5 Best Offshore Brokers in June

Offshore trading is an investment strategy that allows investors to diversify their portfolios with overseas assets. This type of investing also comes with tax benefits which makes it a popular option amongst investors who are looking to decrease payable capital gains tax. To start trading international markets and diversify with offshore investments, investors must open an account with an offshore broker.

Offshore stock brokers provide access to overseas securities that may be otherwise unavailable to investors. There are numerous offshore brokerage accounts available which can make it tricky to find the most suitable option for you. Some brokers are better suited to beginner’s who may be looking for educational resources while others cater to experienced offshore investors who might be interested in advanced charting tools for technical analysis.

In this guide, we will take a look at five potential offshore stock brokers for US citizens to decide whether or not they are worth considering in 2024.

-

-

5 Best Offshore Forex Brokers for US Clients in 2025

While there are several different offshore trading platforms that you can choose from for your trading needs, a list of the top 5 such platforms that you should consider has been given below.

- eToro: eToro provides access to over 2400 assets, including offshore stocks and shares. The platform is also one of the largest offshore brokers that provides copy trading, ready-made portfolios and a live feed. Users can access real-time market data, expert insight, and analysis to complete their own research. eToro is free to use and some stocks can be traded commission-free.

- Webull: Webull offers commission-free trading for a variety of assets. Users can also access advanced charting tools to conduct analysis as well as real-time data and market insights. Webull offers a user-friendly mobile app for trading on the go.

- Libertex: Libertex is a popular offshore trading app amongst experienced investors who want to use third-party charting tools to conduct analysis and integrate APIs. Libertex is compatible with MT4 and MT5. The platform supports high leverage trading and margin trading.

- AvaTrade: Trade offshore assets with high leverage and low fees. AvaTrade offers access to over 1250 assets from around the globe and traders can use MT4 to conduct analysis. AvaTrade is also available to use on mobile.

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

What Are Offshore Brokers?

An offshore broker is a type of investment platform that enables investors to buy securities from markets outside of their countries’ jurisdiction. These brokerage accounts are usually opened at an overseas bank to provide access to international financial markets.

Offshore brokers follow the same processes as most traditional brokers, providing users with the tools that they need to make informed investment decisions. The main difference is that offshore brokers are opened outside of your native country.

The main advantage of using an offshore broker is tax benefits. Many offshore brokerage accounts come with low or zero tax on capital gains, dividends and interest payments. However, the regulatory standing of offshore brokerages can be volatile and the accounts often come with high minimum investment requirements.

How do offshore brokers work?

To use an offshore broker, investors must register through a platform that is not located in their native jurisdiction. This is usually done online but can also be done over the phone or in person.

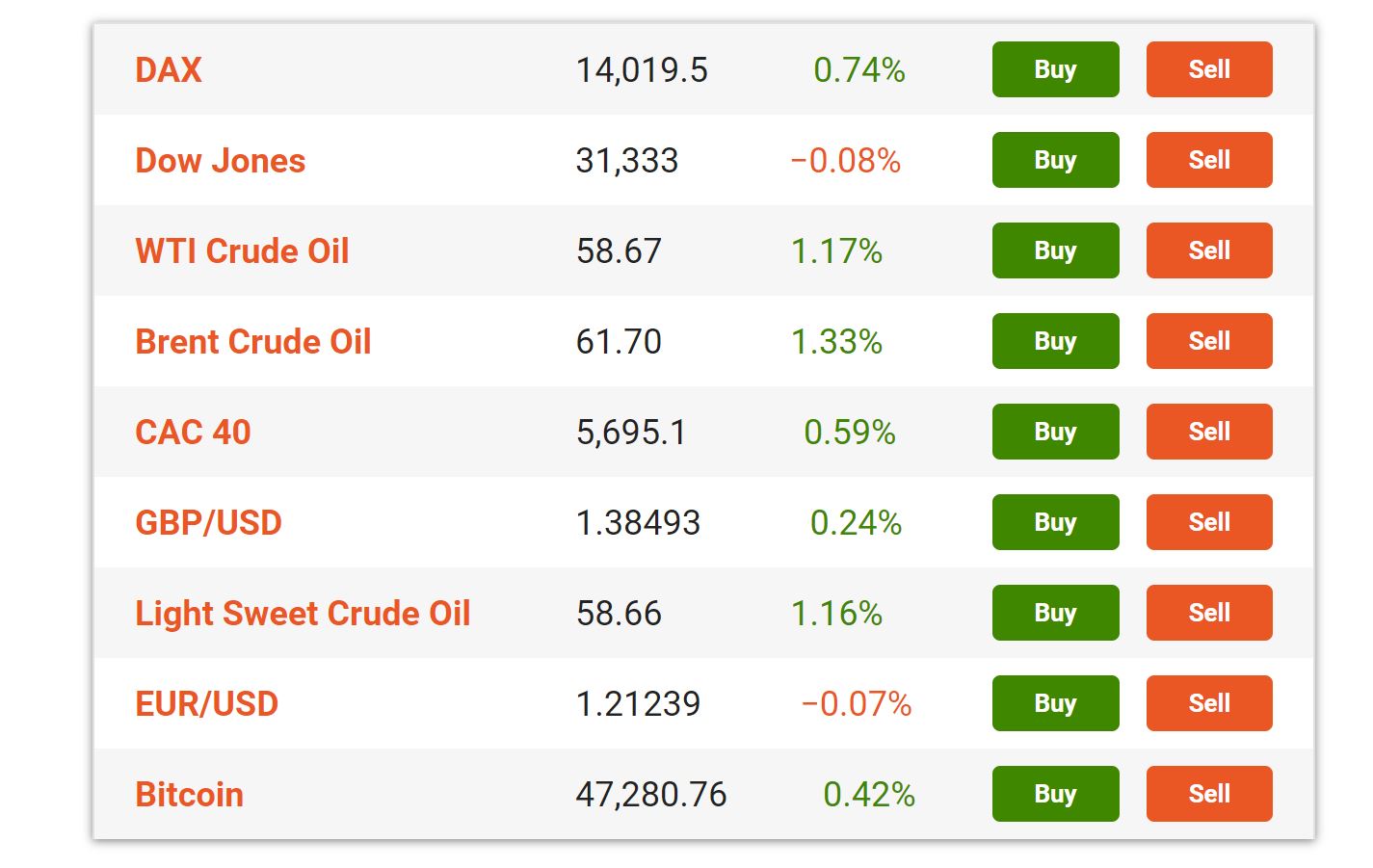

Once registered, investors will be able to place buy and sell orders for securities registered on international exchanges. Offshore platforms work very similarly to traditional trading platforms. Users can browse through the assets available, conduct analysis and determine the size of the trade that they would like to place.

Investors can keep track of their investments through portfolios within their brokerage account. When investing offshore, investors should be aware of different time zones that may affect market hours.

Best Offshore Forex Brokerages Ranked & Rated

A detailed review of the top 5 trading platforms that you should consider for all your offshore trading needs is below. This includes a discussion on the different asset classes, their fees, and the other factors that you must look into before deciding on an offshore trading platform or your needs.

1. eToro – Best offshore broker that accepts US clients; access global markets through a licensed provider.

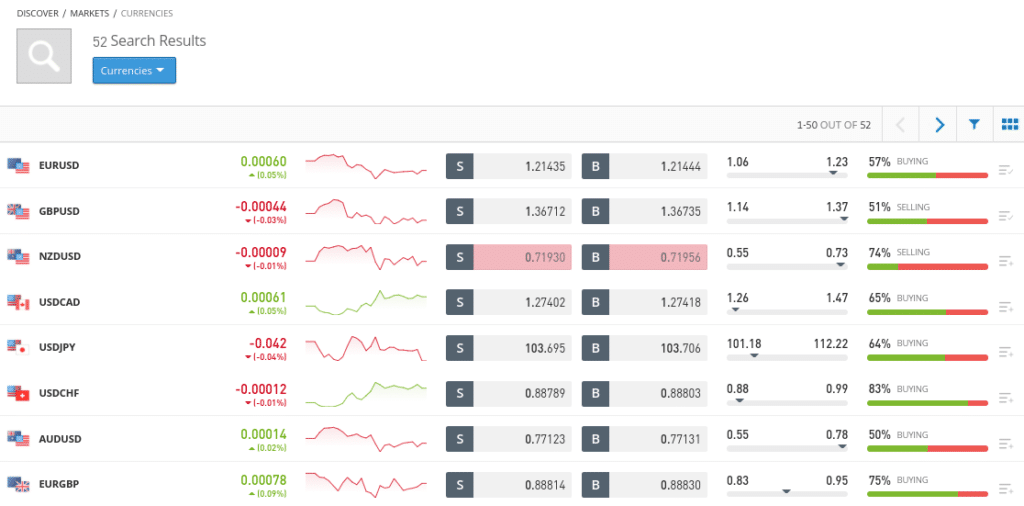

If you’re in search of a trading platform that is easy to use and provides convenience, then eToro is your best bet. As the largest and most popular social trading platform in the world, it allows you to trade over 2400 assets, which includes 45+ currency pairs, stocks, indices, cryptocurrencies, and commodities. One of the main advantages of eToro is that it offers CFD transactions without any extra fees, making it an attractive choice for active traders who frequently open and close positions.

In addition, eToro offers leverage for a variety of assets. For instance, they provide up to x30 leverage for most major currency pairs, x20 leverage for minor currencies, and x15 leverage for most major commodity pairs. With eToro’s web portal or mobile app, you can easily monitor your trading positions while on the move. Opening an account with eToro is a quick and straightforward process, and once you’ve done so, you’ll have access not only to a range of CopyPortfolios but also to a social trading network with over 17 million users. This allows you to follow the trades of more experienced and successful traders, including the best rapid traders.

Furthermore, eToro is heavily regulated and insured by various organizations around the world, which makes it a very reliable platform for trading financial assets. To get started, you need to open an account and make a minimum deposit of $20, after which you can start trading right away.

eToro fees

Fee Amount Stock trading fee Free Forex trading fee Spread, 2.1 pips for GBP/USD Crypto trading fee Spread, 0.75% for Bitcoin Inactivity fee $10 a month after one year Withdrawal fee $5 Pros:

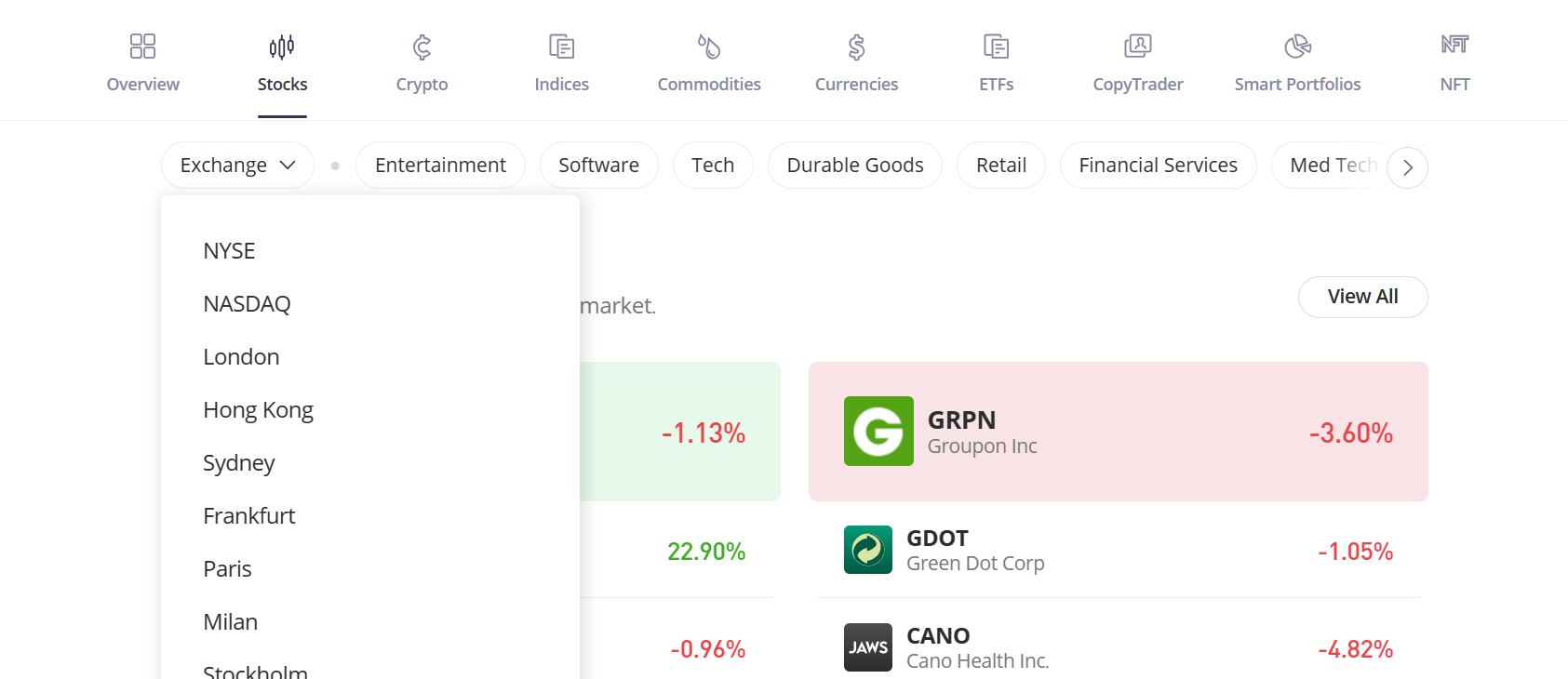

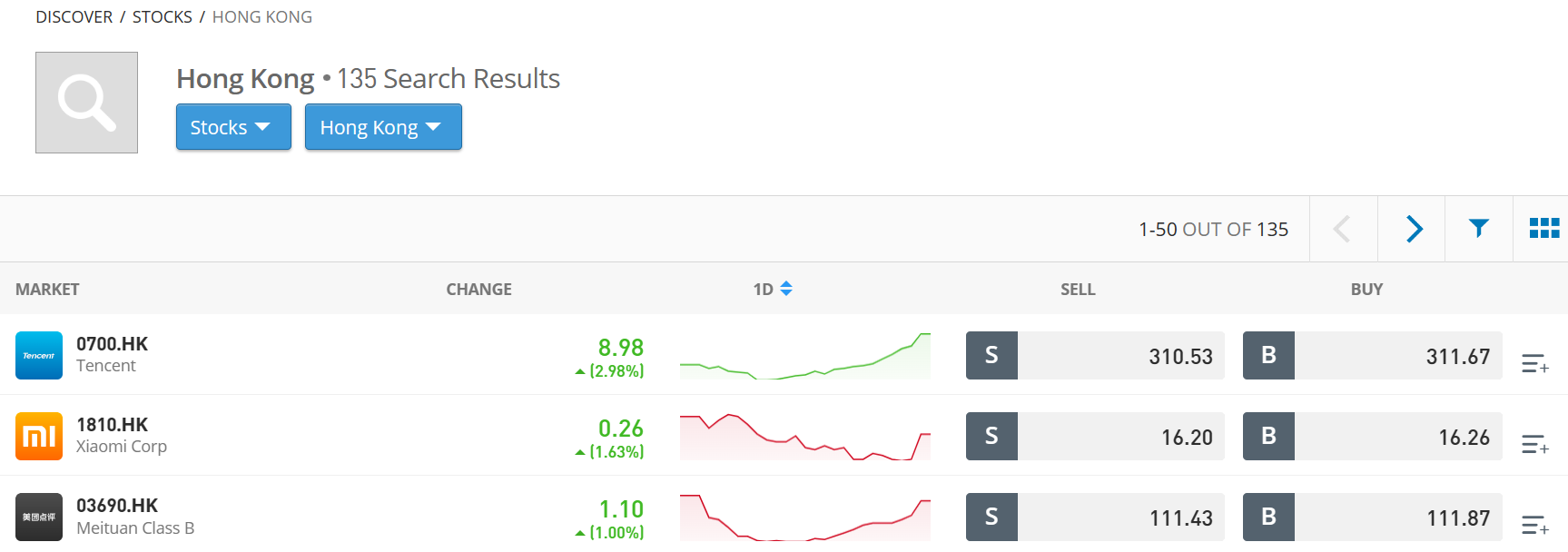

- Invest in assets from 19 different exchanges including the NASDAQ, London, Hong Kon, Sydney, Zurich and more.

- eToro offers a good range of different assets including stocks, ETFs, commodities and crypto assets

- The platform offers advanced social trading features.

- Regulated by the Financial Conduct Authority

Cons:

- eToro is not compatible with any third-party charting tools such as MT4.

- Withdrawals come with a $5 fee.

- The platform offers limited base currencies despite being available in 140 countries.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

2. Webull - Best offshore broker for day trading in the US

Webull is a trading platform that offers a variety of features for investors and traders, all without charging commissions. The platform can be accessed via a web-based platform or a mobile app, providing users with flexibility and convenience in managing their accounts and trading.

Webull's standout feature is its powerful charting and technical analysis tools. The platform offers a wide range of technical indicators and charting options, enabling traders to conduct in-depth analysis and make informed trading decisions. Moreover, the platform provides real-time market data and news feeds, keeping users informed of the latest market trends and developments.

Webull also offers a range of order types, including limit orders, market orders, and stop-loss orders, allowing traders to customize their trading strategies and manage their risk effectively. The platform supports trading in stocks, options, and ETFs, providing users with a range of investment opportunities. Regarding offshore investing, Webull provides access to securities from the US, China, the UK, Singapore, South Africa. Japan, and Australia.

The brokerage is also user-friendly, with a clean and intuitive interface that is easy to navigate. The mobile app is particularly impressive, providing all the features and tools available on the web-based platform in a compact and convenient format.

However, there are some limitations to the platform. Webull currently does not support trading in mutual funds or bonds, which may be a drawback for some investors. Additionally, the platform does not provide access to research reports or investment recommendations, which may be a disadvantage for beginner traders who rely on these resources for guidance.

Overall, Webull is a solid trading platform that offers a range of features and tools for investors and traders. Its charting and technical analysis tools are particularly impressive, and its commission-free model makes it an attractive option for those looking to minimize their trading costs. However, its limited investment options and lack of research resources may be a drawback for some users.

Pros:

- No commissions on US stocks

- Easy-to-use interface and mobile app for on-the-go trading

- Advanced charting tools

- Large range of assets available to trade from 7 different global markets.

Cons:

- Webull is not available to European traders

- Lack of educational materials for beginner investors

There is no guarantee that you will make money with this provider. Proceed at your own risk..

3. Libertex - A reputable offshore forex broker that is registered in St Vincent and the Grenadines

Libertex is a popular CFD brokerage that is known for providing market-leading forex trading services. However, it supports various asset types, such as stocks, commodities, and currencies. Libertex is compatible with the MT4 and MT5 platforms, offering the ability to trade over 51 currency pairs with leverage of up to 30x.

One of the platform's main advantages is its lack of spreads, allowing users to buy and sell items at the same price instantaneously. It's an ideal platform for active traders due to its low commission rate of just 0.006% per trade.

Libertex allows professional traders who meet their experience criteria to trade with leverages as high as 1000x on specific currency pairings, making it the highest leverage available in the market. The platform is compatible with both MT4 and MT5, but it also offers its own trading platform with various features, such as market sentiment research, a built-in news feed, and multiple customizable trading signal services.

Libertex fees

Fee Amount Stock trading fee Commission. 0.034% for Amazon. Forex trading fee Commission. 0.008% for GBP/USD. Crypto trading fee Commission. 1.23% for Bitcoin. Inactivity fee $5 a month after 180 days Withdrawal fee Free Pros:

- MetaTrader 4 and 5 are both available for technical analysis

- High leverage, up to 1000:1 for professional traders

- It is possible to start trading from $10

- The platform is regulated by CySEC

Cons:

- Libertex has slow execution times compared to other platforms

- The broker is limited to CFDs and does not offer traditional stocks and shares

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 85% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

4. AvaTrade - Best offshore broker for day trading across CFDs, forex and cryptos

If you're an experienced trader in search of algorithmic trading tools, high leverage options, and access to diverse financial assets, Avatrade is the ideal choice for you. Not only is Avatrade recognized as one of the leading offshore forex brokers, but it also supports the popular MT4 and MT5 trading platforms. Additionally, it collaborates with several automated trading programs like ZuluTrade, AvaSocial, and DupliTrade.

Avatrade's greatest selling point may be its high leverage on most trades. Experienced traders comfortable with risk will appreciate the leverage of up to 400x on most currency pairs. Additionally, Avatrade offers fixed narrow spreads throughout the day, such as 0.9 pip for the EUR/USD pair and 1.6 pip for the GBP/USD pair. The platform also provides the opportunity to trade CFDs with low fees and high leverage, making vanilla options trading more accessible.

AvaTrade fees

Fee Amount CFD trading fee Variable spread Forex trading fee Spread. 0.9 pips for EUR/USD Crypto trading fee Commission. 0.25% (over-market) for Bitcoin/USD Inactivity fee $50 per quarter after three months of inactivity Withdrawal fee Free Pros:

- Avatrade is regulated in 6 continents by reputable regulatory bodies

- Traders can use either mobile or desktop trading platforms

- Compatible with both MT4 and MT5 charting tools

- Up to 400x leverage is available to traders

Cons:

- AvaTrade charges high inactivity fees.

- The minimum deposit is $100 which is higher than competitors.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

Offshore Broker vs Onshore Broker

When discussing offshore brokers, it is helpful to clarify the difference between offshore and onshore platforms.

An onshore trading platform is considered to be the opposite of an offshore broker. Onshore platforms are limited to the local markets and do not provide users with access outside of their native jurisdiction. On the other hand, offshore brokers support the trading of instruments overseas. This means that it is possible to access a more diverse range of instruments from different exchanges.

What Are The Pros and Cons of Offshore Brokers?

Offshore brokers can be beneficial for investors who want to diversify their portfolios with instruments from alternative markets. However, using an offshore broker also comes with several drawbacks that should be carefully considered before you set up an account.

Pros:

- Tax benefits: Investing in offshore securities can lower tax obligations for some investors. This is because offshore investing makes it possible to invest in countries that have lower tax rates than your own. Countries often offer lower tax rates to international investors to attract outside wealth into their economy.

- Instrument diversity: Investing offshore allows account holders to diversify their holdings with assets from various markets. This is a good way to protect your portfolio against macro economic factors that could effect one jurisdiction but not others.

- Asset protection: Offshore brokerage accounts are sometimes used to protect individuals against lawsuits, debt collection or foreclosing lenders. When funds are held outside of their native jurisdiction, individuals are no longer susceptible certain troubles. However, avoiding difficulty is not as simple as investing in an offshore broker and you should always seek professional advice before making these types of decisions.

Cons:

- Regulatory volatility: Regulations surrounding offshore brokers have become increasingly tighter over the years. This is to reduce tax revenue that is lost to offshore investing. Regular changes in regulation could cause regulatory volatility.

- Expensive account set up: Setting up an offshore account comes with high costs. Investors may have to cover account registration fees, legal fees, and a high minimum investment. Many offshore accounts require minimum deposits of $100k upwards.

How to Choose an Offshore Broker to Use in 2025

Investors who are looking to use an offshore broker typically want to invest with large amounts of capital, reduce their tax obligations and increase their exposure to international markets. When choosing an offshore broker, it is important to look at features that will serve each of these purposes. Below, we will take a closer look at the important aspects to consider when finding an offshore broker.

Asset protection

If you are looking to invest with a large amounts of capital, security should be one of the first things that you consider. Offshore brokerage accounts should provide multiple layers of account protection. This could include data encryption, segregated accounts, negative balance protection and advanced fraud detection systems.

Tax benefits

Some offshore brokerages come with tax benefits that could reduce that amount of capital gains tax paid on investments. It is important to fully understand the tax rates of each offshore account before investing any funds. If you are putting a large amount of capital at risk, it might be beneficial to seek the opinion of an expert who can advise you on best practices.

Asset diversity

Another important to factor to consider when choosing a broker is asset diversity. The best offshore brokers should provide access to a variety of financial markets which makes it easy to diversify your holdings. Diversification is a risk management strategy that can help to reduce the negative impact of a loss. If one instrument experiences a dip, the other instruments in your portfolio may be able to balance put any financial losses.

How to Get Started With an Offshore Trading Platform

It is possible to set up an offshore investment account online in 2025. However, the process is not as straight forward as setting up an account with a traditional online broker.

Offshore brokerage eligibility requirements

Before setting up an account, it is important to familiarize yourself with the requirements of an offshore broker.

Some offshore brokers have minimum capital requirements that you must meet before investing. These brokers are usually better suited to individuals with large amounts of capital who are looking to reduce tax obligations.

Other offshore brokers, that cater towards investors who are looking to simply access overseas markets, have a lower barrier to entry. These platforms are easier to sign up to but may not offer the tax benefits and advanced security features that are provided by more exclusive brokers.

Read carefully through the platform’s account set up requirements before proceeding.

In the following section, we will discuss how to open an account with eToro - our recommended offshore platform. eToro is a suitable platform for beginners who are looking to access international markets.

If you are hoping to invest with large amounts of capital into a brokerage that will provide tax benefits, it may be a good idea to research alternative platforms.

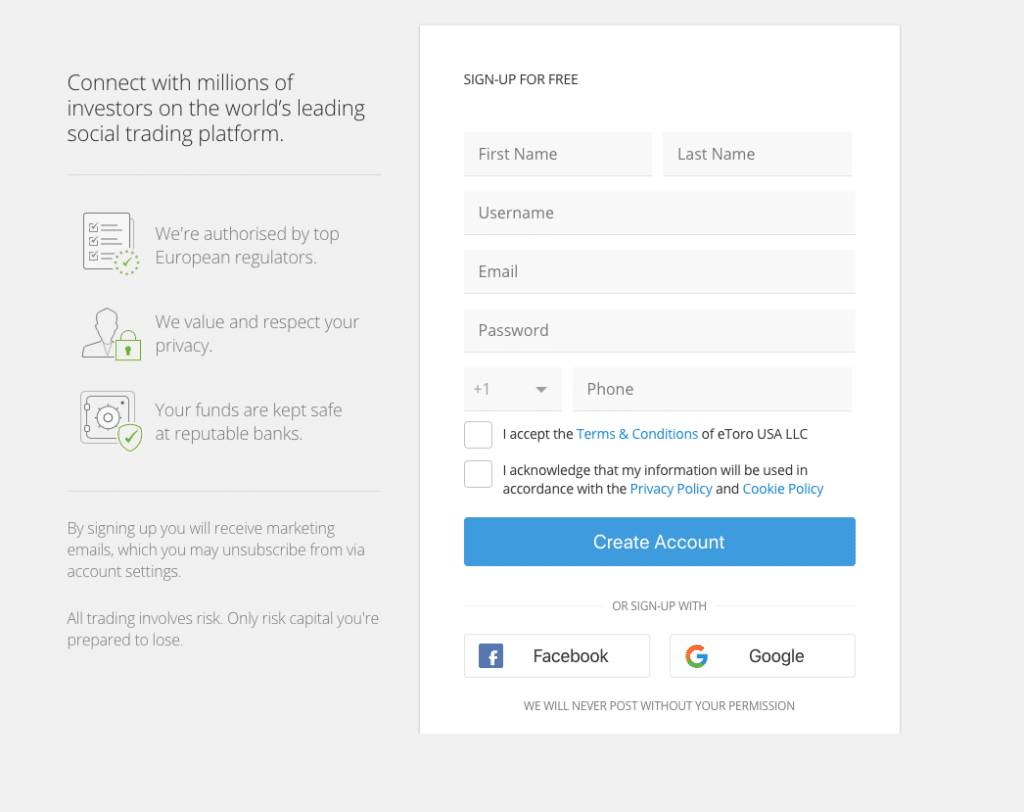

1. Open a trading account

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

You can open an eToro account online by visitng the official eToro website and choosing 'create an account'.

You will be asked to provide some personal information to comply with KYC requirements. The process of filling out the registration form should take no longer than 15 minutes.

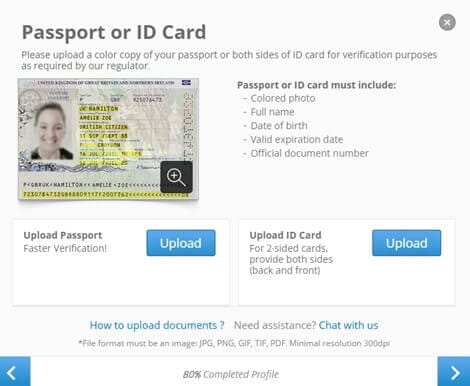

2. Confirm identity

The subsequent phase after creating an account is to confirm your identity. eToro is a highly regulated broker, thus before your account can be validated, you must provide identification and address documentation. You may present any government-issued identification, such as a driver's license or passport, as proof of identity. You might provide a utility bill or your bank statement as evidence of your address.

The eToro verification process is quite quick after the necessary documents have been uploaded. You can go to the following step if your account has been authenticated.

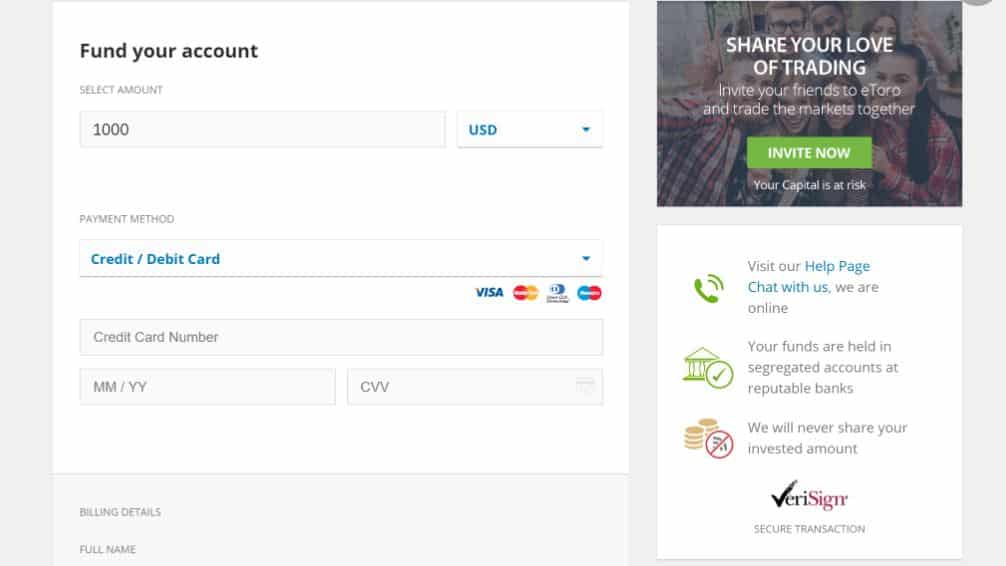

3. Deposit funds

The next step is to deposit funds into your account. eToro supports a wide range of payment methods including credit cards, debit cards, PayPal, International bank wire transfers, Skrill, and more. There are no deposit fees and your funds are credited to your account instantly except for wire transfers that take between 3-5 days.

4. Search for a trading market

The next step is to look for the market on which you want to trade. To do this, choose 'discover' from the left hand navigation and then click the 'exchange' drop down menu. You will be able to search through the markets that are available.

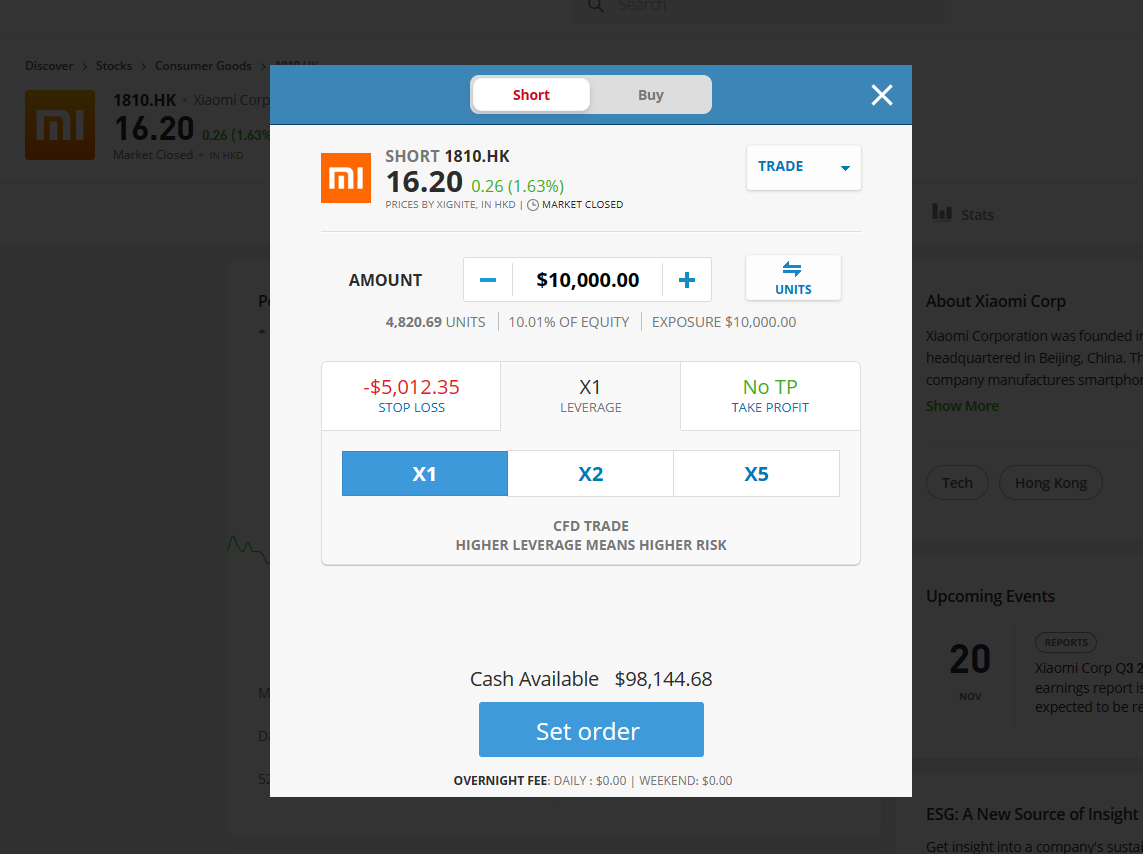

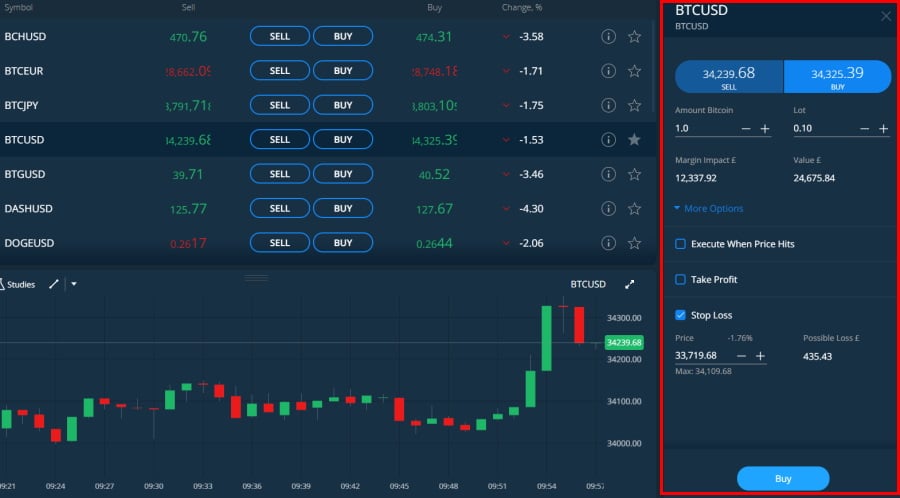

5. Place a trade

Select an asset that you would like to trade and choose 'trade'.

Here, you will be able to execute a short or buy order. Determine the amount that you would like to purchase in the relevant box, enter SL and TP targets, select leverage and then set the order.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Conclusion

Retail traders are increasingly turning to offshore trading as a method to avoid taxes and access a larger range of marketplaces. When trading through an offshore trader, there are a number of crucial factors to keep in mind, all of which have been covered. They include overarching platform considerations like the list of available asset classes and trading costs. The platform's trading tools, such as its analytical features and the many order types that may be sent through it, are also included.

FAQs

What is the best offshore broker?

The best offshore trading platforms should offer advanced security features, access to a wide range of assets and tools for research and analysis. According to this criteria, the best offshore trading platform is eToro which is regulated in 6 jurisdictions and provides access to 21 different markets.

Which is the cheapest offshore trading platform?

The cheapest offshore trading platform with a wide variety of assets and zero spreads is Libertex, which only charges a very negligible commission on every trade.

Which offshore trading platform offers US shares?

Most offshore trading platforms offer US shares, including eToro. However, some platforms will only allow investors to trade shares as CDFs. This is worth researching before signing up to a platform.

Are the offshore trading platforms legit?

Yes, offshore trading platforms are legit. While some of them may not be very safe, using an offshore trading platform that is regulated in another jurisdiction helps you ensure that your capital will be safe.

What is the best offshore trading platform to buy Bitcoin?

The best offshore trading platform to trade Bitcoin and other cryptocurrencies is eToro. eToro provides 25 different crypto assets as well as a cryptocurrency smart portfolio which can be used to invest in the DeFi market.

References

Nishit Kumar Finance Writer and Analyst

View all posts by Nishit KumarNishit is a NGL Trader Analyst at Akari Trading. He has also worked as an analyst for Morgan Stanley and Onyx Commodities.

Before starting his career in finance, Nishit studied at the University of Warick where he was an active member of the Hedge Fund society. Due to his qualifications and experience, Nishit is considered an industry expert and enjoys writing content that could help traders to make informed decisions.

As well as writing, Nishit worked as Associate Editor for The Economic Transcript until 2021. He has also written for Newsweek and has good knowledge of current events that could affect the financial markets.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up

Avatrade's greatest selling point may be its high leverage on most trades. Experienced traders comfortable with risk will appreciate the leverage of up to 400x on most currency pairs. Additionally, Avatrade offers fixed narrow spreads throughout the day, such as 0.9 pip for the EUR/USD pair and 1.6 pip for the GBP/USD pair. The platform also provides the opportunity to trade CFDs with low fees and high leverage, making vanilla options trading more accessible.

Avatrade's greatest selling point may be its high leverage on most trades. Experienced traders comfortable with risk will appreciate the leverage of up to 400x on most currency pairs. Additionally, Avatrade offers fixed narrow spreads throughout the day, such as 0.9 pip for the EUR/USD pair and 1.6 pip for the GBP/USD pair. The platform also provides the opportunity to trade CFDs with low fees and high leverage, making vanilla options trading more accessible.