Best Crypto Staking Platform – How to Stake Crypto in 2025

The process of staking crypto involves ‘locking up’ your digital tokens for a period of time to contribute to the efficiency and safety of the blockchain.

In exchange, you will be able to earn interest by staking your tokens. Our guide reviews the best crypto staking platforms for 2025 and provides a beginner’s guide to how this industry segment works.

Best Crypto Staking Platforms List 2025

Let’s first look at some of the best crypto staking platforms today before getting into our reviews of the best staking solutions.

- Kraken – The Beat Crypto Staking Platform for Beginners

- DeFi Swap – Best DeFi Staking Platform in 2022

- AQRU – User-Friendly Crypto Staking Platform

- Bitstamp – Best Crypto Platform For Ethereum

- Crypto.com – Best Crypto Staking Platform for Flexible Withdrawals

- BlockFi – Best Crypto Staking Platform for Stablecoins

- eToro – Best Crypto Staking Platform for Regulation and Low Fees

- Binance – Great Platform for High Staking Rewards

- Coinbase – Popular Exchange That Also Offers Crypto Staking Services

Best Crypto Staking Platforms Reviewed

As part of our search for the best crypto staking platforms for 2022, we focused on specific criteria. The metrics covered included the yields, lock-up terms, and a number of supported tokens from an investment perspective.

As for security, we looked at whether each platform holds a regulatory license and what measures are in place to make sure your crypto staking endeavors are conducted safely.

Here are the results of our crypto staking platform reviews.

1. Kraken- The Best crypto Staking Platform For Beginners

If you’re a beginner who is a looking for a staking platform that is easy to navigate, Kraken may be a good one to consider. The platform offers staking for 12 different crypto assets and trading for over 185 different tokens. Users can also access the NFT marketplace and trade with a minimum of just $10.

Kraken’s staking platform offers generous rewards of up to 21% per year on some tokens. Users receive rewards twice per week. Among the tokens available to stake on Kraken are Bitcoin, Solana and Polkadot.

As well as staking, Kraken offers traditional crypto trading, margin trading and futures trading. Users can benefit from each type of trading strategy through one easy-to-use platform that charges straight forward fees. Stablecoin trades are charged at 0.9% and other crypto assets or FX pairs have a 1.5% fee.

To start staking on Kraken, users must first hold crypto in their spot wallet. It is very simple to purchase coins through the exchange and start staking. The minimum purchase amount on Kraken is $10. This is great for users who are looking to test out staking without putting much capital at risk.

Kraken is a well-established platform with millions of users worldwide. The exchange offers over 185 different crypto assets as well as NFTs. Users receive 24/7 customer support by a team of experts as well as a range of research and analysis tools to help you make informed trading decisions.

Pros:

Pros:

- Flat fees

- Simple user-interface

- Offers 12 different tokens for staking

- Offers both crypto assets and NFTs

- Excellent security features including an ISO/IEC 27001:2013 certification.

Cons:

Cons:

- Relatively high trading fees

- Not regulated in the US

Cryptoassets are a highly volatile unregulated investment product.

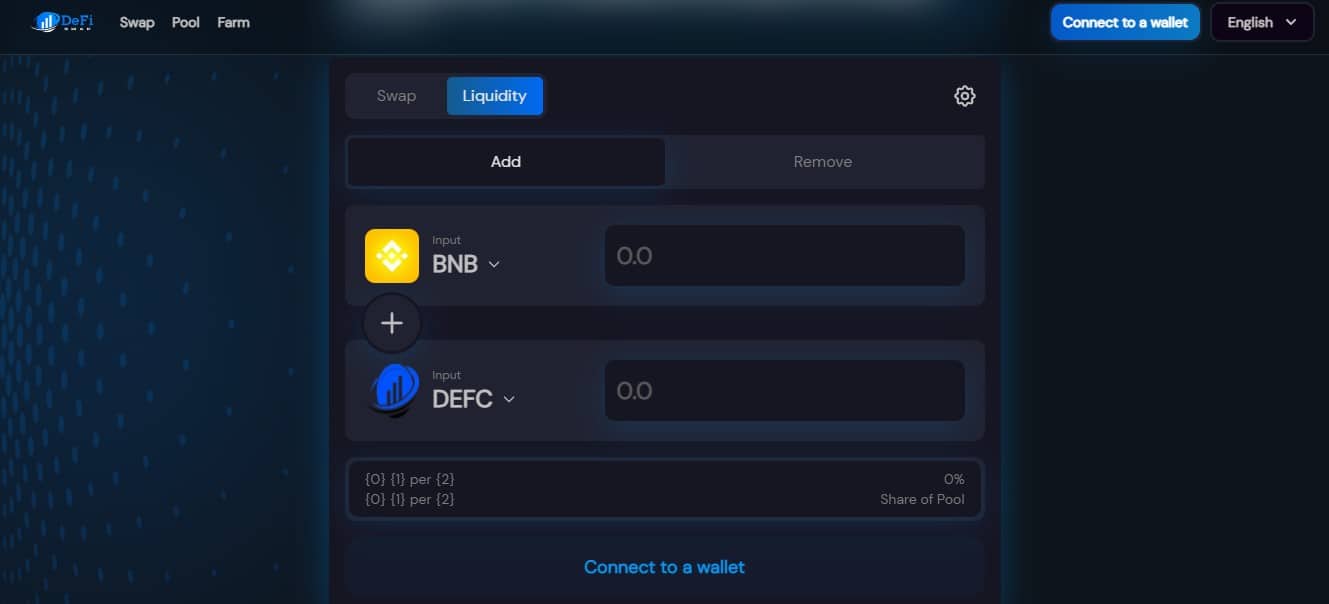

2. DeFi Swap – Best DeFi Staking Platform in 2022

There are currently many top DeFi staking platforms available to you, including DeFi Swap, one of the newest cryptocurrency exchanges. DeFi Swap is a platform for decentralized finance – hence the name. In addition, this exchange offers the native token DeFi Coin (DEFC) as a fully decentralized exchange.

By staking their DeFi Coin, token holders can earn interest up to 75% APY through DeFi Swap, which is among the highest interest rates for DeFi Coin. Neither the amount you stake nor the amount you must stake must meet any requirements. Through DeFi Swap, you can purchase DeFi Coins by exchanging from hundreds of popular cryptocurrencies.

The lock-in period at DeFi Swap is currently 30 days, 90 days, 180 days, and 360 days earning 30%, 45%, 60%, and 75% APY. In addition to locking in for long periods, such high-interest rates are hard to find on other staking platforms. It is also important to remember that DeFi Coin has potential for appreciation – after DeFi Swap was launched, the coin’s value increased by 500%.

Additionally, DeFi Swap charges a 10% transaction fee every time someone sells their DEFC on the site. Investing in DeFi Coin is meant to encourage a long-term mindset. Token holders are rewarded with all fees paid from sales.

It’s important to mention that there are currently more than 6,000 members of the DeFi community on the Telegram platform.

| Staking Rewards on Cryptocurrencies | Rates of 75% APY |

| Min & Max Staking Amounts | N/A |

| Lock-In Period | 4 Lock-In periods from 30 to 360 days |

| Payout Frequency | Anytime |

Pros:

Pros:

- Rates of 75% APY are available

- You can choose from 4 lock-in periods

- DeFi Coin gained 500% after it was listed on an exchange

- A fee on sales encourages long-term holdings

Cons:

Cons:

- Accepts only DeFi Coin for staking

- The mobile app is not available

Cryptoassets are a highly volatile unregulated investment product.

3. AQRU – Overall Best Crypto Staking Platform

Aqru is the first crypto staking platform to consider. With its easy-to-use website and minimal jargon, this provider targeted its staking platform at newbies, as the website itself is easy on the eye. Moreover, you can easily access your crypto staking account from the Aqru app.

Fiat currency and digital tokens are both supported by this top crypto lending platform. The former includes EUR and GBP. These include large-cap tokens like Bitcoin and Ethereum and stablecoins like Tether and USDC. Yields vary depending on the type of crypto asset you want to stake.

Supported stablecoins, for example, return 12% per year. Bitcoin and Ethereum, respectively, yield 7% per year. That is why Aqru tops our list of the best crypto interest accounts and staking platforms.

Platforms like this can offer you these APY rates by lending out your capital to retail and institutional investors seeking to borrow additional crypto. Consequently, consider the risk involved. No fees are charged when withdrawing funds from the Aqru platform in fiat currency. On the other hand, Aqru charges a flat withdrawal fee of $20 for crypto withdrawals, making it unsuitable for small investments.

Due to its fantastic interest rates, Aqru is also one of the best crypto loan sites.

| Staking Rewards on Cryptocurrencies | · Stablecoins (USDT, USDC, DAI) –12%

· Non-Stablecoins (BTC, ETH) – 7% |

| Min & Max Staking Amounts | €100 (£110.80) minimum; no maximum stated. |

| Lock-In Period | No lock-in period; flexible withdrawals offered |

| Security & Regulation Features | · Regulated by the Republic of Lithuania

· VASP under Lithuanian law |

| Additional Rewards Offered | N/A |

| Payout Frequency | Daily |

Pros:

Pros:

- Earn high-interest rates on GBP, USD, BTC, EUR, ETH, USDT, and more

- Gain access to high-interest rates on cryptocurrency

- Get daily interest of up to 12%

- Quick withdrawal

- $100 minimum deposit

- Multiple payment options

Cons:

Cons:

- Cryptocurrency withdrawals cost $20

Cryptoassets are a highly volatile unregulated investment product.

4. Bitstamp – Best Crypto Staking Platform For Ethereum

It was founded by Nejc Kodrič and Damijan Merlak, who founded Bitstamp in 2011 to be a cryptocurrency exchange located in Luxembourg. It is a veteran crypto exchange that provides low-fee cryptocurrency marketplaces for large financial institutions and professional investors for the most part. Since Bitstamp was founded in 2013, it has been one of the first bitcoin exchanges in the crypto market and has been around since the very beginning of Bitcoin.

In our opinion, Bitsamp is the best choice for experienced investors who are seeking a top-notch platform for investing in cryptocurrencies. As a result, Bitsamp is also a great platform for users who want to purchase digital assets only once and store them on Bitsamp’s cold storage web wallet for a limited period.

Bitstamp Earn allows you to earn cryptocurrency in exchange for holding assets for a certain duration as part of their platform. Staking is the process by which this occurs.

Storing your assets on the blockchain allows you to earn more cryptocurrency. However, in exchange for rewards paid out at regular intervals, you will not be able to withdraw or trade coins once you stake cryptocurrency.

To reach a consensus on the one true history of transactions, some blockchains use a consensus algorithm called proof of stake (PoS). Staking your cryptocurrency on a PoS blockchain gives you the right to generate a new block and earn a predetermined amount in cryptocurrency or transaction fees (or both).

When you start earning rewards, it depends on the asset you stake.

- Ether (ETH): once per month

- Algorand (ALGO): Every quarter, usually at the end of the governance cycle

When it comes to ETH, they collect staked assets from their customers in a pool and launch a new staking node every 15 minutes (to start staking the assets on the blockchain).

Furthermore, the blockchain can take a while to process everything in addition to this (approximately) 15-minute queue. The time it takes to process everything depends on the network’s load. Due to network congestion, this could take up to a few weeks after Ethereum 2.0 launches.

A monthly reward program is in place. However, it is also important to note that the rewards will be a different asset (ETH2R) than your staked asset (ETH2), and you will not be able to withdraw ETH2R from your account until the staking period ends.

| Staking Rewards on Cryptocurrencies | Earn up to 4.82% on an annual basis on ETH.

5% APY on Algorand |

| Min & Max Staking Amounts | 0.1 ETH minimum amount |

| Lock-In Period | No lock-in period; flexible withdrawals offered |

| Security & Regulation Features | License by the government of Luxembourg |

| Additional Rewards Offered | N/A |

| Payout Frequency | Monthly |

Pros:

Pros:

- Competitive fees

- Easy to use

- The platform is advanced

- Highly rated mobile app

- Solid selection of cryptocurrencies

Cons:

Cons:

- Missing major cryptocurrencies

Cryptoassets are a highly volatile unregulated investment product.

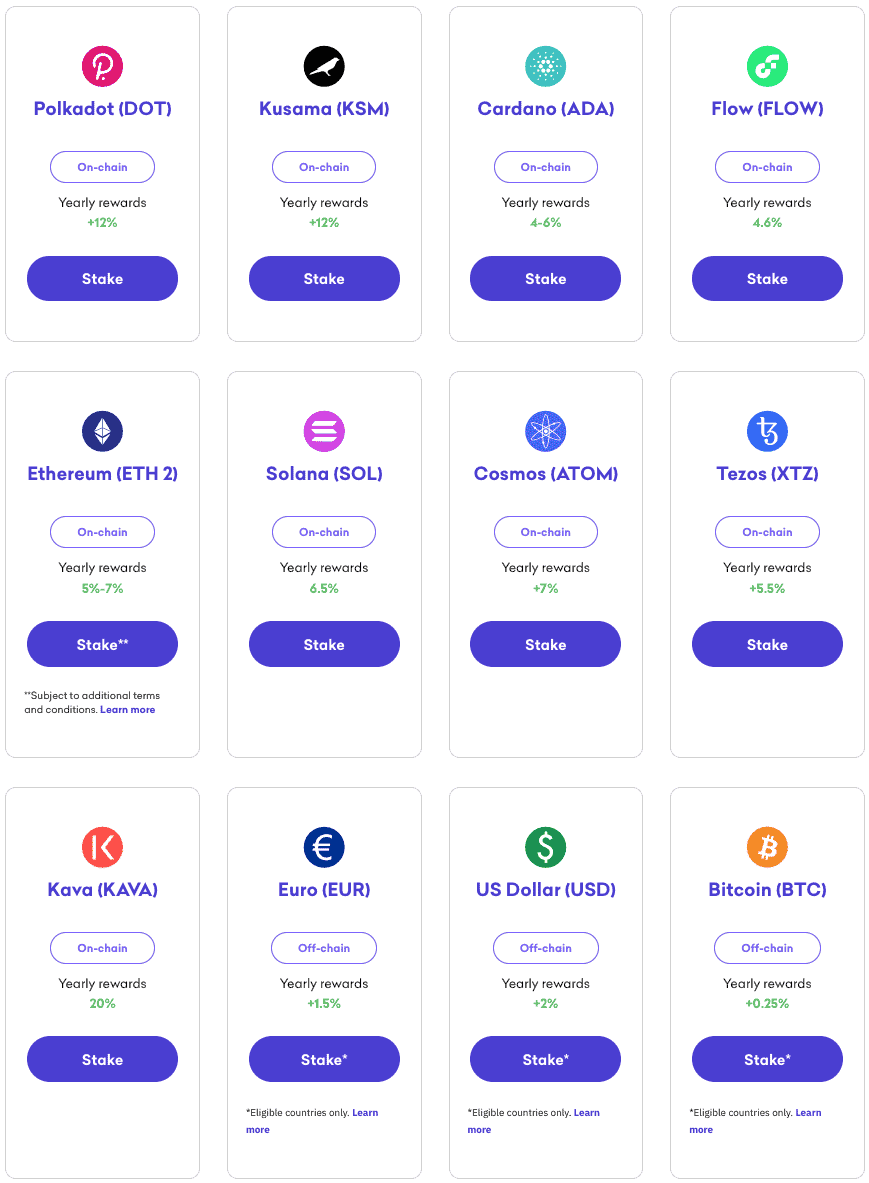

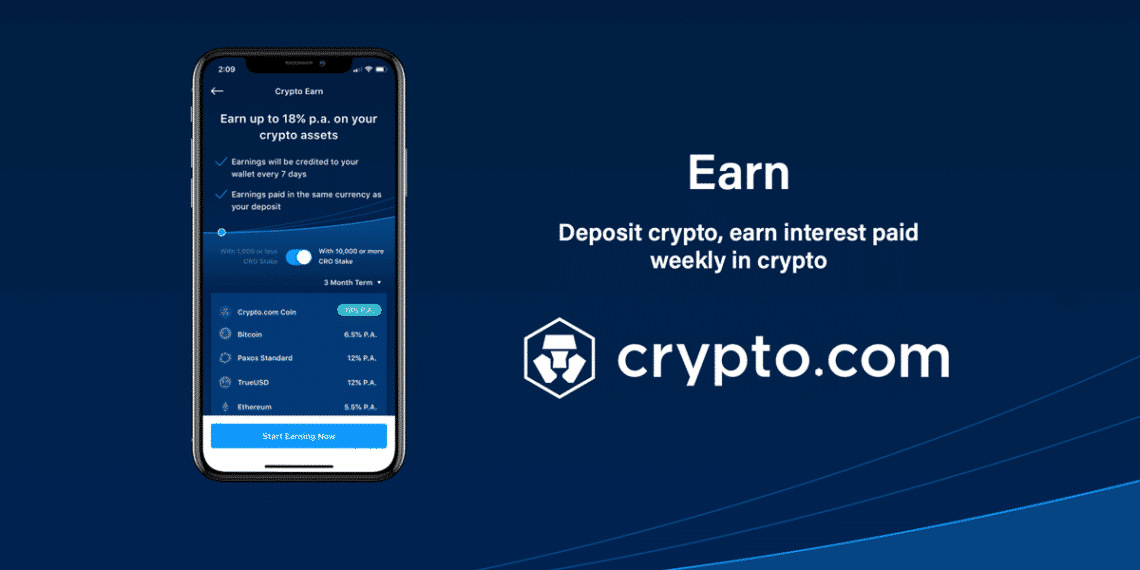

5. Crypto.com – The Best Crypto Staking Platform with Flexible Withdrawals

Launched in 2016, Crypto.com is now one of the world’s largest cryptocurrency exchanges with millions of clients. In addition to offering simple, low-cost exchange services for over 250 tokens, Crypto.com is also involved in several other crypto-centric products.

Through its Crypto Earn facility, Crypto.com also offers digital asset loans, crypto credit cards, debit cards, and NFT markets. The way it works is that once you deposit your chosen digital tokens, Crypto.com will allocate the funds to loan capital to account holders. Then, after the end-borrower repays the funds, you will receive interest daily from the end-borrower.

Pay depends on three main factors. APY rates will, first and foremost, vary based on the token. For example, APYs for stablecoins such as USDC and TrueGBP are 12%, while those for Bitcoin and Ethereum are 6.5%. Second, the rate you receive depends on whether you want to lock up your tokens for one or three months or not.

Finally, if you own CRO tokens – Crypto.com’s native digital asset – you will earn higher APYs. No matter which tokens you decide to stake and under what terms, you must remember that Crypto.com lends the funds out, so the tokens can generate interest. When you join Crypto.com, you’ll also get instant access to a wide variety of digital tokens, which you can buy with a credit card for just 2.99% – making it an appealing option for active traders.

| Staking Rewards on Cryptocurrencies | · Stablecoins (USDC, USDT, DAI, etc.) – Up to 14%

· Non-Stablecoins (BTC, CRO, ETH, LTC, etc.) – Up to 14.5% |

| Min & Max Staking Amounts | · Minimum – Varies depending on the coin (e.g., 0.005 BTC, 0.15 ETH)

· Maximum – $500,000 (USD equivalent) |

| Lock-In Period | Customizable – three months, one month, or flexible |

| Security & Regulation Features | · NIST Cybersecurity Tier 4 assessment

· Stress-tested by Kudelski Security |

| Additional Rewards Offered | As the amount of CRO staked increases, the APR increases. |

| Payout Frequency | Weekly |

Pros:

- Low fees

- Payments in cryptocurrency made easy

- Converting money is easy

- Cashback rewards on Visa cards

- Earn interest in cryptocurrency

- Cryptocurrency selection

- Strong security

Cons:

- Difficult to navigate

- There isn’t a universal supply of coins

- Poor customer service

- Resources for education are scarce

Cryptoassets are a highly volatile unregulated investment product.

6. eToro – Popular Crypto Staking Platform That Charges Low Fees

eToro is a cryptocurrency broker that offers competitive fees and an SEC-regulated low account minimum. eToro offers a portal that allows you to stake your idle cryptocurrency investments. We like most about this platform because the respective tokens are staked on your behalf as soon as you purchase digital assets at eToro.

At writing, eToro offers automated staking rewards for three crypto assets. These include Ethereum, Cardano, and Tron. Fees vary depending on your eToro membership status and location. For example, bronze members and US clients will receive 75% of the eToro staking yield, while diamond and platform+ account holders will retain 90%.

If you wish to engage in a flexible arrangement, eToro is also one of the best crypto staking platforms for 2022. That means that your cryptocurrency tokens do not have to be locked up. Instead, the tokens you hold in your eToro wallet will continue to earn staking rewards until you decide to cash them out. Therefore, there is no need to transfer stake coins between competing platforms.

As a staking provider, eToro offers a full range of additional benefits. The SEC, FCA, ASIC license EToro, and CySEC means that you are staking your crypto assets with a heavily regulated ecosystem. Additionally, if you wish to buy crypto on eToro, you may deposit US dollars free through a debit/credit card, bank wire, or e-wallet. Rather than pay expensive commissions, you only need to cover a spread that starts at 0.75 %.

Credit cards and PayPal are not available for users under UK/FCA regulation.

| Staking Rewards on Cryptocurrencies | Amount varies monthly for all eToro users for ADA, TRX, ETH2.0*; based on total staked volume. |

| Min & Max Staking Amounts | Staking rewards of a minimum of $1 per month in USD equivalent. |

| Lock-In Period | No lock-in period; flexible access |

| Security & Regulation Features | · SEC-regulated

· FINRA and FinCEN Licensed |

| Additional Rewards Offered | The higher the tier of club membership, the higher the percentage of stake rewards retained |

| Payout Frequency | Monthly |

Pros:

Pros:

- Forex, stocks, and crypto trading.

- Hold crypto and earn.

- Automatic stake every month.

- There are several membership levels.

Cons:

Cons:

- Staking service with a small management fee.

Cryptoassets are a highly volatile unregulated investment product.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

7. Binance – Great Platform For High Stake Rewards

Binance is a great crypto staking platform for those looking to earn high rewards. Nearly 100 different staking coins can be supported on this popular exchange platform, which covers a variety of projects and APYs. In addition, Binance offers a variety of options regarding how long you wish to lock up your tokens. In general, this covers a period of 10, 30, 60, or 90 days.

Taking an example from Binance’s website, Moonbeam (GLMR) has a lock-up period of 10 days and a yield of 239%. Other options include Shiba Inu and Solana, which offer APYs of 8.78% (30 days) and 10.12% (10 days), respectively. Binance often pays higher yields for shorter lock-up periods.

Because rates change every day, it is rare for you to lock in promotional APYs for more than one month. Moreover, each staking pool has a maximum allocation, so you may find that the best deals quickly sell out. You may also want to consider digital trading currencies with Binance after you’ve met your staking requirements. The platform offers access to more than 1,000 markets (60 in the US) at industry-leading prices.

Binance charges a maximum of 0.10% a slide for trading. Accordingly, a fee of $1 is collected for every $1,000 traded. Binance also offers a crypto savings account. If you deposit funds, you will be paid interest on your idle crypto assets. In addition, you will be able to access a specific APY rate based on the cryptocurrency and lock-up period. Flexible savings accounts typically have the lowest APY rates.

| Staking Rewards on Cryptocurrencies | You can earn up to 3.78% on stablecoins and 150% on certain non-stablecoins. |

| Min & Max Staking Amounts | It varies depending on the coin |

| Lock-In Period | You can choose between flexible, 10 days, 30 days, 60 days, and 90 days |

| Security & Regulation Features | Obtaining a UK trading license

Money Transmitter license in numerous states in the US |

| Additional Rewards Offered | N/A |

| Payout Frequency | Daily |

Pros:

- Risk-free token staking through a secure trading platform.

- High returns are possible on the platform.

- Locked and DeFi stakes are available.

- Also available is ETH 2.0 staking.

Cons:

- Customer support is poor. Users are often left without an answer for days.

- Staking assets are limited, and most of them are usually sold out.

Cryptoassets are a highly volatile unregulated investment product.

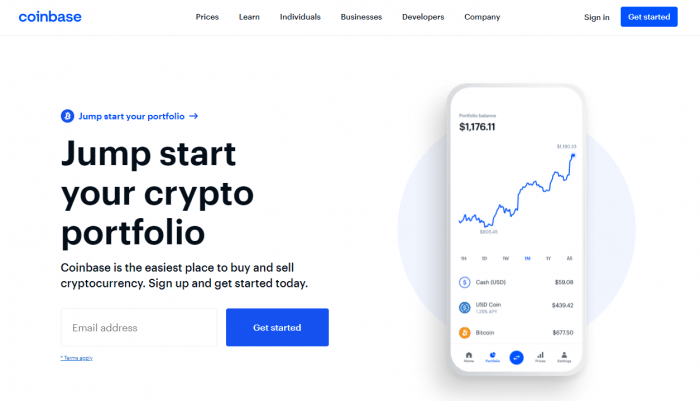

8. Coinbase – Popular exchange that offers crypto staking services

If you are a crypto enthusiast interested in buying and selling digital assets in a safe environment, Coinbase is perhaps the best crypto staking platform to consider. The reason for this is that Coinbase offers a regulated and user-friendly exchange platform in addition to staking. In addition, Coinbase currently supports six digital currencies.

The list includes Ethereum, Algorand, Cosmos, Tezos, Dai, and USDC. The rates available range from 0.15% APY with USDC to 5% with Cosmos. Additional staking coins are expected to be added soon. It is important to note that you are not required to buy cryptocurrency on Coinbase to receive staking rewards. Alternatively, you can stake tokens from an external wallet.

Coinbase lets you open a verified account in less than five minutes by providing basic personal information and a copy of your government-issued identification. Then, you can use your debit or credit card to instantly purchase staking coins if you do not yet have any. There is, however, a nearly 4% fee associated with this payment method.

| Staking Rewards on Cryptocurrencies | 5% for non-stablecoins; 2% for stablecoins |

| Min & Max Staking Amounts | It varies depending on asset (no minimum for ETH) |

| Lock-In Period | It varies depending on the asset |

| Security & Regulation Features | SEC-regulated

NASDAQ-listed company |

| Additional Rewards Offered | N/A |

| Payout Frequency | Varies – from daily to weekly depending on the asset |

Pros:

Pros:

- World’s largest cryptocurrency exchange

- Stake your coins and earn 5% APR.

- Users can access tax documents.

- This platform is very user-friendly

Cons:

Cons:

- Token returns can differ greatly

Cryptoassets are a highly volatile unregulated investment product.

Best Crypto Staking Platforms – Rates Comparison

| Platform | Staking Rewards on Cryptocurrencies | Min & Max Staking Amounts | Lock-In Period | Payout Frequency |

| DeFi Swap | Rates of 75% APY | N/A | 4 Lock-In periods from 30 to 360 days | Anytime |

| Bitstamp | Earn up to 4.82% on an annual basis on ETH.

5% APY on Algorand |

0.1 ETH minimum amount | No lock-in period; flexible withdrawals offered | Monthly |

| Coinbase | 5% on non-stablecoins; 2% on stablecoins | It varies depending on asset (no minimum for ETH) | It varies depending on asset | Varies – from daily to weekly depending on the asset |

| AQRU | Stablecoins (USDT, USDC, DAI) –12%

· Non-Stablecoins (BTC, ETH) – 7% |

€100 (£110.80) minimum; no maximum stated. | No lock-in period; flexible withdrawals offered | Daily |

| Crypto.com | Stablecoins (USDT, DAI, USDC, etc.) – Up to 14%

· Non-Stablecoins (BTC, CRO, ETH, LTC, etc.) – Up to 14.5% |

Minimum – Varies depending on the coin (e.g., 0.005 BTC, 0.15 ETH)

· Maximum – $500,000 (USD equivalent) |

Customizable – three months, one month, or flexible | Weekly |

| eToro | Amount varies monthly for all eToro users for ADA, TRX, ETH2.0*; based on total staked volume. | Staking rewards of a minimum of $1 per month in USD equivalent | No lock-in period; flexible access | Monthly |

| Binance | Stablecoins can offer up to 3.78%; non-stablecoins can offer 150%. | It varies depending on the coin | You can choose between flexible, 10 days, 30 days, 60 days, and 90 days | Daily |

What is Crypto Staking?

The concept of staking is one you will hear about often if you are a crypto investor. Many cryptocurrencies use staking to verify their transactions, allowing participants to earn rewards.

What exactly is crypto staking? The staking process involves committing your crypto assets to support a blockchain network and confirm transactions.

Payments can be made with cryptocurrencies that use the proof-of-stake model. Compared to the original proof-of-work model, this is more energy-efficient. The proof of work requires mining devices that use computing power to solve mathematical equations.

With some cryptocurrencies offering high rates for staking, staking is a great way to generate passive income from your crypto. However, staking cryptocurrency requires a thorough understanding of how it works before you get started.

How Does Crypto Staking Work?

The process of crypto staking involves locking up some of your digital tokens to facilitate safe and efficient transactions on a proof-of-stake blockchain.

By doing so, you will earn interest on the tokens you decide to stake. As a result, you can earn regular income on your tokens instead of keeping idle cryptocurrency investments in a traditional crypto wallet on top of capital gains.

Let’s take a look at a basic example of how crypto staking works:

- Suppose you wish to stake ADA on the Cardano network

- The APY here is 10%

- For three months, you stake $5,000 worth of ADA tokens

- If you stake $5,000 over a year, you’ll earn $500, so if you stake $5,000 over three months, you’ll earn $125

- The staking rewards you receive will be paid in the token of your choice. Thus, in the example above, you would receive your $125 stake reward in ADA.

Additionally, you will still benefit from an increase in the token’s value during the period when your crypto is locked away. The value of your tokens will still increase by 50% even if you stake $1 at the beginning of the lock-up period and $1.50 at the end. Crypto staking can reward you on two fronts, which is its beauty.

That being said, we should note that staking was only possible by downloading the ledger nodes of each blockchain network to your computer. As a result, you staked tokens directly with the blockchain ledger using a supported wallet.

Staking has evolved over the years, making it far more convenient for beginners and experienced investors to earn rewards.

Currently, the best crypto staking platforms are third-party providers that only require you to deposit tokens to earn interest. As a result, staking rewards are possible even on not-proof-stake coins since leading platforms offer interest-earning opportunities through savings accounts.

Lock-Up Periods

Staking crypto directly through a blockchain node almost always requires a lock-up period. Until the lock-up period is over, you won’t be able to withdraw your crypto assets.

As long as the tokens are locked up, you will still receive staking rewards. Therefore, there is no need to spend your original principal investment before the end of the agreement.

During our research, we also found that the best crypto staking platforms even offer flexible programs. For example, despite receiving a less favorable interest rate, you can always withdraw your staked coins.

Mining vs. Staking

A common misconception is that mining and staking are the same. They represent different processes.

- For blockchain networks, mining is used to verify and confirm new transactions.

- Most miners require expensive hardware to be inserted into specialist devices, which consume large amounts of electricity.

- However, miners can earn rewards when new tokens are minted in return for contributing their resources. As an example, Bitcoin pays miners every 10 minutes 6.25 BTC.

Importantly, mining is highly inefficient, especially on popular networks like Bitcoin. This is why staking is more advantageous. For example, you do not need to buy hardware devices or consume enormous amounts of electricity to stake cryptocurrencies online.

Rather, all you have to do is select the best crypto staking platform for your requirements, deposit the appropriate tokens, and then sit back and enjoy your passive income.

On-chain vs. Off-chain Staking

Staking cryptocurrency also involves understanding whether the process will be initiated on-chain or off-chain. In its simplest form – and as the name suggests, on-chain staking involves staking your tokens directly on the respective blockchain network.

That usually requires you to download the entire blockchain ledger to your desktop device and connect to a node through a supported wallet. Even though this allows you to interact directly with the blockchain, on-chain staking is best left to those who have a deep understanding of cryptocurrencies.

However, if you are a complete beginner and would like to keep things simple, you’re better off using an off-chain staking provider. Our review of staking platforms today provides off-chain services, so you don’t need any previous experience to get started.

Instead of the blockchain network, your agreement is with the staking platform itself; therefore, once you have chosen the staking platform, cryptocurrency, and lock-up period, there is nothing more for you to do.

Benefits of Staking Crypto

Crypto staking is not for everybody, especially if you intend to trade digital currencies actively. Consider the following benefits when deciding whether staking is right for you and your cryptocurrency investment goals.

Earn Interest on Idle Crypto Investments

Traditional stocks have every chance of paying you dividends every month if you hold them in your portfolio.

The only way you’ll make money from holding cryptocurrencies is if the value of the digital tokens rises and you sell them. You won’t be able to invest your long-term crypto funds anywhere but in a top-rated staking platform.

If you decide to stake your tokens, you will be paid interest for as long as you do so. You will therefore have the opportunity to grow your crypto wealth on two fronts – as you will still reap the benefits of the underlying digital asset rises in value.

Compound Interest Strategy

Dividend stocks offer you the chance to benefit from compound interest using traditional equity investments as a guide. You can instantly reinvest it back into the same stock whenever you receive a dividend payment.

- For example, if you received $150 from Johnson & Johnson in dividends, you can purchase two additional shares based on the current prices.

- By repeating this process, you increase your ability to earn interest since dividends are paid on a greater number of stocks.

When it comes to staking, the best platforms in this space distribute rewards every day. Therefore, every time you receive staking rewards in the form of new tokens, your holdings increase. Additionally, by reinvesting the tokens back into the staking platform, you will be able to increase your daily payouts exponentially.

Hedge Against Falling Crypto Prices

The other great advantage of crypto staking is that it allows you to hedge against the risk of falling crypto prices. For example, let’s say you are a long-term investor with a portfolio worth $5,000 worth of digital currencies.

When the broader markets go on a prolonged downturn, seeing the value of your portfolio decline can be disheartening.

Even if a digital asset is underperforming, you will still earn rewards from staking your cryptocurrency tokens.

Staking Doubles up as a Storage Facility

To earn interest, you will need to deposit the idle digital currencies into a wallet controlled by the crypto staking platform.

While it might sound risky at first glance, you won’t have to worry about this if you are using a regulated entity.

- Earlier, we mentioned that eToro had been authorized and regulated by many reputable financial bodies, including the SEC.

- Therefore, you can rest assured that your stake tokens are well.

- Moreover, if you choose a trusted staking platform, you don’t have to worry about keeping your private keys safe.

- Instead, wallet security is the responsibility of the staking site you choose

However, you should avoid assuming that all crypto staking platforms are safe. Before proceeding, thoroughly research your chosen provider since anyone can create a website offering staking services.

The 5 Best Crypto Staking Coins

If you’re wondering which to invest in, you have many cryptos to stake. Even if it’s not a proof-of-stake project, the best staking platforms in this industry allow you to earn rewards on idle digital currencies.

Below we explain the five best crypto staking coins to consider for your portfolio today.

Cardano – Overall Best Crypto to Stake

As one of the most popular proof-of-stake cryptocurrencies, Cardano is one of the best blockchain networks to earn rewards. There is no doubt that you are investing in a legitimate protocol with Cardano, a multi-billion dollar asset class.

Our best crypto staking platforms list includes providers that support Cardano, including eToro and Binance. Additionally, your tokens will still increase in value while staked on your chosen platform.

Considering Cardano generated gains of over 1,000% in 2021 alone, this gives you a great opportunity to double your income and capital gains.

USDC – Best Stablecoin to Stake

When staking crypto, if your primary goal is to earn a passive income without the volatility of the broader markets, a stablecoin like USDC is likely your best choice.

Other stablecoins can be staked, but Coinbase backs USDC, so you can rest assured that you are investing in a trusted digital asset. USDC has also had its reserves audited, unlike Tether, its fellow stablecoin provider. That means that every USDC token is backed by a US dollar 1:1.

The crucial point is that USDC allows you to earn interest without worrying about volatility, offering some of the best staking rewards. For example, when you stake USDC at Aqru, you earn 12% per year.

The Graph – Best Crypto to Stake for Growth Potential

You might consider The Graph if you want to invest in cryptocurrencies with high upside potential. That is because the underlying technology provided by The Graph allows blockchains to index data, backing this cryptocurrency.

Therefore, blockchains can automatically move unnecessary data off-chain, which will result in a more efficient network by freeing up unused space. Additionally, The Graph can be staked easily on several leading platforms, with some providers offering double-digit APYs.

Ethereum – Best Crypto to Stake On-Chain

The Ethereum network is still transitioning from proof-of-work to proof-of-stake, although rewards can still be earned directly on-chain. Ethereum requires that you stake 32 ETH to become a registered validator. According to current prices, this amounts to a capital investment of over $85,000.

You can also join a pool of staking on the Ethereum blockchain. If you join forces with other token holders, you will be able to stake Ethereum with a small amount of money. Of course, rewards on offer ultimately depend on how busy the network is and how much transaction fees are collected.

BNB – Best Crypto to Stake with No Fees

Buying BNB and then earning staking rewards could be a good alternative if cryptocurrency staking platform fees put you off because the Trust Wallet cryptocurrency app does not charge any fees for staking BNB. Therefore, any stake reward generated is 100% yours to keep.

Furthermore, you will earn an attractive APY of 11% by staking BNB tokens via the Trust Wallet app. Also, rewards are paid out daily, which is great for earning compound interest. Additionally, Trust Wallet does not require any sort of lock-up period so that you can withdraw your BNB tokens at any time.

Is Crypto Staking Taxed?

Cryptocurrency taxation is very complex, and the specifics will depend on your residency status and profile. Therefore, you should seek tax advice from a qualified professional.

Additionally, some countries will tax staking earnings – though the rules will differ depending on the country.

To give you some insight, Coinbase notes:

“Staking rewards are taxed like mining proceeds: taxes are based on the fair market value on the day they are received.”.

Potential Risks of Crypto Staking

As well as potential rewards, there are certain risks to consider. This sentiment also applies to stakes, so consider the following risks before proceeding.

Platform Risk

The overarching risk of crypto staking is directly related to the third-party platform.

- Initially, your chosen provider will require you to deposit your crypto tokens into its wallet so that staking can begin.

- As a result, you must trust that the platform has your best interests in mind. You could still be at risk if the staking platform is hacked and stolen funds.

- A staking agreement is between you and the staking platform and not with the relevant blockchain network.

- By making a withdrawal request or receiving your rewards.

We believe eToro is the best crypto staking platform for 2022 because the provider is heavily regulated.

Market Value Risk

Staking is often perceived as a way to guarantee income. However, regardless of whether your chosen staking platform meets its advertised APY and makes subsequent payments on time, you still need to consider the market value of the respective cryptocurrency.

For example:

- Suppose you join a staking platform that offers a yield of 50% per year on your chosen cryptocurrency

- You decide to deposit $1,000 in tokens

- After one year of staking, you have earned the equivalent of 50% – or $500

- However, one year after staking, the respective cryptocurrency has gained 80% value.

- Due to this, even though you earned 50% more tokens, your original investment now has a market value of just $200

In light of the above example, you should probably diversify as much as possible when staking crypto coins. That will reduce the risk of overexposure to a specific project.

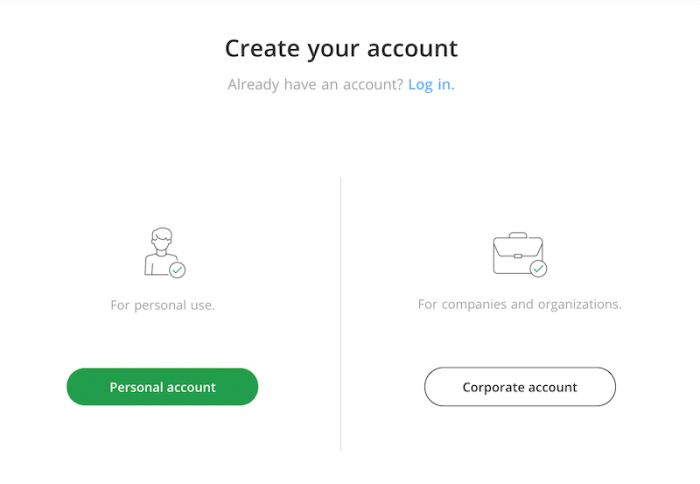

How To Start Staking on Bitstamp

After reading this overview, you should know enough about Bitsatmp to decide whether you should use it for your stake needs. Next, let’s walk you through how to open an account with Bitstamp, download the software, and place an order on the Bitstamp trading platform.

Step 1: Create an Account with Bitstamp

Register for a Bitstamp account by visiting the website and filling out the registration form. As soon as you click on the Register button on Bitstamp’s home page, you’ll be redirected to a page where you need to specify whether you’re an individual investor or a company.

You will then be able to type in your first and last name and your email address as you click on the Personal Account link.

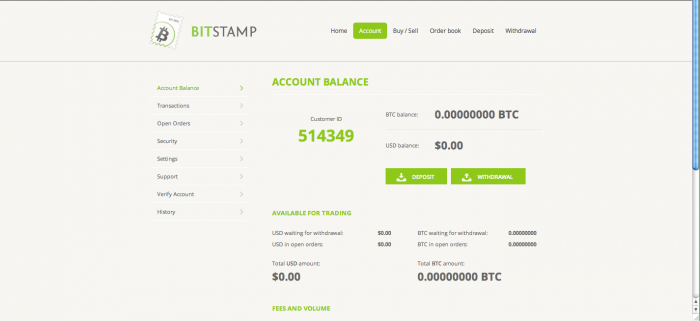

Bitstamp will send you an email to complete your registration. Then, on the next page, Bitstamp will give you a user ID, and the exchange will notify you that your identity must be verified before you can use Bitstamp.

Cryptoassets are a highly volatile unregulated investment product.

Step 2: Verify Your Identity

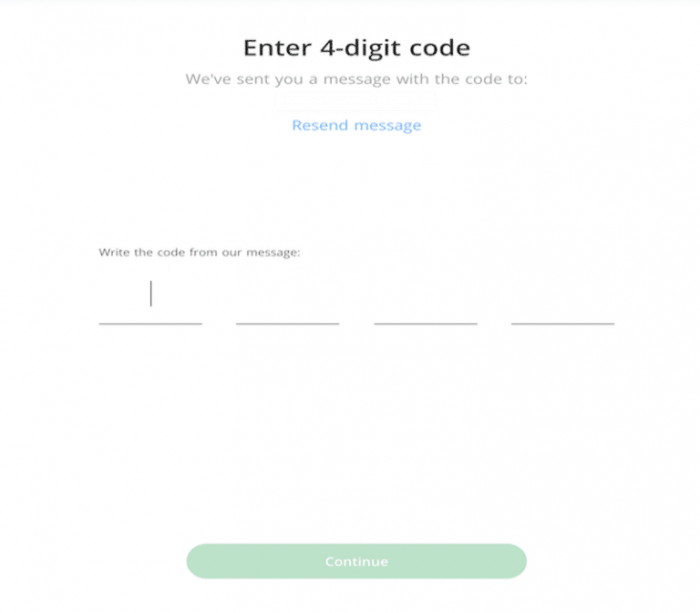

It’s important to note that Bitstamp’s account verification process is very strict. Hence, you’ll be asked to fill out a short questionnaire about your background and personal information. In addition, your phone number must also be verified by entering a four-digit code that is sent to your phone.

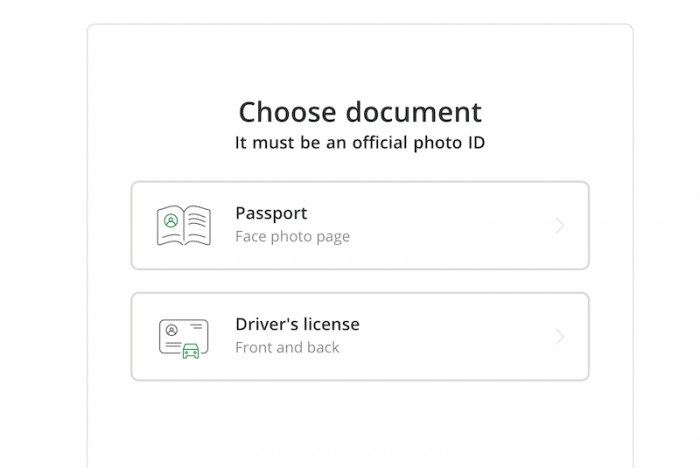

The next step you need to take is to upload your passport or driver’s license to prove your identity.

Last but not least, you must upload proof of residence, provide documents, which include deposit records and trading histories from other exchanges (if you have any), salary payslips, tax statements, investment portfolios, etc., and answer questions about your financial situation, trading history, and activity.

Step 3: Deposit Funds

You can then add funds to your Bitstamp account once approved and opened. To use Bitstamp, you are not required to deposit funds, but once you are ready to make a transaction, there is a minimum deposit of 50 USD/EUR/GBP. On the Bitstamp dashboard, click on the Deposit button and choose one of the available payment methods – bank wire transfer, Faster Payments, SEPA, credit and debit card, or cryptocurrency.

Step 4: Stake Your Coins

You can start buying and selling cryptocurrencies as soon as the funds are available in your account. Bitstamp’s platform offers two ways to trade cryptocurrency: the Markets section and the Tradeview. To demonstrate the ease of buying digital assets on Bitstamp, we delve into the ‘markets’ section, which provides investors with a quick way to buy cryptocurrency.

Cryptoassets are a highly volatile unregulated investment product.

Conclusion

In this comprehensive guide, we have covered every aspect of crypto staking. This article includes not only a rundown of the top crypto platforms for 2022 but also the best coins to consider.

The advantages and risks of crypto staking have also been discussed, and whether you should opt for an on-chain or off-chain agreement.

We found Bitstamp to be the best crypto staking platform if you’re a complete beginner and would like to start earning rewards right now.

Bitstamp – Best Platform to Stake Cryptocurrencies

Cryptoassets are highly volatile unregulated investment products.