Best Crypto Lending Platform 2025 – Safest Platform

If you’re already buying and holding cryptocurrencies, lending crypto is a great way to earn passively from coins and tokens that are just lying around in your wallets. Whether it’s through crypto peer-to-peer lending or lending through a platform or site, DeFi crypto lending lets you turn a profit from idle crypto assets.

Here, we’ll help you find the best crypto lending platform for you as we cover and review crypto lending rates, features of crypto lending platforms, and some other crypto lending programs.

Best Crypto Lending Platforms List 2025

Explore and find the right crypto lending platform for you. Note that some of the best crypto lending platforms not only shine with high-interest rates but with several quality of life features as well.

- AQRU – Overall Best Crypto Lending Platform with Great Interest Rates

- Crypto.com – Fast and Safe Crypto Lending Platform with Rates as High As 14% APY

- BlockFi– User-Friendly Crypto and Bitcoin Lending Platform with Compound Earnings

- Nexo – Best Crypto Lending Platform with highest rates 36% APR

- YouHodler – Beginner-friendly Crypto Lending Platform with over 50 Coins

Best Crypto Lending Platforms Reviewed

Finding the right crypto lending platform for you will require looking into several things. From the cryptocurrencies available for lending to the interest rates offered, your preferences will definitely affect which crypto lending platforms to choose from.

With all of this considered, let’s take a look at how lending crypto works for some of the crypto lending platforms we reviewed.

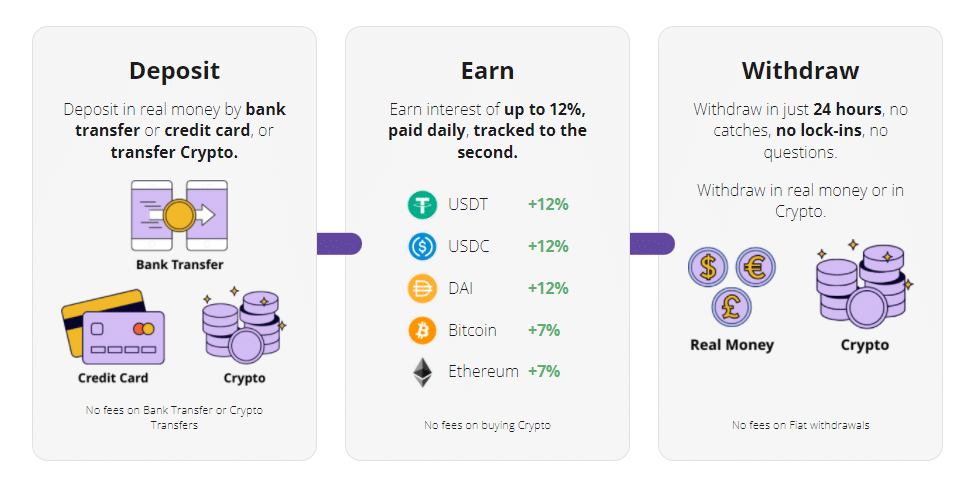

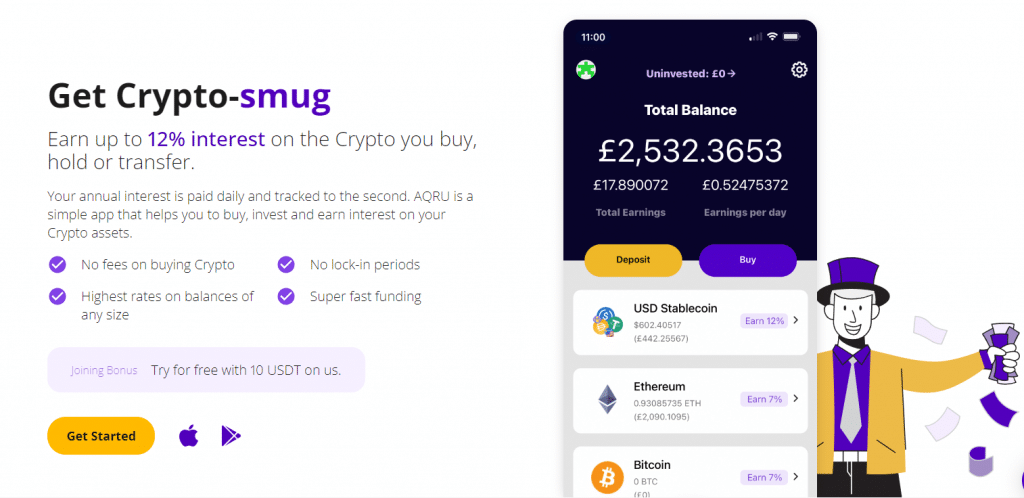

1. AQRU – Overall Best Crypto Lending Platform at Up to 12% APY

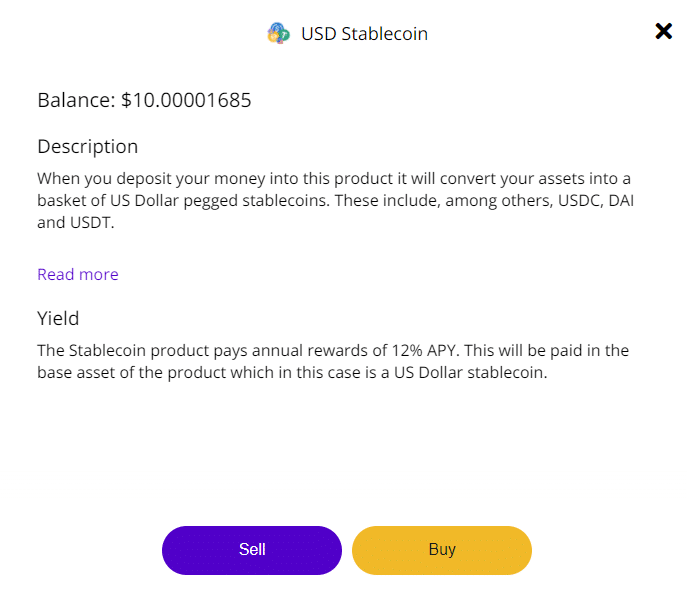

If you’re asking for our recommendation, our overall best crypto lending platform is AQRU. Aside from being very easy to use, AQRU offers the most popular stablecoins and cryptocurrencies for lending. Earn an annual percentage yield (APY) of 12% for lending your Tether (USDT), USD Coin (USDC), or Dai (DAI), and 7% APY for Bitcoin and Ether.

If you’re asking for our recommendation, our overall best crypto lending platform is AQRU. Aside from being very easy to use, AQRU offers the most popular stablecoins and cryptocurrencies for lending. Earn an annual percentage yield (APY) of 12% for lending your Tether (USDT), USD Coin (USDC), or Dai (DAI), and 7% APY for Bitcoin and Ether.

What makes these lending rates incredible is that there are no fees for crypto and bank deposits, no fees for buying crypto, and no lock-in period. This means that you can withdraw any of your cryptocurrencies from AQRU within just 24 hours. AQRU is transparent in that there are no hidden fees and all users really need to factor in is the $20 withdrawal fee that is paid in the currency being withdrawn.

In terms of regulations and security, AQRU is owned by Accru Finance Ltd, a private limited company registered in England and Wales. Their crypto wallet system is secured by Fireblocks, a leading wallet infrastructure provider, to keep your crypto lending accounts safe. In the event that assets are stolen, a $30 million policy is in place to cover the losses from theft.

Most people will find AQRU as the right platform for them because of their high APY rates combined with the option to pull the cryptocurrency that you are currently lending to earn. Lending crypto on the platform for long periods of time will provide the maximum benefit.

The minimum deposit to lend crypto on AQRU is $100 and there is currently no minimum for withdrawals as long as users can cover the $20 withdrawal fee.

| Feature | Amount |

| Maximum Interest Rate for Stablecoins | 12% APY for USDT, USDC, DAI |

| Maximum Interest Rate for Non-stablecoins | 7% APY for BTC and ETH |

Pros:

Pros:

- No buying fees for crypto

- High rates for any balance size

- Zero lock-in periods

- Fast transaction speeds

- Joining bonus of 10 USDT

- Mobile app available

- No bank transfer and crypto transfer fees

Cons:

Cons:

- KYC and ID verification required

- Only 5 coins available for lending crypto

Capital at risk. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk. The price or value of cryptocurrencies can rapidly increase or decrease at any time.

2. Crypto.com - Fast and Safe Crypto Lending Platform with Up to 14% APY Earnings

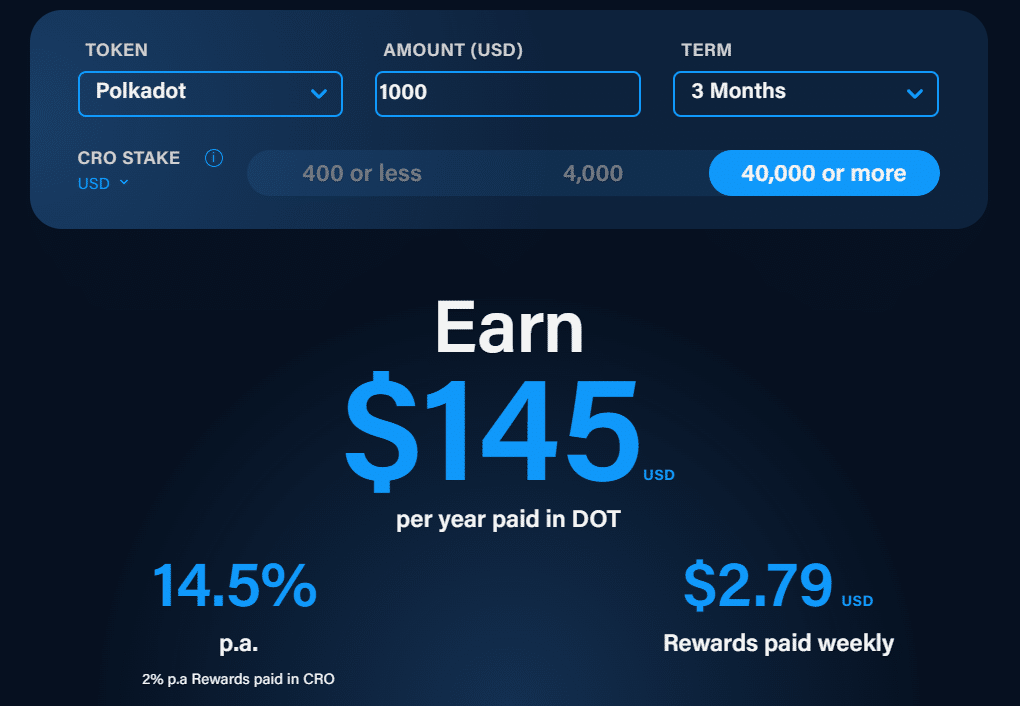

Crypto.com is one of the best and safest crypto lending platforms with high yields. Their crypto lending product, Crypto Earn, provides up to 14.5% APY on cryptocurrencies and 14% APY for stablecoins provided enough Crypto.com Coins are staked.

The platform is also known as being one of the best crypto exchange platforms available, owing to its quick growth and marketing strategies. With over 10 million users worldwide, Crypto.com offers a variety of crypto products and marketplaces for those in the crypto sphere.

If you’re already on or looking to join the Crypto.com ecosystem, then Crypto Earn might be the best crypto lending platform for you. They offer crypto lending for more than 50 cryptocurrencies and users who own a lot of CRO can stake them to increase their yield. There are also three holding term options: flexible holding term, 1-month fixed term, and 3-month fixed term.

Crypto.com’s crypto lending rates will vary depending on how much CRO you’ll stake, the holding terms, and which cryptocurrencies you’ll lend. For example, the maximum yield you can achieve with Crypto.com is if you plan on lending Polkadot (DOT), stake $40,000 worth of CRO, and use a 3-month fixed holding term.

Lastly, the Crypto Earn product has a threshold for earning. For example, to earn fixed and flexible holdings for USDT, you need to lend 250 USDT or more to meet the threshold.

| Feature | Amount |

| Maximum Interest Rate for Stablecoins | 14% APY for 3-month fixed USDT, USDC, and more |

| Maximum Interest Rate for Non-stablecoins | 14.5% APY for 3-month fixed DOT |

Pros:

Pros:

- Supports over 40 cryptocurrencies for earning

- 14% annual returns on staking stablecoin on the platform

- Spend with the Crypto.com Visa Card and get up to 8% back

- NFT marketplace available

- Multiple DeFi integrations on the site

- Mobile app available

- Fees that are competitive, transparent, and offer discounts

Cons:

Cons:

- Lower returns per annum without staking CRO

- Difficult to navigate trading fee discounts

Capital at risk. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk. The price or value of cryptocurrencies can rapidly increase or decrease at any time.

3. BlockFi - User-Friendly Crypto and Bitcoin Lending Platform with Compound Earnings

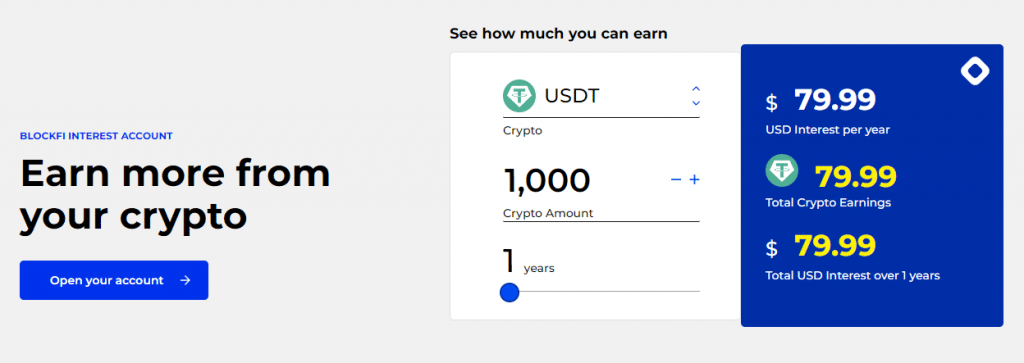

A great platform to start lending crypto and Bitcoin is BlockFi, a user-friendly lending platform with its own crypto wallet and crypto exchange. They specialize in stablecoin lending, offering up to 8% APY on popular stablecoins like USDT, DAI, and BUSD.

Due to the latest regulatory restrictions, lending crypto is unavailable for US-based BlockFi accounts. This means that access to BlockFi Interest Account (BIA), the platform’s crypto savings account, is restricted.

If you’re still keen on using BlockFi, you can still create an account and purchase crypto from their exchange platform. The cryptocurrencies stored in your BlockFi wallet can then be transferred to another crypto lending platform for you to earn yield. Currently, BlockFi is actively engaging with US regulators at both the federal and state level to allow for the use of their crypto lending platform.

For now, BlockFi’s crypto lending rates are not only decently high at 8% APY for stablecoins, but their tier limits are high as well. In particular, users can expect an 8% APY for the first 20,000 USDT they lend. From there, the remaining stablecoins until 10,000,000 USDT will earn a 7% APY.

| Feature | Amount |

| Maximum Interest Rate for Stablecoins | 8% APY for USDT, USDC, BUSD, DAI, PAX |

| Maximum Interest Rate for Non-stablecoins | 11% APY for MATIC |

Pros:

Pros:

- Allows for monthly compounding on earning positions

- Over 14 stablecoins and other cryptos are available for earning

- Higher upper limits for crypto interest tiers

- Rewards credit card and investment products available

- Mobile app available

Cons:

Cons:

- No 24/7 live support

- Available only for non-US clients

Digital currency is not legal tender, is not backed by the government, and crypto accounts held with BlockFi are not subject to FDIC or SIPC protections. Digital currency values are not static and fluctuate due to market changes.

4. Nexo - Best Crypto Lending Platform with highest rates up to 36% APR

Investors who are looking to bag the highest interest rates for lending crypto should definitely consider Nexo. Crypto lending rates on the platform can go as high as 36% APR for Axie Infinity Shards (AXS) which is on promotion. For stablecoins, their highest yield is 17% APR for TerraUSD (UST). For these rates, earnings come in the form of NEXO tokens.

Nexo also offers both flexible and locked term holdings when lending crypto. Flexible holdings don’t offer high crypto lending rates compared to locked term holdings, but they do let you withdraw freely at any moment. Nexo says that 72% of their users are planning to hold their crypto assets for three or more years.

Similar to BlockFi, the Nexo Earn product is currently unavailable for US-based clients. However, US users can still buy, exchange, and store cryptocurrencies through the Nexo platform and Nexo Wallet App. Those looking to use Nexo can still lend their cryptocurrencies by connecting their Nexo Wallet to another crypto lending platform.

Otherwise, the Nexo platform offers great value in their compounding daily payouts, flexible earnings, zero fees, and top-tier insurance. They definitely have the potential to be one of the leading crypto lending platforms if restrictions ease in the US. Already $200 million have been paid out as interest across over 3.5 million users. 32 lending crypto are available on this up-and-coming crypto lending platform.

| Feature | Amount |

| Maximum Interest Rate for Stablecoins | 17% APR for UST |

| Maximum Interest Rate for Non-stablecoins | 36% APR for AXS |

Pros:

Pros:

- Allows for daily compounding

- Up to $375M insurance in the event of third-party hacks, theft, or loss of private keys

- No hidden fees or commissions for adding, withdrawing, or holding funds

- Offers both fixed and flexible holdings

- Mobile app available

Cons:

Cons:

- Requires NEXO staking for higher yields

- Nexo Earn product currently unavailable in the US

Cryptocurrencies are highly volatile and speculative assets. Your capital is at risk.

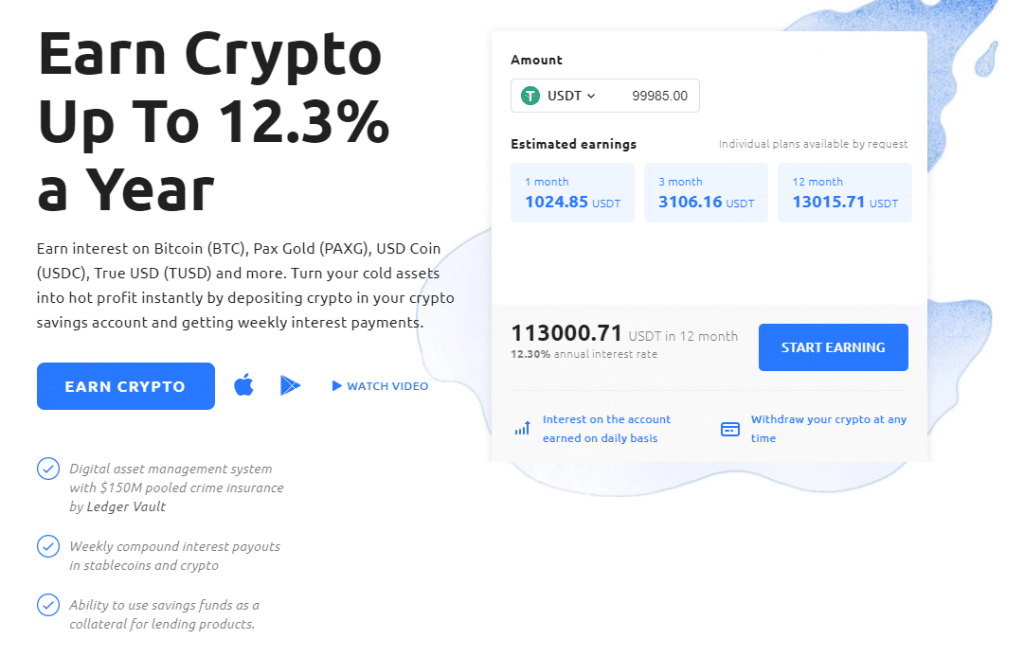

5. YouHodler - Beginner-friendly Crypto Lending Platform with over 50 Coins

If you aren’t already familiar with crypto lending or even crypto trading in general, YouHodler is a great beginner crypto lending platform to help you get started. Aside from offering the most popular coins, YouHodler has lending crypto for over 50 cryptocurrencies.

The highest crypto lending rates on YouHodler are for USDT at 12.3% APR. For other cryptocurrencies such as PancakeSwap (CAKE) and UniSwap (UNI), crypto lenders can expect a 7% APR.

Just like the last two platforms, however, YouHodler’s crypto earning product is unavailable for US jurisdictions. For this case, you can still use the crypto exchange on the YouHodler platform and hold cryptocurrencies on YouHodler’s multi-coin wallet. Transfer the cryptocurrencies from the YouHodler wallet to another crypto lending platform to earn interest from lending crypto

Crypto interest earnings from a YouHodler account are deposited weekly, so compounding can be calculated on a weekly timeframe. Lendings are insured with $150 million pooled crime insurance by Ledger Vault. Furthermore, YouHodler clients can use savings funds as collateral for their lending products.

| Feature | Amount |

| Maximum Interest Rate for Stablecoins | 12.3% APR for USDT |

| Maximum Interest Rate for Non-stablecoins | 7% APR for UNI, SUSHI, TRX, NEAR, CAKE |

Pros:

Pros:

- Beginner friendly platform

- Several popular coins available for yield

- User-friendly mobile app available

- Easy to deposit and access profile

- Multi coin crypto wallet available

Cons:

Cons:

- Limited number of yieldable crypto

- Not available in the US

Your money is at risk.

Best Crypto Lending Platforms - Rates and Yield Comparison

If you’re looking to use crypto as a savings account, then comparing different platforms to find the right one for you is necessary. Below is a comparison table of the crypto lending platforms we’ve reviewed.

| Platform | Coins and Tokens for Lending | Maximum Interest Rate |

| AQRU | USDT, DAI, USDC, ETH, BTC | 12.0% APY for USDT, USDC, and DAI |

| Crypto.com | CRO, USDT, USDC, TUSD, DAI, BUSD, HUSD, BTC, EURS, ETH, LINK, UNI, COMP, MKR, SUSHI, YFI, SNX, OMG, PAXG, DOGE, LTC, XRP, XLM, ZRX, BNT, BNB, ADA, DASH, TRX, EOS, BCH, AAVE, DOT, HT, XTZ, BAT, USDP, REP, AVAX, BTT, 1INCH, FTT, NEAR, ZIL, FIL, ATOM, SRM, FTM, LUNA | 14.5% APY for 3-month fixed USDT, USDC, and more |

| BlockFi | BTC, LTC, ETH, LINK, USDC, GUSD, PAX, PAXG, UDST, BUSD, DAI, UNI, BAT | 11% APY for MATIC |

| Nexo | USDT, USDC, DAI, USDP, TUSD, UST, USDX, EURX, GBPX, BTC, ETH, NEXO, AXS, FTM, MATIC, DOT, LUNA, AVAX, KSM, ATOM, BNB, ADA, SOL, XRP, LTC, LINK, BCH, XLM, TRX, EOS, PAXG, DOGE | 36% APR for AXS |

| YouHodler | USDT, USDC, TUSD, DAI, BUSD, HUSD, BTC, EURS, ETH, LINK, UNI, COMP, MKR, SUSHI, YFI, SNX, OMG, PAXG, DOGE, LTC, XRP, XLM, ZRX, BNT, BNB, ADA, DASH, TRX, EOS, BCH, AAVE, DOT, HT, XTZ, BAT, USDP, REP, AVAX, BTT, 1INCH, FTT, NEAR, ZIL, EGLD, CAKE, FIL, ATOM, SRM, FTM, LUNA | 12.3% APY for USDT |

Crypto Lending Types

Despite being a new product, there are several ways of lending crypto. From peer-to-peer crypto lending to using a crypto lending platform, we’ll discuss each of these crypto lending types in this section.

Lending Crypto from a Site

One of the easiest ways to get started with crypto lending is to use a centralized lending site. This involves holding your crypto in a custodial account which is then used by the site to lend it on your behalf. The lending platform will use analysis to determine when to lend your crypto for optimal returns. The platform will charge a small commission for doing this which will be taken from any returns that you make. Lending crypto this way is considered to be more beginner-friendly.

Lending Crypto to a Platform

Only cryptocurrencies under the Proof-of-Stake (PoS) consensus model can be used for staking. Cryptocurrencies such as MATIC and AVAX are lent out in their perspective blockchains to facilitate the validation of new transactions. Staking is the term that is used to describe lending crypto to a platform.

When you stake crypto, you lock it up for a specific time period so that it can be used by platforms to facilitate crypto mining. Staking is less flexible than lending but is sometimes considered less risky.

The rewards that you gain through staking are a percentage of the rewards that are given for completing new mining blocks. Typically, the returns for staking are higher than those for lending however, this depends on the currency that you wish to stake.

Peer-to-Peer Crypto Lending

Crypto peer to peer lending is directly loaning your crypto assets to another individual. Usually, there are platforms that help facilitate these crypto peer-to-peer lending transactions. One advantage of crypto peer to peer lending is better lending rates. Without middle-man taking commissions like lending crypto from a site, lenders get the full interest rate while borrowers enjoy lower rates.

Many of these crypto peer to peer lending platforms are decentralized and several can be found to connect borrowers and lenders. Overall, you’re still risking your crypto assets to individuals without much of a third-party to intervene.

Capital at risk. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk. The price or value of cryptocurrencies can rapidly increase or decrease at any time.

Bitcoin Lending Interest Rates Explained

There are many different factors at play that can affect Bitcoin lending rates as well as other crypto lending rates. Demand for certain coins, market conditions, and a plethora of other factors affect these rates as a whole. You could say it’s as complicated as the interest rates issued by governments and central banks.

One thing to note is that crypto lending rates can vary widely between crypto lending platforms and the best crypto lending platform for you might be different for others. Some crypto lending platforms offer rewards for lending crypto and staking their native coins while others offer reliably high crypto lending rates.

How to Lend Cryptocurrency

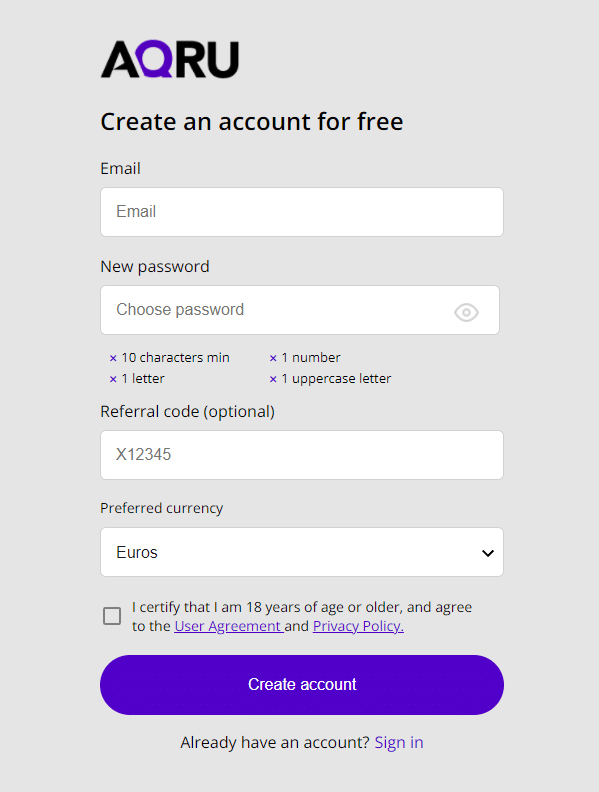

Below are some steps to help you get started with an AQRU Crypto lending account which should take just minutes to open.

Step 1: Open an Account

Capital at risk. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk. The price or value of cryptocurrencies can rapidly increase or decrease at any time.

First, head to the AQRU website and click on the Sign-Up button. You’ll fill in your email, password, optional referral code, and select your preferred currency. Afterward, you should complete your email verification which will allow you to access your AQRU account.

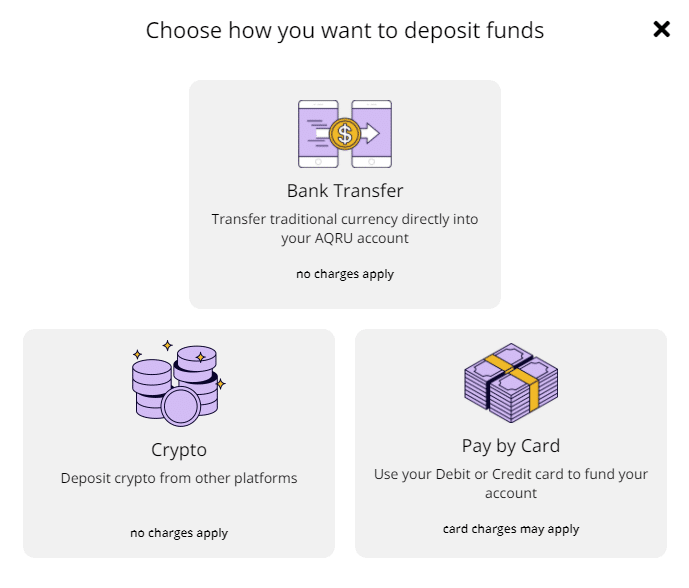

Step 2: Deposit Funds

Before you can deposit funds, you’ll first need to verify your account. This process will simply ask for citizenship details, your address, and also ask you to upload valid IDs. Once your account has been verified, you will be able to deposit funds via bank transfer, crypto from other platforms, or a bank card.

Step 3: Lend Cryptos

Finally, click the ‘Buy’ button on your account dashboard and choose which crypto you want to buy to lend. Once you’ve selected how much you want to earn in your savings account, you can confirm the process to begin earning interest from lending crypto! Withdraw any time while your account accrues daily.

Capital at risk. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk. The price or value of cryptocurrencies can rapidly increase or decrease at any time.

Is it Safe to Lend Crypto?

As we mentioned earlier, crypto lending platforms have little to no regulations. More regulatory frameworks are being discussed as many wonders how the SEC threatens to over crypto lending.

It’s necessary to understand this, especially for those who are looking to deposit large amounts of cryptocurrencies to lend on these platforms. Read carefully on the risk disclaimers found on these sites.

In order to minimize risk, users should sign up and deposit at two to three different decentralized finance lending platforms at a time. Cryptocurrencies remain to be volatile assets, so guaranteed earnings from lending crypto can still net losses if prices fall on certain cryptocurrencies.

Conclusion

In the end, we’ve gone through some crypto lending rates and the different crypto lending platform features to help you find the best crypto lending platform for you. While cryptocurrencies remain speculative and volatile assets, new ways to earn passively from crypto assets like lending crypto can offer actual returns when implemented properly.

If you’re looking to open a crypto lending account today, we recommend the AQRU platform. Start earning 12% APY on stablecoins and 7% APY on BTC and ETH with no hidden fees – all through AQRU’s handy mobile app!

AQRU - Best Crypto Lending Platform

Capital at risk. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk. The price or value of cryptocurrencies can rapidly increase or decrease at any time.