9 Best Demo Trading Accounts in July 2025

If you’re looking to trade stocks online but want to test the waters first – a demo trading account will allow you to do so. In doing so, you will be able to buy and sell stocks using ‘paper money’ – meaning that you can trade without risking any of your capital.

In this guide, we review the popular stock trading demo account platforms for 2025 and walk you through the process of getting started today.

-

-

9 Popular Trading Demo Accounts in 2025

Below you will find the popular stock trading demo account providers available in the market right now. You can read our review of each trading platform by scrolling down.

- eToro: eToro offers a demo trading account with $100k of virtual funds. The account can be used to trade stocks, cryptos, forex, and more. It is also possible to practice using some of the platform’s more advanced features, such as copy trading, with the demo account. Users can access the account as much as they like whilst using eToro.

- Libertex: The Libertex demo trading features allow traders to practice placing trades on MT4 and MT5. The demo account reflects realistic market conditions. The main drawback is that you must deposit funds into your account to be able to use the demo trader.

- AvaTrade: It is possible to try leverage trading risk-free by using the AvaTrade demo account feature. This demo account is available to all AvaTrade users and can be used to trade stock CFDs and forex.

- TD Ameritrade: TD Ameritrade is a well-known stock trading platform that is great for conducting technical analysis. Traders can use the platform’s demo function to test their analysis skills before putting any real funds at risk. You do not need to deposit any funds to use the demo account.

- Fidelity: Fidelity customers can use the Active Trader Pro function to demo trade stocks. After exploring the site with the demo account, you can use Fidelity to trade on a commission-free basis.

- IG: IG supports forex and stock trading as well as a functioning demo account that can be used to test out all of the features that are offered by the platform. IG offers a range of technical indicators that can be used to conduct in-depth analysis and develop trading strategies.

- Interactive Brokers: Interactive Brokers offers an easy-to-use demo account that can be used as and when it is needed. The account is compatible with MT4 and MT5, making it suitable for advanced day traders.

- Trading 212: Trading 212 is a commission-free trading platform with access to over 10,000 markets. Traders who want to test the platform can do so by downloading the IBKR mobile app and implementing the demo trader. There is no deposit required to use the demo account.

- Webull: Webull is a user-friendly trading app that supports paper trading on both mobile and desktop. The platform is fairly beginner-friendly and offers a range of US stocks and shares to trade.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Still not sure which account to use? Here are some things to look for when doing your research:

- Low fees

- A large variety of assets to trade with

- Advanced trading tools and features

- Real-time trading conditions

- Easy-to-use platform interface

- The ability to customize the demo trader to suit your trading needs.

How to Choose a Demo Account for Stock Trading in 2025

With the popular online and mobile trading platforms now offering demo accounts – you may need to compare and choose the most suited accounts to help you in the investment process.

Here are a few factors to look for when picking a stock demo account.

✔️ Supported stock markets

First and foremost, you may need to check what stock markets the demo account provider offers. After all, there is no point going through the registration process only to find your preferred stock, exchange, or market is not offered on the platform. You can easily find this information out by visiting the broker’s website.

✔️ Amount of demo funds

When using a stock demo account platform – it will normally come with a fixed amount of pre-loaded funds.

Depending on how much paper money you want to begin trading with, choose your demo platforms accordingly.

✔️ Time limits

While the amount of demo funds on offer shouldn’t be a major priority, the time limit of the facility should. This is because some stock demo accounts can only be used for a certain amount of time – say 30 days. This is somewhat problematic for two key reasons.

Firstly, if you are completely new to the world of online stock trading – then a time limit of 30 days might not be enough for you to get to grips with how things work. Secondly, it is important to remember that demo accounts are not only used by inexperienced traders.

On the contrary, seasoned traders will also use demo accounts to test out new strategies and systems.

✔️ Demo account functionality

Many demo accounts come with full functionality. This means that you will have access to the same markets, orders, and features as found on real money accounts. More importantly, the best stock demo accounts will mirror live market conditions.

This means that what you see on your demo trading screen is like-for-like with what real market speculators see.

✔️ Trading tools & analysis

Depending on your investing needs, you may want access to more advanced technical features to test out new strategies without risking your money.

Popular Demo Trading Accounts Reviewed

The popular stock trading demo accounts will look to mirror live market conditions and provide users with the chance to invest in plenty of assets and markets as well.

In the sections below, we review some of the popular stock demo accounts in 2025.

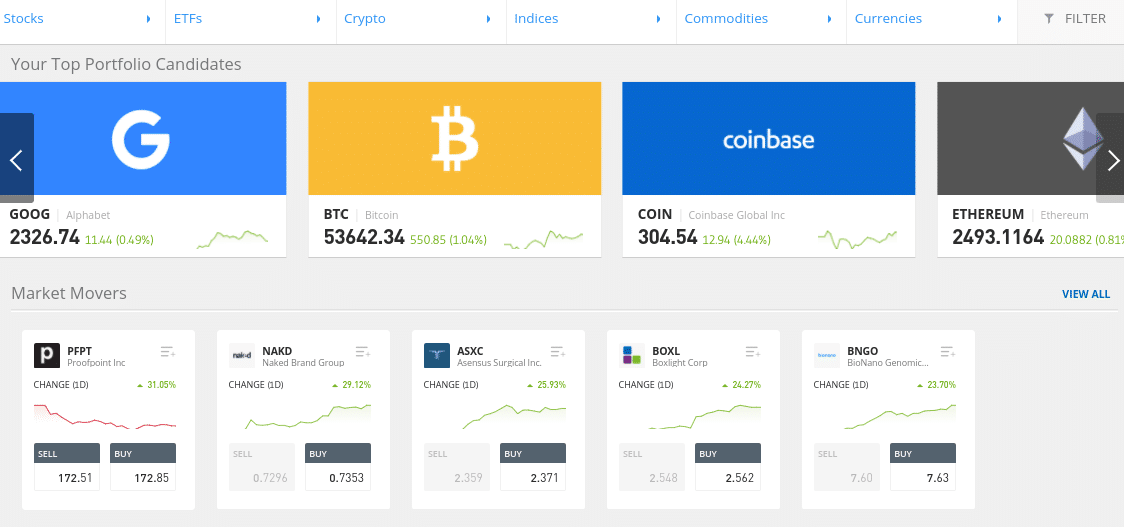

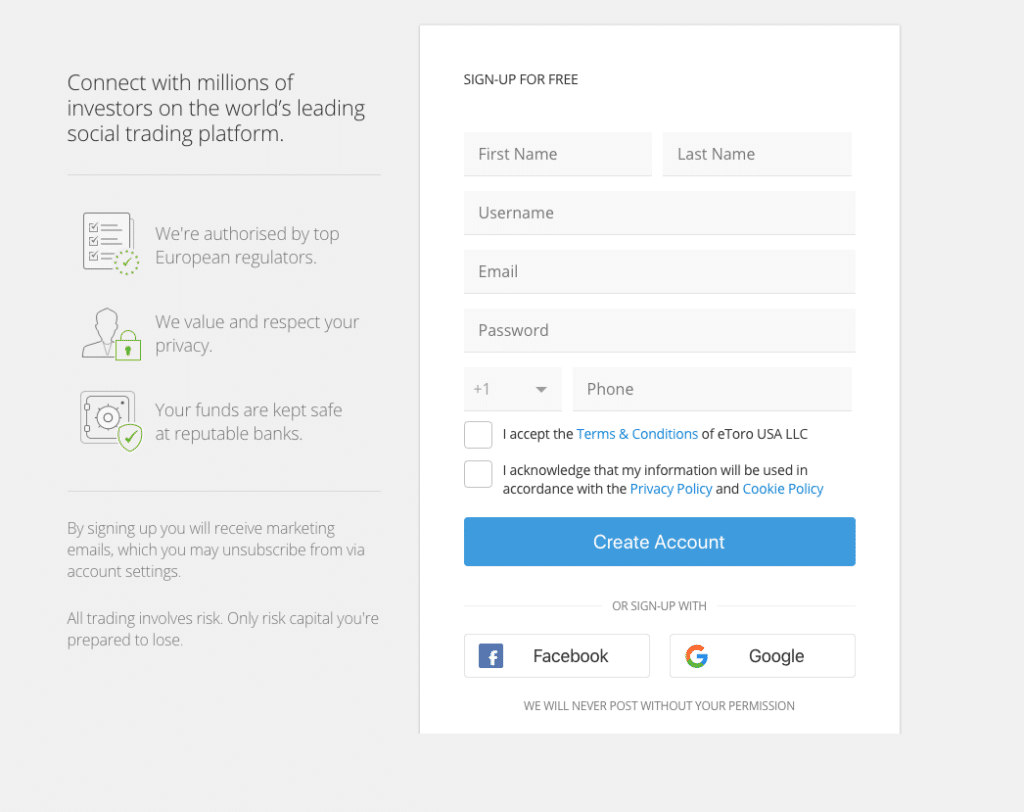

1. eToro – A popular online broker that offers a free demo stock trading account with up to $100,000 in virtual funds

eToro is a popular online broker that now boasts a client base of over 26 million traders. This brokerage site covers an abundance of day trading assets – including commodities such as coffee or sugar, forex, indices, and cryptocurrencies. However, it is the stock trading department where eToro really stands out. This is because you will have access to thousands of stocks from 17 markets.

This includes NASDAQ and NYSE in the US, as well as the UK’s London Stock Exchange. You can also trade stocks from Hong Kong, Saudi Arabia, Germany, the Netherlands, France, and more. You can access these markets via the eToro stock demo trading account – which comes pre-loaded with $100k in paper funds. The demo account mirrors live market conditions, so you can get a real understanding of how stock trading works in a risk-free manner.

You don’t need to deposit any money to use the trading demo facility, albeit, you will need to open an account. This should, however, take you less than a few minutes. If you decide to start trading stocks with real money, you’ll be pleased to know that eToro does not charge any commission or dealing fees. Plus, the minimum stock trade is just $10 – meaning eToro supports fractional stocks. You can easily deposit funds too – as the broker supports debit/credit cards, Paypal, bank transfers, and other e-wallets.

An additional feature at eToro is its Copy Trading tool which makes it a suitable trading platform for beginners. This allows you to browse thousands of successful eToro traders and then copy your chosen investor like-for-like. eToro is also available via an Android and iOS trading app – which also comes inclusive with a day trading simulator. When it comes to safety, eToro is authorized and regulated by ASIC, CySEC, and the FCA. US clients are covered by FINRA registration.

Stock Broker Minimum Deposit Fractional Shares? Pricing System Cost of Buying Stocks Fees & Charges eToro $10 Yes – $10 minimum 0% commission on ALL real stocks, spreads for CFDs Market spread is not included when purchasing real stocks No Deposit fees, $5 withdrawal fee, $10 inactivity fee, no account management fees. Pros:

- There is no limit on how much you can use the demo trading account.

- Can be used to trade traditional stocks and cryptos.

- Low minimum deposit of just $20.

- Access to social trading and copy trading

Cons:

- You cannot use the demo account until you have deposited funds.

- Limited crypto assets available.

- Cannot be used with MT4 or MT5

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

2. Libertex – Demo trade with 50,000EUR for free at anytime; use the demo account to practice trading on MT4

Libertex is a CFD trading platform that allows you to trade with tight spreads.

Many of the stocks hosted by Libertex can also be traded without paying any commission. Some stock markets do attract a commission, but this is usually less than 0.1%. When using the Libertex live stock simulator – you can do this via the platform’s web trading platform.

Alternatively, you can also connect the day trading demo account to MT4 or MT5. In terms of safety, Libertex is regulated by CySEC and it has a two-decade track record in the trading space. You can deposit funds with a debit/credit card, e-wallet, or bank wire – and the minimum is just $100.

Pros:

- Tight spreads and low fees.

- Can be sued with MT4 and MT5 to trade with advanced tools.

- Regulated by CySEC.

Cons:

- The platform only offers CFD assets.

- No social trading features.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 85% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

3. AvaTrade – A regulated platform that offers a demo account to new users; the demo account can be used with MT4

Avatrade is an online trading platform that specializes in stock CFDs – meaning you won’t own the underlying shares. This does, however, allow you to trade stocks with leverage. You can also short sell stocks on AvaTrade – meaning you can profit from both rising and falling markets.

In order to use the MT4 demo account via AvaTrade, you will first need to register your personal details. Then, you can start trading stocks with paper money in live market conditions. If you decide to use AvaTrade to trade with real money, the minimum deposit here is just $100. This MT4 broker is regulated in 6 jurisdictions and it is planning to go public later in 2025.

Pros:

- The platform is regulated around the globe.

- Access to MT4 trading platform for advanced analysis.

- Ability to trade with leverage.

Cons:

- Users can only trade CFDs.

- High minimum deposit of $100.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

4. TD Ameritrade – An established US brokerage that provides a free demo account for stock trading via Thinkorswim

If you are an experienced trader that focuses on technical analysis and chart reading – TD Ameritrade has a proprietary platform – thinkorswim, which is packed with advanced analysis tools. This includes heaps of technical indicators or signals.

The thinkorswim platform can be accessed online through your web browser. But, to get the full experience, it’s worth downloading the software to your desktop device. Best of all, TD Ameritrade allows you to access thinkorswim via a stock demo account.

You’ll need to first register an account to use the demo stocks facility. In doing so, you’ll have access to thousands of stock trading markets from around the world. When it comes to trading fees, TD Ameritrade offers 0% commission trading on US stocks. There is no minimum deposit – should you wish to trade with real instead of virtual money.

Pros:

- Advanced trading tools for experienced traders to analyze the market.

- Can be used through your web browser.

- 0% commissions of US stocks.

- No minimum deposit requirement.

Cons:

- No mobile app available.

- The platform may be too advanced for beginner traders.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

6. Fidelity – The best international stock trading platform demo account

While many trading platforms only give you access to markets in the US – Fidelity takes things to the next level. In fact, this trusted brokerage site allows you to trade stocks from 25 international markets. This covers Europe, Asia, the Middle East, North America, and more.

We like the fact that Fidelity offers fractional stocks – with the minimum trade standing at just $1. You will also avoid paying any commission should you trade a stock listed on the NYSE or NASDAQ. When it comes to its demo online trading account facility – you will be using Active Trader Pro.

This is the native trading platform built by Fidelity from the ground up. This comes pre-loaded with an abundance of tools – including real-time insights, technical indicators and chart drawing tools, and the ability to create up to 50 orders simultaneously. You can download the Active Trader Pro software to your Windows or Mac device – and then start trading with paper funds.

Pros:

- Traders can execute multiple orders at the same time.

- Available on iOS and Windows devices.

- Minimum trading amount of just $1.

Cons:

- Cannot be used on Android devices.

- No access to crypto assets.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

7. IG – Use IG’s demo trader to practice spread betting and CFD trading on a risk-free basis

IG is a popular brokerage firm that offers traditional stocks, funds, CFDs, forex, and much more. With that said, if you’re based in the UK or Ireland – you can use IG for its spread betting facility. This will allow you to trade stocks without paying any capital gains tax.

Much like CFDs, by spread betting stocks you will not own the underlying shares. But, you will be able to choose from a long or short position and apply leverage of up to 1:5. Supported markers at IG include dozens of stock exchanges – ranging from the UK and the US to Australia and South Africa.

IG offers a stock trading practice account which will allow you to get to grips with spread betting stocks in a risk-free manner. If you decide to trade with real money instead of fake money, this heavily regulated broker requires a minimum deposit of £250 – which you can meet with a debit card or bank transfer.

Pros:

- Offers CFDs, forex, traditional stocks and crypto assets.

- Unlimited demo trading account.

- Regulated around the globe and offers excellent customer support features.

Cons:

- High minimum deposit of $250.

- Does not accept PayPal as deposit method.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

8. Interactive Brokers – Free demo day trader account for stock trading international markets

Interactive Brokers is one of the largest trading platforms globally – with millions of investors under its belt. The platform covers a full range of markets – including commodities, futures, options, mutual funds, and stocks.

In fact, the broker supports trading markets across 33 different countries. Interactive Brokers’ native platform, the IBKR platform, is packed with advanced features. This is inclusive of technical indicators, stock screeners, charting tools, flexible orders, and fully customizable screens.

You can also deploy custom trading strategies – which paves the way for algorithmic and automated systems. To gain access to the Interactive Brokers free demo account for stock trading – you will first need to register. Then, once you log in to IBKR (online or through desktop software), you can then select the ‘free trial’ option.

Pros:

- Access to a wide range of markets.

- Ability to customize trading strategies in the demo trader.

- Experienced traders can use advanced analysis tools to find profitable trades.

Cons:

- Not compatible with MT4 or MT5.

- Cannot be used to trade crypto assets.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

9. Trading 212 – US penny stock trading demo account for fractional shares

Trading 212 is a popular trading site that allows you to invest in over 10,000 markets. This includes stocks based in the UK, Europe and the US.

There are no trading commissions or ongoing fees at Trading 212 – and you can invest from just $1 per stock. While using the demo account of Trading 212, there is no need to open a normal stock trading account as well. Instead, you simply need to download the app and click on the ‘demo’ account option. In doing so, you can start trading stocks risk-free.

If you decide to use Trading 212 with real money, you will not need to pay a minimum deposit. You can fund your account with a variety of payment methods – which is inclusive of debit/credit cards, and bank transfers. Trading 212 – which is regulated by the FCA, also offers CFD markets on stocks, forex, commodities, and indices.

Pros:

- Minimum trade amount of just $1.

- Multiple payment methods available.

- Zero commissions of stock trading.

Cons:

- Does not offer crypto assets.

- No social trading features or automated trading tools available.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

10. Webull – US stock demo trading account that can be used on your phone

If you’re based in the US and looking to trade stocks on your cell phone – Webull allows you to trade in stocks and access a demo account as well. This trading app allows you to buy and sell stocks without paying a single cent in commission. It also supports fractional ownership – so you can trade with just a few dollars.

With that said, many investors will initially use the Webull stock trade demo account before trading with real money. In order to gain access, you’ll need to open an account, download the app, and select ‘Paper Trading’ from the menu.

This comes pre-loaded with $1 million in demo funds. Although Webull is commission-free, it does charge $1 per month on its standard account. Other accounts – which come with more features and perks – cost $3 and $9 per month.

To learn more about this trading platform, check out our Webull review.Pros:

- Low commissions on stock trading.

- Demo account has $1 million in virtual funds.

- The platform can be upgraded from $3 per month to access advanced features.

Cons:

- Limited assets available.

- Not all tools are free to use.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

How to Get Started With a Demo Trading Account in 2025

If you’re looking to start using a trading demo account right now – we provide you with a breakdown in the sections below:

Step 1: Open your trading account

Head over to the homepage of your chosen broker and begin the account set-up process. You will be required to fill in your personal details – including your full name, email address and mobile number. Create a username and password for the platform to continue.

Step 2: Switch to virtual portfolio mode

As you are only using the stock demo account facility at this stage – there is no requirement to upload any ID. This means that you can start trading stocks in a risk-free and live environment straightaway.

Simply switch to virtual mode on your demo trading account.

Step 3: Start stock trading in demo mode

Once you are on demo mode, you can review and go through the different features available. Ideally, your chosen platform will mirror live market conditions and give you a large budget to begin trading with.

Step 4: Place demo stock trading order

Once you choose the asset you want to trade, insert the amount of money you wish to begin with and confirm the trade.

Step 5: Trade with real money

Now that you know how to trade on the demo account, you may also want to know how to begin trading on a real trading account.

You simply need to:

- Upload a copy of your government-issued ID.

- Make a deposit with a debit/credit card, Paypal, Neteller, Skrill, or local bank transfer

- Switch your portfolio from virtual to the real setting.

Conclusion

Irrespective of whether you are a first-time stock trader or an experienced pro– demo accounts allow you to test strategies without risking any real money. After carefully reviewing the best demo trading accounts, eToro stands out as the best option because it is free to use and provides users with unlimited virtual funds. Furthermore, it is possible to switch between live and demo trading at any time with eToro.

FAQs

Can you trade stocks on a demo account?

Yes it is possible to trade stocks on a demo account as long as the platform supports this type of financial assets. The best demo account for trading stocks is eToro which offers over 2400 stocks and shares.

Are trading demo accounts accurate?

Demo accounts use simulations to mimic live market conditions. The price movements that are shown in demo accounts are usually based off of past data however, not all trends and prices have actually been seen in the live market.

What is the best app to practice trading stocks?

The best app to practice stock trading is eToro. This is because the platforms allows users to practice stock trading for free at any point during their trading journey. Furthermore, you do not need to deposit any funds into your account to use the demo trader at eToro.

References:

Kane Pepi Finance Writer

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Kane has also written for websites such as MoneyCheck, InsideBitcoins, Blockonomi, Learnbonds, Buyshares n and the Malta Association of Compliance Officers.

Before starting his career as a writer, Kane studied at the University of Central Lancashire where he received a Masters Degree in Financial Investigation and then a Research Doctorate in Criminal Justice. Pepi is passionate about helping people to make informed decisions through high-quality, educational content.

Visit eToroeToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.eToro: Best Trading Platform with 0% Commission

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up