How to Buy Cryptocurrency – Beginner’s Guide

If you’re wondering how to buy cryptocurrency online – the process is actually very simple these days. All you need is an account with an online broker that offers your chosen cryptocurrency and payment method. You do, however, also need to assess how much the broker charges and whether or not the provider is safe.

In this guide, we show you how to buy cryptocurrency online in an easy, safe, and cost-effective way.

-

-

How to Buy Cryptocurrency – Quick Steps for 2025

If you’re looking for a quickfire way of how to buy cryptocurrency right now with a trusted and cost-effective trading platform – follow the steps outlined below.

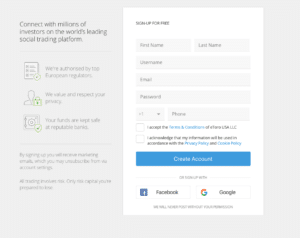

- Open an account with eToro: First, you’ll need to open an account with eToro – a regulated broker that allows you to buy cryptocurrency on a spread-only basis.

- Upload ID: Like all regulated crypto brokers, you’ll need to provide a copy of your government-issued ID

- Deposit: You can deposit funds instantly with Visa, MasterCard, Paypal, and a number of other e-wallets

- Buy cryptocurrency: Finally, search for the cryptocurrency you want to buy, enter your stake (minimum of $25) and confirm the purchase.

And that’s it – you’ve just bought cryptocurrency at eToro! The digital coins will now appear in your portfolio. At any given time, you can cash your cryptocurrency investment out.

eToro Crypto

Visit SiteDon’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong....

Coinbase – crypto

Visit SiteYour money is at risk. The exchange holds an e-money license from the FCA....

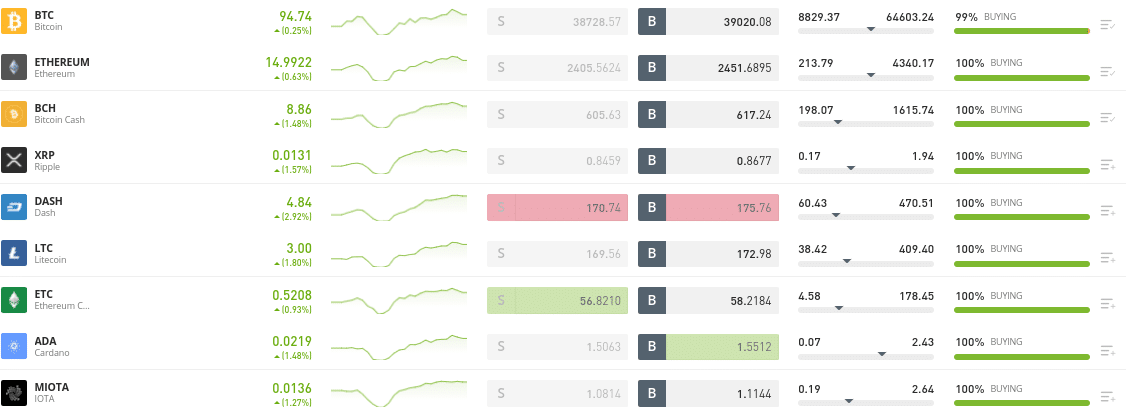

Rating5444For BeginnersInstant VerificationMobile AppWallet ServiceCoin Selection00100RatesTrading fees1% per transactionCommissionsmaker taker feesCommissionsDeposit fees$0$0N/A$0Withdrawal fees$5$0N/A$0Additional featuresRegulatedYes; CySEC, FCA, ASIC, FSASe-Money license from the FCANoYes but not in all regions.Min.Deposit$50$50$10$10LeverageN/AYesNoYesLatest prices by currencyBitcoinEthereumXRPTetherLitecoinBitcoin CashChainlinkCardanoIOTABinance CoinStellarBitcoin SVPayment methodsBank TransferCredit CardGiropayNetellerPaypalSepa TransferSkrillSofortStep 1: Choose a Crypto Trading Platform

If this is your first time learning how to buy cryptocurrency – then you might require a more comprehensive walkthrough. If so, we are going to guide you through the investment process step-by-step.

The first step is to think about where to buy cryptocurrency. After all, there are hundreds of cryptocurrency platforms in the market. To point you in the right direction, below you will find a selection of the best brokers that allow you to buy cryptocurrency safely.

1. eToro – Overall Best Cryptocurrency Trading Platform 2025

Irrespective of whether you are a first-time buyer or an experienced trader – eToro is the best place to buy cryptocurrency online and for Bitcoin trading. Used by more than 20 million people, this broker takes regulation very seriously. For those in the US, eToro is approved by the SEC and FINRA.

The broker is also authorized and regulated by the FCA, CySEC, and ASIC. As a result, you can safely buy and sell cryptocurrencies at eToro without needing to worry about security. In terms of what cryptocurrencies you can buy, eToro offers a great selection of major and minor coins. For example, if you want to buy a large-cap coin – eToro offers everything from Bitcoin and Ethereum to Ripple, VeChain, Cardano, and Dogecoin.

If you’re interested in up-and-coming Defi coins, eToro also has you covered. This includes the likes of AAVE, Decentraland, Compound, Chainlink, and Uniswap. Unlike other providers in this industry, eToro allows you to easily buy cryptocurrency with an everyday payment method. This includes local bank transfers, and e-wallets like Neteller. PayPal and credit card are not available for the UK and FCA users.

In terms of minimums, you can buy cryptocurrency from just $25 per trade at eToro. You will, however, need to deposit at least $50 if you’re from the US and $200 in most other countries. If you’re a complete newbie and not quite sure what cryptocurrencies to buy, eToro has a couple of solutions for you. First, you have the eToro CryptoPortfolio. Through a single investment, you will be buying a diversified basket of digital currencies.

The CryptoPortfolio is professionally managed by the team at eToro and thus – is regularly rebalanced. The second option is the eToro Copy Trading tool. This allows you to choose a successful cryptocurrency trader that uses eToro and subsequently copy all of their trades. Both this and the CryptoPortfolio allow you to buy and sell digital currencies without needing to do any research and also by taking advantage of the crypto signals filled by the portfolio that you’re subscribed on.

If you’re also thinking about diversifying into other asset classes to reduce your exposure to cryptocurrencies, you’ll be pleased to know that eToro offers thousands of financial instruments. This includes forex, commodities, indices, ETFs, and stocks from 17 international exchanges. Finally, eToro also offers a fully-fledged mobile app – so you can buy and sell digital currencies irrespective of where you are located!

Pros:

- Heavily regulated trading platform used by over 20 million people

- 0% commission on stocks and ETFs

- Spread-only pricing structure on crypto, indices, forex, and commodities

- Very easy to use - ideal for beginners

- Minimum stake starts at $25 per trade

- Supports debit/credit cards, bank transfers, and e-wallets

- Copy Trading features promote passive investing

Cons:

- Charting analysis tools are a bit basic

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

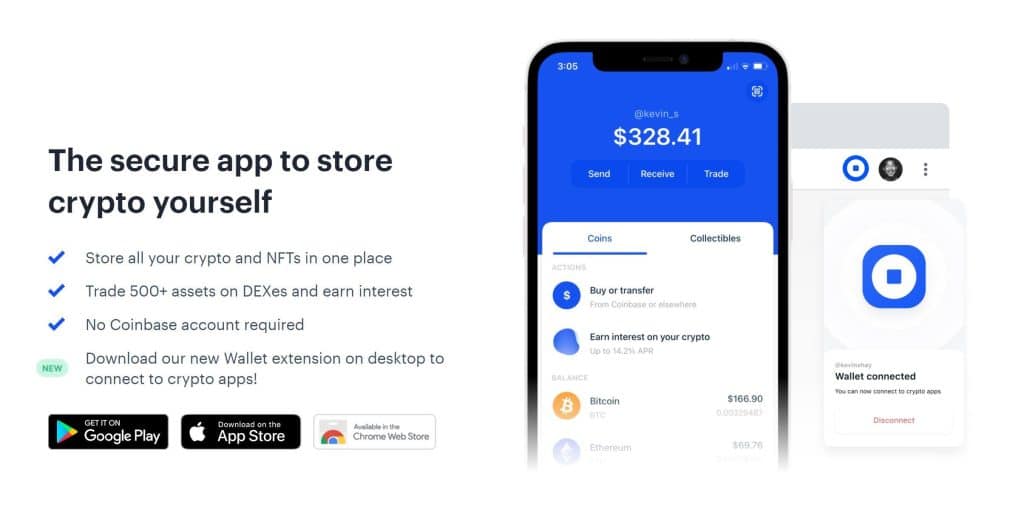

2. Coinbase - Leading crypto trading platform with user-friendly interface

Coinbase has emerged as the favored platform for newcomers in the world of cryptocurrency investment. Founded in 2012, it initially centered its focus on Bitcoin but rapidly broadened its scope to encompass a diverse array of decentralized cryptocurrencies that met stringent criteria. Today, Coinbase presents an array of services, including cryptocurrency trading, an advanced trading platform, custodial accounts tailored for institutions, personal investor wallets, and the option to acquire stablecoins using US dollars.

Over the years, Coinbase has substantially expanded its roster of supported cryptocurrencies. The platform now accommodates Ethereum, Litecoin, Bitcoin Cash, XRP, and various others. Coinbase diligently evaluates new cryptocurrencies for inclusion, adhering to rigorous standards before introducing them to the platform.

What sets Coinbase apart is its user-friendly interface, easily accessible on both iOS and Android devices. Unlike some competing exchanges, Coinbase does not provide downloadable trading software, even for its more advanced counterpart, Coinbase Pro. The platform offers an intuitive dashboard that showcases your portfolio balance and performance across different timeframes. Purchasing, selling, or converting cryptocurrencies is a hassle-free process, requiring just a few clicks. Additionally, users can establish recurring orders on a daily, weekly, or monthly basis.

Pros:

- Available on mobile devices for trading on the go.

- Coinbase has a strong global reputation.

- Access to hundreds of crypto assets.

- User-friendly interface.

- Store crypto safely in the native Coinbase wallet

Cons:

- Charting analysis tools are a bit basic

- Not compatible with MT4

Your money is at risk.

3. Kraken- Top Crypto Exchange for Advanced Traders

Kraken needs no introduction among crypto traders and investors. Whether you’re new in the cryptocurrency space or experienced, you must have heard of the Kraken Exchange at some point. Kraken is home to 10 million+ customers across over 190 countries, and it sits behind Coinbase among the world’s most liquid exchanges.

Read: Kraken vs Coinbase

To cater to customers across all experience levels, Kraken has a standard exchange for newbies and a more advanced Kraken Pro Exchange for seasoned investors. Interestingly, you can easily buy 200+ cryptocurrencies from either of these platforms. In other words, you’ll find any of the most popular cryptocurrencies, including Bitcoin, Ethereum, Bitcoin Cash, and Ripple, on Kraken.

If you’re a mobile-focused player, the Kraken app will come in handy for crypto purchases, as it allows you to buy Bitcoin and other assets in one place. You can also monitor your trades and portfolio on the go using the app.

You can buy cryptocurrencies on Kraken using a decent list of payment options. Whether you prefer fiat or crypto purchases, the exchange has all the options you need. You can deposit funds to buy coins using debit or credit cards, bank transfers, and digital wallets like Apple Pay and Google Pay. Additionally, you can buy other cryptocurrencies and swap them for the coin you prefer - all within the same exchange wallet.

The minimum deposit on Kraken is $10, so you can buy cryptocurrencies worth this amount - whether you want a single coin or prefer to spread your funds across a few options. You can also buy, sell, and trade cryptocurrencies under the safest conditions because Kraken has diverse security features in place. These include proof of reserves for transparency and advanced cold and hot storage solutions.

Pros:

- Low trading fees

- Intuitive mobile app

- 200+ high-liquidity assets

- Robust security features

- Advanced trading available

Cons:

- High Instant Buy fees up to 1.5%

- Staking is unavailable in the US

Your money is at risk.

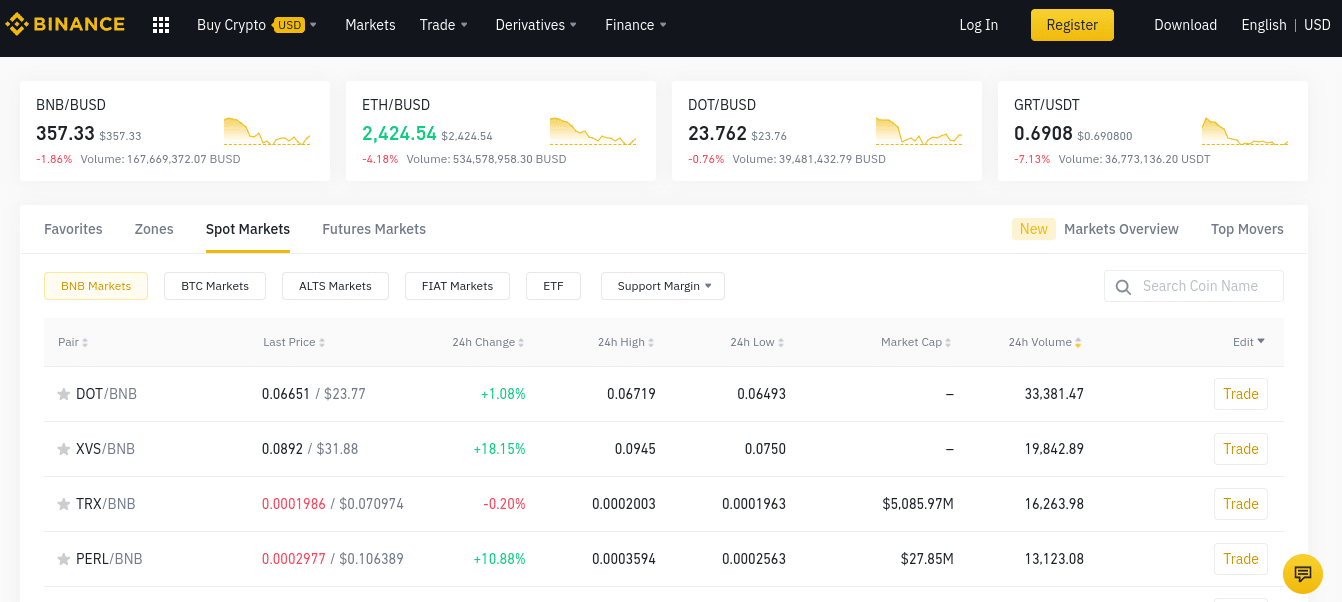

4. Binance – Best Crypto Exchange for Buying Small-Cap Coins

As of mid-2021, there are now more than 10,000 cryptocurrencies in existence. Most, however, are small projects with a low market capitalization and very little exposure. With that said, if you're looking to build a diversified portfolio of up-and-coming coins, Binance is worth considering.

This is because the platform is often the go-to place for smaller projects that are looking to be listed online. In fact, Binance is home to hundreds of cryptocurrencies that you can buy at competitive fees. In most cases, you will only pay a commission of 0.10% to buy a cryptocurrency like Tron and less if you trade larger volumes.

If you hold a minimum number of Binance Coin tokens, your commission rate will also be reduced. The main issue with Binance is that most of its supported coins cannot be purchased directly with a debit/credit card or bank account. Instead, you need to trade it against another digital token. Let's take Yearn.finance as a prime example.

If you want to purchase this blockchain asset, you first need to obtain another digital currency, Bitcoin. Then, you would need to swap Bitcoin into Yearn.finance. Although you can purchase Bitcoin and a number of other cryptocurrencies with a debit/credit card - Binance can charge up to 4% in fees. The specific fee will depend on where you live.

Nevertheless, if you are happy to go through an additional step or two to obtain your chosen cryptocurrency, Binance does offer a number of other benefits. For example, Binance is regarded as a secure platform - with plenty of safeguards in place. This includes its SAFU reserve, cold storage, IP address whitelisting, and 2FA. Plus, Binance offers a savings account that allows you to earn interest on your cryptocurrency holdings.

Pros:

- Maximum commission of 0.10% per slide

- Supports hundreds of crypto markets

- Fiat currency facilities available

- Accounts take minutes to set up

- Crypto derivatives markets include Bitcoin futures and options

- Sinigfcant levels of liquidity and trading volume

Cons:

- High fees on debit/credit deposits

Cryptoassets are speculative and carry high volatility levels. Always consider the risks involved.

Read More: Still not sure which broker to pick? Read how we compare trading platforms to help clear the mist!

Step 2: Choose Which Cryptos You Want to Buy

As we mentioned just a moment ago - there are now more than 10,000 cryptocurrencies that you can buy and sell from the comfort of your home. The tricky part is knowing which cryptocurrency to buy. After all, while some digital tokens have made gains in the thousands of percentage points in the past few months alone - others have made a loss.

With this in mind, this section of our guide on how to buy cryptocurrency will now discuss how to choose the right digital asset for your portfolio and trade the crypto signals.

What are the Best Cryptocurrencies to Invest in?

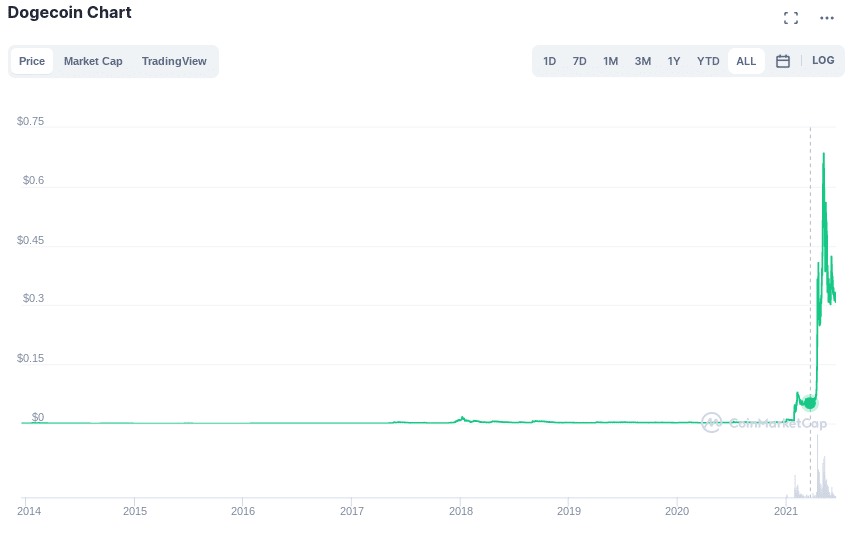

When thinking about the best cryptocurrency to buy - there isn't a hard and fast solution. This is because the cryptocurrency marketplace, in general, is highly speculative - so price action rarely follows logic. Take Dogecoin as a prime example.

- For many years, this so-called 'Joke' cryptocurrency remained virtually worthless - with the token priced at $0.004 on January 1st, 2021.

- Five months later in May, the same digital currency hit highs of $0.71.

- This means that in less than half a year of trading. Dogecoin investors netted gains of over 17,000%.

- The only reason for this is that Tesla founder and CEO - Elon Musk, continuously spoke about Dogecoin in a positive light.

- In turn, this spurned people to buy the digital token in the hope it would continue its rapid upward trajectory.

The Dogecoin example shows us that there is often little substance to a cryptocurrency's rise and fall. Instead, much of the industry is built on fear, greed, and widespread speculation.

With that said, the specific cryptocurrencies that you choose to invest in should align with your attitude towards risk. For example, many would argue that Bitcoin - as the largest and still de-facto cryptocurrency, offers the least amount of risk in this space.

After all, the digital currency has since surpassed a market valuation of $1 trillion - making it worth more than the vast majority of S&P 500 stocks. On the other hand, the upside potential is going to be limited - meaning returns in the thousands of percentage points could be a thing of the past.

At the other end of the spectrum, you have up-and-coming projects with a significantly smaller market capitalization. For example, Decentraland - a Defi coin project that launched its MANA token in late 2017 - carries a market capitalization of just over $1 billion.

Although this might sound like a high valuation, the upside potential is, of course, much higher than the likes of Bitcoin and Ethereum. Naturally, the risks are also much higher. Ultimately, it's a wise idea to spend plenty of time thinking about what cryptocurrency to buy through in-depth research.

Buying Altcoins

For those unaware, any cryptocurrency that isn't Bitcoin is classed as an altcoin. These coins vary in size and substance. For example, Ethereum is by far the largest altcoin - with an all-time high market capitalization of almost $500 billion.

You then have altcoins that are barely known - with a valuation of just a couple of million dollars. Depending on the size of the altcoin project, you might be able to purchase your chosen token from a regulated broker like eToro.

However, if your chosen altcoin carries a really small market capitalization, then you might need to use an exchange like Binance. As we covered earlier, this might require you to first buy a major cryptocurrency like Bitcoin and then swap it for the altcoin you wish to obtain.

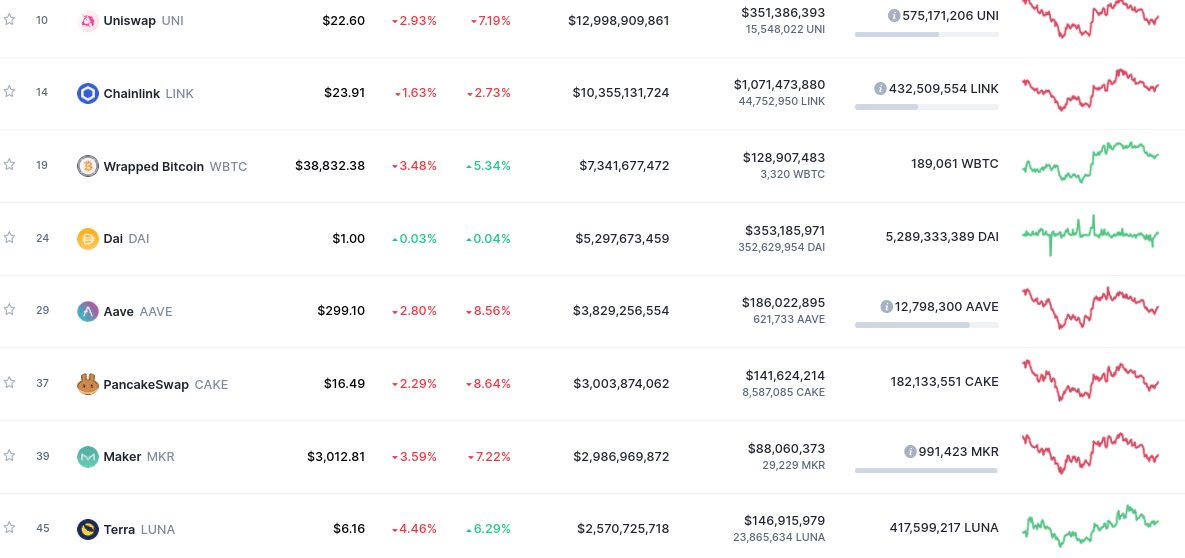

Buy Defi Coins

Many in the digital currency industry argue that Defi coins are the next big thing. For those unaware, Defi refers to the decentralized finance arena. This up-and-coming phenomenon aims to revolutionize traditional financial services by removing the need to go through a third party.

- Potential sectors that Defi platforms are targeting include financial services, insurance, lending, banking, and more.

- In the vast majority of cases, these decentralized finance platforms will have their own cryptocurrency token - which is known as a Defi coin.

- As a new and somewhat unproven industry, Defi coins offer both a high reward and risk profile.In other words, while the profit upside could be huge, as are the risks.Over the course of the first half of 2021, Defi coins have led the way in term of financial gains For example, Uniswap saw gains of 1,100% in its first 8 months of trading, while the PancakeSwap token returned over 5,000% in half the time. In addition to capital gains, some Defi coins also offer the chance to earn regular income on your investment.

One such example is a token named Defi Coin - which at the time of writing, is in its pre-sale launch stage. This innovative project promotes long-term investing by penalizing sellers with a 10% tax. Most interestingly, half of this taxation is distributed to existing Defi Coin holders, meaning that backers earn a dividend.

Understanding the Benefits & Risks of Buying Crypto

Throughout this guide on how to buy cryptocurrency - we have discussed both the benefits and risks of investing in digital assets, even if you trade crypto signals. To recap, the main benefit is that you are investing in a financial asset that is still new - at least in comparison to the stock markets.

In turn, the upside potential - when choosing the right cryptocurrency, has been significant over the past few years. On the other hand, Bitcoin trading and cryptocurrencies, in general, are super-volatile and thus - driven by widespread speculation. As a result, there is every chance that you will lose money by purchasing cryptocurrency.

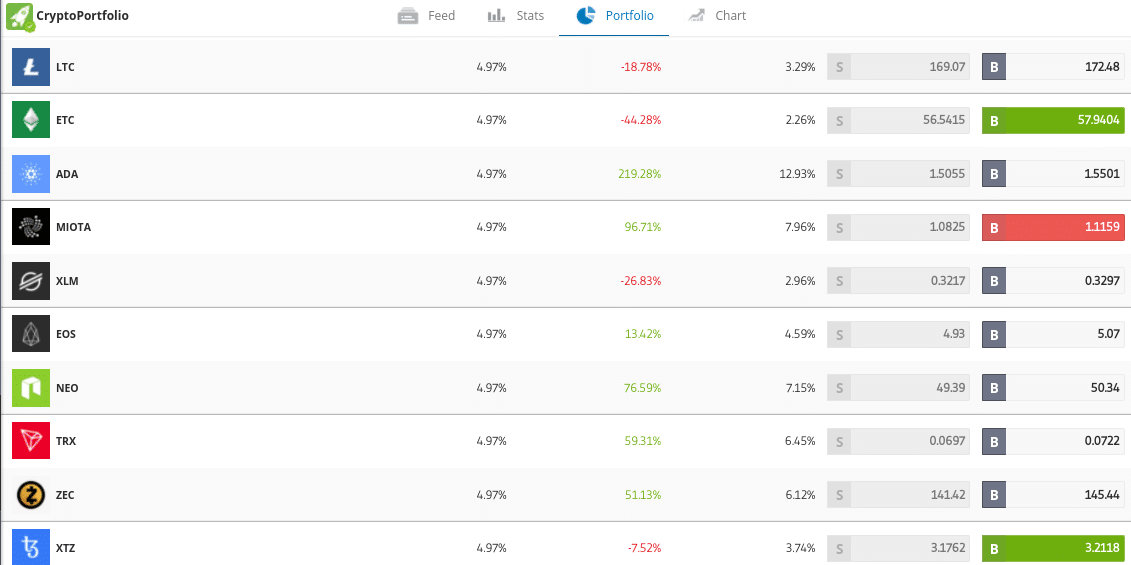

One of the best ways that you can mitigate your risk is to ensure you are not over-exposed. For example, rather than buying just one or two digital currencies, it might be worth considering the previously discussed eToro CryptoPortoflio.

Not only will this give you access to a diversified basket of cryptocurrencies - but the portfolio is weighted based on market capitalization. For example, at the time of writing, Bitcoin carries a weighting of 21.95% while Dash and Bitcoin Cash are both at 4.97%.

Step 3: Choose Your Payment Method

So now that we have discussed the many considerations that need to be made when choosing a cryptocurrency to invest in, the next step is to think about how you wish to pay for your purchase.

Below we discuss some of the many ways in which you can pay for your digital currency investment.

Buy Cryptocurrency With Paypal

Paypal offers a fast, simple, and highly secure way of buying digital currencies from the comforts of home. If you are thinking of how to buy cryptocurrency with Paypal - the best option in the market is Coinbase. On top of other e-wallets like Skrill and Neteller, Coinbase allows you to deposit funds with Paypal instantly.

Buy Cryptocurrency With a Debit or Credit Card

Most first-timers will look to buy cryptocurrency with a debit or credit card. Brokers like Binance all support Visa and MasterCard - so that covers the vast majority of consumers. All you need to do is enter your card details and deposit amount - and the transactions will be processed instantly.

With that said - and much like using Paypal, debit and credit card crypto purchases will require you to go through a KYC (Know Your Customer) process. This means that you need to upload a copy of your ID before you can proceed with your investment.

The aforementioned brokers will typically be able to verify your ID document instantly - which is great. However, plenty of other brokers in this industry rely on manual verification processes - which can take days to complete.

Buy With Another Cryptocurrency

The other option you have when learning how to buy cryptocurrency is to pay for your purchase with an alternative digital token. For example, if you wanted to buy Uniswap, you can obtain the token by exchanging it from Bitcoin. This payment method comes with its pros and cons.

- In terms of the positives, if you are only dealing in cryptocurrency as opposed to fiat money, there is rarely a requirement to go through a KYC process.

- In turn, this means that you can avoid giving your personal information, and thus - you won't need to upload any ID documents.

On the flip side, the actual process of swapping one cryptocurrency into another can be cumbersome and time-consuming. This is especially the case if you don't currently own any digital currencies - as you would first need to use a debit/credit card, e-wallet, or bank account to buy Bitcoin (or another major cryptocurrency).

Step 4: Buy Cryptocurrency

Now that you have had a chance to think about your preferred payment method, we are now going to conclude our guide by showing you how to buy cryptocurrency with eToro.

First, you will need to quickly open an account with the broker. This simply requires some basic personal information and contact details. After verifying your mobile number, you will then be asked to upload a copy of your ID. As we mentioned just a moment ago, eToro will usually be able to verify your ID instantly.

Next, it's time to make a deposit. eToro supports e-wallets - all of which are processed instantly. Bank transfers are also an option but this can taker a few days to process. PayPal and credit card are not available for the UK and FCA users.

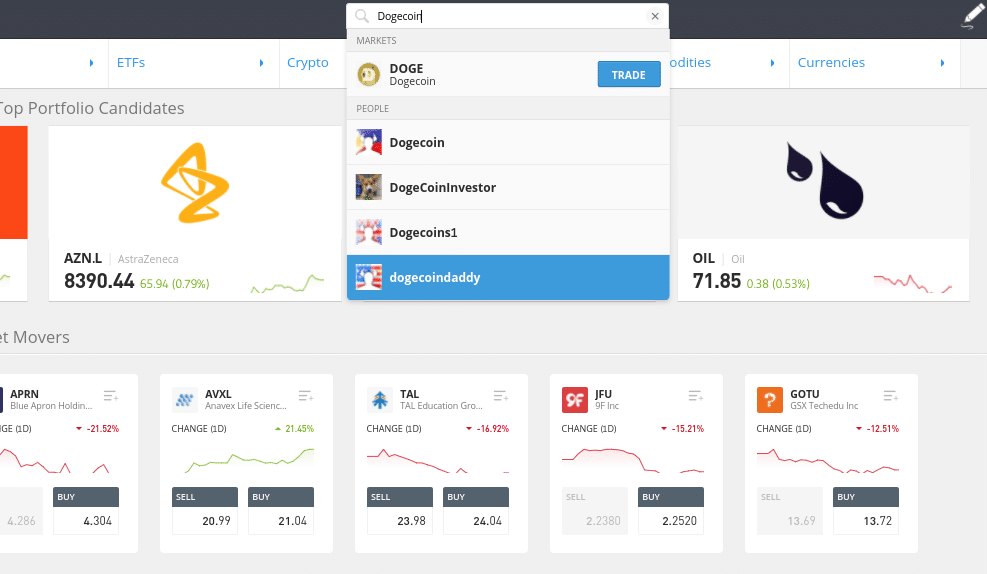

Now that you have funds in your eToro account, you can search for the cryptocurrency that you want to buy. You can do this easily by entering the name of the digital currency into the search box and clicking on the result that loads. In our example below, we are searching for Dogecoin.

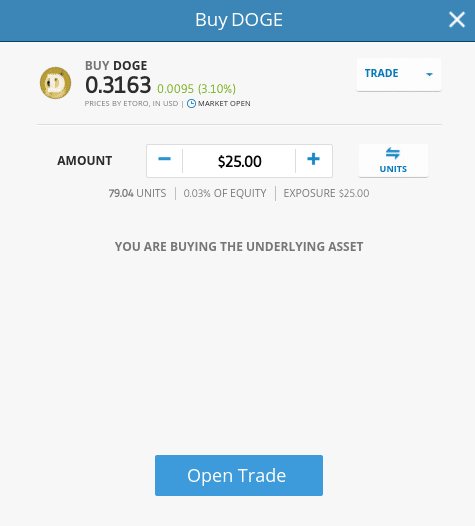

The final step is to complete a buy order on your chosen cryptocurrency. This part of the process is simple as you only need to enter your investment stake into the 'Amount' box. The minimum is just $25 at eToro and you don't need to buy a full coin.

Once you enter your stake in USD, you can see how many tokens (or fractional tokens) you will get. In our example, a $25 stake will get us 79.04 Dogecoin tokens. Finally, click on the 'Open Trade' button to complete your cryptocurrency purchase!

eToro - Overall Best Cryptocurrency Trading Platform 2025

This beginner's guide has explained everything there is to know when learning how to buy cryptocurrency online. Not only have we discussed the best brokers to complete the purchase with - but we've also explained what risks and potential rewards you need to consider.

If you're ready to take the leap by investing in a digital currency right now - eToro is the best broker for the job. You can invest from just $25 into your chosen crypto asset and the broker supports a lot of payment methods. Additionally, eToro is heavily regulated and offers some of the lowest trading fees in the space.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

FAQs

What is the best way to buy Cryptocurrency?

The best way to buy cryptocurrency is through a regulated online broker. This will allow you to buy cryptocurrency in a safe and secure environment and get you access to fiat deposit facilities.Where to buy cryptocurrency online?

If you're wondering where to buy cryptocurrency, there are hundreds of exchanges and brokers to choose from. In choosing the right platform for you, be sure to explore factors surrounding regulation, fees, payment types, and user-friendliness. You also need to ensure the platform supports your preferred cryptocurrencies.What is the best platform to buy cryptocurrency?

We found that the best platform to buy cryptocurrency in 2022 is eToro. This trusted broker is used by more than 20 million people and is regulated by several reputable financial bodies. Plus, the platform offers super low fees and you can invest from just $25 per crypto trade. Other popular platforms include Gemini and Robinhood.Where to buy cryptocurrency with Paypal?

If you're wondering where to buy cryptocurrency with Paypal, eToro allows you to do this in minutes. There is no deposit fee if you're based in the US and an FX charge of just 0.5% for all other nationalities.How much money do you need to buy cryptocurrencies?

Firstly, we should mention that there is no requirement to buy a full cryptocurrency - as digital tokens can be fractionized into much smaller amounts. This is particularly important, when you consider that Bitcoin is now trading in the tens of thousands of dollars. With that said, the minimum investment requirement is actually set by the broker or exchange you choose to sign up with. At eToro, for example, the minimum crypto trade is just $25.Is it safe to buy cryptocurrency online?

Most cryptocurrency exchanges operate without a license - so these platforms should be avoided. On the other hand, you have brokers like eToro that are regulated by several financial bodies. When using these platforms, you can buy and sell crypto in a safe and secure environment.Can you short cryptocurrencies?

The easiest way to short cryptocurrencies is to use a regulated broker that offers CFDs. Shorting is possible at eToro by simply placing a sell order on the digital token you think will go down in value. In terms of cashing out, all you need to do is place a buy order to close the position.Kane Pepi Finance Writer

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Kane has also written for websites such as MoneyCheck, InsideBitcoins, Blockonomi, Learnbonds, Buyshares n and the Malta Association of Compliance Officers.

Before starting his career as a writer, Kane studied at the University of Central Lancashire where he received a Masters Degree in Financial Investigation and then a Research Doctorate in Criminal Justice. Pepi is passionate about helping people to make informed decisions through high-quality, educational content.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up