Best Day Trading Strategies 2025 – Beginner’s Guide

It is important that you know how to day trade financial assets before you risk any capital. In order to do this effectively, you’ll need to have a number of day trading strategies under your belt.

In this guide, we discuss some of the best day trading strategies to consider as a newbie trader.

A List of The Best Day Trading Strategies

Below you find a break down of the best day trading strategies that we will be discussing today. Be sure to read each strategy in full to ensure you get your day trading career off on the right foot!

- Day Trading Strategy 1: Understand Your Market and Open An Account With eToro

- Day Trading Strategy 2: Avoid Volatile Instruments While Trading

- Day Trading Strategy 3: Know How and When to Use Day Trading Orders

- Day Trading Strategy 4: Become an Expert via a Day Trading Simulator

- Day Trading Strategy 5: Ensure you Employ a Bankroll Management Strategy

- Day Trading Strategy 6: Keep Abreast of Relevant Financial News

- Day Trading Strategy 7: Start Learning Technical Analysis

- Day Trading Strategy 8: Automate Your Day Trading Strategy

- Day Trading Strategy 9: Don’t Be Afraid to Keep Day Trading Positions Open

- Day Trading Strategy 10: Choose a Suitable Low-Cost Broker

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

1

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$50

Spread min.

50 pips pips

Leverage max

50

Currency Pairs

49

Trading platforms

Funding Methods

Regulated by

FCACYSECASIC

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1.5 pips

EUR/USD

1 pip

EUR/JPY

2 pips

EUR/CHF

5 pips

GBP/USD

2 pips

GBP/JPY

3 pips

GBP/CHF

4 pips

USD/JPY

1 pip

USD/CHF

1.5 pips

CHF/JPY

6 pips

Additional Fee

Continuous rate

Variable

Conversión

50 pips pips

Regulation

Yes

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

61% of retail CFD accounts lose money.

Day Trading Strategy 1: Understand Your Market

Without a doubt, the best day trading strategy for newbie traders is to ensure you understand the market that you are planning to speculate on.

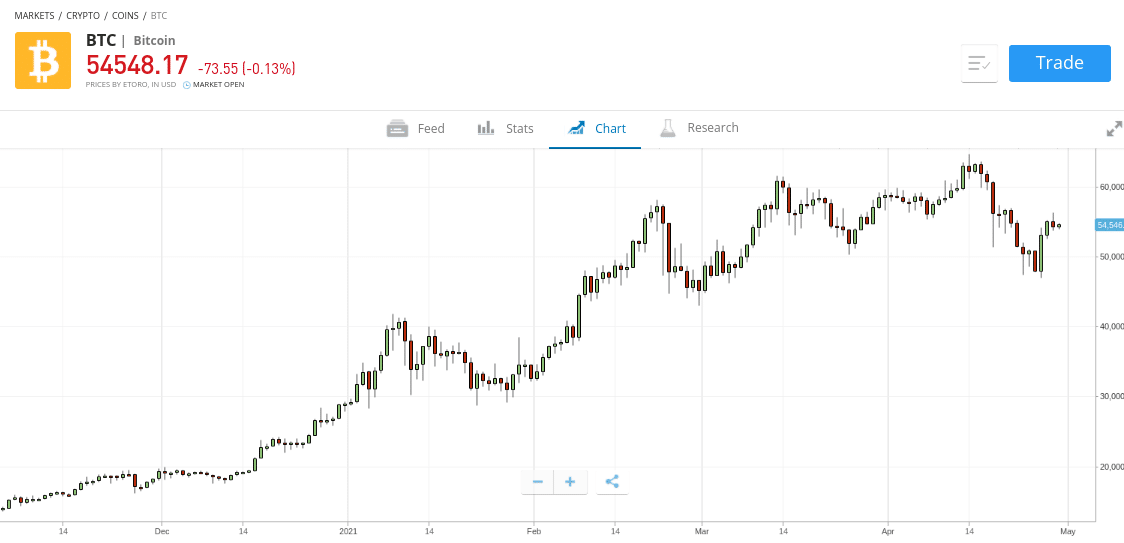

- For example, if you’re looking for the best crypto day trading strategies – you need to have a firm grasp of how the digital currency arena functions.

- Or, if you’re looking for the best forex day trading strategies, you’ll need to have a good understanding of the many factors that can make a currency pair increase or decrease in value.

The key point here is that knowledge is key. Irrespective of which market you want to trade – be it stocks, crypto, forex, or indices, knowing the respective asset class inside out will give you the best chance possible of making consistent gains. Additionally, it’s also worth noting that you are best advised to stick with a specific niche in your chosen market.

For example, instead of trying to trade dozens of different forex pairs, it would be far better to become an expert in one or two. This is the same with stock trading, insofar that it’s best to focus on a particular exchange or market – such as the NYSE or LSE.

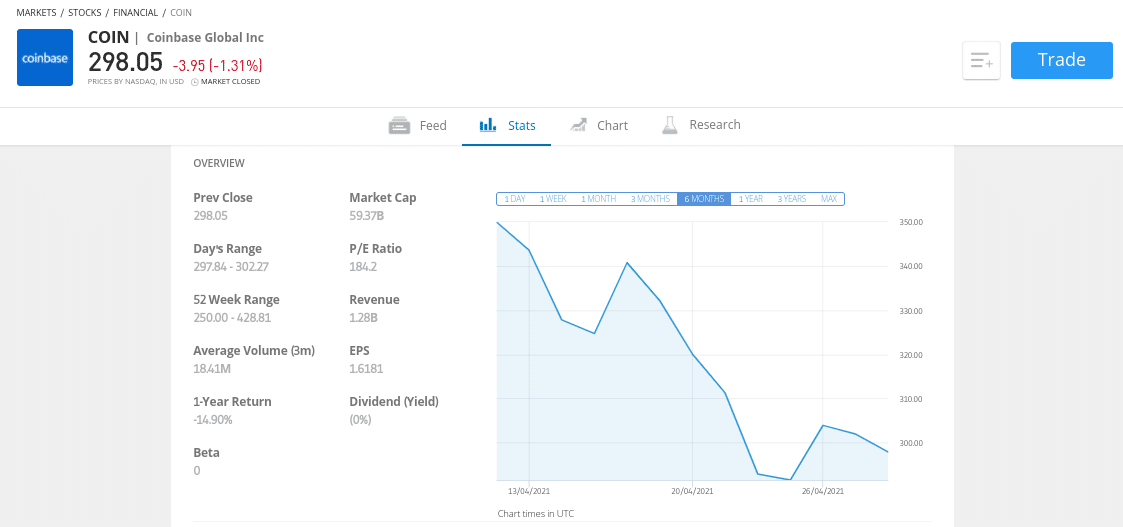

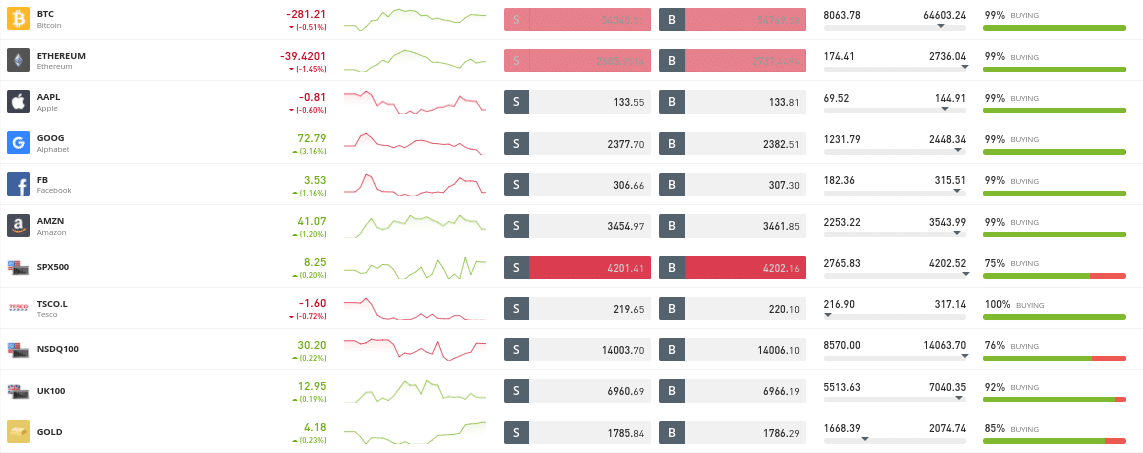

Day Trading Strategy 2: Avoid Volatile Instruments

If you’re a complete newbie in the world of day trading – you’ll want to avoid enhanced volatility. These are assets that increase or decrease at a much faster pace than the market norm. A prime example of this would be penny stocks and cryptocurrencies. In fact, some digital currencies can move by double or even triple-digit percentages in a single day.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

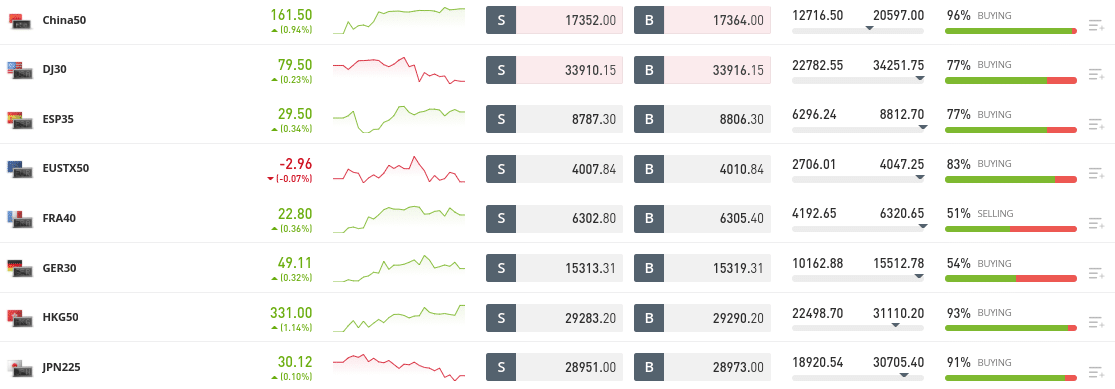

Trading conditions like this are going to be somewhat overwhelming if you’re an inexperienced investor. Instead, you’ll be better off sticking with assets that move in a slow and steady fashion. This might include a major index fund like the Dow Jones or FTSE 100, major forex pairs like EUR/USD or GBP/USD, or even blue-chip stocks. These assets attract levels of high volume and liquidity.

Day Trading Strategy 3: Know How and When to Use Day Trading Orders

The next tip on our list of the best day trading strategies is to ensure that you understand orders. By this, we are talking about trading orders that you place with your online broker. In other words, orders to your broker what position you wish to take in the market.

- The most basic order type is that of a buy or sell order. A buy order is placed when you think the asset will increase in value and sell order when you think the opposite.

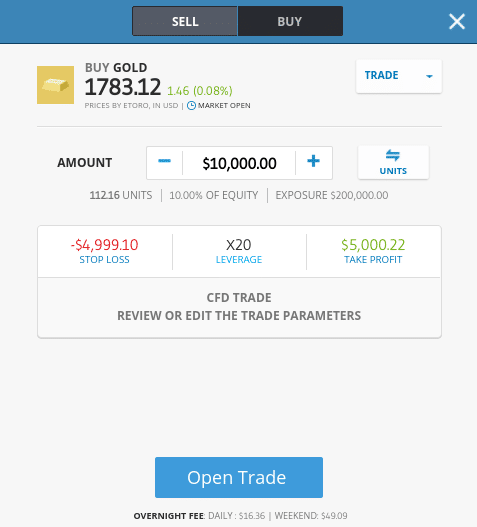

- Then, you have a set of risk management orders that should be entered on each and every day trading position that you place. This starts with a stop-loss order, which is used to limit the potential loss of an unsuccessful position. For example, if you want to cap your losses to 3%, you’d achieve this by implementing a stop-loss order at 3% below your stated entry points.

- You should also consider deploying a take-profit order. This will tell your day trading platform to close your position when it reaches a specified profit target – say 6%.

One of the best day trading strategies in the context of orders is to consider using limit orders as opposed to market orders. This is because market orders are executed at the next best available price – which isn’t a good strategy to use. Instead, by opting for a limit order, you get to specify the exact price that your trade is executed at.

For example:

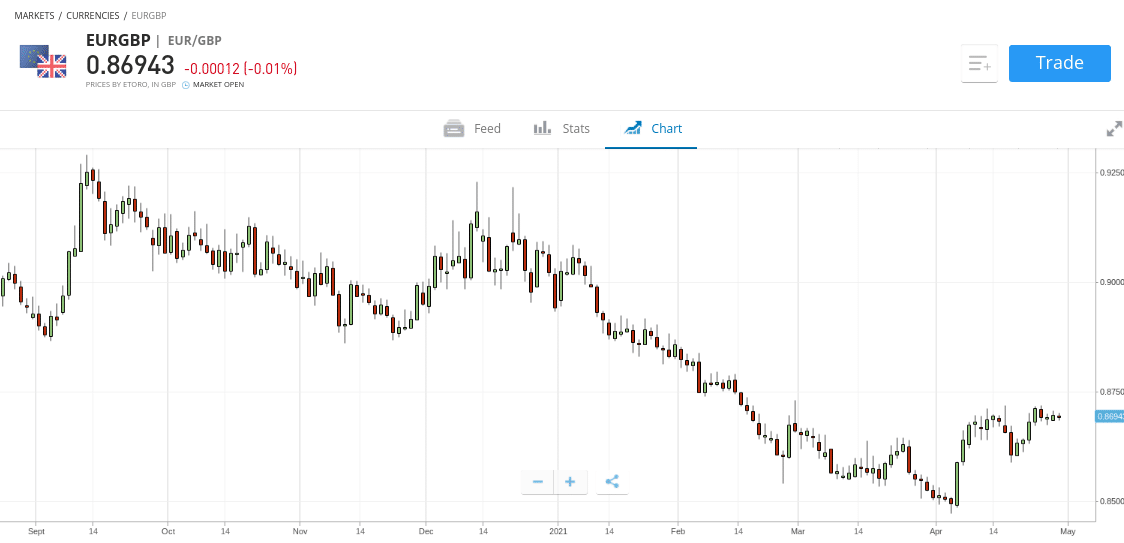

- Let’s say that EUR/GBP is currently priced at 0.86943

- You think that the FX pair will decrease in value if it goes down to 0.86200

- As such, you would place a limit order at 0.86200 (or just below)

This means that your order will only be executed by the day trading platform if EUR/GBP hits a price of 0.86200. If it doesn’t the order will remain pending.

Day Trading Strategy 4: Become an Expert via a Day Trading Simulator

Make no mistake about it – day trading simulators are the best thing since sliced bread in the world of investing. For those unaware, day trading simulators are demo account platforms that allow you to trade in a risk-free environment. The best day trading simulators will mirror live market conditions.

As such, any stock price action that happens in the live trading scene will be reflected on your demo account platform in real-time. Without a doubt, this one of the best day trading strategies for becoming a better trader over the course of time.

In fact, platforms like eToro allow you to use its day trading demo account for long as you wish. As such, you aren’t pressured into upgrading to a real money account if you are not quite ready. An additional point to note when day trading via a demo account is to trade with realistic stakes.

For example, eToro will give you a paper trading balance of $100,000 – which you can replenish at any given time. Sure, you can enter huge stakes at $10,000 per position – but this wouldn’t be smart if you are only planning to day trade day with a few hundred dollars. As such, use the day trading simulator as if you were trading with your own capital.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

Day Trading Strategy 5: Ensure you Employ a Bankroll Management Strategy

When it comes to preserving your capital, one of the best day trading strategies to deploy is that of bankroll management. This is a simple strategy that will ensure you avoid burning through your trading account in its entirety.

To begin, you need to set yourself a maximum stake value in percentage terms.

Most traders will stick to 1% – but you can opt for a slightly higher or lower amount if you wish.

For example:

- Let’s say that you deposit $1,000 into your day trading account

- You opt for a bankroll management strategy that caps your stake to 1%

- This means that your initial trade will be at a stake of $10

- At the end of your first week, you have built your trading balance to $1,200

- This means that your stake should now sit at $12

Crucially, this day trading strategy will ensure that your balance grows organically. It will also ensure that when you are going through a prolonged losing period (which happens to traders of all shapes and sizes), you protect your capital.

For example:

- Let’s say that you have had a bad month, and your trading capital now stands at $800

- This means that your maximum trade value has dropped to $8 per stake

- This is crucial, as if you remained at a stake of $12 per trade, you would be risking more than 1%

Ultimately, while your maximum stake in percentage terms will never change – the monetary value of each position will. In other words, when you are performing well your stake will increase in dollar terms. And, when you are going through a losing period, it will decrease in dollar terms.

Day Trading Strategy 6: Keep Abreast of Relevant Financial News

If you are looking to trade but you have little experience in reading pricing charts, then one of the best day trading strategies to counter this lack of knowledge is to learn fundamental analysis. This means that you will be keeping abreast of relevant news stories that are released by the media.

Crucially, this is because real-world news will have a major impact on the value of an asset, and thus – will determine whether a market rises or falls.

For example:

- Let’s suppose that you are interested in day trading stocks.

- Apple will be releasing its quarterly earnings report in the morning – so you tune into the announcement in real-time

- During the quarter, Apple’s revenues are down by 7% and operating margins have declined by 4%

- Naturally, this is bad news for the company – so it is all but certain that Apple stocks will decrease in value

- As a day trader, all you would need to do is place a sell order with your chosen broker to profit from this announcement

Now, it’s not possible to be aware of each and every financial news story that breaks – as there will likely be hundreds throughout the day. This is why you should stick with a particular trading niche.

For example:

- Let’s say that you are interested in trading commodities like oil and natural gas.

- Therefore, you should sign up with a news platform that can send you alerts in real-time when an important commodity-related story breaks.

- There are many financial and economic news websites – such as Yahoo and Bloomberg, that can send you tailored alerts based on your preferences.

- This will ensure that you are notified in real-time when a crucial economic development breaks.

Additionally, it’s also a good idea to use a reliable economic calendar. This will outline key dates and times related to upcoming economic announcements. This might include anything from a central bank meeting to an OPEC production output announcement.

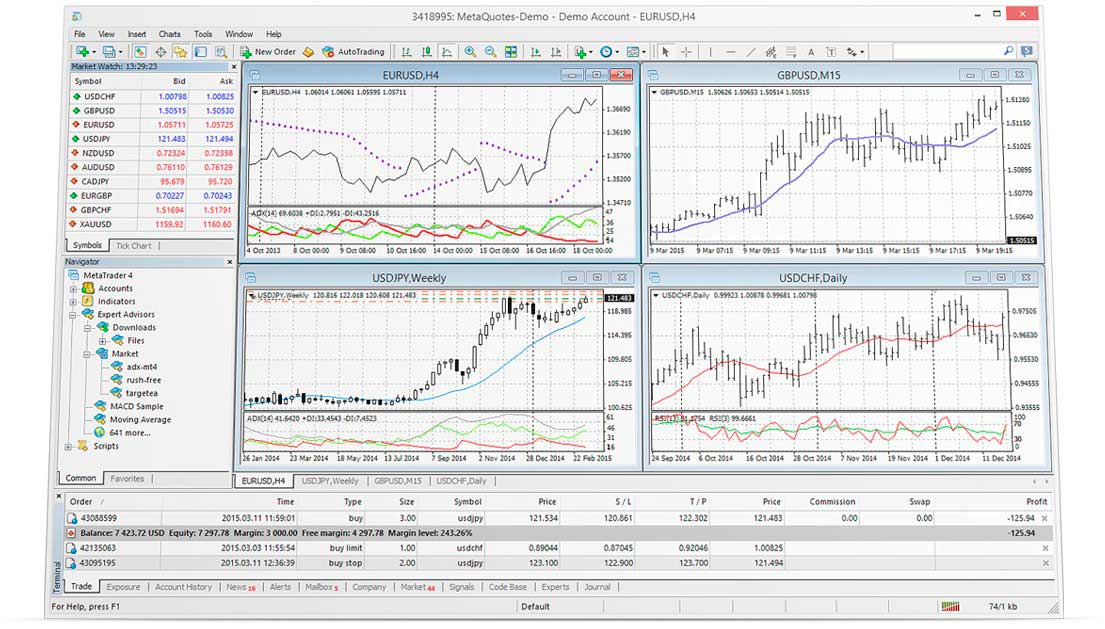

Day Trading Strategy 7: Start Learning Technical Analysis

Many newbie traders are intimidated by the thought of performing technical analysis. However, without knowing how to read, evaluate, and interpret pricing charts – your ability to make money will be hindered.

After all, day trading positions are usually kept open for several hours or minutes – so you need to rely on analysis tools to be able to make a fast entry and exit into and from the market. In order to read pricing charts effectively, you’ll need to learn how technical indicators work.

You have over one hundred technical indicators at your disposal – each of which looks for a specific trend in the market.

- For example, the Moving Average indicator will look at the average price of an asset over various timeframes – usually on a 50-day, 100-day, and 200-day basis. This can help look for a potential breakout or pullback.

- You can then use this indicator in conjunction with the Moving Average Convergence Divergence (MACD). This looks at the relationship between two timeframes and thus – can help highlight where the asset is likely to move in the short term.

- Another popular technical indicator to consider learning is the Bolinger Band. This seeks to predict market sentiment by looking at the relationship between price action and volatility levels.

- We also like the Relative Strength Index (RSI) – which focuses on the price movements and momentum of a financial instrument. More specifically, this tells us whether an asset is potentially overbought or oversold. As such, you can gauge whether the financial markets are bullish and bearish.

Ultimately, by learning the ins and outs of many technical indicators and chart patterns – you will be able to master the craft of financial analysis. In turn, you’ll have access to a much larger pool of the best day trading strategies.

Day Trading Strategy 8: Automate Your Day Trading Strategy

Although there is no such thing as a shortcut in the world of investing – one of the best strategies for newbies without knowledge of technical analysis is to consider automated trading. Put simply, this means that you will be intraday trading without needing to do any research or analysis of your own. Instead, everything is fully or semi-automated – depending on the strategy that you prefer.

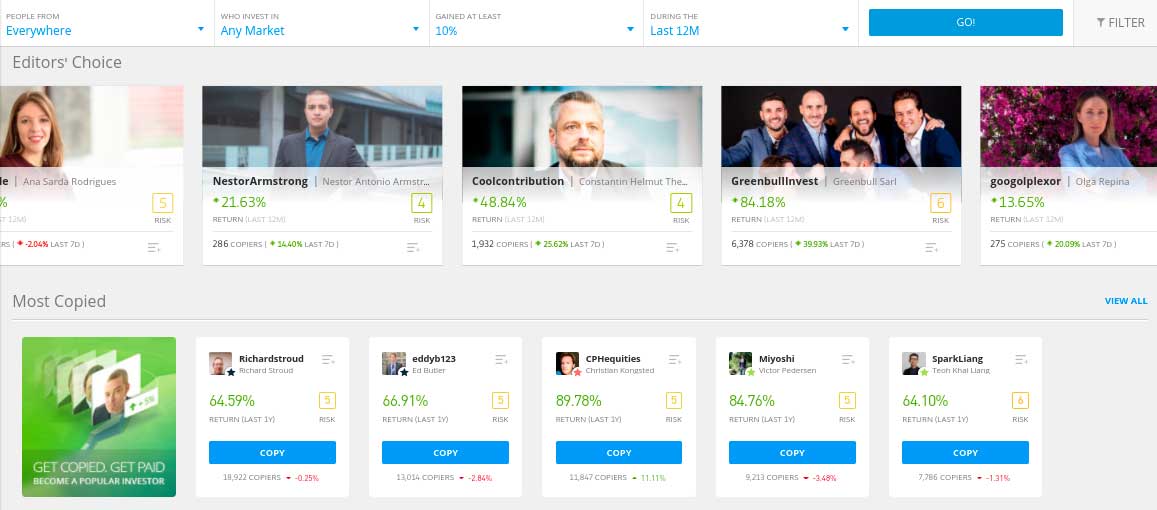

The best two examples of automated day trading are Copy Trading and Signals – which we elaborate on in more detail below.

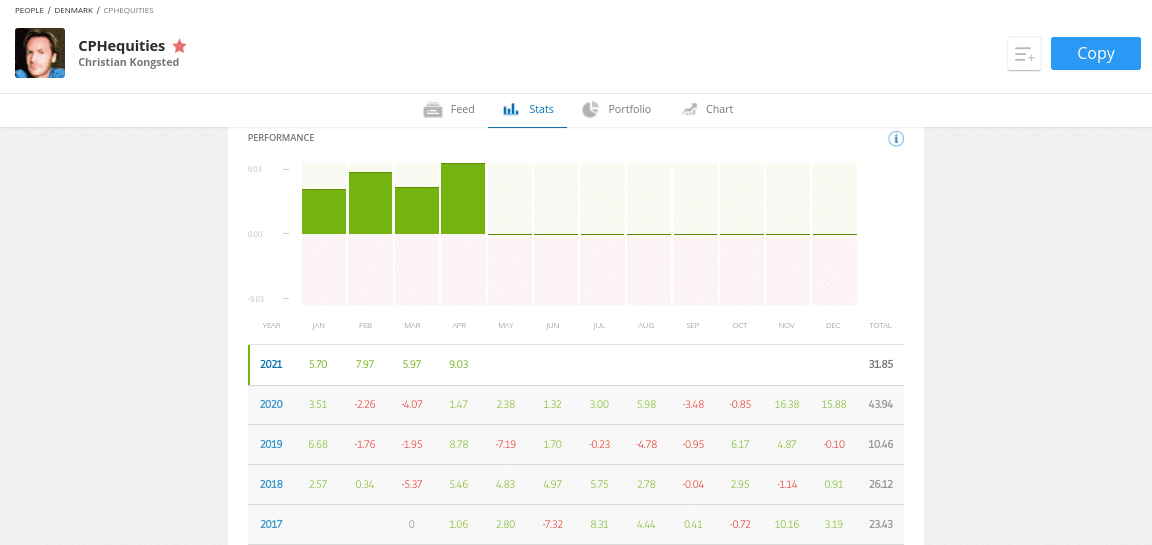

Copy Trading

The Copy Trading arena is dominated by regulated broker eToro. The platform is used by over 20 million people and hundreds of thousands of experienced traders have signed up for the Copy Trading program. In a nutshell, you will be ‘copying’ a verified investor that uses the eToro platform to trade.

You will look to copy a trader that only aligns with your financial goals – but one that has a long-standing track record of making gains

There is no guarantee that you will make money with this provider. Proceed at your own risk..

For example, in the image above you will see the historical performance of an eToro trader Christian Kongsted. This trader has performed exceptionally well since he joined eToro in early 2017. In fact, Kongsted made returns of 23% and 26% in 2017 and 2018. He also made gains of 10% and 43% in 2019 and 2020. In the first four months of 2025, the trader is in profit by 31%.

In addition to past performance, the eToro Copy Trading feature also allows you to look at metrics surrounding:

- Risk rating (1-7) – this is automatically assigned by eToro

- Preferred asset or market – such as cryptocurrencies or stocks

- Maximum drawdown – which gives you a closer insight into the risk tolerance of the trader

- Average trade duration – which tells you the average number of hours or days that the individual keeps a position open

- And much more

In terms of how this day’s trading strategy works – you will initially need to meet a minimum investment of $500 into your chosen investor. Then, any positions that they deploy through eToro will be replicated in your own portfolio.

For example:

- Let’s say that you invested $3,000 into your chosen eToro trader

- The trader enters a long position on Pinterest stocks – risking 2% of their portfolio value

- You replicate the same trade at a stake of $60 (2% of $3,000)

- A couple of hours later, the trader closes their position on Pinterest at a profit of 6%

- You also close the trader and make 6%

- On a stake of $60 – you made a profit of $3.60

Best of all, this automated day trading strategy will cost you nothing in fees or commissions at eToro!

Signals

The other automated option you have when it comes to the best day trading strategies is that of signals. This is more of a semi-automated strategy as you will be required to place the suggested orders with your chosen broker.

The main concept of signals is as follows:

- You sign up with a trading signal provider that has a good track record and verifiable set of results

- The provider sends you a signal on GBP/USD – telling you to go long at a limit order piece of 1.3650

- You are also told to place a stop-loss order at 1.3610 and a take-profit order at 1.3710

- You head over to your broker and place the above orders

There are hundreds of providers offering forex signals and crypto signals – but you do need to be diligent in the one you sign up with. This is because many providers make bold claims about how much money they can make you.

But, whether or not this is the case, remains to be seen. As such, if you do opt for a signal service – we would suggest reverting back to Strategy 4 – where we discuss the importance of using a day trading simulator.

Day Trading Strategy 9: Don’t Be Afraid to Keep Day Trading Positions Open

The general rule of thumb with seasoned day traders is that you should never keep a position open overnight. Instead, most traders will look to make quick and modest gains throughout the day – keeping positions open for a matter of hours or even minutes via a scalping strategy.

However, one of the best day trading strategies to consider is that you should not be afraid to be flexible. That is to say, there is nothing wrong with keeping a position open for more than a day.

In fact, this is the smart thing to do if you believe that you have identified a trend that you believe will remain in place for several days or even weeks. Sure, this would translate into a swing trading strategy as opposed to a conventional day trading system. But, being flexible in the investment world is important.

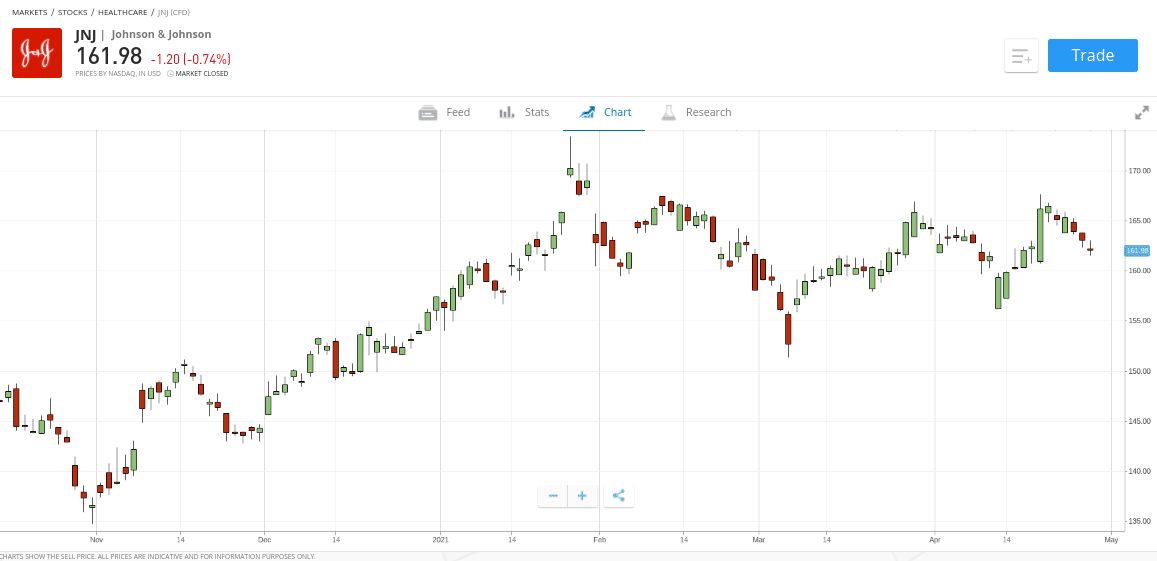

- For example, let’s say that you have decided to go long on Johnson and Johnson stocks because it has just received approval for a new treatment in the US.

- The markets are likely to react to this news in a super positive way – meaning that a prolonged upward trend is possible.

- As such, you would want to capitalize on this good news for as long as the trend is in play – rather than exiting the position before the market closes for the day.

Just remember – if you do keep a day trading position open overnight – you will need to pay funding fees. The only exception to this rule is if you are buying a traditional asset like stocks, bonds, or ETFs and the instrument isn’t in the form of a financial derivative (e.g. CFD).

Day Trading Strategy 10: Choose a Suitable Low-Cost Broker

Last but certainly not least – one of the best day trading strategies to conclude with – is to ensure that you choose a suitable broker. There are many factors that you need to focus on – such as the broker’s regulator standing, supported payment methods, and customer service channels.

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

However, from the perspective of a day trader – it’s crucial that you choose a broker that offers super-low fees. The reason for this is simple – the vast majority of day traders will look to make modest gains – whereby positions might remain open for minutes or hours.

Of course, there is only so much that an asset can increase or decrease in such a short timeframe – which is why potential profit margins are conservative.

As a result of this, your chosen broker must offer:

- Low commissions, and

- Tight spreads

Starting with commissions, this is the fee that you will pay to your broker to enter and exit the market. For example, if you stake $500 and the broker charges a commission of 0.5% per slide – you will pay $2.50 to enter the market. Then, if you decide to close your position when it is worth $550, your commission will amount to $2.75.

Now, although this might not sound like a lot – it is. After all, suppose that you entered a quick day trade that resulted in a profit of 0.6%. This is a good outcome for a couple of hours’ worth of work. But, the vast majority of your profit would be eaten away at by the 0.5% commission you paid to both enter and exit the market.

This is why – as we cover in the section below, we prefer brokers like eToro, Robinhood- as they charge a commission rate of 0%. As such, these platforms are highly conducive for the best day trading strategies that we have discussed today.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

On top of commissions, you also need to have a firm grasp of what spreads you will be paying. If you’re new to this term, the spread is simply the difference between the buy and sell price of an asset.

For example, if the difference is 1% – this means that your broker makes 1% from the trade irrespective of which way the markets move. In other words, when your day trading position is open, you need to make 1% just to break even. As such, you’ll want to choose a commission-free broker that offers super-tight spreads.

Best Day Trading Platforms

It’s time to consider which platform is best suited for your needs. This is the difficult part – as there are hundreds of day trading platforms that are all vying for your business. To save you from having to personally review hundreds of brokers – below we review a selection of the very best day trading platforms for 2025!

1. eToro – Overall Best Day Trading Platform 2025

Not only that, but eToro offers some of the tightest spreads in the day trading space – and opening an account is quick, easy, and free. In terms of supported markets – you’ll have thousands to choose from at eToro. This includes 18 digital currencies – which is perfect if you are looking to deploy the best crypto day trading strategies. You can also trade stocks from 17 different exchanges.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

This includes markets in the US (NASDAQ and NYSE), as well as London, Amsterdam, Frankfurt, Paris, Hong Kong, and more. ETFs and index funds are also supported. The latter covers some of the most liquid indices in the space – such as the Dow Jones, S&P 500, FTSE 100, and NASDAQ Composite. If you’re looking at using the best forex day trading strategies – eToro supports 49 currency pairs across the majors, minors, and exotics.

You can also trade heaps of commodities – including everything from gold, silver, and oil to natural gas, wheat, and sugar. The minimum stake per trade is $25 and $50 on other financial instruments. eToro also offers a fully-fledged day trading simulator that comes pre-loaded with a $100k balance. You can use this for as long as you wish, to perfect the best day trading strategies that we have discussed on this page.

And of course – we couldn’t review eToro without discussing its industry-leading Copy Trading tool. As we covered earlier, this allows you to fully automate your day trading strategies by mirroring the positions of an experienced investor. When it comes to funding, eToro supports debit/credit cards and bank transfers. You can also deposit funds with Paypal, Skrill, or Neteller. Everything is done by the book at eToro – as the broker is regulated by the FCA, CySEC, and CySEC.

Pros:

- Super user-friendly trading platform with 20 million+ clients

- Buy stocks without paying any commission or share dealing charges

- 2,400+ shares and 250+ ETFs listed on 17 international stock markets

- Trade cryptocurrencies, commodities, and forex

- Deposit funds with a debit/credit card, e-wallet, or bank account

- Ability to copy the trades of other stock trading pros

- Regulated by the FCA, CySEC, ASIC and registered with FINRA

Cons:

- Not suitable for advanced traders that like to perform technical analysis

There is no guarantee that you will make money with this provider. Proceed at your own risk..

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

2. Robinhood – Best Day Trading Platform for Americans

If you’re an American and searching for the best day trading platform – you might want to consider Robinhood. This platform gives you access to several popular asset classes – including over 5,000 stocks and ETFs. Most of these assets are US-listed – so you’ll be trading equities on the NASDAQ and NYSE.

In addition to stocks and ETFs, you will also have access to several digital currencies. As such, if you’re looking to use the best crypto day trading strategies discussed today – Robinhood is a great option. If you have a bit of experience in the world of day trading – then you might also consider the options department at the broker. This allows you to placed leveraged positions on stock options at the click of a button.

When it comes to day trading fees – this is where Robinhood really stands out. This is because – and much like eToro, you will not be charged any trading commissions when you enter and exit a position. There is no ongoing platform fee either and deposits and withdrawals are free when using ACH. If you wish to purchase stocks on margin – you can do this by upgrading to the Robinhood Gold Account – which costs just $5 per month. This also gets you access to higher instant deposits.

Pros:

- Hugely popular trading platform in the US

- Buy over 5,000 US-listed stocks

- ETFs, cryptocurrencies, and stock options also supported

- Does not charge any commissions

- No minimum deposit in place

- Very simple to use and ideal for newbies

- Heavily regulated in the US

Cons:

- Only 250-ish international stocks offered

- No debit/credit card or e-wallet deposits

- Confusing margin rates

There is no guarantee that you will make money with this provider. Proceed at your own risk..

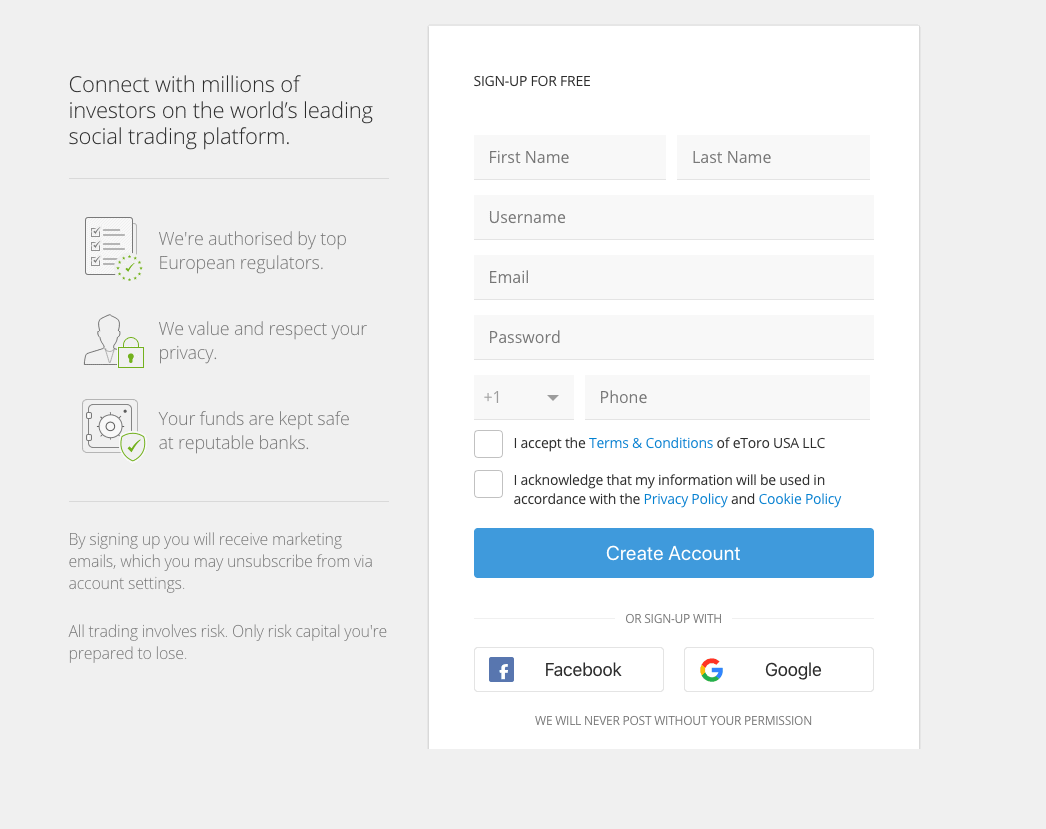

How to Start Day Trading with Strategy

This comprehensive guide on the best day trading strategies will conclude by showing you how to get started today. In fact, by following the simple step-by-step walkthrough below – you will be day trading at commission-free broker eToro in less than 10 minutes!

Step 1: Open a Day Trading Account at eToro

Opening a day trading account at eToro takes no more than 5 minutes. Simply visit the eToro website, click ‘Join Now’, and follow the on-screen instructions.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

You will be asked to provide your:

- Personal information

- Contact details

- National tax number

You also need to upload a copy of your government-issued ID – as per KYC laws. However, you don’t need to do this right now – as long as you are not depositing more than $2,250.

Step 2: Deposit Funds

Now it’s time to make a deposit. If you want your payment process instantly – choose from one of the following deposit types:

- Debit card

- Credit card

- Paypal

- Skrill

- Neteller

If you opt for a bank transfer/wire – it might take a couple of days to process. With that said, eToro also offers instant bank deposits – but this will depend on where you live.

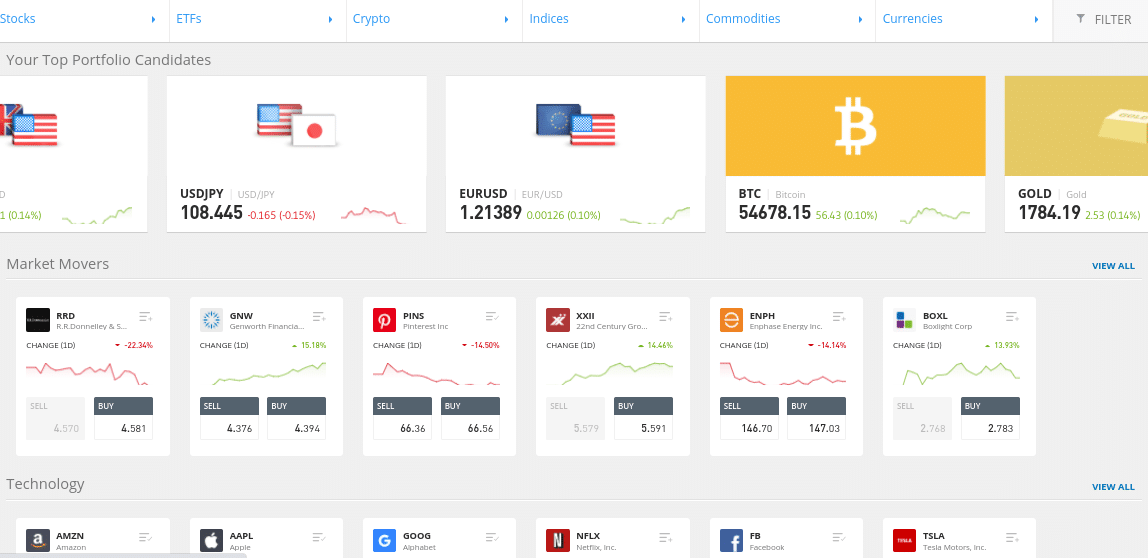

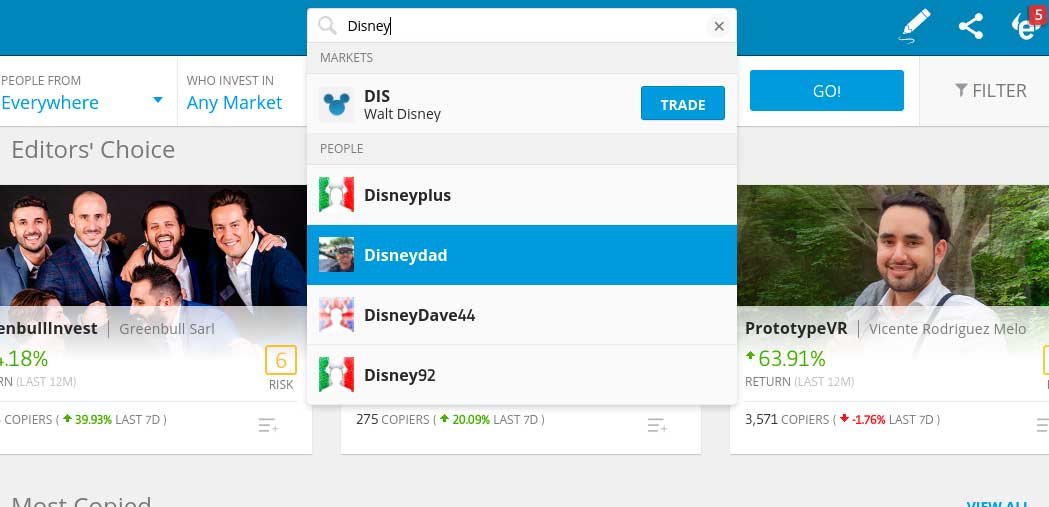

Step 3: Search for a Day Trading Market

Not sure which financial instrument you wish to day trade? If so, click on the ‘Trade Markets’ button and browse the many assets that eToro supports.

Or, if you know which market you want to speculate on – search for it. As you can see from the image above, we are searching for Disney stocks.

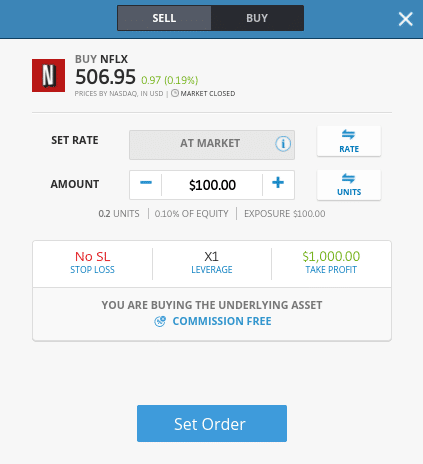

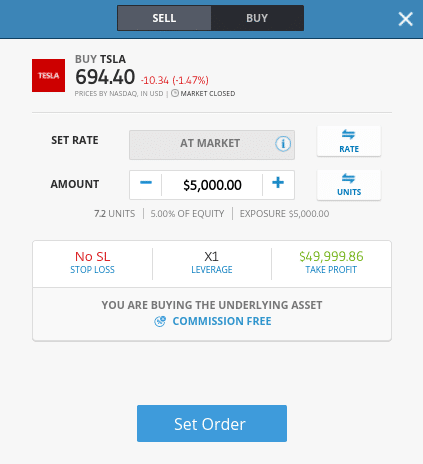

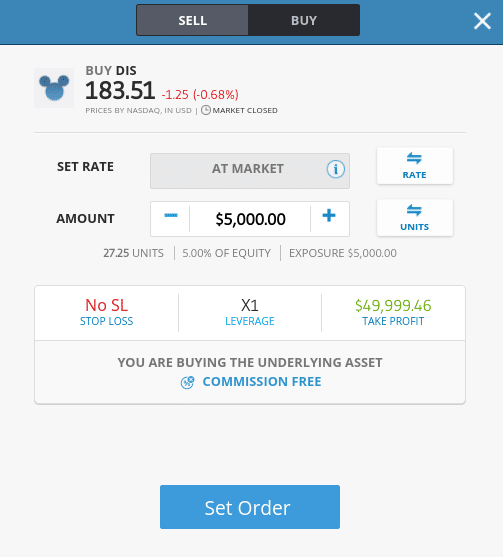

Step 4: Deploy Day Trading Strategy

You now need to deploy your chosen day trading strategy by setting up an order. If you need a refresh on how day trading orders work – scroll back up to Strategy 3.

Finally, click on the ‘Set Order’ button to place your day trading position!

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Conclusion

In conclusion, this guide has discussed 10 of the very best day trading strategies that work. We have also discussed the importance of choosing a good day trading platform – especially when it comes to low commissions and tight spreads. Additionally, you’ll also want to ensure that the broker offers a top-rated day trading simulator.

If you’re looking to deploy some of the best day trading strategies discussed today – eToro is a great option. It takes just minutes to set up an account, you’ll have access to thousands of markets, and you won’t pay a cent in trading commissions. Most importantly – your funds are safe at eToro – as the broker is heavily regulated.

eToro – Best Trading Platform – Friendly-User and Regulated

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.