Libertex Review 2024 and Experience: Fees, Trading and More

Nowadays there are almost countless online brokers who offer their trading offer on the Internet and have numerous customers. However, by no means every online broker is reputable and keeps what they promise their customers. For this reason, it is extremely important for traders to do a double check before registering for the first time in order to be able to rule out that they are dealing with fraudsters.

If you are looking for Libertex experiences, then you have come to the right place on our platform. We have gained experience with the broker Libertex and would like to share this with you in our Libertex test. We also address the question of whether the broker is reputable and present the Libertex offer to you. In addition, as always, we look deeper behind the broker in order to be able to answer as many of your questions as possible!

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 87.8% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

What is Libertex?

Libertex is known as a so-called online broker that offers its customers financial services directly via the Internet. This is a Stocks and CFD broker that was founded in 2012 and therefore has an experience that can look back onyears of work. The CFD trading services offered by Libertex have been well-received by many traders for the past years as this trading option brings numerous benefits together with high risk for sure. Due to this enormous experience in the financial market and now millions of active customers, Libertex has one of the best in-house online trading platforms in the world. The customer base is not only made up forexperienced investors and traders, but also for beginners.

The Libertex trading platform works with clients from the EEA Area and Switzerland and offers access to more than 250 underlying assets. Compared to its competition, Libertex platform is very clear and user-friendly so that the customer does not have to search for a long time, but all the information is displayed quickly and clearly on the website. Basically, the provider’s focus is on extensive CFD trading and investment in real sharesFor this reason, the Libertex portfolio includes CFDs on cryptocurrencies, stocks, ETFs, indices and much more.

What Can You Trade on Libertex?

First of all, it has to be mentioned that at Libertex you will not find the traditional assets that some traders are already familiar with. This means that as an trader on Libertex, you will not acquire ownership of an item when you trade CFDS on metals or cryptocurrencies, for example, but rather speculate on the underlying price of the actual asset when trading CFDs. Consequently, our Libertex experience has shown that you can speculate on the price of forex, cryptocurrencies, stocks, indices and ETFs on this trading platform. However, it is not a direct investment in an asset, except for real shares where you can invest with the Invest Account!

Trading in CFDs constitutes CFD trading and is therefore a financial derivative. This allows traders to speculate on the price value of the underlying asset without actually owning that it. With CFD trading there is the possibility for you as an trader to go “short” or “long”. This means that you only buy the price value if you predict that the underlying value will increase. It works the other way round as well, i.e. if you forecast that the underlying asset will fall, you may sell the price asset.

In addition, you can enjoy full market exposure when trading with what is known as leverage. In simple terms this means only one thing, you can get full market exposure in financial terms when trading CFDs by making a small initial deposit and thus putting a portion of the cost on margin. You should always consider high risks of leveraged trading.

Libertex Broker Costs & Fees

In this section we would like to share with you our Libertex experience in terms of fees and costs. We would like to tell you in advance that our Libertex experiences have been positive in this regard. The broker has nothing to hide and keeps its fees transparent and always provides its customers with the necessary overview. As a result, you always know what commission fees you might incur when trading with Libertex.

CFD trading with tight spreads

What was immediately noticeable in our Libertex test, you have to pay very tight spreads on CFD trading, starting from only 0.1 pips, and this is an important feature of the broker. If we look at all the other reputable online brokers that offer CFD trading, we quickly realize that it’s quite a unique feature.

The Commission Fees

If you trade on the Libertex trading platform, you don’t have to expect high spread fees, but the platform has to make a living from something. For this reason, Libertex charges so-called commission fees. The commission depends on the base value and can start from 0.0003%. As soon as you call up a certain asset via the Libertex platform, you will find a detailed list of how high the commission fees are here and so you can calculate for yourself whether the trade is worthwhile for you or not.

Libertex allows its users to trade crypto CFDs with 0% commission fee (tight spreads apply).

Note that with Libertex you may invest in real shares commission free using the Invest Account (market spreads apply).

The Non-trading fees

To allow your trading positions to extend beyond normal trading hours, an overnight financing fee, also known as swaps, is charged. CFD derivatives are leveraged financial instruments and can attract interest. You can check the cost and fees on the broker’s website at https://libertex.com/specification.

In addition, Libertex charges a so-called inactivity fee. If the Client’s Account is inactive for 180 calendar days (i.e. there is no trading, no open positions, no withdrawals or deposits), the Company reserves the right to charge an account maintenance fee of 10 EUR (10 GBP, 10 CHF, 50 PLN respectively) per month. (Applies to clients with a total account balance less than 5000 euros ( 4500 GBP, 5300 CHF, 22500 PLN respectively).

Advantages and disadvantages of Libertex

We would like to share the Libertex experiences that we have gained with this platform with our readers. At this point it is always important to consider that the advantages in no way outweigh the disadvantages. In addition, interested parties should make sure that the disadvantages are not too negative. At this point we would like to point out that we have only taken objective advantages and disadvantages and in no way wrongly speak well or badly of the provider. We always want users to be as informed as possible so that we can make a proper registration decision. These are the main advantages and disadvantages of the online trading platform Libertex.

Advantages:

- Investors can trade CFDs on Forex s, Commodity and Crypto with the default leverage as per the tradable class of assets.

- Trading CFDsis done on certain assets with a 0% commission, namely on some currency pairs, cryptocurrencies and options.

- Investors enjoy a wide range of different deposit and withdrawal methods

- The company Indication Investments Ltd. is the operator behind Libertex.com and is headquartered in Cyprus.

- The company Indication Investments Ltd. is regulated by the well-known regulatory authority CySEC

- There are no deposit fees on Libertex, so investors can make deposits quickly and free of charge

- The Libertex app is fast and user-friendly

- Two well-known and popular trading platforms such as MetaTrader 4 and MetaTrader 5 are available

- There is a free demo account, which allows you to get to know trading without risk

- The web trading platform is very well designed and uncluttered, which will appeal to any investor

- Investors get direct access to real-time trading news and signals

Disadvantages:

- Some technical indicators that are important for chart analysis are completely absent from Libertex

- Apart from the CFD derivatives, the selection is rather small

Libertex User Experience

If you are a beginner trader with little to no trading experience Libertex is likely a good broker to pick. You can trade CFD derivatives via the Libertex web and mobile trading platforms, or you can use the MetaTrader 4 and MetaTrader 5 platforms.

For example, the account opening process is streamlined which makes funding your account very easy. You can browse through financial instruments based on the following criteria from the Libertex web trading platform:

- Popularity

- Hot

- Indices

- Options

- Top rising

- Top falling

- Top volatility (1 day)

- Uprising trend 30d

- Falling trend 30d

- Commodities

- Oil and gas

- Metals

- Shares

- Currencies

- ETFs

You can also create a list of favorites. Alternatively, you can manually search for the tradable asset of your choice by using the search bar at the top of the trading terminal.

In keeping with the user-friendly and intuitive interface, Libertex makes online trading as simple as possible because all you have to do is click on your preferred asset, specify the trade amount and leverage, place an order type such as Stop Loss and Take Profit, and click on either buy or sell to execute the trade.

Overall, Libertex provides a user-friendly trading platform and website for both beginner and seasoned investors.

Libertex Features, Charting, and Analysis

Charting

As we have already discussed, Libertex gives you access to its proprietary trading platform, as well as MetaTrader 4 and MetaTrader 5.

Advanced traders and seasoned investors will be all too familiar with the MetaTrader suite and the plethora of trading tools and instruments that you can use. MetaTrader is a third-party trading platform created by MetaQuotes Software Corp. that can be linked with your Libertex trading account. MT4 and MT5 both offer fully customizable trading terminals, as well as automated forex robot services. MT4 and MT5 are compatible with both iOS and Apple devices and you can download the trading software to your desktop.

Charting, Features, and Analysis on the Libertex web trading platform

The Libertex web trading platform is user-friendly and you can start trading your favorite assets with the click of a few buttons.

In terms of the charts, you can fully customize each chart by selecting either bars, candles, hollow candles, line, area, and Heiken Ashi charts. You can set the time interval from anything between 1 second to 1 month.

When it comes to technical indicators, there are over 40 to use and these are broken down into three categories:

- Trend – such as Aroon, Choppiness Index, Ichimoku Cloud, MACD, Mass Index, Moving Average, Moving Average Exponential, Moving Average Weighted, Parabolic SAR, Price Oscillator, Triple EMA, Williams Alligator, ZigZag, Arnaud Legoux Moving Average, Coppock Curve, Directional Movement Index, Double Exponential Moving Average, Envelope, Hull MA, Least Squares Moving Average, and more.

- Oscillators – such as Awesome Oscillator, Balance of Power, Stochastic RSI, Williams %R, True Strength Indicator, and much more.

- Volatility – including Bollinger Bands, Bollinger Bands Width, Donchian Channels, Keltner Channels, Relative Volatility Index, Chande Kroll Stop.

You can also compare different assets on the same chart by clicking on the compare button at the top of the screen and entering the asset you wish to compare. You can also use a variety of drawing tools to make the charts suit your trading needs and goals.

The Libertex charts are ideal for beginner traders as each chart features both the traders’ sentiment at the top right-hand corner and an Open Trade Position button so that you can execute trades without having to change tabs or close the chart window.

Libertex traders can also identify unique trading opportunities via the trading signals from the top-rated third-party provider Trading Central.

Libertex Account Types

Libertex offers a live trading account and a demo account with access to paper trading with a virtual account balance of £50,000.

Demo accounts are perfect for new traders to practice online trading and familiarize themselves with the trading platform in a risk-free simulated environment that mimics live market conditions.

You can transition between your live trading account and demo account by simply tapping on either the demo account or real account buttons at the top right-hand corner of the trading platform.

Libertex Mobile App Review

As is common practice amongst trading platforms nowadays, Libertex supports a fully-fledged mobile trading app that is compatible with Apple and Android mobile devices. This means that you can buy and sell CFD derivatives with zero spreads, and pinpoint the best trading opportunities from your mobile smartphone or tablet.

Alternatively, you can download the MT4 or MT5 mobile trading app and log in using your Libertex account details.

The mobile trading platform mirrors the same functionality that you find on the web trading platforms, in that you can trade financial instruments, manage your portfolio, access charts and forex signals from your mobile device.

Another useful and convenient feature is that you can set up price alerts and notifications via the MT4 and MT5 mobile trading apps. This means that you never have to miss a single trading opportunity. Stock and forex trading strategies can become more flexible while reacting to these key events can become much faster as the MetaTrader platforms offer the possibility to use trade alerts.

You can set up alerts to notify you about key trade events so that opportune moments won’t go unattended. Price alerts remove the need to spend countless hours monitoring price movements as the trading platform will notify you in real-time via email or push notification on your mobile device.

Libertex Payments

Libertex supports a wide range of payment methods including credit cards, debit cards, PayPal, SEPA/International bank wire transfers, Skrill, Neteller, and more. There are no deposit fees and your funds are credited to your account instantly except for wire transfers that take between 3-5 days.

When it comes to withdrawals, the options include PayPal and Skrill which incur zero withdrawal fees, while credit/debit card, SEPA bank transfer, and Neteller withdrawals incur a small withdrawal fee.

Let’s take a look at a comprehensive list of the available options and the respective fees and processing times:

| Deposit Payment Method | Fee | Process Time |

| PayPal | None | Instant |

| Credit/debit card | None | Instant |

| Sofort | None | Instant |

| iDeal | None | Instant |

| SEPA/International Bank Wire | None | 3-5 days |

| giropay | None | Instant |

| Skrill | None | Instant |

| Trustly | None | Instant |

| Multibanco | None | Instant |

| Przelewy24 | None | Instant |

| Rapid Transfer | None | Instant |

| teleingreso | None | Instant |

| Neteller | None | Instant |

Withdrawal Methods

| Payment Method | Fee | Process time |

| PayPal | None | Instant |

| Credit/debit card | €1 | 1-5 days |

| SEPA/International Bank wire | 0.5% min €2, max €10 | 3-5 days |

| Skrill | None | Within 24 hours |

| Neteller | 1% | Within 24 hours |

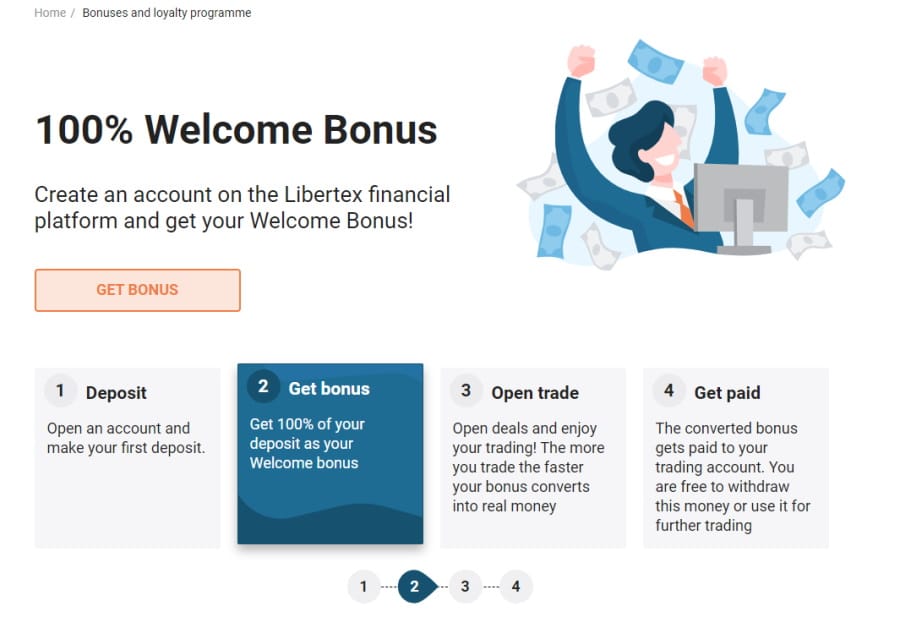

Libertex 100% Welcome Bonus

When you open a Libertex account and deposit a minimum of €100 you could receive a welcome bonus of up to $10,000.

To be eligible for the welcome bonus you need to complete the registration process and fund your account with an initial deposit of at least €100. According to Libertex, the welcome bonus rules state that you can get back 10% of all trading commissions paid as a bonus that is converted into real capital. The broker then pays the converted bonus directly into your trading account in 2% installments. You are obliged to then execute enough trading volume to convert the entire bonus within 90 days.

Libertex Contact and Customer Service

Customer support at Libertex can be contacted via live chat, email, telephone, Whatsapp, and Facebook Messenger.

Additionally, you can find a useful FAQ page, news, blog, education, CFD specification, and economic calendar under the Trading Info tab at the top of the libertex.com website.

When you click on the trading education page you can learn the basics of online investing with a 3-hour trading course created by the award-winning investment academy at Libertex.

Is Libertex Safe?

The brokerage firm does not accept clients from and does not operate in any of the following countries, including the United States, Japan, Brazil, and the EU.

Libertex is a trading platform used by Indication Investments Ltd. a Cyprus Investment company that is regulated by CySEC (the Cyprus Securities and Exchange Commission) with CIF licence number 164/12.

On the other hand, Libertex Pty., is a South African financial services provider and is regulated and supervised by the Financial Sector Conduct with FSP Number 47381.

Setting up two-factor authentication on your live trading account is paramount to protecting your funds on the Libertex trading platform. Libertex supports two options for 2FA via text message and Google Authenticator.

When it comes to client fund protection, CySEC regulation requires brokers to hold all clients’ funds in segregated bank accounts. Additionally, you are covered up to €20,000 by the investor protection scheme should Libertex go into insolvency.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 87.8% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

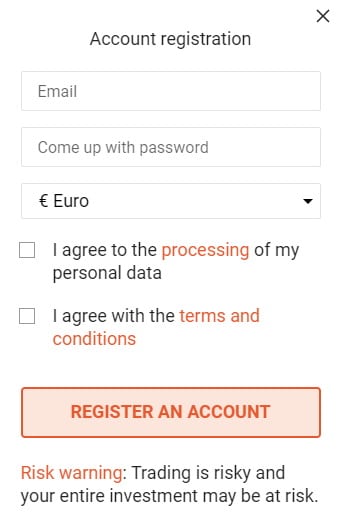

How to Register with Libertex

Registering on Libertex is fairly easy and similar to registering with any other well-known online broker. Nevertheless, we would like to help you and give you a hand so that you don’t have to struggle with the registration process for a long time and give you detailed step-by-step instructions. This will probably speed up the registration process and ensure that you can go through the registration process without any problems.

Step 1: The registration form

Open the Libertex official website on your desktop, laptop, smartphone or tablet. Then navigate to the orange “Register” button and click on it. Now a pop-up window will open showing the registration form and all you have to do is follow the on-screen instructions and fill in all the fields with your personal information.

Step 2: The first deposit

Depositing is very easy. To do this, you must click on “Deposit” in your trading account and select a payment method that suits you. Then enter the desired deposit amount and confirm your data. The money will be credited to your trading account within minutes (depending on the deposit method). After making the first deposit, you still need to upload some documents for identity verification. Due to legal reasons, you still have to wait a while before you can start live trading. Unfortunately, we have had negative Libertex experiences at this point, because the waiting time is up to 3 working days. However, the verification process takes place usually immediately.

Step 3: Enter the trade

After successfully verifying yourself, you can finally jump into live trading. Now all you have to do is choose between several trading platforms. You can choose between the Libertex web trading platform, the mobile Libertex app or the two well-known trading platforms MetaTrader 4 and MetaTrader 5. You can search for your preferred financial instrument directly on the website and then click on “Buy”. Now a trading window will open giving you the possibility to choose a trade amount. The multiplier is set by default. You can also set take profit or stop loss orders here with a click.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 87.8% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Libertex Broker Depot – Trading Offer

We have only had positive experiences with the Libertex trade offer. This online broker is particularly suitable for CFD traders and investments in real stocks. However, investors who do not only like to trade CFDs will probably be disappointed, howverer they still have the possibility to invest in real shares All investors who prefer CFD trading exclusively will be satisfied with the selection of tradable CFD derivatives. In this section we will show you which CFD derivatives can be traded at Libertex.

Share CFDs

If you have not yet gained any experience in terms of stock CFD trading, then it makes sense to gain experience in this area with Libertex. Finally, investors can here with the most popular Stock CFDs from Latin America, Europe or USA Speculate . Popular stocks that can be traded here include Apple, Facebook, Google and more.

Crypto CFDs

If you as an investor would like to bet on the price development of cryptocurrencies, then it makes sense to realize this possibility with Libertex. Of course you can trade Bitcoin CFDs and speculate on falling or rising prices. In addition, the selection of cryptocurrencies at Libertex is large, so that every investor will find the right cryptocurrency for themselves. You can trade CFDs on for example Bitcoin, Bitcoin Cash, Polkadot, Litecoin, IOTA, Dogecoin and many others.

Forex CFDs

Forex trading CFDs offers investors the possibility y to speculate on the price development of various currency pairs. At Libertex, the selection of tradable currency pairs is large and not only the usual constellations such as USD/EUR have to be traded. The experienced Forex traders will surely be happy with the selection of currency pairs.

CFDs on Commodities

With the help of Libertex, traders can trade many different commodities and also speculate on price developments. We would like to list the most popular CFDs on commodities offered by Libertex.

- oil

- Wheat

- gold

- Silver

- Corn

- Coffee

- Grain

- cocoa

- sugar

- soybeans

Indices on CFDs

If you prefer to trade with a bit of diversification then indices on CFDs could be just the right choice for you. Here you are not betting on individual share CFDs, but on entire indices. In addition to the well-known ones such as Dow Jones, DAX or NASDAQ, there are another 100 indices available to you. The indices on CFDs come from Europe, Asia, Middle East, North America and South America.

ETF on CFDs

As a trader, you can trade CFDs on ETFs on Libertex. These can easily be added to your own portfolio and traded. ETFs are so-called exchange-traded funds that are managed by a fund manager. More than 10 ETFs from leading providers such as iShares, SPDR or Vanguard can currently be traded.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 87.8% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Which cryptocurrencies CFDs can you trade at Libertex?

That’s an important question that we’re keen to answer in as much detail as possible in this section. Finally, if you are a crypto trader who only trades cryptocurrencies, you should know what to expect from an online broker like Libertex. At this point we have to mention again that Libertex does not allow real trading with cryptocurrencies and other assets, because it is trading with CFD derivatives, i.e. contracts for difference. Rather, you speculate on whether the price of a certain cryptocurrency will rise or fall. In fact, you do not acquire ownership of any particular virtual currency. Consequently, we will show you which crypto CFDs are partly offered for trading at Libertex.

- Bitcoin

- Litecoin

- Ethereum

- Ripple

- Ethereum/Bitcoin

- Stellar

- Cardano

- Tezos

- Chainlink

- Cosmos

- Maker

- Ontology

- Aave

- yearn.finance

- Compound

- Polkadot

- VeChain

- Uniswap

- Dogecoin

- THETA

- Binance Coin

- Algorand

- Solana

- Avalanche

- Terra

- Elrond

- Filecoin

- Chiliz

- PancakeSwap

- SushiSwap

- Enjin Coin

- Polygon

- internet computers

- Axe Infinity

Libertex broker taxes

Libertex users have to reckon with a so-called final withholding tax for trading transactions. In itself, Libertex does not carry out any tax payments, since the online broker’s headquarters are not in Germany. For this reason, there is no automatic deduction from the capital gains tax that has to be paid in Germany. It is therefore entirely in the hands of the trader, because he has to submit the tax certificate as part of the tax return so that the tax office can determine how much money was generated with Libertex and how much of it has to be repaid to the state. If you as a trader need documents for your tax return, you can create them at any time on the official Libertex website. The trading software MetaTrader 4 or MetaTrader 5 is available for this purpose. The document created can be printed out and then attached to the tax return. On request from Libertex you can also get an annual certificate for the tax office. This is very practical and saves a lot of work.

Libertex experiences – conclusion

If you, as an investor, have been looking for a reputable online broker for a long time, who is always at your side as a loyal trading partner and has a large trading portfolio, then Libertex will probably be exactly the right broker for you. This CFD broker comes with a lot of potential and has a great experience dating back years of hard work. The Libertex app allows you to trade anytime on the go, giving you a trading platform that is not only experienced but also moves with the times.

With the Libertex app, customers always have the possibility to trade CFDS on stock , commodities, cryptocurrency and many other CFD derivatives. In addition, you do not only have to trade with the in-house Libertex web trader, as there are several trading platforms available to you. For example, you get full access to the MetaTrader 4 and MetaTrader 5 trading platforms. If that isn’t enough for you, you can also trade on the go at any time of the day or night.

Another positive Libertex review we can give to this platform is the fact that Libertex offers a ton of different training options. In this way, traders are trained on how to trade properly. It is also a good idea if you, as an inexperienced investor, take part in such training courses and improve your trading experience. All in all, the offer from Libertex has convinced us and we can recommend every investor, whether experienced or inexperienced, to register with Libertex and try out CFD trading

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 87.8% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.