Investire in azioni – Guida facile per principianti

If you are wondering what is the best form of investment in trading today, the answer is investing in stocks . Stocks attract investors for both long-term and daily trading. However, you need to be careful because many investors are not adequately prepared and risk serious losses because they do not have a thorough understanding of the benefits and pitfalls of the financial market.

Therefore, a guide like the one we are going to illustrate is essential to face the stock market also in light of the high commissions that you could find yourself paying and that you could, instead, avoid.

75% dei conti al dettaglio di CFD perdono denaro.

[knock]

Investing in stocks: overview of the best platforms

How to invest in stocks in 2026? Among the many online proposals, which is the best broker to rely on and what characteristics should it have? What service costs should you consider, what type of assets should you look for?

We asked our financial experts who have selected for you some of the best trading platforms for the stock market. Below you can view a handy tool, with all the data of interest of the selected platform, while in the following paragraphs you will find some reviews with features, services, pros and cons of the broker examined.

Let’s now see which are the best online trading platforms to buy and sell shares from Italy.

75% dei conti al dettaglio di CFD perdono denaro.Where can you invest in stocks in Italy?

1 . XTB – The best broker for investing in stocks in Italy

XTB was founded in 2002 and is listed on the Warsaw Stock Exchange. In Europe it is regulated by the CySEC – Cyprus Securities and Exchange Commission.

The platform stands out for its wide range of assets, with access to thousands of global markets, low trading costs and very low spreads, with 0% commissions on stocks and ETFs for volumes up to €100,000

XTB users have access to a wide range of assets, including forex, indices, real and fractional shares, CFDs, ETFs, top cryptocurrencies and commodities. To ensure user safety, XTB guarantees negative balance protection, while additional strengths include educational resources, customer care in Italian, the advanced xStation 5 platform and the consistently lowest spreads in the industry.

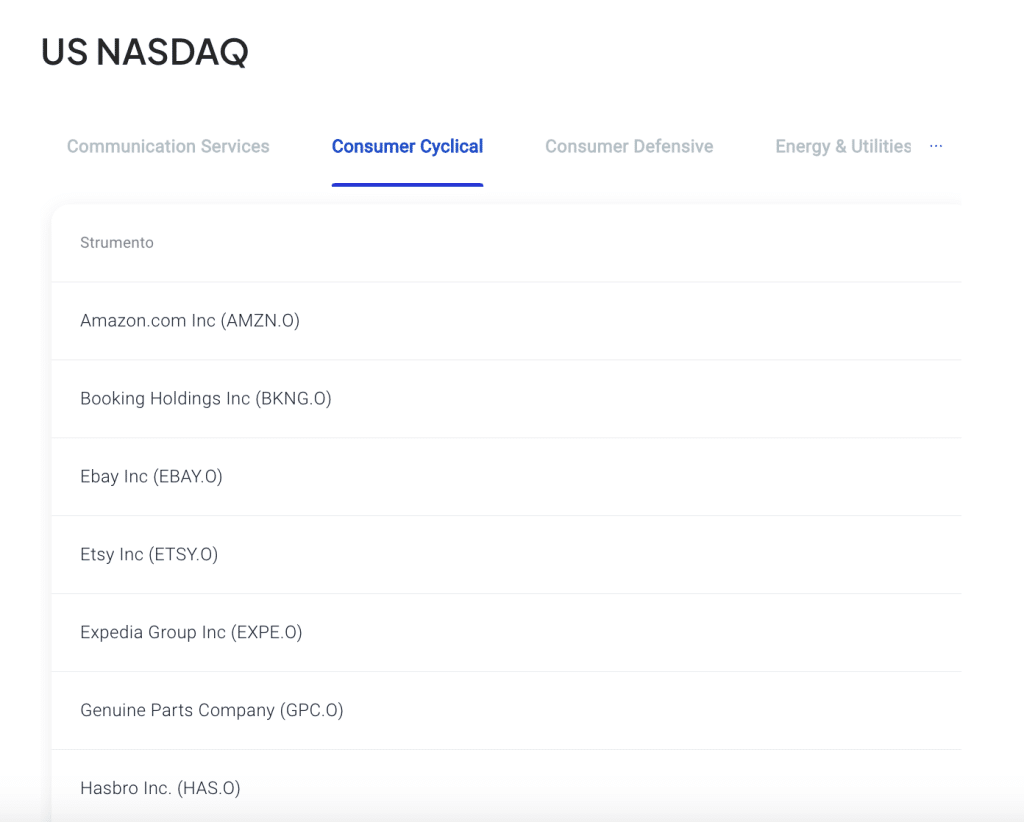

XTB offers a wide range of stock trading options, with more than 3,000 stocks from 16 of the world’s largest exchanges.

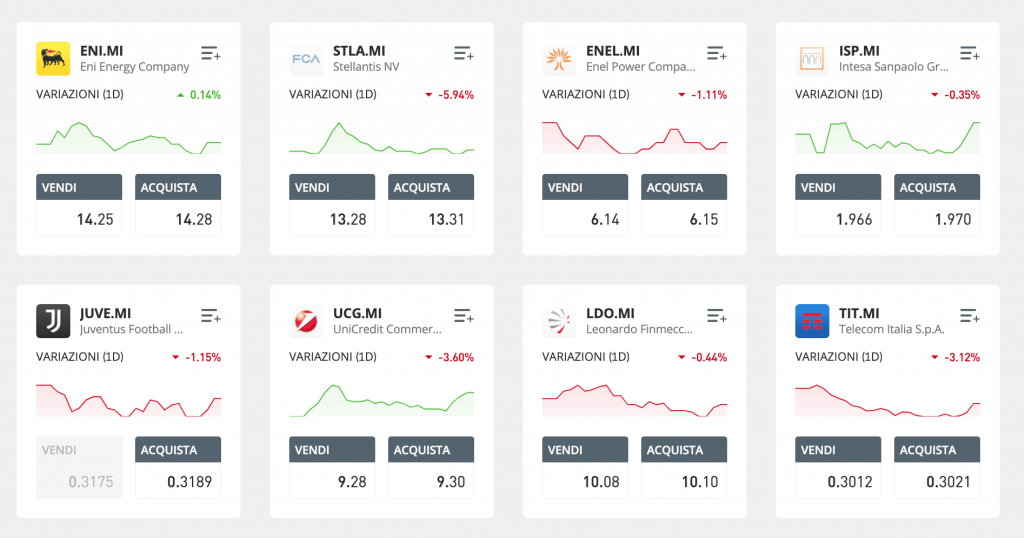

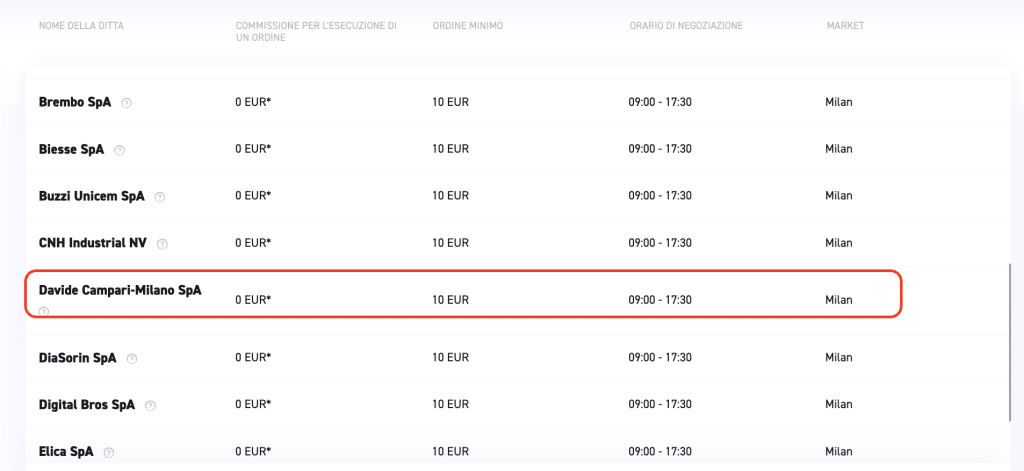

With XTB, clients can explore a wide variety of stocks, including big names such as Tesla, Netflix, Amazon, CD Project and a curated selection of European markets. For the Italian market, XTB offers 46 stocks from the Milan Stock Exchange, thus offering investors a wide choice to build their stock portfolio.

With XTB you can invest in real stocks with 0 commissions for monthly volumes of up to 100,000 euros, a feature that makes XTB quite unique in its sector and truly competitive.

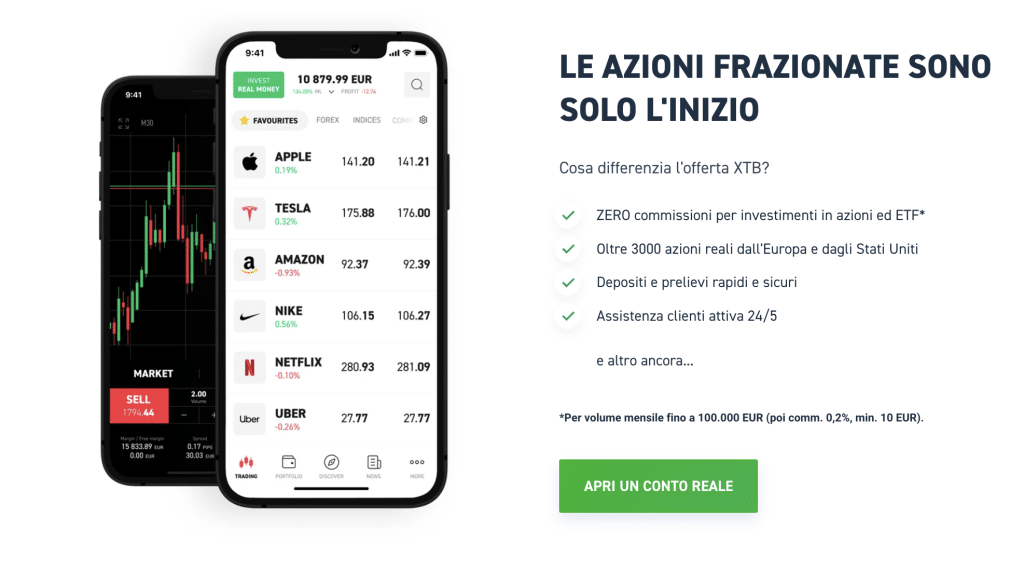

With XTB you can invest in fractional shares

You won’t even be asked for a costly investment since in XTB it is possible to invest in fractional shares starting from just 10 Euros and with zero commissions.

By investing in small portions of stocks, you can have more flexibility and control over your investments, making it easier to customize your investment portfolio. Not only that, by investing in fractional shares, investors receive a proportional share of the economic benefits, such as dividends.

XTB, pros and cons

In this section we take a closer look at the strengths and weaknesses of the XTB broker.

Advantages:

Disadvantages:

75% dei conti al dettaglio di CFD perdono denaro.

2. AvaTrade - Affordable Costs and Attractive Options for Investing in Stocks

Founded in 2006, AvaTrade is a global Forex and CFD broker headquartered in Dublin. AvaTrade is an online trading broker that offers its clients access to over 1,250 financial instruments, including Forex, FX Options, CFDs on stocks, indices, commodities and cryptocurrencies. The company was founded in 2006 and is headquartered in Dublin, Ireland.

AvaTrade has become one of the leading online trading brokers over the years, with over 400,000 clients worldwide and trading volumes of over $60 billion per month. AvaTrade also has offices in other parts of the world, including Paris, Milan, Tokyo and Sydney, offering fast and 24-hour customer service. with over 200,000 registered users and a monthly trading volume of approximately $60 billion.

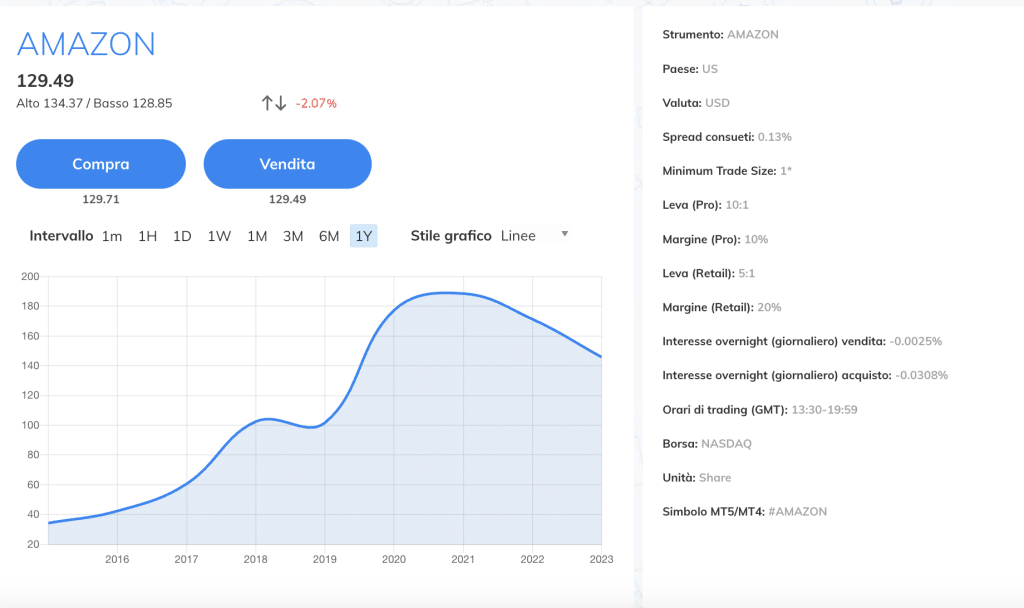

The platform offers users a wide range of trading instruments, including forex, FX options and CFDs for stocks, bonds, ETFs, commodities and indices. The platform is also a cryptocurrency exchange , and also supports some of the most popular cryptocurrencies via CFDs, including Bitcoin (BTC) , Ethereum (ETH) , Litecoin (LTC), Ripple (XRP) and Dash (DASH).

With AvaTrade, you can access the MetaTrader 4 and MetaTrader 5 platforms on Windows and iOS systems, as well as a desktop version and a mobile trading app compatible with Apple and Android devices.

In terms of commissions, AvaTrade offers competitive currency conversion fees. Additionally, deposits and withdrawals (net of bank fees) are free. The broker offers highly competitive spreads, ranging from 1.8 pips for variable spreads to 8 pips for fixed spreads on forex pairs.

AvaTrade also offers a wide selection of educational resources, including in-depth articles, guides and tutorials. The customer service is well organized and the team speaks Italian, ensuring that support is always available.

With AvaTrade you can invest in shares of major companies listed on the NYSE, NASDAQ, London Stock Exchange and other global exchanges without the fees and commissions associated with buying real shares with stock CFDs.

With CFDs you can take advantage of even the smallest market movements, and trade stocks on both rising and falling markets, using leverage of up to 5:1. Be careful though, as leverage is a double-edged sword: while there is a greater reward, there is also a greater loss in the event of a decline. Always use maximum caution with high-risk financial instruments.

AvaTrade Pros and Cons

We now present you some advantages and disadvantages of the AvaTrade trading platform.

Advantages:

Disadvantages:

Your capital is at risk

3. eToro - One of the best platforms for investing in stocks

eToro is ranked #1 in our list of the best international stock brokers, which we consider to be the best overall. More than 20 million traders use the platform in over 140 countries.

With eToro you have access to over 2,400 global markets. There's no additional cost for the 10 best stocks to buy right now either.

eToro also provides access to 250 different types of ETFs and 16 cryptocurrencies, while for those who want to trade commodities, the platform supports trading gold, silver, crude oil and natural gas. eToro also offers a wide range of instruments for trading forex.

The most important aspect of the platform is that it allows you to operate on all types of financial markets. In short, we can say that eToro is the best trading platform for investors who prefer to make moderate investments.

The platform also features a Copy Trading feature, which allows you to identify an expert reference trader and copy all of his trading operations. An example: if the reference trader allocates 3% of his portfolio to Apple shares and 2% to IBM shares, the user can do the same on his portfolio.

On eToro you can find a wide range of American and European stocks: more than 3,000 stocks from 17 different exchanges. One of the advantages of the platform is that by investing you will be the actual owner of the asset, and you will therefore be able to receive the dividends of the company. You will also be able to operate on fractional shares with small amounts and therefore diversify your portfolio.

The advantage is that you start with much less initial capital to dedicate to "real stocks" and without the risk associated with other complex investment instruments.

eToro, pros and cons

We now present you some advantages and disadvantages of the eToro platform:

Advantages:

Disadvantages:

Il {etoroCFDrisk} % dei conti degli investitori retail perde denaro negoziando CFD con questo fornitore. È necessario sapere come funzionano i CFD e se ci si può permettere di perdere i propri soldi.

4. Skilling - The right place to invest in stocks

Founded in 2016 by a group of Swedish investors, Skilling is an internationally operating broker with global recognition offering brokerage services on over 1100 different trading instruments. In Europe it is regulated by the CySEC supervisory body, has its registered office in Nicosia, Cyprus and operational offices in Cyprus and Malta.

Skilling users can trade CFDs on stocks, forex, commodities, stock indices and cryptocurrencies. Skilling also allows trading on soft commodities, such as wheat, coffee and sugar.

With Skilling, investors have the opportunity to diversify their investments while also counting on a competitive commission policy compared to the main players in the market.

The platform also offers two different versions of its trading platform: one for fast trading and analysis and one for advanced analysis and algorithmic trading. In addition to this, there is the MT4 platform for forex trading. There is also a trading app that you can use on the go with your smartphone.

Skilling differs from its competitors in that it offers a variety of CFDs for both stock trading and forex trading, and through CFDs, the broker offers limited trading for commodities and cryptocurrencies.

At Skilling you trade CFD stocks and can speculate on the price movements of over 700 global stocks, without having to own the asset itself. For stock CFDs the platform offers you tight spreads, no commissions and a transparent pricing structure.

Skilling, pros and cons

In the two columns below we have listed the strengths and weaknesses of Skilling.

Advantages:

Disadvantages:

Il 56% dei conti degli investitori al dettaglio perde denaro quando fa trading di CFD con questo fornitore.

5. Pepperstone - Spreads among the lowest on the market for investing in shares

The Australian broker Pepperstone, founded in 2010, has seen a global expansion over the past few years, with clients in over 150 countries around the world. Essentially, it is an online Forex and CFD platform, offering traders from all over the world cutting-edge technology for trading on major markets. In addition to FX and CFDs, the broker offers a wide selection of trading instruments, including cryptocurrencies, indices,

The platform also supports copy trading and social trading, as well as offering a wide range of trading techniques, including scalping and algorithmic trading.

Perhaps the most distinctive aspect of the platform is the wide variety of account profiles offered, designed according to the different needs of users, and which in fact balances the smaller offer of trading tools compared to other international brokers. In addition to the demo account, free for 30 days and extendable to the needs of the platform's users, the most attractive profiles for retail traders are the Standard account and the Razor account.

Pepperstone is also top of the line in regulation, as it is controlled by numerous regulatory bodies, including CySEC, FCA, ASIC, and in Italy it is regulated by CONSOB.

With Pepperstone you can trade online on major CFDs on 60 top-quality stocks such as Facebook, Boeing, IBM, Apple, Alphabet, Tesla and Alibaba, with low spreads, fast execution and no data commission on stock CFDs, with leverage of 5:1.

In addition to gaining exposure to a wide variety of stocks, with Pepperstone you can take advantage of the platform’s aftermarket trading hours reporting season and its commissions starting at USD $0.02 per stock.

Stock CFDs are a great way to hedge other positions and, thanks to leverage, require you to invest less capital. Stock CFDs are also the easiest way to go short on the sale of stocks, which, combined with leveraged trading, gives you the opportunity to trade on falling stock prices.

Pepperstone, pros and cons

We have identified some strengths and weaknesses of the platform. Below you will find the main ones

Advantages:

Disadvantages:

Your capital is at risk

How to invest in stocks in 2026?

There are many trading platforms available for investing online, and a top-notch platform for learning how to invest in stocks is essential. XTB is definitely the best of these platforms and below we will explain in detail how to invest using this platform.

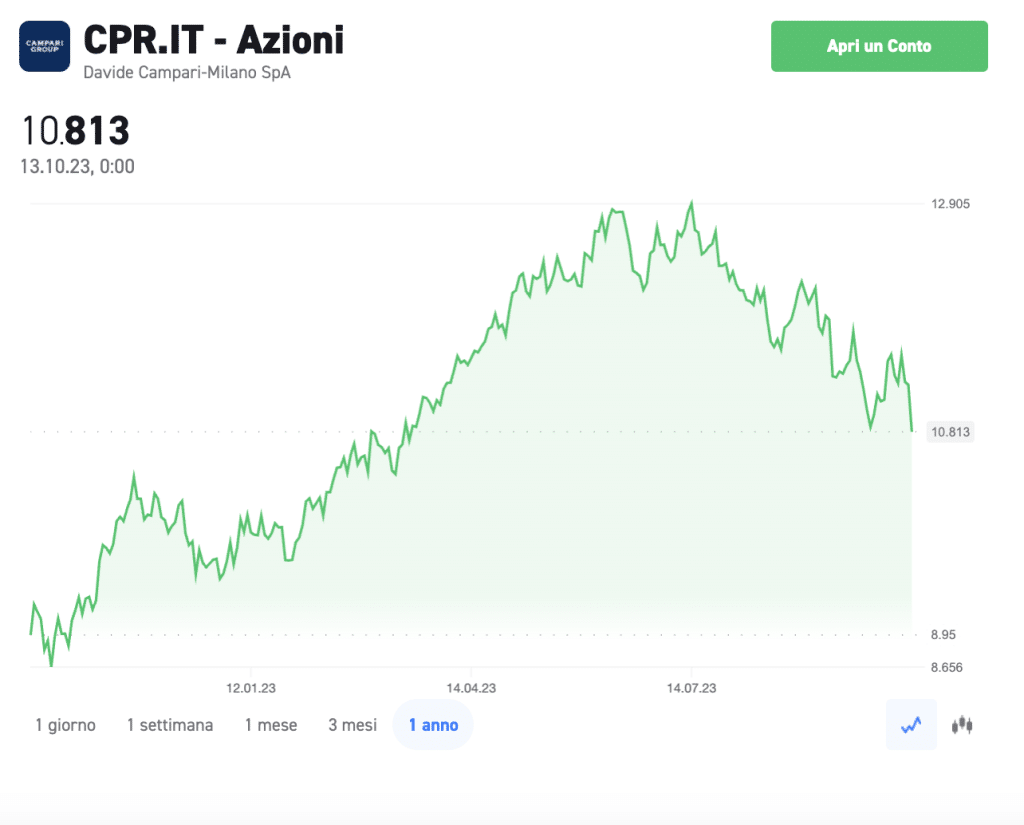

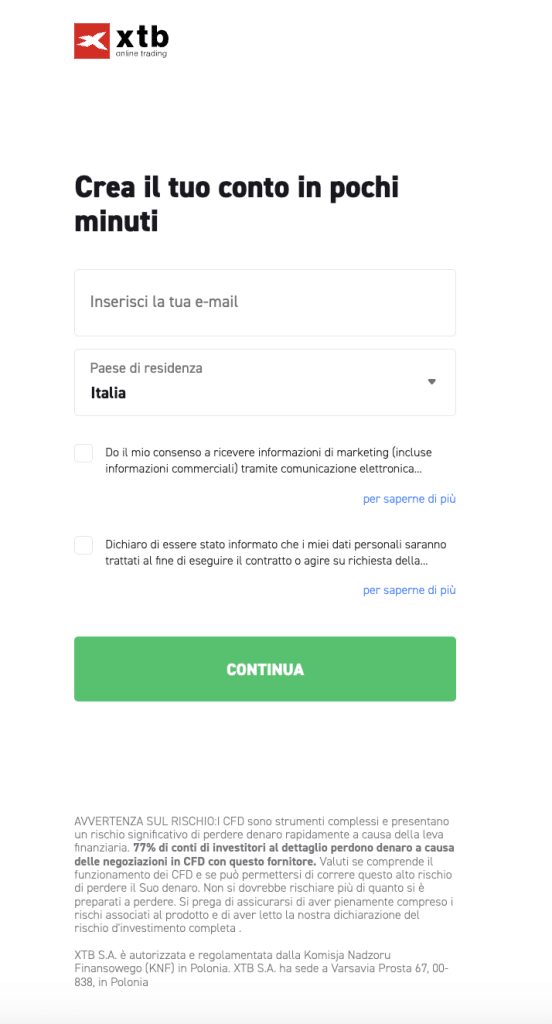

To register on the platform you must provide your personal data such as name, email and a password. As part of the KYC process, you will need to verify your account by providing your personal information and attaching photos of your ID, driving license or passport. XTB may also ask for a copy of your bank statement to verify that the address on your application is the same as your bank statement. You will soon be able to invest in stocks. Every platform that has a regulation requires customers to complete the KYC process or verify their identity. This will be the mandatory next step regardless of whether you created your account through Facebook, Gmail or from scratch. Once your account is set up, before you can invest in stocks, you can deposit funds. For this purpose, you can use credit cards, debit cards and PayPal to fund your trading account. With XTB you can buy shares without any commissions or hidden costs directly from your computer after your account has been topped up. Let’s take Davide Campari-Milano SpA as an example. To open a new trade, enter the company name or the name of the shares “CPR.IT” in the search box at the top of the page and click “invest”. Alternatively, you can search for the stock by browsing the Italian shares supported by XTB.

75% dei conti al dettaglio di CFD perdono denaro.Step 1: Register on the XTB platform

Step 2: Upload an identity document to the platform

Step 3: Deposit your funds

Step 4: Start earning with stocks

Learn the basics of buying stocks in Italy

Let's now look at the key concepts when you want to invest in stocks.

1. Ease of investment

All you need is an online stock brokerage account and today you can invest in many thousands of stocks worldwide on today's market, simply by pressing a button.

2. Commissions

Commissions and fees have never been lower with hundreds of stockbrokers competing for your business. You can even make stock investments without incurring any commission fees on stock trading platforms.

3. How actions work

It would be very important to learn how stocks work, investments, the rules and tax benefits that you can avail, along with understanding the basics of how to invest in stocks. Your best chance of avoiding costly mistakes is if you familiarize yourself with the basics. Once you have bought stock in a company, they must send you a stock certificate within two months.

Investing in stocks: what are stocks

Shares are the individual units into which the capital of a joint-stock company is divided. The owner of a share, therefore, owns a "small piece" of the company, with all the rights and obligations. It is necessary to register on a stock trading platform in order to purchase shares.

Sale of shares

Shares can be sold at any time during normal market hours. Depending on the number of shares you hold and the current share price of the company, you may be able to receive a refund. Dividends are one of the most important aspects of this, as is the ability to vote at annual general meetings (AGMs). This is where this guide can be very helpful in deciding which shares to buy and when.

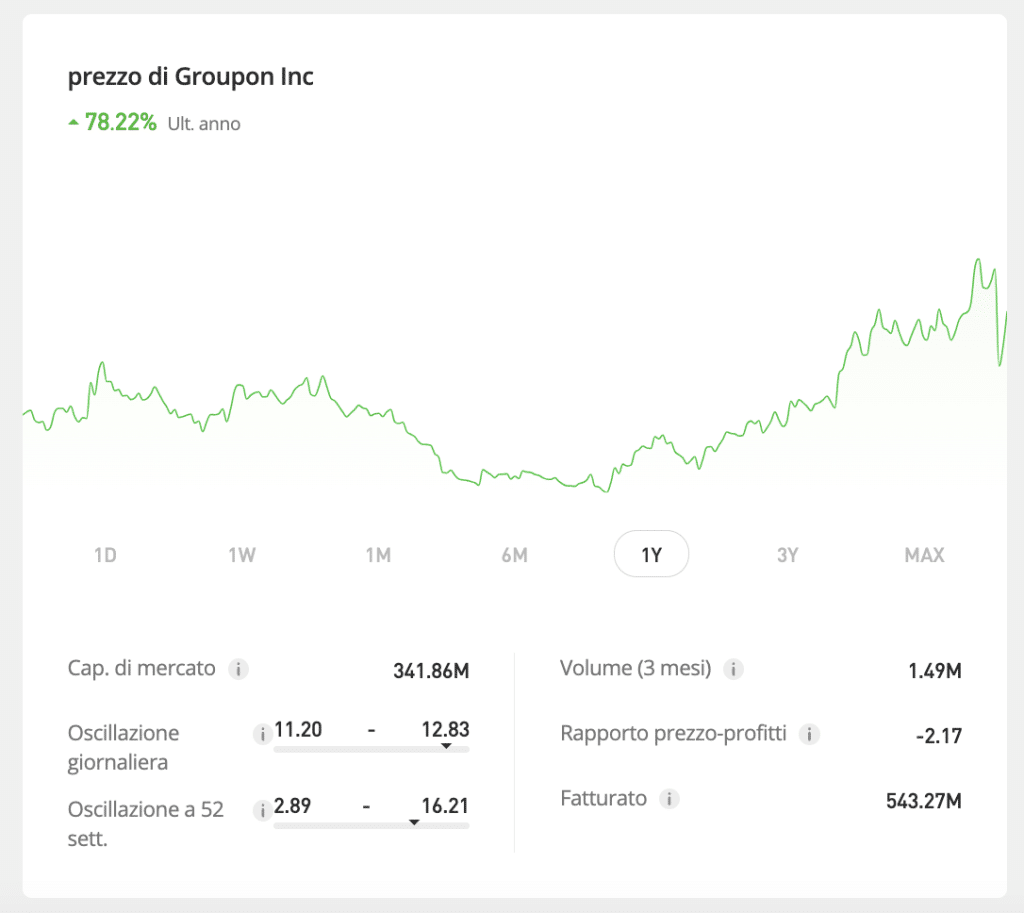

How much money can you make investing in stocks?

Obviously the choice of stocks to bet on is fundamental, because based on this and the behavior and trend of the purchased stocks, the profit can increase or decrease. It is very important to understand that this is not a simple game and it is absolutely necessary to practice and develop your skills in order to avoid making wrong decisions.

How to make money with stocks

- Capital Gains. It is known as a "capital gain" if the value of your shares is higher than the original purchase price.

- Dividends. Dividends are another way to earn income from stocks. Dividends are a way for large companies to share profits with shareholders.

- Compound Growth. Investors prefer to reinvest the earnings of a business to produce a higher income over time, rather than cashing in the capital gains or waiting for dividends. This is called compounding . Compounding can be achieved by holding a stock for a long time and consistently reinvesting the capital gains.

What to Consider Before Investing in Stock in a Company

Below are some helpful stock tips that will help you mitigate your risk when learning to invest in stocks for the first time.

Diversification is, instead of investing in just one or two companies, investing in a well-diversified portfolio consisting of dozens, if not hundreds, of different stocks. In addition to this, you can invest in various sectors, thus avoiding overexposure to a specific niche. Typically, most regulated stockbrokers require a minimum investment of between 100 and 200 euros, although you do not have to invest your entire balance in one trade. Platforms like eToro, on the other hand, allow a minimum stock investment of 50 euros. Therefore, starting with a small contribution will build your confidence without affecting your funds. In addition to knowing how to buy stocks, you should also learn how to do stock research. We are not talking about anything too complex like technical analysis or reading charts. Instead, keep track of any market developments that could impact the value of your investment. It might be worthwhile to add yourself to a platform that sends third-party news alerts to your contact list. For example, you can add the companies you’ve invested in to your Yahoo! Finance portfolio and then receive real-time news when relevant stories break. If you have little or no knowledge of how stocks and shares work, a copy trading portfolio is a serious consideration. You can mirror the trades of experienced investors on beginner-friendly platforms like eToro.Tip 1: Diversify as much as possible

Tip 2: Start with low stakes

Tip 3: Learn to research stocks

Tip 4: Consider a Copy Trading Portfolio

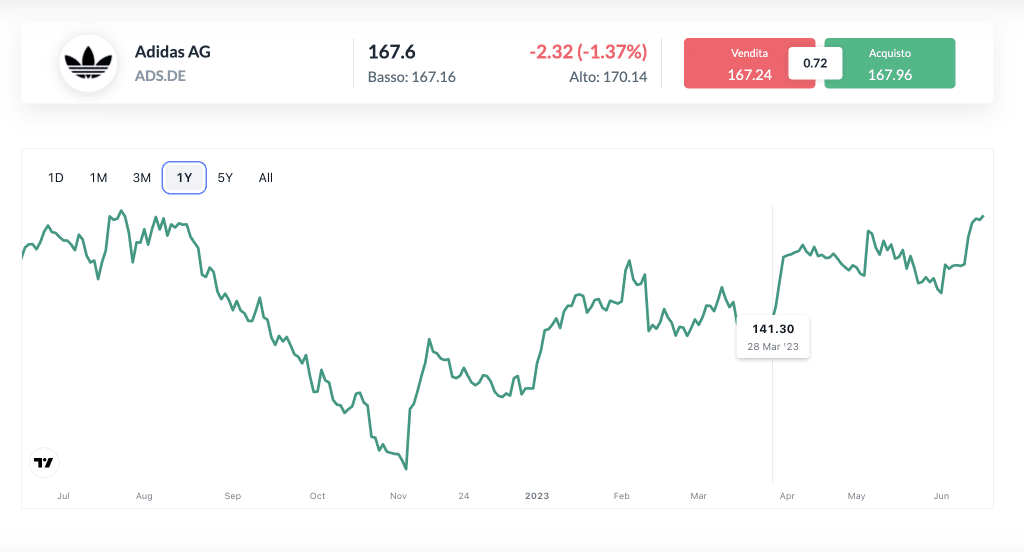

The best stocks to invest in

It is possible to buy a stock easily, but it is very difficult to buy the right stock without a consolidated strategy over time.

So how can you buy the best stocks right now or add them to your agenda? The best candidates are General Motors (GM), Deere (DE), Hilton Worldwide (HLT), STMicroelectronics (STM) and Cheniere Energy (LNG).

How to build a good investment portfolio

1. Decide how much help you want

Without building a portfolio from scratch, you can manage your money and invest.

You can build your portfolio and map out a comprehensive financial plan with an online financial planning service or a financial advisor.

2. Select an account that helps you reach your goals

There are several types of investment accounts. IRAs are intended to be used for retirement and offer tax advantages when you invest. Regular brokerage accounts are better for non-retirement goals, such as a down payment on a house.

3. Determine the best asset allocation for you

Your asset allocation is how you divide your portfolio among different types of assets based on your risk tolerance.

Risks

1. Corporate risk

1. Corporate risk

The most common threat to investors buying individual stocks is company-specific risk. A company's market value can be damaged by poor operating performance.

2. Volatility and market risk

A company's stock can still be volatile and subject to market risk regardless of its performance.

3. Opportunity cost

There is a risk of losing something. Opportunity cost refers to the gain you could have made by choosing a different investment.

4. Liquidity risk

Liquidity risk receives little attention, but it is important and intuitive. A liquid asset is easy to exchange for another. Cash is considered the most liquid asset.

Taxes and regulations related to shares in Italy

All financial activity is subject to taxation. In Italy, there are many investors who choose to invest in stocks every year. This gain is in turn defined as the difference between the selling price and the loading price, i.e. the purchase value including commissions. It should also be noted that 26% is the applicable tax rate.

Investing in stocks involves buying a portion of a company’s assets (shares) in the hope that the value of the stock will increase and generate a profit. The goal is to earn a profit when the stock price increases. Shareholders may also receive dividends if the company makes a profit. To get the greatest profit opportunities eToro is certainly the best online platform for trading. This also allows beginners to trade safely using a serious and reliable broker, to avoid falling into online scams, as has already happened to other investors.

75% dei conti al dettaglio di CFD perdono denaro.Conclusion

Frequently Asked Questions About Stock Investing

How many people invest in stocks?

How to invest in stocks?

Can I invest in stocks with an Italian broker?