FXCM Review 2025 – Pros & Cons Revealed

FXCM is a UK-based online broker that provides access to CFD and forex trading with tight spreads as low as 1.3 pips on popular currency pairs such as EUR/USD. If you are looking to open an account with FXCM we recommend reading this thorough broker review beforehand.

In this FXCM review 2025, we cover all the key metrics from supported markets, fees and commissions, account types, mobile trading, payments, regulations, and much more.

What is FXCM?

Launched in 1999, FXCM is a CFD and forex broker based in the UK and is owned by Jeffries Financial Group which is listed on the New York Stock Exchange under the ticker symbol JEF and has a market cap of $7.25 billion.

FXCM is a popular online forex and CFD trading platform that is regulated by major financial authorities including the UK’s Financial Conduct Authority

FXCM traders only have access to forex and CFD trading. As such you can expect to invest in 40 different currency pairs, stock index CFDs, stock CFDs, commodity CFDs, and crypto-derivatives. Does this raise the question as to why CFD trading appeals to investors? CFD trading is a type of derivatives trading which means that you trade on prices derived from underlying markets.

Perhaps the most attractive feature of contracts for difference trading is that investors have access to leverage. Simply put, with leverage your purchasing power increases, as you are only required to deposit a percentage of the investment’s total margin to open positions. On the one hand, this lowers the overall cost of opening a position, but on the other hand, leverage comes with the inherent risk of maximizing potential losses.

Another benefit of CFD trading is that you can go short or long. Because CFD trades involve a contract to exchange the difference between the opening and closing price of the trade, investors can trade on both bullish and bearish markets.

FXCM Pros & Cons

What we like

- Streamlined account opening process

- Trade commission-free with zero exchange fees as the trading fees are built into the spread

- Access to crypto-derivatives with spreads as low as 0.5 pips for XLM/USD

- Simple and intuitive user interface ideal for beginner traders

- Competitive spreads with typical spreads for the EUR/USD pair equalling 1.3 pips and 1.7 pips for the GBP/USD forex pair.

- CFD traders can go short or long with the tap of a button on popular major stock CFDs including Amazon (AMZN) and Apple (AAPL).

- FXCM clients have access to heaps of platforms including Trading Station, MetaTrader 4, NinjaTrader, ZuluTrade, TradingView, and Capitalise AI for automated trading services.

- Free paper trading account with $50,000 of paper funds to practice your trading strategies in a risk-free simulated environment.

- Access to innovative and popular social and copy trading features provided by ZuluTrade.

- Low non-trading fees including free withdrawals to accounts accepting SEPA and BACS payments.

- No deposit fees

What we don’t like

- No access to traditional investment products such as stocks and ETFs

- £300 minimum deposit

- Two-factor authentication is not supported

Your capital is at risk.

What Can You Invest in and Trade on FXCM?

As we have already discussed FXCM only provides access to CFD and forex trading. So, let’s take a look at the markets and products you can access when trading with FXCM.

Forex Trading

Forex trading is very popular amongst beginner and experienced traders as it offers access to high levels of liquidity and often requires a low amount of capital to get started. With this in mind, the minimum deposit at FXCM is £300.

FXCM also offers tight spreads, for example, the typical spread for the EUR/USD pair is 1.3 pips. As well as low spreads FXCM also supports a range of trading platforms such as its flagship Trading Station platform which is compatible with desktop, web, and mobile trading apps. Additionally, you can access the top-rated and popular MetaTrader 4 platform and the advanced functionality of automated robo-advisors otherwise referred to as Expert Advisors.

Expert Advisors are automated programs that are used to manage and trade financial markets based on sophisticated trading algorithms.

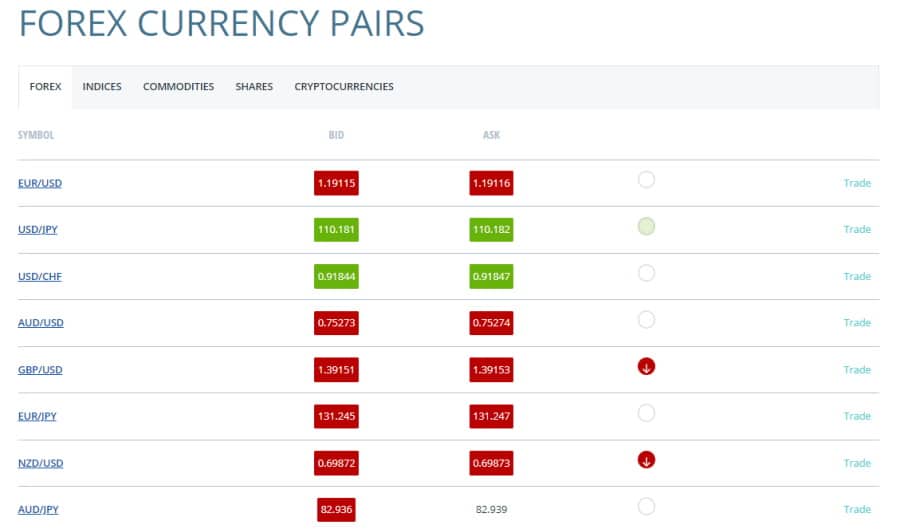

FXCM users can buy and sell 40 different currency pairs including majors, minors, and exotics. These include AUD/CAD, EUR/JPY, GBP/JPY, USD/JPY, EUR/USD, USD/TRY, just to name a few.

FXCM offers different leverage based on the tradable assets; as such you can access leverage up to 30:1 for major forex pairs and 20:1 for minor currency pairs.

Share CFDs

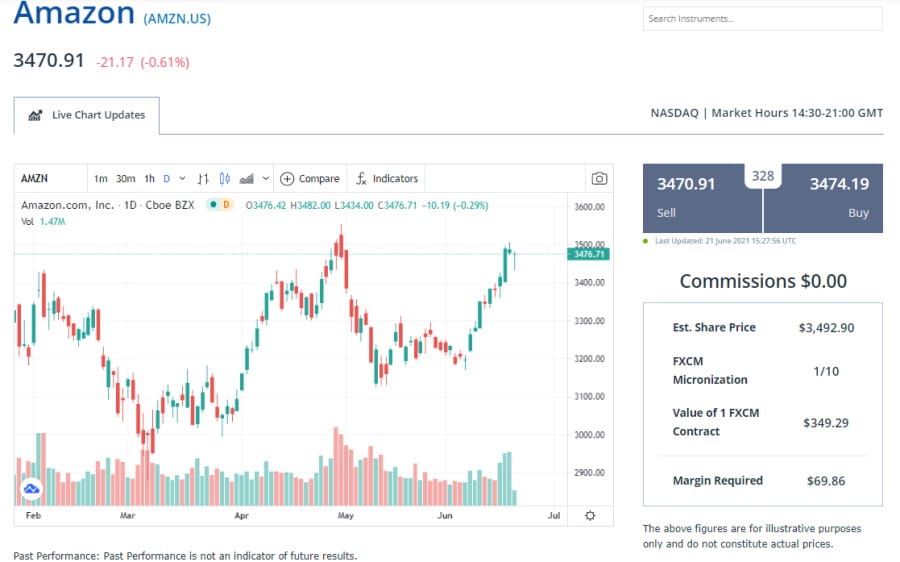

With commission-free stock CFD trading, you can invest as much as you can afford with fractional share trading with minimum trade sizes of 1/10th of a share. FXCM users can buy and sell international share CFDs of stocks listed on major exchanges including the NASDAQ, New York Stock Exchange, London Stock Exchange, Hong Kong Stock Exchange, and European stock markets with a low margin requirement of 20%.

For example, let’s say that the current share price of Amazon (AMZN) stock is $3,492.90. With FXCM’s fractional share trading, you could purchase 1/10th of a share at $349.29, and seeing as the margin requirement is 20% this would mean that the margin required to enter the trade would be $69.86.

Furthermore, CFD traders have the option to either go short or long by speculating on the potential price movements of the underlying asset without actually owning it. FXCM clients also have the opportunity to choose from top-rated online platforms such as Trading Station, and MetaTrader 4.

Stock Index CFDs

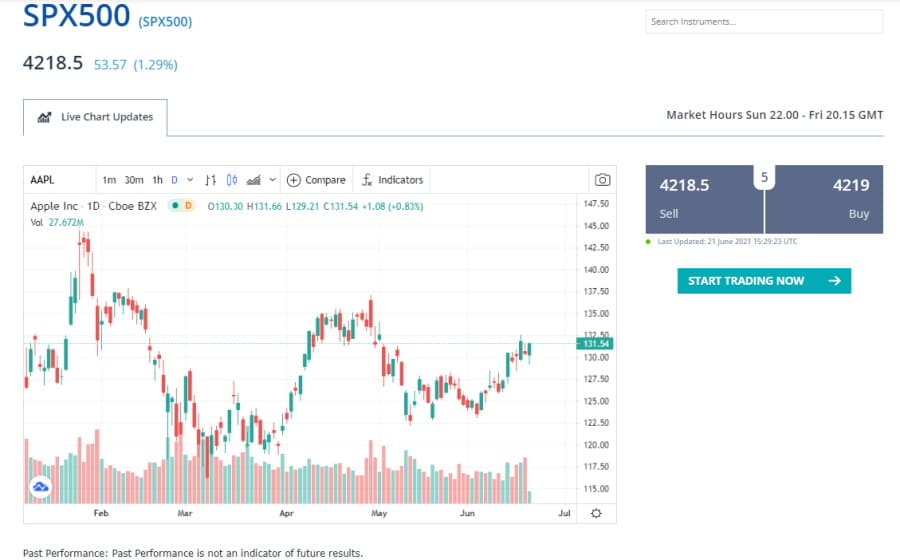

Benefits of trading stock index CFDs with an FXCM brokerage account include:

- The ability to manage your position sizes with small contract sizes as micro-contract sizes provide the flexibility to risk less capital per trade.

- FXCM provides varying leverage for different financial instruments such as 10:1 for non-major equity indices and 20:1 for major indices such as the FTSE 100. This means that with 20:1 leverage on a major stock index CFD like the UK 100 you can trade with £10,000 in the market by putting £420 aside as a security deposit.

- Low transaction costs mean that you can trade without having to pay a penny in commissions, as well as no exchange fees as the transaction costs are included in the spreads. For example, the typical spread for the UK100 is just 1 pip, and the spread for the US2000 index is just 0.43 pips.

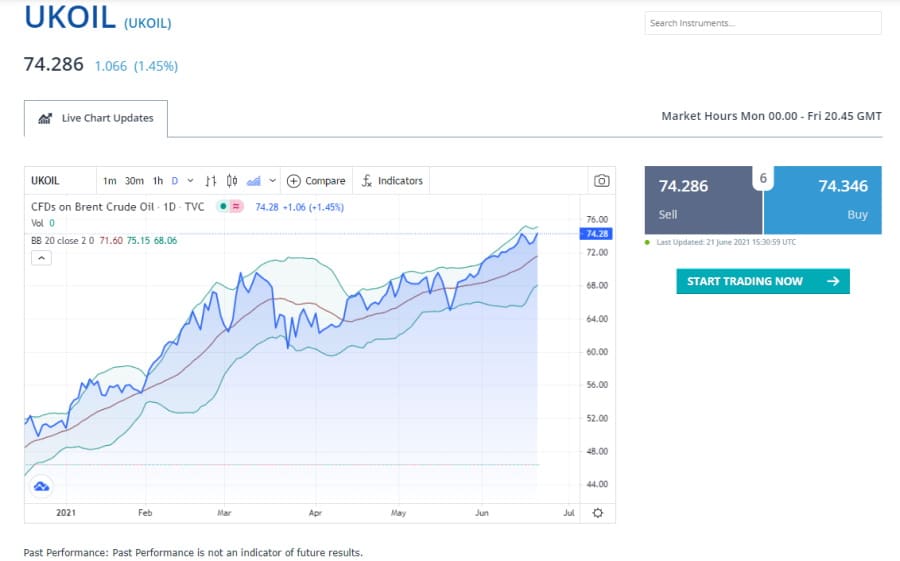

Commodity CFDs

FXCM traders have access to commission-free commodity CFD trading with tight spreads such as 0.05 pips for Brent Crude Future (UKOil) and 0.90 pips for CORNF. The greatest advantage of commodity CFD trading is that it allows you to participate in the markets, gaining exposure to the products and markets, without taking ownership of the underlying assets.

Some of the commodities you can trade at FXCM include:

- XAG/USD

- XAU/USD

- USOil

- UKOil

- NGAS

- Copper

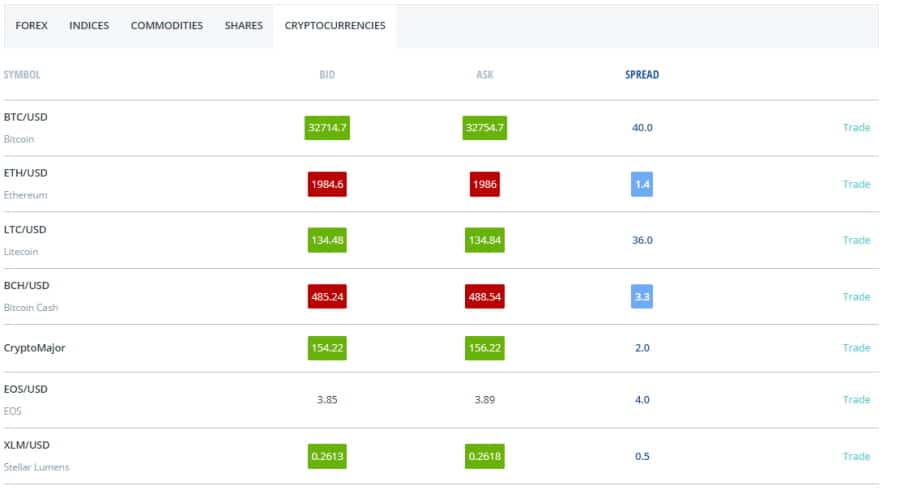

Crypto CFD Trading

Trading cryptocurrency CFDs with FXCM appeals to many traders as they can control their position sizes with small contract sizes. For example, a single contract of BTC/USD at FXCM is the same as one percent of the underlying price of Bitcoin.

Additionally, you can buy and sell major digital assets with 2:1 leverage and speculate on the increase and drop in crypto prices.

Moreover, with crypto derivatives you do not have to worry about cold and hot crypto wallets for storing and holding your digital assets as you are only speculating on the price of the underlying asset. In keeping with its strong reputation as a free trading platform, you can trade cryptocurrency CFDs commission-free with zero exchange fees as the trading costs are built into the spread. For example, the average spread for BCH/USD is 3.50 pips.

When investing in crypto CFDs with FXCM, the trading fees are included in the spread and there are no commission fees when opening and closing positions.

When it comes to fractional crypto trading, FXCM’s minimum trade sizes are made to give traders the flexibility to regulate their exposure to a particular asset. For example, the minimum trade size equals 1% of the price of BTC. Therefore, if Bitcoin is trading at $30,000 then 1 contract of BTC/USD would be priced at $300.

FXCM Fees & Commissions

Let’s take a look at the trading and non-trading fees charged by FXCM in the following tables.

| Asset | Commission fee |

| Forex | 0% Commission; Typical spread for EUR/USD is 1.3 pips |

| Stock CFDs | 0% Commission; Typical spread for AMZN is 0.02% |

| Commodity CFDs | 0% Commission; Typical spread for UKOil is 0.05 pips |

| Crypto CFDs | 0% Commission; Typical spread for ETH/USD is 2.73 pips |

When it comes to FXCM’s non-trading fees check out the table below for a complete breakdown:

| Fee Type | Charge |

| Currency Conversion Fee | For amounts between $0 – $9,999.99 FXCM will convert with a 150 pip mark-up |

| Wire Withdrawal Fee | Varies depending on the withdrawal method. $25 for domestic wire withdrawals to accounts in the US and UK. $40 for withdrawals to accounts outside the UK and US. £0 for withdrawals to accounts accepting BACS payments |

| Cheque Stop Payment Fee | $25 |

| Deposit Fee | None |

| Inactivity Fee | $50 after one year of inactivity |

| Account Processing Fee | Corporate and Trust Accounts are subject to a one-time account processing fee of 300 units of the Base Currency. |

| Minimum Deposit | $300 in the EU, $50 for non-EU based-clients for Standard accounts, and $25,000 for Active Traders accounts |

As we have already mentioned, FXCM does not charge trading commissions. Simply put, you can open and close positions without having to worry about trading commissions. Consequently, the trading fees are included in the variable spread, which fluctuates throughout the day based on the overall market conditions. Some assets have lower spreads than others, so this is something you need to consider when placing orders.

Margin Trading

FXCM trading accounts use a Tiered Margin system which is based on an entry and maintenance margin as well as a liquidation margin.

The entry/maintenance margin is the initial deposit set aside as collateral in order to open and maintain a position. To find the exact amount of required margin to open a position, simply check under the MMR column on the Trading Station platform.

As for the liquidation margin, otherwise referred to as the minimum required margin, this is typically set to 50% of the entry margin, which means that if your account equity drops below this set level, all open positions will be closed.

FXCM User Experience

As FXCM supports a wide range of trading platforms and features, both beginner and experienced traders will find that this online broker has a lot to offer to help meet their trading needs and goals.

In summary, the FXCM web trading platform is highly customizable, supports heaps of order types, and has a plethora of educational resources from online Live Classrooms, to Free SMS Trade Alerts.

FXCM users have access to multiple trading platforms such as:

- ZuluTrade – one of the largest social auto-trading platforms which enables traders to copy traders directly in your FXCM brokerage account, as well as follow the trading strategies and activities of a mixed network of investors. There is a $30 monthly subscription fee to follow other traders’ strategies.

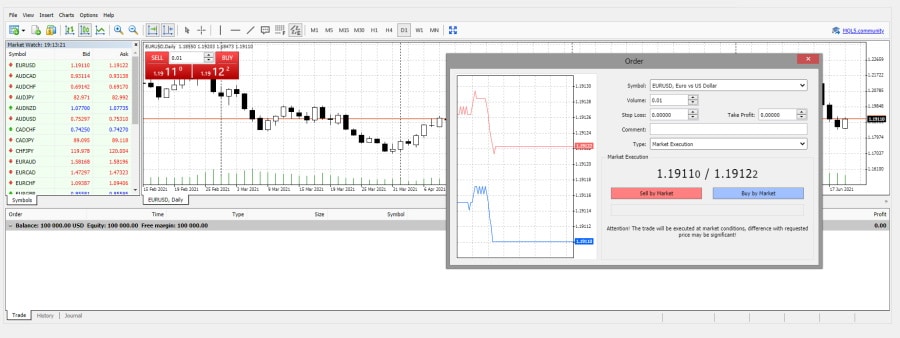

- Trading Station is FXCM’s proprietary CFD and forex trading platform that supports advanced analytical tools and customizable charts. Trading Station is compatible with iOS and Android mobile devices and is available as a web and desktop app.

- The top-rated third-party MetaTrader 4 trading platform is compatible with Mac, Windows, iOS, and Android operating systems. MT4 also offers a demo account to practice your forex, crypto, and CFD trading strategies without the risk of losing your capital.

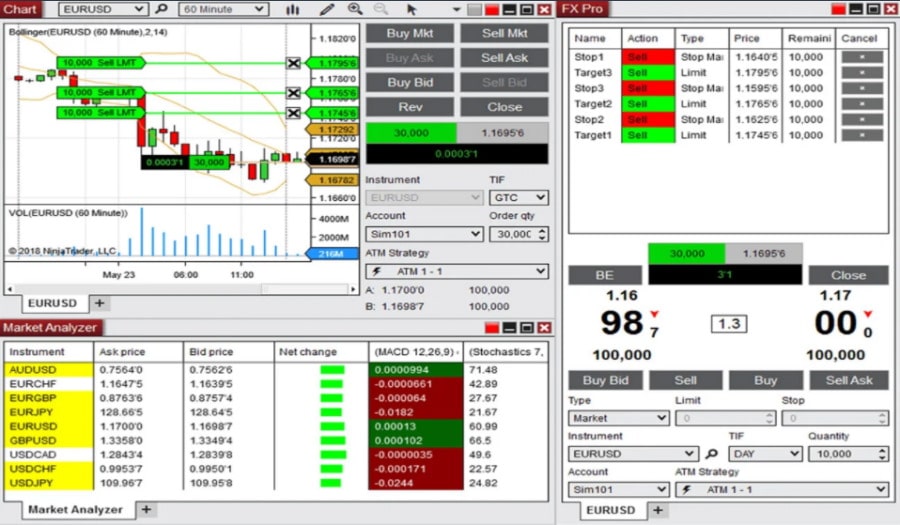

- NinjaTrader offers automated trading, a risk-free demo account, and extensive forex functionalities.

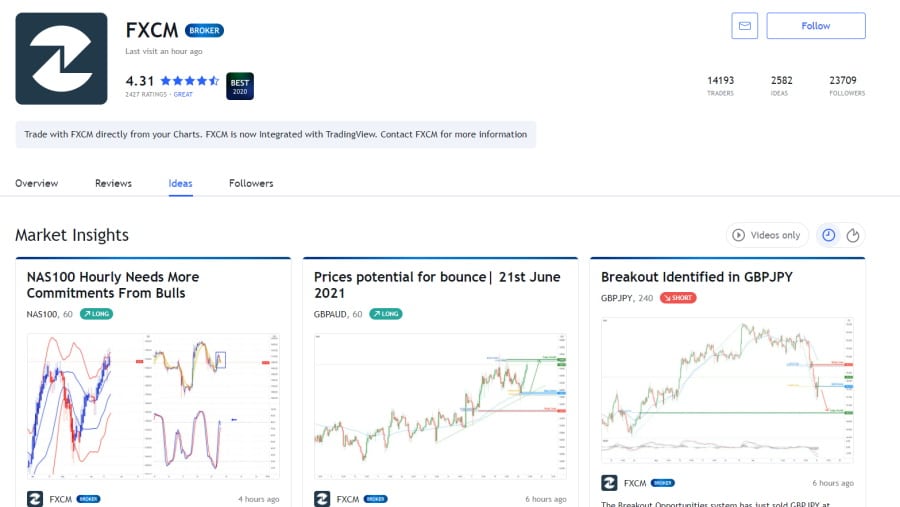

- TradingView – a social network for forex traders that features live quotes, advanced charts, and trading ideas. You can trade from your TradingView charts by simply selecting FXCM under the Trading Panel tab at the bottom of the screen and logging into your FXCM trading account.

- Capitalise AI platform allows traders to access hassle-free automated trading. Capitalise.ai tracks real-time market data, technical analysis and indicators, and macroeconomic events throughout the day so that you can participate in the markets by adopting a passive investing strategy.

The FXCM web trading platform offers a user-friendly and intuitive interface making navigating through the different features a breeze. For traders looking for a customizable trading experience, FXCM’s customizability is spot on.

On the flip side, two-factor authentication is not available with FXCM. There are plenty of order types to choose from on the FXCM platform such as market orders, limit orders as well as some order time limits like GTD and IOC.

FXCM Features, Charting Tools, and Analysis

FXCM offers trading ideas via the Trading Signals and Technical Analyzer pages. On the other hand, it does not support fundamental data such as P/E ratios, market capitalization, and dividend yields.

When it comes to charts, FXCM provides more than 50 technical indicators such as Bollinger Bands and Klinger Oscillators. FXCM clients also have access to a feature called Market Scanner that uses technical indicators to create buy and sell signals.

Additionally, FXCM provides access to a news feed and an economic calendar as well as the option to subscribe to a newsletter.

FXCM Account Types

If you plan on opening an account with FXCM there are four options to choose from including either a Standard or Active Trader individual account, a Joint account and a Corporate account.

As you would expect, FXCM’s Active Trader account is ideal for active traders as it offers very competitive spreads when compared to the individual standard trading account. For instance, the typical spread for the EUR/USD currency pair is 0.2 pips.

FXCM Mobile App Review

As we have already discussed, FXCM provides access to a variety of trading platforms, and as a result, you can trade via the Trading Station, MT4, or ZuluTrade mobile trading app.

FXCM’s proprietary Trading Station platform is compatible with iOS and Android mobile devices. During our research, we found that the web platform offers a better user experience when compared to the mobile app as you cannot set price alerts or push notifications and 2FA (two-factor authentication) is not supported.

When it comes to placing order types this is a straightforward process that mirrors the web platform.

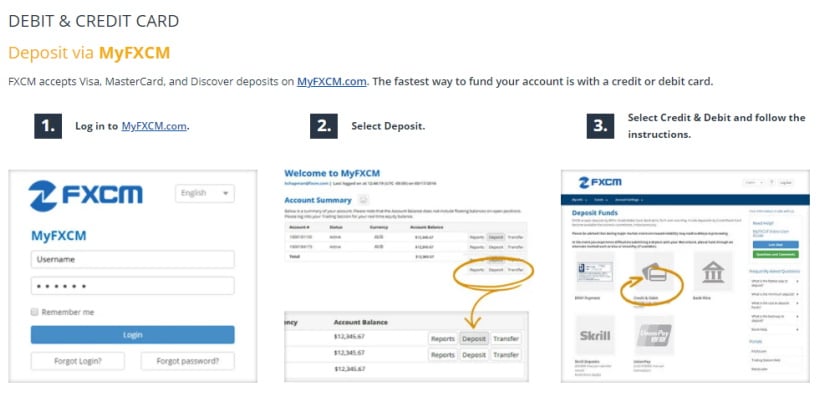

FXCM Payments

FXCM supports several different funding options for fast and secure payments. All FXCM traders can access the client-service portal via their live trading account login details.

With zero deposit fees, you can deposit and withdraw funds to and from your FXCM live trading account via:

- Debit card and Credit card (Visa, Mastercard, Discover)

- Bank wire transfer

- Skrill payments up to $20,000 per month

- Neteller payments up to $20,000 per month

- Klarna online transfer up to $5,000 per transaction

- Rapid Transfer deposits up to £5,000 per transaction

Funds deposited via debit cards and credit cards are typically processed instantly, whereas bank wire deposits usually take 1-2 business days.

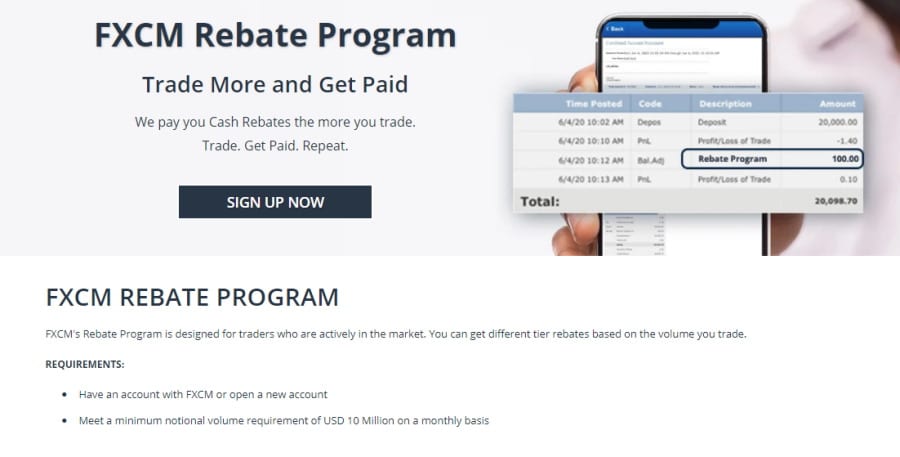

FXCM Bonus Rebate Program

The FXCM Rebate Program is ideal for investors who are active in the financial markets. There are varying tier rebates based on your trade volume.

The requirements are that you have an existing FXCM trading account and that you meet a minimum notional volume bracket of at least $10 million per month.

For instance, let’s say you buy and sell the EUR/GBP currency pair and during a given calendar month you reach $160 million in notional volume traded. As you reach Tier 4, you will earn $20 per million traded, giving you a total rebate of $3,200.

| Forex and Commodities | Notional Volume (USD) | Rebate (USD per Million) |

| Tier 1 | 10 – 25 | $5 |

| Tier 2 | 25 – 50 | $10 |

| Tier 3 | 50 – 150 | $15 |

| Tier 4 | 150 – 300 | $20 |

| Tier 5 | 300+ | $25 |

FXCM Contact and Customer Service

You can contact customer support at FXCM via live web chat, email, telephone.

There is also a FXCM forex trading desk available to live account holders. Users can place and manage orders through the phone with the FXCM trading desk. The trading desk is open on Sundays between 5:00 PM ET and 5:15 PM ET and closes on Fridays at 4:55 PM ET.

When should you consider calling the trading desk? It is recommended that all FXCM users call the trading desk if they cannot access the internet, they fail to receive a confirmation when placing an order online, or they cannot connect to the FXCM servers.

Is FXCM Safe?

The companies that make up the FXCM Group are regulated by multiple jurisdictions. FXCM complies with regulations set by top-tier financial authorities including the United Kingdom’s Financial Conduct Authority, the Australian Securities and Investments Commission, the Cyprus Securities and Exchange Commission, and the Financial Sector Conduct Authority in South Africa.

What about client fund protection? Should FXCM go into liquidation, segregated client funds cannot be used to compensate shareholders. Furthermore, if FXCM cannot satisfy any repayment claims, eligible UK-based clients can claim up to £85,000 in compensation through the Financial Services Compensation Scheme.

How to Start Trading with FXCM

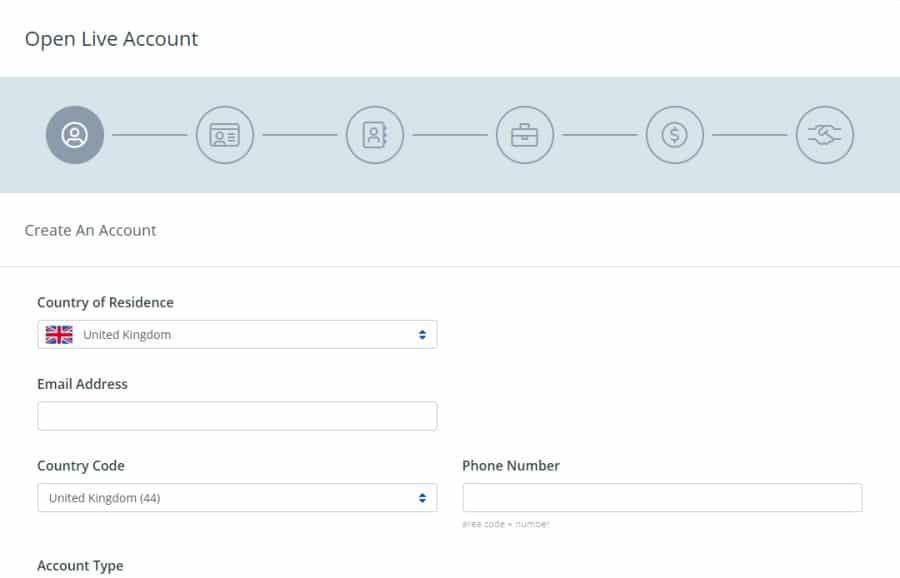

Step 1: Opening an FXCM account

The account opening process at FXCM is streamlined and fully digital. Firstly, you need to choose your country of residence and your preferred trading platform. Then you will be directed to the FXCM secure server to complete the online registration which involves entering your personal information and uploading copies of ID and bank statements to verify your identity and address as is standard KYC procedure.

Step 2: Login and deposit funds to start online trading with FXCM

After having completed the application you will be given your login credentials. The quickest method to use when depositing funds to your account is with a credit card or debit card.

To do this simply log into the client-service portal, tap on Deposit then Credit & Debit card and follow the onscreen prompts.

Once you have deposited funds into your account, you can start trading financial instruments with the click of a button. Choose from the supported trading platforms such as MT4 and Capitalise.ai based on your trading goals and preferences. Placing your first trade involves a myriad of key elements such as leverage, margin requirements, choosing whether to go long or short, placing an order type and more.

FXCM vs eToro

After analyzing all key metrics from fees and commissions to payments and user experience, we found that eToro is a better alternative when it comes to online trading for the following reasons:

eToro is regulated by major financial institutions including the FCA, CySEC, ASIC, and the US Securities and Exchange Commission. Since its launch in 2007 it has become home to over 20 million traders worldwide.

This social trading platform offers a broader range of tradable assets including traditional investments such as stock trading across 17 major exchanges, as well as fractional share trading, crypto trading, ETFs, commodities, CFDs, and more.

Past performance is not an indication of future results

Furthermore, eToro clients also benefit from commission-free stock and ETF trading, and spreads that start from just 1 pip on the most popular forex pairs and 0.75% for Bitcoin trades.

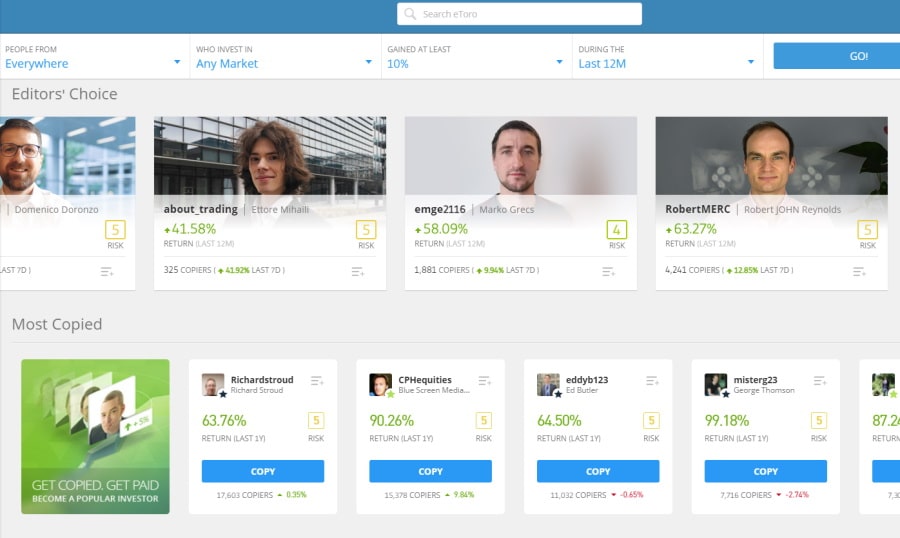

eToro also supports two proprietary copy trading features referred to as CopyTrader and CopyPortfolio which allow you to trade passively by copying the trades of other eToro investors by browsing through thousands of public profiles on the social trading network.

67% of retail investor accounts lose money when trading CFDs with this provider.

When it comes to payment options, eToro supports an array of deposit methods such as via debit cards and credit cards, Neteller, PayPal, and more.

For those looking to invest in shares of stock listed on the London Stock Exchange, you can save yourself the 0.5% stamp duty tax as eToro is one of the only brokers on the market to waive this fee, which therefore helps to reduce your overall trading costs.

With its intuitive user-friendly interface, educational resources, and streamlined account opening process, eToro was designed for beginner traders with little to no experience in online trading. In keeping with its ease-of-use and mission to make online trading as accessible and easy as possible, eToro offers two account types: a live trading account and a demo account.

But what is a demo account, and why is it so important for all types of traders?

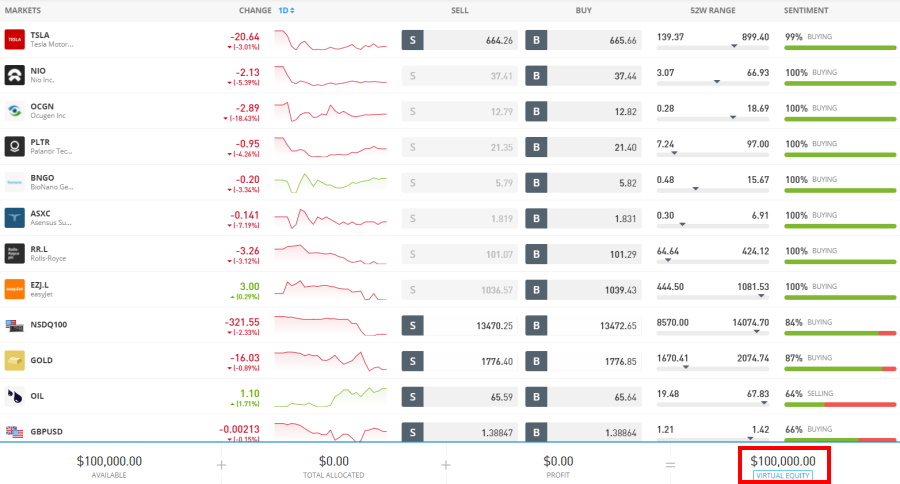

Simply put, a demo account is a practice trading account that provides access to a simulated trading environment with virtual capital known as paper funds. At eToro, paper trading accounts provide users with $100,000 worth of paper funds to practice their trading strategies in a risk-free trading environment and to familiarize themselves with the trading platform.

FXCM Review: The Verdict

If you are new to online trading and are looking for a top-rated online broker to trade stocks and ETFs on a commission-free basis, copy the trades of other advanced investors like-for-like with sophisticated copy trading tools, and practice your trades with $100,000 of paper funds, then eToro is the best option for you in 2025.

With access to some of the industry’s lowest spreads, 17 different stock markets, fractional share trading, innovative copy trading features, eToro traders have all the right tools and resources to take their trading experience to new heights.

So, to start trading stocks without paying a penny in commissions, simply follow the link below and open an eToro account in less than 10 minutes today!

eToro – Top Copy Trading Platform for Commission-Free Stock Trading

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.