Where & How to Buy Amazon (AMZN) Stock in 2025

Bookstore turned e-commerce giant Amazon has stood the test of time. It first went public in 1997 at $18 per share, and the subsequent dot-com boom saw its stock soar, reaching a peak of $106 in 1999. Despite setbacks in the early 2000s, its price surpassed the 1999 peak by 2007, and with a market cap of $1.49tr (the world’s fifth largest), it stands today as one of the most attractive investments on the market. With that in mind, the question of how to buy Amazon stock in 2024 remains at the forefront of investors’ minds.

In this guide, we will address the question of how to buy Amazon stock in 2024, in addition to examining Amazon’s price history, and our top recommended broker to invest in Amazon stock on a zero commission basis.

-

-

How to Buy Amazon Stock in 2025

Step 1: Begin by selecting an online broker and initiating the setup of your brokerage account.

Step 2: Complete the account verification process, which often involves providing two forms of government ID as required by many brokers.

Step 3: Deposit funds into your account using a debit or credit card, or via bank transfer. While several brokers have no minimum deposit requirement, some may set it as low as $10.

Step 4: Locate the Amazon (AMZN) stock ticker to access the latest news and performance data.

Step 5: You can execute a purchase order once your account is funded, allowing you to open a position in Amazon (AMZN) stock.

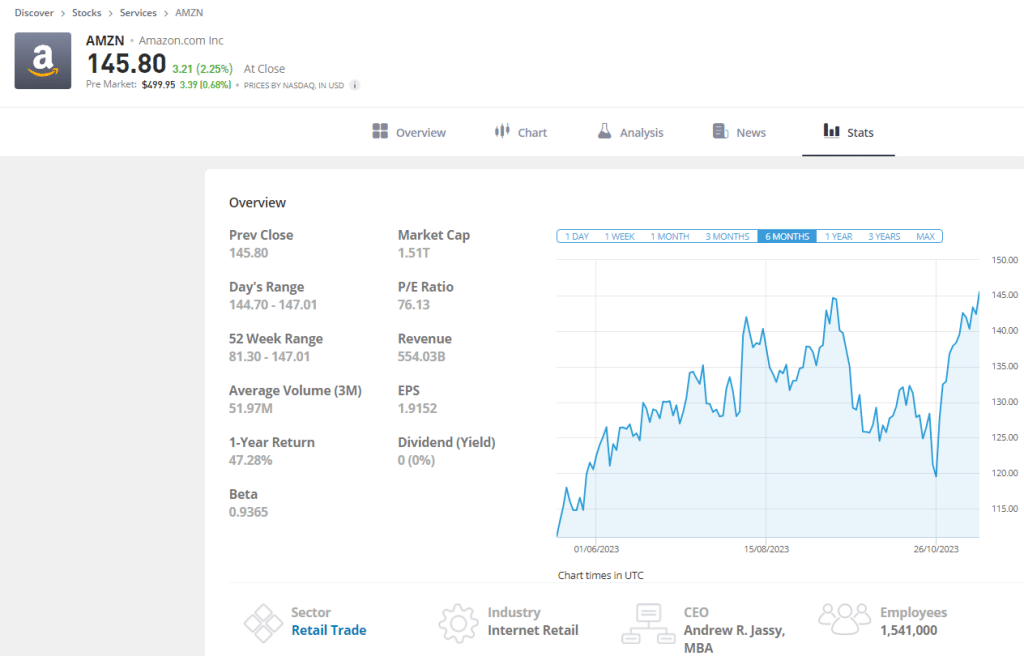

Amazon (AMZN) stock data June 2025

What is Amazon?

Amazon is the epitome of a technology conglomerate. Having been founded as a bookstore in the mid-90s, the firm has evolved into something unrecognizable, dominating the world of e-commerce whilst expanding into streaming, cloud computing and much more.

The Seattle-based firm’s flagship platform is synonymous with modern e-commerce, but the firm’s cloud computing division, Amazon Web Services, is becoming increasingly dominant, providing services to business and organizations and boasting a commanding lead in the industry’s market share.

Many believe that Amazon’s success, aside from its vast product suite, is largely driven by its commitment to industry-leading customer service. This is just one reason why the firm, in 2023, is one of the world’s most valuable, boasting a market capitalization of more than $1.5tr.

Amazon share price 2025

Amazon stock has seen significant turbulence in recent years. Despite the unprecedented disruption caused by COVID-19, the company’s share value hit an all-time high of $186.12 in July 2021, having suffered an initial slump during the bear market of 2020.

But this good fortune was cut short, with the stock losing 50% of its value during 2022 – its worst annual performance since the dot-com bubble burst in 2000.

Though Amazon stock has failed to return to the record-breaking heights of the pandemic era, investors who bought the 2020 dip have been rewarded, with share prices currently up nearly 65% year-on-year.

However, at the time of writing, Amazon’s share price still trails 16% below its 2021 year-end closing price and 25% below its peak in mid-2021.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

Is Amazon (AMZN) a good investment in 2025?

A $1,000 investment in Amazon stock 10 years ago would be worth nearly $12,000 today. But does this mean that beginner investors should still buy Amazon stock in 2024?

Prospective investors should, for instance, be wary of the longstanding controversy regarding Amazon’s tax affairs. The latest development in this saga came in June earlier this year, when The Guardian reported that Amazon’s main UK division paid no corporation tax for the second year in a row.

Competition also remains a significant threat to Amazon’s operations. The company’s success in recent years has sparked a fundamental shift in the world of e-commerce, with rivals such as Wall-Mart, Best Buy and Home Depot being forced to evolve their online offerings.

The same applies to Amazon’s cloud infrastructure business, Amazon Web Services (AWS) which faces increasing pressure from Microsoft’s Azure and Alphabet’s Google Cloud Platform. According to reporting by CNBC, the two players grew their revenue 29% and 22% respectively in Q3 2023. This has been reflected in somewhat slowed growth for the Amazon since 2021.

However, Amazon remains as one of the world’s most productive companies, and has seen a short-term boost in net sales this year, with net income more than tripling in Q3.

AWS also still comfortably leads the cloud infrastructure market, and its other higher-margin business lines, such as third-party seller services and advertising, are also growing fast.

Additionally, Amazon looks poised to be a long-term beneficiary of the modern era’s AI boom. Besides offering machine learning and generative AI technology as part of its cloud computing business, the company is also integrating AI into its e-commerce offering.

Taking these factors into account, Amazon stock arguably remains a worthwhile buy in 2024.

Where to buy Amazon (AMZN) stock in 2025

Investors can buy Amazon stock through a range of online brokers. Robinhood tends to be a popular choice, offering a user-friendly interface, low minimum deposits, and supporting fractional share trading. These factors contribute to making the platform accessible for beginners. Other popular choices include, Webull and Charles Schwab.

1. Robinhood – Best brokerage account for commission-free investment

Robinhood, a widely acclaimed zero-commission trading platform, is celebrated for its intuitive user interface, garnering millions of users since its inception.

Setting itself apart with a commission-free model, Robinhood extends this benefit to include zero trading fees for individual stocks, ETFs, and options. The platform goes beyond conventional trading by facilitating social trading, creating a community-oriented ambiance reminiscent of social networks.

Featuring a low minimum deposit, accessible fractional share trading, and the absence of account fees, Robinhood serves as a cost-effective entry point for investors. Its beginner-friendly approach makes it particularly well-suited for those new to investing, providing an affordable and user-friendly platform for financial endeavors.

With a minimum trade amount of $1, Robinhood is also the most suitable platform for investors who wish to implement a dollar-cost-averaging strategy. This is a good way to build a diverse portfolio with limited funds.

2. Charles Schwab – Reputable broker with educational tools and resources for stock trading

Charles Schwab stands as a distinguished online brokerage platform, renowned for its expansive array of investment options and comprehensive services. Known for its reliability, it caters to a diverse investor base.

Providing a user-friendly interface, Charles Schwab grants access to a multitude of financial markets and investment products. While it doesn’t adopt a zero-fees model, it compensates with a robust suite of research tools and educational resources.

Catering to both beginners and advanced investors, Charles Schwab’s platform accommodates different account types. With an emphasis on customer service and a commitment to innovation, Charles Schwab emerges as a prominent choice for those seeking a well-rounded online brokerage experience. For the latest information, please verify current details on their official website.

3. Webull – A modern and affordable brokerage platform for day trading Amazon

Webull, a dynamic commission-free trading platform, has garnered popularity for its intuitive design and advanced features since its launch in 2018. Providing a user-friendly interface equipped with real-time market data and analysis tools, Webull caters to both novice and experienced traders.

Specializing in equities and options, Webull distinguishes itself by offering commission-free trades across various assets, including stocks and ETFs. Notably, the platform supports extended trading hours, catering to the flexibility sought by active traders.

With an accessible mobile app and desktop platform, coupled with no minimum deposit requirements, Webull presents an appealing option for those in search of a modern and affordable trading experience.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

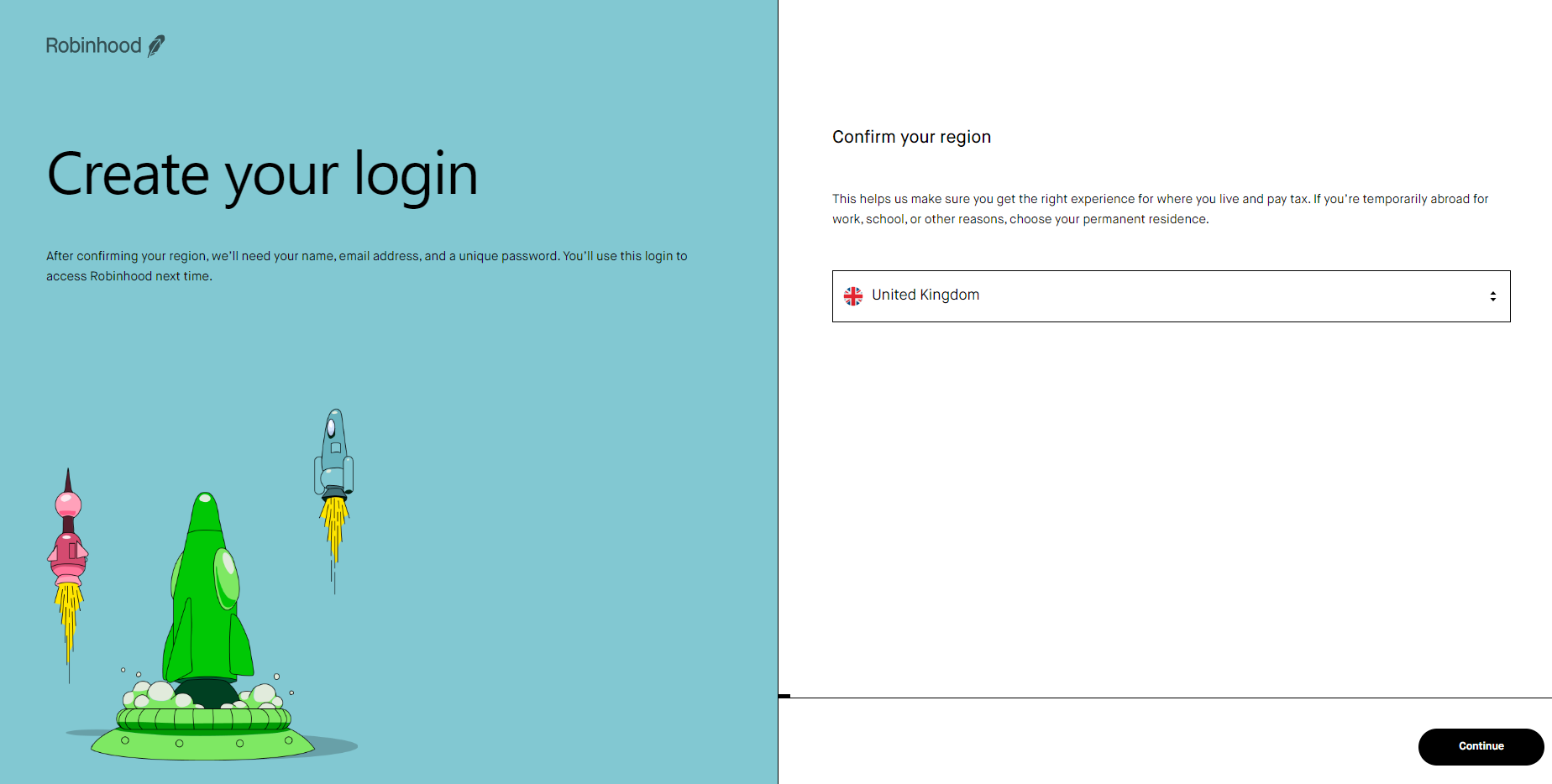

How To Buy Amazon Stock From Robinhood

In the following section, we will take a closer look at how to buy Amazon shares from our top brokerage, Robinhood. Before starting the process, make sure that you understand the risks involved with investing in the stock market.

Step 1: Create a Robinhood online brokerage account

To buy Amazon from Robinhood, you will need to register for an account with the broker. You can do this through the website or mobile app.

You will be asked to provide personal details such as your name, email address, and residential address. You will also be asked to provide tax information.

After completing the registration form, you must upload proof of ID to be able to withdraw funds from your Robinhood account. This process takes no longer than 20 minutes to complete.

Step 2: Fund your account

After successfully signing up to the platform, the next step is to fund your Robinhood trading account. Robinhood accepts payments with debit card or bank transfer and deposits can take up to 30 minutes to complete.

The minimum deposit to trade on the platform is $1. We recommend starting with a small amount of funds before slowly increasing your investments.

Step 3: Search for Amazon ticker symbol

On the app or web trading platform, search for the Amazon ticker symbol, AMZN. Select the stock to view more details.

From here, you will be able to see a summary of the stock fundamentals as well as expert insight. It is a good idea to spend time analyzing Amazon stock before making any investment decisions.

Step 4: Place a market order

Once you have researched the stock market, select ‘buy’ to place a market order.

Enter the amount of Amazon you would like to buy. You can also enter stop losses, take profit, and leverage. Check that all of the details are correct before placing the trade. Amazon stock will appear in your Robinhood portfolio after a few minutes.

Selling Amazon Stock

It is also helpful to understand how to sell Amazon stock after you have bought it. On Robinhood, you can sell stocks by selecting the stock that you would like to sell and clicking ‘trade’. Here, select ‘sell’ and then enter the amount of shares that you would like to sell.

The funds will appear in your Robinhood trading account. You can withdraw these to your bank account or use them to invest in alternative stocks.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

Our verdict on Amazon (AMZN) stock in 2025

In summary, investing in Amazon stock in 2025 has both promise and caution. Despite a rollercoaster in recent years, Amazon’s resilience and rebound make it an appealing choice. Still, challenges exist, like controversies over taxes and growing competition in e-commerce and cloud services.

For those keen to buy Amazon stock in 2025, Robinhood is an intuitive and beginner-friendly option comprising a large and thriving community of users ranging from beginner to expert. With competitive fees, free stock trading, and a $0 minimum deposit for US investors, it offers an ideal environment for amateur investors.

FAQs

Can I buy Amazon stock directly?

No, Amazon stock must be purchased through a brokerage platform. One popular option is Robinhood, a user-friendly platform offering access to a variety of stocks, including Amazon.

Does Amazon pay a dividend?

As of now, Amazon doesn’t pay a dividend. The company has historically focused on reinvesting profits for growth rather than distributing them to shareholders.

Is it worth it to buy one share of stock?

Yes, buying even one share of stock can be worthwhile. It allows you to participate in the company’s performance and potential growth. Consider your investment goals and budget when deciding.

How much will one share of Amazon be worth in 5 years?

Predicting future stock prices is uncertain. It depends on various factors like market conditions, company performance, and economic trends. It’s advisable to focus on the long-term potential rather than short-term predictions.

References:

Sam Alberti

View all posts by Sam AlbertiSam Alberti has recently joined Trading Platforms as a content editor, having spent the past four years working as a journalist across various financial and business niches. He graduated from the University of Kingston in 2019 with a Master’s Degree in Journalism and an NCTJ Diploma, and has since developed a passion for both consumer and corporate finance. He now specializes in producing engaging and thoroughly-researched web content on all things finance.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up