How to Invest in Coffee Stocks in 2025 – Coffee Commodity Trading

Investing in coffee stocks can sometimes be a very profitable activity when you know the right time to buy the stock.

In this guide, we will mention some of the best coffee companies in the United States so that all those who desire to buy coffee stocks can buy the best available stocks in the market.

How to Buy Coffee Stocks – Quick Steps To Coffee Commodity Trading

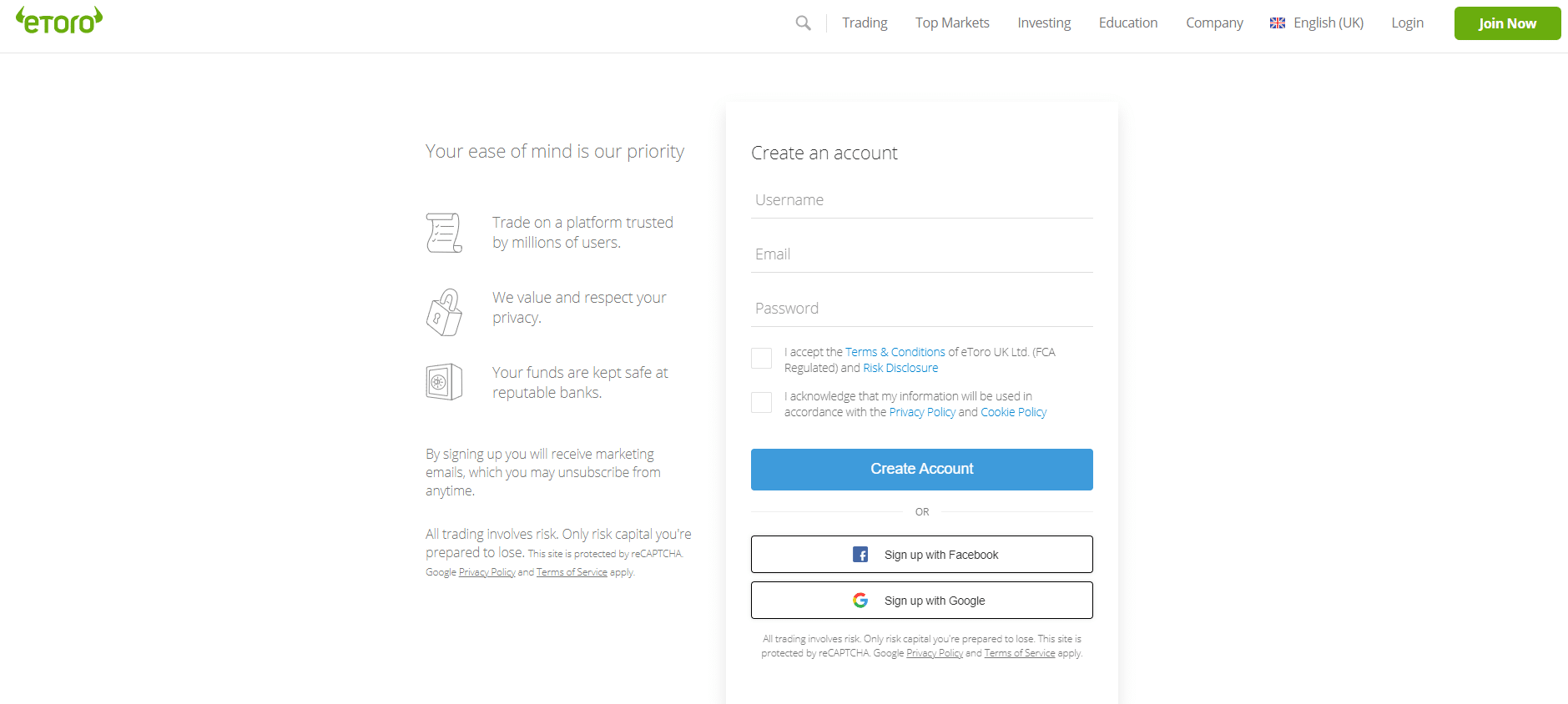

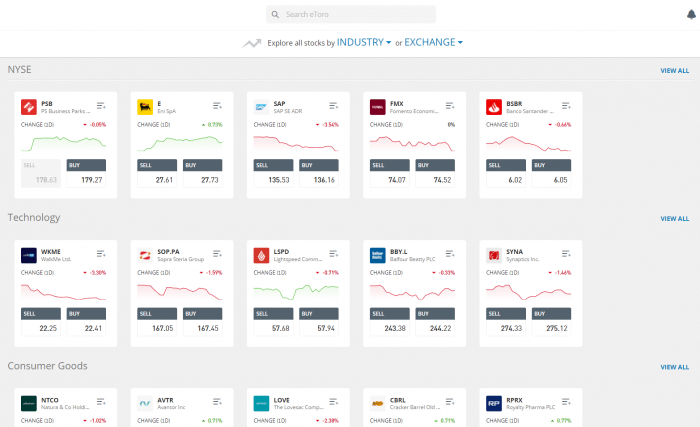

If you would like to get simple instructions on how to buy coffee stocks, then we recommend that you access the eToro platform to learn about the stocks of some of the companies that hold coffee stocks. When you access the eToro platform, you need to do the following:

- Create your account – Start by opening a free eToro account, or log in with your Facebook or Google account.

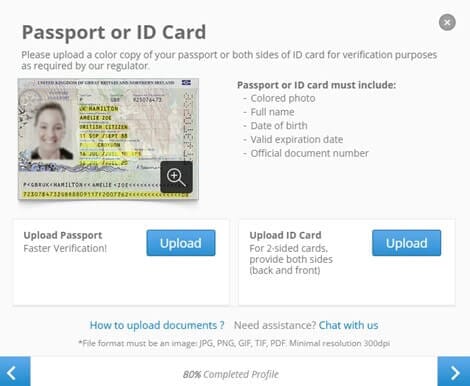

- Verify your identification – Next, verify your identity by providing your driver’s license, passport, or ID card.

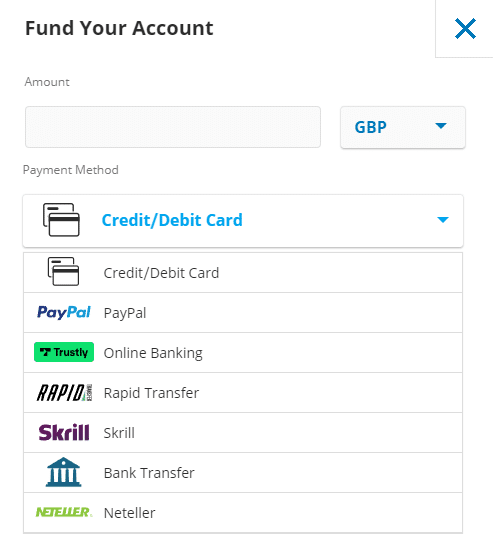

- Deposit funds – Deposit the funds you will use as your initial investment using one of the many payment methods available.

- Buy Coffee Stocks – Finally, search for the best coffee stocks to buy and begin the process of buying the stocks that most appeal to you.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Step 1 – Choose a Coffee Stocks Broker

It is important always to choose a regulated broker where all the guarantees in terms of security are given so that the experience is the best possible. Therefore, in the following part of our guide, we have prepared reviews on different brokers for you to choose the one that best suits your needs.

1. eToro – The Best Trading Platform To Invest In Coffee Stocks

Out of all the brokers, eToro is the most profitable. There are no account charges to worry about with no deposit fees and 0% commissions on stock and exchange-traded fund activity. Also, you can buy coffee stocks in major stocks with a minimum investment of $50.

CopyTrader and CopyPortfolios are two innovative copy trading features provided by eToro. With these tools, you can copy the trading strategies and CFD portfolios of other more experienced traders in the market.

eToro is regulated by both the FCA as well as CySEC and ASIC. As a result, your assets and trading account are protected by higher financial authorities, including the FCSC.

eToro fees:

| Fee | Amount |

| Stock trading fee | Free |

| Forex trading fee | Spread, 2.1 pips for GBP/USD |

| Crypto trading fee | Spread, 0.75% for Bitcoin |

| Inactivity fee | $10 a month after one year |

| Withdrawal fee | $5 |

Pros:

Pros:

- Top-tier financial regulatory bodies: FCA, CySEC, and ASIC

- 0% commissions and no share dealing fees

- Lots of stocks listed on 17 international exchanges

- Use your debit/credit card, e-wallet, or bank account to deposit funds

- Copy-trading features

- Set price alerts on the mobile trading app

Cons:

Cons:

- $5 fee for withdrawals

- 5% conversion fee for non-USD deposits

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

2. Webull - One Of The Most Popular Brookers To Buy Coffee Stocks In The US

Webull has positioned itself as one of the most famous platforms in the US market. Its interface is completely easy to use and without any problems for beginners.

Webull is used by users who intend to make investments in small amounts. Fractional investments can be made on this platform starting from one dollar. This platform is also a platform that does not charge a single commission.

Webull charges a monthly fee to access the details of the level II market. This fee will cost you $1.99 per month. In addition, security is not an issue at Webull, as the broker is regulated and registered by the SEC and FINRA and is a member of SIPC.

Webull fees:

| Fee | Amount |

| Stock trading fee | 0% |

| Forex trading fee | Not Supported |

| Crypto trading fee | 0% |

| Inactivity fee | No |

| Withdrawal fee | $25 |

Pros:

Pros:

- Thousands of stocks and ETFs to trade

- Support for foreign companies via ADRs

- Trading in cryptocurrencies and stock options

- Trading with a 0% commission

- Simple and easy-to-use interface

- Mobile apps are available for iOS/Android

Cons:

Cons:

- Platform fee of $1.99 per month for Level II pricing data

- There is no support for PayPal or debit/credit cards

There is no guarantee that you will make money with this provider. Proceed at your own risk..

3. Robinhood - With An Extensive Portfolio To Buy Coffee Commodity Stocks

Robinhood is a broker created in 2013 in the United States thanks to the collaboration between Vladimir Tenev and Baiju Bhatt. This company seeks to invest without the need to make large investments and without commissions. According to the website, the platform seeks to "democratize finance for all."

Robinhood offers a fairly large portfolio of stocks and ETFs listed on the US markets (NYSE and NASDAQ). In addition, you can invest in coffee stocks and cryptocurrency markets. Beyond its commission-free offering, Robinhood's main advantage lies in its ease of use.

Opening an account only takes a few minutes to complete the process and be able to invest in stocks, and no prior experience is required.

RobinHood fees

| Fee | Amount |

| Stock trading fee | 0% |

| Forex trading fee | Not Supported |

| Crypto trading fee | 0% |

| Inactivity fee | No |

| Withdrawal fee | Free |

Pros:

Pros:

- Over 5,000 stocks and ETFs listed in the US

- Investing in cryptocurrencies and stock options

- Commission-free

- There is no minimum balance requirement

- Even a few dollars can be used to trade

- Intensively regulated

Cons:

Cons:

- Only 250+ international stocks are supported

- Neither forex nor commodities are traded

There is no guarantee that you will make money with this provider. Proceed at your own risk..

4. TD Ameritrade - The Best Broker For Experienced Traders To Buy Coffee Stocks

TD Ameritrade founded in 1975, is one of the longest-established brokerage firms in the industry in the United States. The platform, which enjoys great recognition, has about 11 million users.

This platform is characterized by its reliability, broad portfolio, and prestige. Among the products are stocks, bonds, and mutual funds.

TD Ameritrade also has trading services for options, futures, and currencies if you like short-term investing. In addition, TD Ameritrade has initiated commission-free trading of U.S.-listed stocks and exchange-traded funds.

The multitude of functions and modern strategies offered by TD Ameritrade's unique "thinkorswim" day trading platform proves that the broker is best suited for more experienced traders. Therefore, TD Ameritrade may not be a good choice if you are not experienced in trading.

TD Ameritrade fees:

| Fee | Amount |

| Stock trading fee | 0% |

| Forex trading fee | Not Supported |

| Crypto trading fee | Not Supported |

| Inactivity fee | No |

| Withdrawal fee | Free |

Pros:

Pros:

- There are tens of thousands of traditional investment products

- Exchange-traded funds, stocks, and ETFs from US exchanges

- Forex, futures, and options are available to active traders

- Trade US-listed stocks and ETFs with 0% commission

Cons:

Cons:

- For new traders, it’s too complex

- A confusing fee structure

- Debit/credit cards are not supported

There is no guarantee that you will make money with this provider. Proceed at your own risk..

5. Interactive Brokers - Best Broker To Diversify Your Investment In Coffee Commodity Stocks

Founded in 1978, Interactive Brokers is a free trading platform located in the U.S. This platform is regulated by different economic authorities, including the Financial Conduct Authority of the United Kingdom and the U.S. Securities and Exchange Commission.

Interactive Brokers is listed on the NASDAQ under the symbol IBKR, and its market capitalization is $28.08 billion. As Interactive Brokers is a publicly-traded company, it must make its financial statements public for public knowledge. As a result, many investors consider this platform one of the most reliable markets.

Interactive Broker is a platform that offers a commission-free system. In addition, Interactive Brokers has one of the widest product and market offerings. This discount broker has conventional stocks and ETFs, futures, CFDs, and forex trading at a low price and without commissions, allowing you to diversify your portfolio.

You can invest in the best coffee stocks listed on international exchanges with Interactive Brokers. You can even trade and invest in fractional shares on this free investment platform. In short, both beginners and more experienced traders can invest as much capital as they see fit to meet their expectations and deadlines and diversify their portfolios without determining the number of whole stocks they can buy.

Interactive Brokers fees:

| Fee | Amount |

| Stock trading fee | 0% |

| Forex trading fee | Not Supported |

| Crypto trading fee | $5.00 per contract |

| Inactivity fee | No |

| Withdrawal fee | One free withdrawal request per month. |

Pros:

Pros:

- US clients can trade ETFs and stocks commission-free

- Interest rates at low margins

- Access to social trading services and robo-advisory services

- Shares of stocks listed on international exchanges can be purchased.

- You can buy and sell fractional shares.

Cons:

Cons:

- Accounts with less than $2,000 in balance are subject to a $20 monthly inactivity fee.

- For new or inexperienced traders, the interface might seem cumbersome.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

Step 2 – Research On Coffee Commodity Trading

Now that you know where you can go if you want to buy the best coffee stocks, you may think you are ready to enter the market. However, we recommend that you first do a little research on coffee stocks to decide which are the best stocks to invest in.

What Is Coffee?

Coffee is a beverage prepared from coffee beans, resulting from the Coffea arabica tree roasting.

The population drinks coffee mainly to relieve mental and body fatigue and increase mental agility. Coffee is also used to prevent diseases such as Parkinson's, dementia, and several other conditions, although there is no scientific proof to reinforce many of these uses.

Best Coffee Commodity Stocks

Nestle S.A.

Nestlé's most relevant activity is powdered and liquid beverages, including Nescafé and Nespresso's coffee brands. This sector contributed $25.9 billion of the $93.9 billion profit in 2021. In addition, soluble coffee and coffee products contributed $18.4 billion in sales as the company recovered from a decline caused by the pandemic the previous year.

Overall, the powdered and liquid beverage line is highly profitable, with an underlying operating return of 23.5%, placing it as the company's second most profitable category. In addition, trading bagged coffee, and ready-to-drink beverages have been a key expansion source for Nestlé.

Keurig Dr Pepper Inc.

As a private company, investors may not own JAB stock. However, coffee investors should be sensitive to this company's influence in the market, as it has acquired several coffee companies in recent years. It also led to the IPO of Krispy Kreme on July 1, 2021. In addition, at the end of 2020, JAB owned 33% of Keurig Dr Pepper.

Coffee systems, the business segment consisting of Keurig coffee makers, K-Cup pods, and other types of coffee, contributed $4.7 billion in revenue in 2021, 37% of KDP's total. But it accounted for $1.31 billion in operating income or 46% of the company's total. In other words, Keurig's coffee business remains very lucrative, thanks to a 28% operating profit, even as it has abandoned numerous earlier patents. Moreover, the pandemic did not significantly affect Keurig because of its focus on home coffee consumption.

Keurig's system takes advantage of the blade business model; consumers have to buy high-margin K-Cup capsules to continue using their machines. The investment in Keurig also deters users from switching to a competitor.

Sales of KDP coffee systems only grew by 6% in 2021, suggesting that the category may be maturing. Demand for soft drinks has also declined. However, Keurig's high margin will continue to generate profits for KDP.

Sales of KDP coffee systems only grew by 6% in 2021, suggesting that the category may be maturing. Demand for soft drinks has also declined. However, Keurig's high margin will continue to generate profits for KDP.

Coffee Holding Company, Inc.

In June 2021, Coffee Holding Co. purchased its 50,000-square-foot roasting facility from La Junta, Colorado. The acquisition will benefit the company's operational performance and save more than $100,000 in rental costs per year.

The company has a market price of $33.05 million. During the first quarter of 2021, Coffee Holding Co. reported earnings per share of $0.12, beating the earnings per share of $0.11 for the same period in 2020. During the first quarter, the company's revenue totaled $18.13 million, decreasing from $19.26 million for the same period in 2020.

Coffee Stocks Investing Fundamentals

Fundamentals include cash flow and return on assets (ROA). Fundamental analysis examines the fundamentals of a coffee stock. This sense studies any data that may impact the price factor or the value received. It is distinguished from trading models. Fundamental analysis is based on going back to basics.

In fundamental analysis, the value of a company is determined by its shares, which are bought or sold based on their value. The fundamentals of a company can be valued by considering the following indicators:

- Cash flow

- Return on assets

- Use of moderate leverage

- Earnings retention history for financing future growth

Coffee Stocks Dividends

Dividends are another way to profit from coffee stocks. Dividends are a way for large companies to distribute their profits to stocks.

When they do, you will receive your share of the profits. The results of dividends depend on the performance of the company. If the shares pay dividends, they are usually distributed every 3 to 6 months.

Dividends accrue to capital gains, so you receive both. Therefore, it is best to invest in coffee stocks that increase in value and, in turn, pay profits.

What Coffee Stocks To Buy Today?

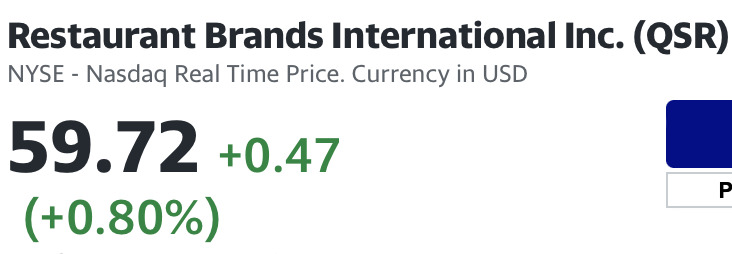

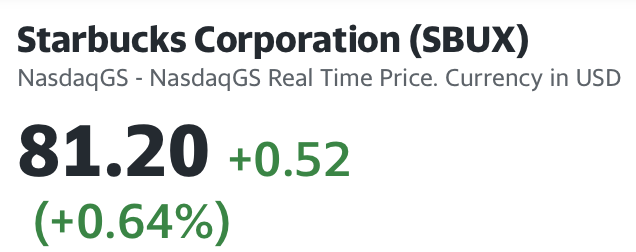

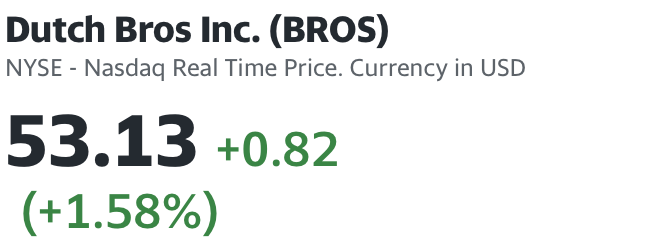

So what are the best coffee stocks to buy or add to your watch list right now? Among the best are Restaurant Brands International Inc. (QSR), Starbucks Corporation (SBUX), and Dutch Bros Inc. (BROS).

Restaurant Brands International Inc. (QSR)

The company has a stock price of $30.92 billion and offers a dividend yield of 3.17%. The company reported second-quarter adjusted EPS of $0.77, beating the consensus EPS of $0.61. Restaurant Brands International's revenue was $1.44 billion, above consensus expectations of $1.15 billion.

As Keurig Dr Pepper Inc, Starbucks Corporation, Nestle S.A., McDonald's Corporation, Monster Beverage Corporation, and Yum China Holdings, Inc, Restaurant Brands International is among the best coffee stocks to buy today.

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Starbucks Corporation (SBUX)

Today, Starbucks holds more than 34,000 places worldwide. Although Starbucks has long seemed ubiquitous, the coffeehouse chain continues to grow.

Starbucks has been one of the pioneers in recognizing the impact of mobile applications. It was a forerunner in digital payment methods, a rewards program, and the mobile ordering and payment system, making it easy for customers to place orders remotely and pick them up upon arrival.

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Dutch Bros Inc. (BROS)

The Oregon-based coffee chain is making remarkable progress, and it's only fitting that it has piqued investor interest. While most coffee chains worked during the pandemic, Dutch Bros operated to prosper thanks to its self-service model. After a modest development in 2020, comparable sales increased by 8.4% in 2021. The organization also extended 98 new stores in 2021 and has 538 locations in 12 states, split evenly between franchised and company-operated stores.

In addition, the company's drive-thru model helps it distinguish itself from coffee chains like Starbucks, and its large average unit volumes signal strong demand. Dutch Bros closed in 2021 with average sales of $1.85 million at its stores, which is better than most fast-food restaurants.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Best US Coffee Companies

We find those mentioned in this article among the best U.S. coffee companies except for Nestle and other great companies such as Dunkin' and Black Rifle Coffee Company.

Always remember to do previous research on the coffee market to know which are the best companies. In this way, you will be able to acquire the best coffee stocks in the market. It is good to reiterate that you should never invest more than what you can lose of your income in theory. If you do not have much experience in the field, starting with a minimum investment to diminish the risks is always advisable.

Is it Worth Investing in Coffee Stocks?

Coffee is a high-yield sector for the world's leading FMCG companies. It is also a timeless product that is likely to grow in popularity as more people seek alternatives to sugary beverages such as soda.

Although coffee is a highly competitive sector, it offers possibilities for selective and mass consumption stocks. Therefore, different investor profiles can make the right choice, whether they are looking for expansion stocks or dividend stocks.

For investors, a product like coffee is clearly attractive. Coffee has addictive properties, but research has shown that it is actually good for health. Moreover, the nature of the coffee-drinking habit means that users are not as susceptible to coffee prices.

Step 3: Open Account & Invest with eToro

1. Create Your Account

By accessing the website, you can create an account with eToro. Regardless, you must have a brokerage account to trade stocks on any regulated brokerage platform, of which eToro is one of the most prominent. Therefore, the first requirement is to open an eToro account, which can be avoided using a Gmail or Facebook account.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

2. Verify Your ID

It makes no difference if you already have a Facebook or Gmail account or if you start from scratch. KYC or identity verification is required on all regulated platforms. Since users can verify that they are who they claim to be, they are covered against identity theft. What's more, because traders are built into the system, fraudulent activity of any kind is prevented.

To verify your account, you only need to provide certain personal information, such as a photo of your ID card, passport, or driver's license. eToro may also ask you to send a copy of your bank statement to verify that your home address corresponds to the one shown on your application.

3. Deposit Funds

Investing in the best coffee stocks requires you to deposit funds in the more convenient second tier. Log in to your eToro account and click on the "Deposit Funds" button.

You will then be redirected to a new window where you can choose the payment method and value you want to use. Once you are done with the payment requirements, you can proceed to the end of the process.

4. Buy Coffee Stocks!

You can now buy coffee stocks. By entering the name or indicator of a particular stock, eToro will immediately take you to its page. The markets are also available to you on the platform's stock page.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Conclusion

You will most likely make a return if you invest in the market for the best coffee stocks. First, however, you have to find a way to lower the stock price as much as possible. And if you want to achieve this, you should opt for one of the platforms that do not charge commissions. In this guide, as mentioned, there is more information about coffee shares and how to buy shares. Our recommendation is eToro, a commission-free platform with a perfect learning environment, so you should consider it your platform of choice. To find the best or the smallest coffee stocks to buy, you need to study the two or three best developing companies to buy, and based on your research, choose the appropriate investment decision.

eToro – Buy Coffee Stocks

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.