Charles Schwab Review 2025 – Pros & Cons Revealed

Did you know that Charles Schwab is one of the oldest financial institutions in the United States and is now the third-largest asset manager in the world, just behind BlackRock and Vanguard?

If you’re thinking about using this platform then it’s important to know the pros and cons. As well as, the fees, payment types, supported markets, and account types.

In this Charles Schwab review, we cover all of this and much more, so let’s dive in!

-

-

Charles Schwab History & Background

The Charles Schwab Corporation is one of the largest financial services company in the world. Founded in 1971 by Charles R. Schwab the company was the first to offer discount sales of equities, during the 1970 financial deregulation.

Since then, the company has grown to over 360 branches (mainly in the US and UK), with more than 29 million active brokerage accounts and more than 3 million banking and retirement accounts. That’s more than $5 trillion of client assets!

With Charles Schwab, you can access a whole range of services which includes banking, wealth management advisory, trading, and investing. So whether you are a short term trader or long term investor they have the right products. You can also access a variety of markets such as stocks, bonds, fixed income, options, Bitcoin and currency futures, and much, much more.

While there are now more low-cost brokers than ever, as you can see in the Robinhood review, Webull review, and TD Ameritrade review, Charles Schwab offers some unique products as you’ll learn about further in this Charles Schwab review!

Charles Schwab Pros & Cons

If you’re looking for a quick pros and cons list, then here is what this Charles Schwab review found:

Pros:

- Large range of investment products available

- Stocks, mutual funds, ETFs, bonds, options, futures

- Trading, investing, retirement, IRA accounts

- $0 online stock and ETF trade commissions

- Powerful trading platform and research tools

Cons:

- Wealth of choice can be overwhelming

- High account minimums for Schwab Intelligent Portfolios

- Limited number and regions for international stocks

- Debit and credit cards not supported

- Futures fees higher than the industry average

What Can You Trade and Invest in on Charles Schwab?

First up in this Charles Schwab trading review is to have an in-depth look at the investment products available to trade and invest in.

Charles Schwab Forex

With Charles Schwab, you cannot trade foreign exchange using direct market access like most in the currency market. However, you can trade on currency futures and use Charles Schwab as a futures trading platform. This still provides traders with exposure to the forex market but a much more limited range confined to what is available from the Chicago Mercantile Exchange (CME).

For example, you can trade currency futures contracts on the euro, British pound, Japanese Yen, Swiss Franc, Canadian Dollar, Australian Dollar, Brazilian Real, Korean Won, Mexican Peso, New Zealand Dollar, South African Rand, Swedish Krona, and US Dollar Index.

Charles Schwab Crypto

While management at Charles Schwab has announced they would like to enter the cryptocurrency space, they have yet to do so. They have commented that they are waiting for more clarity from regulators regarding crypto assets.

However, in this Charles Schwab review it’s important to know that you can trade Bitcoin futures. This is because this futures contract is available through the Chicago Mercantile Exchange (CME).

So, if you were looking to buy Dogecoin, then you probably need a more specialised crypto day trading platform. If you’re happy to just trade on Bitcoin futures with Charles Schwab, then you should also read about the best Bitcoin trading platforms before you make your decision.

Charles Schwab Stocks

In this Charles Schwab review, we have to talk about the stock offering as it is quite competitive in the industry. With the broker, you can trade all stocks that are listed on US exchanges such as the New York Stock Exchange, NASDAQ Exchange, plus any over-the-counter (OTC) stocks and IPOs.

One really great feature is the Schwab Stock Slices product where you can buy fractional shares in any company in the S&P 500 index, for as little as $5. You can also trade a limited number of international stocks such as American Depositary Receipts (ADRs) and Canadian stocks.

Charles Schwab Options

In 2011, Charles Schwab acquired OptionsXpress for around $1 billion which boosted Schwab’s retail trading offering for options trading. You can trade online options with Charles Schwab using its specialised trading platform.

There is also a ton of support in trading options on the platform which includes support from options specialists, expert commentary, education articles, and more.

Charles Schwab ETFs

With Charles Schwab, you can invest in more than 2,000 different exchange-traded funds (ETFs). This includes more than 25 low-cost Schwab ETFs which cover domestic equity, international equity, and fixed income. This makes it a top contender when looking for the best ETF trading platform.

Charles Schwab Additional Markets

There are some additional markets you can trade or invest in that we found in this Charles Schwab review. This includes:

- Mutual funds

- Government and corporate bonds

- Money market funds

- Annuities

- Margin trading

- Commodities via Futures

- Indices via Futures

Charles Schwab Fees & Commissions

The table below outlines the Charles Schwab fees for each asset class supported:

Asset Commission (online) Commission (broker assisted) Stocks and ETFs $0 $0 + $25 service charge Schwab Mutual Funds $0 $0 + $25 service charge Other Mutual Funds Up to $49.95 per purchase Online commission + $25 service charge Options $0 base + $0.65 per contract fee $0.65 per contract + $25 service charge Futures $2.25 per contract $2.25 per contract + $0 service charge The table below outlines the Charles Schwab fees for non-trading activities:

Fee Type Charge Brokerage (Individual and Joint) $0 IRA (Traditional, Roth or Rollover) $0 Schwab Trading Services Account $0 Schwab Bank High Yield Investor Checking $0 As you can see, the fees for online trading, opening, and maintaining different accounts are competitive. There are also no fees for deposits or withdrawals. However, if you are interested in trading forex, cryptos, commodities, or indices via futures contracts then this is where Charles Schwab is the least competitive as the charge is $2.25 per contract.

This can easily add up if you are a day trader or trading in large size. For example, if you were to buy 50 euro futures contracts it would set you back $112.50 in commission to do so which is pretty hefty.

If you are interested in buying mutual funds outside of Schwab’s funds, then this can also be costly as it can cost up to $49.95 per purchase with an extra $25 if you choose the broker-assisted way.

Margin lending is also very high. In this Charles Schwab review, we found that you will pay 8.325% on balances up to $24,999.99. Even if your account is $499,999.99 you will end up paying 6.575%.

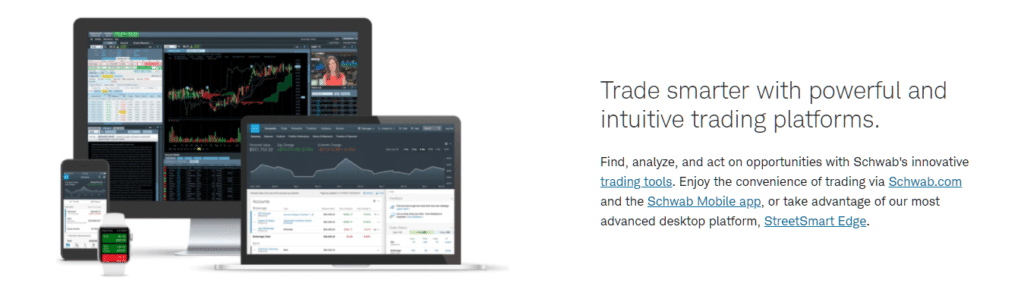

Charles Schwab Platforms

With Charles Schwab, you can trade stocks, ETFs, options, futures, and more using the broker’s own proprietary trading platforms for desktop (called StreetSmart Edge), web or mobile.

All of the platforms are very powerful and come fully loaded with unique features. Each of the trading platforms allows you to view live real-time quotes and news, as well as access technical analysis tools with in-built charting and studies.

While the trading platforms come packed with a variety of features, there will be a steep learning curve for complete newbies as there are a lot of advanced options to navigate. This makes it great for advanced traders though, who want a lot of customisation and flexibility.

Charles Schwab: User Experience

In this Charles Schwab trading review, we found that the user experience of the services they provide and how to access them to be quite friendly. But, this is only if you know what you are looking for.

The wealth of services and products is quite daunting for beginner traders. It also takes some time to go through all the different fees for each of their products.

Furthermore, the trading platform can be confusing for some as it provides a lot of features to trade a lot of different products (stocks, futures, options) all from one place. This can make it difficult for newbie investors to know how to navigate the platform.

Charles Schwab Features, Charting and Analysis

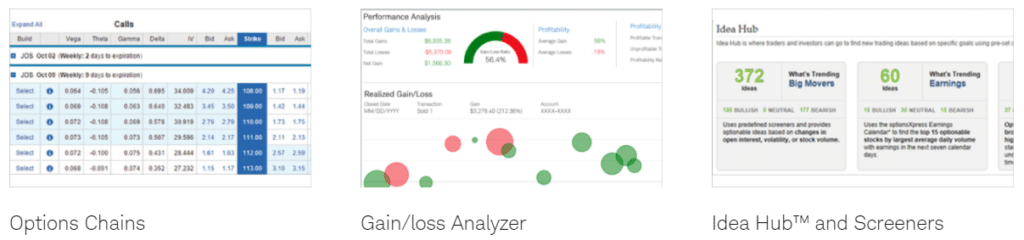

As we mentioned earlier in this Charles Schwab review, the platforms provided by the broker come fully loaded with advanced features and customisations. This includes:

- Idea Hub and Screeners. This is where you can find trading opportunities based on sentiment and trends.

- All-in-one Trade Ticket. Trade equities, options, bracket orders, and up to three conditional orders.

- Fundamental Research. View fundamental information such as company dividends, earnings announcements, ratings, and more.

- Options Chains. View real-time options chains and Greek values.

- Access an interactive Trade & Probability calculator.

- High level of customisations through adjusting layouts, scales, colours, etc.

As you can see, there are quite a few trading platform tools and analysis to use which is great for more advanced traders who are seeking a high level of analytical data and customisations.

Charles Schwab App Account Types

In this Charles Schwab trading review, we found that there are quite a few different account types to choose from. Here’s a quick rundown of them.

Brokerage Account

The Charles Schwab brokerage account allows you to invest in stocks, ETFs, options, bonds, and other products. There are no fees to open an account or to maintain it.

Retirement Account

If you’re looking to build a retirement account with certain tax advantages, then you can choose from three different options.

- Traditional IRA

- Roth IRA

- Rollover IRA

Automated & Managed Portfolios

You can access both automated and fully managed investment portfolios using Intelligent Portfolios.

The Schwab Intelligent Portfolios is a robo-advisor built portfolio that is also managed automatically. The minimum investment for this is $5,000.

The Schwab Intelligent Portfolios Premium gives you all the benefits of the Intelligent Portfolios, as well as unlimited 1:1 guidance from a certified financial planner. There is a one-time planning fee of $300 and a $30 monthly advisory thereafter.

Estate & Charitable Planning

In this Charles Schwab review, we found that you can also open:

- A Schwab Trust Account - a brokerage account for estates of any size.

- A Schwab Charitable Account - providing a tax-efficient solution for charitable giving.

Banking Account

You can also open a Schwab Bank High Yield Investor Checking Account linked to a Schwab Brokerage Account. This means you can easily fund your investments, access unlimited ATM fee rebates, and pay bills online.

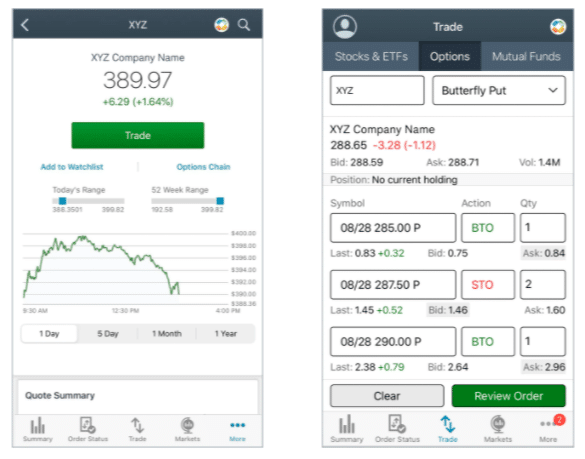

Charles Schwab App Review

Being able to access your account and make investment decisions on the move is quite important to navigate the fast pace of the financial markets. In this Charles Schwab review, we found that Charles Schwab provides a top-of-the-market mobile trading app.

You can download the Schwab Mobile trading app for Android, iPhone, iPad, and Apple Watch devices. The app is very secure too, offering the following features:

- Fingerprint and facial recognition

- Industry-standard encryption

- Schwab Security Guarantee - 100% of losses covered due to unauthorized activity

The app is simple to use and navigate with a lot of different features available. This includes:

- The ability to place and monitor trades

- Receive breaking news and real-time data

- Access interactive charts for analysis

- Enter single and multi-leg option orders

- Livestream CNBC

As there are quite a few features, it will take beginners a while to figure out where things are. However, once you get the hang of it, the app makes trading, research, and monitoring very quick.

Charles Schwab Payments

In this Charles Schwab review, we found that the broker only supports wire transfer, account transfer (cash or securities from an account at another financial institution), and via a check/money order in USD to fund your account.

Unfortunately, there is no support for debit/credit cards or e-wallets. Also, funds sent to your account in any other currency than the US dollar will be automatically converted to US dollars upon receipt.

Charles Schwab Minimum Deposit

When opening a brokerage account with Charles Schwab there is no minimum deposit to do so.

Charles Schwab Contact and Customer Service

You can contact the Charles Schwab customer service team from Sunday 5.30 pm to Saturday 1:00 am (US EST). As markets are constantly moving, it’s great to have a 24 hour a day customer support line to help with any issues or questions.

There is also a mailing address to send applications, deposits, and other materials, as well as a live chat feature open 24/7.

Is the Charles Schwab App Safe?

From our research in this Charles Schwab review, we found that the broker is regulated by top some of the world’s most well-known authorities. This means clients can enjoy a high level of security and safety of their funds.

So, in answer to the common question ‘is Charles Schwab safe?’ the answer would be yes! With over 12.3 million accounts, managing more than $4 trillion in client assets it comes as no surprise that the broker is heavily regulated by the:

- Securities and Exchange Commission (SEC)

- Financial Industry Regulatory Authority (FINRA)

- Commodity Futures Trading Commission (CFTC)

The broker is also regulated by the local authorities in other jurisdictions they operate in. This includes the UK Financial Conduct Authority (FCA), the Hong Kong Securities and Futures Commission (SFC), and the Monetary Authority of Singapore (MAS).

And if you are still asking the question ‘is Charle Schwab safe?’, then you should know that the broker is a member of the Securities Investor Protection Corporation (SIPC) which protects customers up to $500,000 ($250,000 for cash). They also work with Lloyd’s of London and other London insurers.

How to Start Trading with Charles Schwab

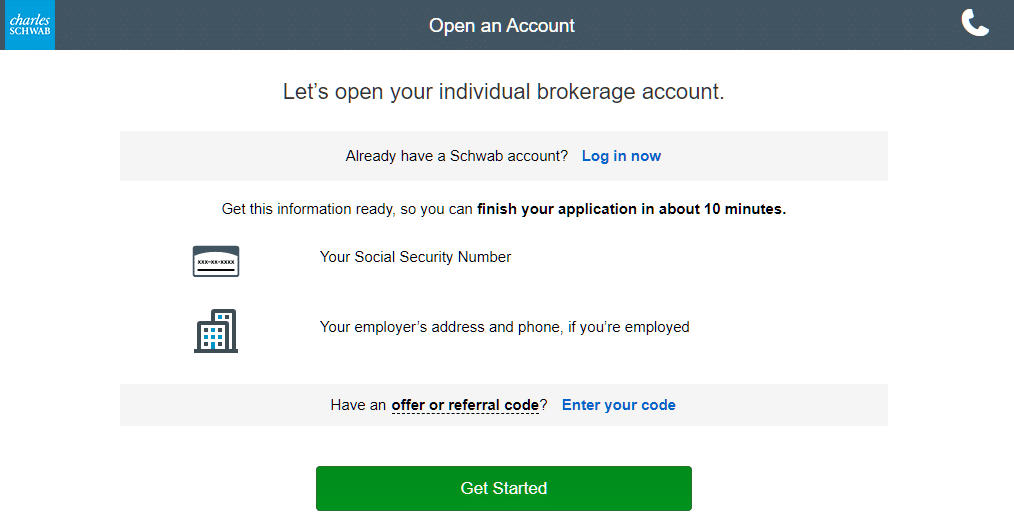

If want to start trading with Charles Schwab, then simply follow this step-by-step process to get started with the broker.

Step 1: Open an Account

You can open an account with Charles Schwab by visiting the broker’s website and clicking on the Open an Account tab. This will first ask you for your location and then ask you which account type you would like to open: Brokerage, Retirement, Automated & Managed Portfolios, Estate & Charitable Planning, or a Banking Account.

You can open an account by filling in the application form which will take about 10 minutes.

Step 2: Review Application & Submit

Once you’ve filled in your details, Charles Schwab will ask you to confirm all of your details. After reviewing the are correct, you can submit your application.

Step 3: Fund your Account

You can fund your account in a variety of ways, using bank wire transfer, sending in a check, or transferring funds from another account with another institution. The quickest way is for a bank wire transfer. You can also manage your deposit directly from the Schwab Mobile trading app.

Step 4: Select your Platform

With Charles Schwab, you can trade or invest from a variety of platforms including the StreamSmart Edge trading platform, the Web Trading platform or the Schwab Mobile trading app. Each platform comes with a variety of impressive trading tools.

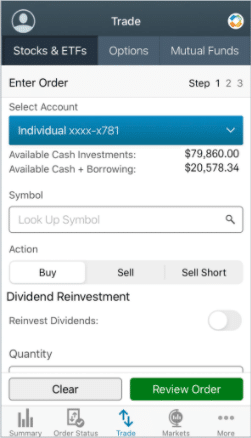

Step 5: How to Buy on Charles Schwab

Buying any security on any of the Charles Schwab platforms is relatively simple. Simply search for the market you wish to buy from the Symbol Search bar and select the quantity you wish to purchase.

You can buy stocks, mutual funds, options, and other markets and also select different accounts from the investing ticket.

Step 6: How to Sell on Charles Schwab

If you want to sell on any of the platforms provided by Charles Schwab you can do so by searching for the market and clicking Sell on the investing ticket. You can input the quantity yourself before confirming the transaction.

Charles Schwab vs eToro

In this Charles Schwab review, we found the broker does provide an impressive range of account types, markets, and tools. For example, you can invest in thousands of different US stocks, ETFs, and mutual funds - as well as options and futures markets.

However, when considering which broker best serves you it is important to do your research and look at all the options available. In this instance, you should explore the products and services provided by eToro.

From our research and comparison in this Charles Schwab review, we found that the eToro broker edges out Charles Schwab for a variety of reasons which includes:

- Global Markets. With eToro you can access stocks from all over the world and a variety of other asset classes such as forex, commodities, indices, and more. With Charles Schwab, you can only access US stocks and some Canadian stocks.

- Cryptocurrency Trading. With Charles Schwab, you can only trade on Bitcoin futures via the Chicago Mercantile Exchange. However, with eToro, you can trade on more than 20 different cryptocurrencies 100% commission-free, with a low minimum investment of just $25.

- Social Trading. One, new and popular method of investing is to copy the trades of other profitable traders. eToro is the world’s largest social trading platform. You can view the performance of traders and decide to copy their trades, like a copy trading platform. You can also interact with them to learn more about how they make investing decisions.

- Trading Fees. While Charles Schwab offers commission-free trading only on US stocks and ETFs, eToro provides commission-free trading on all asset classes including stocks, commodities, indices, and cryptocurrencies.

- Payment Methods. eToro supports a variety of payment methods including bank wire transfer, debit/credit card, and e-wallets such as PayPal while Charles Schwab only accepts bank transfer or account transfer.

- Trading Platform. The eToro trading platform is very simple to use and navigate and supersedes the Charles Schwab platform which can be complex in some places. You can also open a free account and use it as a stock trading demo account.

Charles Schwab: The Verdict

Charles Schwab is one of the oldest brokerages on Wall Street and pioneered discount equity sales. They offer a wide range of account types and access to a wide variety of markets covering different asset classes.

However, in this Charles Schwab review, we found that eToro is much further ahead in what it offers. For example, you can invest 100% commission-free in stocks from all around the world (17 countries in fact), commodities, indices, forex, and cryptocurrencies.

Furthermore, you can benefit from eToro’s standing as the world’s biggest social trading platform and copy the trades of other profitable traders and investors. We are big fans of the eToro Copy People and ready-made Investing Portfolios.

You can open an account with eToro in just a few minutes and deposit funds via bank transfer, debit/credit card or e-wallets such as PayPal.

eToro - Best Trading Platform with 100% Commission Free Trading

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

FAQs

Who owns Charles Schwab?

Charles Schwab was founded in 1971 by Charles R. Schwab. It is now a publicly listed company on the New York Stock Exchange with a variety of different shareholders.How do I withdraw money from my Charles Schwab account?

You can withdraw funds easily and commission-free from your Charles Schwab account by clicking the Transfer & Payments tab at teth top and selecting Online Transfers.Is Charles Schwab safe?

Charles Schwab offers a high level of safety and security of your funds as they are heavily regulated by the SEC, FINRA and the CFTC. They are also covered by the SIPC.Does Charles Schwab have a demo account?

Unfortunately, Charles Schwab does not offer a demo account. However, you can open an account with no minimum deposit which means you can still test the features.Can you day trade with Charles Schwab?

Yes, you can day trade with Charles Schwab but will need to satisfy the SEC Pattern Day Trading Rules which means you need to have a minimum deposit of at least $25,000.Ruby Layram Finance Editor

View all posts by Ruby LayramRuby is a Finance Editor who has 5 years of experience in the finance and cryptocurrency space. Ruby attended the University of Winchester where she received a BSc in Psychology. During her studies, Ruby developed an interest in financial psychology and began writing content around the topic on a freelance basis. Whilst she was studying for her degree, Ruby spent time learning about personal finance, investing and trading. She has written content for The Motley Fool UK, Bankless Times and Cryptonary where she also worked as an editor. Her interest in cryptocurrency came about after writing a piece for The Motley Fool about the rise of CBDCs. Since then, Ruby has actively invested in the crypto market with a focus on long-term investing. Ruby is also an experienced trader with good analytical skills. She has used a used a variety of platforms and tools to trade and has first-hand experience with many of the platforms that are featured on the Trading Platforms website.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up