8 Best DeFi Trading Platforms in July 2025

In 2025, Decentralized Finance (DeFi) is expected to be one of the hottest trends in finance. With an eye toward removing the middleman from a range of financial transactions and lowering costs, DeFi relies on the innovative blockchain technologies of platforms such as Bitcoin and Ethereum.

As noted by DeFi Pulse, over $66 billion worth of value has already been locked up by DeFi protocols in the last two years – and will only continue to increase as more DeFi trading platforms are introduced.

-

-

8 Best DeFi Platforms for Trading in 2025

- Dash2Trade: Dash 2 Trade is the world’s first crypto social analytics trading platform that provides users with everything that they need to make informed crypto trading decisions. The platform is built on the Ethereum blockchain and is compatible with cryptos, NFTs and other digital assets. As well as using the platform to trade DeFi tokens, users can also access exclusive presales, airdrops, competitions and other events. It is also possible to stake tokens on the platform for passive rewards.

- Battle Swap: Battle Swap, part of the Battle Infinity metaverse, is a decentralized exchange that enables players to buy IBAT tokens or convert game winnings into cryptocurrencies. IBAT tokens are the native currency, used for various in-game purchases. Battle Swap is decentralized, supports token staking, and provides access to the Battle Infinity metaverse.

- DeFi Swap: DeFi Swap is a decentralized exchange that operates on the Binance Smart Chain. It is a great DeFi trading platform to consider due to the fact that users can earn passive rewards through staking and yield farming. The platform is supported by a tax-free native crypto token and offers a user-friendly interface.

- eToro: eToro is a regulated crypto trading platform that offers access to 25 different crypto tokens. Users can trade cryptos and then store them in the eToro Money Wallet. eToro also provides ready-made crypto portfolios that are suitable for long-term crypto investors.

- Binance: Binance is one of the largest crypto trading platforms in the world. It offers over 200 assets and low-fess, making it a beginner-friendly option to consider. Binance also provides good customer support through its ticket system.

- Coinbase: Coinbase is a reputable crypto exchange that also supports the trading of NFTs. Users can store their DeFi assets in the native Coinbase wallet, which is compatible with most dapps. Coinbase provides a good range of assets and educational resources that can be used to improve trading decisions.

- Crypto.com: Crypto.com is one of the first DeFi platforms to introduce a crypto credit card, which rewards users with 8% cashback on purchases. The platform also offers low fees and a beginner-friendly interface.

- Kraken: Kraken is one of the easiest DeFi exchanges to use in 2025. The platform offers a user-friendly app and desktop trading site as well as a good range of technical analysis tools and research. Kraken also supports staking and trading with leverage which makes it suitable for advanced crypto traders.

The price or value of cryptocurrencies can rapidly increase or decrease at any time. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk.

What is Decentralized Finance (DeFi)?

It is an acronym for “decentralized finance.” The term is used to describe a variety of financial applications implemented in cryptocurrency or blockchain that aim to disrupt financial intermediaries.

We can draw inspiration from blockchain, the technology behind digital currency bitcoin, a system that allows multiple entities to hold a copy of a record of a transaction, so it’s not controlled by a single party. The reason that’s important is that human gatekeepers and centralized systems can slow down and complicate transactions while offering users less direct control over their money. DeFi uses blockchain to allow more complex financial transactions than simple value transfers.

Digital-native assets like Bitcoin are distinct from legacy payment methods, including those provided by Visa and PayPal, because they do not involve middlemen in the transaction. A financial institution controls the transaction when you use a credit card to buy coffee at a cafe, keeping authority over it and recording it in its ledger. However, bitcoin does away with these institutions.

Big companies are involved in more than direct purchases. They are involved in loans, insurance, crowdfunding, derivatives, betting, as well as other financial applications. One of the primary advantages of DeFi is that middlemen are removed from all kinds of transactions. These are some of the most disruptive DeFi applications:

In the past, the concept of decentralized finance was widely known as open finance before it became widely known as decentralized finance.

How To Invest in DeFi?

If you are interested in investing in Decentralized Finance and wanting to know where to buy DeFi cryptos, there are several ways to do so. The simplest way to gain exposure to DeFi, which provides only a general overview of the technology, is to purchase ETH and other coins which use DeFi technology. In the case of DeFi-powered coins, one gains exposure to almost the whole of the DeFi industry.

To earn interest directly on your cryptocurrency holdings, you can deposit it directly with a DeFi trading platform. Depositing funds for longer terms can result in higher interest rates, and the interest rate paid on your deposit may be either fixed or variable according to the market.

Since the demand for deposits is so high, DeFi trading platforms have developed an algorithm called “yield farming.”. The idea is that yield farmers deposit their funds on platforms that offer the highest interest rates or other incentives in order to maximize their profits. Moreover, they also constantly compare current interest rates and incentives offered by other platforms. Yield farmers can maximize their profits by moving their deposits to a platform where incentives are greater. Yield farmers continue to switch their money between platforms due to the fluctuations in incentives.

Uniswap’s UNI (CRYPTO: UNI) is a token that can be purchased by anyone who is interested in participating in the development of DeFi protocols. As a governance token, UNI gives you the right to vote on future Uniswap protocol decisions based on your holdings. Purchasing UNI coins creates greater interest in the future of the service, and large holdings of UNI are required in order to maintain substantial decision-making authority as more people participate in the process. Token prices can rise significantly as a result of this dynamic.

Best DeFi Trading Platforms Rated and Reviewed

If you’re still wondering which platform is the best for DeFi trading in 2025, below we take a closer look at each of the options mentioned above.

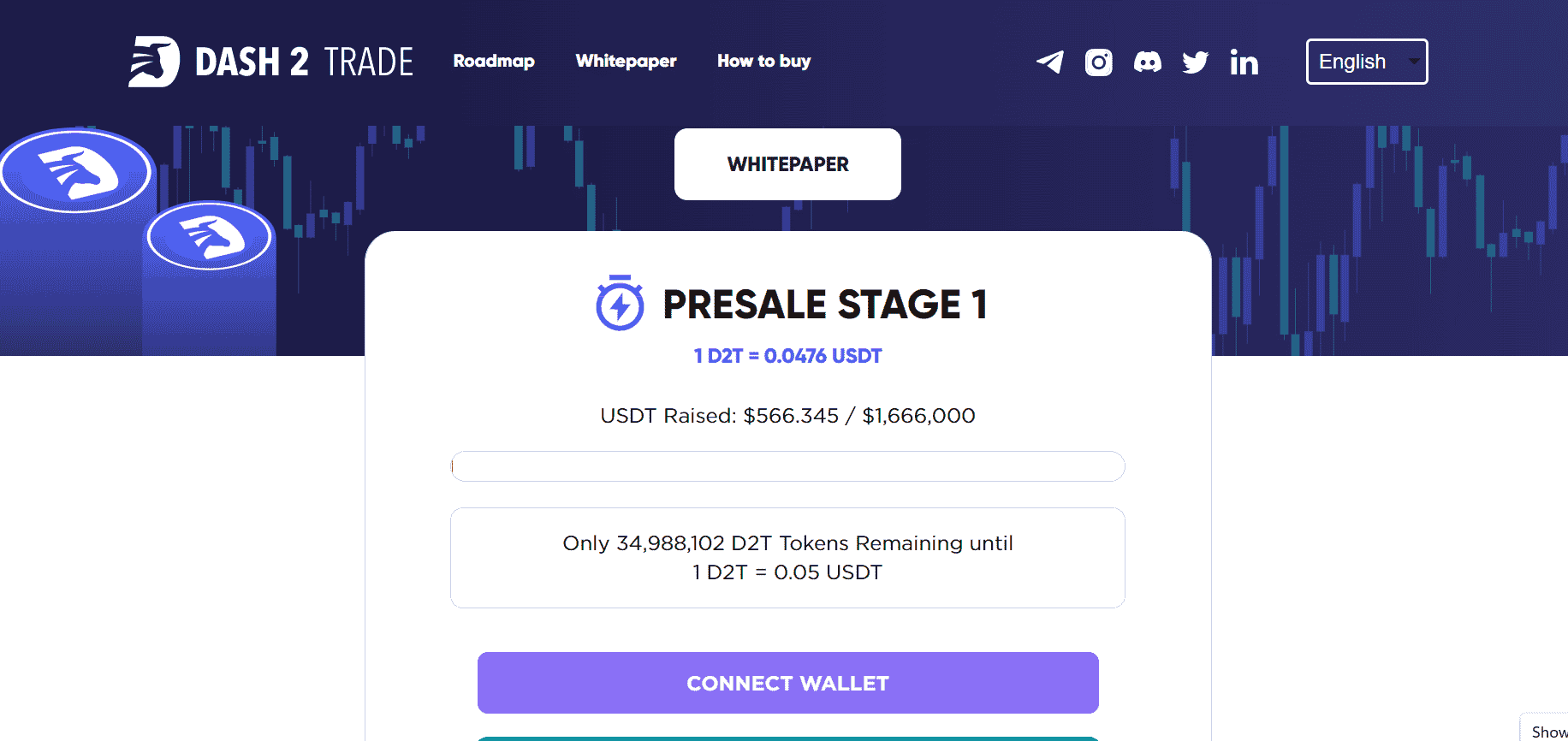

1. Dash2Trade- Word-class Crypto Analytics Platform That Could Transform The Industry

At the top of our list of Best DeFi trading platforms is Dash2Trade– a brand new innovative crypto trading and analytics platform that plans to transform the industry as we know it.

The main aim of the platform is to help traders make informed decisions about the market with the help of powerful analytics and social trading features. The platform provides a wide range of helpful tools that could make it easier to navigate the crypto space and determine

Main features of the Dash2Trade platform include:

- Accurate trading signals

- On-chain analytics to spot trending tokens

- Social trading for traders to learn from others and share market insight

- Innovative strategy builder to make it easy to create your own trading strategy that works!

- Crypto asset listing alerts

- Trading competitions for subscribers to win rewards

Dash2Trade differs from other platforms on the market by providing as much value as possible to users. This is not another trading bot! Instead, Dash2Trade is a trading tool that provides everything you need to make informed decisions and build a successful crypto trading strategy.

The native token of Dash2Trade is D2T. The token will power the entire platform and operates on the Ethereum blockchain. D2T is a utility token that provides access to the platform as well as advanced features.

Perhaps the most appealing aspect of the token is that it is completely tax-less. The team behind the project stands behind the idea that value should come from the project and not from tokens traders. As a result, the D2T community will never be charged tax. D2T tokens will be required by users to take part in competitions, run strategy back tests and subscribe to the platform.

There are 3 different subscriptions available that all offer unique platform features: free tier, starter tier, premium tier. The Dash2Trade ecosystem is community centric. This means that the project will be propelled by those who are invested in it. D2T is also scalable and transparent- making it an appealing investment for the future.

Pros:

- Tax-free crypto token

- Guaranteed profits if you invest during presale phase

- Innovative social trading platform unlike any other

- Capped token supply of 1 billion

- Trade-2-Earn design that will reward users

Cons:

- The project is brand new and success can never be guaranteed

The price or value of cryptocurrencies can rapidly increase or decrease at any time. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk.

2. Battle Swap- Best Exchange Within The Metaverse

At the top of our list is Battle Infinity’s ‘Battle Swap’ which is the best exchange within the metaverse

ecosystem in 2025. The Battle Swap exchange allows Battle Infinity to players to buy IBAT tokens directly or convert their game winnings into another cryptocurrency.

The exchange is completely decentralized and is available as part of the Battle Infinity metaverse gaming project. Battle Infinity is a brand new NFT-based gaming platform on which users can play NFT multigame for rewards and take part in the IBAT premier league.

The IBAT token is the native currency of Battle Infinity. It can be used by players to purchase games, gaming accessories and NFTs through the ‘Battle Market’. You can purchase IBAT through the Battle Swap exchange with BNB, ETH, USD and other widely used currencies.

Battle Swap is the best place to buy IBAT in 2025. You can purchase IBAT today and start taking part in the Battle Infinity platform by heading over to the presale event.

Pros:

- Easy to use platform that great for NFT gamers

- The best place to buy IBAT

- A new exchange with huge future potential and many future offerings in the works

- 100% decentralized platform built on blockchain

- Token staking is coming soon

- Provides access to Battle Infinity which is a revolutionary metaverse project

Cons:

- Limited token availability

Min Investment 0.1 BNB Max Investment 500 BNB Chain Binance Smart Chain Presale Start Date 11th July 2022 Presale End Date 10th October 2022 The price or value of cryptocurrencies can rapidly increase or decrease at any time. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk.

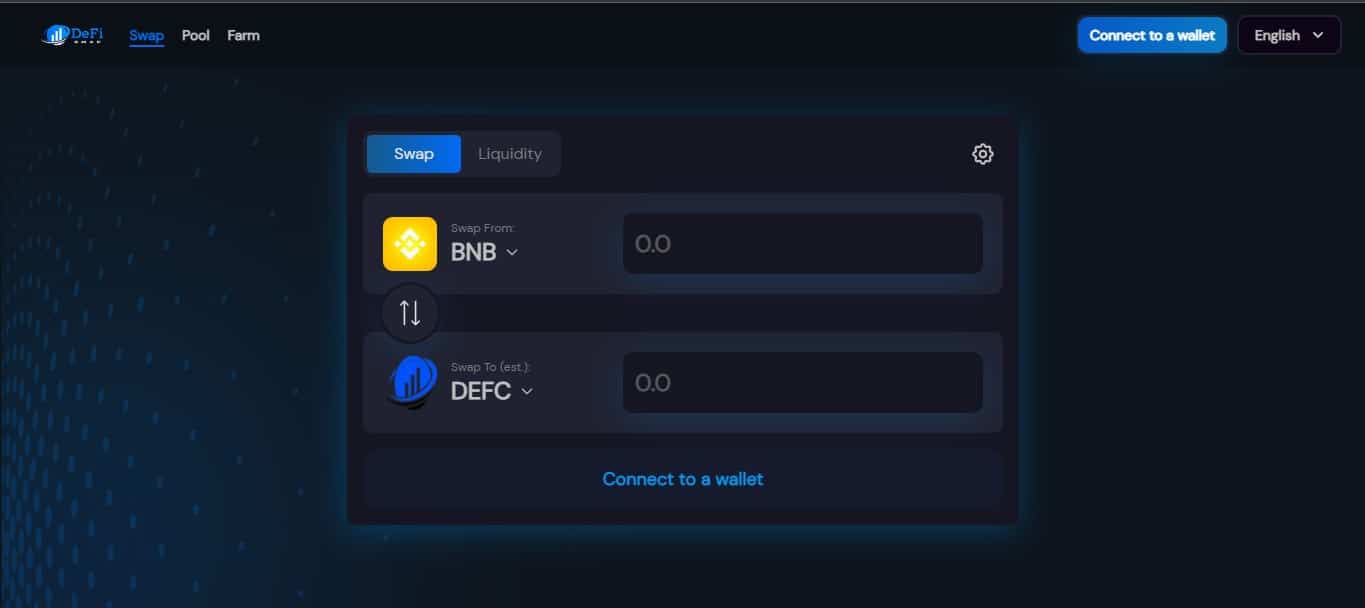

3. DeFi Swap – Overall Best DeFi Exchange

It is considered one of the best DeFi apps on the market, but it also supports the best DEX coins right now, making it the best DeFi exchange available right now. The DeFi Swap is a DEX that offers services such as token swaps, staking, and yield farming. Operating the platform requires DeFi Coin (DEFC), which acts as its native token.

You can access DeFi Swap’s online portal through your browser, making it simple to get started with this DeFi platform. You can purchase Binance Coin and then exchange it for one of DeFi Swap’s supported tokens since the platform is built on the Binance Smart Chain (BSC) network. Over 50 popular tokens, such as DAI, USDC, USDT, and ANKR, are currently supported by DeFi Swap.

The exchange’s liquidity pools can also be used to generate returns. Using smart contracts, these liquidity pools enable you to earn a fixed rate of interest on your digital currency holdings. With DeFi interest rates usually higher than traditional bank accounts, this ‘yield farming’ strategy can be highly profitable over time.

Users can also ‘lock-up’ their tokens with DeFi Swap for a specified period of time, paying interest as a result. Although this process is similar to liquidity pools, your holdings will remain locked up until the lock-up period has passed.

As a final benefit, holders of DEFC, DeFi Swap’s native token, can also generate a passive income stream by leveraging the token’s innovative taxation mechanism. DEFC charges 10% on purchases and sales, with half of that amount going to other holders as a ‘dividend.’ As a result of all of the above, DeFi Swap won our award for best DeFi exchange this year.

There are over 6000 users in the DeFi Swap Telegram group who interact frequently.

DeFi Swap fees

Fee Amount Crypto trading fee 10% when selling DEFC Inactivity fee N/A Withdrawal fee N/A Pros:

- Easily the best DeFi app on the market

- High yields on offer

- Provides liquidity and yield farming support for crypto

- Smart contracts ensure 100% decentralization of the platform

- A mobile app and NFT marketplace are on the way

- Powered by the top-rated growth cryptocurrency DeFi Coin

Cons:

- The platform is not as established as some other DeFi platforms

The price or value of cryptocurrencies can rapidly increase or decrease at any time. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk.

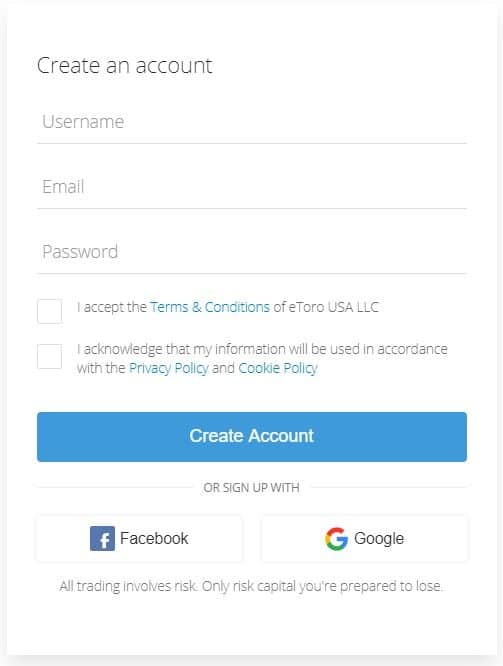

4. eToro – Overall Best Trading Platform for DeFi Cryptos

Our review of 50+ crypto day trading platforms for 2025 showed that eToro is by far the best. The site is heavily regulated, which may be the most important fact. That includes licenses from FCA, ASIC, and CySEC – but eToro is also registered with and authorized by FINRA.

eToro is therefore safe and secure for DeFi Coin traders in the United States and around the world. There are 18 popular cryptocurrencies you can buy and sell on eToro, in addition to Bitcoin, EOS, BCH, Ethereum, Uniswap, Ripple, Cardano, and Binance Coin. The ability to trade derivatives related to cryptos may also be available depending on where you live.

The yen, euro, British pound, and U.S. dollar are all fiat-to-crypto pairs included in this category. In addition to crypto-to-crypto trades, you can also trade BTC/XRP and ETH/BTC. Most eToro customers can trade these crypto CFD derivatives – unless you are from the U.S., U.K., or Hong Kong. Nonetheless, with regards to fees, eToro is a 100% commission-free cryptocurrency day trading site. In other words, you are not charged any fees if you enter and exit the market as often as you like.

Registration and payment methods in USD are free. You will be charged a small currency conversion fee of just 0.5%. You will also be offered passive investment tools in eToro’s user interface, making it one of the best crypto day trading platforms around. CryptoPortfolios include a diversified basket of digital currencies with various weightings. eToro manages your portfolio for you not to have to worry about rebalancing your portfolio yourself.

Another option is to use the Copy Trading tool to buy and sell cryptocurrencies. eToro uses crypto traders who are skilled and proven investors. You will copy their trades. The minimum amount you need is $500. You only need $25 to make a crypto trade if you do it yourself. It takes minutes to open an eToro trading account – and you can deposit with a debit/credit card, bank transfer, or e-wallet like Paypal.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

eToro fees

Fee Amount Crypto trading fee Spread, 0.75% for Bitcoin Inactivity fee $10 a month after one year Withdrawal fee $5 Pros:

- Trading platform and online broker that is extremely user-friendly

- Spreads are tight on thousands of assets

- 100% commission-free

- In addition to stocks, indices, ETFs, and cryptocurrencies, you can trade a wide variety of instruments

- Debit/credit cards, e-wallets, and bank accounts can be used to deposit funds

- Social trading and copy trading

- Accepts PayPal

- Regulated by the FCA, ASIC, and CySEC, and registered with FINRA in the US

Cons:

- Traders who perform technical analysis may not be interested in this product

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

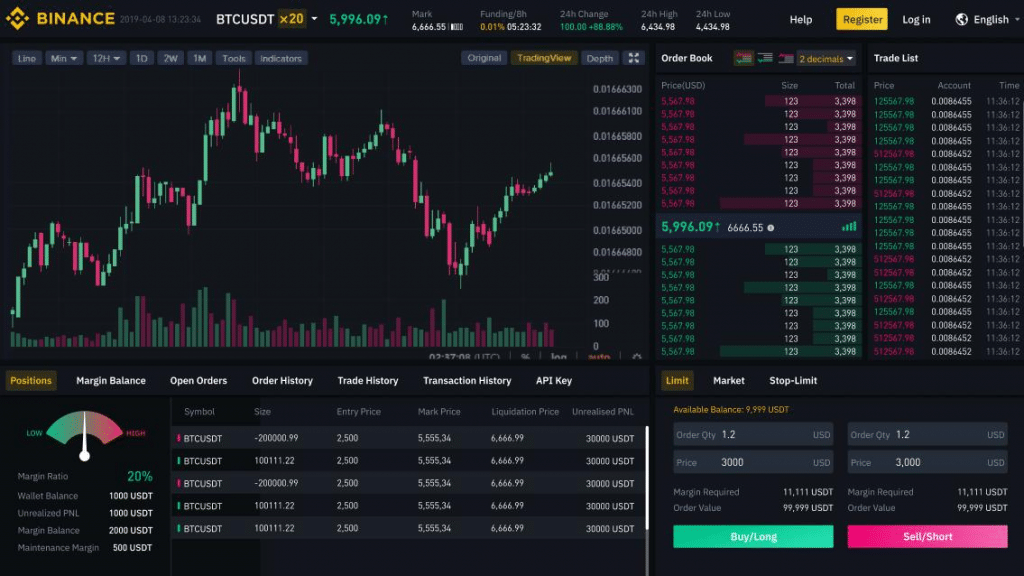

5. Binance – The Best DeFi Platform For Small-Cap Coin Pairs

You will likely have a chance of finding the cryptocurrency you are looking for on Binance. That is because a huge volume of transactions is conducted on this cryptocurrency exchange every day, worth billions of dollars.

It includes several small-cap coins as well as hundreds of pairs. There are hundreds of ERC-20 tokens included as well. The industries range from DeFi, Metaverse tokens, to NFTs, and much more. Your debit/credit card might be accepted where you live.

Fees range between 3 and 4%, however. Even so, Binance’s trading fees are exceptionally low. If you own Binance Coins (BNB), you’ll pay even less – just 0.1% – on the platform. Besides offering various charting options and order types, Binance is a great option if you enjoy performing technical analysis.

Binance fees

Fee Amount Crypto trading fee Commission, starting from 0.1% Inactivity fee Free Withdrawal fee 0.80 EUR (SEPA bank transfer) Pros:

- Advanced charting platform with customizable indicators

- There are hundreds of supported pairs

- 0.10% commission

- Supports fiat currency

- BNB users get a discount on fees

- Security measures have proven to work

Cons:

- Support is provided only through the ticket system

- Deposits by debit/credit card are charged up to 3.5%

The price or value of cryptocurrencies can rapidly increase or decrease at any time. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk.

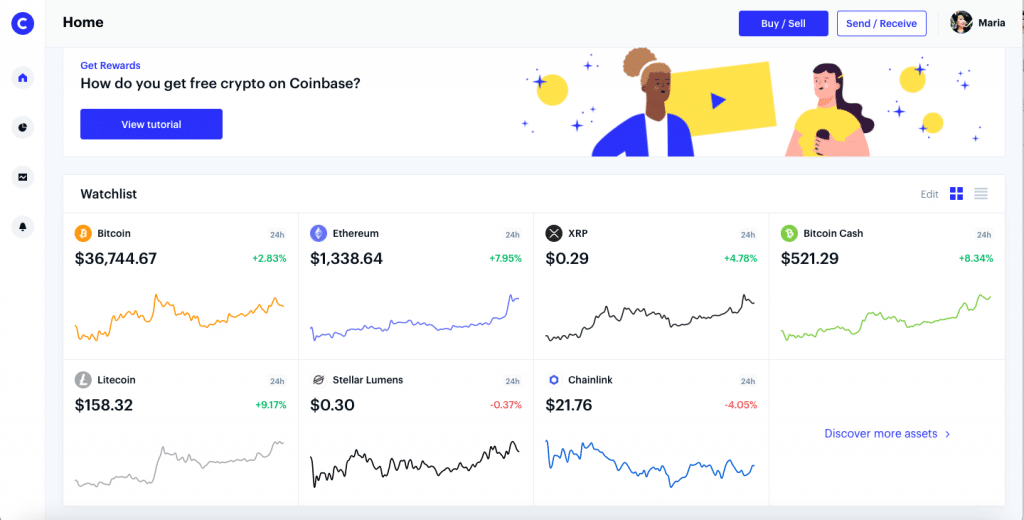

6. Coinbase – DeFi Platform for Good Selection of DeFi Tokens

Over 100 tradable cryptocurrencies such as Bitcoin, Ethereum, and Dogecoin are offered through Coinbase, a cryptocurrency trading exchange for DeFi trading, yield farming and investing platform. Over 73 million users access Coinbase, which has more than $255 billion in assets under management.

Simple buy and sell orders are likely to be preferred by beginners on the original Coinbase platform. However, Coinbase Pro, available to all Coinbase users, offers more advanced features and order types.

In general, digital currencies are an emerging asset class that can be risky and volatile, making them unsuitable for all investors. Nevertheless, if you’re into cryptocurrencies, Coinbase is an excellent option for both beginners and veterans.

Coinbase fees

Fee Amount Cryptocurrency trading fees Commissions starting at 0.50% Fee for inactivity It’s free Fees for withdrawals 1.49 % to an account in the U.S. Pros:

- Easy to use for cryptocurrency beginners

- Support for a large number of cryptocurrencies

- Opportunities to earn cryptocurrency

- Lower pricing available with Coinbase Pro

Cons:

- Potentially high transaction fees

- Customer service issues

- No access to trade many altcoins

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

7. Crypto.com – Best Trading Platform With An Integrated DeFi wallet

Crypto.com, founded in 2016, is one of the fastest and most secure cryptocurrency exchanges today. Several developers and a strong marketing team have helped Crypto.com grow rapidly over the past few years. The exchange offers more than 250 different currencies, and those who possess a significant amount of Crypto.com’s token (CRO) can take advantage of reasonable fees and discounts.

The Crypto.com account can be connected to multiple digital wallets simultaneously, and there are several ways to store digital assets within Crypto.com that make it an ideal place to invest in cryptocurrencies. The DeFi wallet is one example that illustrates this best. In addition, as a result of this app, users can earn rewards using tokens or coins, which are similar to those used with decentralized financial applications that operate using blockchain networks.

Since you only have to deposit US$1 to open a crypto position on Crypto.com, it is one of the most accessible cryptocurrency trading platforms you can find. Furthermore, the platform offers crypto trading and offers derivative products so that anyone interested in leveraging their position on the platform has this option.

Crypto.com fees

Fee Amount Crypto trading fee 0.04% maker and taker fees Inactivity fee Free Withdrawal fee According to the currency withdrawn. 0.0004 for ETH Pros:

- The platform supports over 250 cryptocurrencies and stablecoins

- For staking stablecoins on the platform, users can earn between 14 and 15 percent per year

- You can get up to 8% back on your purchases with the Crypto.com Visa Card

- NFT marketplace available

- Integration with DeFi

- Fees that are competitive, transparent, and at a discount

Cons:

- CRO fees are high if you don’t use them.

- Educators have fewer resources to choose from

The price or value of cryptocurrencies can rapidly increase or decrease at any time. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk.

8. Kraken – The Safest Crypto Exchange For Investing With More Than 60 Digital Assets Available

As one of the first cryptocurrency exchanges in the United States, Kraken was founded in 2011 in San Francisco. Just a decade after it was launched, it has been used by more than 4 million users in many countries all around the world.

The platform allows traders to trade cryptocurrencies in the future, which is not available on most other trading platforms. As a result, Kraken is a very popular choice among traders, as you can get a high margin based on the currency you prefer, and it is extremely user-friendly.

The company offers one of the highest levels of security and safety in the industry. In addition, it is an application that is straightforward and allows users to trade on high margins, depending on the currency they wish to trade, regardless of what kind of currency they trade. There is a large range of leverage levels that can be selected from.

The Kraken and Kraken Pro exchanges offer the ability to buy cryptos depending on your needs, and you can choose either an advanced or a basic interface. Moreover, all versions are mobile-friendly to use on your Android or iOS device. In addition to Kraken’s no minimum deposit policy, if you run into any issues with the platform, the company’s 24/7 customer support team will be available to assist you as soon as you log on to it.

Kraken fees

Fee Amount Crypto trading fee Commission, starting from 1% per trade for sellers. Free for buyers Inactivity fee Free Withdrawal fee According to the currency withdrawn. 0.0005 for BTC Pros:

- Multiple technical indicators on a charting platform

- Starting at a $10 minimum deposit

- Cold storage available for most deposits

- Earn cryptocurrency via staking platform

- Derivatives and margin trading

Cons:

- Deposit and withdrawal limits

The price or value of cryptocurrencies can rapidly increase or decrease at any time. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk.

DeFi Platform Fees Compared

Platform Crypto trading fee Inactivity fee Withdrawal fee DeFi Swap 10% when selling DEFC N/A N/A eToro Spread, 0.75% for Bitcoin $10 a month after one year $5 Binance Commission, starting from 0.1% Free 0.80 EUR (SEPA bank transfer) Coinbase Commission, starting from 0.50% Free 1.49% to a US bank account Crypto.com 0.04% maker and taker fees Free According to the currency withdrawn. 0.0004 for ETH Kraken Commission, starting from 1% per trade for sellers. Free for buyers Free According to the currency withdrawn. 0.0005 for BTC List of the Largest DeFi Cryptos By Market Cap

Uniswap – One of the largest Ethereum DeFi Exchanges

Uniswap is one of the top cryptocurrency exchanges using the ERC20 DeFi token as its trading base. This exchange uses an automated liquidity protocol, and it utilizes a cryptocurrency trading system called Automated Liquidity Protocol. Uniswap is a blockchain-based platform developed in 2018 that utilizes Ether blockchain technology, thus making it compatible with any other ERC20 token and cryptocurrency wallet service.

Because UniSWAP operates on 100% open-source software, anyone can use the code to create their own DeFi crypto coins or tokens. Additionally, crypto enthusiasts can list tokens free of charge on this decentralized crypto exchange.

Unify’s native token, DeFi (UNI), is a utility token. Users can vote on everything from fee structures to token distribution, so they gain the right to influence key developments. The trading volume for UniSwap for the 24-hour period reached $326,514,063. There is a price of $17.36 for UniSwap.

Chainlink – A Popular Decentralized Trading Platform

The Chainlink oracle network is a leading DeFi oracle network that enables off-chain data to be merged into smart contracts. At the moment, there are approximately 419 million LINK tokens available, which represents approximately 41% of the overall supply.

In less than one year after its launch, Chainlink has grown significantly thanks to the growing popularity of decentralized platforms. The Chainlink ecosystem has begun to fund other blockchain efforts that can further enhance its value.

Fundamentally, DeFi tokens are expected to appreciate in value in the near future with a 24-hour trading volume of $716,769,258 and a current value of $17.42. The company plans to expand the capability of its DeFi trading platform, allowing LINK to offer greater flexibility to DeFi developers. Tokens such as LINK are among the best DeFi tokens to invest in in July 2021.

DAI – A Top DeFi Stablecoin

A stablecoin based on Ethereum blockchain produced by MakerDAO and Maker Protocol, DAI is soft pegged to the USD fiat currency and is developed by the MakerDAO and Maker Protocol. As such, DAI represents the first DeFi crypto of its kind.

Its soft peg to the US dollar is one of its key benefits. Cryptocurrency markets are usually the most volatile out there, with coins such as Bitcoin (BTC), the most popular cryptocurrency, sometimes experiencing substantial price changes within a 24 hour period. During these situations, investors seek out safe-haven assets that are stable in price to balance out the large price fluctuations in crypto markets.

DeFi coins such as DAI, which is pegged to the USD, are considered safe places to store value. According to its market cap, DAI has a market cap of $5,409,391,509; its trading volume is $330,828,126 in 24-hours. In July 2021, we suggest DAI as the best DeFi coin.

Compound – DeFi Token for Earning Interest

By storing digital assets in one of many supported liquidity pools, users can earn interest on their digital assets through Compound, a DeFi trading platform. Depositing cryptos to a pool of Compound tokens provides users with cTokens.

Compound allows users to earn interest by storing Ethereum tokens. This is one of its most notable features. COMP token holders have the ability to suggest changes to the lending protocol and vote on how tokens are distributed.

A recent report shows that DeFi coin (COMP) of compound has a market capitalization of $3,098,924,460.71 based on its fully diluted market capitalization. As of May 12, 2021, Compound’s price reached an all-time high of $911.20. Analysts anticipate Compound’s price rising into the future.

0x – Ethereum-based Decentralized Finance Exchange

A P2P (peer-to-peer) exchange for ERC20 DeFi tokens on the Ethereum blockchain using the 0x protocol is supported by the DeFi protocol. Users can trade ERC20 tokens without relying on traditional cryptocurrency exchanges by using this infrastructure protocol.

It is provided by 0x, a decentralised exchange powered by an open-source network of smart contracts that have been integrated to form a streamlined trading protocol that is flexible for developers to integrate into their own products.

By supporting both fungible and non-fungible DeFi tokens (ERC 723 and ERC 20), 0x stands out from the vast majority of Ethereum decentralized exchange protocols. As a result, ZRX tokens can be traded freely on online markets for both goods and services.

With a record high of $2.53 in 2018, the price of 0x has risen by a whopping 535.97% from its all-time low of $0.104 in 2017. Currently, the market capitalization of ZRX has reached $558,904,364.01.

Risks of Trading DeFi Cryptos

Negative outcomes can be unexpected when using DeFi technology due to its newness. Decentralized Finance may not be successful for new companies (start-ups fail frequently), and mistakes by programmers can lead to profitable opportunities for hackers. You can lose all your funds if you invest or store money in a DeFi project that fails.

The Federal Deposit Insurance Corporation (FDIC) insures deposits with traditional centralized financial institutions, whereas DeFi trading platforms generally don’t provide a way to recover lost funds. As a consumer, you can file a complaint with the Consumer Financial Protection Bureau (CFPB) if a traditional financial transaction fails, but this option does not exist if you are victimized by a deceptive DeFi transaction.

An interesting advancement is the availability of another type of DeFi application that addresses these shortcomings. Individuals who wish to protect themselves from other smart contracts are being offered decentralized insurance created by pooling their cryptocurrency as collateral. Those covered by cryptocurrency pools are charged premiums by the individuals who contribute to them.

DeFi Trading Strategies

You will need to consider your risk tolerance, investment objectives, and the ‘best’ strategy for you based on the following 4 options. Having said that, these four strategies provide a good starting point to buy the best DeFi coins.

HODL (Hold On for Dear Life!)

HODL or hodl originated from a post on a Bitcoin forum in 2013 that discussed a surge in Bitcoin prices and a subsequent collapse. HODLING is the message posted by the user “GameKyuubi,” a clear statement of desire to hold bitcoin. HODL quickly became a meme and was all over the internet.

In that sense, the word HODL came from a strategy to invest in stocks. But how does HODL work as an investment strategy? All short-term price movements that are based on HODL are disapproved of. Despite the drop in the market, Hodlers maintain their coins. A coin or asset that drops in price is considered a negative asset by most investors. While using the HODL strategy, investors are continuing to hold onto their assets and coins and do not sell them. One way of benefitting from holding on to your assets long term is by using a crypto savings account which can generate interest on your asset.

Investors have a variety of strategies at their disposal, among them HODLing. It is probably a good strategy for beginners if they aren’t obsessive about their investments, such as day-trading does. Hodlers hold their cryptocurrencies in the hope that the price will increase in the near future, rather than relying on short-term price movements as their investment strategy.

In spite of the simplicity of HODLing, it requires a certain degree of mental fortitude and resilience to execute. The price of the asset could drop or surge, which means that holders have to cope with significant levels of volatility.

Hodlers are also faced with the fears of FOMO (Fear of Missing Out) and FUD (Fear, Uncertainty, and Doubt). These factors can sometimes force investors to downgrade their prices and therefore make fewer profits. If investors hold through the fluctuations, they can still make a lot of money.

Buy and Sell Governance Tokens

Additionally, one can purchase or sell governance tokens, in addition to hodling, for investing in DeFi apps. A token can be traded in three ways:

- DeFi Degen.

- Rules-based

- Momentum-based.

- DeFi Degen

Crypto Twitter uses the term “Degenerate” to describe those who constantly switch between one DeFi token and another. Research is not done by these people and they are largely driven by FOMO. It’s almost as if they don’t do any risk management. DeFi degens can invest in projects with hardly any assets, much less a website or a whitepaper.

Rules-based DeFi trading

The rule-based approach is in opposition to DeFi degen. A trader uses this system to determine when to enter and exit. E.g. A rule could be to buy the moment the price crosses 50% of the listing price and to sell the moment the price falls 30% of the peak.

Momentum-based DeFi Trading Strategy

The DeFi degen strategy is a hybrid of the rules-based strategy and the DeFi degen strategy. In this case, the price must drop just a little bit to justify selling. Otherwise, the rule-based approach applies.

“Holding onto your tokens” and “buying and selling” different tokens is a pretty standard practice. Despite this, DeFi offers a whole new world of financial products. How can you take advantage of this? Here are some tips.

Interest On Lending Protocol – Earning Passive Income from DeFi Exchanges

Three different investment strategies will be explored – the third is leveraging one of the most famous tools in the DeFi-verse – lending protocols.

I would like to take a moment to introduce Automated Market Makers (AMMs). In the DeFi ecosystem, AMMs are integral to allowing digital assets to be traded permissionless and automatically using liquidity pools rather than a traditional market where buyers and sellers interact.

At its very core, an AMM works like this:

- Liquidity providers (LPs) contribute funds to liquidity pools

- Using the pool, users may borrow, lend, or swap tokens.

- The pools charge a fee for each use, which the liquidity providers receive in return.

Although the core concept of the project is the same, different projects could implement it differently. Limited partners are paid all fees. Token farming refers to the entire process of locking up your tokens in order to add liquidity and earning rewards. It is only one factor of the equation, however.

Liquidity mining is also possible through lending protocols. Whenever you lock up your tokens in a liquidity pool, Liquidity Mining rewards you with a token. For example, you are rewarded with token X whenever you lock up token A in a pool of liquidity B.

In stablecoin pools, most funds are locked up in DAI, USDT, USDC, and BUSD. Tokens may be minted by some protocols to represent coins deposited into their system. As an example, when you lock up DAI in Compound, you get cDAI.

Advantages Of Yield Farming on A DeFi Platform

Yield farming offers many benefits. Here are a few:

It offers users the opportunity to make a profit with yield farming. Up-and-coming projects can provide token rewards to early movers. By picking the right project, one can earn a lot of money.

Earning yield can be achieved using one of the many DeFi protocols. There are different risks and rewards associated with different protocols. The user who is well-versed in these platforms can cleverly move between them to maximize rewards.

A system that allows farmers to farm continuously and reinvest their profits to earn rewards forever. This drastically reduces the overall token velocity since a significant amount of tokens are stored as stakes.

Is DeFi Trading Legal?

DeFi developers and users have received guidance from several regulators. Because DeFi is decentralized, it is uniquely difficult to regulate as it is an area that is rapidly changing, so anyone trying to regulate it faces the dilemma of trying to figure out who, what, where, and how.

How to Get Started With the eToro DeFi Platform

Step 1: Open an Account

Before you can open an eToro live account, you must first open an eToro demo account. However, if you possess a few basic documents and have some spare time, it is a relatively simple process that anyone can handle.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

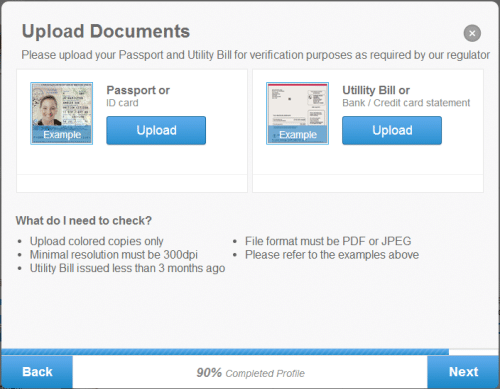

Step 2: Upload ID

- Uploading documents is a simple process that can be done by clicking here. Documents can be uploaded in the following formats: .pdf, .jpg, or .doc

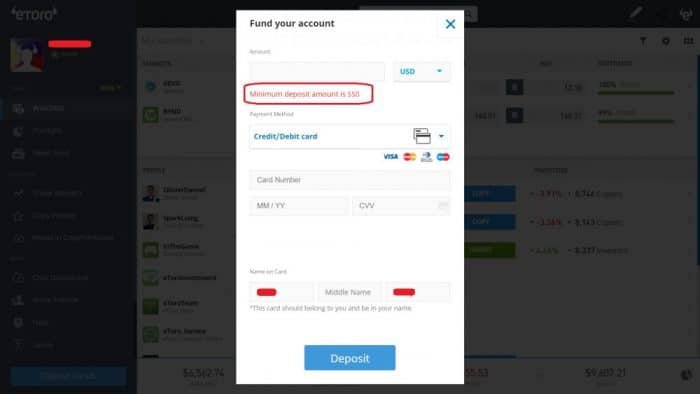

Step 3: Deposit Funds

- In the left-hand navigation box, select the “Deposit Funds” button. Enter the amount you would like to deposit. Enter your payment information and choose your preferred method of payment. Users in the U.S. have the following three payment options:

Step 4: Start DeFi Trading

Your trading or buying of Ripple will be the final step after verifying and depositing your eToro account. eToro provides the option to select “Crypto” on your “Markets” page.

Click the “Buy (non-leveraged)” button in the crypto menu once you have selected “A DeFi coin.” When you are ready to open the trade, you need to enter the amount you would like to purchase and click buy.

Having traded DeFi on eToro, you will own a certain amount of the cryptocurrency, which you can trade again at any time or store in your eToro wallet for future use.

Conclusion

In a similar way to the way fintech led to the emergence of online banking and online transactions that we are familiar with today, Trading DeFi has the power to change how global financial services operate. In spite of this, it is important to bear in mind that blockchain and decentralization aren’t a panacea for everything. The goal of mainstream adoption of this emerging technology will likely be to identify proper use cases that can truly benefit from it

Interested in start trading DeFi? The first step is to purchase Ethereum, which can be purchased directly from eToro which is considered the best trading platform using a variety of different currency pairs. Learn more about decentralized finance by joining today.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

FAQs

Which are the best DeFi cryptocurrencies to trade?

Uniswap, Chainlink, DAI, Compound and OXWhat are the best DeFi trading platforms?

Aave, Compound, Curve Finance, Uniswap, MakerDAO, Synthetix, Yearn.Finance, Pancakeswap, Sushiswap or FalconswapDo I need a crypto wallet to start trading DeFi?

Using DeFi protocols is also dependent on a DeFi wallet, which is one of the most important requirements. Using DeFi, you can become your own bank without having to deal with middlemen. In order to interact with DeFi products, wallets provide a secure, accessible, and intuitive interface.What is DeFi leverage trading?

Whereas the general idea of leverages is the same in both traditional and crypto finance, a major difference lies in the action of borrowing. As the only identity on the blockchain is merely a string of alphabetic codes, it would be almost impossible to borrow upon credit. In other words, DeFi borrowing is usually fully collateralized.How much money do I need to start trading DeFi cryptocurrencies?

Buying Ether or another coin that uses DeFi technology is the most straightforward way to gain exposure to DeFi. Trading DeFi coins entitle their holders to exposure to the whole industry. In order to earn interest on cryptocurrency, you can deposit it directly with a lending platform like DeFi.Is there a defi trading bot?

What is a DeFi Wallet?

References:

- https://www.ig.com/sg/trading-strategies/what-is-defi-and-how-does-it-work–220926

- https://www.analyticsinsight.net/how-to-invest-in-defi-a-simplified-guide/#:~:text=To%20invest%20in%20DeFi%2C%20you,store%20your%20wallet’s%20private%20keys.

- https://finimize.com/content/4-defi-investment-strategies-help-grow-your-crypto-portfolio-zerion

- https://financefeeds.com/the-most-common-defi-trading-strategies-explained/

- https://www.antiersolutions.com/defi-yield-farming-and-other-defi-trading-strategies-of-2022/

Jhonattan Jimenez Finance and Crypto Writer

View all posts by Jhonattan JimenezBefore starting his career as a freelance writer, Jhonattan studied at the Universidad La Gran Columbia from which he graduated in 2019. Jhonattan describes himself as a crypto enthusiast and regularly writes price prediction articles for new projects. During his time as a writer, Jhonattan has gained great knowledge about the crypto space and has mastered technical analysis skills that he uses when writing token price predictions. As well as writing for Trading Platforms, Jhonattan has written for Stocksapps.com and Buyshares.co.uk.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

ecosystem in 2025. The Battle Swap exchange allows Battle Infinity to players to buy IBAT tokens directly or convert their game winnings into another cryptocurrency.

ecosystem in 2025. The Battle Swap exchange allows Battle Infinity to players to buy IBAT tokens directly or convert their game winnings into another cryptocurrency.