eToro Review for July 2025 – Fees & Features Revealed

eToro is now one of the largest brokerage sites in the online trading scene – with over 20 million clients using the platform. Not only is the broker low cost across thousands of assets and user friendly, but you can even invest passively via the Copy Trading feature.

But, is eToro the right online broker for you?

In this eToro review 2025 – we cover everything there is to know about this popular brokerage site.

** Below content does not apply to US users

1

Payment methods

Features

Customer service

Classification

Mobile App

Fixed commissions per operation

Account Fee

- Buy shares and ETFs with 0% commission

- Social and copy trading network

- Invest and trade crypto with low fees

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Account Info

Fees per operation

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

What is eToro?

eToro is an online broker that was first launched in 2007. The platform – which calls itself the “world’s leading social trading network” – is now home to over 20 million traders and investors. eToro’s rise to fame in such a modest amount of time is attributed to several stand-out features.

Perhaps, at the forefront of this is its social trading offering features which allow traders to communicate with other users of the platform, post and reply to threads, and even ‘Like’ comments. This ultimately allows you and your fellow investors to discuss trading ideas.

You then have the innovative Copy Trading tool, which allows you to select seasoned eToro investors and copy their portfolio and ongoing positions like-for-like. .

Unlike many of its industry counterparts, the eToro platform is user-friendly – making it suitable for less-experienced traders. eToro is also regulated across several jurisdictions – so your capital is safe.

eToro Pros & Cons

Before we delve into the ins and outs of our comprehensive eToro review – allow us to break down the key pros and cons that we discovered.

Pros:

- A user-friendly online broker and trading platform

- eToro offers low fees with commissions from 0%

- It is possible to trade stocks, indices, ETFs, cryptocurrencies, forex, and more

- Deposit funds with a debit card, or bank account

- Social trading and copy trading features are available

- Regulated by the ASIC, and CySEC

Cons:

- Not suitable for advanced traders that like to perform technical analysis

- $5 withdrawal fee

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

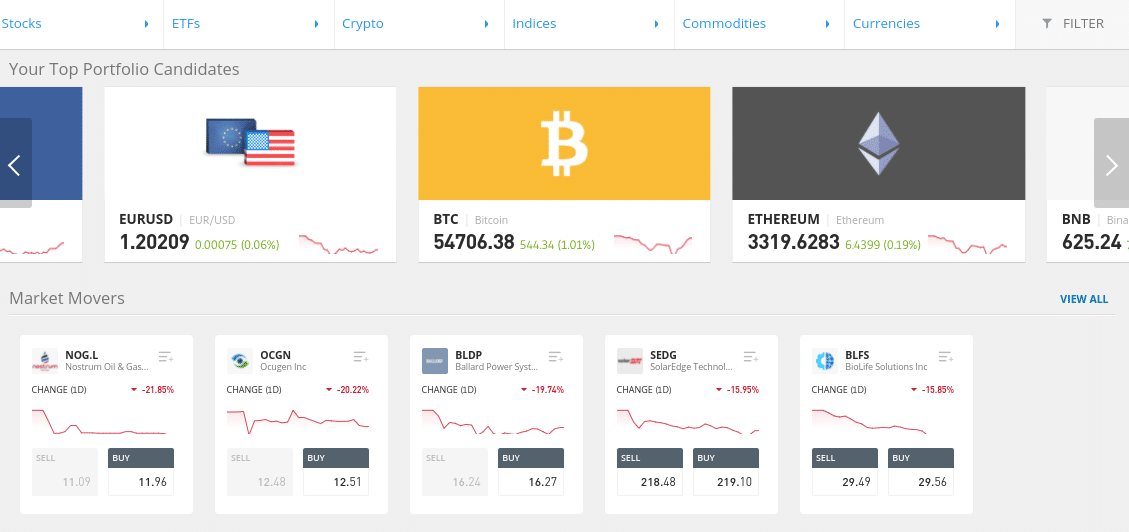

What Can You Trade on eToro?

In the first part of our in-depth eToro review, we took a close look at the markets and asset classes that eToro supports.

Note: As we cover in more detail below, some assets (stocks, ETFs, cryptocurrencies) can be purchased and owned in the traditional sense, while others (forex, commodities, indices) are traded as leveraged Contract for Difference (CFD) products.

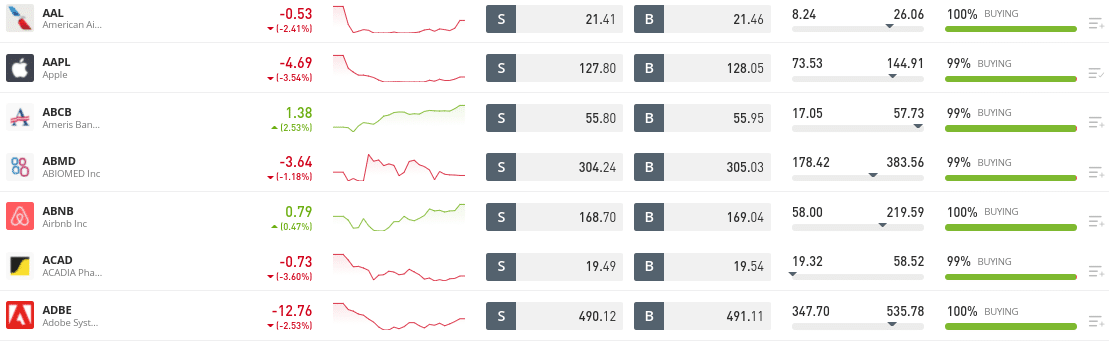

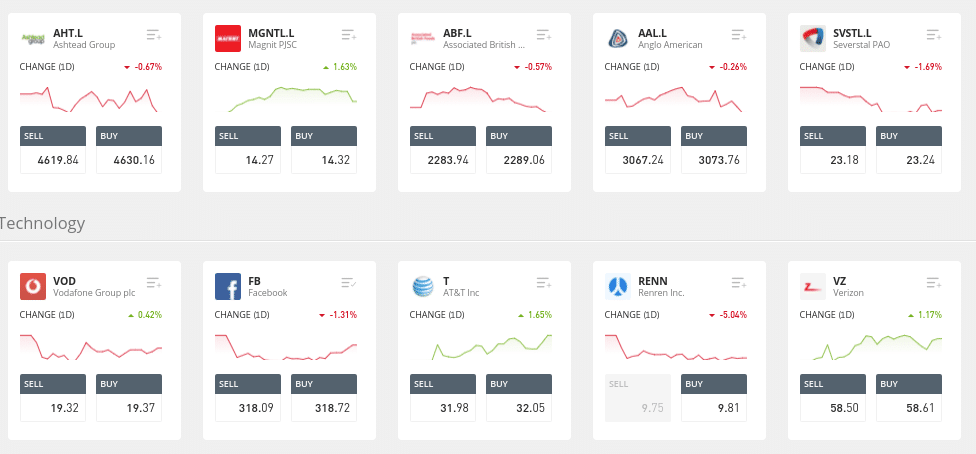

eToro Stocks Review

Let's start with the eToro stock trading department. In a nutshell─ this brokerage site gives you access to thousands of stocks. Not only does this include the two leading US exchanges - the New York Stock Exchange (NYSE) and NASDAQ, but 15 other international markets.

This includes:

- Frankfurt

- London

- Paris

- Madrid

- Milan

- Zurich

- Oslo

- Stockholm

- Copenhagen

- Helsinki

- Hong Kong

- New York

- Lisbon

- Brussels

- Riyadh

- Amsterdam

As you can see from the above, you'll have access to stock markets in North America, Europe, Asia, the Middle East, and more. There are a number of key points to note about the stock trading department at eToro.

Firstly, when you buy stocks you own them outright. This means that you are officially a stockholder and thus - you will be entitled to dividend payments as and when the respective company makes a distribution. Secondly, eToro supports fractional ownership - which paves the way for small investors.

eToro Fractional Ownership

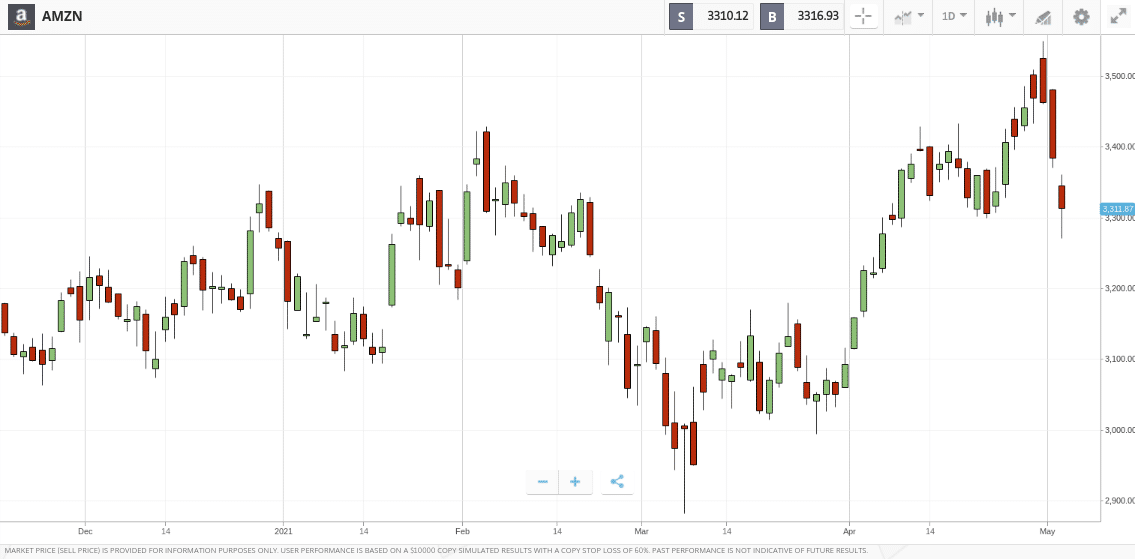

Fractional ownership is a crucial aspect of the modern stock trading scene - especially if you wish to invest in US-listed companies that can be deemed 'expensive'. For example, Amazon stocks trade at over $3,300 and Tesla in excess of $700.

At eToro, the minimum stock investment is just $10 - irrespective of how much the shares are priced at.

If you're new to fractional stock investments - here's how it works at eToro.

- Let's suppose that you are interested in buying Alphabet (Google) stocks

- Currently priced at over $2,300 per share - you don't have the means to purchase a full stock

- At eToro, you decide to invest the minimum - which is just $10

- In doing so - this means that you own 2.17% of one Alphabet (Google) stock

Now, not only is the fractional stock investment tool at eToro great for those on a low budget - but it's also ideal for diversification purposes. For example, if you were to deposit $1,000 on eToro - you could purchase nearly 20 different stocks at $50 each. This allows you to create a risk-inverse portfolio with ease.

Stock CFDs

We mentioned above that when you buy stocks on eToro you own them outright. With that said, the popular online broker also allows you to trade stocks via CFDs. This will of interest to those of you that wish to trade on a short-term basis. This is because stock CFDs allow you to benefit from additional perks - such as leverage and short-selling.

For example:

- Traders from most countries will be offered leverage of 5:1 on eToro when trading stock CFDs. This means that you are able to trade stocks with five times the amount you have in your eToro account.

- Stock CFDs also allow you to enter a short-selling position on eToro. This means that you can profit in the event a stock goes down in value.

All of the same stocks and exchanges that can be purchased in the traditional sense can also be traded via CFD instruments.

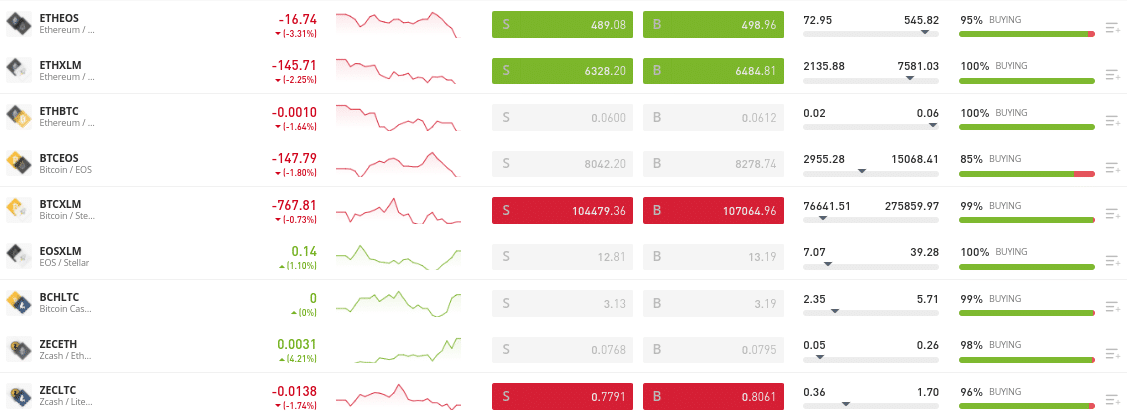

eToro Cryptocurrencies review

So now that we have covered stocks, in this section of our eToro review will are going to look at the cryptocurrency department. This is split into various digital currency markets and pair types, so we will break each segment down one by one.

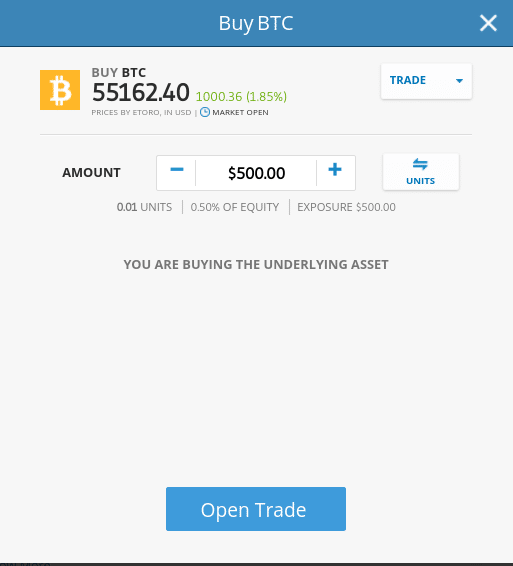

Buy Cryptocurrency on eToro

If you are a long-term crypto investor - you will be pleased to know that eToro allows you to buy and own 25 different cryptocurrencies.

This includes:

- Bitcoin

- Ethereum

- Bitcoin Cash

- Ripple

- Dash

- Litecoin

- Ethereum Classic

- Cardano

- IOTA

- Stellar

- Aave

- EOS

- NEO

- TRON

- Zcash

- Tezos

- Chainlink

- Uniswap

- Dogecoin

- Shiba Inu

- Enjin

- Basic Attention Token

- Yearn.finance

eToro is constantly adding new digital currencies to its list of supported coins - in line with market demand. For example, in the few days prior to writing this eToro review, the broker added Dogecoin.

In terms of ownership, you will be buying your chosen cryptocurrency outright - meaning that you can keep hold of your investment for as long as you wish. You will, of course, also need to consider how you intend storing your newly purchased digital coins on eToro.

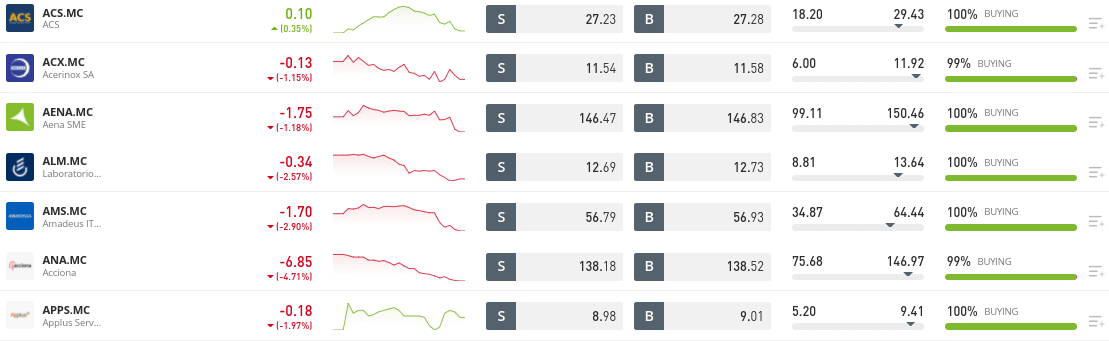

eToro Wallet

Once you have purchased a cryptocurrency on the eToro website - you have two options when it comes to storage.

- The vast majority of investors will simply leave the coins in the eToro web wallet.

- This is managed and governed by the eToro team, meaning that you will benefit from institutional-grade security practices.

- It also means that you do not need to have any knowledge or experience of how cryptocurrency wallets work.

- Instead, you will see the coins displayed in your eToro portfolio and how much they are worth in real-time.

Furthermore, by taking this option, you can sell your coins at the click of a button without needing to perform a transfer.

The second option you have is to download the native eToro crypto wallet - which is available via an Android in Google Play and iOS mobile app. This option will give you more control over your cryptocurrency investments - as you have the option to transfer coins in and out of the wallet.

The eToro wallet supports over 120 digital currencies and you can instantly convert one coin to another without leaving the app.

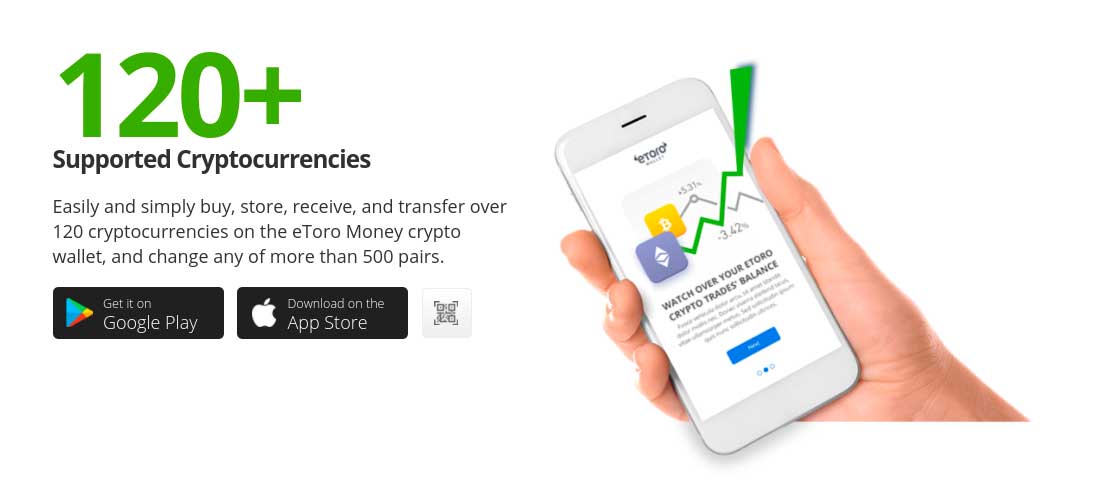

eToro Cryptocurrency Trading

In addition to being able to buy digital coins on the eToro website - you can also engage in cryptocurrency trading. Once again, this will appeal to those of you that wish to adopt a crypto day trading strategy. Now, most digital currency trading on eToro is done via CFD instruments.

As we covered earlier, not only does this allow you to apply leverage but you can also enter a short-selling position. Regarding the former, most traders are capped to leverage of 2:1. This means that you can trade cryptocurrencies with twice the amount you have in your eToro account.

In terms of supported markets - this comes in two forms.

First, you have crypto-to-fiat pairs. This means that you are trading the exchange rate between a fiat currency and a cryptocurrency. All of the 19 coins we listed earlier can be traded against the US dollar. Furthermore, many of the aforementioned coins can also be traded against another fiat currency - such as the British pound, euro, Japanese yen, and Australian dollar.

Secondly, you have crypto-to-crypto pairs. As the name suggests, this means you will be trading the exchange between two digital currencies - say Bitcoin and Ripple (BTC/XRP) or EOS and Ethereum (EOS/ETH).

Crucially - irrespective of whether you buy cryptocurrency or trade via CFDs - the minimum stake is just $10. Once again, this is through the eToro fractional ownership tool.

How to transfer cryptos from eToro wallet to MetaMask

While eToro does offer trading on the largest crypto assets, the availability to tokens is limited. Luckily, it is possible to transfer crypto from eToro to other platforms so that you can swap tokens for assets that aren't available on the platform.

To do this, you will need to transfer your tokens from eToro Money to a decentralized wallet such as MetaMask.

Step 1: Open the eToro money app

To send crypto from your eToro account to MetaMask, you will first need to make sure that it is held in the eToro Money wallet rather than the trading account.

Download eToro Money on your mobile device and create an account. Then, login in using your trading account credentials. You will then be able to transfer assets from your trading account to the eToro Money wallet.

Step 2: Send crypto to your MetaMask address

Once your cryptos are stored in the eToro Money wallet, you will be able to send them to toher addresses.

To do this, simply click on the token that you want to transfer and choose 'send'. Then, you will need to enter your MetaMask wallet address or scan the QR code.

It is important that you enter the address correctly. If you enter the wrong wallet address your funds will be lost forever.

After confirming the address, click 'send' and the tokens will leave your eToro Money wallet and should appear in your MetaMask after a few minutes.

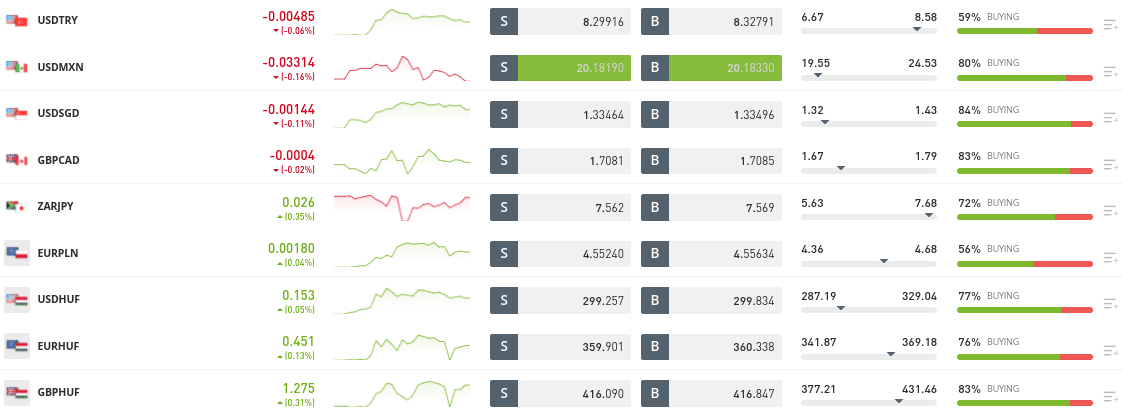

eToro Forex review

If you're preferred asset class is forex - eToro has you covered. At the time of writing the brokerage site offers 49 forex trading pairs - all of which can be traded around the clock. You will have access to all major and minor pairs - covering the likes of EUR/USD, GBP/USD, and EUR/GBP.

eToro is also a great option if you have a higher appetite for risk and thus - you wish to trade exotic currencies. Some of the exotic forex pairs hosted by eToro include USD/CZK, USD/RON, EUR/PLN, and ZAR/JPY.

In terms of leverage, most traders on eToro will be offered 30:1 on major currency pairs, and 1:20 on minors and exotics. This is ideal if you wish to trade forex but only have access to a small amount of capital.

eToro ETFs

If eToro currently offers in the region of 250+ ETFs - which is ideal if you wish to invest in a diversified portfolio of assets. This includes index funds such as the Dow Jones, FTSE 100, and S&P 500 - backed by providers like Vanguard, iShares, and SPDR.

You can also invest in ETFs that track commodities like gold and silver, as well as portfolios that track dividend stocks, growth stocks, blue-chip stocks, and more. Regardless of the ETF you wish to invest in, the minimum stake is just $10. You will, of course, be entitled to dividends as and when the ETF provider makes a payment.

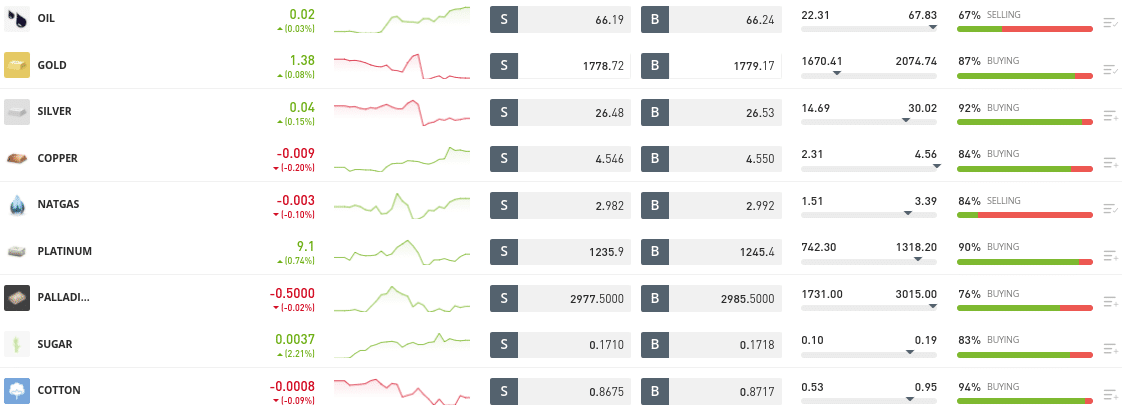

eToro Commodities

If you wish to trade commodities from the comfort of your home - eToro offers 31 markets. These can also be traded via leveraged CFDs - with offering typically offering 1:20 on gold and 1:10 on other assets. Short-selling is also available should you believe a commodity is overvalued.

The commodity trading department on eToro consists of three core categories:

- Precious Metals: Gold, silver, platinum, etc.

- Energies: Crude oil, natural gas, etc.

- Agricultural: Wheat, sugar, corn, etc.

The minimum trade size when buying and selling commodity CFDs on eToro is $1000.

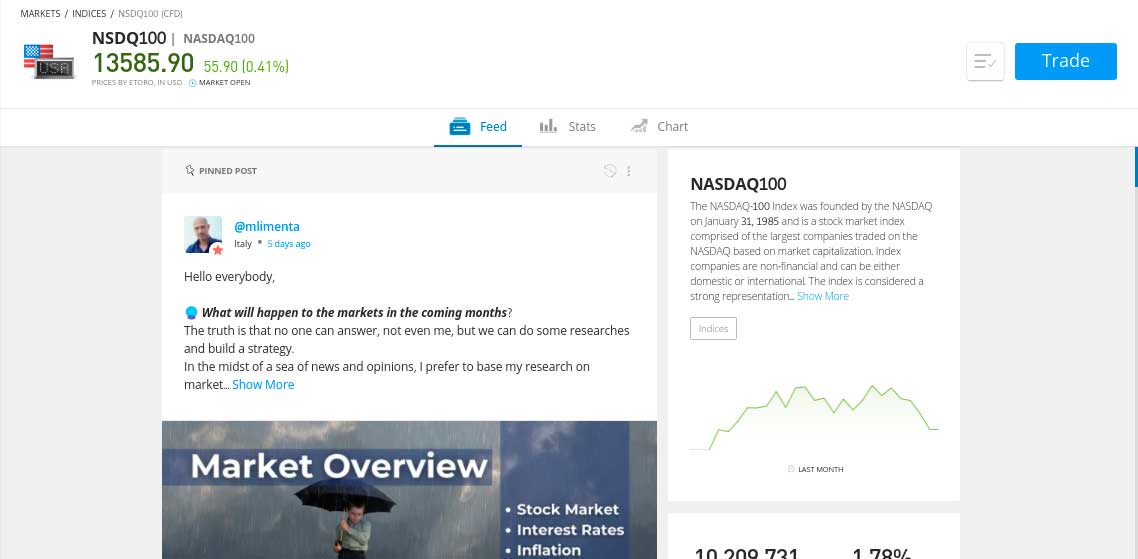

eToro Indices

The final asset department that we came across during our eToro review process is that of indices. In total, you can speculate on the future value of 13 different indices - covering the likes of the FTSE 100, Dow Jones, S&P 500, Spain 35 (IBEX 35), Hong Kong 50, and more.

Leverage of 1:20 and 1:10 will be offered on major and minor indices, respectively.

eToro Fees & Commissions

So now that we have covered what financial instruments the broker supports - in this section of our eToro review we will break down the main fees that you will need to pay.

Before we explain the pricing structure in more detail - check out the eToro fees table below

eToro Fees review (Non-Trading)

| Fee Type | Charge |

| Open an account | FREE |

| Platform fee | FREE |

| Inactivity fee | $10/month after 12 months |

| Deposit fee | 0.5% on non-USD deposits |

| Withdrawal fee | $5 |

As per the above, there is no ongoing platform charge at eToro - meaning you can keep hold of your investments for as long as you wish without needing to worry about monthly/quarterly fees.

Stamp Duty

If you are looking to buy shares that are listed on the London Stock Exchange - a stamp duty tax of 0.5% is payable. This is ordinarily deducted by the brokerage site that you use to make the investment. However, eToro waivers this fee - meaning that you can buy UK stocks and save yourself a further 0.5%.

eToro Spreads

eToro uses the industry-wide system of variable spreads. For those unaware, this means that the spread - which is the difference between the buy and sell price of an asset, will vary throughout the day. This will generally be more competitive during busy market hours - such as when you trade EUR/USD during the US/European cross-over.

The spread will, of course, vary quite considerably depending on which market you wish to trade. For example, if you are trading major stocks listed on the NASDAQ or NYSE - you'll likely pay an average of 0.2%. If trading gold or a major index like the Dow Jones, this will be even lower.

In the case of cryptocurrencies like Bitcoin - we found the spread to average 1% - and slightly more on other digital assets. Ultimately, while listing each and every spread is beyond the remit of this eToro review - we found that across the board the broker is generally very competitive.

Deposit and Withdraw Fees

First and foremost, if you are a US resident depositing in US dollars - you can fund your account without paying any fees. Everyone else will pay a foreign conversion fee of 0.5% - which is multiplied against the size of your deposit.

Although this isn't ideal - don't forget that you will be using eToro without paying any ongoing fees. You will also avoid paying an FX fee when buying or selling assets listed on an international market.

In terms of withdrawals, eToro charges a flat fee of just $5 - which is payable irrespective of how much you wish to cash out or the payment method you are using.

Inactivity Fee

Like most brokers in the online space, eToro charges an inactivity fee. This will cost you $10 per month after 12 months of inactivity. Of course, if you have assets in your portfolio - then the inactivity fee will not come into play. Furthermore, if your account balance is empty anyway - you don't need to worry about this fee.

If, however, you have funds in your account and no assets in your portfolio - the clock will start ticking towards your inactivity period of 12 months. Simply place a trade and the clock will reset

Overnight Financing

If you decide to buy an asset like stocks or cryptocurrencies in the traditional sense - you don't need to worry about overnight financing. This fee only comes into force if you are:

- Trading CFDs, and

- Keep your position open overnight

If you're a seasoned trader then you will know that all CFD trading platforms charge overnight financing fees. After all, CFDs are leveraged financial instruments.

As always, the amount you pay on eToro will depend on several variables, such as:

- Your stake

- The asset you are trading

- The amount of leverage applied (if any)

The good news is that you can view your daily overnight financing fee in dollars and cents when setting up an order on eToro. As you make changes to your order - for example in terms of stake size or leverage, the overnight financing fee will update. This ensures you have a full understanding of your trading costs before you enter the position.

eToro User Experience

We mentioned earlier in our eToro review that the broker is particularly popular with inexperienced traders. This is because the eToro website is as simple as it gets in the world of online investing. You can see for yourself as soon as you land on the eToro homepage how clean and crisp the layout is.

Initially, you are presented with a list of popular financial instruments - such as Facebook, Amazon, and Apple stocks, gold, and the S&P 500 index. You can, however, view the full asset library by clicking on the 'Trade Markets' button. You can then choose the specific asset - such as stocks, for a further breakdown of what is on offer.

The preferred market can found by using the search box at the top of the page. Either way, once you have found the asset you want to buy or trade, the process of setting up an order is also simple. In fact, it's just a case of entering your stake and confirming the positions.

This is in stark contrast to other online trading platforms that are jam-packed with overly complex tools and features. This makes the platform suitable for less-experienced users who may find the abundance of advanced tools on other platforms confusing to navigate.

eToro Social Trading

Our eToro trading platform review was particularly keen to explore the platform's claim as the "world’s leading social trading network". For those new to the phenomenon, this works in a similar way to social media platforms like Facebook. For example, you have the option of uploading a photo to your profile and choosing a username.

You can publish your thoughts via a post - which other eToro traders can then see. Some traders might decide to 'Like' or reply to your post. You can also add traders to your 'watchlist' - meaning that you will be notified if and when they comment or 'Like' post on the eToro website.

All in all, we really like the eToro social trading side of things - as it allows you to communicate with like-minded people. It also allows you to learn and grow while you trade - as you get to see what the most successful investors are doing. You can also use the social trading tools to gauge what the wider market sentiment is at any given time.

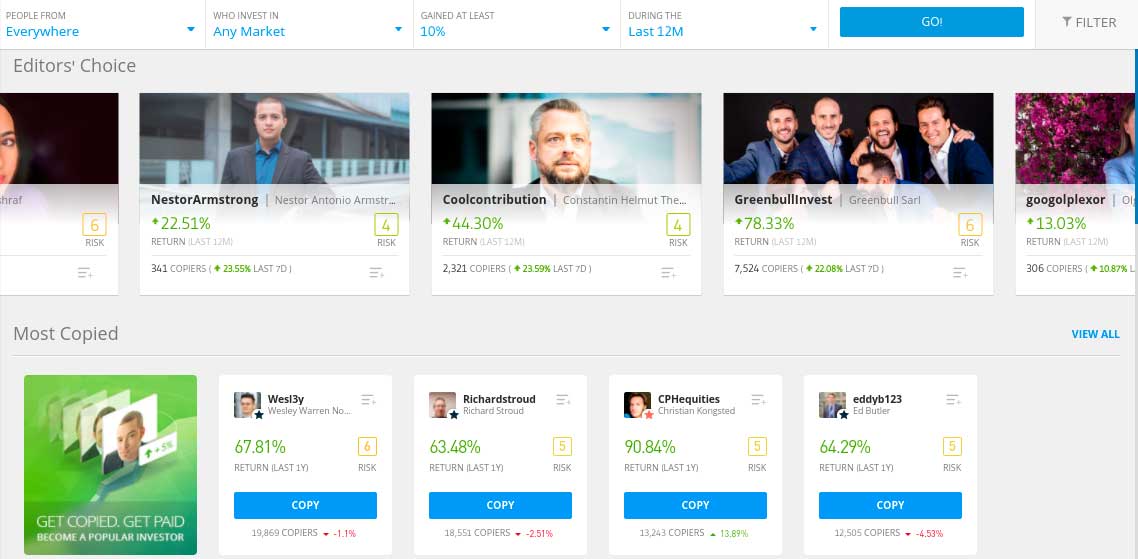

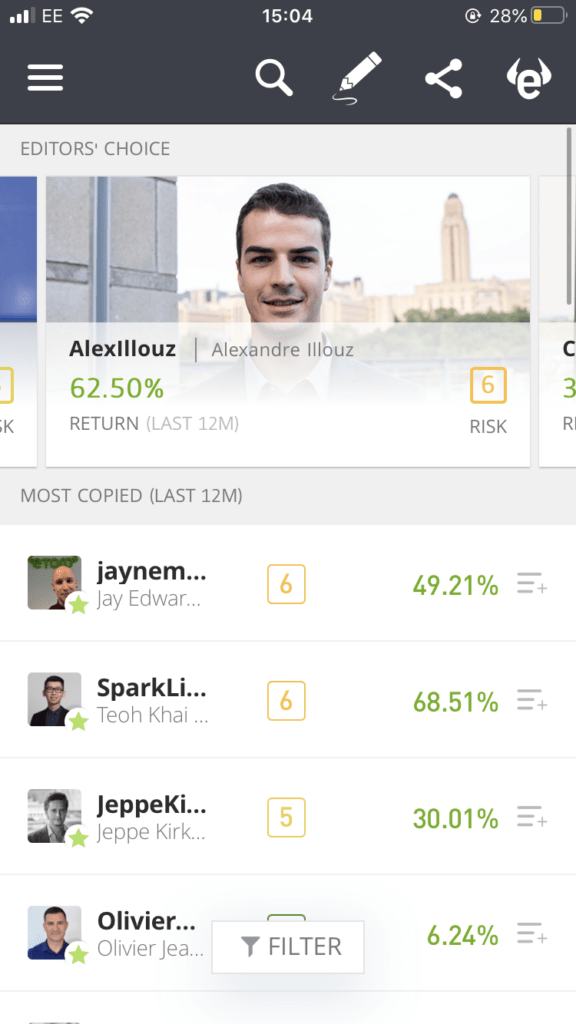

eToro Copy Trader review

A direct offshoot of the social trading phenomenon is that of copy trading. In our view, this is arguably the 'Flagship' product offered by eToro - as it paves the way for a 100% passive way of trading.

The main concept is as follows:

- Those with a proven track record of investing on the eToro website can join the copy trading program

- In total, there are thousands of such traders active on the platform

- Once you find a trader that you like the look of - you can elect to copy them

- Moving forward, any trades that they place will be reflected in your eToro portfolio

When you invest in a copy trading pro - your mirrored positions will be proportionate to the amount you invest. The minimum per trader is just $200 - and there are no additional eToro fees that come into play.

Past performance is not an indication of future results

Here's a more detailed example of how the eToro copy trading tool works:

- You decide to invest $1,000 into an eToro trader that specializes in stocks

- The trader allocates 10% of their portfolio into Microsoft stocks and 15% to Facebook

- This means that you automatically invest $100 (10%) and $150 (15%) into the respective companies

- The trader exits their Facebook position - making gains of 50%

- You also close the position - making a profit of $75 (50% of your $150 investment)

- A few days later, the trader also closes their Microsoft position - this time at a profit of 40%

- You do the same - making a profit of $40 along the way (40% of your $100 investment)

As you can see from the above, the automated trading aspect of this feature is heavily suited to traders with little time to spend on research and analysis. Instead, it's just a case of choosing a trader to copy and allowing them to trade on your behalf.

You still retain full control over your eToro portfolio at all times - so you can add or remove assets as you please. You can also elect to stop copying a trader at any time. When you do, all of the open positions you are mirroring will be closed.

How to Choose an eToro Copy Trader

Once you click on the 'Copy People' button on the left-hand side of your eToro account - you will have access to thousands of verified traders. As you can imagine, reviewing the credentials of each trader is beyond the realms of possibility, so you will need to use the filter buttons.

This is great, as you can find a trader that specifically meets your needs, financial goals, and appetite for risk.

To give you an idea of some of the filters you can use to find a trader, this includes:

- Minimum ROI over a specific time period (e.g. 10% per year for at least 24 months)

- Preferred asset class (e.g. stocks or forex)

- Risk score (1 being the lowest and 6 the highest)

- Daily or weekly drawdown in percentage terms

- Average trade duration

- And much more

Once you have narrowed down your filters, you can click on a trader to take a closer look at their statistics. For example, you can see how much the trader has made each month since joining the eToro website.

You can also explore what trades they currently have in play and the total amount of risk associated with the individual. Additionally, you can view how many eToro customers are copying the specific trader and what this relates to in dollars and cents.

Examples of eToro Copy Traders in 2025

If the thought of vetting thousands of investors seems like a daunting task - below we have listed three active eToro copy traders currently available on the site.

Jeppe Kirk Bonde - 30% Average Annual Return Since 2013

This trader is based in the UK and has been using eToro since 2013. As such, we have over 8 years' worth of trading data to work with. In a nutshell, Jeppe Kirk Bonde has generated average annual returns of 30% since joining in 2013 - meaning that he has outperformed the wider financial markets.

Apart from a very small holding in Bitcoin - Jeppe Kirk Bonde focuses exclusively on stocks. In 2019 and 2020 the trader grew his portfolio by 45% and 36% respectively. In the first four months of 2021 - Jeppe Kirk Bonde is up 10%.

Wesley Warren Nolte- Returns of 650% Over the Past 5 Years

Much like Jeppe Kirk Bonde - this eToro copy trader has an excellent track return on the brokerage site. Put simply, Wesley Warren Nolte has generated returns of over 650% in the past five years for his strong following. At the time of writing, almost 20,000 eToro customers are copying the trader.

This amounts to millions of dollars worth of capital under management. All of the assets held by Wesley Warren Nolte come in the form of stocks - most of which are US-based. The trader aims to outperform the S&P 500 by at least 20% this year.

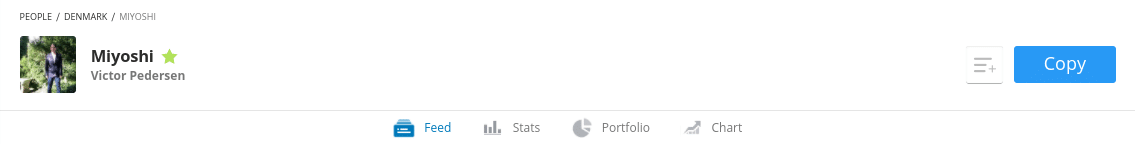

Victor Pedersen - Successful eToro Swing Trader

Victor Pedersen - who goes under the username Miyoshi - is a swing trader based in Denmark. Although the individual joined eToro as recently as January 2018 - it's been up, up, and away ever since. In fact, in his first year of trading - Victor Pedersen made financial returns of over 103%.

In the following year, the trade made 68% and the first four months of 2021 - is almost 8% in the green. Victor Pedersen is super active on eToro - with an average of 48.45 trades placed each and every week. The average trade duration is just 1.5 weeks and Victor Pedersen aims to 'radically' outperform the S&P 500.

Note: If you want more information on one of the above traders - search for their username on the eToro website.

Past performance is not an indication of future results

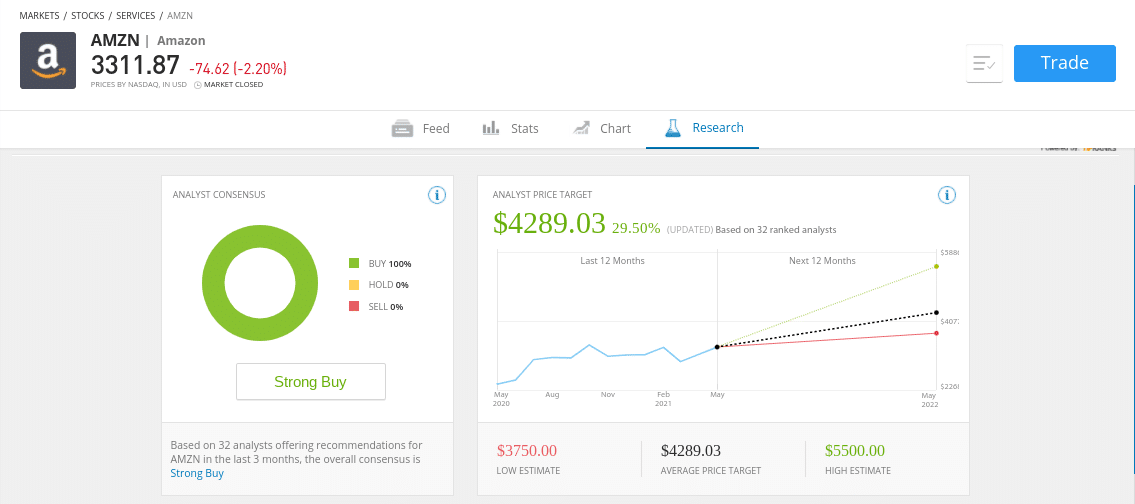

eToro Charting and Analysis

eToro is a super user-friendly trading platform that's typically preferred by inexperienced investors that don't have any knowledge of financial analysis. With this in mind, it will come as no surprise to learn that the number of research and analysis tools is a bit thin on the ground.

On the other hand, eToro does offer a fairly comprehensive fundamental research facility on major stocks. For example, you can view key metrics surrounding market sentiment with a breakdown of whether analysts believe the stock is a buy, sell, or hold. You can also view price targets and hedge fund ratings.

eToro App Account Types

When you register on the eToro website - by default you will be given a standard account. This gives you access to all of the markets, tools, and features discussed so far in this eToro review.

If, however, you are a follower of the Islamic faith, eToro can offer you a specialist account. You will need to contact eToro to get this opened and you will be required to deposit at least $1,000 to be eligible.

Additionally, eToro also offers corporate accounts. The minimum deposit on this account type is $10,000 for clients in the UK, Australia, Denmark, Estonia, France, Germany and Ireland; $25,000 for clients in Italy and $50,000 for clients in all other eligible countries.

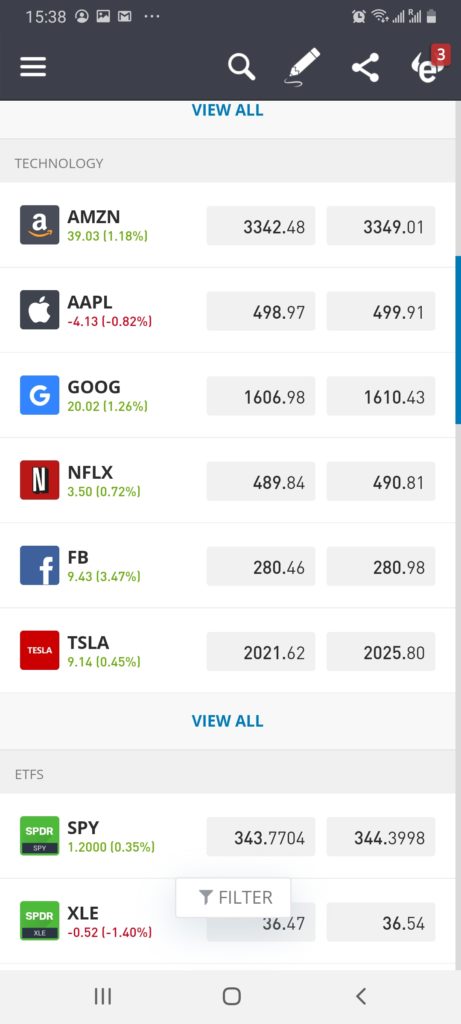

eToro App Review

More and more investors are turning to the eToro trading app - which is available on iOS and Android devices. The app is connected with your main eToro account - meaning you can switch between the two as you see fit.

More importantly, the eToro app comes with all of the same features as found on the main website. This means you can buy, sell, and trade your preferred financial market no matter where you are located.

The app - much like the main website, is really user-friendly. It has been built from the ground up and thus - has been designed specifically for your operating system - whether that's iOS or Android.

You can easily deposit funds via the app to - as well as make a withdrawal request. If you want to find an asset or place an order - you won't be hindered by a smaller screen.

eToro Payments

Another standout feature with eToro - both online or via its mobile app, is the ease in which you can find your account. Unlike a number of brokers active in this space - eToro allows you to deposit funds instantly via a debit/credit card or e-wallet.

Supported payment types include:

- Visa

- Visa Electron

- MasterCard

- Maestro

- Paypal

- Skrill

- Neteller

- Local Bank Transfer (selected countries)

- Interntional Bank Wire

Perhaps the main draw here is the fact that you can deposit and withdraw funds with Paypal. This isn't something that many online brokers offer - so it's notable that eToro supports it. All withdrawals - apart from a bank transfer, are instantly processed by eToro. This means that you can start trading straight away.

When it comes to withdrawals, you can cash out your funds back to the same payment method that you used to deposit.

eToro Minimum Deposit

The minimum deposit at eToro will depend on where you live.

- For most users, the minimum first-time deposit is $50

- If you're from the US - this stands at just $100

- A small selection of nations need to meet a minimum deposit of $1,000

- Those from Israel will need to deposit at least $5,000 and $10,000 respectively

- Islamic accounts require a minimum deposit of $1,000

- Corporate accounts require a minimum deposit of $10,000 for clients in Australia, Denmark, Estonia, France, Germany, Ireland and the UK; $25,000 for clients in Italy and $50,000 for all other eligible countries.

eToro Demo Account

We are huge fans of the eToro demo account for several reasons.

- As soon as you register, you will have access to the eToro demo account by switching from 'Real' to 'Virtual'

- The demo account mirrors live market conditions and you have access to all of the same assets and order types

- You will get $100,000 in paper trading funds which you can reset at any given time

- There is no time limit on the day trading simulator - so you can use it for as long as you wish

There is no requirement to deposit any funds or even upload any ID to use the demo account - which is great.

eToro Contact and Customer Service

Customer support is offered on a 24/5 basis on the eToro platform - which mirrors the traditional financial markets. You can contact the support team in real-time via a live chat facility. This is accessible by logging into your account.

There is no telephone support team, albeit, eToro does accept queries via email. Additionally, eToro is heavily active on social media platforms like Twitter - which is another angle you can take if you need assistance on your account.

Is the eToro App Safe?

Wondering is eToro safe? If so, as great as it is to have access to crypto trading, small stake sizes, Copy Trading tools, and heaps of supported payment types - safety is the most important metric when choosing an online broker. In the case of eToro - the platform is heavily regulated.

The three financial bodies that authorize and regulated eToro are:

- UK Financial Conduct Authority (FCA)

- Australian Securities and Investments Commission (ASIC)

- Cyprus Securities and Exchange Commission (CySEC)

For US-based traders, eToro is also registered with the Securities and Exchange Commission (SEC) and Financial Industry Regulatory Authority (FINRA).

Having such a strong regulatory standing ensures that your capital is protected at all times. Client funds are kept in segregated bank accounts - meaning eToro cannot use them for its own operational purposes. All traders using eToro will also need to go through a Know Your Customer (KYC) process. This will require you to upload a copy of your government-issued ID.

How to Start Trading with eToro

This comprehensive eToro review has covered everything there is to know about the broker – from supported assets and fees to payment types and regulation. If you are planning to join more than 20 million traders by opening an eToro account right now – follow the steps outlined below.

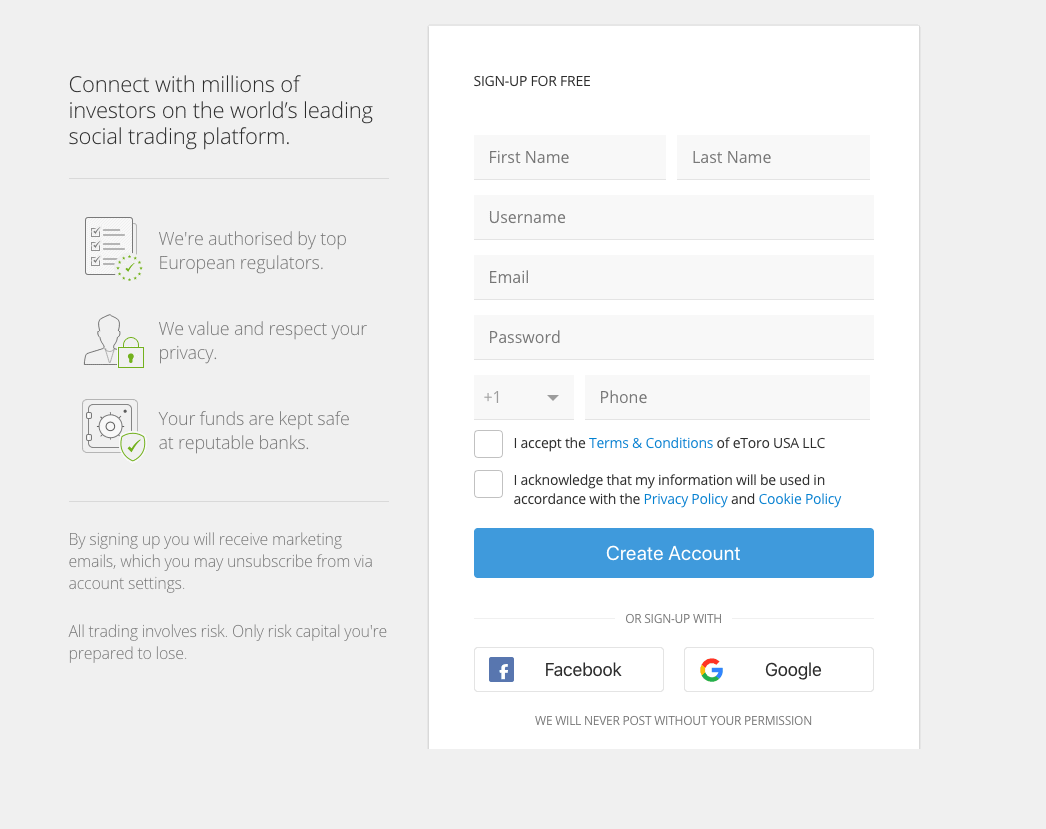

Step 1: Open an Account

Visit the eToro website and begin the account opening process. This will require you to enter some personal information – such as your name, home address, date of birth, national tax number, and contact details.

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Step 2: Confirm Identity

As per KYC regulations, you will need to upload a copy of your government-issued ID. This can be a valid driver’s license, passport, and in some cases – a national ID card. You also need to provide a proof of residency document. This can be a recently issued bank statement or utility bill.

Step 3: Deposit Funds

You can instantly deposit funds into your eToro account via the following payment methods:

- Debit Card

- Credit Card

- Paypal

- Skrill

- Neteller

Bank transfers are also accepted but this might delay the deposit process by a few days.

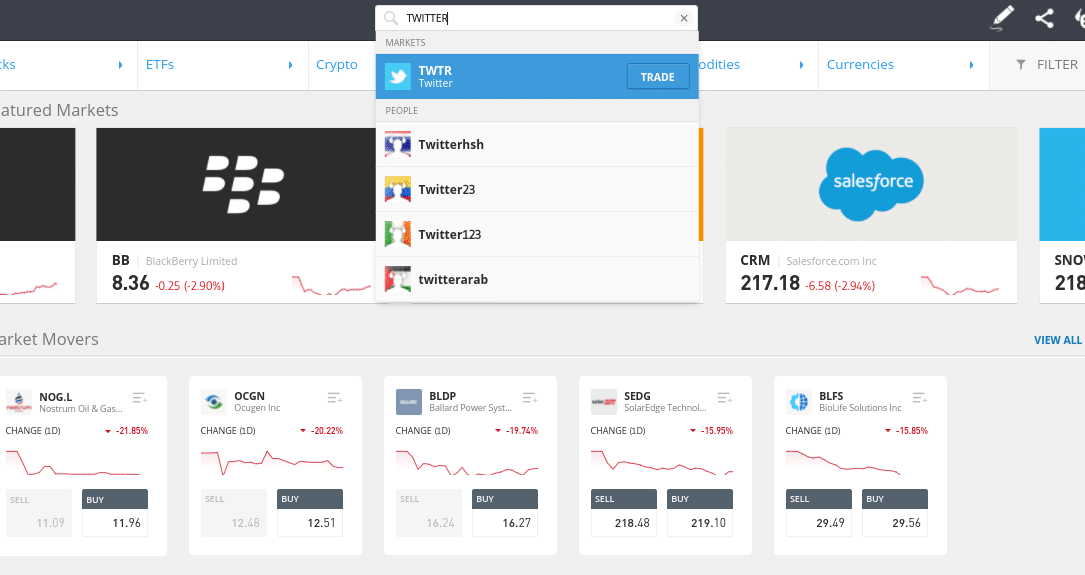

Step 4: Search for Asset

If you know which asset you want to buy or trade – use the search box at the top of the page. As you can see from the below, we are searching for ‘Twitter’ stocks.

Or, you can manually brose what instruments are supported by clicking on the ‘Trade Markets’ button.

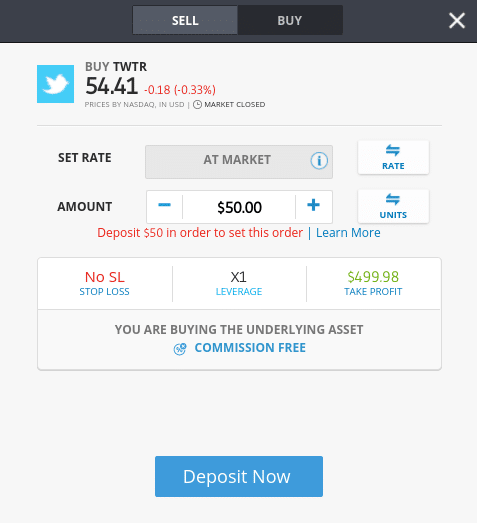

Step 5: Buy Asset

You will now need to complete a simple order form to complete your investment or trade. Simply enter your stake into the ‘Amount’ box and click on ‘Set Order’ to complete the order.

Step 6: How to Sell on eToro

Your position will remain open until you decide to cash out. When you are ready to sell on eToro, head over to your portfolio and find the respective asset. Then, once you click on the ‘Sell’ button and confirm the order – the position will be closed.

The funds – at the current market value of the asset you sold, will be placed into your eToro cash account. You can use the funds to invest in other assets or make a withdrawal.

The Verdict

This highly comprehensive eToro review has covered the nuts and bolts of what this hugely popular brokerage site offers. More than 20 million clients now take advantage of low account minimums, and heaps of supported deposit methods.

Investors of all shapes and sizes are also attracted by the social and copy trading features offered by eToro - as well as the broker's strong regulatory standing. All in all, eToro ticks all of the right boxes that we would expect from a trading platform.

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.