Libertex Recensioni e Opinioni 2026

Libertex is a CFD broker regulated by CySEC and FCA, with which you can invest online comfortably from home in stocks, cryptocurrencies, indices, commodities and forex in the form of derivatives. It is an online trading platform aimed at all those users who want to invest with CFDs, even for novice traders, as it offers a demo, which explains the various steps to take to start investments, and a trial portfolio, which allows you to take your first steps without spending real money. On this page we will discover all the details of Libertex reviews and we will see what the costs of this online trading platform are.

85% of retail investor accounts lose money when trading CFDs with this provider.

[knock]

What is Libertex?

Since 1997, Libertex has been a point of reference for the financial market and online trading. It provides its services in more than 27 countries around the world, has 2.9 million registered users and over 700 employees, and is a very reliable financial broker as it is authorized and supervised.

Specifically, the platform has been dealing with online trading for more than 40 years, especially in the field of CFD investments: forex, commodities, cryptocurrencies, stocks, indices and ETFs. It is a trading platform managed and used by Indication Investments Ltd and regulated and controlled by Cysec (Cyprus Securities and Exchange Commission) with CIF license number 164/12.

In 2010, it acquired the shares of the Russian Forex broker Acmos Trade, whose brand remained included in the ForexClub group of companies. In 2014, it ranked among the three largest Russian Forex brokers with the highest number of clients and monthly turnover volumes. In 2015, Libertex settled in Cyprus, with the aim of renewing the financial world at a time when many very important companies in the sector were already in strong expansion.

As we have already mentioned, Libertex is a company with millions of users and with a very high growth path. The credit for so much success, and this notable growth, is to be found above all in the attractive offer of products, at lower costs if compared to other companies in the sector.

We summarize the main information in the following table:

| Broker Name: | Libertex |

| ? Regulation and license number: | CySEC (No. 164/12) |

| ? Site: | Limassol (Cyprus) |

| ? Website | Libertex.com |

How does Libertex work?

The platform has more than 250 instruments, through which you can invest on WebTrader, via third-party apps and software such as MetaTrader 4 and MetaTrader 5. Some of the cryptocurrencies to invest with are Bitcoin , Ethereum, Ripple, Monero and Dash, and there is also the option to invest through CFDs of American and European stocks.

Finally, Libertex offers the possibility of self-training through courses for beginners and a demo account to start operating safely. Users are also given the opportunity to reach support also in Live Chat in Italian.

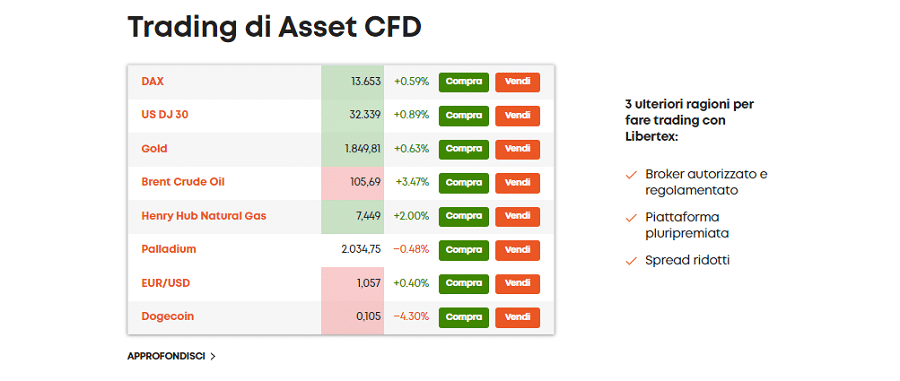

CFD Overview

CFD is the Anglo-Saxon acronym for Contract for Difference, and indicates a type of contract relating to derivative instruments, on the basis of which the variation in the value of a given security, or underlying, that is created between the moment of opening the contract and the moment of its closure is exchanged. CFDs are, therefore, complex instruments that present a significant risk of losing money very quickly, precisely because of financial leverage. According to statistics, approximately 70% of investors suffer monetary losses after trading in CFDs.

The substantial difference between stocks and CFDs is that the former are purchased and become the owner of the title, while with the latter one is limited to the negotiation of derivative securities (trading). The advantage in choosing to invest in CFDs is given by the possibility of proceeding with an investment in the asset without necessarily buying it and of having a profit, if one is shrewd and lucky, based on the difference between the current price of the title in question and the rate accumulated at closing.

The Libertex platform

The Libertex broker includes in its platform, all tradable assets in Italian and offers a clear and easy-to-use interface, even for beginners. At the top of the page is the list of instrument categories, while in the central part is the list of assets and the graph.

On the right column you will find all the information related to your account: balance, open positions, trend with profit or loss margin and update from the financial markets. The portal also includes an easy order management, which allows you to set key aspects such as Stop Loss and Take Profit, opening an order at the price, position amount and leverage.

If you want to perform more specific analysis, there is the possibility of viewing a full-screen graph or in the order opening window, where we will find all the analysis tools such as Trend Line and indicators, with the possibility of modifying the Time Frame and the graph display. The portal is not simple in managing the graphs, since it is necessary to open them to be able to trace even a simple trend line, but in general it is complete and usable even by beginners.

As for Scalping and Hedging, the broker is quite fast but its organization is not particularly suitable for those who mainly operate with these trading strategies. Libertex is not customizable for advanced traders and this can be a limitation, being mainly suitable for beginner and intermediate level traders.

MetaTrader 4 and MetaTrader 5

MetaTrader 4 and MetaTrader 5 are the two most used platforms for trading Forex and CFDs on cryptocurrencies, commodities, ETFs, stocks and indices, because they are simple to use, proving useful for both novice and professional traders.

Through the above you have access to all the forex pairs offered and have multiple features, such as click trading, automatic trading, robo advisors, connection to the Metaquotes marketplace to purchase other indicators, automatic trading systems and trading signals.

You can also run tests on historical data, try strategies and robots that evaluate potential profit/loss performance based on past price data, very useful for those interested in carrying out test trading before implementing their own strategy.

The platforms are available in desktop, web and mobile versions.

The site offers the possibility of registering through two different methods: Libertex Invest, and Libertex. By proceeding with the Libertex Invest registration, the main functions enabled are the following: no commission on the operation, without SWAP, no stop out, trade shares, dividends paid monthly and quarterly. The second option instead allows us to have access to broader features, such as trading gold, bitcoin, indices, Forex oil and many other instruments, as well as analytical support including indicators, news and so on. The data required for registration are very simple, we will only need to enter a valid email and a password, so as to receive confirmation of the operation carried out in our email inbox. Alternatively, you can continue through smart buttons such as Apple ID or Google account, which allow you to register in just a few moments and create your trading account in less than 5 minutes. As regards opening a demo account, the steps to follow are: To create a real account, here are the steps outlined:

85% of retail investor accounts lose money when trading CFDs with this provider.How to register on the Libertex website

How to Withdraw and Deposit

The minimum deposit amount is €100, depositable via credit/debit card or via a classic digital wallet, such as PayPal. After the first investment the minimum deposit amount drops to €10. Through a dedicated section you are asked to enter your preferred method, all free. The deposit is immediate and only in the case of bank transfer the requested operation takes 3-5 working days.

It should be noted that the chosen deposit method will also be applicable during the withdrawal phase and that, based on the chosen method, the timing may vary; with PayPal, for example, you can withdraw instantly and then transfer the money to your bank account, while other withdrawal methods such as prepaid cards or bank transfer may require a minimum of 1 working day to a maximum of 5 working days for the credit.

As for withdrawal fees, they are also variable, in fact for PayPal and other eWallets such as Skrill, no costs are applied, while with a credit card or debit card, the cost is €1.

Awards and recognitions

Libertex has won more than 40 awards and received numerous accolades around the world, including: “Best CFD broker Europe” in 2022, “Best trading platform” in 2021 and “Best FX broker Europe”.

In 2017 and 2018, Real Madrid midfielder James Rodriguez was also the brand ambassador, giving further visibility to the trading platform, which in recent years has also landed in countries such as Ukraine and Kazakhstan, further expanding its global user base.

Costs and spreads

Unlike many online trading platforms, Libertex does not offer zero-commission trading, but applies a low spread model that allows the user to easily consult the entry and exit price of the financial operation, making it one of the sites where the costs are clearer and more evident.

Spreads can be fixed or dynamic and vary based on the instrument, among the most traded assets we find the following:

| Asset | Spread |

| DAX | 0.0623% |

| US DJ 30 | -3.11% |

| Brent Crude Oil | +0.73% |

| Light Sweet Crude Oil | +0.62% |

Interesting is the discount on spreads offered by Libertex to new clients or to all those clients who manage large sums of money. It is in fact possible to access discounted spreads of up to 50%, significantly reducing trading costs.

This type of discount is divided into three categories with different benefits:

- at the lowest step of the podium we find the “Gold” which, with a minimum deposit of €250, allows access to a 3% discount;

- it is followed by “Platinum”, which requires a minimum deposit of €1,500 and gives access to a 20% discount;

- finally there is the “Vip”, with a minimum deposit of €5,000 and a 30% discount on the spread.

Other withdrawal costs, in addition to those mentioned, vary based on the chosen method: they are variable and can range from €0 (PayPal) to €5. The deposit is always free, the price regarding the currency exchange is not clear.

Products offered by Libertex

On Libertex the products are varied but, as we have already said, they mainly refer to CFDs, although there is the possibility of buying real shares without commissions on trading and receiving a dividend. It is possible to either create a personal investment portfolio from scratch or opt for ready-made solutions.

As regards investment markets we find:

- Actions

- ETFs

- Cryptocurrencies

- Forex

- Metals

- Indexes

- Agriculture

- Oil and gas

Although the number of securities made available by Libertex is smaller than other platforms, we can detect an interesting range of different asset classes in its offer, including the most widespread and well-known stocks in the world and a decent choice in the Forex sector.

Libertex App

Libertex allows you to use its platform from a wide variety of devices, not only laptops or desktop PCs, but also smartphones and tablets, through its application downloadable from the Play Store or the App Store.

Android, iOS, macOS and Windows are all operating systems compatible with the App, while Linux is not yet supported.

Customer Service

Customer service is excellent and provides many contact methods to facilitate the user. Among these we highlight the presence of an online chat, social channels Whatsapp-Twitter-Facebook, the email at [email protected].

The answers are always quite timely and exhaustive, not leaving the user with doubts that could negatively influence his investments.

Demo account

Libertex offers the possibility of opening a demo account for free, an excellent solution for testing without investing real money. The demo account is a valid initial solution, both for beginners and for more experienced investors, since it offers the opportunity to understand how online trading works and gain experience without taking risks.

The demo account gives access to a fund of €50,000, usable in all products of the platform, is unlimited and can always be recharged.

To open a trial account, simply follow these steps:

- Go to the platform’s website;

- Click on the “Practice on a Demo Account” button;

- Enter an email and create a password;

- Confirm and log into your trial account.

Once you open your account, you have all the tools of the platform at your disposal and you can start investing the trial capital without restrictions.

Packaging account

Libertex’s proposal for opening a real money account is aimed at retail clients, i.e. those clients who do not operate through financial institutions. The set currency is the Euro.

Opening is very simple, just register and the broker will immediately allow you to operate with a standard account. This account allows full access to the catalog that includes all products, including stocks and cryptocurrencies.

Trading lessons

The Libertex platform offers a section dedicated to training divided into 9 lessons accompanied by related videos. Let’s see in detail what it is about through the titles of each of them:

- How to open a CFD position on Libertex;

- What is a multiplier?

- What is Stop Loss?

- What is a Take Profit?

- How to invest with Libertex Invest;

- How do I deposit funds into a Libertex Invest account?

- How to make your first investment;

- How to receive dividends;

- Investment portfolios.

As you can easily see, the training covers all the main topics needed for trading, and is great for those who use a demo account and are beginners. It will be useful and fun to put into practice the concepts learned without incurring the risk of losing money.

Pros and cons

It is time to evaluate what are the points in favor of the Libertex platform, also touching on the aspects that could certainly be improved. Among the pros we can certainly include the great experience, given that the portal has been present in the field for more than twenty years and has a reputation in the field of truly excellent security.

Another plus point of the online broker is the ease and speed of registration and the presence of over 250 CFDs and instruments. Real shares with 0% commissions on navigation and low spreads are also to be considered valid, as well as the trial account and training: it can be said that, in general, a complete and varied service is offered.

Now let’s get to the cons: it offers only 2 types of accounts, the demo and the standard one, while other platforms have a wider offer, even if Libertex’s is still well made and structured, it could offer more variety of trading products in addition to CFDs and finally it provides for the inactivity commission after 90 days.

Risks

The company, also thanks to its twenty-year experience, is internationally recognized also and above all for its seriousness, which removes any suspicion about the nature of Libertex. If instead we talk about reliability, Indication Investments Ltd is an investment company regulated and controlled by the Cypriot CySEC (Cyprus Securities and Exchange Commission) with the CIF license number 164/12, while Libertex is a broker with a regular CySEC license, authorized to operate in all European Union countries, allowing users to trade CFDs on forex, stocks, raw materials, cryptocurrencies and indices.

The management of personal data is done in line with current regulations, and Libertex is always committed to implementing technical and management measures to ensure a high level of security. The broker also ensures protection of personal data from accidental or illicit loss, destruction, alteration, unauthorized disclosure.

Browsing the internet and reading the various reviews on this platform, an extremely positive picture emerges, the risk margins detected do not concern a fraudulent nature of the platform and are mainly linked to the little experience of the users.

Regulation

As already reported, Libertex is a company that operates within the territory of the European Union and is authorized through the license made available by CySec. According to European regulations, the money deposited with Libertex will never be used by the broker to manage its financial activity, because it can only be used for trading or withdrawal operations, based on your choices.

Considering the exclusive collaboration of the broker only with some countries belonging to the European Union, Libertex benefits from the regulation of only one financial institution, as we can see: the Cypriot branch is of Russian origin, the ForexClub, active since 1997 in the field of trading on the Forex market.

In 2016, Libertex joined FinaCom, the international regulatory body focused on CFD trading, and the Cypriot Investor Compensation Fund, a tool designed to introduce additional protection for traders’ funds in the event of unpleasant unforeseen events (including the bankruptcy of the broker).

Conclusions

Libertex is a broker that has been operating since 1997, therefore able to boast experience and transparency and to be able to offer a training program, which deserves special attention, as it is useful for both novice and more experienced traders. Its trading platform is very intuitive and provides various analytical tools, giving the possibility of investing in over 250 CFDs and real shares with a minimum deposit of only €100.

When trading, the risk is to lose only the funds invested directly in the operations, never the amount of the balance. You can learn to use the software and understand how it works with the platform on a Demo account, which does not require any deposit.

In conclusion, we believe that Libertex is a suitable choice for those who wish to invest in CFDs or buy shares in a simple and safe manner.

Libertex, trade CFDs with maximum security

85% of retail investor accounts lose money when trading CFDs with this provider.

Frequently Asked Questions

Is there a minimum deposit required by Libertex?

Is Libertex reliable?

How much can you earn with Libertex?

How many types of accounts are there on Libertex?

I received an error message when depositing, what should I do?