6 Best Yield Farming Crypto Platforms in June 2025 for US Traders

Crypto yield farming seems to be the latest buzz in the crypto sphere as a ton of investors and developers look to build the next best yield farming platforms. Being able to earn passively through the top yield farming platforms can jumpstart your crypto compound earnings.

In this guide, we’ll go through and review the best crypto yield farming platforms by going through key features and metrics. We’ll also take a look at beginner yield farming crypto platforms and some leveraged yield farming platforms as well.

-

-

Best Yield Farming Crypto Platforms in 2025

If you’re ready to jump in and start earning passively with your idle crypto assets, then check out some of our best platforms for yield farming.

- DeFi Swap: DeFi Swap is a new yield farming platform that offers up to 75% APY. Users can also earn through crypto staking, with higher rewards offered to users who stake DEFC (DeFi Coin). The platform is completely decentralized and accepts a range of major currencies.

- AQRU: AQRU has an easy-to-use interface and offers an APY of 12% for yield farming. Users can farm major tokens including USDT, USDC and DAI with no lock-in periods. The platform is secured by Fireblocks and has a strong focus on asset security.

- Crypto.com: Crypto.com offers a high APY for stablecoins of up to 14%. The platform provides different holding plans to offer flexibility as well as a native crypto wallet that supports 34 blockchains and over 700 tokens.

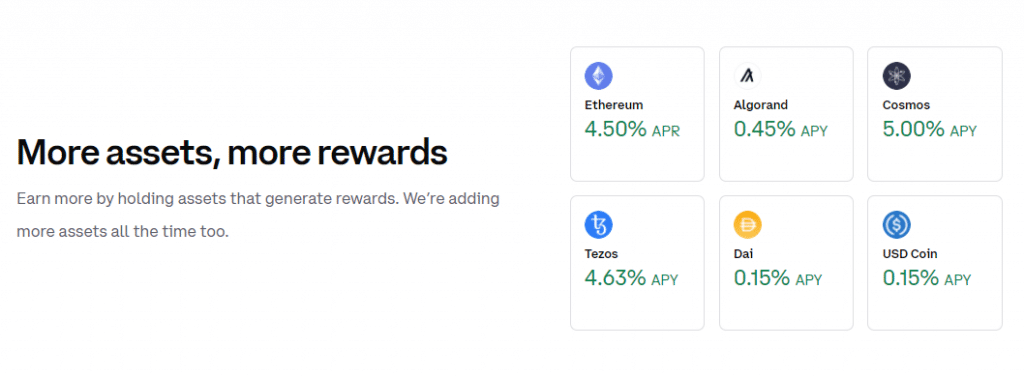

- Coinbase: Coinbase is an established crypto trading platform that offers yield farming amongst other features. Users can lock up major currencies including ETH, ATOM, ALGO, DAI, USDC, and XTZ. Coinbase also offers a good range of educational resources and real-time market data.

The price or value of cryptocurrencies can rapidly increase or decrease at any time. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk.

What is Crypto Yield Farming?

Yield farming is the process of allocating your cryptocurrencies in the most optimal places to let you earn more crypto. Allocating your cryptocurrencies can be better understood as choosing which cryptocurrencies in particular you would want to move and how much of it would you arrange. Deciding where to optimally place your cryptocurrencies to earn yield is when you’d want to find the best yield farming platforms.

There are several different methods for crypto yield farming. Some of them are:

- Providing liquidity for crypto exchanges

- Borrowing and lending crypto

- Staking cryptocurrencies

- Holding coins with redistribution fees

How does Crypto Yield Farming Work?

Each method of yield farming works and earns differently from others. The crypto earning products in the top yield farming platforms we reviewed usually hold your cryptocurrencies to earn through one or more of the yield farming methods.

Placing your cryptocurrencies in these centralized platforms gives you the advantage of fast transactions, an easy-to-use interface, and some insurance and securities if those platforms offer it. However, since you’ll be handing out your cryptocurrencies to these exchanges, you relieve a lot of control over those crypto assets.

If you want to earn by using some of the decentralized finance (DeFi) best yield farming platforms, then it’s important to know exactly how some of the yield farming methods work. If you want to provide liquidity to a decentralized exchange (DEX), you can be an investor that supplies coins and tokens in return for a very small fee of all the trades happening on the platform.

The price or value of cryptocurrencies can rapidly increase or decrease at any time. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk.

Borrowing and lending cryptocurrencies, on the other hand, are two significant functions for yield farming crypto platforms. Many borrowing and lending services provide rewards for those who lend their crypto to the platform.

As for borrowing, you can earn a lot through leveraged yield farming platforms that let you borrow crypto which you can then invest in and earn substantially when the price rises.

Crypto Yield Farming Explained – The Basics

By understanding some fundamentals of crypto yield farming, you can better choose the best yield farming platforms and leveraged yield farming platforms for you.

Let’s go through some of the terms and key ideas that will give you a better grasp of yield farming crypto.

APYs

Though there might be many different ways of yield farming, the best way to compare earnings from different yield farming approaches is through the annual percentage yield or APY. APY is basically the compounded version of annual percentage return or APR.

Generally, you’d see the best yield farming platforms hold high APYs. Note that because APY is compounded, meaning rewards are added to the principal amount depending on the distribution frequency. For example, lending 100 USDT at 12% APY will earn 12 USDT in a year.

Yield Farming Pairs

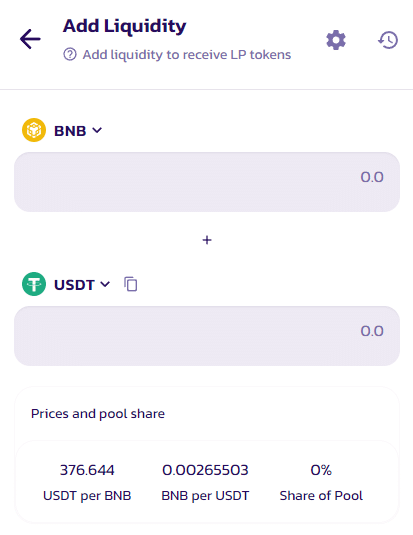

When yield farming by providing liquidity to a decentralized exchange, two cryptocurrencies need to be added to the liquidity pool. These are known as yield farming pairs which the liquidity pools use so that other users can swap one of the cryptocurrencies for the other.

As an example, let’s look at the BNB and USDT yield farming pair on the PancakeSwap DEX. If you place $100 worth of BNB and $100 worth of USDT, you’ll earn a small percentage share of the pool. Around 0.17% of all swaps of BNB and USDT on the liquidity pool are split across investors and are paid in the CAKE LP token. You can then further stake the CAKE tokens you earn more.

Reward Coins

By either providing liquidity or holding coins that have redistribution fees, you can earn reward coins as a form of yield farming. This is important to understand when finding some of the best platforms for yield farming since it can dictate your compounded earnings.

Lock-Up Period

Another important aspect for yield farming platforms crypto is the lock-up period. Essentially, the lock-up period is the amount of time you need to leave your coins and tokens while they earn. This is also important when finding some of the top yield farming platforms since you cannot withdraw your cryptocurrencies that are currently locked-up.

Distribution Frequency

Lastly, the distribution frequency refers to how often yield is given back to your crypto accounts or wallets. Distribution frequency can affect compound growth since being able to collect rewards more frequently means that more of your earnings can be used to yield more free crypto.

While some platforms require you to manually claim your rewards, some of the best crypto yield farming platforms do this automatically.

The price or value of cryptocurrencies can rapidly increase or decrease at any time. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk.

Our Review of The Best DeFi Yield Farming Platforms to Use in 2025

We’ve done individual reviews on what we think are the top yield farming platforms available. In particular, we mention key features, rates, and coins available per platform.

Let’s take a look at these yield farming platforms crypto.

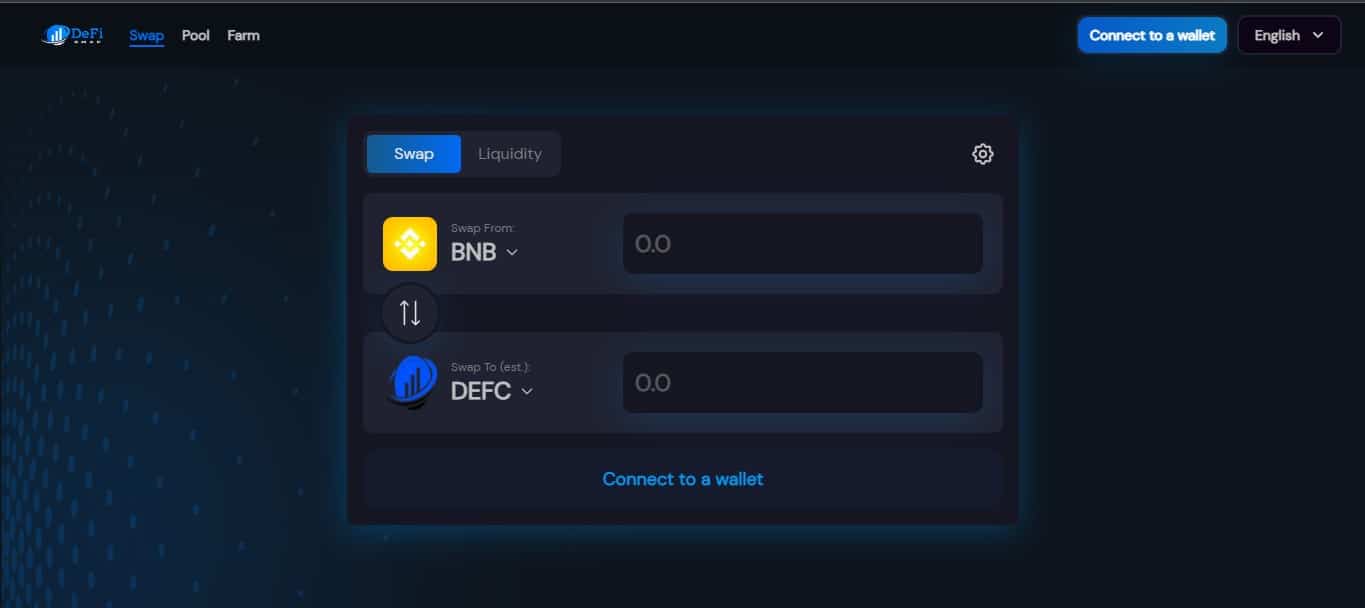

1. DeFi Swap – Overall Best DeFi Yield Farming Platform 2025

This cryptocurrency exchange and yield farming platform offers crypto investors up to 75% APY on their investments. DeFi Swap’s high rates are due primarily to its native DeFi Coin token (DEFC), the only cryptocurrency available for stake on the platform.

As previously mentioned, you have four options for lock-up terms when staking DeFi Coin on the DeFi Swap exchange:

- Bronze: 30 Days with a 30% Annual Percentage Yield (APY).

- Silver: 90 Days with a 45% APY.

- Gold: 180 Days with a 60% APY.

- Platinum: 365 Days with a 75% APY.

The DeFi Swap platform is a fully decentralized exchange. Almost any major cryptocurrency, including most stablecoins, can be swapped into DeFi Coin. Early investors will likely see higher rates or more options for yield farming in the future since DeFi Swap has made no secret that it intends to become the place for decentralized finance.

As of now, the DeFi swap is available for download online or through a decentralized app. However, if you want to see available staking options and interest rates, you must connect your wallet.

There are over 6000 users in the DeFi Swap Telegram group who interact frequently.

Feature Amount Maximum Yield for Stablecoins 75% APY Maximum Yield for Non-stablecoins 30% APY for 30 days Pros:

- You can earn interest at 75% APY

- The stake period can be 30, 90, 180, or 365 days

- Convert most cryptocurrencies to DeFi Coin

- Platform with full decentralization

Cons:

- The platform is not as established as some other DeFi platforms

The price or value of cryptocurrencies can rapidly increase or decrease at any time. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk.

2. AQRU - Overall Best Crypto Yield Farming Platform for 2025

For its great user interface and yield rates, AQRU tops our list of best yield farming platforms. AQRU offers popular stablecoins and cryptocurrencies without any lock-in periods. A 12% annual percentage yield (APY) is rewarded for USDT, USDC, and DAI. Yield farming BTC and ETH give a 7% APY.

With no hidden fees and just a $20 withdrawal fee, AQRU will benefit long-term holders for their available cryptocurrencies. Aside from this, users get to keep their cryptocurrencies safe thanks to the proper regulations and security AQRU has in place.

AQRU is owned by Accru Finance Ltd, a private limited company registered in England and Wales. Their crypto wallet system is secured by Fireblocks, a leading wallet infrastructure provider, to keep your Yield Farming Crypto accounts safe. In the event that assets are stolen, a $30 million policy is in place to cover the losses from theft.

The minimum deposit to lend crypto on AQRU is $100 and there is currently no minimum for withdrawals as long as users can cover their withdrawal fee.

Feature Amount Maximum Yield for Stablecoins 12% APY for USDT, USDC, DAI Maximum Yield for Non-stablecoins 7% APY for BTC and ETH Pros:

- No buying fees for crypto

- High rates for any balance size

- Zero lock-in periods

- Fast transaction speeds

- Joining bonus of 10 USDT

- Mobile app available

- No bank transfer and crypto transfer fees

Cons:

- KYC and ID verification required

- Only 5 coins available for yield farming

The price or value of cryptocurrencies can rapidly increase or decrease at any time. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk.

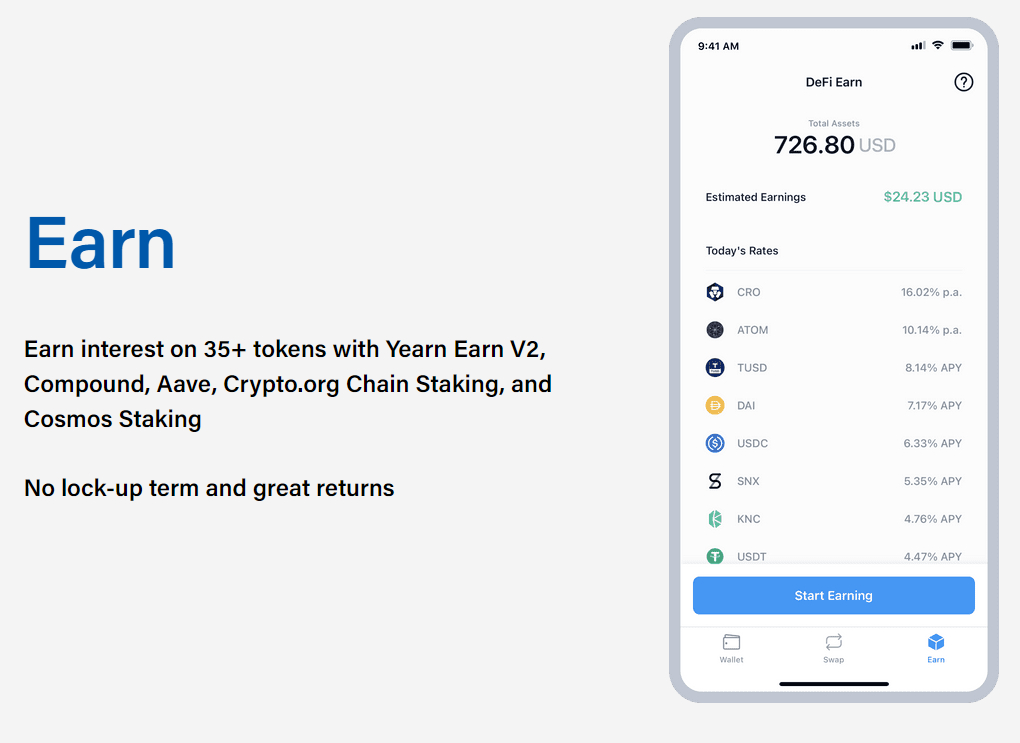

3. Crypto.com - Fast Crypto Platform with High Stablecoin APY

If you’re willing to stake a lot of their native tokens then Crypto.com can be one of the top yield farming platforms with high stablecoin APY. In particular, Crypto.com’s yield farming product called Crypto offers up to 14% APY on stablecoins.

What puts Crypto.com among the best crypto yield farming platforms aside from high APY is that it has several options for earning. Combined with over 50 cryptocurrencies available for yield farming, Crypto.com offers three different holding plans as well. These holding terms are flexible holding terms, 1-month fixed term, and 3-month fixed term.

So depending on how much Crypto.com Coin (CRO) you’ll stake, the holding term you’re using, and which cryptocurrency you’re using to yield farm, the APY will vary.. For example, if you want to earn the maximum amount for USDT which is 14% APY, you’ll need to stake $40,000 worth of CRO, and use a 3-month fixed holding term.

Available Cryptocurrency

Supported Locations

BTC, BNB, ATOM, VET, ALGO, eGLD, ONE, NEAR

All

CRO

United States, Canada, South Korea, Singapore and Thailand only

USDT, USDC, and DAI

All except for Texas

USDP

All except for Texas and Singapore

APT

All except for United States, Canada, France, United Kingdom, Netherlands, Germany, Japan and Korea

PYUSD

All except for Texas and Canada

ADA, AVAX, ETH, MATIC, DOT and SOL

All except for Japan, Germany, Netherlands, France and the United Kingdom

ZIL

All except for the United States and Canada

Alternatively, Crypto.com’s wallet app is one of the best DeFi yield farming platforms as well. Over 35 tokens are offered here with no lock-up periods and decent returns.

Feature Amount Maximum Yield for Stablecoins 14% APY for 3-month fixed USDT, USDC, and more Maximum Yield for Non-stablecoins 14.5% APY for 3-month fixed DOT Pros:

- Supports over 40 cryptocurrencies for earning

- 14% annual returns on staking stablecoin on the platform

- Earn rewards from staking CRO

- DeFi wallet available for DeFi yield farming

- Fees are competitive, transparent, and offer discounts

Cons:

- Lower returns per annum without staking CRO

- Difficult to navigate trading fee discounts

The price or value of cryptocurrencies can rapidly increase or decrease at any time. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk.

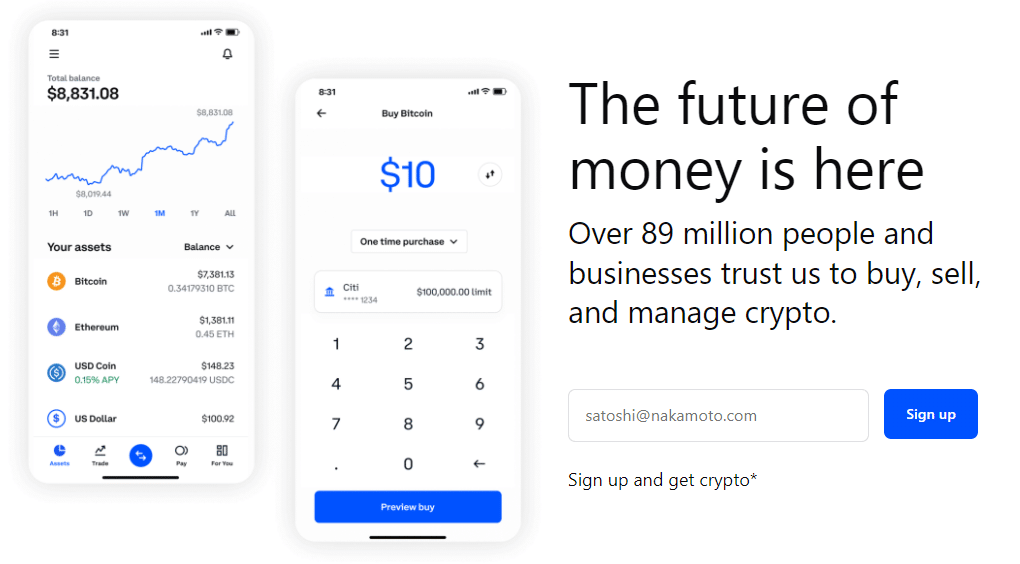

4. Coinbase - One of the Best Yield Farming Platforms for Beginners

Coinbase is one of the most popular and best crypto exchange platforms which also offers decent yield farming options. With a simplistic, easy-to-use interface as well as accessible payment options, new crypto investors will benefit greatly from Coinbase.

As one of the best yield farming platforms, Coinbase lets users select which DeFi protocol to use to earn interest.

Asset

Est. Reward Rate

Ethereum

ETH

Solana

SOL

Cardano

ADA

Polkadot

DOT

Cosmos

ATOM

Tezos

XTZ

TRON

TRX

Avalanche

AVAX

Perhaps the most value that Coinbase gives as one of the best platforms for yield farming beginners is the educational resources available. Not only do they have entire courses on how to earn and yield farm from crypto, but accomplishing some of these resources lets you avail of free cryptocurrencies.

Pros:

- Beginner friendly platform

- Several popular coins available for yield

- User-friendly mobile app available

- Easy to deposit and access profile

Cons:

- Limited number of yieldable crypto

- Below average returns

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Best Yield Farming Crypto Platforms - Rates Comparison

If you want to better compare the different yield farming platforms, we’ve formulated a table below showing each platforms’ cryptocurrencies for earning as well as the maximum yield you can earn.

Platform Cryptocurrencies for Yield Farming Maximum Yield AQRU USDT, DAI, USDC, ETH, BTC 12.0% APY for USDT, USDC, and DAI Crypto.com CRO, USDT, USDC, TUSD, DAI, BUSD, HUSD, BTC, EURS, ETH, LINK, UNI, COMP, MKR, SUSHI, YFI, SNX, OMG, PAXG, DOGE, LTC, XRP, XLM, ZRX, BNT, BNB, ADA, DASH, TRX, EOS, BCH, AAVE, DOT, HT, XTZ, BAT, USDP, REP, AVAX, BTT, 1INCH, FTT, NEAR, ZIL, FIL, ATOM, SRM, FTM, LUNA 14.5% APY for 3-month fixed USDT, USDC, and more BlockFi BTC, LTC, ETH, LINK, USDC, GUSD, PAX, PAXG, UDST, BUSD, DAI, UNI, BAT 11% APY for MATIC Coinbase ETH, DAI, XTZ, ATOM, USDC, ALGO 5% APY for ATOM Is Yield Farming Crypto Profitable?

Although a very new form of earning passively, crypto yield farming has helped many crypto investors earn passively. However, there are certain risks involved in terms of regulations and crypto volatility. It’s at the discretion of each individual investor to identify if the rewards are worth the current risks when it comes to finding the best yield farming platforms and methods.

What Cryptos Can You Yield Farm?

There’s virtually no limit when it comes to what crypto assets can be used to yield farm since any crypto asset can be borrowed to earn interest. Ideally, the best yield farming platforms crypto offers popular coins that many know and understand.

Before yield farming yourself, it’s best to understand the cryptocurrencies that you’ll be using to earn. This is especially true for non-stablecoin cryptos that can vary in price. Crypto volatility can be a major factor in your yield farming earnings.

Crypto Yield Farming Taxes?

US citizens that are subject to US tax reporting must report their earnings from crypto staking rewards and other earnings like interest and yield from cryptocurrencies.

Particularly for US clients who earn over $600 per calendar year will need to fill up a 1099-MISC Miscellaneous Income form for the IRS. Some of the top yield farming platforms like Coinbase usually offer this form and more about these tax requirements can be found on the official IRS website.

To offer clarification regarding airdrops, hard forks, and mining, the IRS issued Notice 2014-21 and Rev. Rul. 2019-24, determining that any new cryptocurrency units received by the taxpayer are classified as taxable income. While there is no official tax guidance specifically addressing yield farming income, it is typically treated similarly to mining income in terms of taxation.

Crypto Yield Farming vs Staking

As mentioned earlier, staking is a form of crypto yield farming. It only works for cryptocurrencies that run under the Proof-of-Stake (PoS) consensus mechanism and requires you to lock the crypto that you stake in order to validate certain transactions on respective blockchains.

Where crypto yield farming usually involves borrowing and lending, staking gives more mining power when it comes to blockchain aspects. However, both methods are rewarded with cryptocurrency in the end.

Is Crypto Yield Farming Safe?

Many top yield farming platforms are still new products and have not been tried and tested in the long run. Some platforms do offer certain safety measures like insurance and security, but as crypto yield farming remains a novel income-generating activity, quite a few risks remain.

Little to No Regulations

Presently, there exist no distinct tax regulations pertaining to yield farming. Nonetheless, any cryptocurrency earned through yield farming, in the form of rewards, is classified as income and necessitates reporting for income tax purposes.

Should you decide to sell the rewarded asset at a profit or exchange it for another cryptocurrency, it becomes subject to capital gains tax as a crypto-to-crypto transaction. Staying updated on tax laws and seeking advice from a tax consultant is essential in this regard.

Impermanent Loss

Impermanent loss is one of the other risks of losing money for providing liquidity in yield farming. Basically, impermanent loss is the opportunity cost of what you lose when you provide liquidity for different platforms. Although you are earning fees, you may lose out on potential profits when coins appreciate in value.

If you invest, you will earn the fees, but may lose out on potential profits from coins appreciating in value. If you HODL, you get complete exposure to the coins increasing in value, but you do not earn any extra incentives.

Conclusion

Ultimately, the rewards of yield farming are very enticing as they offer many more returns as compared to usually interest paid from traditional bank savings accounts. Choosing the right yield farming platform for you can give you an edge especially as you plan on starting early.

If you want to start yield farming today, we recommend AQRU, one of the best yield farming platforms available. Start earning 12% APY on stablecoins and 7% APY on BTC and ETH with no hidden fees – all through AQRU’s great mobile app!

AQRU - Best Yield Farming Crypto Platforms Platform

The price or value of cryptocurrencies can rapidly increase or decrease at any time. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk.

FAQs

What is crypto yield farming?

Yield farming is figuring out where to put your cryptocurrencies to see the highest returns usually in a passive manner. Providing liquidity, lending and borrowing crypto, staking crypto, and holding coins with a redistribution fee are all forms of yield farming.Is crypto yield farming worth it?

Although a very new form of earning passively, crypto yield farming has helped many crypto investors earn passively. However, there are certain risks involved in terms of regulations and crypto volatility. It’s in the discretion of each individual investor to identify if the rewards are worth the current risks in yield farming.What is the best crypto yield farming platform?

Our overall best crypto yield farming platform is AQRU. Aside from being very easy to use, AQRU offers the most popular stablecoins and cryptocurrencies for yield farming.How do you earn yield on crypto?

There are different ways of earning yield from crypto. You can stake coins for rewards, provide liquidity and earn yield, and even lend your cryptocurrencies and earn interest.What is the best crypto for yield farming?

Yield farming is another kind of investment strategy that is more passive. Therefore, the best yield farming cryptocurrency will depend on your time horizon, risk tolerance, and other financial circumstances. Stablecoins are usually great for earning yield since the value is pegged to an underlying fiat currency.References:

- https://www.bitcoin.com/get-started/what-is-yield-farming/

- https://www.financemagnates.com/cryptocurrency/education-centre/everything-you-need-to-know-about-crypto-yield-farming/

- https://yourcryptolibrary.com/defi/what-is-apy-apr-in-defi/

- https://thedefiant.io/what-is-yield-farming

- https://koinly.io/blog/how-is-yield-farming-taxed/

Jose Rafael Aquino Finance Wriiter

View all posts by Jose Rafael AquinoJose Rafael Aquino is a seasoned writer who specializes in the Finance and Tech industries. Jose is passionate about education and uses his writing skills to create informative content that improves the reader's understanding of complex industries.

Before he started working as a writer, Jose studied at the Ateneo de Manila University where he was awarded a Bachelor of Science in Information technology Entrepreneurship. After graduating, Jose founded AKADS PH - a tech startup that allows parents to book tutors for students. Aquino has a strong understanding of the tech industry which extends to blockchain and web3 technologies.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up