11 Best Crypto to Buy Now in July 2025

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Keeping up with the cryptocurrency markets is no easy feat with hundreds of new tokens landing on the market every week. This can make it difficult to stay on top of which coins are worth investing in and have potential. The cryptocurrency market is volatile which means that top tokens change regularly.

To help you navigate the market and find the best tokens to buy, our team of experts have spent time reviewing new crypto projects. We looked for tokens that show long-term potential, have strong utility and are currently undervalued.

In this guide, we will take a closer look at the best cryptos to buy right now. We will also discuss how to invest in the best cryptos so that you can start building your portfolio today.

-

-

- Earn passive rewards through gamified staking

- The sustainable version of Bitcoin built on Ethereum

- Invest at a discounted price during the presale event to maximize returns

Project LaunchedFebruary 2024Purchase Methods- ETH

- USDT

- The latest AI based crypto project that will transform the security of the blockchain space

- Early presale investors will receive guaranteed returns

- Stake SCOTTY to receive passive rewards

Project LaunchedFebruary 2024Purchase Methods- ETH

- USDT

- Debit

- Buy and hold to take part in the biggest Solana airdrop event

- The next meme coin to explode

- SMOG is set to be the biggest Solana token in 2024

Project LaunchedFebruary 2024Purchase Methods- USDT

- Solana

- $SPONGEV2 tokens can only be obtained by staking $SPONGE

- Stake your Sponge V1 tokens to recieve a V2 token bonus

- Earn more crypto with the SPONGE P2E game

Project LaunchedDecember 2023Purchase Methods- ETH

- USDT

- Debit

- Invest in the newest sustainable cryptocurrency

- $TUK tokens can be staked for passive rewards

- The eTukTuk project helps to develop sustainable initiatives for a greener future

Project LaunchedJanuary 2024Purchase Methods- BNB

- USDT

- Debit

- Revolutionizes Bitcoin mining with an innovative stake-to-mine model

- Allows all crypto investors to earn passive BTC rewards

- A transparent and fair Bitcoin mining system that is accessible to anyone

Project LaunchedSeptember 2023Purchase Methods- ETH

- BNB

- USDT

- Matic

- Debit

- +2 more

11 Best Crypto to Buy Right Now

Before we take a closer look at the best digital currency to invest in right now, here is a list of the tokens to consider for your crypto portfolio. Remember, the crypto market is volatile and prices can change quickly. We aim to keep this list updated but it is always a good idea to conduct your own research into the projects that are mentioned.

- Green Bitcoin (GBTC): The groundbreaking crypto project merging the allure of Bitcoin with Ethereum’s eco-conscious technology. Dive into its unique “Gamified Green Staking” system, empowering users to earn rewards while contributing to a greener future.

- Scotty The AI (SCOTTY): New AI crypto project that will provide innovative security solutions to blockchain technology. Scotty The AI is the newest meme token with strong utility.

- Smog Token (SMOG): The newest meme coin making waves on the Solana blockchain. With an exciting airdrop campaign on the horizon, Smog aims to shake up the meme coin world and make a splash in the Solana community.

- Sponge V2 (SPONGEV2): The second version of Sponge token that brings utility to the ecosystem. Sponge is a popular meme coin that saw huge gains after the recent presale. The V2 token provides investors with a second chance to take advantage of a price pump.

- eTukTuk ($TUK): Green cryptocurrency is striving to transform the landscape of transportation Utilizing blockchain technology, its goal is to develop sustainable transport solutions with the additional aim of lessening the global economic disparity.

- Bitcoin Minetrix (BTCMTX): Bitcoin Minetrix rewards investors with cloud mining credits that can be used to mine BTC and earn passive income. The project is currently holding a presale in which it is possible to buy BTCMTX for just $0.0112. You can buy BTCMTX with USDT, ETH or card.

- Bitcoin (BTC): Crypto’s ‘gold’ that is expected to rise in value after the upcoming BTC halving. Bitcoin is currently considered to be undervalued which makes now a good time to buy.

- Ethereum (ETH): The most widely-used blockchain network and utility token. ETH provides access to the wider defi space and tends to perform well in the bull market. Ethereum provides popular crypto projects with smart contract functionality.

- Bitcoin Cash (BCH): A peer-to-peer crypto payment system that aims to make defi payments more accessible. Bitcoin Cash offers fast transactions, low fees, and anonymity. BCH was created as an alternative to BTC that can be used on a wider scale.

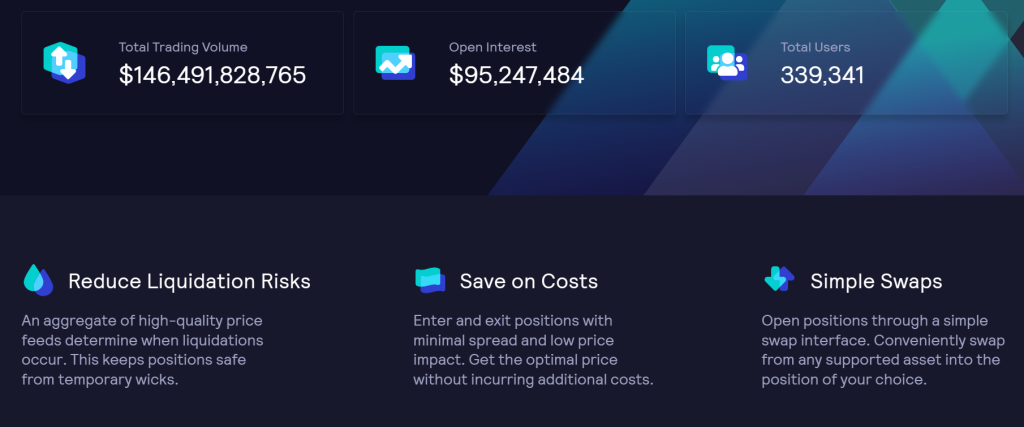

- GMX (GMX): A low-fee decentralized exchange with a native utility token. The token can be used for governance and for unlocking exclusive platform features. GMX supports zero-price impact trades and rewards liquidity providers with tokens.

- Cosmos (ATOM): A blockchain network that enables interoperability. Anyone can build on the network using industry-leading services and resources. COSMOS is a utility token that powers the ecosystem.

The price or value of cryptocurrencies can rapidly increase or decrease at any time. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk.

How to Find The Best Cryptos to Invest in

The best crypto assets to buy list changes regularly depending on market conditions. Therefore, it is good to have an understanding of how to spot the best crypto investment opportunities for yourself. Here’s how to find the best crypto to invest in July 2025.

✔️ Marketing and community

You can tell a lot about the potential of a crypto coin by the way that it is spoken about (or not) in the media. Marketing and community play a huge role in whether or not a new crypto project will take off.

If a crypto has a strong community of supporters and an effective marketing campaign, it has a good chance of attracting investors. On the other hand, crypto coins that are unheard of with small communities, may struggle to gain traction in the market.

The importance of marketing and community is particularly true for meme coins, which rely on clever marketing efforts and community support to gain value. If you have to search deep into the realms of Reddit or Twitter to find any evidence of a new crypto marketing campaign or community, this is a sign that the project might struggle to attract enough investors to generate returns.

Some of the best crypto projects, such as Bitcoin ETF and Meme Kombat have huge online communities and have been featured in some of the most prominent crypto news publications. Coins that are trending attract more investors so have a better chance of becoming profitable.

✔️ Utility

Another key feature of the best cryptocurrencies is utility. This refers to whether or not the token has any relevant use cases, other than being an investment opportunity. If a crypto has utility, investors are more likely to hold it long-term so that they can use the crypto to access defi apps and other offerings. Alternatively, cryptos that lack utility are often sold as soon as a pump occurs – investors buy these coins for quick gains rather than long-term potential.

From our best crypto to buy right now list, Green Bitcoin and Scotty The AI are all examples of tokens that have utility. Green Bitcoin, for example, will be used to support blockchain security. The token will also provide investors with access to the Scotty AI companion.

✔️ Deflationary supply

The cryptocurrency market works just like the traditional stock market. When there is high demand and low supply, the price of a coin will go up. When there is low demand and high supply, the price will go down. Therefore, the best cryptos to buy in 2025 have a deflationary supply, which means that the number of tokens in circulation will decrease over time.

The most common method of removing tokens from circulation is called burning. This involves moving tokens to an anonymous wallet address that no one has access to. Another way that some projects decrease the supply overtime is by locking up tokens in staking pools. For example, Meme Kombat encourages holders to stake their tokens for interest. When tokens are staked, they cannot be sold or swapped. The more investors stake, the more $MK will grow.

✔️ Clear roadmap

Another way to tell whether or not a coin has best crypto potential is to look at the project roadmap. The top cryptocurrencies to buy have a clear roadmap with growth strategies and room for development. If a new crypto project does not have a roadmap, this could be a sign that the token will disappear after the ICO.

The price or value of cryptocurrencies can rapidly increase or decrease at any time. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk.

Top Cryptos to Buy in 2025 – Our in-depth Reviews

Below is an overview of the best crypto to buy in July 2025. Read each mini review and conduct your own research before making any investment decisions.

1. Green Bitcoin – The groundbreaking crypto project merging the allure of Bitcoin with Ethereum’s eco-conscious technology

Green Bitcoin (GBTC) is a novel cryptocurrency project that combines the appeal of Bitcoin with Ethereum’s environmentally conscious approach. Unlike traditional Bitcoin mining, which relies on energy-intensive Proof of Work (PoW), Green Bitcoin utilizes a more eco-friendly Proof of Stake (PoS) asset class, significantly reducing its environmental footprint. This innovative approach reflects growing market trends towards sustainability and responsible energy consumption.

One of the standout features of Green Bitcoin is its “Gamified Green Staking” system, which offers investors a sustainable way to earn passive income. Through staking their tokens and predicting Bitcoin price movements, users can earn rewards in a dynamic and engaging environment. This incentivizes long-term investment and active participation within the Green Bitcoin community, fostering a sense of ownership and commitment among token holders.

The Green Bitcoin presale presents an opportunity for early investors to acquire $GBTC tokens before they are listed on exchanges. With a total token supply of 21 million tokens, the distribution includes allocations for staking rewards, marketing, liquidity, and community engagement. This strategic allocation aims to support the project’s long-term growth and sustainability, ensuring a robust ecosystem for $GBTC.

Investing in Green Bitcoin during the presale phase not only offers the potential for financial gains but also aligns with eco-friendly values. By supporting a project that prioritizes environmental sustainability, investors contribute to a more responsible and sustainable future in the crypto industry. Additionally, the presale phase allows investors to capitalize on the project’s unique features and growth potential, setting a solid foundation for its future success.

The price or value of cryptocurrencies can rapidly increase or decrease at any time. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk.

2. Scotty The AI (SCOTTY) – The best crypto project for investing in AI technology

Scotty The AI is a new crypto project that will harness the power of AI to provide security solutions for blockchain technology. SCOTTY is a meme token with utility that aims to become the next crypto project to explode. Like most meme projects, Scotty The AI will use viral marketing and community support to attract investors and reach its ambitious targets.

Scotty The AI is a cartoon Scottish Terrier that possesses incredible AI powers. The dog can scan complex code to spot patterns and detect fraud in the crypto realm. Scotty will use these powers to protect the crypto space and provide much-needed transparency. The team behind the project hopes to make Scotty a recognizable symbol of security in the blockchain space.

As well as providing AI-driven security solutions, Scotty The AI will act as an artificial intelligence companion for crypto enthusiasts who invest in SCOTTY. The chatbot will be able to provide investors with real-time market insight to help them better understand the crypto market and make informed trading decisions.

The Scotty token is an ERC20 governance token that can currently be bought at a discount during the ongoing Scotty The AI presale. The presale will be held in stages and the price of SCOTTY will go up at each stage. Therefore, it is wise to invest as early as possible.

The price or value of cryptocurrencies can rapidly increase or decrease at any time. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk.

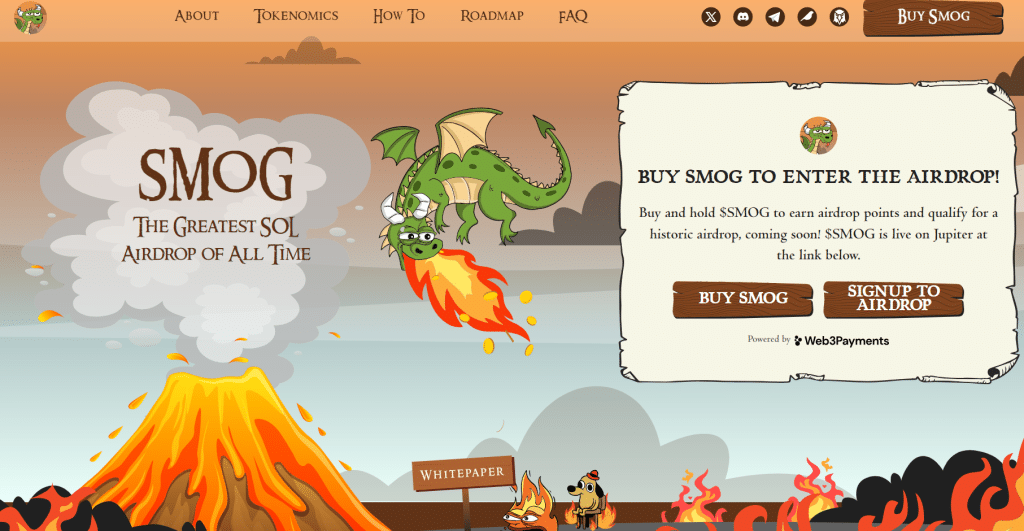

3. Smog Token – The newest meme coin making waves on the Solana blockchain

With an exciting airdrop campaign on the horizon, Smog aims to shake up the meme coin world and make a splash in the Solana community.

The $SMOG token brings holders into an exclusive crypto community called “The Dragon’s Court.” This community is set to spark massive growth in meme coins through interactive airdrop campaigns.

While the details of these campaigns are still under wraps, investors are encouraged to hold onto $SMOG tokens to earn airdrop points. Plus, there’s a community bounty program that doubles the incentives for participants.

Taking a closer look at Smog’s tokenomics, it’s clear the team is serious about driving excitement around the airdrop campaign. Fifty percent of the token supply is dedicated to marketing, signaling big plans ahead.

Another 35% is set aside for future airdrop rewards, promising enticing prizes for those involved. These strategic allocations, combined with a decrease in circulating supply, give Smog Token a strong start compared to other Solana meme coins like BONK.

Looking ahead, Smog Token has an exciting roadmap lined up. Features like staking hint at future airdrop strategies, while discussions around burning tokens and multiple airdrop launches add to the intrigue. The project’s goal of reaching 10,000+ “Loyal Chosen” members promises even more rewards for engaged community members.

The price or value of cryptocurrencies can rapidly increase or decrease at any time. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk.

4. Sponge V2 – The best crypto to invest in if you’re looking to diversify with meme coins

SPONGEV2 is an extension of the successful SPONGE token which exploded after presale in the summer of 2023. The new token has been created to take advantage of the upcoming bull market and provide investors who missed the previous bull run a chance to see returns.

Furthermore, the V2 token will bring utility to the ecosystem. SPONGEV2 will provide access to an exclusive P2E game which is currently being developed by the project team. Investors can also stake their tokens for passive rewards over time.

Sponge V2 is not a traditional crypto presale. Instead, the token can only be acquired by investing in SPONGEV1 and staking your tokens through the official website. By staking Sponge V1, you will receive Sponge V2 as a reward. The amount of V2 tokens that you receive will be equivalent to the amount of V1 tokens that you stake.

The main appeal of SPONGEV2 is the possibility of a second pump. The price of SPONGEV1 saw a huge increase after the completion of it’s presale and the team behind the project believe that they can replicate this by encouraging investors to stake their tokens for V2.

The value of SPONGEV2 will eventually be launched on tier 1 exchanges. The price is expected to go up at this stage as the token becomes more accessible. Therefore, investing early is the best way to take advantage of future gains.

The price or value of cryptocurrencies can rapidly increase or decrease at any time. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk.

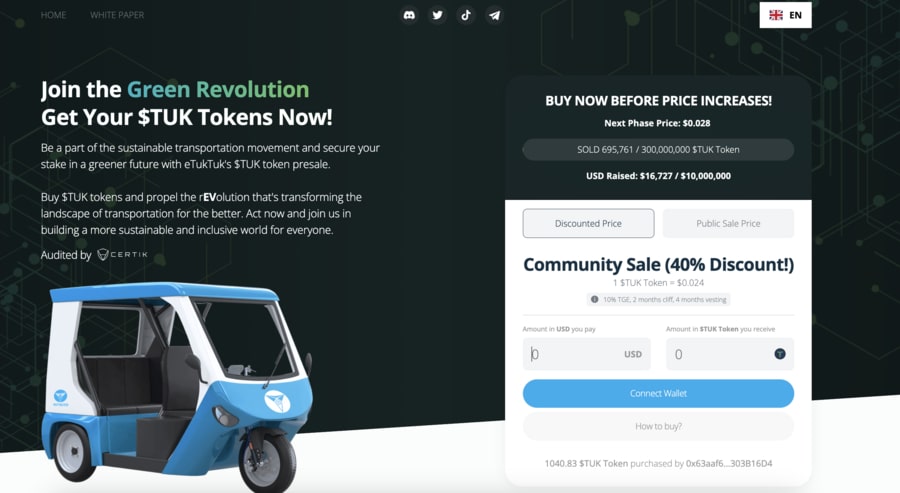

5. eTukTuk ($TUK) – Green cryptocurrency is striving to transform the landscape of transportation

eTukTuk is spearheading a sustainable journey driven by its innovative $TUK token, and investors are increasingly optimistic about its potential, indicating a potential 50x growth at the current price. With over $135,000 raised in its presale, the project demonstrates a building momentum behind its sustainability initiative.

The primary goal of eTukTuk is to introduce affordable electric vehicle (EV) solutions to developing nations, addressing the challenge of rising carbon emissions and air pollution. The project aims to revolutionize transportation in these regions with a focus on safety, affordability, and environmental impact.

The $TUK token plays a pivotal role in eTukTuk’s sustainability project, serving as the backbone of the entire ecosystem. Currently in presale, the token has garnered considerable interest from investors looking to position themselves in this transformative initiative. With carefully designed tokenomics, $TUK aims to incentivize long-term holders, rewarding them as the efficient charging network expands.

eTukTuk is setting new standards in the EV sector by prioritizing safety, reliability, and local manufacturing. Positioned as one of the early movers in the two and three-wheeler EV sector, eTukTuk aims to become a market leader by 2030.

As the presale progresses, the $TUK token is currently available at $0.024, but with an impending price increase in the next three days, early adoption becomes critical for investors looking to capitalize on the project’s potential 50x growth.

With an already operational EV solution and a clear blueprint for expansion, eTukTuk presents a compelling opportunity for those seeking passive revenue and substantial token value growth in the realm of sustainable transportation.

The price or value of cryptocurrencies can rapidly increase or decrease at any time. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk.

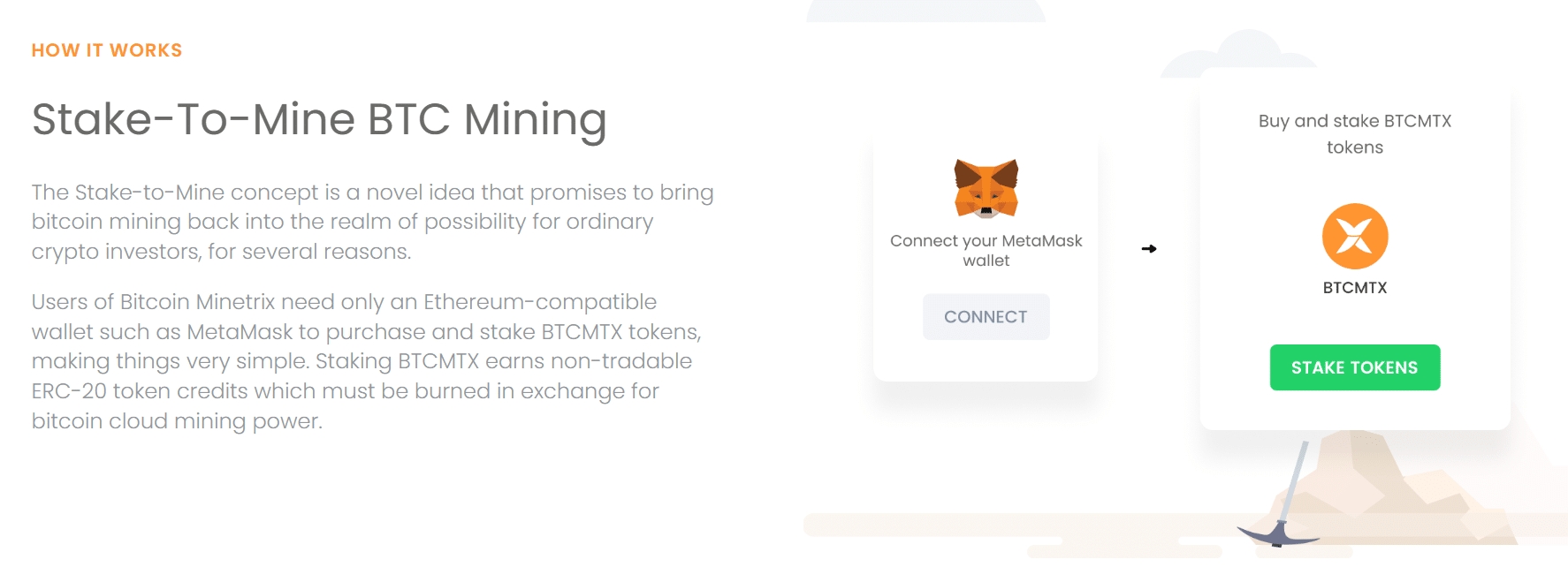

6. Bitcoin Minetrix – The best Bitcoin derivate to buy in 2025 before halving

Bitcoin mining has long been considered to be one of the most lucrative ways to earn money from crypto. However, traditional mining isn’t accessible to everyone due to the amount of computational power that it takes to mine BTC tokens. This is where Bitcoin Minetrix comes in. The new crypto project with allow anyone to earn mining rewards via cloud mining – the process of mining tokens by purchasing a stake in third-party operations.

Bitcoin Minetrix will reward users with cloud mining credits, that can be used to take part in cloud mining operations. To earn credits, users must stake $BTCMTX tokens. The process is pretty simple but very rewarding

Cloud mining isn’t new however, Bitcoin Minetrix solves many of the problems that persist in the cloud mining space such as third party cloud mining scams. Bitcoin Minetrix is an entirely decentralized platform that is built on the Ethereum blockchain, control will be given to token holders.

As well as earning rewards through staking and mining, there is a good chance that the value of BTCMTX will go up after the ongoing presale. Therefore, now is the best time to invest in Bitcoin Minetrix and start staking your tokens for passive income.

The presale event has already managed to raise almost $3 million in just a few weeks. This momentum suggests positive investor sentiment which is a sign that the project could be successful after presale. However, the success of Bitcoin Minetrix is not guaranteed and new cryptos are known for volatility.

The price or value of cryptocurrencies can rapidly increase or decrease at any time. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk.

7. Bitcoin – The world’s largest crypto by market cap that has bullish predictions for the end of 2025

Bitcoin is the largest crypto asset by market cap that has experienced a turbulent few years. At the time of writing, Bitcoin’s price sits at around $60,000 which means that it has managed to bounce back to its all-time high. However, many experts believe that the token is undervalued and could experience a new all-time-high of $100k very soon.

Of course, it is important to take these predictions lightly as there are many other analysts who do not believe that Bitcoin will reach this goal.

Never the less. Bitcoin stands as one of the top cryptos to buy in 2025. This is partly due to the fact that the cryptocurrency can be used as a hedge against inflation. Bitcoin is often referred to as ‘digital gold’ because its price stands against fiat currency inflation, which is known for decreasing wealth overtime.

Due to the fact that it runs on a decentralized network, Bitcoin does not experience inflation in the same way that fiat currency does. However, inflation can still effect the price of the token so it is wise to keep on top of market conditions if you choose to invest.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

8. Ethereum – The native utility token of the biggest blockchain network

Ethereum (ETH) is another popular cryptocurrency to invest in 2025. ETH is the native utility token of the Ethereum blockchain network that is used to facilitate transactions, access dApps, and power smart contracts. ETH has a lot of use cases which makes it a strong long term cryptocurrency to invest in.

Ethereum is the second-largest crypto by market cap that could perform well during the new bull market. Ethereum was created as a sustainable alternative to Bitcoin that offers faster transactions, lower fees and a more environmentally-friendly blockchain technology. This makes it it an appealing investment opportunity for investors who want to diversify with a strong Bitcoin competitor.

The Ethereum network recently underwent an upgrade (Ethereum 2.0) that increased transaction speeds and enhanced scalability. However, this does not guarantee any upward price movement and ETH is a volatile investment even in the new bull market.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

9. Bitcoin Cash – Bitcoin derivative that offers fast and easy payments

Bitcoin Cash was created in 2017 as an alternative to Bitcoin. The project is a peer-to-peer payments system that allows individuals to send and receive money quickly, with no third-party intervention. Traditional Bitcoin payments require a lot of power to complete which is a barrier to wider adoption. Bitcoin Cash offers a solution that could pave the way for the future of crypto payments.

Bitcoin Cash is a promising token to buy now because it has strong fundamentals, great usability and a high market cap. Some analysts believe that the token could reach $574 by the end of 2025, which would provide a return of 174%.

Furthermore, Bitcoin Cash has managed to hold its value even during the bear market. This is largely due to its use cases which ensure that the coin always has demand from traders. As a fork of the original Bitcoin, BCH has a total supply of 21 million tokens that will be issued over 120 years. The rate of issuance will slowly decline every four years to place upwards price pressure on the asset.

In 2023, over 90% of BCH tokens have been mined. It is worth noting here that BCH uses power-heavy PoW mining to approve transactions and mine new tokens. This method of mining is less efficient than the PoS mechanism that is used by ETH and other altcoins. Therefore, BCH may struggle with scalability as the crypto industry evolves.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

10. GMX – A decentralized perpetual exchange with a native utility token

GMX is a perpetual decentralized exchange that offers low fees, fast transactions and leverage trading. The exchange has over 300k users and a trading volume of over $146 million at the time of writing. The DEX is supported by its native governance token, $GMX. This token can be used for governance and staking. Stakers receive rewards in $GMX, ETH, AVAX or multiplier points.

The GMX token is an inflationary asset. The number of tokens in circulation will vary depending on how many coins are vested. The predicted maximum supply stands at 13.2 million and minting over this will only occur if there is a strong need for it. Although it is not a deflationary token, coins are taken out of supply when they are vested or staked. Therefore, the more investors who lock up the tokens, the lower the circulating supply will be.

GMX is a strong token to consider in 2025. However, the token is prone to volatility and there is no guarantee that it will provide any returns.

11. Cosmos – An ‘internet blockchain’ network that provides interoperability

Cosmos is an internet blockchain network that makes it possible for anyone to build web3 systems on the chain. The network is designed to scale and interoperate which should support expansion and adoption. The network is supported by the ATOM utility token which is used to pay fees and prevent fraudulent transactions.

As well as supporting the network, ATOM can be used for crypto staking. Stakers provide security to the blockchain and are rewarded with regular payouts. The %APR of staking rewards is variable but is considered to eb quite competitive.

The Cosmos blockchain network could play a big role is the mass adoption of blockchain technology. Therefore, ATOM is considered to be a good long term crypto investment in 2025. Analysts believe that ATOM could reach a price of $20 by 2025, which would be a 225% increase from the current price. However, to see these returns, ATOM must be staked by investors to decrease the circulating supply. There is no guarantee that the value of the token will go up.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Conclusion

Right now, the best cryptocurrency to buy is Green Bitcoin. Green Bitcoin stands out as one of the most promising presales to consider due to its innovative approach to cryptocurrency investment. By combining elements of Bitcoin with Ethereum’s blockchain technology, Green Bitcoin offers investors a unique opportunity to participate in sustainable crypto projects while potentially reaping rewards akin to those of Bitcoin.

Other top cryptos to buy now include Bitcoin Minetrix, Meme Kombat, eTukTuk, and Smog Token. Investing in a basket of new crypto tokens could be one way to minimize the risks that are associated with investing in cryptocurrencies.

Before investing in any cryptocurrencies, make sure to conduct research and analysis. There is no guarantee that you will make money by investing in the best cryptos.

Your money is at risk.

FAQs

What is the best crypto to buy right now?

Given the upcoming Bitcoin halving event, Green Bitcoin stands out as one of the best cryptos to buy now. This new Bitcoin derivative provides investors with a sustainable alternative to Bitcoin investing and offers passive rewards which is appealing to long-term investors.

What crypto has the most potential?

The Scotty AI token presale is selling quickly which suggests that sentiment around this token is positive. Therefore, SCOTTY could be considered to have the most potential out of the tokens on our list. Bitcoin and Ethereum are also in the running for this position as both tokens are predicted to do very well in the upcoming bull run.

Do I need a crypto wallet to buy cryptos?

No, you do not need a crypto wallet if you choose to buy cryptocurrencies through CFD platforms. However, buying actual cryptocurrencies through a wallet means that you will be able to transfer cryptocurrencies between platforms

Should I invest in crypto right now?

You could invest in crypto right now if you are looking for a way to diversify your investment portfolio and have money that you can afford to lose. Cryptocurrency is a risky investment and is not suitable for people who are using money that they may need for important expenses.

How much money do I need to buy a Bitcoin?

The amount of money you need to need to buy Bitcoins will depend on the minimum balance requirements associated with your platform, however, in general, it can be as low as $1.

Which crypto has 1000x potential?

Smog coin is a cryptocurrency with 1000x potential. The project aims to replicate the success of meme tokens such as BONK and PePe coin.

Which crypto has the most potential?

Green Bitcoin has the most potential because it introduces a novel concept: gamification.

Which crypto is the next Bitcoin?

Green Bitcoin is the next Bitcoin as it emerges as a distinct cryptocurrency, representing a novel iteration of Bitcoin within the Ethereum blockchain ecosystem.

Nishit Kumar Finance Writer and Analyst

View all posts by Nishit KumarNishit is a NGL Trader Analyst at Akari Trading. He has also worked as an analyst for Morgan Stanley and Onyx Commodities.

Before starting his career in finance, Nishit studied at the University of Warick where he was an active member of the Hedge Fund society. Due to his qualifications and experience, Nishit is considered an industry expert and enjoys writing content that could help traders to make informed decisions.

As well as writing, Nishit worked as Associate Editor for The Economic Transcript until 2021. He has also written for Newsweek and has good knowledge of current events that could affect the financial markets.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up