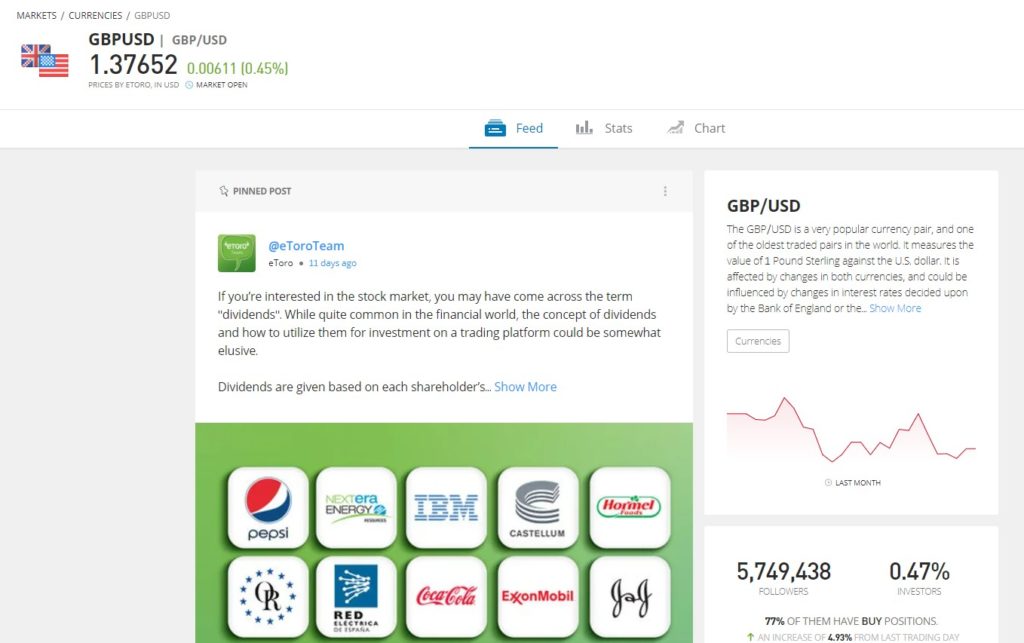

Drilling into the forex pairs, there is a raft of information to digest. There are posts and analysis from other traders which helps to add to the community feel of the platform. Furthermore, on each pair, there are useful stats and a trading guide. This information is also available on the other asset classes too.

Furthermore, if you are into your social trading platforms and automated trading platforms then you have everything you need on the eToro platform with their Copy Trader. There is a huge community of traders to copy. This is a platform where traders can get the best from social trading by choosing to copy some of the best traders around.

Past performance is not an indication of future results

Pros:

- An extremely informative and user-friendly platform

- A huge number of instruments to trade

- Trade cryptocurrencies on the platform

- Excellent for Copy Trading and Social Trading

- Strong regulation across several authorities

Cons:

- The platform has been known to crash occasionally under the weight of huge demand

- Limited tools for technical analysis

Your capital is at risk.

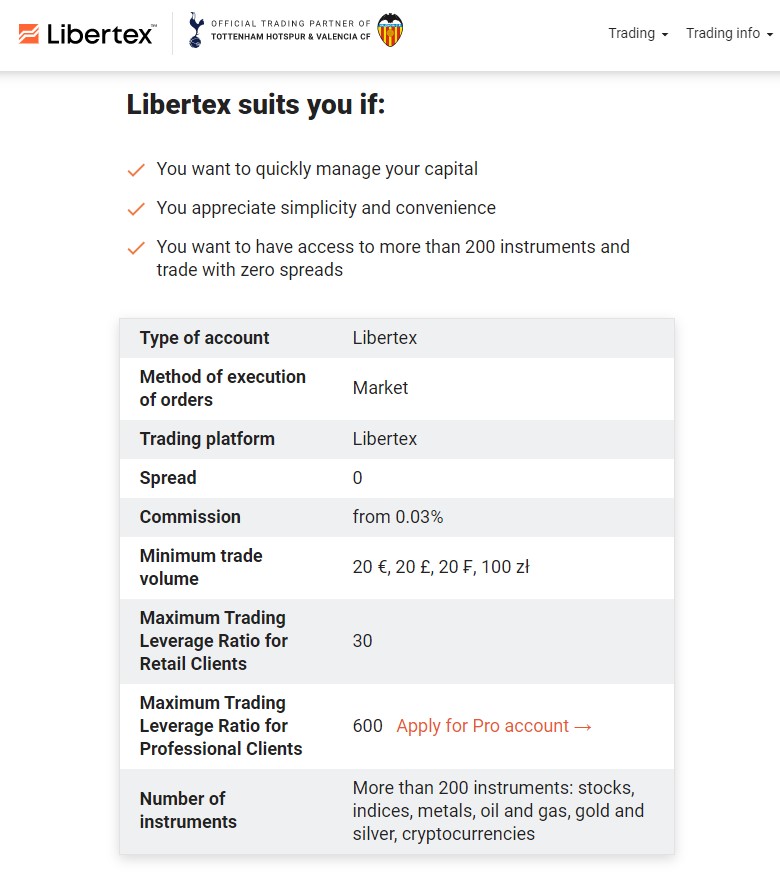

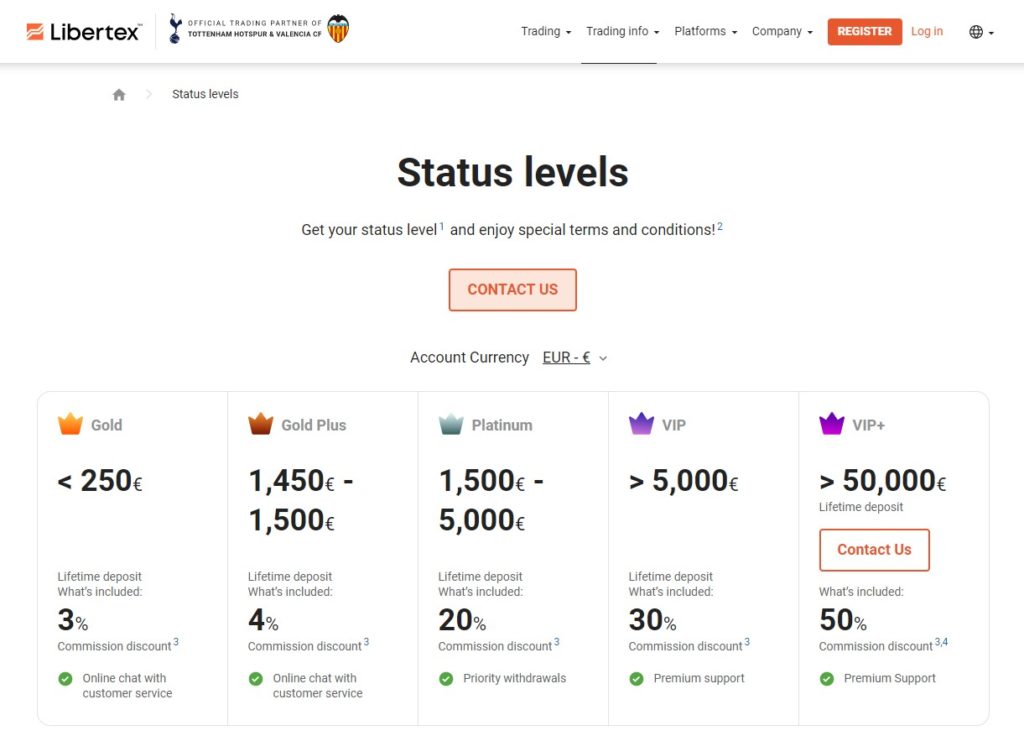

Libertex – Tight Spreads With Small Commissions and Discounts Available

When it comes to low trading costs, Libertex is a broker that fits the bill. The more you trade and in greater size, the trading spread will become an issue for your costs. However, with the Libertex platform, there are zero spreads.

Instead, you pay a small commission on each trade as small as 0.03%. If you prefer, you can also trade on the ubiquitous MT4 platform as well as MT5 too. On Libertex’s MT4 platform you can also trade with zero spreads and commission as small as €0.04.

There is also an added bonus which will save you even more on costs. Traders on the Libertex platform can gain commission discounts on certain traded instruments. Depending upon the size of the account on deposit, discounts of up to 50% are available.

Pros:

- Tight spread accounts

- Low commissions means low trading costs

- Additional discounts up to 50% on commissions are available to reduce costs further

- Wide range of payment methods

Cons:

- Withdrawal fees can be applied (such as a €1 fee for credit or debit card withdrawals).

- Inactivity fees are charged after only 180 days

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 85% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

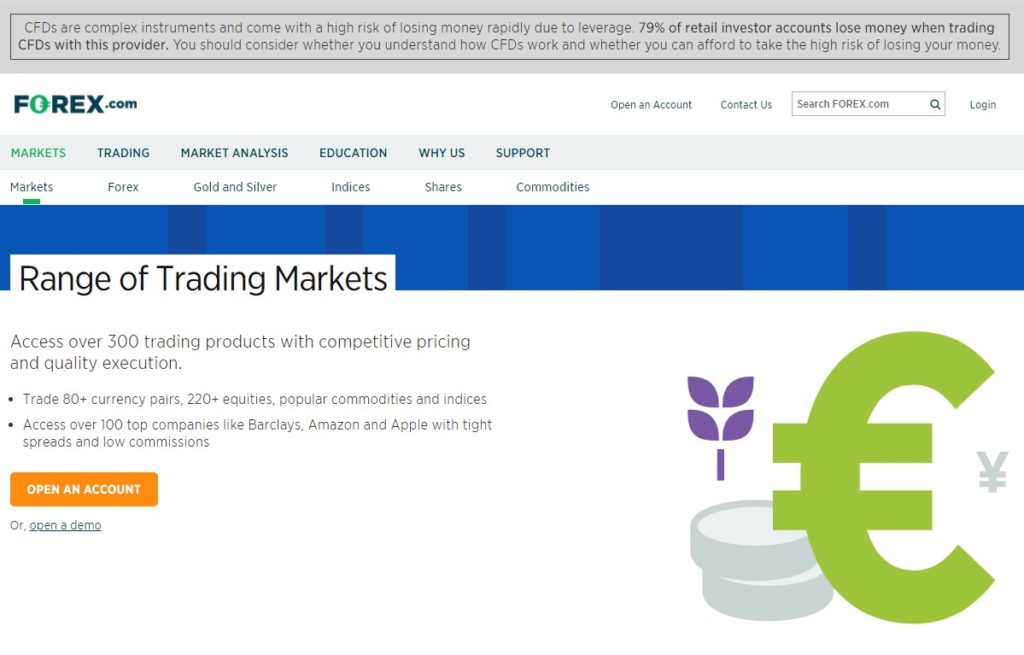

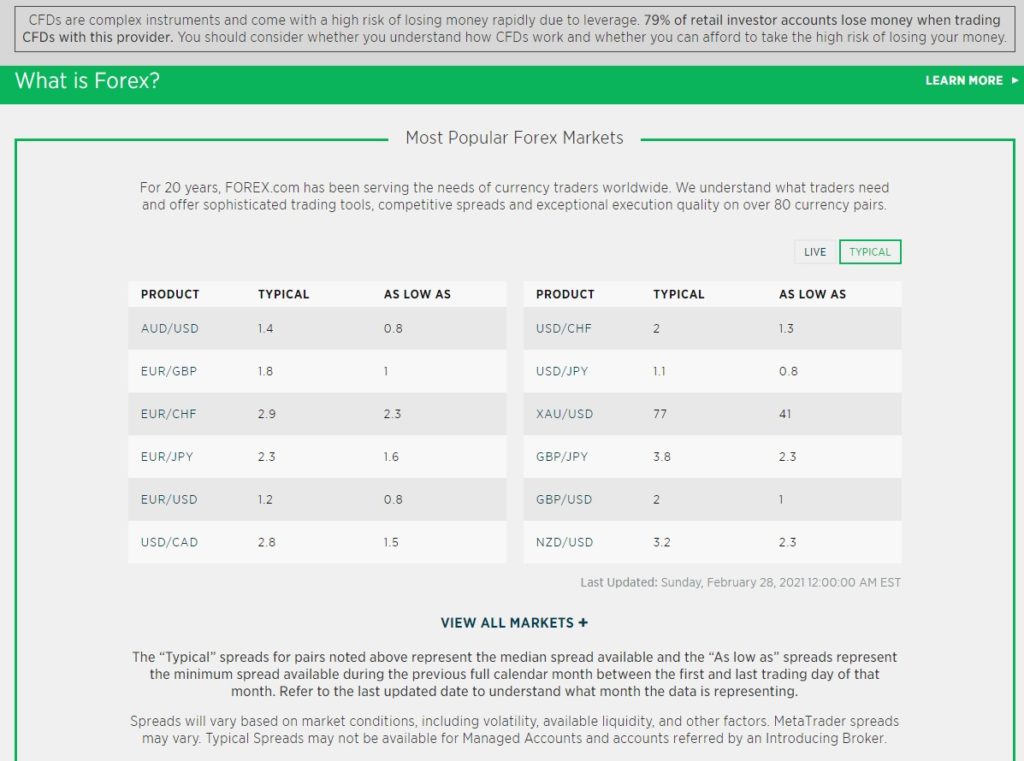

Forex.com – A Huge Selection of Forex Currency Pairs

When looking for a broker, if you are into trading forex, then Forex.com has to make your short-list of choices. The clue is in the name…

Most brokers you come across may have 50 to 60 currency pairs to trade. However, Forex.com tops the lot with a vast selection of over 80 currency pairs to choose from! If you are looking to trade exotic currency pairs, then this is the place to do it.

Their spreads are narrow, with as low as 0.8 pips on EUR/USD. Anything less than 1 pip on the spread is going to be competitive. Spreads can also be even tighter via the STP Pro account.

The Forex.com platform is also strong on technical analysis. With over 50 technical indicators the functionality is strong, with advanced drawing tools and ten chart types.

The research and education content is also wide-ranging. However, there is also an added extra where you can get the personal touch too. Forex.com offers access to a market strategist that can help you to devise a trading strategy.

Pros:

- The widest selection of forex pairs to trade

- Available for US forex traders

- Excellent analysis tools

- Strong research and education content

- Access to dedicated market strategists to develop a trading plan

- Multi-jurisdiction and strong regulation

Cons:

- With just over 300 traded instruments available, this is not a great selection for equities traders

- Over €500,000 (or currency equivalent) portfolio size is quite high for professional client status eligibility

There is no guarantee you will make money with this provider.

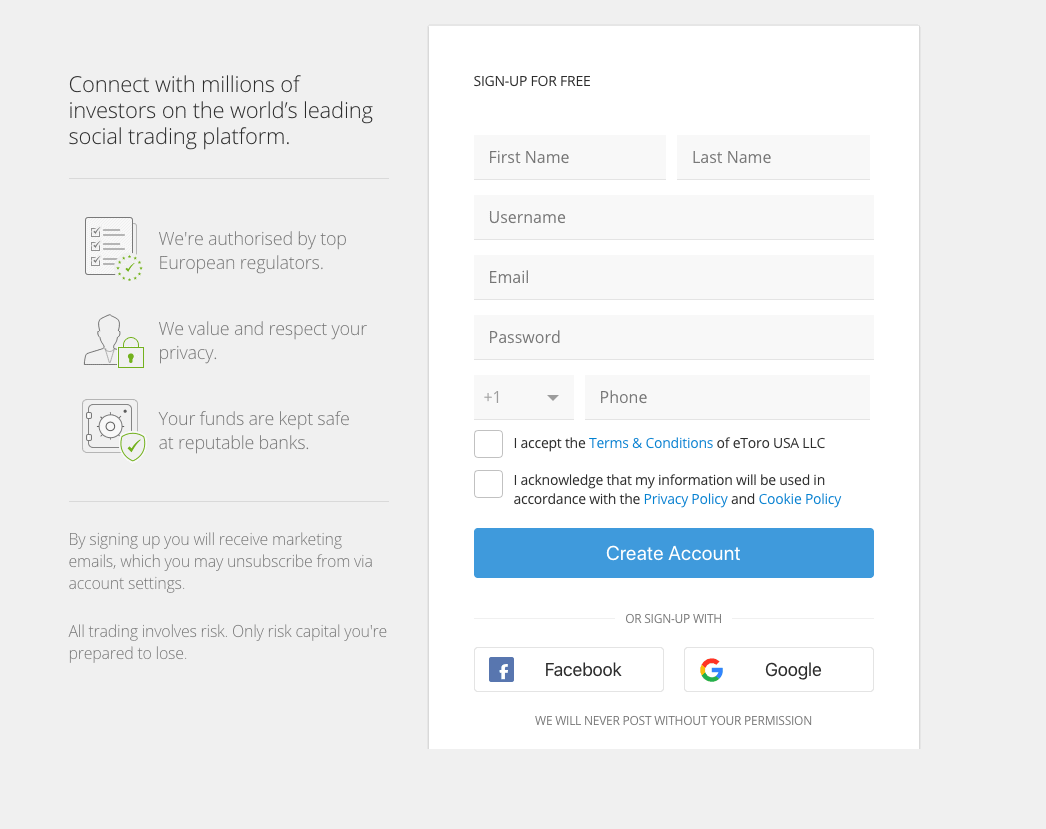

How to Create a Forex Account on eToro

Signing up for a forex trading account with a broker can be a fairly quick process. Here are the steps it takes to sign up for an eToro trading account.

Step 1: Choose a Username and Password

First, you will need to choose a username and password, whilst also adding an email account.

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Step 2: Complete Your Profile

When you have chosen your username and password (and have verified your email) you can complete the sign-up process. Once logged into the account, you are taken through to their Watchlists page where you are then asked to “Complete Your Profile”.

This involves adding some further personal details. And don’t forget to make sure that they match your ID or passport!

Step 3: Confirm your identity

You will now need to confirm your identity through two forms of ID. You will need to show:

- Your passport or driver’s licence

- A utility bill or bank statement

Step 4: Now Deposit Funds Into Your Account

Finally, eToro will ask you to deposit funds into your trading account. Depositing funds can be done through several different payment methods including:

- Credit/debit card

- The eToro crypto wallet (Paypal, Skrill, Neteller)

- Wire transfer

- Klarna

- Rapid Transfer

- iDEAL

- Online banking transfer via Trustly

On the FAQs page, you will see that minimum first-time deposits vary depending upon which country and currency you are in. Traditionally it has been $200 but they have also been known to increase this during times of exceptional demand.

Once you have deposited your funds (and they have cleared), you are free to start trading!

Conclusion

Choosing the correct forex trading account can be a difficult choice as there are so many available. Hopefully, the Trading Platforms guide has at least pointed you in the right direction.

- If you are a beginner trader worried about blowing your account quickly, then perhaps start with a Mini or Micro Trading Account. When you’re happy, you can then work your way up to a Standard Trading Account.

- If you are worried about trading transparency, then perhaps go for an STP or ECN account.

- If you are more concerned with costs then go for a low spread Standard Account or a zero spread account. Professional clients can also consider VIP Trading Accounts.

- If you want to reduce some of the stress of trading, then go for a Managed Trading Account.

- If your trading needs to be Sharia-compliant, then an Islamic Trading Account is the way to go.

If you want to trade forex, there is an account for every type of trader. Good luck in your trading, everyone!

eToro – Best Forex Trading Platform

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.