TD Ameritrade Review 2025 – Pros & Cons Revealed

TD Ameritrade is one of the most established online brokers in the US. If you’re thinking about using this platform, you’ll need to consider key metrics like supported markets, fees, minimum account balances, payments, and more.

In this TD Ameritrade Review 2025 – we cover everything there is to know about this popular trading platform.

-

-

TD Ameritrade History & Background

Founded in 1975 – TD Ameritrade is one of the oldest brokerage houses in the US. With more than four decades in the investment scene – it will come as no surprise to learn that the platform is now home to 11 million clients. This translates into over $1 trillion worth of assets and an average of 500,000 trades per day.

Not only does TD Ameritrade stand out in terms of trust and reputation, but the sheer size of its asset library. In fact, you should expect to find tens of thousands of traditional investment products on the platform – including stocks, bonds, ETFs, mutual funds, and access to IPOs.

If you’re a short-term trader, TD Ameritrade also supports options, futures, and forex trading markets. With a plethora of low-cost brokers like Robinhood and Webull now competing with TD Ameritrade – the broker has since opened the doors to commission-free trading on US-listed stocks and ETFs.

You will find that TD Ameritrade is more suitable for experienced traders – which is evident in the number of advanced tools and features that its proprietary ‘thinkorswim’ day trading platform offers. As such, if you’re a complete newbie in the world of trading – TD Ameritrade might not be the right brokerage firm for you.

TD Ameritrade Pros & Cons

If you’re strapped for time and looking for the pros and cons of choosing this broker – check out what our TD Ameritrade review found:

Pros:

- Tens of thousands of traditional investment products

- Stocks, ETFs, and mutual funds from US exchanges

- Active traders can access futures, options, and forex

- 0% commission trading on US-listed stocks and ETFs

- Advanced platform - thinkorswim, is ideal for professional traders

Cons:

- Too complex for newbie traders

- Confusing fee structure

- Does not support debit/credit cards

- No fractional shares

- No direct access to international stock exchanges

What Can You Trade and Invest in on TD Ameritrade?

In the first section of our TD Ameritrade review, we are going to explore the highly in-depth asset library that the broker offers.

TD Ameritrade Stocks

Make no mistake about it - if you are interested in a US-listed stock, you can be all-but-certain that TD Ameritrade offers it. However, we should note that the broker does not give you direct access to international stock trading markets.

Instead, you would need to go through an OTC (over-the-counter) marketplace - which is far from suitable for casual traders. On the other hand, our TD Ameritrade review team was impressed that the broker allows you to gain access to newly launched IPOs (initial public offerings).

TD Ameritrade Crypto

Another major pitfall with TD Ameritrade is that you cannot invest in cryptocurrencies in the traditional sense. Instead, the only option on the table is to trade Bitcoin futures. Once again, this will not appeal to the Average Joe trader that wants to invest a little bit of money in a simple and burden-free manner.

Instead, we would suggest considering eToro if you wish to invest in cryptocurrencies. Across more than 19 digital currencies you can invest from just $25 per coin without needing to pay a single cent in commission.

TD Ameritrade Funds and ETFs

While the broker does fall short when it comes to international stocks and cryptocurrencies - our TD Ameritrade found that the platform is great for funds. This includes thousands of ETFs, index funds, and mutual funds.

TD Ameritrade Derivatives

TD Ameritrade allows you to access futures and options trading markets from a wide variety of asset classes. This includes everything from stocks, indices, commodities, currencies, and even interest rates. These highly complex financial derivatives also come with the option of trading on margin.

TD Ameritrade Other Markets

On top of the markets discussed above, our TD Ameritrade review found that the platform also offers the following financial products:

- Government Bonds

- Corporate Bonds

- Forex

- Managed Portfolios

- Annuities

TD Ameritrade Fees & Commissions

Below we outline the TD Ameritrade fees applicable to each supported asset class.

Asset Commission US Stocks 0% Crypto Not Supported Futures $2.25 per contract US ETFs 0% Commodities Not Supported Mutual Funds 0%, No-Load at $49.99 Options $0.65 per contract Below we outline the TD Ameritrade fees applicable to non-trading activities.

Fee Type Charge Open an account FREE Platform fee FREE Deposit FREE Withdrawal FREE Inactivity fee None Margin rate Starts at 9.50% Trading Commissions

If you're looking to buy stocks listed on a US exchange - you will pay nothing in commissions. This is also the case with ETF trades. There is no commission on Load mutual funds, but No-Load investments will cost $49.99 per trade.

Both futures and options trades can be placed without commission, but contract fees do apply. This stands at $0.65 and $2.25 per contract on options and futures, respectively.

Deposits and Withdrawals

Our TD Ameritrade review found that there is a no-transaction-fee policy on deposits and withdrawals when you fund your brokerage account via ACH. The only exception to this rule is if you decide to transfer your entire account balance out of TD Ameritrade. If you do, you'll pay a fee of $75. Wire deposits are free but withdrawals will cost you $25.

Margin Rates

TD Ameritrade is very expensive when it comes to margin trading. In fact, our TD Ameritrade review found that you'll pay a whopping 9.50% on balances of below $10,000. To get this down to 7.50% you would need to have a balance of at least $250,000.

Pricing Data

If you're not a professional-client account then you can gain access to Level I and II Nasdaq data free of charge. This is also the case with real-time quotes from the NYSE, AMEX, and OPRA. Professional clients will need to pay $24 for Level I Nasdaq data and $45 for NYSE real-time quotes.

TD Ameritrade User Experience

Our TD Ameritrade review found that the user experience will ultimately depend on which platform you decide to use. For example, if you are using the TD Ameritrade web platform - which can be accessed instantly via your browser, this offers a relatively user-friendly experience.

However, in comparison to the likes of eToro and Robinhood, the platform is still a lot more complicated to use. If you are an experienced trader, then you'll likely find the broker's native trading platform - thinkorswim, of great value.

This is because thinkorswim - which is available online, as well as via desktop platform software and a mobile trading app, is packed with advanced features. As we cover in more detail later, this is inclusive of technical indicators, chart drawing tools, stock screeners, bespoke order types, and more.

TD Ameritrade Features, Charting, and Analysis

If you are a seasoned trader then you will find all of the charting and analysis tools that you need via thinkorswim.

This includes the following:

- More than 400+ technical indicators - which is more than we have ever come across when reviewing an online broker

- Dozens of chart drawing tools that can be fully customized

- Real-time news developments provided by CNBC, MarketWatch, Benzinga, and more

- Highly in-depth stock screens and market insights

- View multiple pricing charts on a single screen

- Build custom strategies

And of course, even if you're a complete newbie when it comes to technical analysis - you'll be pleased to know that TD Ameritrade offers a paper trading facility. In a similar nature to a day trading simulator - this allows you to trade in live conditions without risking any money.

Our TD Ameritrade review that although the demo account comes pre-loaded with $100k in paper capital - you can only use the simulator for 60 days.

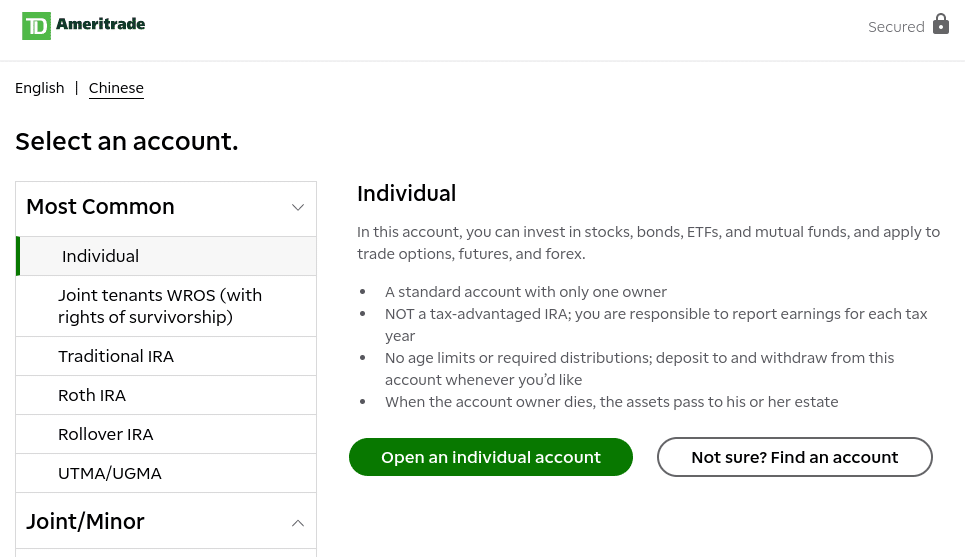

TD Ameritrade App Account Types

TD Ameritrade offers several account types for you to choose from - some of which you might not be eligible for.

This includes:

Standard Account

Our TD Ameritrade account found that the vast majority of investors will open a Standard Account. This will allow you to purchase trading traditional investment products - such as stocks, mutual funds, ETFs, bonds, and more. If you want to access more complex financial products like futures and options - you'll need to upgrade your Standard Account.

Retirement Accounts

If you are planning to invest for your Golden Years - our TD Ameritrade review can confirm that the broker offers the following options:

- Traditional IRA

- Roth IRA

- Rollover IRA

Education Accounts

These are specific TD Ameritrade accounts that allow you to save for your educational goals in a tax-efficient manner.

Specialty Accounts

If you have a specific investment need that isn't covered by the aforementioned account types - TD Ameritrade has you covered. This includes everything from business accounts and pension plans to individual trusts.

Margin Accounts

By opening a Margin Account at TD Ameritrade you have the potential to increase your investment purchasing power by 50%. As is standard in the US, you need to add at least $2,00 to your margin trading account to be eligible.

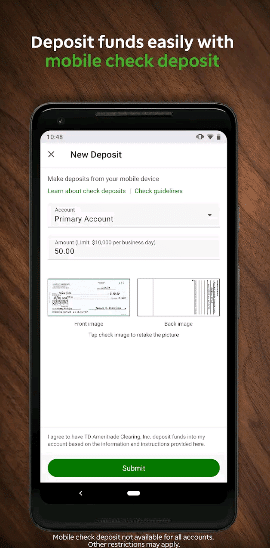

TD Ameritrade App Review

If you want to access your investment account while on the move - our TD Ameritrade review found that you have two options.

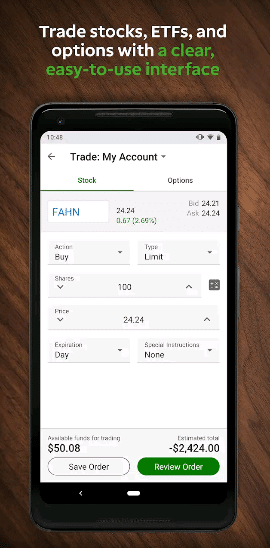

TD Ameritrade Mobile App

This app is available on both iOS and Android devices. It is more suited to newbie traders that find the thinkorswim platform overly complex.

The TD Ameritrade mobile app allows you to buy and sell stocks, ETFs, and options. You can also view comprehensive pricing charts, create and view custom watchlists, and even access market news.

Thinkorswim Mobile App

As noted above, the thinkorswim app is most definitely suited to experienced traders. Also available on iOS and Android devices, the thinkorswim app is packed with features.

You can trade stocks, options, futures, and forex alongside customized charts, technical indicators, and drawing tools.

TD Ameritrade Payments

Our TD Ameritrade review team found that the broker only supports bank transfers. This includes support for ACH and bank wire deposits/withdrawals. As such, there is no support for e-wallets or debit/credit cards.

In many cases, you might find that your bank account deposit is credited within 2-3 hours - which is reasonable. However, if you have your eye on an urgent trade that requires instant funding - this likely won't suffice.

TD Ameritrade Minimum Deposit

Although across the board, the broker is best suited for experienced trading professionals - our TD Ameritrade review team was surprised to find that there is no account minimum balance required.

TD Ameritrade Bonus

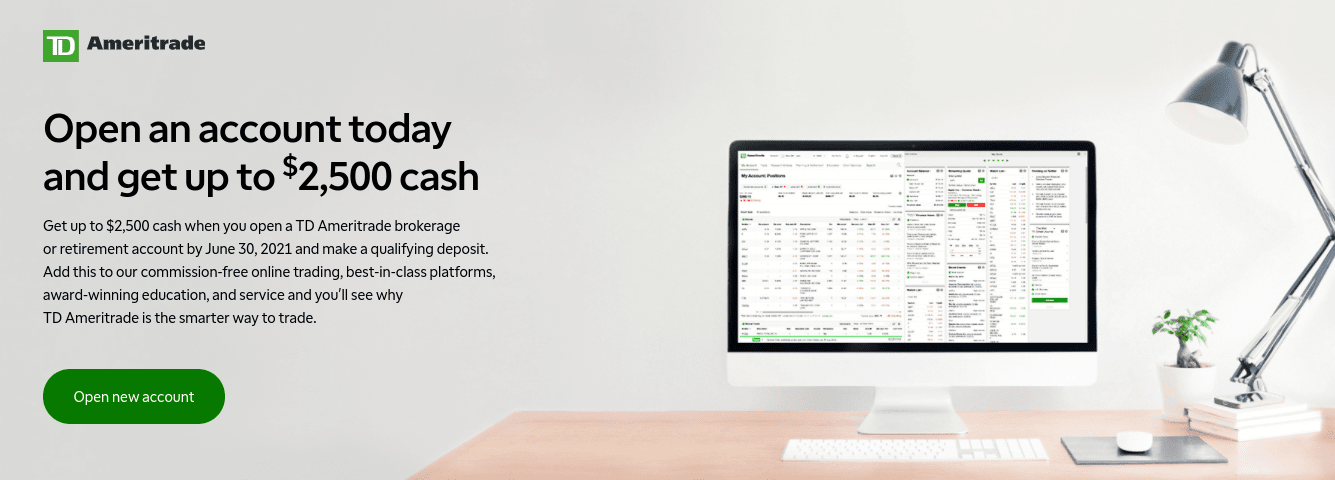

At the time of writing, TD Ameritrade is offering a new customer welcome bonus. The headline promotion states that you can receive up to $2,500 simply for opening an account and meeting a minimum deposit requirement.

However, upon taking a closer look at the terms and conditions, you'll need to deposit at least $2 million to receive the full $2,500 bonus. The smallest cash bonus of offer is $350, but this still requires a deposit of at least $250,000!

TD Ameritrade Contact and Customer Service

One of the most notable aspects of TD Ameritrade is that it offers world-class customer support. Not only is the customer service team available 24 hours per day - 7 days per week, but you have several channels at your disposal.

This includes a telephone support line, email, and even a live chat facility. The latter is only accessible via the TD Ameritrade app.

Is the TD Ameritrade App Safe?

As an established broker that has been in the investment space for over four decades - it will come as no surprise to learn that TD Ameritrade is heavily regulated.

The regulation comes from:

- Financial Industry Regulatory Authority (FINRA)

- Commodity Futures Trading Commission (CFTC)

- Securities and Exchange Commission (SEC)

In addition to the above, TD Ameritrade is also covered by the Securities Investor Protection Corporation (SIPC). This covers the first $500,000 ($250 cash balances) of assets held at the broker should the unlikely happen and it collapses.

How to Start Trading with TD Ameritrade

Like the sound of TD Ameritrade and wish to get started with an account today? If so, this section of our TD Ameritrade review will talk you through the process step-by-step.

Step 1: Register an Account

The first step will require you to visit the TD Ameritrade website and open an account. You will initially be asked the account type that you wish to open and then to enter your personal information. You also need to enter your social security number and your contact details.

Step 2: Review and Submit Application

Once you have completed the account registration form, TD Ameritrade will ask you to confirm the information that you have entered. Make sure all of the data is correct before submitting your application.

Step 3: Transfer Funds

The fastest way to deposit funds into your newly created TD Ameritrade account is via ACH. Follow the on-screen instructions to link your ACH account to TD Ameritrade and specify the amount you wish to deposit.

Step 4: Choose Platform

Before you can start investing or trading at TD Ameritrade, you need to choose your preferred platform. If you're a newbie, opt for the web-trading platform that can be accessed via your browser. Otherwise, you might consider using thinkorswim. This can be accessed online, via desktop software, or through the mobile app.

Step 5: How to Buy on TD Ameritrade

Once you have chosen your preferred platform, it's then just a case of searching for the market you wish to access. Then, you need to set up an order, enter your stake, and confirm the position. Your asset will then be added to your TD Ameritrade portfolio.

Step 6: How to Sell on TD Ameritrade

If you want to sell an investment on the TD Ameritrade platform - the process is the same as buying but in reverse. Simply select the asset you wish to sell from within your portfolio and confirm the position. The funds will then be added to your cash balance within a couple of seconds.

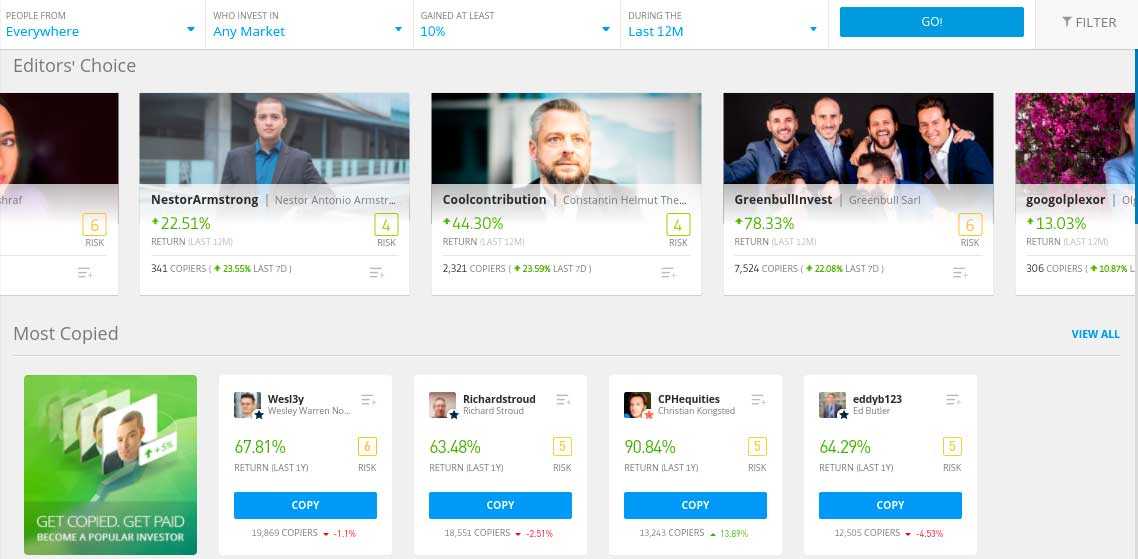

TD Ameritrade vs eToro

Our TD Ameritrade review found that all in all - the broker does score in several departments. Not only does the platform offer tens of thousands of US-listed stock, ETFs, and mutual funds - but dozens of financial derivative markets. The latter is inclusive of futures, options, and forex.

Past performance is not an indication of future results

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

However, it's important that you consider whether or not this broker is right for you before signing up. Before you do, we would consider exploring what eToro has to offer, as our TD Ameritrade review found that the eToro broker is a much better option.

Here's what our eToro vs TD Ameritrade comparison found:

- Ease of Use: First and foremost, if you're not from a professional trading background - TD Ameritrade will not be suitable for you. On the contrary, eToro is an online trading platform that is designed for casual traders, and thus - the overall user experience is seamless.

- International Markets: The only way to invest in international stocks at TD Ameritrade is via an OTC trade. This is a cumbersome process and far from ideal if you're a newbie. eToro, on the other hand, allows you to invest in thousands of stocks from 17 US and international markets at the click of a button.

- Cryptocurrencies: When it comes to cryptocurrencies, TD Ameritrade allows you to trade Bitcoin futures - but nothing else. eToro allows you to invest in 19 popular digital assets on a commission-free basis. The minimum investment per digital currency is just $25.

- Social Trading: A stand-out feature that you will struggle to find elsewhere is the eToro Copy Trading tool. As the name suggests, this allows you to copy an experienced trader of your choosing. eToro also offers social trading features that allow you to communicate with other users of the platform.

- Fees: TD Ameritrade allows you to buy and sell US-listed stocks and ETFs commission-free. eToro extends this commission-free offering to all of its supported markets - which on top of stocks and ETFs includes indices, commodities, forex, and cryptocurrencies.

- Payments: An additional area where eToro supersedes TD Ameritrade is in the payments department. The latter permits bank transfers only, while eToro also supports instantly processed debit/credit cards and e-wallets (including Paypal).

TD Ameritrade Review: The Verdict

On the one hand, there is no denying the TD Ameritrade is one of the oldest and most trusted brokerage sites in the online space. The platform offers thousands of markets across dozens of asset classes. However, our TD Ameritrade review found that eToro offers a much better service in most areas.

For example, eToro offers commission-free trading across thousands of US and international stocks, ETFs, and even cryptocurrencies. You can also trade indices, commodities, and forex - and the eToro platform itself is perfect for newbies. We are also huge fans of the eToro Social and Copy Trading features.

You can get started with eToro in less than 10 minutes by opening an account and instantly depositing funds with your debit/credit card or an e-wallet like Paypal.

eToro - Best Trading Platform with Zero Commission to Trade ETFs

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

FAQs

Does TD Ameritrade have a demo account?

Yes, TD Ameritrade offers a paper trading account that can be used with thinkorswim. The account comes pre-loaded with $100k in paper funds and you can use it for 60 days.

Is TD Ameritrade trustworthy?

Yes, TD Ameritrade is a trustworthy broker that has been active in the brokerage industry for over four decades. It is regulated by the SEC, FINRA, and the CFTC, as well as being covered by the SIPC.

Is TD Ameritrade good for beginners?

No, TD Ameritrade is not good for beginners. On the contrary, the platform is best suited for experienced traders that seek advanced investment tools - especially when it comes to technical analysis.

Is TD Ameritrade really free?

TD Ameritrade offers commission-free trading on US-listed stocks and ETFs. Load mutual funds are also commission-free. You can trade options and futures without paying a commission, but you will be charged a contract fee of $0.65 and $2.25 respectively.

Can you day trade on TD Ameritrade?

You can day trade on TD Ameritrade - but you need to deposit at least $25,000 as per SEC Pattern Rules.

What is the TD Ameritrade minimum deposit?

There is no minimum deposit at TD Ameritrade.

Can you buy cryptocurrencies on TD Ameritrade?

The only cryptocurrency market supported by TD Ameritrade is that of Bitcoin futures. If you want to buy cryptocurrencies, it's worth considering commission-free broker eToro - which supports 19 digital assets.

Does TD Ameritrade have monthly fees?

No, all of the supported account types outlined in this TD Ameritrade are free of monthly fees.

Does TD Ameritrade accept debit cards?

No, TD Ameritrade only supports ACH and bank wires.

Kane Pepi Finance Writer

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Kane has also written for websites such as MoneyCheck, InsideBitcoins, Blockonomi, Learnbonds, Buyshares n and the Malta Association of Compliance Officers.

Before starting his career as a writer, Kane studied at the University of Central Lancashire where he received a Masters Degree in Financial Investigation and then a Research Doctorate in Criminal Justice. Pepi is passionate about helping people to make informed decisions through high-quality, educational content.

Visit eToroeToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.eToro: Best Trading Platform with 0% Commission

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up

The TD Ameritrade mobile app allows you to buy and sell stocks, ETFs, and options. You can also view comprehensive pricing charts, create and view custom watchlists, and even access market news.

The TD Ameritrade mobile app allows you to buy and sell stocks, ETFs, and options. You can also view comprehensive pricing charts, create and view custom watchlists, and even access market news.