Where & How to Buy Facebook (META) Stock in 2025

Conceived and launched by a university student from the inside of a dorm room in 2004, Facebook is the ultimate tech startup story. Nearly 20 years later, the firm now known as Meta is an astronomical success, its suite of products and services consumed by billions worldwide.

Facebook’s IPO, held in March 2012, was at the time the largest technology flotation in US history, raising a total of $16bn. Despite initially failing to meet expectations (the stock plummeted, creating $50bn in losses by August 2012), the company’s market capitalization falls just shy of $900bn today.

And despite some major bumps along the way (chiefly, Facebook’s involvement in the 2018 Cambridge analytica scandal), Meta stock has demonstrated exceptional overall growth and resilience over the years. In this guide, we will examine these factors in determining whether Meta is a worthwhile buy, in addition to addressing the question of where and how to buy Meta stock in 2025.

-

-

An Overview of How to Buy META Stock

Step 1: Open an account with an online brokerage that offers low fees, a user-friendly interface, and tools to implement your desired investment strategy.

Step 2: Verify your brokerage account by uploading two forms of ID. You will then be asked to connect a payment method to your account.

Step 3: Fund your account with the amount that you would like to invest with. Start with the minimum deposit whilst you familiarize yourself with the platform.

Step 4: Search for META or Facebook stock in the search bar.

Step 5: Use available resources to research the stock before executing a BUY order.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

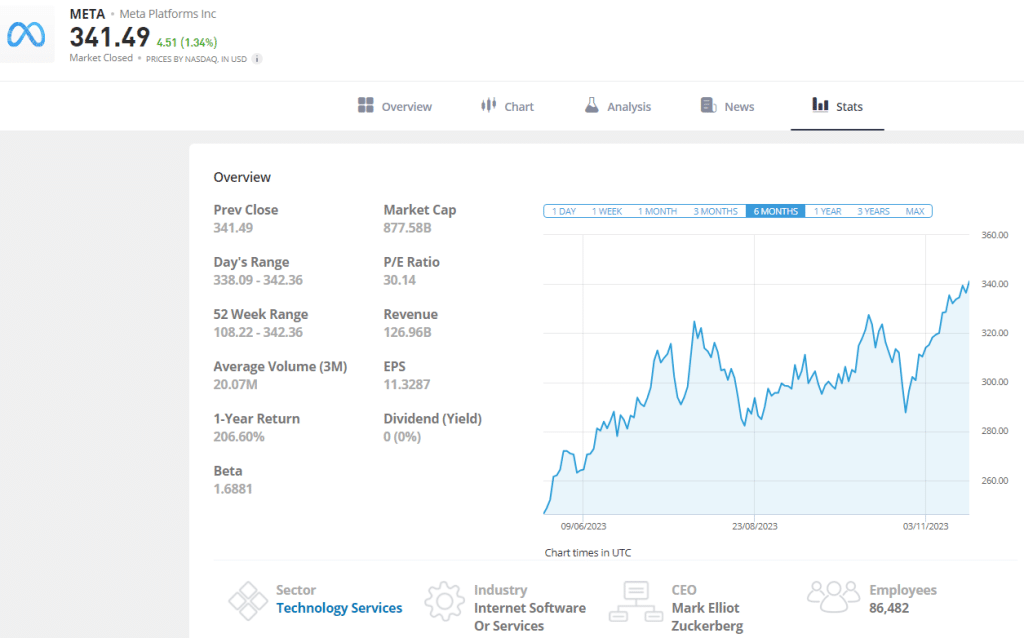

Meta (META) Stock Data July 2025

What is Meta Platforms (META)?

As chronicled in the 2010 movie The Social Network, Meta (formerly Facebook) was founded by CEO Mark Zuckerberg in 2004 while he was a student at Harvard University. While still a social media platform at heart, the firm is an entirely different beast in 2025, having evolved into a technology conglomerate. In addition to Facebook, Meta is responsible for two more of the world’s most popular social networking platforms (Instagram and WhatsApp), all of which are among the most downloaded apps worldwide. The firm also recently launched Threads, a challenger to Elon Musk’s X (formerly Twitter).

Rebranding from Facebook to Meta Platforms in 2021, the firm introduced the public to a concept it called ‘The Metaverse’ – an entirely new social media platform based around virtual reality (VR). In support of this endeavor, the firm is establishing itself as a major player in the VR hardware space with its line of Meta Quest headsets.

Beyond its social networking and VR products, Meta’s advertising business is a significant revenue stream for the firm. It was precisely this that saw Meta become embroiled in the infamous Cambridge Analytica scandal in 2015.

Meta (META) Stock Price 2025

Meta Plantforms Inc. has been enjoying a year-long rally. The stock closed at $124.51 per share on January 3, and at the time of writing (November 23), it sits at $341.13 – a 175% increase. This makes it comfortably the best performing FAANG stock of the year, and the second best in the S&P 500 Index.

One driving factor behind the run, analysts believe, was the sharp crash in Q4 2022. Meta’s Q3 financials revealed a concerning 4% dip in earnings, causing the firm’s share price to plummet 25% and become undervalued. In 2023, Meta stock has arguably undergone a major revaluation.

The rally has also been spurred on by much improved 2023 financial performance. In Q2, Meta’s earnings grew to $32bn, an 11% uptick year-on-year, and the company’s first double-digit revenue growth since Q4 2021. Share prices surged by 8% in response.

Analysts also argue, however, that the Meta stock price is still undervalued, despite being at its highest level for more than a year. Notably, Meta’s next-12 months price-to-earnings multiple sits at 19x, despite it averaging at 21.4x over the past three years, and 22.2x over the past five.

Is Meta (META) a Good Investment in 2025?

Meta stock price has swung from one extreme to the other in recent years. Owing to disappointing earnings results, the stock ended 2022 with total losses of nearly 65%, making it the year’s worst performer on the S&P 500.

By contrast, 2023 has been an exceptional year for the technology giant. As of November, the company’ stock price is +175%, making it the S&P 500’s second best performer.

Many have even argued that this upswing is yet to reach its peak. But, as noted in analysis by Barchart, projections of a 12.4% rise in sales next year still pale in comparison to 2021’s 37.18% increase.

However, there is good reason for investors to be optimistic. Firstly, as the AI race intensifies, Meta has established itself as a frontrunner, having recently made its large language model, Llama 2, available for commercial use through partnerships with cloud providers such as Amazon and Microsoft. By making it more widely accessible, Meta stands to improve its AI product offering at a far greater rate, which bodes well for prospective investors.

Once again looking to further its cause through strategic partnerships, Meta has reportedly also struck a deal with Amazon to allow users to buy products “directly from ads on Instagram and Facebook”. The arrangement will doubtless bolster the bottom line of both companies.

The future also looks bright for Meta’s suite of flagship social media platforms. Not only are Facebook, Instagram and Whatsapp all among the world’s most downloaded apps in 2023, but crucially, Reels (Instagram and Facebook’s answer to short-form, vertical video content, a la Tik Tok) is proving to be a major success. The product has now earned Meta $10bn dollars in advertising revenue, up from around $3bn last year.

Finally, Meta is further cementing its presence in the VR market through its range of heads. Its latest model, the Meta Quest 3, officially launched on October 10. Meta is currently the dominant force in VR technology, boasting more than a 50% market share.

But as ever, there are certain risks to be wary of. And for Meta, predominantly an advertising company, chief among them is economic turbulence and a subsequent decline in consumer spending. As financial headwinds continue to sweep across the globe, this will be a key area for investors to keep an eye on.

Where to buy Facebook stock (META) in 2025

Being one of the most popular tech stocks on the stock market to buy in 2025, Meta is available on several reputable exchanges. Before investing, it is a good idea to research the different platforms that are available to find one that suits your individual goals and strategy.

Here are four potential options to consider.

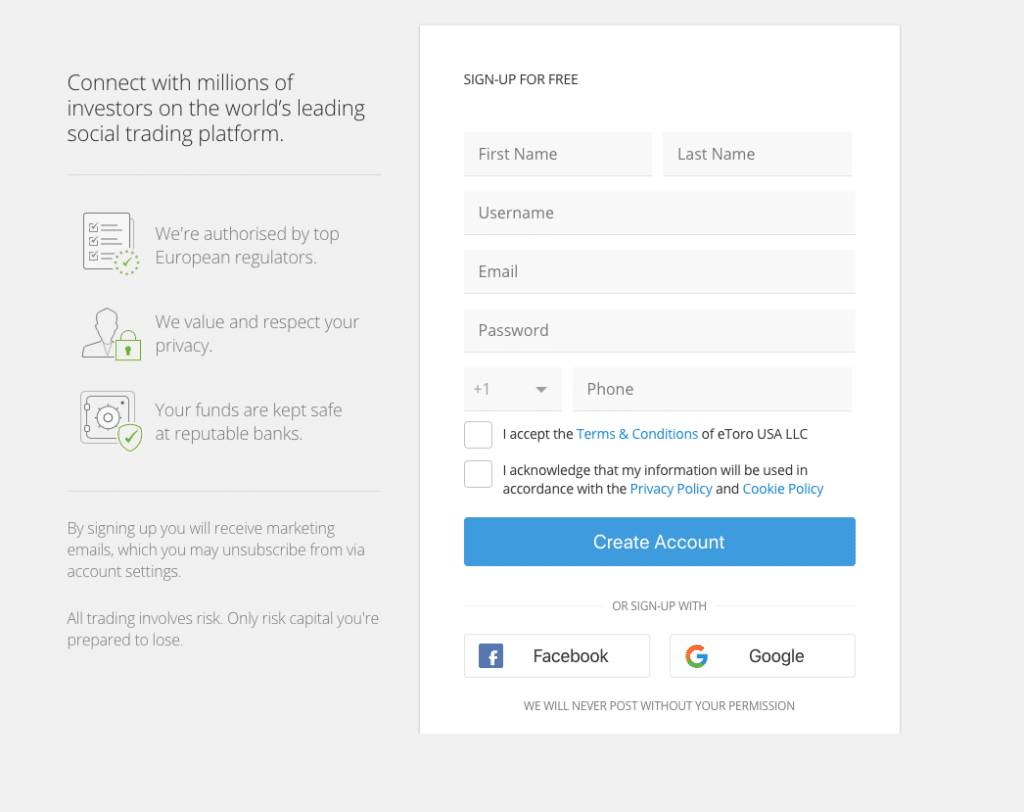

1. eToro – The best social trading platform to buy META shares

eToro is the best social trading platform for buying Meta shares in 2025. The online brokerage offers a social feed through which users can gain insight into the trading decisions and analysis of other investors.

As well as offering marketing-leading social trading features, eToro provides a zero-commission fee structure which means that it is possible to buy META without paying any extra fees.

Another reason that we liked eToro for buying Meta stock is that the platform provides a variety of different exchange traded funds, smart portfolios, and indices that can be sued to gain exposure to META whilst diversifying with a variety of other promising shares on the stock market.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

2. Robinhood – The best mobile app for investing in Meta

Robinhood is one of the best investment apps on the market that makes it possible to manage your investment portfolio on the go. The app has a simple interface and provides investors with a variety of tools and resources to inform trading decisions.

It is possible to invest in Meta stock commission-free and buy fractional shares from $1. This makes it a suitable option for investors who want to start with a small portfolio of META stock and grow it over time.

Robinhood also offers a good range of educational resources that can be used to research Meta before making any decisions. This includes market news, expert insight, an economic calendar, and price analysis.

3. Charles Schwab – The best online brokerage account for educational resources

If you are new to long-term investing and looking to improve your knowledge before buying META, Charles Schwab could be a good broker to consider.

The platform offers an excellent range of educational resources including webinars, in-depth guides, and expert insight. Users can also work 1-to-1 with professional investors through the broker, free of charge.

The brokerage is a reputable US investment platform that has been around since 1971. META stock trades are charged at $0. However, broker-assisted trades will come with a $25 charge.

4. Webull – The best place to buy Meta for active traders

If you’re an active trader looking to trade Meta stock short term, Webull could be a good platform to consider. The platform provides a demo account to practice different strategies risk-free and offers a good range of indicators and tools for technical analysis.

Webull comes with its own charting tools which can be used on desktop or mobile. It is also possible to use the platform with MT4 to access even more tools for advanced trading strategies.

For experienced traders, Meta stock can be traded with leverage up to 4x. The platform also provides access to META stock options and margin trading.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

How To Buy Meta Shares from eToro in 2025

In the following section, we will provide a in-depth guide on how to buy Meta shares through our recommended broker eToro.

The process of investing in Meta in 2025 is similar for most brokers. However, if you choose to use a different broker, we recommended taking time to familiarize yourself with the platform through demo trading, if this is available.

Step 1: Create an eToro trading account

You can create an eToro trading account for free by heading to the official website and selecting ‘create account’.

You will be asked to provide some personal information including your name, email address and password.

eToro account verification

After filling out the initial registration form, new eToro users are required to provide two forms of ID. This is due to KYC protocols that are followed by the broker.

The ID verification process takes about 10 minutes to complete. You must take clear photos of both forms of ID, upload them to the platform and wait for verification.

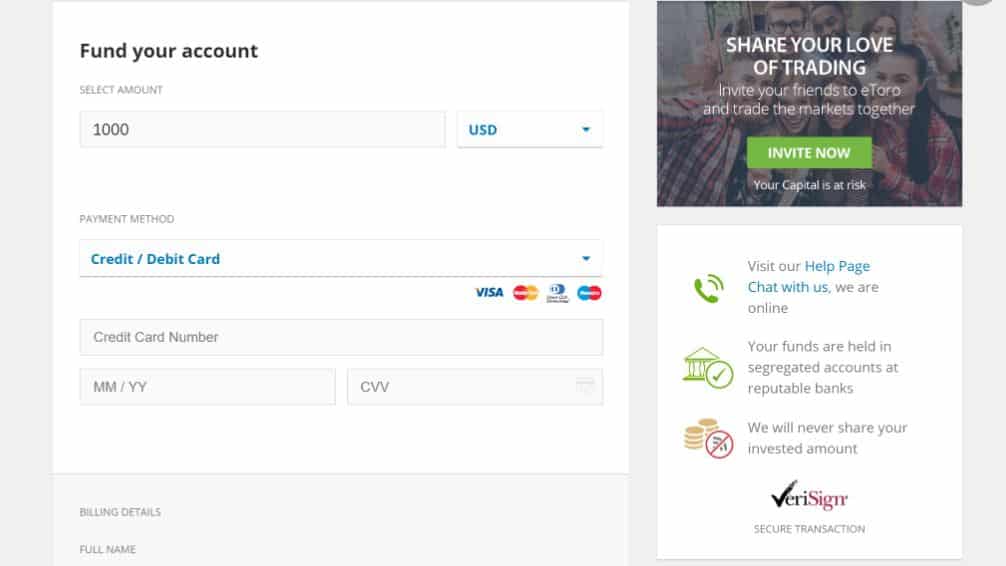

Step 2: Connect a payment method to your account

In order to invest in Facebook stocks, you will need to connect a valid payment method to your eToro trading account. The platform accepts debit card and bank transfer payments.

The minimum deposit is $20 and there are no fees charged for deposits or withdrawals.

Make sure to use a privte internet connection when sharing your payent details with eToro.

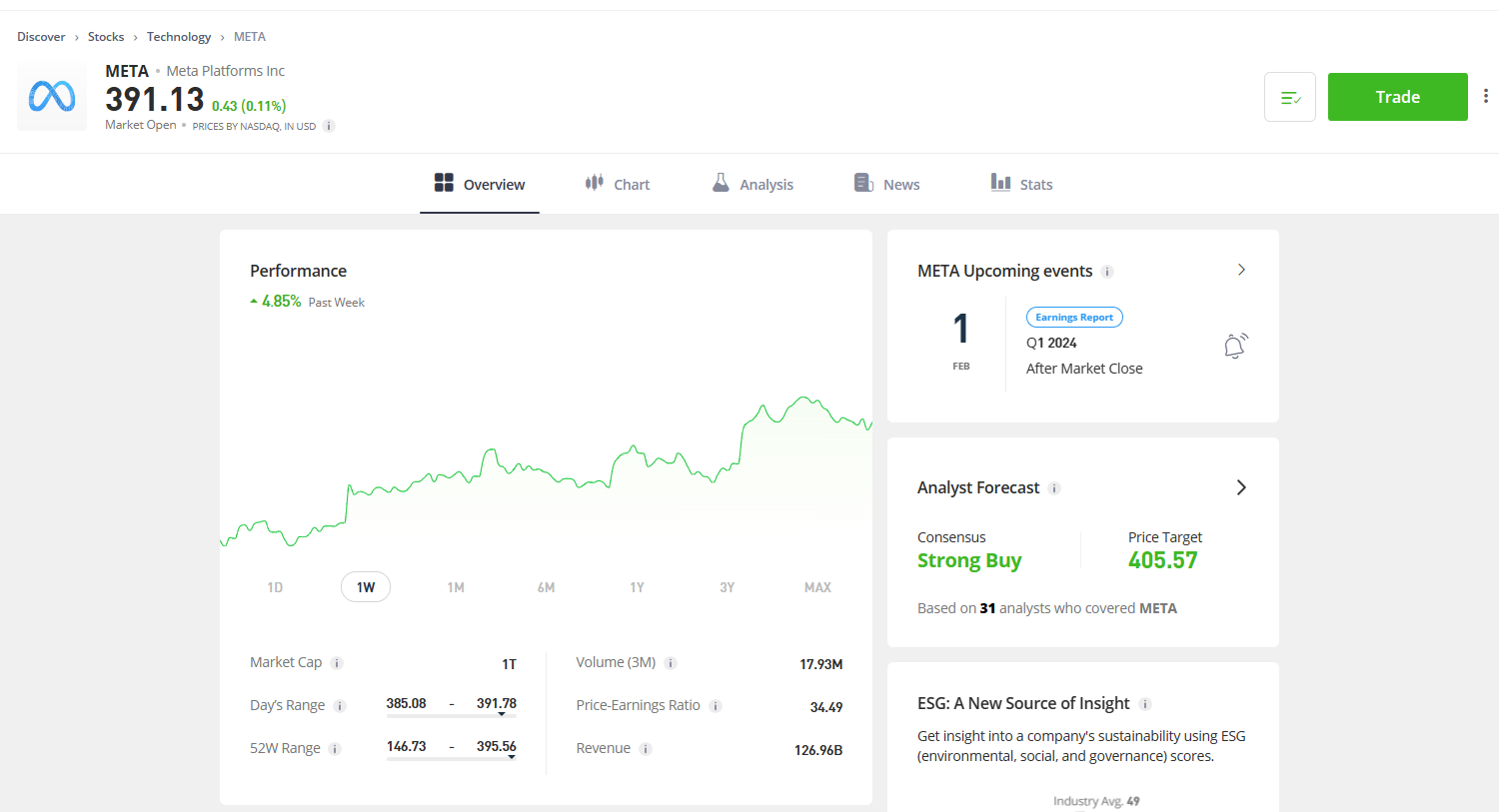

Step 3: Research META stock

Before making any investment decisions, it is important to spend time researching Meta stock to determine whether or not it is a good investment opportunity.

Search for the Facebook ticker symbol (META) to find stock market data about the stock.

eToro provides a range of resources that can be used to conduct research. This includes live market news, a social trading feed, and a detailed overview of each asset. To learn more about META, search for the ticker symbol in the ‘explore’ feature and then select ‘analysis’.

Here, you will find useful information about the stock’s current price. This includes an insight into whether the stock is currently considered to be a ‘buy’ or a ‘sell’ as well as an analyst price target that is based on several top-rated analysts. eToro also provides an overview of the current investor sentiment, which is a good way to understand what other traders are doing.

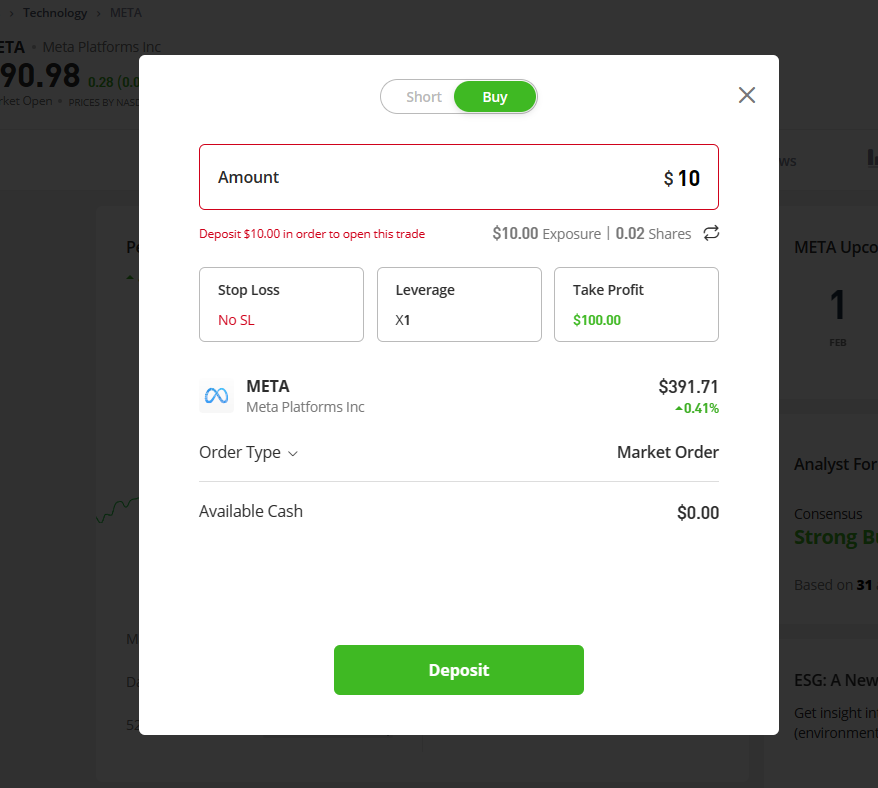

Step 4: Place a market order

If you decide that META is a good investment opportunity for your portfolio, you can buy the stock by selecting ‘trade’.

From here, enter the amount that you would like to invest in ‘amount’ and then set stop loss and take profit targets.

It is also possible to increase the leverage. By doing this, you are increasing te risk involved with investing in META stock. For less-experienced investors, it is a good idea to leave the leverage at x1.

Step 5: Monitor Facebook performance

After placing the order, Meta shares will appear in your eToro portfolio. Here, you can monitor the performance of your investment.

eToro provides a mobile app that can be used to keep an eye on your portfolio throughout the day. This is a good option for short-term investors who may need to manage their Meta position on the go.

The eToro application will provide insight into your daily portfolio performance as well as news alerts about events that could potentially effect your portfolio.

It is important to stay up-to-date with relevant news and events so that you can manage your investment portfolio accordingly.

Our Verdict on Meta (META) Stock in 2025

From dorm room startup to tech colossus, Meta is undoubtedly one of the biggest and most influential companies in the world today, continuing to capture the attention of investors 20 years after its inception.

Even amid the pandemic, numerous instances of high inflation, and the notorious Cambridge Analytica scandal, Meta stock has persisted in demonstrating resilience and growth. But with that said, investors considering buying Meta stock should weigh the firm’s success and seemingly limitless potential against headwinds such as regulatory setbacks.

But taking everything into account, it is clear that Meta continues to demonstrate impressive financial performance combined with highly ambitious innovation plans, making it a strong buy in 2025.

Meta stock FAQs

How do beginners buy shares of Meta?

Potential investors can explore various online brokerage platforms, including eToro, Robinhood, Charles Schwab, and Webull. These platforms offer diverse features, from social trading to commission-free structures. In TradingPlatforms’ view, eToro is the best all-round choice for most investors.

Does Meta pay a dividend?

Meta does not pay a dividend, instead opting to maximise cashflow in order to invest in new, large-scale projects such as the Metaverse

What is Mark Zuckerberg’s stake in Meta?

Mark Zuckerberg is by far the majority shareholder in Meta. He currently holds approximately 398 million shares of the company, equivalent to around 17% of shares outstanding.

How much is Meta worth in 2024?

At the time of writing, Meta’s market capitalization is $909.63bn.

References:

- https://www.statista.com/statistics/1285960/top-downloaded-mobile-apps-worldwide/

- https://www.nasdaq.com/articles/why-meta-platforms-stock-still-looks-undervalued-after-doubling-in-2023

- https://finance.yahoo.com/news/meta-opens-ai-chatbot-tech-155000404.html

- https://www.nasdaq.com/articles/why-meta-platforms-stock-still-looks-undervalued-after-doubling-in-2023

- https://www.bloomberg.com/news/articles/2023-11-09/amazon-and-facebook-partner-on-new-app-based-shopping-feature

- https://www.reuters.com/technology/metas-reels-revenue-narrows-tiktok-boosted-by-ai-2023-07-27/

Sam Alberti

View all posts by Sam AlbertiSam Alberti has recently joined Trading Platforms as a content editor, having spent the past four years working as a journalist across various financial and business niches. He graduated from the University of Kingston in 2019 with a Master’s Degree in Journalism and an NCTJ Diploma, and has since developed a passion for both consumer and corporate finance. He now specializes in producing engaging and thoroughly-researched web content on all things finance.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up