Best Day Trading Simulators for US Traders in June 2025

Day trading simulators provide traders with a risk-free way of testing new platforms and strategies on an interface that replicates real-time market conditions. These tools, also known as demo trading accounts, provide users with virtual funds that can be used to implement strategies, test out features and explore new platforms in a way that reflects real trading conditions.

As a day trader, finding the best simulator is key to a seamless and efficient trading experience. The most suitable platforms should be free to use, offer unlimited demo trades, have an easy-to-use interface, and provide traders with the same tools that are available on the live trading platform.

To help you find the most suitable day trading simulator to use in 2025, our team has spent time testing various platforms. We looked for simulators that met the above criteria and also looked closely at the native broker to determine which platforms come out on top.

In this guide, we review the best day trading simulators for 2025 and show you how to start using one to practice trading for free today.

-

-

A Complete List of The Best Day Trading Simulators in 2025

Here is a list of the best day trading simulator platforms that we reviewed for 2025. We recommend taking time to go through each one before making a final decision.

- eToro: eToro’s demo trading account can be used without depositing any funds onto the platform. traders can access up to $100,000 in paper funds and trade a variety of instruments including copy trading portfolios and Smart Portfolios.

- Libertex: Libertex is a CFD trading platform known for providing competitive spreads on various assets, particularly in the forex market. The platform is notable for its support of the MT4 charting tool, widely regarded as one of the best platforms for conducting technical analysis. With a range of 50 different FX pairs available for trading, Libertex offers a diverse selection.

- AvaTrade: AvaTrade can be used to trade a variety of instruments including forex, stock CFDs and indices. The demo account provides users with access to all features of the platform, including charting tools and technical indicators.

- Forex.com: As the name suggests, Forex.com is a forex trading site that offers over 80 currency pairs. Users can test out forex trading via the paper trading account. The virtual account can be used for just 30 days after which, users will have to trade with real funds.

- TD Ameritrade: TD Ameritrade is considered to be one of the best platforms to trade stocks in the US. The platform is available to use on mobile and desktop and offers commission-free trading for US stocks. Users can test TD Ameritrade through the native demo trading account before using any real funds.

- Interactive Brokers: Users Interactive Brokers can access a day trading simulator by downloading the IBKR mobile app. Here, users can paper trade real-market conditions based off of historical data. After using the simulator, traders can take advantage of commission-free trading for a diverse range of assets.

- FXCM: FXCM is a popular platform that facilitates the trading of forex, cryptos and more. It is possible to use the platform’s day trading simulator to test out trading robots and algo systems on NinjaTrader, MT4 and ZuluTrade. This makes the platform suitable for anyone who wants to try automated trading in a risk-free way.

- TradeStation: Paper trade futures and options trading with the TradeStation simulator. Traders can practice trading stocks, currencies, indices, and metals on the platform before trading live with zero commissions.

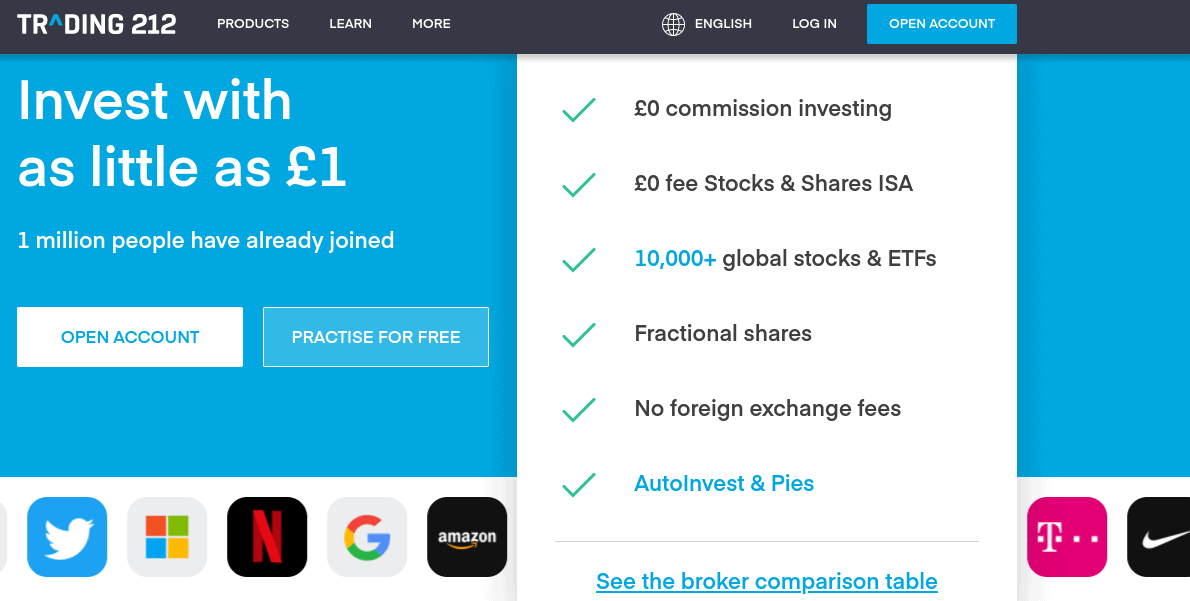

- Trading 212: Trading 212 offers a demo account with £50,000 of virtual funds, which can be used to test the entire platform risk-free. Users can practice day trading CFDs in real-time.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

What is a Day Trading Simulator?

A day trading simulator is a virtual trading account that can be used to test platforms and strategies without using real funds. Simulators emulate real market conditions, based on historical price data, so that traders can practice trading in a realistic environment.

Most day trading simulators will grant users access to the main features of the trading platform so that they can develop strategies based on the tools that are available. Simulators use virtual money which has no intrinsic value. Therefore, it is not possible to make real profits using a simulator account.

Trading simulators are beneficial because they can help traders to prepare for live trading conditions. Simulators remove the emotional aspect of trading, making it easy to place informed, logical trades. Using a simulator is also a good indication as to whether or not you are ready to place live trades. Most traders who fail to profit in the demo trader will not see success in live trading conditions. It is wise to wait until you experience a run of successful demo trades before putting any money at risk. However, successful demo trading does not guarantee that you will make any live profits.

How Do Stock Market Simulators Work?

Day trading simulators work similarly to regular trading accounts. Users sign up, search for assets, use price charts to conduct analysis and execute trades,

Most day trading simulators reflect real market conditions. However, everything is done in a simulation and demo trading platforms do not show the same prices as the live market. Instead, the platforms use algorithms to develop ‘fake’ market conditions that are based on real-life price movements and patterns.

The algorithms work to make these accounts as realistic as possible so that traders can develop accurate strategies that can then be used in live trading.

It is important to understand that trading simulators differ from live trading conditions. The market is volatile and strategies that work in the simulator may not be as effective in real conditions.

How To Use a Trading Simulator in 2025

To use stock simulators in 2025, you will need to create an account with the platform that you wish to use. Some trading platforms will also require you to deposit funds into your account before you can access a simulator.

Here are the basic steps involved with using a demo account:

Step 1: Register an account

Create a trading account with your email address or phone number. You will also be asked to upload proof of ID to the brokerage and connect a payment method to your account.

Step 2: Switch to demo trading

Most brokerages will automatically open a real brokerage account when you sign up. You will have to manually switch to paper trading by searching for the option within the trading platform’s dashboard.

In some cases, you may need to reach out to customer support and request a demo account.

Step 3: Test trading strategies

It is important that you don’t use a trading simulator like a stock market game. Instead, use the platform to test various trading strategies as if you are trading on the real stock market. This means developing a risk management strategy and sticking to lot sizes that reflect what you can afford to trade in real life.

Test new strategies until you feel comfortable with the trading platform. At this point, you can consider switching back to live trading and using your own money to trade. However, it is important to understand that success in a demo account may not transfer to live trading.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Our Review Of The Best Stock Market Simulators in 2025

Below is a closer look at each of the platforms mentioned in the list above. Here, we will discuss, in detail, the key features of each simulator provider, platform fees, regulation,s and asset availability.

1. eToro – Best free day trading simulator with up to $100k in virtual funds

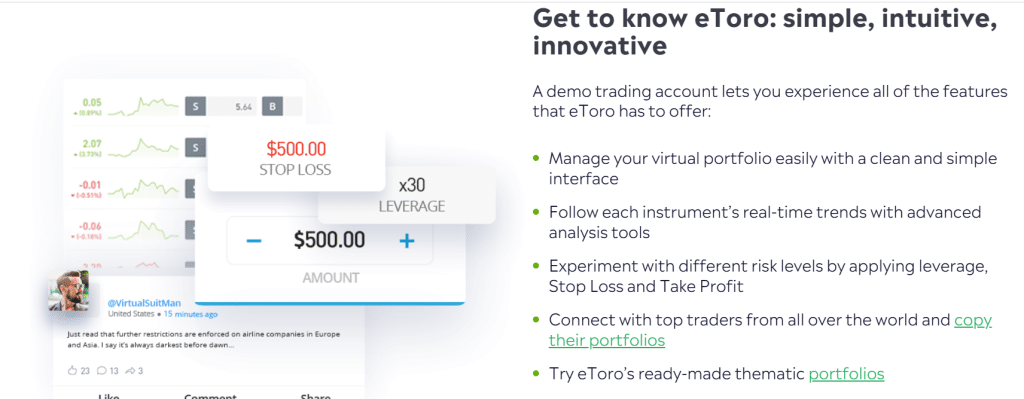

eToro is an online broker that is simple to use and offers a huge number of asset classes. Once you open an account, you will have access to the provider’s day trading simulator. This mirrors actual market conditions in terms of price movements, liquidity, and volatility.

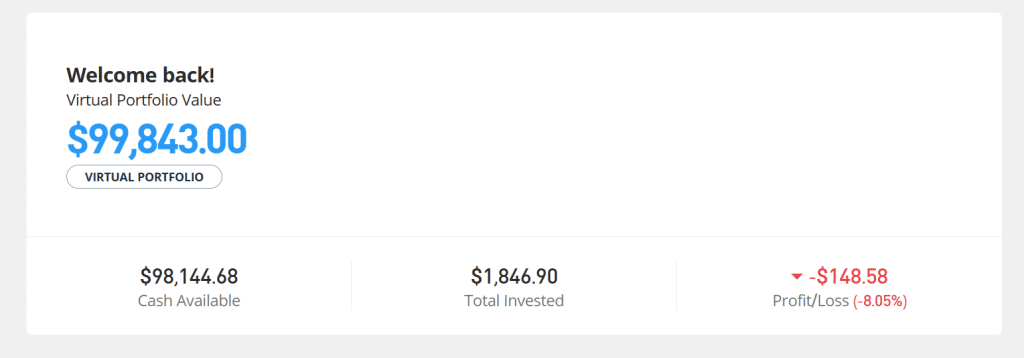

Regulation eToro’s regulation includes the FCA, ASIC and the CySEC. Applicable fees The demo trader is free to use. eToro charges 0% commissions for stocks, 1% commissions for crypto trades and variable spreads for forex trading. There are no account management fees or withdrawal fees. Supported assets Crypto (for US users only). Global users may also access stocks, forex, commodities, indices, and ETFs. Simulator key features The eToro demo account is free and provides traders with $100k in virtual funds. The account can be topped up if needed and there is no usage limit. The demo account can be used to test all features of the trading platform. Charting tools eToro is not compatible with any third-party charting tools. The platform provides traders with its own price charts and also offers ProCharts which can be used to conduct technical analysis. Platform key features eToro is a pioneer of social trading which enables users to share their trades with others. eToro also supports copy trading and Smart Portfolios which can be used to build a diverse portfolio based on expert analysis. Payment methods eToro accepts payments in credit card, debit card, PayPal, Neteller, and Bank Transfer Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

2. Libertex – Practice trading on MT4 and MT5 for free

Libertex is a popular MT4 trading platform that provides users with a free demo account. The day trading simulator is funded with $50,000 in virtual funds and can be used to test the entire platform for free. You do not need to deposit any funds to start using the Libertex simulator, however, you must register for an account.

Regulation Regulated by the CySEC in Europe. Applicable fees The day trading simulator is free to use. For live trading, spreads start from 0.2 pips. There are no account management fees or fees associated with deposits or withdrawals. Supported assets CFDs in stocks, forex, crypto, commodities, indices and options. Simulator key features The simulator can be used to test the MT4 and MT5 trading platforms which means that traders can practice day trading technical analysis strategies risk-free. The demo account can be accessed at anytime and is free to use. Charting tools Libteretx is compatible with MT4 and MT5. The platform also offers its native Libertex charting tool that comes with a range of indicators and features. Platform key features Libertex offers a plethora of educational materials, an economic calendar, market news and an informative daily digest. Payment methods Traders can deposit funds with Paypal, credit card, debit card, bank transfer, Skrill and Neteller. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 85% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

3. AvaTrade – Popular stock trading simulator available on mobile for trading on the go

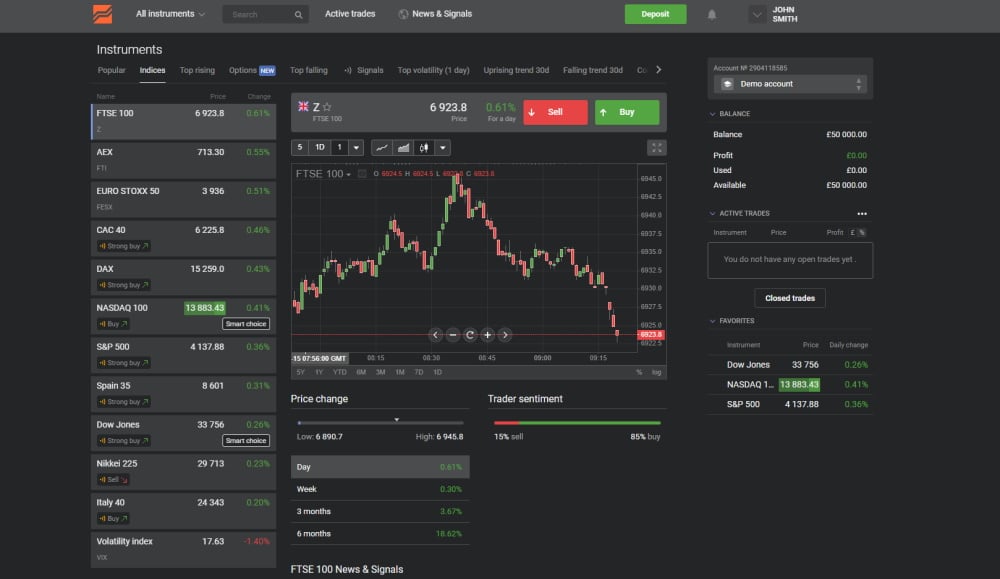

AvaTrade is a great option if you are looking to connect MT4 or MT5 to a free simulator platform. The demo trading account is free to use and provides traders with realistic market conditions that are based on historical price data.

Regulation AvaTrade regulation includes the Central Bank of Ireland, the BVI, FSA, FFAJ, FSCA, ASIC, ADGM, CySEC and ISA. Applicable fees AvaTrade charges tight spreads across all markets. The platform does not charge an account management fee but does charge inactivity fees after 3 months of no activity. Supported assets CFDs in stocks, ETFs, commodities, and bonds. Simulator key features The day trading simulator is free to use. Users can access all platform features including the MT5 trading platform. Charting tools AvaTrade is compatible with a number of trading platforms including MT5, MT4, WebTrader, AvaOptions and AvaGo. Platform key features AvaTrade is well known for its user-friendly mobile app and simple interface. The platform supports CFD trading and spread betting on over 1200+ instruments. Payment methods Traders can deposit funds debit card/ credit card, Ewallets and bank transfer. There is no guarantee that you will make money with this provider. Proceed at your own risk..

4. Forex.com – Practice trading Forex for free on an award-winning platform

If you are looking a day trading simulator for currencies, Forex.com is well worth considering. This top-rated forex trading site gives you access to over 80 currency pairs. You can trade online or via the Forex.com app. In fact, Forex.com also gives you access to third-party trading platforms like MT4.

Forex.com stands as a prominent FX broker, recognized for providing a diverse selection of currency pairs and boasting some of the lowest fees within the industry. Notably, spreads for the EUR/USD can be as minimal as 0.0, accompanied by a $7 commission per $100k traded.

Regulation Regulated by the FCA (under the name StoneX Financial Ltd.) Applicable fees Forex.com charges variable spreads plus a flat commission of $5 per lot traded for trades over $100k. There are no fees associated with opening an account, depositing funds or withdrawing funds. An inactivity fee of $15 is charged after 3 months. Supported assets Forex.com offers 80 FX pairs including major, minor and exotic currencies. Simulator key features The Forex.com simulator is an award-winning platform that provides access to global financial markets. The demo trader can be used for 90 days. Charting tools Forex.com supports MT4, TradingView, and Web Trader. Platform key features Forex.com provides traders with a wide range of technical indicators that cater to all trading strategies. Forex.com also offers a trading academy that is suitable for users who want to improve their knowledge and skills. Payment methods Accepted payment methods include credit card, debit card, wire transfer and PayPal. There is no guarantee that you will make money with this provider. Proceed at your own risk..

5. TD Ameritrade – Online day trading simulator that uses the Thinkorswim platform

TD Ameritrade is one of the most popular stock trading brokers in the US. As such, it makes sense that this age-old brokerage site offers one of the best day trading demo accounts for stocks. In order to gain access to the TD Ameritrade demo account facility, you will first need to open an account. Then, you will be required to install the Thinkorswim trading platform.

Regulation TD Ameritrade is regulated by the SEC for US traders and forex accounts are protected by the Securities Investor Protection Corporation (SIPC). Applicable fees TD Ameritrade charges 0% commissions and tight spreads. There are no account fees, withdrawal fees and deposit fees. Supported assets TD Ameritrade offers stocks, ETFs, Indexes, mutual funds, futures, forex, margin trading and cryptocurrency trading. Simulator key features The demo account works in a real-time environment and allows users to access all features of the platform. There is no usage limit and it is possible to switch between demo and live trading. Charting tools TD Ameritrade is compatible with the Thinkorswim platform which is available on mobile nd desktop. Platform key features TD Ameritrade is suitable for long-term investors. It offers different account types based on your needs as well as a good range of educational resources. Payment methods You can deposit funds via bank transfer. There is no guarantee that you will make money with this provider. Proceed at your own risk..

6. Interactive Brokers – The best stock simulator paper trading app for mobile

If you are looking for a day trading simulator app – Interactive Brokers stands out for us. The IBKR Mobile app is proprietary to Interactive Brokers and is available on both iOS and Android devices. We like this day trading simulator app because it comes packed to the rafters with features and tools.

Regulation Interactive Brokers is regulated by the US SEC, and the UK Financial Conduct Authority (FCA) Applicable fees Commissions start at 0.005 for US shares. The platform also charges a $10 withdrawal fee for US clients. Supported assets Stocks, ETFs, options, futures, spot currencies, CFDs, metals, bonds and mutual funds. Simulator key features The Interactive Brokers free trial provides access to advanced trading tools, IKBR’s research and new platform, real-time market data, and the mobile trading app. Charting tools The IKBR charting tool is available on mobile. The tool provides a range of technical indicators and analysis tools that can be used to place informed trades. Platform key features Interactive Brokers has a seamless user interface that caters to both beginner and advanced traders. As well as the trading platform, the broker offers a PortfolioAnalyst, expert advisors, cash management tools and educational resources. Payment methods Bank transfer, bank wire, credit card, debit card and mail a check. There is no guarantee that you will make money with this provider. Proceed at your own risk..

7. FXCM – Practice using NinjaTrader, ZuluTrade and TradingView in a risk-free environment

FXCM has been offering online trading services for over 20 years. This brokerage site is particularly popular with those that wish to deploy automated trading strategies via algo systems of forex EAs. You can install your chosen trading robot via a number of supported third-party platforms – inclusive of MT4, ZuluTrade, and NinjaTrader.

Furthermore, FXCM offers a third-party marketplace that allows you to purchase proven algo strategies and systems. Best of all, FXCM offers a fully-fledged day trading simulator that is free to use. All you need to do is open an account and you can use the demo facility via your chosen platform. This comes packed with $/£ 50,000 in paper trading funds. When it comes to supported markets, FXCM offers a diverse asset library.

Regulation FXCM is regulated by ASIC. Applicable fees FXCM charges spreads that start from 0.1 pips. There are no fees for opening a trading account or depositing funds. Supported assets Forex, shares, indices, and commodities Simulator key features The FXCM demo account is compatible with third-party charting tools including MT4 and ZuluTrader. There is no usage limit and traders can use the account to test a variety of strategies. Charting tools FXCM supports MT4, ZuluTrader, Trade Station TradingView and Capitalise AI. Platform key features FXCM provides basic trading features that can be used to implement popular trading strategies. Key features include a good range of charting tools, an easy-to-use desktop platform, live market data spread betting and educational resources. Payment methods Debit/credit card, bank wire, PayPal, Google Pay, Apple Pay, Skrill, Neteller, Rapid Transfer. There is no guarantee that you will make money with this provider. Proceed at your own risk..

8. TradeStation – An advanced charting tool that supports a wide range of strategies; practice trading derivatives

Financial derivative markets like futures and options are getting more and more popular in the retail investor space. This is because they offer a more flexible approach to financial speculation – both in terms of long/short capabilities and being able to trade with leverage. If this is something you wish to try for yourself – consider TradeStation.

Regulation Regulated by the UK Financial Conduct Authority. Applicable fees 0% commissions for stocka & ETFs, $0.60 per contract for stock options. 0 account management fees. Supported assets Stocks, ETFs, options, futures, crypto and mutual funds. Simulator key features The Trade Station demo account is unlimited and can be used by traders as and when they need it. The simulator uses real-time data and also supports back testing with decades of histoical market data. Charting tools Trade Station offers its own proprietary trading platform that can be used on desktop or mobile. Platform key features TradeStation provides users with a number of useful features that can assist in building a robust trading strategy. Trade Station also offers an API for experienced traders. Payment methods Bank transfer. There is no guarantee that you will make money with this provider. Proceed at your own risk..

9. Trading 212 – Demo trading platform for fractional trading and long-term investing strategies

Trading 212 is a popular share dealing and CFD trading platform that is popular with beginner investors. The Trading 212 Demo Account provides unrestricted access to all available instruments and markets, and there are no inactivity fees on live accounts. All demo accounts come with a paper trading balance of $/£50,000 – but you can reset this at any given time. As such, even if you blow through your balance, you can continue to use the Trading 212 simulator. Supported markets at this brokerage platform include more than 10,000 stocks and ETFs from a variety of exchanges. Crucially, buying assets at Trading 212 is 100% commission-free. You can also trade CFD instruments – such as forex, commodities, and indices.

Regulation Regulated by the CySEC. Applicable fees Trading 212 offers commission-free investing and there are no withdrawal or deposit fees. It is possible to start trading with $1. Instead of commissions, variable spreads are charged on each trade. Supported assets Stocks, ETFs, forex CFDs, indices and ISAs. Simulator key features The Trading 212 practice account uses historical data to reflect real market conditions. The simulator is free to use and provides up to $50,000 in virtual funds. Charting tools Trading 212 is not compatible with any third-party charting tools and the tools available on the platform are limited. Trading 212 is catered more towards long-term investors rather than day traders. Platform key features Trading 212 provides a range of features that allow users to build a diverse investment portfolio. This includes a selection of stock CFDs, a unique Pies and Autoinvest feature for portfolio creation, fractional shares, and daily interest. Payment methods Bank transfer, card payments, Giropay, Carte Blue, Bilk and direct eBanking. There is no guarantee that you will make money with this provider. Proceed at your own risk..

What Makes A Good Stock Market Simulator?

With virtually all top-rated brokers now offering a day trading simulator of some sort – knowing which one to go with can be challenging. We would suggest choosing a provider that you intend on using once you get around to trading with real capital. This is because you will have already got to grips with how the platform itself works.

Nevertheless, if you’re still looking for a bit of inspiration – below we discuss the core metrics to look out for when choosing the best day trading simulator for you.

- Usage limits: The best paper trading platforms provide unlimited usage so that traders can test new strategies whenever they need to. However, some platforms limit the amount that their demo accounts can be used for, which means that traders cannot access them at later stages in their trading journey.

- Real-life trading conditions: One of the most important requirements of a trading simulator is that it reflects real-life market conditions. This allows traders to test strategies as they would in the live markets. Platforms should provide full access to their trading features through their paper trading accounts.

- Asset variety: To be able to practice different strategies, traders should have access to a range of different assets and instruments through a demo account. The best brokers will offer stocks, forex, and crypto trading with their paper trading accounts.

- Research and education: To help traders improve their skills whilst using a simulator, platforms should provide educational resources and tools for market research. This could include expert insight, webinars, social trading, and in-depth guides.

Conclusion

Day trading simulators are a super-useful tool that investors use to test new platforms and strategies without putting any real money at risk.. Whether you want to learn how online trading works or to wish to test out a new strategy – the best day trading simulators allow you to achieve this goal on a risk-free basis.

We found that the best broker offering a free day trading simulator is eToro. Once you register, you’ll have access to live market conditions across thousands of assets. The broker is commission-free too – so when you eventually decide to start trading with real money, you’ll be doing so in a cost-effective environment.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

FAQs

What is a day trading simulator?

Otherwise referred to as a ‘demo account’ or ‘paper trading’ facility, day trading simulators allow you to trade financial assets without risking any money. Instead, you will be trading with demo funds. The best day trading simulators will mirror actual market conditions and offer full functionalities.

What is the best day trading simulator?

Commission-free broker eToro offers the best day trading simulator. You can trade each and every market that eToro offers on its real-money accounts – but in a risk-free manner. The demo account comes with $100,000 in paper funds and you don’t need to deposit any money to gain access.

What is the best day trading simulator app?

The best simulator app is eToro which has a user-friendly interface and provides access to the entire trading platform. The eToro demo trading app is available on both Android and iOS devices in the US and is free to install.

What is the best free demo account for beginners?

If you are looking to learn how to trade via a free demo account – you can start using our recommended broker eToro in minutes. The platform is simple to navigate and you can use the free demo account for as long as you wish

Do practice trading platforms follow real markets?

Yes, in the vast majority of cases – practice trading platforms offered by brokers will mirror real market conditions.

What is the best stock simulator?

If you’re looking for the best backtesting platform for stocks – consider eToro. You will be able to trade more than 2,400 stocks in a risk-free manner by using the eToro demo account.

How do you use a demo account on MT4?

In order to trade on MT4 via a demo account, you first need to register with a suitable broker. The broker must, of course, offer support for MT4. Once you have registered, you can sign into your MT4 demo account with the username and password you choose when registering with the respective broker.

References:

Kane Pepi Finance Writer

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Kane has also written for websites such as MoneyCheck, InsideBitcoins, Blockonomi, Learnbonds, Buyshares n and the Malta Association of Compliance Officers.

Before starting his career as a writer, Kane studied at the University of Central Lancashire where he received a Masters Degree in Financial Investigation and then a Research Doctorate in Criminal Justice. Pepi is passionate about helping people to make informed decisions through high-quality, educational content.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

Scroll Up