5 Best Algorithmic Trading Platforms & Software in June 2025

Navigating the financial markets is no easy feat. As a result, a growing number of trading platforms are offering algorithmic trading services that conduct analysis and execute trades on behalf of users. These platforms can be used to automate the trading process and improve your trading strategy. In this article, we take a look at the best algorithmic trading platforms including the cheapest platforms to use in 2025.

-

-

5 Best Algorithmic Trading Platforms in 2025

Some of the top algorithmic trading platforms that you can use in order to trade have been listed below:

- eToro: Users can access algorithmic trading on eToro through the Copy Trading feature. Copy Trading involves mirroring your trading account to that of an expert trader so that trades are automatically placed according to their analysis. eToro is a regulated trading platform in several jurisdictions and provides a free demo account that can be used to test the copy trading feature.

- Dash 2 Trade: Dash2Trade supports algorithmic cryptocurrency trading. The platform is blockchain-based and offers a range of features including algo trading, signals, bots and social trading. Users can also access expert analysis and real-time market insight to complement their trading strategies.

- Webull: Webull is a commission-free platform that provides access to MetaTrader 4, MetaTrader 5, and other advanced charting tools. It caters to traders interested in technical analysis. Webull also offers a user-friendly mobile app that can be used to manage algo trading on the go.

- ETrade: ETrade is an algorithmic trading platform that has a strong focus on education. It provides algorithmic trading for stocks, forex, options and ETFs in the US.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.Past performance is not an indication of future results.

What is Algorithmic Trading?

Algorithmic trading is the process of using pre-programmed software to conduct transactions based on pre-defined trading signals or specific criteria set by a human user. Algorithmic trading is also sometimes referred to as ‘automated trading‘ due to the fact that trades can be placed passively without the account owner having to intervene.

However, not all algorithmic trading is automated. For example, algo signals can be used to guide manual trading whereby traders use signals to spot potential opportunities and then conduct their own research and analysis before placing the trade.

Algorithmic trading tools can assist traders with efficiently navigating the market. Algorithms are typically able to scan for potential trading opportunities on a much faster scale than human traders which allows users to take advantage of all opportunities and minimize the risk of missing out on a profitable trade.

Different Types of Algorithmic Trading Software

There are a number of different types of algo trading tools that can be used to facilitate algorithmic trading. Here is an overview of the most popular types of software.

Bots

A bot is a program that is designed to automatically execute trades based on a set of parameters supplied by a human trader. Among the various variables that make up these parameters are the following:

- A signal to purchase and sell.

- The maximum size of a position.

- A price that serves as a point to stop and exit the trade

The advantage of a bot is that it can execute trades objectively by following a strategy, removing the psychological and emotional aspects of trading that can affect even the most experienced players’ performance.

Signal Bots

Signals are a type of trading alert that notify traders of profitable opportunities. These signals are often provided by algorithmic software that scans the market for potential trades and then notifies users.

Despite the fact that signals are closely linked to the usage of automated bots, algo trading techniques can also rely on external or third-party signals that aren’t always tied to a specific technical configuration.

One example would be to trade relevant indices after the release of a major economic report if the report falls short of the consensus forecast. Level II market data, such as bid/ask spreads, buy and sell order volumes, and other related variables could also provide trading signals.

In essence, everything that has the ability to alter the price of a specific financial instrument can be regarded as a variable to trade on, and a signal is an occurrence in which there is an exploitable relationship between the variable and the price of an index, in one direction or the other.

Third-party services that give signals for algorithmic trading are also available. A newsletter, RSS feed, or even a Telegram message can be used to deliver these messages. The bot will receive the signal and process it promptly in order to complete the transaction.

Copy Trading

Copy trading is a form of automated trading that involves mirroring the trades of a more experienced trader. Although the strategy itself is not based on an algorithm (unless the trader used algorithmic trading themselves), the process of placing trades could be classed as algorithmic.

Algorithms work to monitor the trades of the trader that you choose to copy and make changes to your portfolio accordingly.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Best Algorithmic Software & Trading Platforms Reviewed

In the following section, we take a closer look at the top algo trading platforms to consider in 2025. We reviewed each platform to find out their key features, pros and cons and fees.

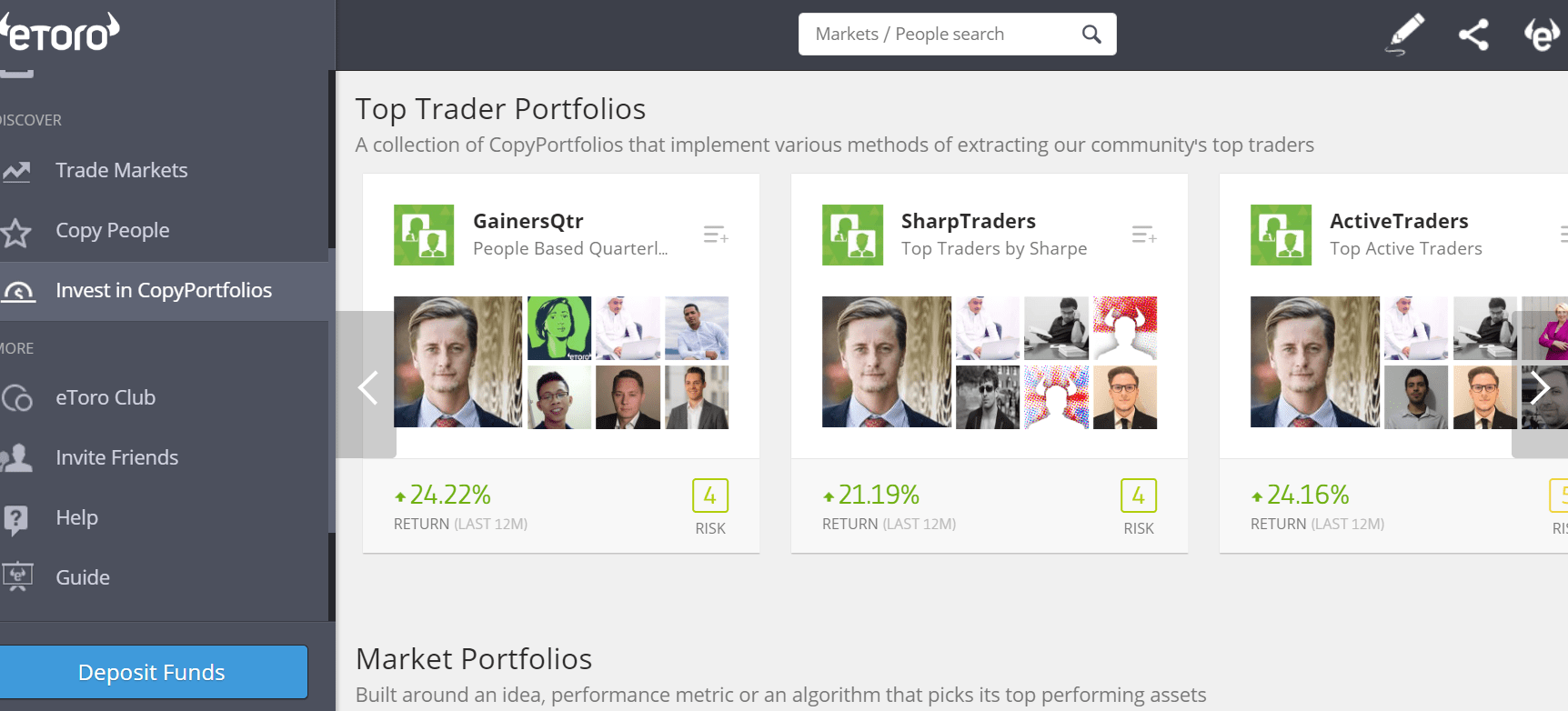

1. eToro: The best platform for algorithmic trading via copy trading

eToro is a reputable platform that offers algorithmic trading through its innovative copy trading feature. The global broker is regulated by a number of financial bodies and has over 21 million users around the world. Furthermore, eToro provides access to a diverse range of markets including cryptocurrencies, stocks, ETFs, commodities and index funds. It is also worth noting that eToro provides a free demo trading account that can be used by all traders.

Copy trading involves copying the trades of more experienced traders to take advantage of their research process and strategy. There are a collection of different ‘expert’ traders available to copy on eToro and the platform provides an overview of each trader’s profile to help you better understand the kinds of trades that they might place.

It is possible to adjust the amount that you put into each position and it is also possible to copy more than one trader at a time. Once you have chosen to copy a trader, the platform will automatically execute trades whenever the trader that you copy places a trade.

Each portfolio comes with a risk score that is developed by taking several metrics into account. The higher the risk, the more chances there are of losing funds. This is very useful when deicidng which portfolio to copy.

eToro fees

Fee Amount Stock trading fee From 0% commission Forex trading fee Spread, 2.1 pips for GBP/USD Crypto trading fee 1% commission Inactivity fee $10 a month after one year Withdrawal fee $5 Pros:

- eToro charges 0% commissions on some stocks and shares as well as no monthly account management fees.

- There are hundreds of copy trading profiles to choose from, catering to a range of different strategies and goals.

- It is possible to trade stocks, ETFs, cryptocurrencies, indices, commodities and more.

- eToro is a licensed broker that offers user protection and excellent customer service.

Cons:

- The platform lacks advanced charting tools and indicators, making it less suitable for experienced traders who want to employ complex strategies.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

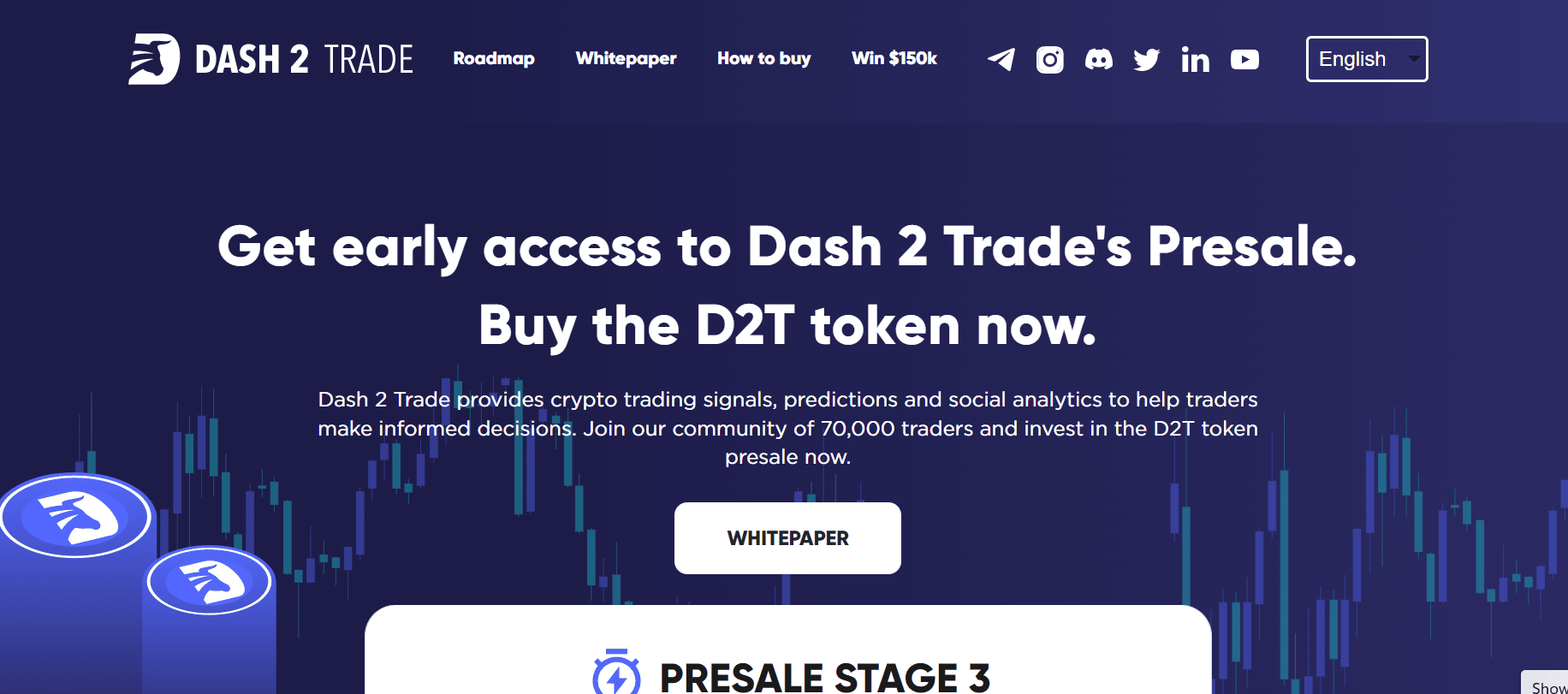

2. Dash 2 Trade: Best algorithmic trading platform for cryptocurrency in 2025

Crypto assets are among the most popular assets to trade with an algorithmic trading platform. The high volatility of the market makes it difficult to manually make trading decisions so many investors and traders choose to use algorithmic tools to help them.

Dash 2 Trade is a new tool that is set to be the next best platform for cryptocurrency enthusiasts who want to take advantage of algorithmic trading strategies. The Dash 2 Trade platform offers absolutely everything that you may need to navigate the market, make informed trading decisions and automate your crypto trading. This includes accurate trading signals, social trading features, token listing alerts, token ranking and an advanced strategy builder.

The team behind this innovative new trading tool is made up from experts from the Learn 2 Trade Project- a successful trading education platform that is highly rated and has helped thousands of traders worldwide. The team want to provide crypto traders with everything that they need to trade with confidence. This will make the platform stand out from others that don't offer everything under one roof.

Dash 2 Trade Tokenomics

The Dash 2 Trade platform is supported by D2T- an ERC-20 utility token that has a deflationary supply. The token is used by subscribers to pay for platform subscriptions, unlock advanced features and enter trading competitions. The token will also be given to users as a reward for making successful trades.

To access the platform and start using the tools to place informed trades, you can by D2T from DEX with ETH tokens.

The price or value of cryptocurrencies can rapidly increase or decrease at any time. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk.

3. Webull - Leading trading app that supports multiple algorithmic trading tools

Webull is a commission-free platform that provides access to MetaTrader 4, MetaTrader 5 and a range of other advanced charting tools. This makes the platform an excellent option for traders who are looking to conduct thorough technical analysis.

As a whole, the Webull platform has an intuitive design that makes it easy to navigate. What's more, the platform offers interest on uninvested cash which makes it possible to earn even without investing or trading.

The advanced tools offered by Webull are appealing to algorithmic traders. However, the platform also has some drawbacks including a limited variety of assets available and limited payment/withdrawal methods.

Nevertheless, Webull is still a good option to consider. The MetaTrader platforms are considered amongst the best for algorithmic trading because they support APIs and allow traders to personalize the strategies.

Webull fees

Fee Amount Stock trading fee U.S. SEC transaction fee (sells only) - $0.0000051*Total $ Trade Amount (Min $0.01) Forex trading fee N/A Crypto trading fee Variable spread Inactivity fee Free Withdrawal fee $25 via wire transfer (U.S.) - $45 via wire transfer (international) Pros:

- The platform does not charge fees for trading stocks, ETFs or commodities.

- Webull is compatible with MT4 and MT5 which both support algorithmic APIs.

- The platform is available to use on mobile which makes it suitable for trading on the go.

- Users can earn interest on cash that they don't invest.

Cons:

- Limited payment methods (the platform only accepts bank transfers).

- Does not support cryptocurrencies.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

4. ETrade : User-friendly platform for algorithmic trading

When looking for a beginner trading site, you might initially have trouble navigating the world of algorithmic trading, and this is primarily due to the jargon and the technical terms that surround the industry.

ETrade makes the process easier, since it offers you the ability to easily learn how to trade using algorithmic strategies. For example, ETrade has a vast library of educational resources that you can use in order to learn different strategies, their suitability, and the different circumstances under which they can be used.

As well as it's market-leading algorithmic features, ETrade has a number of other great features that make it worth considering.

Firstly, the platform provides commission-free trading on stocks, options and ETFs. There is also a mobile app available that makes it easy to manage your trades on the go. We found the mobile app to be advanced compared to other applications that are available but is easy-to-use and navigate.

However, the same can't be said for the website version of the platform which is more difficult to navigate, especially as a less-experienced trader.

Pros:

- No fees are charged for trading stocks, ETFs or options.

- ETrade has a great mobile app that can be used to trade on the go.

- The platform offers a range of educational resources that can be used to learn about algorithmic trading.

- ETrade is a product of Morgan Stanley, a reputable brokerage firm.

- There are no account minimums which means that you can start trading from $1.

Cons:

- Does not offer cryptocurrency trading.

- The website is fairly tricky to navigate compared to other trading sites.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

Algorithmic Trading Apps Assets & Software Comparison

Asset Class/Software eToro Webull ETrade Forex Yes Yes No Stocks Yes Yes Yes Commodities Yes Yes No Cryptocurrencies Yes No No Indices Yes Yes Yes MT4 Trading Platform No Yes No MT5 Trading Platform No Yes No Popular Algorithmic Trading Strategies

There are numerous algorithmic trading strategies that can be used to achieve different outcomes. A good idea is to use a paper trading account to practice various strategies without putting any real money at risk. Here is a look at some of the popular algo trading strategies that are used by traders in 2025.

Arbitrage Trading

Arbitrage is a strategy for profiting on modest, transient price differences in an asset between many brokers at the same time. Arbitrageurs benefit by purchasing an asset at the lowest ask price on one broker and then selling it at a profit through another broker with a higher bid price.

This algorithmic trading method works best for illiquid securities since their bid/ask gaps are typically wider, making it easier to spot possible arbitrage opportunities.

For forex or Bitcoin algorithmic trading, an arbitrage algorithmic method might be utilized. Due to a large number of cryptocurrency exchanges now available, this latter asset in particular is a popular target for arbitrageurs.

Signal Trading

Signal trading entails searching for and recognizing specific trading signals that are set by a trader as the parameters which the bot follows when they are spotted. Signals can be acquired from a third-party service that is constantly searching the market for these setups, or they can be recognized by completing a technical study of numerous instruments.

Signals can be obtained from price action or volume-related indicators like the accumulation/distribution chart, MACD, RDI, and Bollinger Bands in technical analysis.

Trend following

This strategy involves taking advantage of movement by buying at the start of a trend and selling when the price reaches it’s peak. Algorithmic tools can be used to spot breakout opportunities and buy as soon as trends begin.

By automating the trading process, traders reduce the risk of missing the start of a trend.

Scalping

Scalping is a day trading strategy that aims to profit from small price movements in the markets. Traders who use this strategy typically execute multiple traders per day. The profits from each trade are often small however, they can add up throughout the course of a trading period.

Due to the short length of scalp trades, it can be difficult for traders to manage their positions manually. In this case, algorithmic software is used to execute trades and close them automatically.

Key Features of an Algorithmic Trading Platform

The platforms that we have looked at in this article all offer slightly different features that will appeal to different traders. Ensuring that you choose the right trading platform for your individual strategy is the key to successful algorithmic trading. Here are a few things to consider before choosing a platform.

✔️ Trading Tools & Features

Algorithmic trading requires thorough analysis. Therefore, it is important that platforms offer a range of advanced tools that can be used to make price predictions, spot emerging trends and highlight potential trading opportunities. There are a number of different tools and features that could be used in algorithmic trading. Below, we will explain a few of the more important to look out for.

Automated Trading

Automated trading involves using AI and ML to passively execute trades on your behalf. It is a common misconception that automated trading and algorithmic trading go hand in hand however, this is not the case.

Most automated trading platforms will use algorithms to place trades however, not all algorithmic platforms are automated. Some algorithmic trading platforms require traders to formulate the strategies themselves and then deploy these using an API. This is not ideal for less-experienced traders. Therefore, it is important to check that platforms offers automated trading features that will execute algorithmic trading on your behalf.

Research and Analysis Tools

All traders must perform research and analysis alongside using algorithmic trading systems. Understanding the market that you are trading could help you to spot potential trading opportunities, better understand the algorithmic software that you are using and to spot unsuccessful trades so that you can exit the trade before making a large loss.

Advanced traders may use multiple tools at one time to accurately navigate the market. If you are less advanced, it is a good idea to pick a handful of tools an features that you could use and perfect your ability to use these before adding any others into your strategy.

The two types of analysis used by traders are fundamental and technical analysis. Each type of analysis will require different tools. Technical analysis tools are typically found within the charting feature of a trading platform. Common technical analysis tools include moving averages, trading volume, Bollinger bands, MACDs and EMAs.

Fundamental analysis tools are usually found on the main dashboard of a trading platform. These tools include market news, information about a project and expert price predictions.

✔️ Demo Account

Algorithmic trading is difficult to perfect and can be very risky. Therefore, it is a good idea to use a demo trading account to practice trading without putting any real money at risk. Demo trading platforms are simulated trading environments that use virtual (fake) money to create a realistic trading environment that you can practice in.

Most of the time, demo account will offer the same features as a live trading account which allows traders to practice using different strategies and tools. The best demo accounts are free to use and can be access at any time. This way, traders can switch between live and demo trading to practice new strategies and techniques. Use a demo account for as long as possible before live trading.

✔️ Mobile App

The ability to manage trades on the go is an appealing feature that shouldn't go over looked. The best algorithmic trading platforms should offer a mobile app that allows traders to manage their trades, conduct analysis and execute trades from anywhere. In a volatile market, it is important that you are able to exit a trade at anytime, in case the market direction turns and your trade becomes unsuccessful.

✔️ Payment Methods

Payments and withdrawal methods are another vital component to consider when choosing a platform. Some banks have placed restrictions on the amount of funds that can be deposited into trading platforms.

Therefore, it is useful to be able to choose from various alternative payment methods such as PayPal, Skrill and Neteller. Some platforms even offer crypto deposit options which are appealing to crypto investors.

✔️ Customer Service

Good customer service options make it easy to solve problems if they arise. It should be considered as a red flag if a platform does not provide good customer service because this could leave you with no way of getting any help or support.

The best platform will provide a variety of customer support options such as email, live chat and phone support. It may also be helpful to find a platform that offers a telegram group so that you can connect with other platform users who may be able to answer your queries.

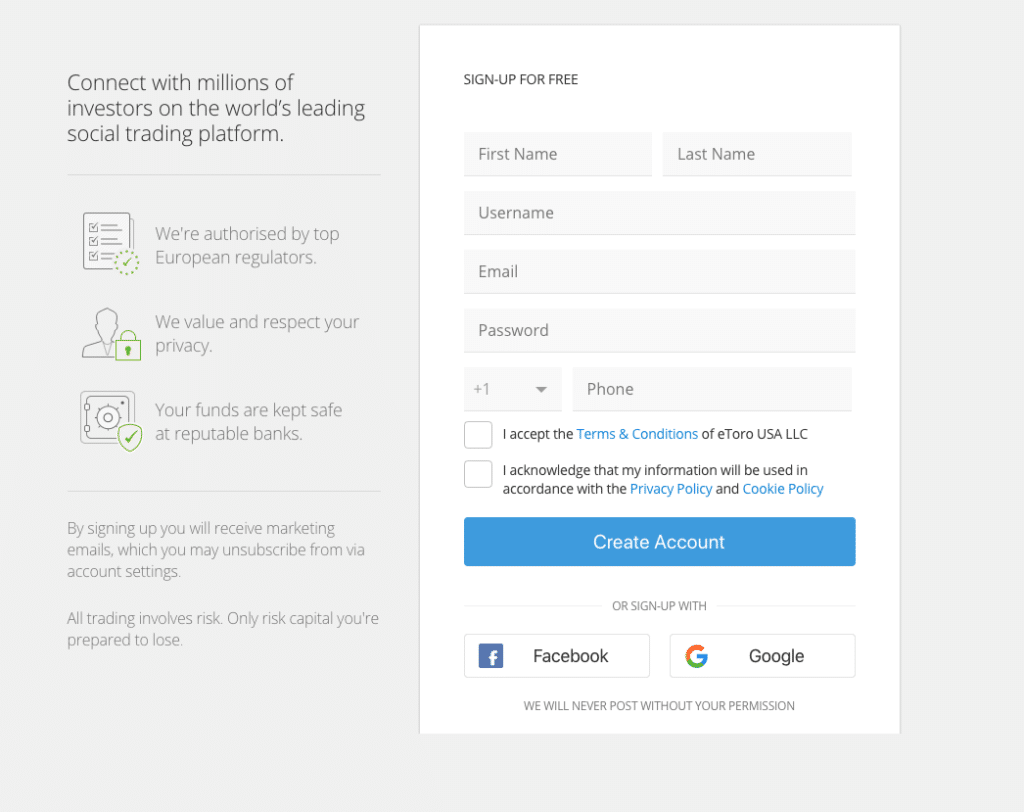

How to Get Started with the Best Algorithmic Trading Platform - eToro

It is important to take all the above options into consideration when choosing the best algorithmic trading platform for your individual strategy and experience. However, for the purpose of this guide we will use eToro as an example. eToro is a great platform to consider and the registration process can be completed in less than 30 minutes.

Step 1: Create an account

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

To start using eToro, you will need to complete the account registration form. The platform is regulated which means that it must collect KYC information. Therefore, all users must provide their names, addresses, mobile phone numbers and date of birth. All information is protected by eToro's enhanced security features.

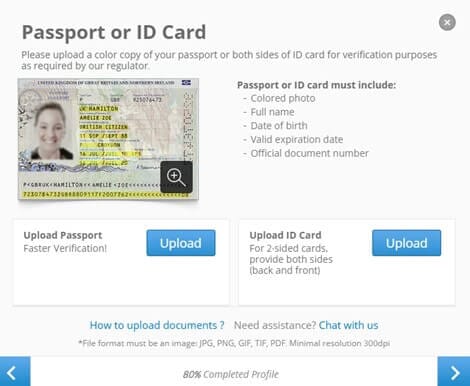

Verify ID

As part of KYC protocol, all users must verify their ID before they can access the eToro trading platform. To do this, you will be asked to upload two ID documents. One must prove your ID and the other must prove your address. Acceptable documents including a passport, birth certificate, drivers license, utility bill and bank statement.

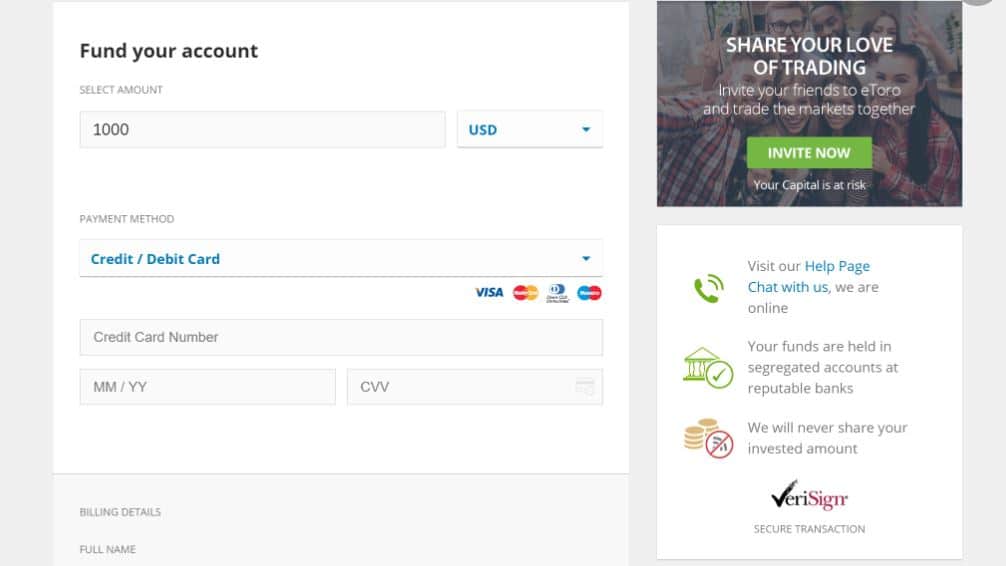

Deposit Funds

Once your ID has been verified by the platform, you will be able to deposit funds onto your account. The minimum deposit is just $20 and you can choose between a range of payment methods to deposit the funds. Payments methods available include PayPal, credit card, debit car, Skrill, Neteller and bank transfer.

It is important to note here that you do not need to deposit any funds into the account to use the demo trading feature. It is a good idea to practice with this first before putting any real money at risk.

Search for a Trading Market

Once you have spent time practicing with the demo account, you can go ahead and start looking for potential trading opportunities. The first step is to determine which type of asset you would like to trade and then explore the selection of copy trading portfolios that are include the asset class that you wish to trade.

Place an Algorithmic Trade

When you have identified which portfolio/trader you would like to copy, go ahead and copy the trades. You can choose the amount that you wish to trade with and then let the trades execute passively. However, it is a good idea to keep an eye on your portfolio and take any action necessary.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Conclusion

Algorithmic trading is a relatively new type of trading that is rapidly gaining traction among investors. When trading with an algo trader, there are several key things to keep in mind, all of which have been mentioned. These include things like trading costs and the asset class list, as well as more general platform considerations. However, they also include the platform's trading tools, such as its analysis capabilities and the many order types that may be put through it.

Our review concludes that eToro is one of the best options to consider for algorithmic trading. The platform is heavily regulated and offers a variety of assets to trade. You can start trading with just $100 and the registration process takes less than 30 minutes to complete.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

FAQs

What is the best algorithmic trading platform?

eToro is the best algorithmic trading platform because it is simple to use and offers protection to investors. It also offers a demo trading account which can be used to test out algo trading tools in a risk-free manner.

Which is the cheapest algorithmic trading platform?

eToro is the cheapest algorithmic trading platform in regards to spreads and commissions. However, the platform does require a $200 minimum deposit to use the algo trading feature.

Which algorithmic trading platform offers cryptos?

eToro offers crypto trading. The platform supports 25 different cryptocurrencies including BTC, ETH, ADA, XRP and more.

Are algorithmic trading platforms safe?

Algorithmic trading comes with a high level of risk. However, some platforms offer user protection and others are regulated which means that they must adhere to compliance.

Which trading algorithm is most efficient?

Arbitrage is considered to be the most efficient algorithmic trading strategy. However, the efficiency of algorithms will vary depending on market conditions.

Is algorithmic trading still profitable?

It is possible to make money with algorithmic trading in 2025 however results are not guaranteed. Many algo traders have a high success rate but never 100%.

References:

Nishit Kumar Finance Writer and Analyst

View all posts by Nishit KumarNishit is a NGL Trader Analyst at Akari Trading. He has also worked as an analyst for Morgan Stanley and Onyx Commodities.

Before starting his career in finance, Nishit studied at the University of Warick where he was an active member of the Hedge Fund society. Due to his qualifications and experience, Nishit is considered an industry expert and enjoys writing content that could help traders to make informed decisions.

As well as writing, Nishit worked as Associate Editor for The Economic Transcript until 2021. He has also written for Newsweek and has good knowledge of current events that could affect the financial markets.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up