Trading 212 Review 2025 – Pros & Cons Revealed

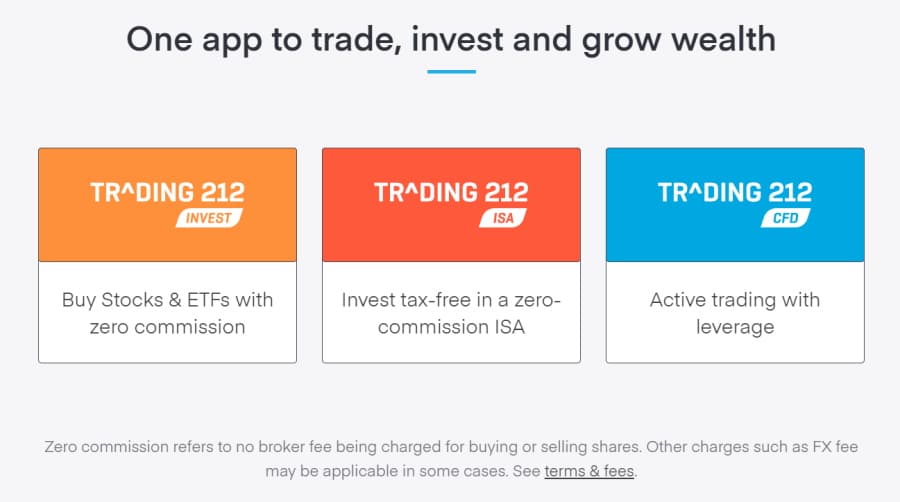

Trading 212 is mainly a forex and CFD broker, but traders can also buy and sell stocks and ETFs on a commission-free basis. With thousands of financial instruments to trade, you can choose between three account types depending on your trading preferences.

So, does this broker meet your trading needs and goals? In this Trading 212 review, we’ll explore all the key metrics from fees and commissions to payments and security, so that you can pick a broker that’s right for you.

What is Trading 212?

Launched in 2004, Trading 212 is a UK-based fintech trading platform that makes online trading accessible to all types of investors with commission-free trading and user-friendly platforms. Trading 212 clients can buy and sell forex, stocks, ETFs, and more with the click of a button.

Trading 212 was the first brokerage firm in the financial sector to provide 0% commission stock trading in Europe and the UK, which therefore allowed millions of traders to access the stock markets on a low-cost basis.

In terms of compliance, Trading 212 is authorized and regulated by the UK’s FCA (Financial Conduct Authority), and the Financial Supervision Commission in Bulgaria. Furthermore, client funds are held in segregated accounts and are covered up to £85,000 by the Financial Services Compensation Scheme (FSCS).

According to Trading 212, its mobile trading app has had more than 15 million downloads and has been rated by over 180 thousand users, thus making it one of the most popular trading apps in existence. However, due to unprecedented demand, Trading 212 has stopped account opening as they try to expand their services. In the time being, you can join a waiting list by entering your email address and Trading 212 will notify you when you can open a new account.

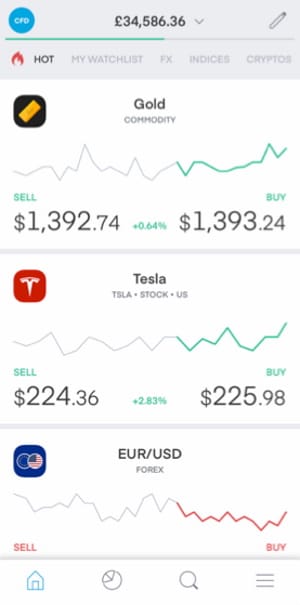

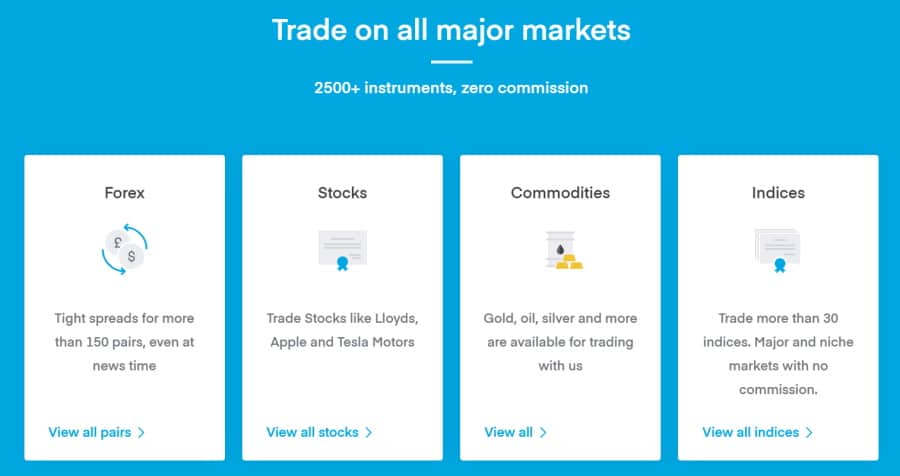

Trading 212 caters to a variety of investors as there are three account types to choose from. The CFD account allows you to trade on all major markets including over 2,500 instruments such as forex, stocks, commodities, and indices. One of the broker’s best selling points is that all trading instruments come with zero commission. This means that you only have to pay the competitive spreads.

On the other hand, the Invest and ISA accounts provide access to more than 10,000 real stocks and ETFs with instant execution on the world’s major exchanges including the London Stock Exchange, the NYSE, NASDAQ, Deutsche Borse Xetra, Euronext Amsterdam, SIX Swiss Exchange, Bolsa de Madrid.

Trading 212 Pros & Cons

What we like

- Three trading accounts to choose from including CFD trading, Invest, and Individual Savings Account.

- Trade stocks, forex, ETFs, commodities, and more with 0% commission and competitive spreads.

- Top-rated mobile trading app with more than 15 million downloads, compatible with Apple and Android mobile devices.

- Access to more than 2,500 CFD instruments including 150+ forex pairs and 30+ indices.

- Client funds are held in segregated bank accounts and are protected up to £85,000 by the FSCS.

- Regulated by the UK’s FCA.

- Provides negative balance protection.

- Place order types including stop loss and take profit with the click of a button.

- Wide range of educational features including a YouTube channel.

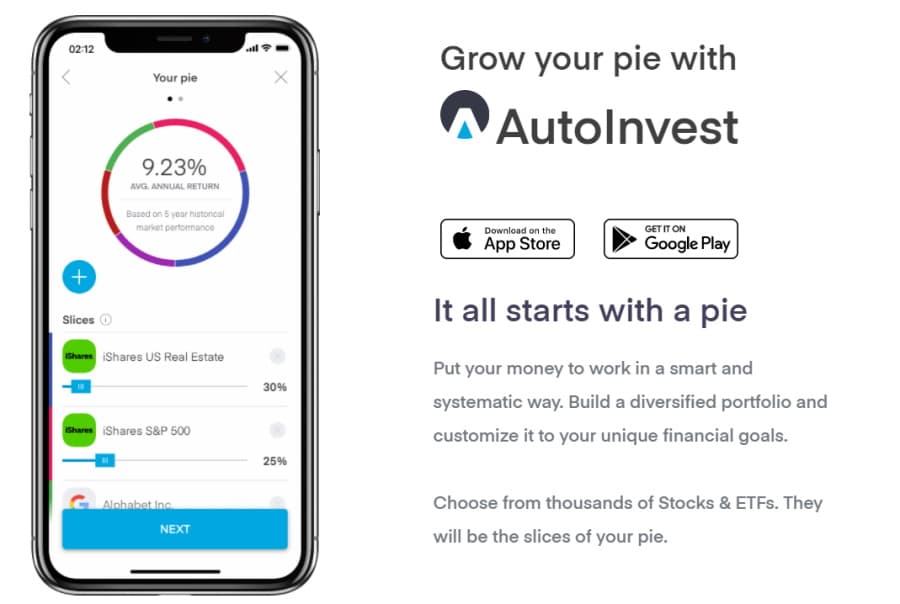

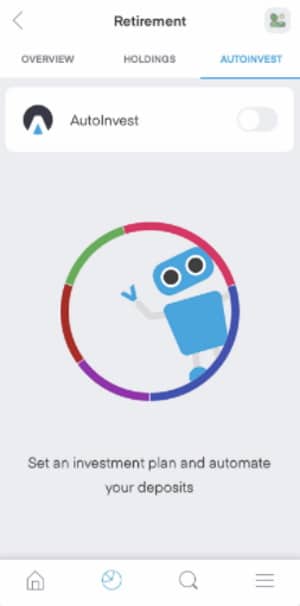

- Automated trading with AutoInvest.

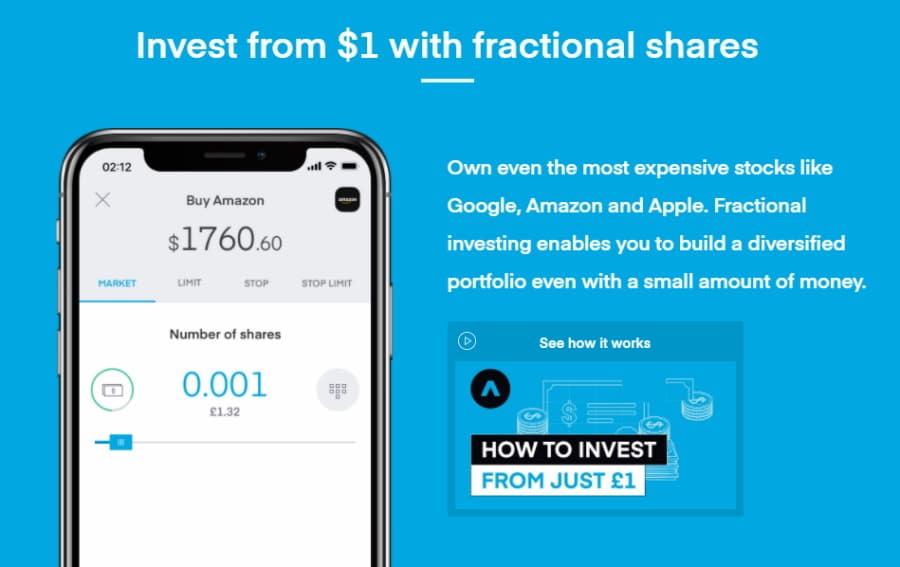

- Invest from just $1 with fractional share trading.

- Access to more than 10,000 real stocks and ETFs with a Trading 212 Invest account.

- Multiple supported payment options

What we don’t like

- Customer services cannot be contacted via live chat or telephone.

- Above average spreads

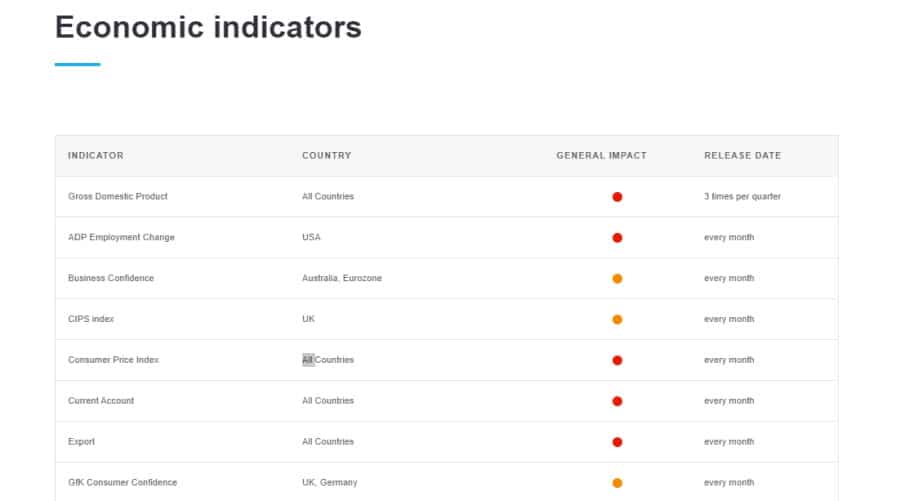

- Lack of fundamental data

76% of retail investor accounts lose money when trading CFDs with this provider.

What Can You Trade on Trading 212?

Trading 212 provides access to more than 2,500 CFDs and over 10,000 real stocks and ETFs on the world’s leading exchanges.

CFD Trading

CFD account holders can trade stock CFDs, stock index CFDs, forex, ETF CFDs, and commodity CFDs.

Before we move on any further, it’s important to understand what CFD trading is all about.

So, what are the benefits of contract for differences?

Buying and selling CFDs involves exchanging the difference in the price of an underlying asset between the time you open the position and when you close it.

CFD trading allows you to increase the purchasing power of your investment capital with leverage, as you only have to deposit a portion of the trade’s value to open the trade. The deposit is commonly referred to as the margin. While leverage can maximize your potential profits it also works in the opposite direction, in that it amplifies any potential losses you may incur.

Additionally, as CFDs work on a speculative basis you can either trade at the buy price if you believe the market is going to rise, or you can trade at the sell price if you believe that the market is going to drop. In investment terms, this is known as going long and going short.

Forex

When it comes to forex CFDs you can buy and sell more than 150 major, minor, and exotic currency pairs. For major currency pairs the margin requirement is 3.33% and for non-major currency pairs is 5%. The minimum traded quantity varies depending on the currency pair that you choose. For example, the EUR/USD pair has a minimum traded quantity of 500 and a margin rate of 3.33%, whereas the EUR/PLN pair has a minimum traded quantity of 5,000 and a margin rate of 5%.

Commodities

For your open positions with a Trading 212 CFD account, the margin requirements vary depending on the trading instrument. As such, the margin requirement for spot gold is 5% and for other commodities is 10%.

Trading 212 CFD account holders can access a wide range of commodities including energies, precious metals, and agricultural products. Additionally, you can also trade commodity futures such as Chicago SRW Wheat-14Jul21, Coffee-21Mar22, Copper-29Dec21, Crude Oil-19Nov21, and many more. The minimum order size varies between 0.001 and 1.

Stocks

Trading 212 investors have access to thousands of stocks that are listed on the world’s major stock markets such as the London Stock Exchange, the NYSE, NASDAQ, and the SIX Swiss Exchange. With this said, you can trade almost all shares of companies that make up the FTSE 100 and S&P 500 index, in addition to heaps of stocks from mainland Europe and Hong Kong.

You can also trade CFDs for stock indices such as the EURO STOXX 50, Germany 30, Japan 225, SPX 500, UK 100, and US 30.

Commission-free Stock and ETF trading with Trading 212 Invest and ISA Accounts

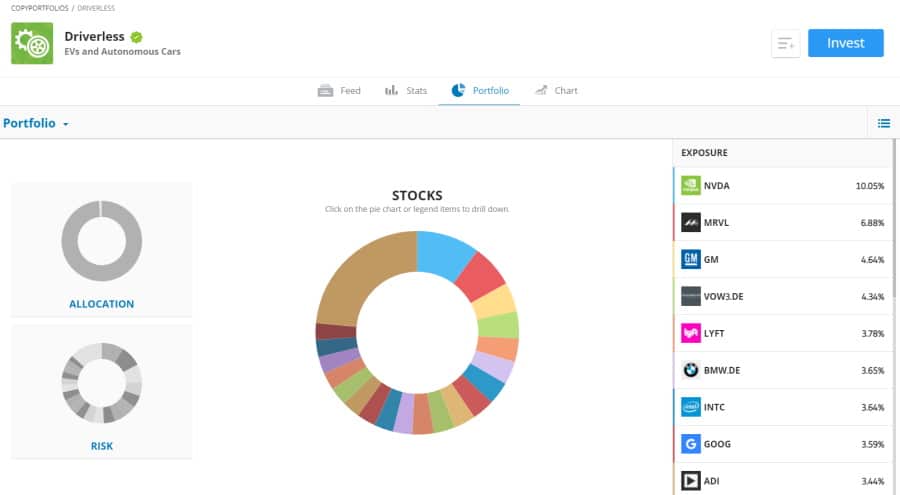

Trading 212 Invest and ISA accounts have access to over 10,000 stocks and ETFs. Invest account holders can also diversify their investment portfolios with AutoInvest that creates an investment plan based on your trading needs and objectives. With automated trading, you can deposit funds, invest profits into your investment pie automatically. With each stock and ETF you choose to invest in, they will make up the slices of your pie.

Furthermore, you can also invest in fractional shares from just $1. Simply put, you can invest in the most costly shares of Amazon, Apple, and Google stocks with as much money as you can afford. You can even invest in as little as 0.001 of a share with the click of a button.

Trading 212 Fees & Commissions

Trading 212 is popular amongst the investing community as a free trading platform. This means that all supported trading instruments are commission-free, with the CFD broker making most of its money from the spread on trades.

Crucially, the spreads charged by Trading 212 can be slightly above average when compared to other online brokers. For example, if you wanted to trade the EUR/USD major currency pair, Trading 212 charges a spread of 1.4 pips whereas eToro charges just 1 pip.

The majority of US and UK stocks trade with an average spread of 0.50%. On the flip side, trading low liquidity share CFDs with Trading 212 can incur spreads of nearly 10%.

| Trading / Non-Trading Fee | Charge |

| Trading Commissions | 0% as fees are included in the spreads |

| Account fee | None |

| Minimum deposit/withdrawal for Invest and ISA Accounts | $1 |

| Minimum deposit/withdrawal for CFD account | $10 |

| Deposit fee | No fees for bank transfers and instant bank transfers. For other supported payment methods, there are no deposit fees up to £2,000, thereafter a deposit fee of 0.7% is charged. |

| Withdrawal fee | None |

| Minimum buy/sell order for Invest/ISA accounts | $1 |

| Inactivity fee | None |

| Stamp Duty | 0.5% Stamp Duty Reserve Tax is charged when trading shares of stocks listed on the LSE. |

When you invest in shares of stock via an Invest or ISA account you are not charged any spreads. This means that for the majority of traders the ISA and Invest accounts at Trading 212 provide 100% free trading.

Furthermore, the costs are kept to a minimum when it comes to non-trading fees. As well as no withdrawal fees and account fees, there is no inactivity fee which is especially ideal for long-term traders.

In summary, Trading 212 is a discount broker that offers an extensive range of stocks and ETFs as well CFD derivatives including more than 150 currency pairs for forex trading. Trading 212 is a great match for beginner traders looking for exposure to major stock markets with fractional share trading, as well as passive trading with AutoInvest.

Trading 212 User Experience

The user interface and design are user-friendly and intuitive. You can choose either the web trading platform or the mobile trading app which is compatible with both iOS and Android devices.

Even with little to no trading experience, you can navigate around and use the trading platforms comfortably and competently. You can customize the trading terminal to suit your trading preferences and needs.

When it comes to security and logging into your account, Trading 212 supports two-factor authentication which allows you to gain access to your trading account only after you have successfully provided two or more pieces of evidence in the form of a verification code which is sent via email or SMS.

The search functionality is also very easy to use, as you can either type the name of the instrument in the search bar at the top of the platform or you can browse through assets via categories such as currencies and commodities.

You can set up price alerts and push notifications on executed orders, margin calls with the click of a button.

As for the trading212.com website, this is very user-friendly, with a clear and well-designed layout you can find all the vital information you need, from metrics such as tradable assets to trading terms and a useful educational section under the Learn tab that features educational videos and a community forum.

Overall, Trading 212 offers a user-friendly online trading experience that beginner traders will appreciate.

Trading 212 Features, Charting, and Analysis

Trading 212 provides a comprehensive web-based trading platform for both CFD and stock trading. A great feature of the trading platform is the ability to manage several charts on a single screen, as well as the watchlist in the sidebar that allows you to monitor any chart and even place an order without having to open a new tab.

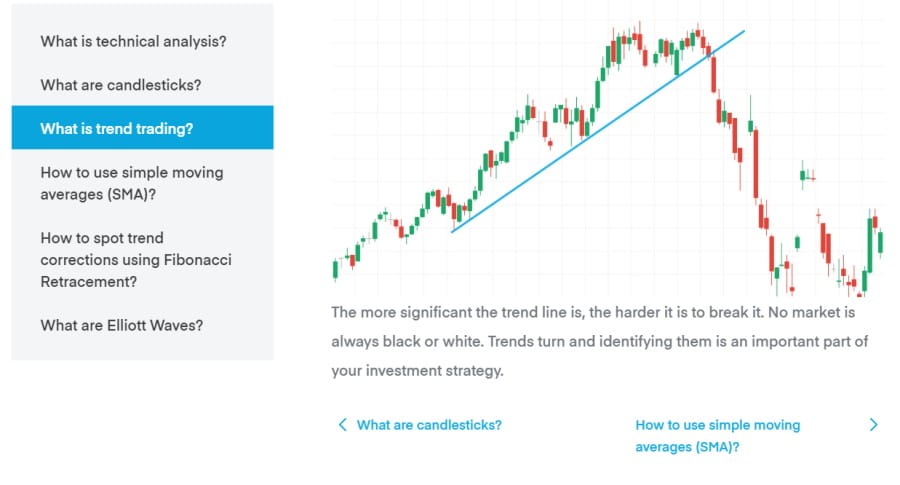

Charting

When it comes to technical charting, Trading 212 provides access to over 60 technical indicators such as MACD and Bollinger Bands. You can choose between a range of chart styles including candlestick, Heikin-Ashi, and line charts, with time intervals available between one minute and one month.

Another great charting feature is that of a pattern identification tool. This means that when you analyze charts, the pattern identification algorithm outlines patterns such as bullish and bearish trends.

Trading 212 also provides drawing tools like Fibonacci retracements and Elliot wave tools. You can also save your charts with all modifications to a template for reuse whenever you need them.

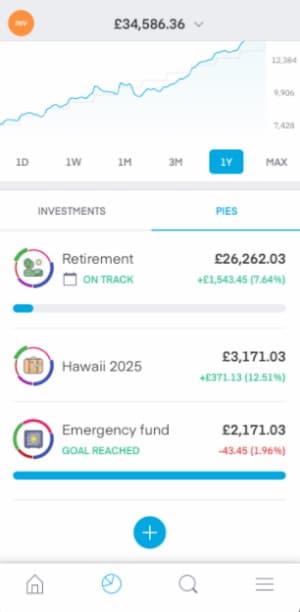

What is AutoInvest and how does it work?

Trading212’s AutoInvest feature allows traders to customize a deposit schedule to one or more portfolios referred to as pies, allocate a payment method, and invest automatically based on trading parameters that you set.

The Pie System was designed and developed to help traders reach their financial goals by offering a solution to two key sticking points:

- To maintain a diversified investment portfolio for long term trading strategies as markets continue to rise and fall

- To be able to fund your portfolio without needing to use complicated calculations to assign the right amount of capital to each asset you own to balance your portfolio properly.

This is where AutoInvest comes in, all you have to do is set the investing parameters and the automated trading software does the rest.

In terms of the fundamentals, a pie is a basket of both ETFs and stocks. Each asset represents a slice of the pie, with each pie holding up to 100 assets. For example, if you deposit $1,000 into a pie of 5 slices each with a target of 20%, $200 will be automatically allocated to each slice of the pie.

Paper trading

New traders can access a free practice account with £50,000 worth of virtual funds to practice their trades in a risk-free simulated environment.

Trading 212 Account Types

There are three account types to choose from when trading with Trading 212:

- CFD trading account – As the name suggests, the CFD trading account allows you to gain exposure to active CFD derivatives trading with leverage, as you speculate on the price movements of the underlying market.

- Invest account – allows you to buy more than 10,000 ETFs and stocks with 0% commission and you take ownership of the underlying asset.

- ISA account – allows you to invest in stocks and ETFs tax-free in a commission-free Individual Savings Account.

When it comes to fractional share trading, this is accessible via the ISA and Invest accounts.

Trading 212 Mobile App Review

The mobile trading app mirrors the sentiment discussed regarding the web platform. The app is user-friendly and offers the same functionality as its web platform counterpart. You can open an account, deposit and withdraw funds, and place trades with ease from your mobile device.

In terms of placing a trade, this is a streamlined process. To get the ball rolling simply specify the amount you want to invest, place an order type, or even invest as little as £1 in fractional shares.

For example, if you want to invest £25 in Amazon shares, the Trading 212 mobile app allows you to do this through fractional share trading. Alternatively, if you wanted to trade CFD derivatives you could do so within the trading app, as well as use technical indicators and advanced charting tools.

Trading 212 Payments

While there are no deposit fees for bank transfers, there is a 0.7% deposit fee charged when you deposit more than $2,000 with a credit card, debit card, Google Pay, Apple Pay, Skrill, iDeal, DotPay, GiroPay, and Sofort.

The minimum deposit and withdrawal amount varies depending on the type of account you have. This stands at $1 for Invest and ISA accounts and $10 for the CFD account.

Bank transfers typically take two to three business days, while credit card, debit card, e-wallet payments are credited instantly to your account.

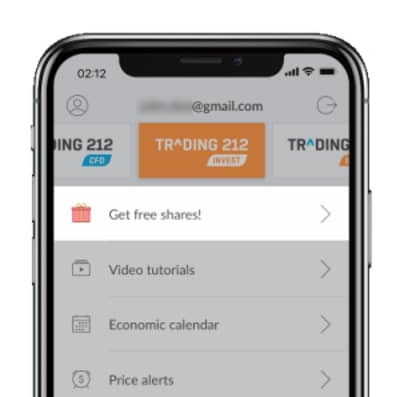

Trading 212 Invite a Friend Promotion

By inviting and referring your friends to open a live trading account with Trading 212, both parties can receive a free share with a value of up to $100.

To qualify for the promotion you will need to have an active Trading 212 Invest or ISA account. To get started simply click on the More tab at the bottom of the mobile app, and click on the get free shares button, then tap on the share link to send your friends a referral link.

You can refer up to 20 friends, and after you receive the twentieth free share the promotion will automatically terminate. You receive your free share within three business days provided that your friends have verified and deposited funds into their Invest or ISA accounts with the required minimum deposit.

Trading 212 Contact and Customer Service

You can only contact customer support at Trading 212 by submitting a request which involves providing your email address and a brief description of your issue or question, as well as having the option to include an attachment. The Trading 212 customer service department operates 24/7 and provides prompt and relevant assistance.

On the negative side, live chat and telephone support are not available.

Is Trading 212 Safe?

Considering that Trading 212 is authorized and regulated by the UK’s Financial Conduct Authority and the Financial Supervision Commission in Bulgaria, we would suggest that this CFD broker is a safe option.

Furthermore, all client assets are held in segregated bank accounts. This means that your money is kept separate from the broker’s capital. Should Trading 212 liquidate its shares, segregation of client funds plays a key part in client fund protection.

Additionally, if the broker were to go bust, the FSCS compensation covers you up to £85,000, and the ICF Bulgaria compensation is up to 20,000 euros.

Finally, Trading 212 also offers negative balance protection which means that you cannot lose more money than you have in your account balance.

How to Start Trading with Trading 212

In this section of the broker review, we will show you how to get started with Trading 212 in a few easy steps.

It’s worth mentioning that due to unprecedented demand Trading 212 has paused its account opening process as it tries to expand its services to a wider client base. As a result, if you want to open an account with Trading 212 you will need to enter your email address and the broker will notify you when you can open a live trading account.

Step 1: Open a Live Trading Account

The first step involves heading over to the Trading 212 website and clicking on the open account button located at the top right-hand corner of the screen.

You will then be required to enter your personal details such as country of residence, full name, phone number, date of birth, national insurance number. Then you need to choose the account type that suits your trading goals and needs, and the account base currency.

To complete the initial registration phase you will simply need to click on the I Confirm button at the bottom of the window.

Step 2: Verification

Standard KYC policies require client verification as a way of combating financial fraud and identity theft.

For the Trading 212 document verification team to verify your identity and address you will be required to upload copies of your passport or driver’s license and a recent utility bill or bank statement.

Step 3: Deposit Funds

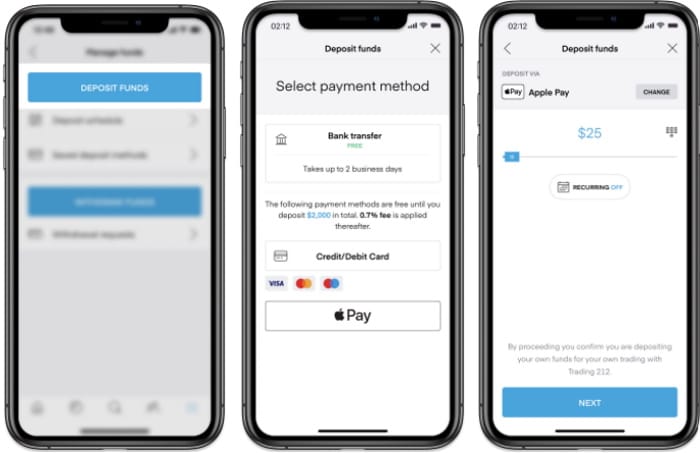

To deposit funds into your account simply click on the account menu at the bottom of the mobile trading app, and select Deposit Funds, and choose your payment method such as bank transfer or credit/debit card, or e-payment. Then specify the amount and based on your payment method.

Payments made via credit or debit cards typically take around 10 minutes to be credited to your account. On the other hand, payments made with Bank Transfers can take 2-3 business days to process.

Alternatively, you could use an Instant Bank Transfer through TrueLayer.

Step 4: Start Trading Financial Instruments

With access to thousands of stocks and ETFs, as well as fractional shares, you can buy and sell assets with the click of a button on both the web and mobile trading apps.

Trading 212 vs eToro

In summary, Trading 212 is widely popular amongst the trading community for a number of reasons. Firstly, this CFD and stock trading platform offers shares and ETFs on a commission-free basis, it provides a user-friendly trading app and supports a variety of instant payment options.

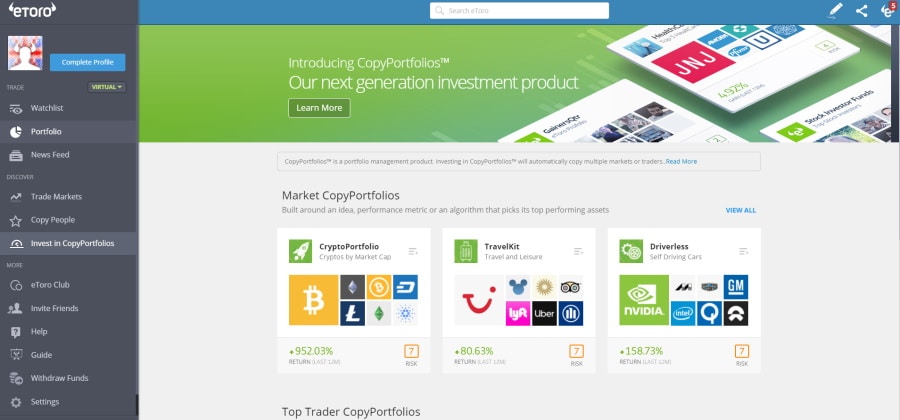

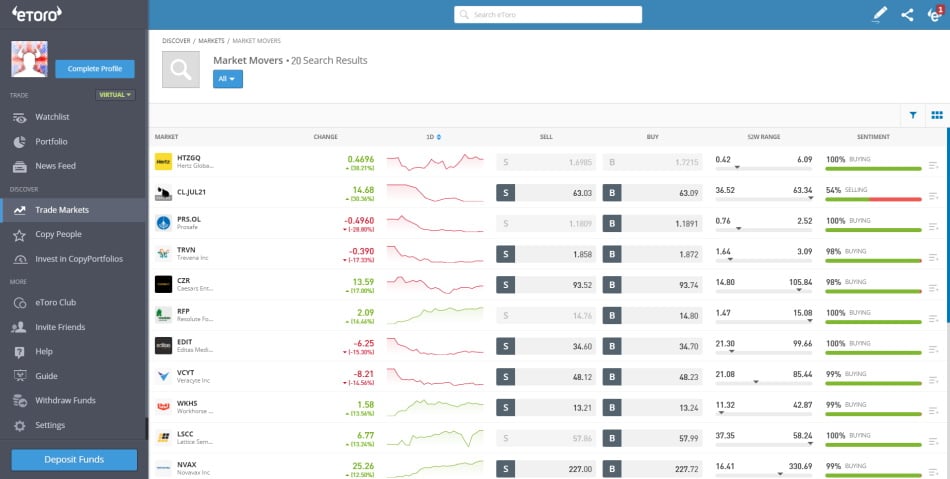

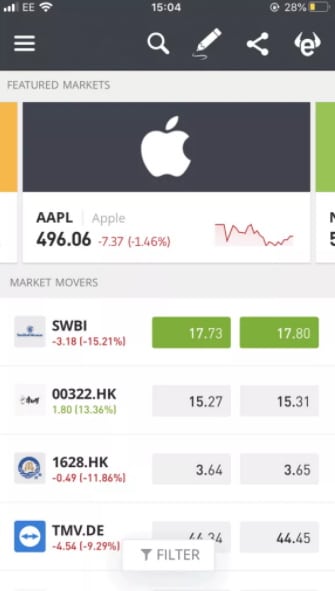

Nevertheless, our in-depth Trading 212 review found that there is an alternative broker that stands out in several key areas. Launched in 2006, eToro has become the go-to social trading platform for more than 20 million traders worldwide. eToro also offers 0% commission when trading CFDs, forex, cryptocurrencies, and more.

67% of retail investor accounts lose money when trading CFDs with this provider.

Furthermore, unlike Trading 212, eToro waives the 0.5% stamp duty fee on shares of stocks listed on the London Stock Exchange, thus helping you to keep your trading expenses to a minimum. Moreover, when trading non-UK CFDs with Trading 212 you have to pay a 0.5% forex fee, whereas eToro charges 0% commission.

Additionally, eToro facilitates copy trading which means that through automated trading you can copy the trades of other experienced investors like-for-like from the comfort of your own home. This free trading platform also supports cryptocurrency trading which is something that Trading 212 falls behind on.

If you are interested in Bitcoin trading, then you will be pleased to know that eToro allows you to trade 16 different cryptos without having to pay a penny in commission. As for storing your digital assets, eToro provides its own secure crypto wallet so you don’t have to source a third-party hot or cold wallet.

Trading 212 Review – The Verdict

We recommend eToro as the best online trading platform in 2022 because it offers the perfect balance of tradable assets, market-leading trading fees, and a social trading platform that acts as a catalyst for copy trading.

So, for a more comprehensive look into this FCA-regulated broker, read our in-depth eToro review. If you want to start trading with eToro, just click the link below and open an account today!

eToro – Best Copy Trading Platform with 0% Commission Stock and ETF Trading

67% of retail investor accounts lose money when trading CFDs with this provider.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.