TradeStation Review 2025 – Pros & Cons Revealed

TradeStation is a US-based trading platform that offers a diverse range of markets. This includes everything from stocks and ETFs to options, futures, and even cryptocurrencies.

With TradeStation claiming that it offers super-low fees and top-rated customer support – we sought to review the platform from top to bottom.

In this TradeStation Review 2025 – we explore how the broker ranks in terms of fees, markets, payments, support, regulation, and more.

-

-

TradeStation History & Background

Launched in 1982, TradeStation is an established brokerage firm that is based in the US. The platform aims to appeal to investors of all shapes and sizes – with varying financial products and services on offer. For those looking to build a long-term portfolio, TradeStation offers thousands of stocks, ETFs, and mutual funds, as well as access to IPOs.

The broker has also delved into the ever-growing digital asset arena – with the addition of a fully-fledged cryptocurrency trading platform. For those seeking even more complex financial instruments, TradeStation supports markets on futures and options trades.

In a similar nature to many other trading platforms, TradeStation allows you to buy US-listed stocks and ETFs without paying any commission. This is also the case with futures and stock options. All buy and sell positions can be executed at TradeStation from the comfort of your home via the main website or through its native mobile trading app.

TradeStation Pros & Cons

Below you will find an overview of the main TradeStation pros and cons that our review team identified.

Pros:

- Buy US-listed stocks and ETFs at 0%

- Reletively easy to use

- Mobile app

- Supports cryptocurrencies, options, and futures

- Multiple account types

- Heavuly regulated and great reputation

Cons:

- No copy trading tools

- Could be more user-friendly

- Limited access to international assets

- No forex trading markets

- No fractional shares

What Can You Trade and Invest in on TradeStation?

The first area that our TradeStation review sought to explore was that of the asset library. Below you will find an overview of the main trading markets supported by the broker.

TradeStation Stocks

TradeStation will appeal to those seeking stock trading markets in the US. The platform supports thousands of companies across the Nasdaq and NYSE - all of which can be bought and sold commission-free.

However, there are two major disadvantages when it comes to stocks and shares at stock TradeStation. Firstly, the platform does not offer any international stock markets. This means that you won't be able to invest in stocks listed in the UK, Europe, Asia, or any other notable region.

Secondly, and perhaps most importantly, TradeStation does not support fractional shares. This means that many causal traders are going to be extremely limited when it comes to buying stocks like Tesla, Google, or Amazon. For example, the latter is trading at over $3,200 per share at the time of writing.

Unless you are able to fork out enough money to buy a full share - TradeStation won't be suitable. Instead, you might want to consider a broker like eToro - which supports fractional shares at a minimum investment of just $50 per stock.

TradeStation Crypto

TradeStation is also popular with those looking to trade cryptocurrencies. The platform supports a relatively small number of digital assets - which includes Bitcoin, Ethereum, Litecoin, Bitcoin Cash, and USDC. You can buy and sell these cryptocurrencies throughout the day with a one-click order entry.

TradeStation also allows you to earn up to 6% interest per year (paid monthly) when storing your digital assets on the platform. Although it is notable that you can trade cryptocurrencies at an established platform like TradeStation, it should be noted that other online brokers in this space offer substantially more in the way of supported coins.

Other TradeStation Assets

On top of stocks and cryptocurrencies - TradeStation also gives you access to the following asset classes:

- ETFs

- Mutual Funds

- Bonds

- Stock Options

- Futures

The above financial markets are all US-listed. It is also possible to invest in newly-listed IPOs through TradeStation. Perhaps the main asset class missing at the platform is forex.

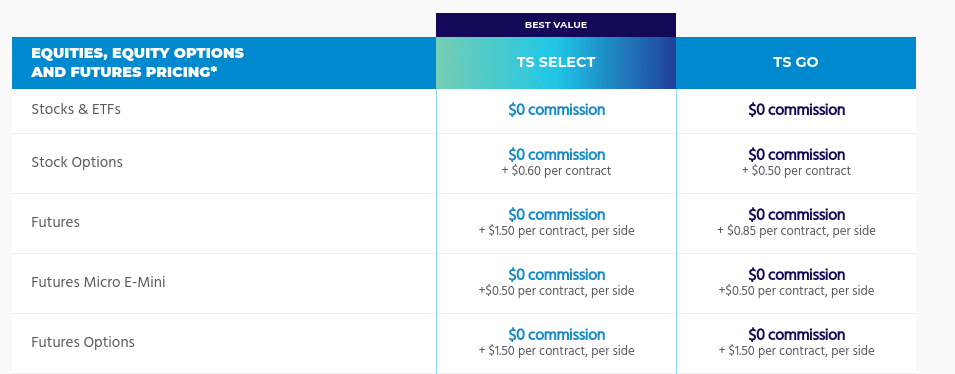

TradeStation Fees & Commissions

Fees and pricing structures should play an important part in your brokerage decision-making process. As such, below you will find an overview of the main TradeStation fees when trading.

Asset Commission US Stocks 0% Crypto Starts at 0.30% Futures $1.50 per contract US ETFs 0% Bonds $14.95 + Additional $5 per bond Mutual Funds $14.95 per trade Options $0.60 per contract In terms of TradeStation fees for non-trading activities - see the table below.

Fee Type Charge Open an account FREE Platform fee FREE Deposit FREE Withdrawal FREE Market Data FREE Margin rate From at 3.50% Trading Commissions

Trading commissions at TradeStation will depend on the market. For example, you can buy and sell US-listed stocks and ETFs without paying any commission. There is no commission on futures or options, but you will need to pay a contract fee of $1.50 and $0.60 respectively.

Cryptocurrency trading markets are charged on a maker and taker system. The latter means that you use the liquidity already available on the platform.

The former means that you contribute liquidity yourself. Assuming you are a casual trader - you will pay a take fee of 0.30% per slide to trade cryptocurrencies. You will only be able to get your rate down if you trade more than $100k. In doing so, you'll pay 0.10%.

When it comes to bonds, this is expensive at TradeStation - as the broker charges a commission of $14.95 + Additional $5 per bond. Mutual funds are also costly, with TradeStation charging $14.95 per trade.

Payment Fees

There are no transaction fees applicable to deposit or withdrawals on TradeStation - which is a major plus-point.

Margin Rates

If you decide to use TradeStation to trade on margin, fees start from 3.5%. This will, of course, depending on the asset you are trading and whether you keep your position open over the weekend. It also depends on the volume of your trade. With so many variables in play - it's best to assess how much you will be charged by placing a leveraged order.

TradeStation User Experience

Our TradeStation review found that the trading platform itself is relatively straightforward to use. For example, you can easily open an account as TradeStation will guide you through the process step-by-step. Then, it's just a case of deciding which trading platform is best for you.

- For example, if you are a newbie, you might find the user experience on the browser-based web platform more conducive to your needs.

- On the other hand, if you have experience in the trading scene and want access to more complex tools - you might consider TradeStation's desktop platform.

The latter comes with the likes of fully customizable charting, advanced order management, and dynamic market screening. As an inexperienced investor, you might find these additional features somewhat overbearing, so it's probably best to stick with the web platform.

TradeStation Features, Charting, and Analysis

As noted above, you will find the vast majority of charting tools on the TradeStation desktop platform. This will require you to download and install software to your device. Breaking the availability of trading tools down further, TradeStation, we like the fact that you can backtest new trading strategies and systems without risking any capital.

You then have the RadarScreen tool - which gives you access to more than 180 fundamental and technical indicators - most of which can be fully customized. You'll also be able to monitor more than 1,000 symbols in real-time and even create your own criteria via EasyLanguage.

Another feature that is suited for professional traders is that of OptionStation Pro. As the name implies, this is a tailor-made tool that gives you a full birds-eye view of the options trading arena. You can really dive into in-depth options chains and create custom scenarios to see how a potential position may play out.

TradeStation App Account Types

Our TradeStation review 2025 found that the broker offers a number of different account types.

This includes:

- Individual Account

- Joint Account

- Traditional IRA

- Roth IRA

- SEP IRA

- Entity Account

Note: TradeStation offers lower options trading commissions on its TS GO account at just $0.85 per contract. On the standard TS Select account, this will cost you $1.50 per contract.

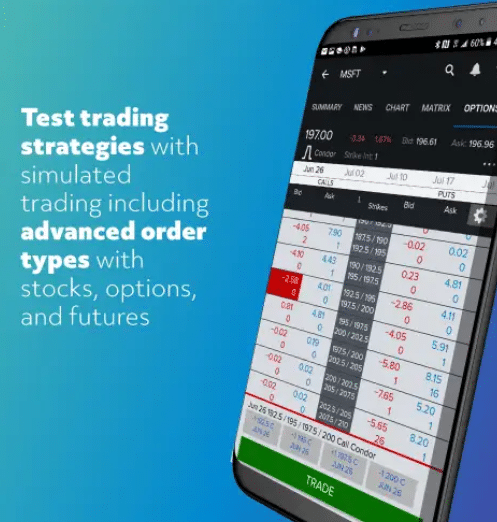

TradeStation App Review

Like most brokers in the online space, TradeStation offers a mobile trading app. This TradeStation review found that the app connects seamlessly to your main account - as it does between desktop and web trading platforms. All you need to do is download the app by clicking on the iOS or Android logo and then log in with your TradeStation credentials.

It goes without saying that the TradeStation app allows you to buy, sell, and trade assets on the move. We found that the user experience was somewhat clunky at times - especially when it comes to browsing the asset library.

Nevertheless, if you are planning to use TradeStation anyway - it's a good idea to have the app installed. In doing so, you can instantly view the value of your position in real-time. In fact, this will update on a second-by-second basis in line with the current value of your purchased assets.

Our TradeStation review also found that you can access real-time quotes through the app - and even create a custom watchlist. The TradeStation app also permits custom alerts - with options including volume, price triggers, net changes, and even the VWAP.

TradeStation Payments

Like a lot of US-based day trading platforms, TradeStation does not support e-wallets or debit/credit cards. On the contrary, the only way to fund your account is via ACH or bank wire. There are no fees attached and transfers typically take one business day to arrive.

TradeStation Minimum Deposit

There is no account minimum at TradeStation, which ensures that the platform can be used by people of all budget levels. Our TradeStation review also found that the platform does not implement any deposit limits.

TradeStation Contact and Customer Service

The TradeStation customer support team works during the week - so no assistance can be obtained over the weekend. You can, however, contact TradeStation via live chat, email, and telephone - which is great. Email replies are typically slow and often non-descript, so you are best off opting for a real-time support channel.

Is TradeStation Safe?

Wondering is TradeStation safe? If so, you should know that the broker is as solid as it gets in the brokerage industry. First, the platform was launched in the early 1980s, so it has a long-standing track record in the brokerage scene that now spans almost four decades.

- Our TradeStation review 2025 also found that the broker is regulated by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA).

- TradeStation is also covered by the Securities Investor Protection Corporation (SIPC).

- This means that the first $500k is protected in the event of a brokerage collapse - of which $250k can be cash.

The only drawback when it comes to investor safeguards is that there is no negative balance protection in place. This is something that you need to bear in mind when trading on margin. After all, if your position loses more than your account balance can cover - you will owe the money to TradeStation.

How to Start Trading with TradeStation

If you have read our TradeStation review up to this point and wish to proceed with an account - the steps below will walk you through the process.

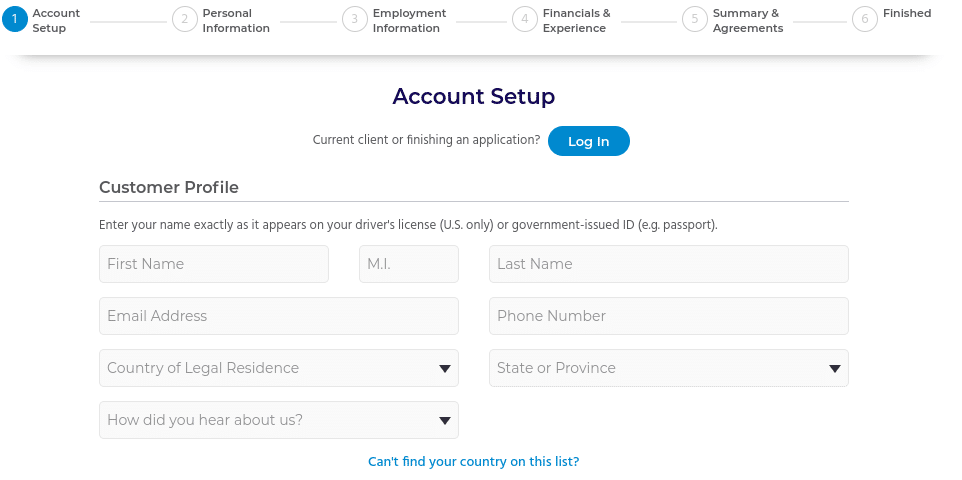

Step 1: Register an Account

Visit the TradeStation website and click on the 'Open Account' button to begin the registration process. As is industry standard, this will require you to provide some personal, financial, and contact information.

You will also need to choose a username and password. Our TradeStation review found that in the vast majority of cases, the platform will be able to verify your identity from third-party sources.

Step 2: Deposit Funds

In order to fund your TradeStation account, you will need to perform a direct bank transfer. This can be via ACH or a bank wire. You will find the relevant bank details on the TradeStation website or from within your account dashboard.

Step 3: Choose Platform

Once your account is funded, you can proceed to select your preferred platform. If you are a beginner, the TradeStation web platform is likely going to be the best option. If you access to advanced trading and analytical tools, you might consider downloading the TradeStation desktop platform to your device.

Step 4: Start Trading

All that is left to do is to place trades! If you have an asset or market in mind, use the search box to go straight to the respective trading page. Alternatively, you can use the filters offered on your chosen TradeStation platform to find a suitable instrument.

Once you have placed an order, the asset will be added to your TradeStation portfolio. You can exit your position at any given time during standard market hours.

TradeStation vs eToro

With hundreds of trading platforms available in the online space - it's important that you conduct lots of research before proceeding with a provider. Having reviewed many of the best brokers in this industry - we found that there are plenty of TradeStation alternatives that are worth considering.

Past performance is not an indication of future results

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

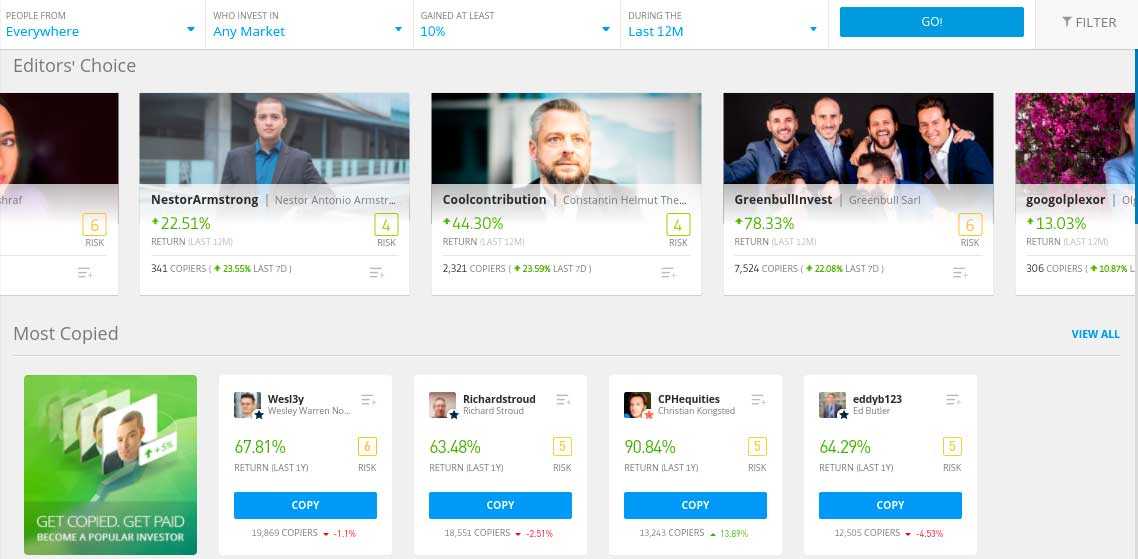

In fact, the bottom line is that we found that eToro is arguably the best trading platform for 2025 - especially when comparing the broker to TradeStation.

Here's why:

- User-Friendliness: The TradeStation platform is most definitely suitable for experience trading pros. After all, it comes packed with really advanced charting and analysis tools. However, these tools won't be suitable for newbies - which is why we prefer eToro. As such, if you're an inexperienced investor - you will have no issues navigating through the eToro website.

- Payments: The most convenient way to deposit and withdraw funds in the online brokerage scene is with a debit/credit card. At eToro, not only can you instantly fund your account with Visa, Maestro, and MasterCard - but also Paypal, Skrill, and Neteller. Our TradeStation review found that the only option is a bank transfer - which can be both slow and cumbersome.

- Copy Trading: eToro is known around the investment world for its copy trading feature. This is super innovative, as you can copy an experience and skilled eToro trader-like-for-like. Not only in terms of their current portfolio but all future trades. This allows you to actively day trade in a passive manner. There are no copy trading tools at TradeStation - which is a major drawback for newbies.

- International Assets: We mentioned in this TradeStation review that the platform is solely focused on US-listed assets. This isn't great for diversification purposes, as you are essentially putting all of your investment eggs into one marketplace. At eToro, you will have unfettered access to 17 exchanges. Not only does this include the US, UK, and several European nations, but less liquid markets like Saudi Arabia and Hong Kong.

TradeStation Review: The Verdict

This comprehensive TradeStation review has unravelled everything there is to know about the US-based brokerage firm. We like the fact the TradeStation offers plenty of advanced features and tools for experienced investors - especially when it comes to technical analysis and backtesting bespoke strategies.

However, across the board, we found that TradeStation does fall short in many areas. This includes a lack of support for international markets, copy trading, and forex - and a platform that isn't really suitable for beginners. Instead, we found that eToro is the best option for those with little to no experience in online trading.

The platform allows you to buy stocks and ETFs from 17 international marketplaces without paying any commission, as well as low-fee trading on forex, commodities, and cryptocurrencies. All supported markets can be accessed in a user-friendly manner and deposit methods include debit/credit cards and Paypal!

eToro - Best Trading Platform With Low Fees Commission

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

FAQs

Does TradeStation have a demo account?

Yes, all account holders at TradeStation will have access to a free demo trading facility. This allows you to test out new strategies and investment ideas without needing to risk any capital.

Is TradeStation trustworthy?

If you're concerned about the safety of your funds at TradeStation - you shouldn't be. The broker was first launched in 1982, is covered by the SIPC, and regulated by the SEC and FINRA.

Is TradeStation good for beginners?

Our TradeStation review found that the platform is best suited for active traders that wish to perform advanced technical and fundamental analysis. As such, if you're a complete newbie, you will find the trading experience at eToro a lot more seamless and burden-free.

Does TradeStation offer fractional shares?

No, unlike a lot of trading platforms that market their services to retail investor accounts, TradeStation does not offer fractional shares. If this is something you seek, eToro allows you to invest in stocks from just $50 upwards - irrespective of the price of the shares.

How much does TradeStation charge to trade?

Fees at TradeStation will depend on the asset. US-listed stocks and ETFs are commission-free, while futures and options cost $1.50 and $0.60 per contract, respectively. Cryptocurrency trading commissions start at 0.30%.

What is the TradeStation minimum deposit?

Our TradeStation review found that there is no minimum deposit requirement at TradeStation. This is the case across all pricing plans.

How do you deposit funds on TradeStation?

TradeStation supports ACH and bank wire transfers only.

Does TradeStation have monthly fees?

No, TradeStation does not charge any ongoing platform fees. You will only pay a fee when you place a buy and sell order, or when you trade on margin.

How much does TradeStation charge for margin trading?

Margin trading fees on TradeStation will depend on several factors - such as the amount being traded, the asset, and how long you keep the position open. With that said, TradeStation notes that this starts at 3.5% per year.

Kane Pepi Finance Writer

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Kane has also written for websites such as MoneyCheck, InsideBitcoins, Blockonomi, Learnbonds, Buyshares n and the Malta Association of Compliance Officers.

Before starting his career as a writer, Kane studied at the University of Central Lancashire where he received a Masters Degree in Financial Investigation and then a Research Doctorate in Criminal Justice. Pepi is passionate about helping people to make informed decisions through high-quality, educational content.

Visit eToroeToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.eToro: Best Trading Platform with 0% Commission

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up